Professional Documents

Culture Documents

Form 16: Ibm Daksh Business Process Services Pvt. LTD

Uploaded by

madan mehtaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16: Ibm Daksh Business Process Services Pvt. LTD

Uploaded by

madan mehtaCopyright:

Available Formats

IBM DAKSH BUSINESS PROCESS SERVICES PVT.

LTD

Form 16 Digitally Signed

Form16 Details:

Employee Name: VAIBHAV TIWARI

Employee PAN: AKHPT3825D

Employee Serial Number: 194082

Employee Designation: PRACTITIONER-CRM OPERATIONS

Form16 Control Number: 194082/AKHPT3825D/2012-13

Assessment Year: 2013-14 2013-14

Certificate Number:

E-file your Income-tax Return:

Filing

You cyour tax returns has now been made simple as the Corporate Accounting Group has indentified service providers who can assist employees in completing

the process online. In collaboration with the service providers this facility has been extended online, to assist employees across all DCs and countries.

However, employees are required to note that the Company is only acting as a facilitator in enabling employees to file their tax returns through a service provider

and there is no direct involvement or recommendation on the part of Company. Employees are required to make their own assessment of the services offered

by the service provider, and the Company makes no guarantees as to the quality of the service or that tax returns will be filed in an accurate and correct

manner. The Company will not be held liable for any use of the services by employees.

If employees wish to file their tax returns through the service providers identified by the Company, employees may click on the link below.

EMPLOYEES MUST NOTE THAT IF THEY CLICK ON THE LINK GIVEN BELOW, THEY WILL BE TAKEN TO THE SERVICE PROVIDER WEB SITE AND

THEIR PERSONAL DATA (AS GIVEN IN THIS FORM) WILL BE AUTOMATICALLY FILLED ON THE SERVICE PROVIDER WEB SITE. IF EMPLOYEES DO

NOT WISH TO HAVE THEIR DATA AUTOMATICALLY ENTERED ON TO THE SERVICE PROVIDER WEBSITE THEY SHOULD NOT CLICK ON THE

BELOW LINK. EMPLOYEES ARE ALSO REQUESTED TO CHECK THE ACCURACY OF THE DATA ENTERED ON THE SERVICE PROVIDER WEBSITE

BEFORE SUBMITTING THIS DATA.

Click here to prepare your Income-tax Return

If you cannot open the link above then please visit www.myITreturn.com and follow the instructions mentioned therein.

Signature Details:

This form has been signed and certified using a Digital Signature Certificate as specified under section 119 of

the Income-tax Act, 1961. (Please refer Circular No.2/2007,dated 21-5-2007).

The Digital Signature of the signatory has been affixed in the box provided below.To see the details and validate

the signature,you should click on the box.

Digitally Signed by : INDRANIL SEN

INDRANIL SEN

Digital Signature Certificate issued by : SAFESCRYPT SUB-CA FOR RCAI CLASS 2 2012 2013.05.31 08:09:38

Signer:

Serial Number of DSC : 262254

CN=INDRANIL SEN

C=IN

Number of pages : 5 (including this page)

O=Personal

2.5.4.17=122002

Public key:

RSA/2048 bits

IBM VAIBHAV TIWARI/194082/2012-13

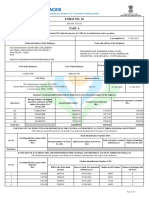

FORM NO.16

2013-14

PART A

Certificate under section 203 of the income-tax Act, 1961 for tax deducted at source on Salary

Certificate No.: Last Updated on:

Name and address of the Employer Name and address of the Employee

IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD VAIBHAV TIWARI

PRACTITIONER-CRM OPERATIONS

1ST FLOOR,BIRLA TOWER,25, BARAKHAMBA ROAD,NEW 194082

DELHI,DELHI,110001

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference No. provided

by the Employer (if available)

AABCD4187D DELD04603E AKHPT3825D 194082

CIT (TDS) Assessment Year Period

The Commissioner of Income Tax (TDS) Aayakar Bhawan, District Centre, From To

6th Floor Room no 610 Hall no.4 Luxmi Nagar Delhi-110092 2013 -14

30/05/2012 01/02/2013

Summary of amount paid / credited and tax deducted at source theron in respect of the employee

Quarter(s) Receipt Numbers of original statements of Amount paid /credited Amount of tax deducted Amount of tax

TDS under sub-section (3) of section 200 deposited/remitted

(Rs.) (Rs.) (Rs.)

