Professional Documents

Culture Documents

SCM Assignment 2.1 CVP Analysis

Uploaded by

Maxine Constantino0 ratings0% found this document useful (0 votes)

18 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pageSCM Assignment 2.1 CVP Analysis

Uploaded by

Maxine ConstantinoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

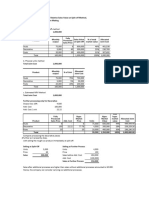

Assignment 2.

1 CVP Analysis (MG3)

Calculate the new breakeven point (in units, in pesos and as a percentage of capacity) under each of the following

independent assumptions as to changes in the different factors given the following tentative budgeted data: (3 points per

item)

Sales P300,000

Variable Cost 225,000

Fixed Cost 50,000

Net Profit 25,000

Selling Price P10

Break Even Point Break Even Point Break Even Point

Independent Situations

(units) (Peso) (Percentage)

1. Physical sales volume (units) will increase by

20,000.00 200,000.00 68%

30%

2. Sales price will increase by 20% 11,111.11 133,333.33 37.04%

3. Variable costs will increase by 6 2/3% as

42,500.00 425,000.00 141.67%

result of the increase in price of materials

4. Fixed costs will increase by 10% 22,000.00 220,000.00 73.33%

5. Contribution margin per unit will decrease by

25,000.00 250,000.00 83.33%

20%

6. Sales Price will increase by 30% and

10,526.32 136,842.00 46%

variable costs per unit will increase by 10%

7. Units to be sold will be decreased by 50% to

16,650.00 166,500.00 111%

offset an increase in fixed costs of P4,000

8. P3,000 of the fixed costs will be transferred

19,583.33 195,833.30 65.28%

to the total variable costs

9. P2,000 of the total variable costs will be

20,259.74 202,597.40 67.53%

transferred to fixed costs

10. The following changes will be made:

Units sold will increase by 12% 18,018.02 189,189.21 53.63%

Sales price will increase by 5%

Unit variable costs will increase by 3%

You might also like

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- 5th Homework FAR 1Document2 pages5th Homework FAR 1Ahmed RazaNo ratings yet

- Quiz On CVP AnalysisDocument9 pagesQuiz On CVP AnalysisRodolfo ManalacNo ratings yet

- Answer Key CVP AnalysisDocument9 pagesAnswer Key CVP AnalysisJaybert DumaranNo ratings yet

- Chapter 6-ExamplesDocument6 pagesChapter 6-ExamplesNguyen Tan AnhNo ratings yet

- Q1Document5 pagesQ1Thảo Hương PhạmNo ratings yet

- Solution Quiz 2 CostingDocument2 pagesSolution Quiz 2 Costingfarsi786No ratings yet

- Total Peso Sales Required 120,000 / (.25-0.1) 800,000 Less Prior Sales 400,000Document2 pagesTotal Peso Sales Required 120,000 / (.25-0.1) 800,000 Less Prior Sales 400,000kmarisseeNo ratings yet

- Unit 1 SCM Activities KEY Answer PDFDocument2 pagesUnit 1 SCM Activities KEY Answer PDFFernando III PerezNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- Cash+flow+estimation (14-1759)Document9 pagesCash+flow+estimation (14-1759)M shahjamal QureshiNo ratings yet

- CVP AnalysisDocument10 pagesCVP AnalysisHarold Beltran DramayoNo ratings yet

- On IdaDocument5 pagesOn IdaHiten SanganiNo ratings yet

- CVP VAnswer Practice QuestionsDocument5 pagesCVP VAnswer Practice QuestionsAbhijit AshNo ratings yet

- Bill French Google Docs Group 5Document7 pagesBill French Google Docs Group 5Jay Florence DalucanogNo ratings yet

- Week 6 HomeworkDocument9 pagesWeek 6 HomeworkMelanie RuizNo ratings yet

- Assignment 1-1Document19 pagesAssignment 1-1mishal zikriaNo ratings yet

- 1 - 4-1Document11 pages1 - 4-1sandeshjhanbia021No ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- Personal ProfileDocument13 pagesPersonal ProfileKristine Lei Del MundoNo ratings yet

