Professional Documents

Culture Documents

Account: 1. Double Entry System

Uploaded by

Gautham SajuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Account: 1. Double Entry System

Uploaded by

Gautham SajuCopyright:

Available Formats

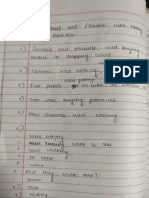

1.

DOUBLE ENTRY SYSTEM

For every transaction, two parties are required. Between these parties there is

the exchange of equal values. Accordingly, every transaction has two aspects or

elements or effects. One is receiving aspect and the other is giving aspect. The

receiving aspect of a transaction is known as debit and the giving aspect of the

transaction is known as credit. Thus every transaction has two aspects, namely debit

aspect and credit aspect.

For example, when A sells goods to B for Rs. 20,000, A exchanges goods for money.

A gets money and he gives away goods. In this transaction, cash is the receiving

aspect (debit) and goods is the giving aspect (credit).

In order to record a transaction completely, it is necessary to record both

aspects of the transaction. The method of recording the two fold aspects of every

transaction is called double entry system. Thus, “every debit has an equal and

corresponding credit”. To conclude, double entry system is the system of recording

both aspects of every transaction in order to maintain the equality between debit and

credit

2. Account

Every business transaction has two aspects. Each aspect has an account. An account is

summary of business transactions for a particular period of time.

Types or Classification of Accounts

Personal Account

Real Account

Nominal Account

Personal Account

Personal accounts itself refer to a name of person and it represents an Individual or

Company or any Organization. Personal account may be of the following three types:

1. Natural Personal Accounts

2. Artificial Personal Accounts

3. Representative Personal Accounts

1. Natural Personal Accounts: Natural Persons are human beings. Therefore, we include

the accounts belonging to them under this head.

For Example, Midhun’s account , Joseph’s account etc.

2. Artificial Personal Accounts: Artificial persons are not human beings but can act and

work like humans. They have a separate identity in the eyes of law and are capable to

enter into agreements.

These include H.U.F, partnership firms, insurance companies, co-operative societies,

companies, municipal corporations, hospitals, banks, government bodies, etc. For

example, Bank of Baroda, Oriental Insurance Co,

3. Representative Personal Accounts: These accounts represent the accounts of natural

or artificial persons. When the expenses become outstanding or pre-paid and incomes

become accrued or unearned, they fall under this category. For example, Outstanding

Salary A/c, Pre-paid Rent A/c, Accrued Interest A/c, Unearned Brokerage A/c, etc.

Rules of Personal Accounts

If a person receive something in cash or goods, transaction will be debited and if a

person gives something in cash or goods, than transaction will be credited.

Debit the receiver

Credit the giver

Real Accounts

Real Accounts refer to an assets owned or possessed by business. This real accounts

reveals the valuation and movement of assets that occurred between firm and other

parties. Assets can be real assets or intangible assets. Real account may be of the

following two types:

1. Tangible Real Account: It consists of assets, properties or possessions that can be

touched, seen and measured. For example, Plant A/c, Furniture and Fixtures A/c,

Cash A/c, etc.

2. Intangible Real Account: It consists of assets or possessions that cannot be touched,

seen and measured but possess a monetary value and thus can be purchased and sold

also. For example, Goodwill, Patents, Copyrights, etc.

Rules of Real Accounts

The assets that are coming in to business, transaction will be debited. If the assets are

going out of business, than the transaction will be credited.

Debit what comes in

Credit what goes out

Nominal accounts

Nominal accounts are temporary accounts that related to incomes, expenses. revenues

and losses of business. Nominal accounts are mainly deal with the amount of income

earned and expenses/costs incurred. It records all expenses and incomes which are not

carried forward to future.

E.g. of Nominal Accounts: – Sales, cost of goods, rent, interest, etc

Rules of Nominal Accounts

The expenses and losses of business transactions are debited, and the gains and profits of

business are credited.

Debit all expenses and losses

Credit all gains and profits.

3.

