Professional Documents

Culture Documents

Solved Efficient Diversification Part 2

Uploaded by

ana lisa melano0 ratings0% found this document useful (0 votes)

13 views3 pagesSolved Efficient Diversification part 2(1) (5)

Original Title

Solved Efficient Diversification part 2(1) (5)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSolved Efficient Diversification part 2(1) (5)

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesSolved Efficient Diversification Part 2

Uploaded by

ana lisa melanoSolved Efficient Diversification part 2(1) (5)

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

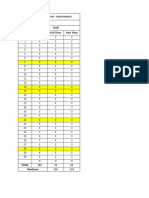

A B C D E F G H I

8 Rates of Return Deviations from Average Returns Product of Deviations

9 Year Stock Fund Bond Fund Stock Fund Bond Fund

10 2006 30.17 5.08 20.17 0.08 1.53

11 2007 32.97 7.52 22.97 2.52 57.78

12 2008 21.04 -8.82 11.04 -13.82 -152.56

13 2009 -8.1 5.27 -18.10 0.27 -4.82

14 2010 -12.89 12.20 -22.89 7.20 -164.75

15 2011 -28.53 -7.79 -38.53 -12.79 493.00

16 2012 22.49 6.38 12.49 1.38 17.18

17 2013 12.58 12.40 2.58 7.40 19.05

18 2014 14.81 17.29 4.81 12.29 59.05

19 2015 15.5 0.51 5.50 -4.49 -24.70

20

21 Average 10.00 5.00 Covariance 30.08

22 Variance 360.85 64.07 Correlation 0.20

23 Standard Deviation 19.00 8.00

24

25

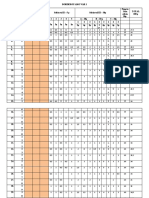

An Exercise

The following table present returns on various pairs of stocks in several periods. Draw scatter plots and find correlations

Table 1 Table 2 Table 3

Percentage Retruns Percentage Retruns Percentage Retruns

Stock 1 Stock 2 Stock 1 Stock 2 Stock 1 Stock 2

1 1 1 5 5 5

2 2 2 4 4 3

3 3 3 3 1 3

4 4 4 2 2 0

5 5 5 1 3 5

Perfect positive correlation perfect negative correlation positive correlation

1 -1 0.540062

Stock 2 Stock 2 Stock 2

6 6 6

5 5 5

4 4 4

3 3 3

2 2 2

1 1 1

0 0 0

0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5

Table 4

Percentage Retruns

Stock 1 Stock 2

5 4

4 3

1 1

2 0

3 5

positive correlation

0.686244

Stock 2

6

5

4

3

2

1

0

0 1 2 3 4 5 6

You might also like

- Kool & The Gang - Get Down On ItDocument7 pagesKool & The Gang - Get Down On Italfredo veraNo ratings yet

- R Lab - Probability DistributionsDocument10 pagesR Lab - Probability DistributionsPranay PandeyNo ratings yet

- Marine Corps Institute: Corrections Job AidDocument96 pagesMarine Corps Institute: Corrections Job AidUnited States Militia100% (1)

- Analysis of VarianceDocument52 pagesAnalysis of VarianceNgọc Yến100% (1)

- JUMP Math AP Book 3-1 Sample OA3-10 To 14 - 2Document15 pagesJUMP Math AP Book 3-1 Sample OA3-10 To 14 - 2Sónia RodriguesNo ratings yet

- EViews 3rd Week Assignment With SolutionDocument26 pagesEViews 3rd Week Assignment With SolutionFagbola Oluwatobi Omolaja100% (2)

- Manha de Carnaval 1 by Luis Bonfa PDFDocument2 pagesManha de Carnaval 1 by Luis Bonfa PDFPhuongNguyễnNo ratings yet

- Stats For Primary FRCADocument7 pagesStats For Primary FRCAtomlawson88No ratings yet

- Hallelujah: Jake ShimabukuroDocument7 pagesHallelujah: Jake ShimabukuroMenta PoleoNo ratings yet

- Modulo ArtDocument49 pagesModulo ArtAbbygail PingolNo ratings yet

- Break-Out Session 3b Winner PLC Salary Discrimination?: Kristin Fridgeirsdottir Data Analytics For LeadersDocument6 pagesBreak-Out Session 3b Winner PLC Salary Discrimination?: Kristin Fridgeirsdottir Data Analytics For LeadersEklilEklildzNo ratings yet