- MAS - 1416 Profit Planning - CVP AnalysisDocument24 pagesMAS - 1416 Profit Planning - CVP AnalysisAzureBlazeNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Chapter 6Document28 pagesChapter 6Faisal Siddiqui0% (1)

- CVP Analysis Quiz and SolutionDocument18 pagesCVP Analysis Quiz and SolutionElaine Joyce GarciaNo ratings yet

- SOLUTION For Break Even Analysis Example ProblemDocument11 pagesSOLUTION For Break Even Analysis Example ProblemArly Kurt TorresNo ratings yet

- Practice Problem 2Document5 pagesPractice Problem 2panda 1No ratings yet

- Module 1.6 Forecasting Financial Statements Excercise ExcelDocument27 pagesModule 1.6 Forecasting Financial Statements Excercise Excelsachin kambhapuNo ratings yet

- International Finance: Lecturer: Nguyễn Vân Hà Student Name: Nguyễn Hoàng Trường ID: 18071260 Class: INS303204Document10 pagesInternational Finance: Lecturer: Nguyễn Vân Hà Student Name: Nguyễn Hoàng Trường ID: 18071260 Class: INS303204Nguyễn Hoàng TrườngNo ratings yet

- Problem 7-34 AbxcjasidhDocument1 pageProblem 7-34 AbxcjasidhrpztxNo ratings yet

- Breakeven Quiz 1 With SolutionDocument2 pagesBreakeven Quiz 1 With Solutionfarsi786No ratings yet

- FM Lab Week 8Document2 pagesFM Lab Week 8M shahjamal QureshiNo ratings yet

- Parameter List PDFDocument4 pagesParameter List PDFNaresh HingonikarNo ratings yet

- Quiz 2 Costing 23 AprilDocument2 pagesQuiz 2 Costing 23 Aprilfarsi786No ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- (Lecture 2 W2) Tuto Answer-Cost Classification - QADocument6 pages(Lecture 2 W2) Tuto Answer-Cost Classification - QAMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Consignment Sales Work BookDocument20 pagesConsignment Sales Work BookHannah NolongNo ratings yet

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Cart-2 + Production Unit FinalDocument4 pagesCart-2 + Production Unit Finalman789840No ratings yet

- COST VOLUME PROFIT ANALYSIS ExercisesDocument5 pagesCOST VOLUME PROFIT ANALYSIS ExercisesjenieNo ratings yet

- CPKDocument6 pagesCPKBilly GemaNo ratings yet

- Bill Assignment Report PDFDocument9 pagesBill Assignment Report PDFAJAY KUMARNo ratings yet

- 8th Homework CMADocument3 pages8th Homework CMAAhmed RazaNo ratings yet

- Far 06Document2 pagesFar 06ARISNo ratings yet

- CMA Exercises 1Document9 pagesCMA Exercises 1Ariel VenturaNo ratings yet

- Financial-Management Adil AliDocument15 pagesFinancial-Management Adil AliAdil AliNo ratings yet

- Year Sales Volume Sales VC FC DepDocument8 pagesYear Sales Volume Sales VC FC DepMohammad Umair SheraziNo ratings yet

- SFAD Week 1Document4 pagesSFAD Week 1Talha SiddiquiNo ratings yet

- Cost Classification-PQDocument7 pagesCost Classification-PQRomail QaziNo ratings yet

- Baldwin CompanyDocument4 pagesBaldwin CompanyShubham TetuNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- Working Papers in PPE UpdatedDocument29 pagesWorking Papers in PPE UpdatedTrisha VillegasNo ratings yet

- Maruti CaseDocument7 pagesMaruti Caseratneshdubey3No ratings yet

- The Trade and Climate Change Nexus: The Urgency and Opportunities for Developing CountriesFrom EverandThe Trade and Climate Change Nexus: The Urgency and Opportunities for Developing CountriesRating: 5 out of 5 stars5/5 (1)

