Professional Documents

Culture Documents

Quiz Credit

Uploaded by

Keb Limpoco0 ratings0% found this document useful (0 votes)

6 views2 pagesThe document appears to be a quiz on principles of money, credit, and banking. It contains two sections - an identification section with 30 multiple choice questions defining financial terms, and a short form section asking to draw a sample check with given parties and details. The quiz seems designed to test understanding of concepts like checks, negotiable instruments, debtors, creditors, and their rights.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document appears to be a quiz on principles of money, credit, and banking. It contains two sections - an identification section with 30 multiple choice questions defining financial terms, and a short form section asking to draw a sample check with given parties and details. The quiz seems designed to test understanding of concepts like checks, negotiable instruments, debtors, creditors, and their rights.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesQuiz Credit

Uploaded by

Keb LimpocoThe document appears to be a quiz on principles of money, credit, and banking. It contains two sections - an identification section with 30 multiple choice questions defining financial terms, and a short form section asking to draw a sample check with given parties and details. The quiz seems designed to test understanding of concepts like checks, negotiable instruments, debtors, creditors, and their rights.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

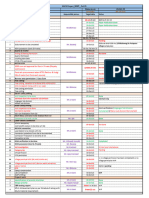

LONG QUIZ: PRINCIPLES OF MONEY, CREDIT AND BANKING

NAME, YEAR, & SECTION:

I. IDENTIFICATION (30 POINTS)

1. A check recognized by the presence of two parallel lines on the left

2. A post-dated check has a __________.

3. A check wherein the date on the face against the date of encashment exceeds six months

4. A check which requires a deposit to payee’s account

5. A check which does not require presentation for deposit to a payee’s account

6. Checks drawn by a bank for the same bank, signed by either of the two offices of the bank,

7. requiring payment to a party designated by the depositor

8. A check purchased from a bank that can be payable anywhere during client’s tour

9. A check drawn against insufficient funds

10. A check drawn by a depositor to a bank to pay a specified third party a sum of money at a future

time

11. A check drawn by a depositor to a bank to pay on demand the third party a sum of money at a

future time

12. A check which specifies payee’s name

13. The party issuing a check

14. A check payable to cash

15. The party who will receive payment in a check

16. Stocks with voting rights

17. Written order drawn by a depositor or company upon a bank directing to pay on demand a

specified sum of money to bearer or order

18. Written order drawn by one bank to another bank directing it to pay the third party a sum of

money at a future time

19. Stocks with rights to a fixed dividends

20. Instruments which are substitutes for cash during business transactions

21. Creditor In legal action for unpaid obligation

22. Refers to the endorsement when instrument is payable to order

23. Third party appointed by court who has the right to hold, control, and dispose of property of

debtor

24. Refers to the endorsement when instrument is payable to bearer

25. Debtor in the legal action for unpaid obligation

26. Right of the unpaid seller when he has parted with the perishable goods to stop them in transit

due to insolvency of the buyer

27. Party appointed by court who has the right to hold and control property of the debtor

28. Signature of the payee on the back of the negotiable instrument

29. Right of creditor to repossess an item for unpaid obligation

30. Right of the debtor to voluntarily settle his obligation

II. DRAW ME CHECK (10 POINTS)

The following are the parties to a check that has a face value of One Hundred Twenty Thousand Pesos and Twelve Centavos:

Ms. ABC - Payee

Ms. DEF - Drawer

GHI - Drawee Bank

You are the new holder (student name). With the current date the following instrument:

1. OPEN CHECK

You might also like

- RFBT-08 (Negotiable Instruments)Document22 pagesRFBT-08 (Negotiable Instruments)Erlinda MolinaNo ratings yet

- Negotiable Inctruments LawDocument15 pagesNegotiable Inctruments LawAr Di SagamlaNo ratings yet

- Nego-Bar Rev Memo Aid 2019 PDFDocument15 pagesNego-Bar Rev Memo Aid 2019 PDFSofia DavidNo ratings yet

- Unit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementDocument9 pagesUnit - 2 Negotiable Instruments: Kantharaju N.P. Ananya Institute of Commerce and ManagementvasistaharishNo ratings yet