- Panen - Trial SubangDocument30 pagesPanen - Trial Subangpoed28No ratings yet

- Panelis Kodesampel / Konsentrasi 415 704 490 998 643 218 0,6 % 0% 0,2 % 0,4 % 0,8 % 1%Document2 pagesPanelis Kodesampel / Konsentrasi 415 704 490 998 643 218 0,6 % 0% 0,2 % 0,4 % 0,8 % 1%Andika PrasetiaNo ratings yet

- Data Uji Ambang RasaDocument2 pagesData Uji Ambang RasaAndika PrasetiaNo ratings yet

- Participant Number Loyalty Brand Product ShoppingDocument4 pagesParticipant Number Loyalty Brand Product Shoppingsaswat1953419No ratings yet

- Taller 11Document2 pagesTaller 11angie_varela8511No ratings yet

- Length of Fish (CM) : NB: This Data Is For Tutorial Demonstration Only and SHOULD NOT Be Included in The Lab Write Up!!!Document8 pagesLength of Fish (CM) : NB: This Data Is For Tutorial Demonstration Only and SHOULD NOT Be Included in The Lab Write Up!!!Caitlin StuartNo ratings yet

- Tabel MPNDocument1 pageTabel MPNDiah RahmawatiNo ratings yet

- Training in September 2019.1Document44 pagesTraining in September 2019.1Xuân Huy HoàngNo ratings yet

- Taller 11Document2 pagesTaller 11angie_varela8511No ratings yet

- Validitsa RelibailitasDocument16 pagesValiditsa RelibailitasFajar Yumanhadi AripinNo ratings yet

- Certamen 22Document5 pagesCertamen 22Barbara BrevisNo ratings yet

- Business Statistics - ViconDocument24 pagesBusiness Statistics - ViconIndra VirnandiNo ratings yet

- Tugas Beer GameDocument9 pagesTugas Beer GameFithNo ratings yet

- Conteo de Personal de ObraDocument19 pagesConteo de Personal de ObraDAYANA BARRERANo ratings yet

- Data Set For MRDocument8 pagesData Set For MRharyroyNo ratings yet

- Contoh Simulasi Grocery CheckoutDocument11 pagesContoh Simulasi Grocery CheckoutandikaNo ratings yet

- Weekly Kpi Report Nov-3Document4 pagesWeekly Kpi Report Nov-3C21fg AmazonNo ratings yet

- TABELUL 2 NTG STAS 1991 Analiza ApeiDocument1 pageTABELUL 2 NTG STAS 1991 Analiza Apeiionela21tmNo ratings yet

- BRM Endterm 2022-24 (Hitesh - Section B)Document10 pagesBRM Endterm 2022-24 (Hitesh - Section B)hitesh pandeyNo ratings yet

- HUMILITY!!!!!! Segregation Always Often Sometimes Never: Overall Total 45 67 67 44Document4 pagesHUMILITY!!!!!! Segregation Always Often Sometimes Never: Overall Total 45 67 67 44Do ReynaNo ratings yet

- LPNHSAlmanzaFOS2nd2019 20Document80 pagesLPNHSAlmanzaFOS2nd2019 20Nhet Esteva AbalNo ratings yet

- Demand Prob Cumu. Pr. Lower Demand InventoryDocument39 pagesDemand Prob Cumu. Pr. Lower Demand InventoryMay YANNo ratings yet

- PDP Small PDP Big Enermax Megamix Crackcorn GF 2K 7 Kinds BSCDocument4 pagesPDP Small PDP Big Enermax Megamix Crackcorn GF 2K 7 Kinds BSCjanica rose maloloy-onNo ratings yet

- Comparação de MétodosDocument10 pagesComparação de MétodoszeleaoNo ratings yet

- Token Loot Distribution V3Document2 pagesToken Loot Distribution V3Gabriele RaimondoNo ratings yet

- Fractal ImplosionDocument5 pagesFractal ImplosionQuentin LandoltNo ratings yet

- Fractal ImplosionDocument5 pagesFractal ImplosionjohnNo ratings yet

- 9 Sonata K.11/L.352 K.11/L.352: Domenico Scarlatti DDocument6 pages9 Sonata K.11/L.352 K.11/L.352: Domenico Scarlatti DchenchenNo ratings yet