Quarter 1 NOT APPLICABLE 16008.00 0.00 0.00

Quarter 2 NOT APPLICABLE 47711.00 0.00 0.00

Quarter 3 NOT APPLICABLE 53421.00 0.00 0.00

Quarter 4 NOT APPLICABLE 22584.00 0.00 0.00

Total 139724.00 0.00 0.00

II. DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sr. Tax Deposited in Respect of the Employee Challan Identification Number (CIN)

No (Rs.) BSR Code of the Date on which Tax Challan Serial Status of matching

Bank Branch Deposited (dd/MM/yyyy) number with OLTAS*

1 0.00 N/A N/A N/A N/A

2 0.00 N/A N/A N/A N/A

3 0.00 N/A N/A N/A N/A

4 0.00 N/A N/A N/A N/A

5 0.00 N/A N/A N/A N/A

6 0.00 N/A N/A N/A N/A

7 0.00 N/A N/A N/A N/A

8 0.00 N/A N/A N/A N/A

9 0.00 N/A N/A N/A N/A

10 0.00 N/A N/A N/A N/A

11 0.00 N/A N/A N/A N/A

12 0.00 N/A N/A N/A N/A

0.00

Verification

I, INDRANIL SEN son / daughter of SUBIR KUMAR SEN, working in the capacity of GROUP MANAGER-HR (designation) do hereby certify that a sum of Rs. 0.00

[(RUPEES ZERO ONLY) (in words)] has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

For IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD

Place : NEW DELHI Signature of the person responsible for deduction of tax

Date : 31-May-2013 This form is signed using Digital Signature. Please see page 1.

Designation : GROUP MANAGER-HR Full Name : INDRANIL SEN

IBM VAIBHAV TIWARI/194082/2012-13

Part B (Annexure)

Details of Salary paid and any other Income and tax deducted Rs. Rs. Rs.

1. GROSS SALARY

(a) Salary as per provisions contained in section 17(1) 139,724.00

(b) Value of perquisites under section 17(2) 0.00

(as per Form No:12BA,wherever applicable)

(c) Profits in lieu of salary under section 17(3) 0.00

(as per Form No: 12BA,wherever applicable)

Total 139,724.00

2. Less : Allowance to the extent exempt u/s 10 1,646.00

3. Balance (1-2) 138,078.00

4. DEDUCTIONS :

(a) Entertainment Allowance 0.00

(b) Tax on Employment 0.00

5. Aggregate of 4 (a) and (b) 0.00

6. INCOME CHARGEABLE UNDER THE HEAD 'SALARIES' ( 3-5 ) 138,078.00

7. Add : Any other income reported by the employee

(a) Income under the Head 'Income from House Property' 0.00

0.00

8. GROSS TOTAL INCOME ( 6+7 ) 138,078.00

9. DEDUCTIONS UNDER CHAPTER VI-A

(A) Sections 80C, 80CCC & 80CCD

(a) Section 80C Gross Amount Deductible Amount

Employee Provident Fund 6654.00 6654.00

(b) Section 80CCC 0.00 0.00

(c) Section 80CCD(1) 0.00 0.00

(d) Section 80CCD(2) 0.00 0.00

Total of (a) + (b) + (c) + (d) 6,654.00

Note: Aggregate amount deductible under sections, i.e., 80C, 80CCC and 80CCD(1) shall not

exceed one lakh rupees.