Rules For Real Accounts Personal Accounts Nominal Accounts

Accounting

Debit What comes in The Receiver Expenses and Loses

Credit What goes out The Giver Incomes and Gains

4. Trading account

All the direct expenses are taken on the debit side of trading account

Opening stock on the debit side, closing stock on credit side

Purchases on debit side

Sales on credit side

Purchases returns is deducted from purchases

Sales returns is deducted from sales

5. Marginal costing

marginal cost is a variable cost

marginal costing is a special technique of costing

it supplies necessary information to management, to enable it to study the

side effect on profit of changes in volume

the management solves a wide variety of problems by applying the

technique of marginal costing

in marginal costing only variable cost is considered

6. BEP

It is the point or level of activity at which there is no profit no loss

It means total cost= total revenue or total sales

Bep in units=fixed expenses/contribution/unit

Bep in sales=Fixed expenses/contribution* sales

7. Profit volume ratio

p/v ratio=contribution/sales

or

change in profit/contribution/change in sales

8. margin of safety

The margin of safety is the difference between the amount of expected

profitability and the break-even point

You might also like

- FIA-FA1 NotesDocument37 pagesFIA-FA1 NotesAbdul Rehman QureshiNo ratings yet

- Tally Notes: AccountingDocument49 pagesTally Notes: AccountingAshwin KumarNo ratings yet

- RH Consult - Training AcctDocument13 pagesRH Consult - Training Acctjoseph borketeyNo ratings yet

- Unit-5 of Accounting For ManagerDocument70 pagesUnit-5 of Accounting For Managerklrahulprasad112No ratings yet

- FA UNIT 2Document28 pagesFA UNIT 2VTNo ratings yet

- AccountDocument37 pagesAccountGaurang MakwanaNo ratings yet

- accountancy III yr.docDocument24 pagesaccountancy III yr.docdrismailkm20No ratings yet

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocument44 pagesBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- Bank Financial Management BasicsDocument78 pagesBank Financial Management BasicsAksNo ratings yet

- Classification of AccountsDocument12 pagesClassification of AccountsNaurah Atika DinaNo ratings yet

- Accounting Concepts, Conventions, Terms ExplainedDocument25 pagesAccounting Concepts, Conventions, Terms ExplainedVen KatNo ratings yet

- Accounting SystemDocument5 pagesAccounting SystemJayanta SinghaNo ratings yet

- MC1404 - Unit 2Document111 pagesMC1404 - Unit 2Senthil KumarNo ratings yet

- Traditional vs Modern Account ClassificationDocument4 pagesTraditional vs Modern Account ClassificationManan MunshiNo ratings yet

- Basics of Accounting: Chapter Two Basic of Accounting Types and Golden Rules of AccountingDocument15 pagesBasics of Accounting: Chapter Two Basic of Accounting Types and Golden Rules of AccountingTausif RazaNo ratings yet

- Tally Notes Computer Training - Sscstudy PDFDocument49 pagesTally Notes Computer Training - Sscstudy PDFfreelancertech Nepal100% (1)

- Book KeepingDocument11 pagesBook KeepingRocket SinghNo ratings yet

- Fundamentals of AccountingDocument9 pagesFundamentals of AccountingJason Marites RicaldeNo ratings yet

- Double Entry Book Keeping SystemDocument14 pagesDouble Entry Book Keeping SystemVisakh Vignesh100% (1)

- Unit 1 TAPDocument19 pagesUnit 1 TAPchethanraaz_66574068No ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- An Introduction To AccountingDocument20 pagesAn Introduction To AccountingRocket SinghNo ratings yet

- Course Pack (FOA)Document114 pagesCourse Pack (FOA)Ghufran KhanNo ratings yet

- Basics of Accounting and Book KeepingDocument16 pagesBasics of Accounting and Book KeepingPuneet DhuparNo ratings yet

- Accounting TermsDocument14 pagesAccounting TermsNishi YadavNo ratings yet

- Basics of AccountingDocument82 pagesBasics of AccountingDivyaNo ratings yet

- Tally ERP9Document68 pagesTally ERP9Jinesh100% (1)

- Tally Lesson 1Document13 pagesTally Lesson 1kumarbcomca100% (1)