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Summary of Corrections and ComplianceDocument1 pageSummary of Corrections and ComplianceMaxine ConstantinoNo ratings yet

- Impactof Accounting SoftwareDocument29 pagesImpactof Accounting SoftwareMaxine ConstantinoNo ratings yet

- International Trade TheoryDocument6 pagesInternational Trade TheoryMaxine ConstantinoNo ratings yet

- Assignment 4.2 Case Analysis of The Effect of Exchange RateDocument2 pagesAssignment 4.2 Case Analysis of The Effect of Exchange RateMaxine ConstantinoNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Chapter 1Document5 pagesChapter 1Maxine ConstantinoNo ratings yet

- Global Monetary SystemDocument8 pagesGlobal Monetary SystemMaxine ConstantinoNo ratings yet

- Management Accounting OverviewDocument27 pagesManagement Accounting Overviewfreya cuevasNo ratings yet

- MAN 010 Module 5Document2 pagesMAN 010 Module 5Maxine ConstantinoNo ratings yet

- Schedule MG2Document1 pageSchedule MG2Maxine ConstantinoNo ratings yet

- MAN 010 Module 5Document5 pagesMAN 010 Module 5Maxine ConstantinoNo ratings yet

- SOCSC Module 1 and 2Document4 pagesSOCSC Module 1 and 2Maxine ConstantinoNo ratings yet

- SCM 2nd RecitDocument5 pagesSCM 2nd RecitMaxine ConstantinoNo ratings yet

- MAN 010 Module 3 and 4Document4 pagesMAN 010 Module 3 and 4Maxine ConstantinoNo ratings yet

- MAN 010 Assignment 3Document1 pageMAN 010 Assignment 3Maxine ConstantinoNo ratings yet

- Chap 1 Scope N DelimiDocument1 pageChap 1 Scope N DelimiMaxine ConstantinoNo ratings yet

- MAN 010 Module 1Document8 pagesMAN 010 Module 1Maxine ConstantinoNo ratings yet

- Intended Learning Outcomes (Ilos)Document9 pagesIntended Learning Outcomes (Ilos)Mon RamNo ratings yet

- SCM Module 1Document5 pagesSCM Module 1Maxine ConstantinoNo ratings yet

- Assignment 1.1 Overview, Cost Concepts and Variable CostingDocument3 pagesAssignment 1.1 Overview, Cost Concepts and Variable CostingMaxine ConstantinoNo ratings yet

- Assignment 6.2 BIR Form 1702Document1 pageAssignment 6.2 BIR Form 1702Maxine ConstantinoNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Assignment 5.2 IA2Document4 pagesAssignment 5.2 IA2Maxine ConstantinoNo ratings yet

- RPH Mod 3 N 4Document26 pagesRPH Mod 3 N 4Maxine ConstantinoNo ratings yet

- Ais PPT Module 1Document6 pagesAis PPT Module 1Maxine ConstantinoNo ratings yet

- Assignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Document4 pagesAssignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Maxine ConstantinoNo ratings yet

- Ais Module 3Document13 pagesAis Module 3Maxine ConstantinoNo ratings yet

- Tutorial 4 SolutionsDocument4 pagesTutorial 4 SolutionsMADHAVI BARIYA100% (1)

- Employment Contract RevisedDocument5 pagesEmployment Contract RevisedTukneNo ratings yet

- Test Driven DevelopmentDocument26 pagesTest Driven DevelopmentAksam Ali KhalidNo ratings yet

- LPG Bunkering 2019Document74 pagesLPG Bunkering 2019ИгорьNo ratings yet

- Invoice Fendi LumajangDocument1 pageInvoice Fendi LumajangFendi KurniawanNo ratings yet

- MCQ's On Intellectual Property Act - SpeakHRDocument6 pagesMCQ's On Intellectual Property Act - SpeakHRTkNo ratings yet

- 2020 Rental Contract Draft PDFDocument5 pages2020 Rental Contract Draft PDFAdrian Paul E. AlcosNo ratings yet