- Happiness Sample 2022 (Prac)Document22 pagesHappiness Sample 2022 (Prac)Nguyễn GiangNo ratings yet

- FHC Data EntryDocument19 pagesFHC Data EntryLittle DevilNo ratings yet

- De Volta Pro AconchegoDocument2 pagesDe Volta Pro AconchegoCauê BrisollaNo ratings yet

- Luiz Bonfa Original Solo GuitarDocument2 pagesLuiz Bonfa Original Solo GuitarDANYNo ratings yet

- Chir13012 - l9Document17 pagesChir13012 - l9api-450541389No ratings yet

- Data Pengerjaan Harian Teknisi Aircon Solution 2023Document25 pagesData Pengerjaan Harian Teknisi Aircon Solution 2023rusmin aircon solutionNo ratings yet

- AppendicesDocument59 pagesAppendicesJea Rizelle InguilloNo ratings yet

- Isometric Splits - PNFDocument3 pagesIsometric Splits - PNFನವೀನ್ ಎಲ್ ಭಂಡಾರಿNo ratings yet

- Practical Data CollectionDocument19 pagesPractical Data CollectionMa Pamela RicardelNo ratings yet

- Excel Kesuaian Resep Dengan Formularium Mei 2021Document14 pagesExcel Kesuaian Resep Dengan Formularium Mei 2021Auliya Ma'ruf AzisNo ratings yet

- Data 5Document12 pagesData 5Albert CamachoNo ratings yet

- UntitledDocument3 pagesUntitledKimNgan PhamNo ratings yet

- Cab Exam PracticeDocument6 pagesCab Exam Practice9890 Adnan Ivna Kashem BNo ratings yet

- Consultant Manpower - HilaliDocument8 pagesConsultant Manpower - HilaliShine GopalNo ratings yet

- Study 26 in A Major by Dionisio AguadoDocument3 pagesStudy 26 in A Major by Dionisio AguadochenchenNo ratings yet

- Trabajo Lumiric: Yi Simple (Fi) Acumulada (Fi) Simple (Hi)Document8 pagesTrabajo Lumiric: Yi Simple (Fi) Acumulada (Fi) Simple (Hi)Ricardo Abel VasquezNo ratings yet

- Inst. HFC Inst. Hub Inst. TV Alt. S 1p Alt. S 2p Manut Man.D/FDocument2 pagesInst. HFC Inst. Hub Inst. TV Alt. S 1p Alt. S 2p Manut Man.D/FJorge FarinhaNo ratings yet

- Inverse Multi FileterDocument3 pagesInverse Multi FileterKaju KatliNo ratings yet

- JanuariDocument6 pagesJanuariBima AditamaNo ratings yet

- JanuariDocument6 pagesJanuariBima AditamaNo ratings yet

- Validitas Kuisoner 1Document9 pagesValiditas Kuisoner 1Iqbal PutraNo ratings yet

- Sample Data AnalysisDocument6 pagesSample Data AnalysisDarleneNo ratings yet

- Chart TitleDocument4 pagesChart TitleSasuke UchihaNo ratings yet

- Borderou PUNCTAJ AMG 2021Document4 pagesBorderou PUNCTAJ AMG 2021Mara RusuNo ratings yet

- Solution Assignment 1Document11 pagesSolution Assignment 1ana lisa melanoNo ratings yet

- Solved Efficient Diversification Part 1Document5 pagesSolved Efficient Diversification Part 1ana lisa melanoNo ratings yet

- Final Exam Selected Topics IIIDocument8 pagesFinal Exam Selected Topics IIIana lisa melanoNo ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part IIDocument6 pagesSolved Exercises - The Capital Asset Pricing Model Part IIana lisa melanoNo ratings yet

- Exercise - Option Market - Part 2Document3 pagesExercise - Option Market - Part 2ana lisa melanoNo ratings yet

- Solved Exercises - Options Market Part 3Document3 pagesSolved Exercises - Options Market Part 3ana lisa melanoNo ratings yet

- Bombardier Q12021 Quarterly Report enDocument55 pagesBombardier Q12021 Quarterly Report enana lisa melanoNo ratings yet

- Solved Exercises - Options Market Part 3Document6 pagesSolved Exercises - Options Market Part 3ana lisa melanoNo ratings yet