- Introduction To Accounting BasicsDocument25 pagesIntroduction To Accounting BasicsBaktash Ahmadi100% (1)

- Identifying and Analyzing Business TransactionsDocument2 pagesIdentifying and Analyzing Business TransactionsMardy DahuyagNo ratings yet

- Frsa Theory Notes Unit IDocument7 pagesFrsa Theory Notes Unit ISuganesh NetflixNo ratings yet

- Journal EntriesDocument8 pagesJournal Entriesrayyan64003No ratings yet

- Basic NoteDocument8 pagesBasic Noteworld2learnNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 3 and 4Document5 pagesAccountancy Notes PDF Class 11 Chapter 3 and 4Rishi ShibdatNo ratings yet

- Break-Even Point:c: CC CC CCCCCCCCC CCC CCCCCCCCC C C CCC C CCCC CCCCC C CCCCC CCCCCCCCC C CCCDocument8 pagesBreak-Even Point:c: CC CC CCCCCCCCC CCC CCCCCCCCC C C CCC C CCCC CCCCC C CCCCC CCCCCCCCC C CCCchanduanu2007No ratings yet

- Download the original attachment - The complete basics of accountingDocument32 pagesDownload the original attachment - The complete basics of accountingvijayNo ratings yet

- 1 Understanding and Analyzing Business TransactionsDocument2 pages1 Understanding and Analyzing Business Transactionsapi-299265916No ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- CRT - Accounting BasicsDocument28 pagesCRT - Accounting BasicsSiddarth Hari AnantaneniNo ratings yet

- Financial Accounting TheoryDocument14 pagesFinancial Accounting TheoryNimalanNo ratings yet

- Accounting and Financial MangementDocument25 pagesAccounting and Financial MangementSHASHINo ratings yet

- The Original Attachment: BasicsDocument32 pagesThe Original Attachment: BasicsVijayGogulaNo ratings yet

- Accounting Principles Lecture-3Document5 pagesAccounting Principles Lecture-3shivani chhipaNo ratings yet

- Accounting BasicsDocument59 pagesAccounting BasicsLovemore MalakiNo ratings yet

- Ournal Ledger Trial Balance: Basic Accounting Mechanics: Rules of Debit and CreditDocument13 pagesOurnal Ledger Trial Balance: Basic Accounting Mechanics: Rules of Debit and CreditNaman JainNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- BASIC ACCOUNTING PROCEDURESDocument35 pagesBASIC ACCOUNTING PROCEDURESjune100% (1)

- Tally ERP9Document68 pagesTally ERP9sah100% (10)

- Chapter # 1 Business TransactionDocument22 pagesChapter # 1 Business TransactionWaleed NasirNo ratings yet

- Unit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingDocument5 pagesUnit-1:-Introduction of Financial Management Accounting, Book Keeping & RecordingShradha KapseNo ratings yet

- Basic AccountingDocument13 pagesBasic AccountingPavan Kumar RNo ratings yet

- Double Entry SystemDocument12 pagesDouble Entry SystemANKUR GOGOINo ratings yet

- Accounting Training OverviewDocument74 pagesAccounting Training Overviewzee_iitNo ratings yet

- Journal: Double Entry System of AccountingDocument17 pagesJournal: Double Entry System of AccountingBole ShubhamNo ratings yet

- Acc PDFDocument61 pagesAcc PDFSmarika BistNo ratings yet

- Mba AssignmentsDocument8 pagesMba AssignmentsRamani RajNo ratings yet

- Wiley Notes Chapter 2Document7 pagesWiley Notes Chapter 2hasanNo ratings yet

- Unit IiDocument20 pagesUnit IinamianNo ratings yet

- Pyrami DLP Yr PRM Amstrn TRNG Srever Base Convre Ser Form Cool PrinterDocument1 pagePyrami DLP Yr PRM Amstrn TRNG Srever Base Convre Ser Form Cool PrinterGautham SajuNo ratings yet

- ReportDocument1 pageReportGautham SajuNo ratings yet

- Construction of DFADocument9 pagesConstruction of DFAGautham SajuNo ratings yet