IBM VAIBHAV TIWARI/194082/2012-13

(B) Other Sections(e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

(a) 80 CCG Rajiv Gandhi Equity Scheme 0.00 0.00 0.00

(b) 80 D Health Insurance Premium 954.00 954.00 954.00

(c) 80 DD Handicapped Dependents 0.00 0.00 0.00

(d) 80 DDB Medical Expenses, Chronic Diseases 0.00 0.00 0.00

(e) 80 E Interest on Loan taken for Higher Education 0.00 0.00 0.00

(f) 80 U Permanent Physical disability 0.00 0.00 0.00

(g) 80 G Donation 0.00 0.00 0.00

(h) 80 GG Rent paid(HRA not received) 0.00 0.00 0.00

(i) 80 TTA Deduction on Interest on Saving Account 0.00 0.00 0.00

954.00

10. Aggregate of deductible amounts under chapter VI-A 7,608.00

11. Total income (8-10 ) 130,470.00

12. Tax on total income 0.00

13. Education Cess @ 3% (on tax computed at S.No. 12) 0.00

14. Tax Payable (12+13) 0.00

15. Relief under section 89 0.00

16. Tax Payable (14-15 ) 0.00

Verification

I, INDRANIL SEN son / daughter of SUBIR KUMAR SEN, working in the capacity of GROUP MANAGER-HR (designation), do hereby certify that the information given above is true, complete and

correct and is based on the books of account, documents, TDS statements, and other available records.

For IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD

Place : NEW DELHI Signature of the person responsible for deduction of tax

Date : 31-May-2013 This form is signed using Digital Signature. Please see page 1.

Designation : GROUP MANAGER-HR Full Name : INDRANIL SEN

IBM VAIBHAV TIWARI/194082/2012-13

FORM NO. 12BA

{See Rule 26A(2)(B)}

Statement showing particulars of perquisites, other fringe benefits or

amenities and profits in lieu of salary with value thereof

1. Name and Address of the Employer : IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD

1ST FLOOR,BIRLA TOWER,25, BARAKHAMBA ROAD,NEW

DELHI,DELHI,110001

2. TAN : DELD04603E

3. TDS Assessment Range of the Employer : The Commissioner of Income Tax (TDS) Aayakar Bhawan, District

Centre, 6th Floor Room no 610 Hall no.4 Luxmi Nagar Delhi-110092

4. Name of Employee : VAIBHAV TIWARI

Designation : PRACTITIONER-CRM OPERATIONS

PAN : AKHPT3825D

5. Is the Employee a Director or a person with substantial

interest in the company (Where the employer is a company) : NO

6. Income under the Head "Salaries" of the Employee : 139,724.00

(Other than from perquisites)

7. Financial Year : 2012-13 2012-13

8. Valuation of perquisites

Sl. Nature of perquisite Value of perquisite Amount,if any, recovered Amount of Taxable

No as per rules(Rs.) from employee(Rs.) perquisite(Rs.)

(1) Accommodation 0.00 0.00 0.00

(2) Cars/Other automotive 0.00 0.00 0.00

(3) Sweeper,gardener,watchman or personal attendant 0.00 0.00 0.00

(4) Gas,electricity,water 0.00 0.00 0.00

(5) Interest free or concessional loans 0.00 0.00 0.00

(6) Holiday expenses 0.00 0.00 0.00

(7) Free or concessional travel 0.00 0.00 0.00

(8) Free Meals (Food Coupons Taxable ) 0.00 0.00 0.00

(9) Free Education 0.00 0.00 0.00

(10) Gifts,vouchers,etc. 0.00 0.00 0.00

(11) Credit card expenses 0.00 0.00 0.00

(12) Club expenses 0.00 0.00 0.00

(13) Use of movable assets by employees 0.00 0.00 0.00

(14) Transfer of assets to employees 0.00 0.00 0.00

(15) Value of any other benefit/amenity/service/previlege 0.00 0.00 0.00

(16) Stock Options (ESOS Perquisites) 0.00 0.00 0.00

(17) Other Benefits or amenities (Conveyance Perks) 0.00 0.00 0.00

(18) Total Value of Perquisites 0.00 0.00 0.00

(19) Value of profits for in lieu of salary as per section 17(3) 0.00 0.00 0.00

9. Details of Tax

a) Tax Deducted from Salary of Employee u/s 192(1) : 0.00

b) Tax Paid by Employer on behalf of Employee u/s 192(1A) : 0.00

c) Total Tax Paid : 0.00

d) Date of Payment into Government Treasury : Refer Form16

DECLARATION BY EMPLOYER

I, INDRANIL SEN son of SUBIR KUMAR SEN working as GROUP MANAGER-HR do hereby declare on behalf of IBM DAKSH BUSINESS PROCESS SERVICES PVT.

LTD that the information given above is based on the books of account, documents and other relevant records or information available with us and the details of value of

each such perquisite are in accordance with section 17 and rules framed thereunder and that such information is true and correct.