- Final Activity 2Document5 pagesFinal Activity 2Thea BaruzoNo ratings yet

- Negotiable InstrumentsDocument5 pagesNegotiable InstrumentsJinky MartinezNo ratings yet

- Negotiable Instrument Sales Credit TransactionDocument25 pagesNegotiable Instrument Sales Credit TransactionKathleen LeynesNo ratings yet

- Topic 5 Law of Negotiable InstrumentsDocument28 pagesTopic 5 Law of Negotiable InstrumentsShaneNo ratings yet

- NIL THEORY - Doc 2Document7 pagesNIL THEORY - Doc 2nikoleNo ratings yet

- Chapter 09 Negotiable Instruments (Law & Practice of Banking)Document8 pagesChapter 09 Negotiable Instruments (Law & Practice of Banking)Rayyah AminNo ratings yet

- Negotiable Instruments LawDocument2 pagesNegotiable Instruments LawkrstnkyslNo ratings yet

- Lecture Notes On Negotiable InstrumentsDocument72 pagesLecture Notes On Negotiable InstrumentsAmarra Astudillo RoblesNo ratings yet

- Assignment No. 2 PGB-20-078Document3 pagesAssignment No. 2 PGB-20-078kishan kanojiaNo ratings yet

- Bill of Exchange and ChecksDocument8 pagesBill of Exchange and ChecksSmurf82% (17)

- BUS LAW 103 AssignmentDocument4 pagesBUS LAW 103 AssignmentAireyNo ratings yet

- Negotiable Instruments (Word)Document74 pagesNegotiable Instruments (Word)MaanNo ratings yet

- Negotiable Instrument Law ReviewerDocument22 pagesNegotiable Instrument Law ReviewerChris Javier100% (1)

- Negotiable InstrumentsDocument60 pagesNegotiable InstrumentsTrem GallenteNo ratings yet

- LAW 6 ReviewerDocument24 pagesLAW 6 ReviewerNacelleNo ratings yet

- 007 The Law On Negotiable InstrumentsDocument10 pages007 The Law On Negotiable InstrumentsClyde Ian Brett PeñaNo ratings yet

- Negotiable Instruments Law Reviewer PDFDocument51 pagesNegotiable Instruments Law Reviewer PDFKarla Mae RicardeNo ratings yet

- Negotiable Instruments ReviewerDocument18 pagesNegotiable Instruments ReviewerMary Joyce Lacambra AquinoNo ratings yet

- Commercial Law, Professors Sundiang and Aquino) : Promissory Note Bill of ExchangeDocument10 pagesCommercial Law, Professors Sundiang and Aquino) : Promissory Note Bill of Exchangeroa yusonNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument31 pagesNegotiable Instruments Non-Negotiable InstrumentspyriadNo ratings yet

- Negotiable Instruments Non-Negotiable Instruments: 1. Maker 2. PayeeDocument38 pagesNegotiable Instruments Non-Negotiable Instruments: 1. Maker 2. PayeeNasrollah Magayoong NuskaNo ratings yet

- Ateneo Negotiable Instruments ReviewerDocument16 pagesAteneo Negotiable Instruments ReviewerRacheal SantosNo ratings yet

- Negotiable and CorporationDocument33 pagesNegotiable and CorporationBryan ReyesNo ratings yet

- Chapter 10-Promisorry NotesDocument6 pagesChapter 10-Promisorry NotesAngelica Joy ManaoisNo ratings yet

- 62-6 Mesina vs. IACDocument11 pages62-6 Mesina vs. IACRudejane TanNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument18 pagesNegotiable Instruments Non-Negotiable InstrumentsRichard DuranNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument34 pagesNegotiable Instruments Non-Negotiable InstrumentslopoNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument32 pagesCommercial Law - Negotiable Instruments LawGlenda PambagoNo ratings yet

- Law 3 PrelimsDocument6 pagesLaw 3 PrelimsRaña Marie Macaranas BobadillaNo ratings yet

- Forgery CasesDocument2 pagesForgery CasesLittle GirlblueNo ratings yet

- Negotiable Insturment NotesDocument19 pagesNegotiable Insturment NotesEman CipateNo ratings yet