- Kshitija's ResumeDocument1 pageKshitija's ResumeNavinNo ratings yet

- 3 MotivationDocument15 pages3 MotivationSona VikasNo ratings yet

- (Grade 8) 3C - Vocabulary ListDocument2 pages(Grade 8) 3C - Vocabulary ListClass LaceyNo ratings yet

- First Exam - System Analysis and DesignDocument2 pagesFirst Exam - System Analysis and DesignRod S Pangantihon Jr.0% (1)

- Instructions and Assumptions:: Bottles 1 Tranche (Rev) 2 Tranche (Rev) 3 Tranche (Rev) Total RevDocument2 pagesInstructions and Assumptions:: Bottles 1 Tranche (Rev) 2 Tranche (Rev) 3 Tranche (Rev) Total RevSIDDHARTH GAUTAMNo ratings yet

- The Impact of Body Art On EmploymentDocument2 pagesThe Impact of Body Art On EmploymentKathlyn BelistaNo ratings yet

- Smart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamDocument14 pagesSmart Locker - A Sustainable Urban Last-Mile Delivery Solution: Benefits and Challenges in Implementing in VietnamQuynh LeNo ratings yet

- VBL AR 2022 AnnualReportDocument378 pagesVBL AR 2022 AnnualReportPriya JalanNo ratings yet

- Longenecker19e PPT Ch03 FinalDocument44 pagesLongenecker19e PPT Ch03 FinalAhmad Al-RusasiNo ratings yet

- Presentation 4 - Basics of Capital Budgeting (Draft)Document27 pagesPresentation 4 - Basics of Capital Budgeting (Draft)sanjuladasanNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document29 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- The Northcap University Internship Report: TOPIC: Digital Marketing ManagementDocument11 pagesThe Northcap University Internship Report: TOPIC: Digital Marketing ManagementChirag GodaraNo ratings yet

- ICM-SU-5102-C.3 CV Selection & FabricationDocument67 pagesICM-SU-5102-C.3 CV Selection & FabricationShivani DubeyNo ratings yet

- The Effect of Information Privacy Concern On Users ' Social Shopping IntentionDocument15 pagesThe Effect of Information Privacy Concern On Users ' Social Shopping IntentionIzzuddin KarimiNo ratings yet

- Pitch Lake: Oiler Network May 2022Document8 pagesPitch Lake: Oiler Network May 2022lexiNo ratings yet

- Disconnection NoticeDocument2 pagesDisconnection NoticeDelyah FanninNo ratings yet

- Full Download Essentials of Contract Law 2nd Edition Frey Solutions ManualDocument13 pagesFull Download Essentials of Contract Law 2nd Edition Frey Solutions Manualswooning.sandman.xjadd2100% (38)

- Due Process LaborDocument7 pagesDue Process LaborbrownboomerangNo ratings yet

- Mindtree SA IndAS 1Q21Document41 pagesMindtree SA IndAS 1Q21sh_chandraNo ratings yet

- Outcome Vs Output Vs ImpactDocument2 pagesOutcome Vs Output Vs ImpactPavitra Tandon100% (1)

- Customer Operated Machines 2021-02-26.enDocument42 pagesCustomer Operated Machines 2021-02-26.ensharadNo ratings yet

- Mid-Term Exam Schedule For Spring 2023Document12 pagesMid-Term Exam Schedule For Spring 2023Kemale ZamanliNo ratings yet

- Policybrief: Redeem Policy Implementation in Uganda by Takling The Political QuestionDocument4 pagesPolicybrief: Redeem Policy Implementation in Uganda by Takling The Political Questionwycliff brancNo ratings yet

- Session 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesDocument12 pagesSession 3: Creating Accounting Masters in Tally - ERP 9: Go To Gateway of Tally Press F11: FeaturesAfritam UgandaNo ratings yet

- IMS Checklist 5 - Mod 4Document9 pagesIMS Checklist 5 - Mod 4Febin C.S.No ratings yet