- MatrixDocument19 pagesMatrixGautham SajuNo ratings yet

- Consider Brainstorming and Outlining As Effective PreDocument5 pagesConsider Brainstorming and Outlining As Effective PreGautham SajuNo ratings yet

- Nirmala College Car Showroom Management ProjectDocument43 pagesNirmala College Car Showroom Management ProjectGautham SajuNo ratings yet

- CDocument21 pagesCGautham SajuNo ratings yet

- CssDocument4 pagesCssGautham SajuNo ratings yet

- WAITINGDocument1 pageWAITINGGautham SajuNo ratings yet

- SeminarDocument32 pagesSeminarGautham SajuNo ratings yet

- MytpcDocument1 pageMytpcGautham SajuNo ratings yet

- 24 HRDocument41 pages24 HRGautham SajuNo ratings yet

- The Past Progressive and The Simple Past: in LondonDocument3 pagesThe Past Progressive and The Simple Past: in LondonVioleta KrncevicNo ratings yet

- TT-First Sem BSCDocument5 pagesTT-First Sem BSCGautham SajuNo ratings yet

- Hardware and software specs for VB.NET hotel management systemDocument3 pagesHardware and software specs for VB.NET hotel management systemGautham SajuNo ratings yet

- Manage car showroom with 40-char systemDocument28 pagesManage car showroom with 40-char systemGautham SajuNo ratings yet

- What is CSS? - A guide to Cascading Style SheetsDocument5 pagesWhat is CSS? - A guide to Cascading Style SheetsAbhiNo ratings yet

- Hotel Project ReportDocument97 pagesHotel Project ReportGautham SajuNo ratings yet

- Algorith 1Document3 pagesAlgorith 1Gautham SajuNo ratings yet

- EnglishDocument2 pagesEnglishGautham SajuNo ratings yet

- Coding Question in C On NumbersDocument6 pagesCoding Question in C On NumbersGautham SajuNo ratings yet

- Use of Drone in Indian AgricultureDocument19 pagesUse of Drone in Indian AgricultureGautham Saju100% (1)

- Class XII Computer Project - Hotel ManagementDocument29 pagesClass XII Computer Project - Hotel ManagementLakshmi Puthiyedath71% (7)

- Audit Course QB-Disaster Management-OrderDocument36 pagesAudit Course QB-Disaster Management-OrderGautham SajuNo ratings yet

- Introduction To Drone TechnologyDocument20 pagesIntroduction To Drone TechnologyGautham SajuNo ratings yet

- II Sem HTML & CDocument2 pagesII Sem HTML & CGautham SajuNo ratings yet

- NCAS NoticeDocument1 pageNCAS NoticeGautham SajuNo ratings yet

- Basics of Web Design, Development and StandardsDocument27 pagesBasics of Web Design, Development and StandardsGautham SajuNo ratings yet

- Bca Unit IiDocument58 pagesBca Unit IiGautham SajuNo ratings yet

- CERC Guidelines For Power Projects: Under The Guidance of Prof Gireesh TripathyDocument30 pagesCERC Guidelines For Power Projects: Under The Guidance of Prof Gireesh Tripathysatya61711100% (1)

- Johannes Kananen - The Nordic Welfare State in Three Eras - From Emancipation To Discipline (2014, Ashgate Publishing)Document219 pagesJohannes Kananen - The Nordic Welfare State in Three Eras - From Emancipation To Discipline (2014, Ashgate Publishing)MelanieNo ratings yet

- Ielts WritingDocument10 pagesIelts WritingJung AuLiaNo ratings yet

- Course Instructor: Manish Chauhan: 410-MCC-UMDocument41 pagesCourse Instructor: Manish Chauhan: 410-MCC-UMLlanraeyNo ratings yet

- Macroeconomics VII: Aggregate Supply: Gavin Cameron Lady Margaret HallDocument18 pagesMacroeconomics VII: Aggregate Supply: Gavin Cameron Lady Margaret HallTendai MatsikureNo ratings yet