- Negotiable Instrument LawDocument16 pagesNegotiable Instrument LawVel JuneNo ratings yet

- Mercantile Law 2015Document9 pagesMercantile Law 2015Axel FontanillaNo ratings yet

- Concept of Negotiable InstrumentsDocument6 pagesConcept of Negotiable InstrumentsJemmieNo ratings yet

- Law On Negotiable Instruments ReviewerDocument97 pagesLaw On Negotiable Instruments ReviewerLyka Mae Palarca IrangNo ratings yet

- Nego Memo AidDocument49 pagesNego Memo AidGigiRuizTicarNo ratings yet

- RFBT Negotiable Instruments LawDocument8 pagesRFBT Negotiable Instruments LawKatzkie Montemayor Godinez100% (1)

- Advertisements: Philippine Law ReviewersDocument20 pagesAdvertisements: Philippine Law ReviewersJexelle Marteen Tumibay PestañoNo ratings yet

- Negotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezDocument26 pagesNegotiable Instruments Laws Carlos Hilado Memorial State University Submitted By: Atty. Jul Davi P. SaezJellie ElmerNo ratings yet

- Negotiable Instruments Non-Negotiable InstrumentsDocument31 pagesNegotiable Instruments Non-Negotiable InstrumentsMychie Lynne MayugaNo ratings yet

- 2.15 Areza Vs Express Savings BankDocument22 pages2.15 Areza Vs Express Savings BankMarion Yves MosonesNo ratings yet

- Category Archives: Negotiable Instruments LawDocument50 pagesCategory Archives: Negotiable Instruments LawJane Ericka Joy MayoNo ratings yet

- Memorandum BP 22 ProsecutionDocument5 pagesMemorandum BP 22 ProsecutionBuen Libetario100% (2)

- RFBT Bouncing Checks Consumer ProtectionDocument11 pagesRFBT Bouncing Checks Consumer ProtectionengenekaiNo ratings yet

- Rfbt3 Negoin Lecture NotesDocument14 pagesRfbt3 Negoin Lecture NotesWilmar Abriol100% (1)

- Business Law ReviewerDocument30 pagesBusiness Law ReviewerBea EchiverriNo ratings yet

- Negotional Instrument Law 2Document9 pagesNegotional Instrument Law 2Kristiana Montenegro GelingNo ratings yet

- Nego Cases 1st ExamDocument6 pagesNego Cases 1st ExamAmanda ButtkissNo ratings yet

- Nego Cases 15-17 (Digested)Document3 pagesNego Cases 15-17 (Digested)Supply ICPONo ratings yet

- Negotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Document88 pagesNegotiable Instruments Reviewer (Agbayani Villanueva Sundiang Aquino)Lee Anne Yabut100% (3)

- Commrev DigestDocument4 pagesCommrev DigestGabby PundavelaNo ratings yet

- What Are The Kinds of Bill of Exchange?Document3 pagesWhat Are The Kinds of Bill of Exchange?AireyNo ratings yet

- NIL Memory AidDocument52 pagesNIL Memory AidMasterboleroNo ratings yet

- Letters of Credit: Prudential Bank V IACDocument3 pagesLetters of Credit: Prudential Bank V IACPraisah Marjorey Casila-Forrosuelo PicotNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument31 pagesCommercial Law - Negotiable Instruments LawJeremias CusayNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Chapter 1 - Business Information Systems (An Overview)Document8 pagesChapter 1 - Business Information Systems (An Overview)Keb LimpocoNo ratings yet

- Exam2 - Midterm Set ADocument3 pagesExam2 - Midterm Set AKeb LimpocoNo ratings yet

- Quiz BankingDocument2 pagesQuiz BankingKeb LimpocoNo ratings yet

- Exam1 - Prelim Set ADocument1 pageExam1 - Prelim Set AKeb LimpocoNo ratings yet

- Management Accounting ExamDocument3 pagesManagement Accounting ExamKeb LimpocoNo ratings yet

- Deed of Sale (Motorcycle)Document2 pagesDeed of Sale (Motorcycle)Keb LimpocoNo ratings yet

- College of Management: Bachelor of Science in AccountancyDocument1 pageCollege of Management: Bachelor of Science in AccountancyKeb LimpocoNo ratings yet