- Solved Exercises - The Capital Asset Pricing Model Part 1Document3 pagesSolved Exercises - The Capital Asset Pricing Model Part 1ana lisa melanoNo ratings yet

- Bombardier Financial Report 2018 enDocument260 pagesBombardier Financial Report 2018 enana lisa melanoNo ratings yet

- Bombardier Financial Report 2019 enDocument236 pagesBombardier Financial Report 2019 enana lisa melanoNo ratings yet

- Probability & Statistics: DefinationDocument3 pagesProbability & Statistics: DefinationSufi TechNo ratings yet

- STAT - Lec.2 - Measures of Centeral Tendency - Measures of Dispersion.Document33 pagesSTAT - Lec.2 - Measures of Centeral Tendency - Measures of Dispersion.Salma Hazem100% (1)

- Latin Square Design Stat-301&stat-512Document7 pagesLatin Square Design Stat-301&stat-512Raksha SandilyaNo ratings yet

- 3 - ReliabilityDocument38 pages3 - ReliabilityJhunar John TauyNo ratings yet

- STTN115 - 1st Opp Exam 2021 EngDocument13 pagesSTTN115 - 1st Opp Exam 2021 EngAngelNo ratings yet

- Probability and Statistics Mat 271EDocument50 pagesProbability and Statistics Mat 271Egio100% (1)

- Introductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Document7 pagesIntroductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Bill Ramos100% (2)

- Statistical Learning Methods Applied To Process Monitoring An Overview and Perspective - JQT - 2016 PDFDocument24 pagesStatistical Learning Methods Applied To Process Monitoring An Overview and Perspective - JQT - 2016 PDFCarlos Dario CristianoNo ratings yet

- Finite PopulationsDocument4 pagesFinite PopulationsNguyễn TrangNo ratings yet

- Problems On Hypothesis TestingDocument2 pagesProblems On Hypothesis TestingFarzana AlamgirNo ratings yet

- Class Limits Class Boundaries Class Mark/MidpointDocument10 pagesClass Limits Class Boundaries Class Mark/MidpointrollramsNo ratings yet

- Project #3 Hypothesis Testing ProjectDocument2 pagesProject #3 Hypothesis Testing ProjectVENKAT SAI PENCHALANo ratings yet

- Chi-Square Test For Feature Selection in Machine LearningDocument15 pagesChi-Square Test For Feature Selection in Machine LearningAmit PhulwaniNo ratings yet

- RCBD CRD Anovas LSD Using ExcelDocument4 pagesRCBD CRD Anovas LSD Using ExcelMuhammad AnasNo ratings yet

- CL 3 - Set 1Document4 pagesCL 3 - Set 1Amirul MukhlisNo ratings yet

- International Airline Passengers International Airline PassengersDocument8 pagesInternational Airline Passengers International Airline PassengersngojchieernNo ratings yet

- Estimation From Sample Data: Introductory Business StatisticsDocument19 pagesEstimation From Sample Data: Introductory Business StatisticsKavilashini SubramaniamNo ratings yet

- IEM 4103 Quality Control & Reliability Analysis IEM 5103 Breakthrough Quality & ReliabilityDocument46 pagesIEM 4103 Quality Control & Reliability Analysis IEM 5103 Breakthrough Quality & ReliabilityHello WorldNo ratings yet

- SVM PresentationDocument27 pagesSVM Presentationneeraj12121No ratings yet

- Business Statistics: Session 2Document60 pagesBusiness Statistics: Session 2HARI SINGH CHOUHANNo ratings yet

- Conditional Power of One Proportion Tests PDFDocument7 pagesConditional Power of One Proportion Tests PDFscjofyWFawlroa2r06YFVabfbajNo ratings yet

- Kang Demand Forecasting of New Products Using Attribute AnalysisDocument46 pagesKang Demand Forecasting of New Products Using Attribute AnalysisMuntaquir Hasnain100% (1)

- Stats 250 W17 Exam 2 For PracticeDocument13 pagesStats 250 W17 Exam 2 For PracticeAnonymous pUJNdQNo ratings yet

- Decomposition of Time SeriesDocument3 pagesDecomposition of Time Seriesjohn949No ratings yet

- Chi-Square As A Statistical TestDocument27 pagesChi-Square As A Statistical TestjimmyNo ratings yet