For IBM DAKSH BUSINESS PROCESS SERVICES PVT. LTD

Signature of the person responsible for deduction of tax

This form is signed using Digital Signature. Please see page 1.

Place: NEW DELHI Full Name : INDRANIL SEN

Date : 31-May-2013 Designation : GROUP MANAGER-HR

IBM VAIBHAV TIWARI/194082/2012-13

You might also like

- DeepWeb LinkDocument16 pagesDeepWeb LinkLucas Javier75% (4)

- Concentrix Form 16Document9 pagesConcentrix Form 16Neeraj M.RNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedArun MohantyNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro Limitedbharath50% (2)

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedsaisindhuNo ratings yet

- Form 16: Wavelabs Technologies Private LimitedDocument11 pagesForm 16: Wavelabs Technologies Private LimitedrshserhsrtNo ratings yet

- Synopsis TDSDocument20 pagesSynopsis TDSNand Kishore DubeyNo ratings yet

- Form 16Document9 pagesForm 16Satyam MaramNo ratings yet

- Form 16 - 2020-21 - Part A and B - FY 2020 - 2021 3Document10 pagesForm 16 - 2020-21 - Part A and B - FY 2020 - 2021 3kamalkarki03No ratings yet

- MLWB User ManualDocument35 pagesMLWB User ManualManish ShahNo ratings yet

- Epf On Line Regn. User ManualDocument38 pagesEpf On Line Regn. User ManualRachelNo ratings yet

- Online Registration of Establishment With DSC: User ManualDocument39 pagesOnline Registration of Establishment With DSC: User ManualroseNo ratings yet

- Form 16: Ibm India Private LimitedDocument7 pagesForm 16: Ibm India Private LimitedNeha Upadhyay MehtaNo ratings yet

- Form 16: Signature Not VerifiedDocument6 pagesForm 16: Signature Not VerifiedPritha DasNo ratings yet

- Animesh Das - Form16 FY 21-22 - FY 2021 - 2022.Document7 pagesAnimesh Das - Form16 FY 21-22 - FY 2021 - 2022.Dass AniNo ratings yet

- Income Tax Payment Challan: PSID #: 138637167Document1 pageIncome Tax Payment Challan: PSID #: 138637167naeem1990No ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- Income Tax Payment Challan: PSID #: 138638394Document1 pageIncome Tax Payment Challan: PSID #: 138638394naeem1990No ratings yet

- Income Tax Payment Challan: PSID #: 138414509Document1 pageIncome Tax Payment Challan: PSID #: 138414509naeem1990No ratings yet

- It 000128980840 2021 00Document1 pageIt 000128980840 2021 00Salman GagaNo ratings yet

- Form 16: How Do I E-FileDocument9 pagesForm 16: How Do I E-FilePadmanabha MNo ratings yet

- Employer Registration Manual PDFDocument46 pagesEmployer Registration Manual PDFbhandari0148No ratings yet

- Income Tax Payment Challan: PSID #: 165866345Document1 pageIncome Tax Payment Challan: PSID #: 165866345Ashok KumarNo ratings yet

- Income Tax Payment Challan: PSID #: 152672806Document1 pageIncome Tax Payment Challan: PSID #: 152672806JosephNo ratings yet

- Income Tax Payment Challan: PSID #: 138458893Document1 pageIncome Tax Payment Challan: PSID #: 138458893naeem1990No ratings yet

- (State Bank of India) (Use Separate Challan For Each Month)Document2 pages(State Bank of India) (Use Separate Challan For Each Month)snehalbhoyarNo ratings yet

- Form 15CA - ARNDocument1 pageForm 15CA - ARNZaid KhanNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedIbrahim MohammadNo ratings yet

- Attpp2455j 2021-22Document2 pagesAttpp2455j 2021-22Aditya PLNo ratings yet

- It 000133212268 2023 01Document1 pageIt 000133212268 2023 01omer akhterNo ratings yet

- Polymorphism of The WorldDocument9 pagesPolymorphism of The WorldShobhit MathurNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Income Tax Payment Challan: PSID #: 138458243Document1 pageIncome Tax Payment Challan: PSID #: 138458243naeem1990No ratings yet

- Epicor Software India Private Limited: Brief Details of Your Form-16 Are As UnderDocument9 pagesEpicor Software India Private Limited: Brief Details of Your Form-16 Are As UndersudhadkNo ratings yet