- Science G6: Quarter 2Document40 pagesScience G6: Quarter 2Frances Datuin100% (1)

- Capto: 3 Good Reasons To Use The Capto For Handling Heavy FabricsDocument2 pagesCapto: 3 Good Reasons To Use The Capto For Handling Heavy FabricsgustirizkiawanNo ratings yet

- A Study On Supply Chain and Logistics Managemernt For K.M.B GraniteDocument50 pagesA Study On Supply Chain and Logistics Managemernt For K.M.B GraniteRaja Thrisangu100% (1)

- Bearing CapacityDocument4 pagesBearing CapacityahmedNo ratings yet

- Jeselo O. Gorme, RN, MNDocument109 pagesJeselo O. Gorme, RN, MNcoosa liquorsNo ratings yet

- The Greatest Trump Raffle Ever - A Tommy Zegan OriginalDocument2 pagesThe Greatest Trump Raffle Ever - A Tommy Zegan OriginalPR.comNo ratings yet

- PW 1989 12Document76 pagesPW 1989 12Milton NastNo ratings yet

- Deed of Absolute Sale Including FranchiseDocument2 pagesDeed of Absolute Sale Including FranchiseJOBS MANILATRANS100% (1)

- Separation of Powers - WikipediaDocument15 pagesSeparation of Powers - WikipediaSacredly YoursNo ratings yet

- Ece 250 Project PortfolioDocument7 pagesEce 250 Project Portfolioapi-511924847No ratings yet

- Fundamentals of Software Engineering Course OutlineDocument4 pagesFundamentals of Software Engineering Course Outlinebetelhem yegzawNo ratings yet

- Music For BandDocument143 pagesMusic For BandTedTerroux604No ratings yet

- Anchoring BiasDocument2 pagesAnchoring Biassara collinNo ratings yet

- Syllabus (Economic Analysis For Business)Document5 pagesSyllabus (Economic Analysis For Business)S TMNo ratings yet

- Preparation and Practice Answer KeyDocument16 pagesPreparation and Practice Answer KeyHiệp Nguyễn TuấnNo ratings yet

- Lindsey Position PaperDocument14 pagesLindsey Position PaperRamil DumasNo ratings yet

- CBLM Bartending Ncii # 1 & 4aDocument265 pagesCBLM Bartending Ncii # 1 & 4aQueenly Mendoza Aguilar81% (21)

- Japanese ScriptDocument67 pagesJapanese ScriptBrat_princeNo ratings yet

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- Advertising & SALES PROMOTIONAL-AirtelDocument78 pagesAdvertising & SALES PROMOTIONAL-AirtelDasari AnilkumarNo ratings yet

- Islam in The Middle Ages - WORKSHEETDocument4 pagesIslam in The Middle Ages - WORKSHEETcrabbydreamerNo ratings yet

- Background: The Islamic World of Academy of ScienceDocument5 pagesBackground: The Islamic World of Academy of ScienceNusrat MaqboolNo ratings yet

- Refrigeration Technology: SymbolsDocument44 pagesRefrigeration Technology: SymbolsGaluh AjengNo ratings yet

- Data Coding SchemesDocument26 pagesData Coding SchemesJovanie CadungogNo ratings yet

- Walt Disney BiographyDocument8 pagesWalt Disney BiographyIsaacRodríguezNo ratings yet

- Extended AbstractDocument4 pagesExtended Abstractadi_6294No ratings yet

- Types of Plant MaintenanceDocument7 pagesTypes of Plant MaintenanceTHEOPHILUS ATO FLETCHERNo ratings yet

- Technical Support Questions and Answers: How Do I Access Commseciress?Document3 pagesTechnical Support Questions and Answers: How Do I Access Commseciress?goviperumal_33237245No ratings yet

- Transurethral Resection of The Prostate Anesthetic ConsiderationsDocument25 pagesTransurethral Resection of The Prostate Anesthetic ConsiderationsSeaoon IdianNo ratings yet

- Incidence of Alveoloplasty PDFDocument4 pagesIncidence of Alveoloplasty PDFaleeza sanaNo ratings yet