- Rizal's Family Conflict Over Calamba HaciendaDocument5 pagesRizal's Family Conflict Over Calamba HaciendaAngelo OñedoNo ratings yet

- Ifrs 9 PresentationDocument26 pagesIfrs 9 PresentationJean Damascene HakizimanaNo ratings yet

- Crespo Logistics QuestionerDocument21 pagesCrespo Logistics QuestionerJulie CrespoNo ratings yet

- USD/PKR Forecast Blog Post Predicts Currency Rate RiseDocument79 pagesUSD/PKR Forecast Blog Post Predicts Currency Rate RiseSaira WaqasNo ratings yet

- Registered Post: On 29 Sep 2022 Vide This Officeletter No. 8926/07/E8 DT 29 Sep 2022. andDocument1 pageRegistered Post: On 29 Sep 2022 Vide This Officeletter No. 8926/07/E8 DT 29 Sep 2022. andSunil SalunkeNo ratings yet

- Big Tree Inv TNL-SHW-CPVDocument14 pagesBig Tree Inv TNL-SHW-CPVClick PixelNo ratings yet

- Ch 2 review questionsDocument3 pagesCh 2 review questionsMarienella MarollanoNo ratings yet

- Ch12 Segment Reporting and DecentralizationDocument84 pagesCh12 Segment Reporting and DecentralizationMaricar CachilaNo ratings yet

- TDS - Troykyd D704Document2 pagesTDS - Troykyd D704APEX SON100% (1)

- المصرف الإسلامي كآلية لتحقيق التنمية المستدامةDocument18 pagesالمصرف الإسلامي كآلية لتحقيق التنمية المستدامةAnna StephyNo ratings yet

- CH 7 The Production Process - The Behaviour of Profit Maximising FirmDocument32 pagesCH 7 The Production Process - The Behaviour of Profit Maximising FirmBhargav D.S.No ratings yet

- Company Profile QCSDocument29 pagesCompany Profile QCSsachinNo ratings yet

- Pakistan and Global Financial CrisisDocument12 pagesPakistan and Global Financial Crisiswaqas ghouri100% (2)

- Quo-Pantry & Tempat Whudu Musholla Control Room Utility - Tmmin Kp#1Document1 pageQuo-Pantry & Tempat Whudu Musholla Control Room Utility - Tmmin Kp#1gunawan sujiadiNo ratings yet

- Donation Request Form 03Document2 pagesDonation Request Form 03Mara DiasNo ratings yet

- Container Terminal Operational GuidelinesDocument30 pagesContainer Terminal Operational GuidelinesAbdelkader ChaouiNo ratings yet

- PDFViewerDocument2 pagesPDFViewerKunal GiriNo ratings yet

- ELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofDocument1 pageELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofCHANIELOU MARTINEZNo ratings yet

- Vessels Due at Outer Anchorage: The Chittagong Port Authority Dated: 22/04/2021 11:04:33Document14 pagesVessels Due at Outer Anchorage: The Chittagong Port Authority Dated: 22/04/2021 11:04:33Aseef AmeenNo ratings yet

- Arrow-Pak Retrievingtool: Specification GuideDocument7 pagesArrow-Pak Retrievingtool: Specification GuideTech AlfaNo ratings yet

- Tutorial 7Document6 pagesTutorial 7KÃLÅÏ SMÎLĒYNo ratings yet

- AI assignment_KAUR_GURNOOR (1)Document9 pagesAI assignment_KAUR_GURNOOR (1)gurnoorkaurgilllNo ratings yet

- Forecasting Costs for an Online RTW BusinessDocument17 pagesForecasting Costs for an Online RTW BusinessHoney Grace Dela Cerna100% (1)

- Pure Power - Opportunity Green OG25 Finalist 2010 - Sept 24, 2010Document6 pagesPure Power - Opportunity Green OG25 Finalist 2010 - Sept 24, 2010Opportunity Green ConferenceNo ratings yet

- Farm Supply Business Sales and ForecastsDocument65 pagesFarm Supply Business Sales and ForecastsIfechukwu AnunobiNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)