- SubContractor Registration FormDocument18 pagesSubContractor Registration Formanbumani0% (1)

- Caef Aditya SonkarDocument41 pagesCaef Aditya Sonkarmessisingh1706No ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- 顾客注册文件Document5 pages顾客注册文件Mubasyir LokmanNo ratings yet

- It 000126794858 2023 08Document1 pageIt 000126794858 2023 08Anas KhanNo ratings yet

- 1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019Document10 pages1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019sossmsNo ratings yet

- Form 16: E-File Your Income-Tax ReturnDocument8 pagesForm 16: E-File Your Income-Tax ReturnRishabh PareekNo ratings yet

- Form 16: High Court AllahabadDocument6 pagesForm 16: High Court Allahabadbushra aliNo ratings yet

- Income Tax Payment Challan: PSID #: 138384574Document1 pageIncome Tax Payment Challan: PSID #: 138384574naeem1990No ratings yet

- It 000130389542 2023 11Document1 pageIt 000130389542 2023 11Muneeb ChaudhryNo ratings yet

- Income Tax Payment Challan: PSID #: 148094666Document1 pageIncome Tax Payment Challan: PSID #: 148094666omer akhterNo ratings yet

- NABL MedicalLabsDocument3 pagesNABL MedicalLabsar nedungadiNo ratings yet

- Form 9Document1 pageForm 9TharunNo ratings yet

- AABCK2145E - Issue Letter - 1026116688 (1) - 04032020Document2 pagesAABCK2145E - Issue Letter - 1026116688 (1) - 04032020Dhairya ShuklaNo ratings yet

- Webfurther India Private Limited: Form 16Document8 pagesWebfurther India Private Limited: Form 16RAHUL MITTAPALLYNo ratings yet

- Form11 1638000270970Document2 pagesForm11 1638000270970omkarsahane2001No ratings yet

- Documentation of Tax Deduction at SourceDocument147 pagesDocumentation of Tax Deduction at SourceNand Kishore DubeyNo ratings yet

- Income Tax Payment Challan: PSID #: 162486635Document1 pageIncome Tax Payment Challan: PSID #: 162486635samNo ratings yet

- Devyani Employee FormDocument12 pagesDevyani Employee FormAbisekNo ratings yet

- Company Profile...Document15 pagesCompany Profile...tahirNo ratings yet

- Income Tax Payment Challan: PSID #: 148473407Document1 pageIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaNo ratings yet

- Globallogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EDocument4 pagesGloballogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EneerajNo ratings yet

- KVIC Payroll User ManualDocument16 pagesKVIC Payroll User ManualD SRI KRISHNANo ratings yet

- It 000135879998 2023 00Document1 pageIt 000135879998 2023 00Qavi UddinNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro LimitedSanjay RamuNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Songs List 27-03-2022 ProgDocument3 pagesSongs List 27-03-2022 Progmadan mehtaNo ratings yet

- SONGS LIST 27-03-2022 PROG EditedDocument2 pagesSONGS LIST 27-03-2022 PROG Editedmadan mehtaNo ratings yet

- Adobe Scan Jul 20, 2022Document1 pageAdobe Scan Jul 20, 2022madan mehtaNo ratings yet

- Universal Business School Karjat, MumbaiDocument12 pagesUniversal Business School Karjat, Mumbaimadan mehtaNo ratings yet

- FINAL Song List For Yeh Bharat Desh He Mera at Ravindra Natyagrah Indore On 13.08.2022 SaturdayDocument1 pageFINAL Song List For Yeh Bharat Desh He Mera at Ravindra Natyagrah Indore On 13.08.2022 Saturdaymadan mehtaNo ratings yet

- Dubai Air TicketDocument4 pagesDubai Air Ticketmadan mehtaNo ratings yet

- Event Report: Name of The Event Date(s) Time Venue AgendaDocument5 pagesEvent Report: Name of The Event Date(s) Time Venue Agendamadan mehtaNo ratings yet

- UntitledDocument132 pagesUntitledDigital ServiceNo ratings yet

- New Jeevan Dhara 1 - Pension Plan - My LIC IndiaDocument10 pagesNew Jeevan Dhara 1 - Pension Plan - My LIC IndiaAntony ChackoNo ratings yet

- Human Resource Accounting: BY: Ompriya Acharya Pradyusha Patro Uma Rani TantyDocument11 pagesHuman Resource Accounting: BY: Ompriya Acharya Pradyusha Patro Uma Rani TantyOmpriya AcharyaNo ratings yet

- How PIM Adopters Are Outperforming Their CompetitionDocument37 pagesHow PIM Adopters Are Outperforming Their CompetitionAmirul Amin IV0% (1)

- Usha Letter Head CurvedDocument1 pageUsha Letter Head Curvedsales7705No ratings yet

- G Ym 6 F 8 HEtoev 4 GEbDocument6 pagesG Ym 6 F 8 HEtoev 4 GEbPrakhar AgarwalNo ratings yet

- Chapter 13 Intermediate AccountingDocument18 pagesChapter 13 Intermediate AccountingDanica Mae GenaviaNo ratings yet

- Managerial Economics-CasesDocument3 pagesManagerial Economics-Casessherryl caoNo ratings yet

- Faq Transitional Issues Companies Act 2016 - Technical 2 2 2017 PDFDocument14 pagesFaq Transitional Issues Companies Act 2016 - Technical 2 2 2017 PDFazilaNo ratings yet

- Reflection Paper: Laborers in The PhilippinesDocument6 pagesReflection Paper: Laborers in The PhilippinesJv ManuelNo ratings yet

- Consumer Reactions To Sustainable PackagingDocument10 pagesConsumer Reactions To Sustainable Packagingxi si xingNo ratings yet

- Chapter 1 - The First Big Question - Where Is The Organization NowDocument7 pagesChapter 1 - The First Big Question - Where Is The Organization NowSteffany Roque100% (1)

- Summary Of: The Value of Saving A Life: Evidence From The Labor MarketDocument2 pagesSummary Of: The Value of Saving A Life: Evidence From The Labor MarketFreed DragsNo ratings yet

- Define PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project ManagementDocument4 pagesDefine PERT and CPM in Project Management and Its Importance and PROS and Cons of Pert and CPM in Project Managementbaskar rajuNo ratings yet

- CHP 3 Insurer Ownership, Financial & - Operational StructureDocument24 pagesCHP 3 Insurer Ownership, Financial & - Operational StructureIskandar Zulkarnain Kamalluddin100% (1)

- Confederation of All India Traders Confederation of All India Traders Confederation of All India TradersDocument2 pagesConfederation of All India Traders Confederation of All India Traders Confederation of All India TradersSatya Prakash SinghNo ratings yet

- Glossary: A/B TestDocument10 pagesGlossary: A/B TestfnskllsdknfslkdnNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 2Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 2DM MontefalcoNo ratings yet

- Marketing Analsyis For Fish Farming BusinessDocument12 pagesMarketing Analsyis For Fish Farming BusinessNabeel AhmadNo ratings yet

- Vision: WWW - Visionias.inDocument19 pagesVision: WWW - Visionias.inDivyanshu SinghNo ratings yet

- Hacof Company Profile 2021 Revised 8Document12 pagesHacof Company Profile 2021 Revised 8Ahmed HanadNo ratings yet

- Tata Technologies IPO PDF 201123Document1 pageTata Technologies IPO PDF 201123Hitesh PhulwaniNo ratings yet

- Wind Turbine Operation and Maintenance Literature ReviewDocument4 pagesWind Turbine Operation and Maintenance Literature Reviewwaleedishaque50% (2)

- Advanced Manufacturing Tutorial AnswersDocument12 pagesAdvanced Manufacturing Tutorial Answerswilfred chipanguraNo ratings yet

- Imp Question Listing Inter Nov 23 ExamDocument3 pagesImp Question Listing Inter Nov 23 Examg6rb6nz0No ratings yet

- Data File Barang BajuDocument12 pagesData File Barang BajuRian YongNo ratings yet

- Thesis Statement Examples For Child LaborDocument7 pagesThesis Statement Examples For Child Laborafbtbegxe100% (2)

- Dream Construction Profile 9.9Document8 pagesDream Construction Profile 9.9virNo ratings yet

- E41.50.530.N Avril2011 ENDocument14 pagesE41.50.530.N Avril2011 ENEhsan Arbabtafti100% (1)