Professional Documents

Culture Documents

ACCC271 Class Test 1 2018

ACCC271 Class Test 1 2018

Uploaded by

Emai TetsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCC271 Class Test 1 2018

ACCC271 Class Test 1 2018

Uploaded by

Emai TetsCopyright:

Available Formats

QUESTION 1 32 MARKS

Louis Rossouw conducts a brick manufacturing business named Big Bricks (Pty) Ltd (‘Big

Bricks’). The company buys sand and rock from Sand and Rock Ltd and cement from PPC

Ltd. The cement is stored in silo’s ensuring that it is kept dry. Big Bricks applies IFRS for

SME’s as their financial reporting framework and they have a 30 June year end. Big Bricks is

not registered for VAT.

The process of manufacturing is as follows: The sand is spread evenly over a big steel plate

(50 square meters) about 50 to 100 mm thick. Then the cement and rock is evenly spread

over the sand. The cement, rock and sand are mixed until the colour of the mixture is

uniform. The mixture is then spread out again and water is sprinkled over the surface after

which it is mixed again. The process is repeated until the right amount of water has been

mixed into the mixture. The business uses hand mixing, which means that the rock, sand

and cement is mixed using shovels. The mixture has to be moist enough to bind together

when it is compacted, but not so wet that the blocks sag or come apart when the mould is

removed.

When the material is mixed and it contains the right amount of water, a mould is placed over

the mixture which moulds the mixture into bricks. One mixture normally makes a 1 000

bricks. The business can also make a partial mixture on specific orders and thus does not

always need to make full batches. The raw material mixture ratios however always remain

consistent. When cement is dispatched to production, all other raw material included in the

mixture, is also dispatched.

When the mould is removed, it has to be done very cautiously, to prevent the blocks from

cracking. After the blocks stayed on the production plate for three hours, it can be removed

and placed in the brick for curing. Curing is the process where the moist content and the

temperature of the bricks are regulated, to ensure hydration so that the cement reaches its

optimum level of strength. This process takes four hours. It takes place in a special brick

building, which contains the necessary equipment. There is one supervisor (Sam) who is

always in the building during production and who ensures that the correct temperature and

moist content is maintained. Due to the high risk that the bricks can crack if the temperature

or the moisture is not correct, Louis employed Sam as a permanent invigilator who earns R5

000 per month. In this way Louis can ensure that a knowledgeable person is always on duty.

The water bill amounted to R2 000 for the period 1 January 2018 to 28 February 2018. If no

bricks are produced then no water is needed. Direct labourers were paid R6 000 during the

two month period 1 January 2018 to 28 February 2018.

Louis budgeted to produce 2 000 bricks for the period 1 January 2018 to 28 February 2018.

One standard mixture uses 100kg of sand, 30kg of rock and 200kg of cement. He has one

silo which can store only 250kg of cement. The sand and rock is stored in a warehouse with

the capacity to house a total of 400kg of sand and 200kg of rock. Louis’s business is of such

a nature that he sometimes receives very little orders for bricks and then his cement goes

bad, resulting in him having to throw it away. Other times he receives so many orders that he

needs to refill the silo 5 to 6 times a month. This results in him not having enough cement on

ACCC271 2018 Class test 1 1/4

hand to fill his orders and then he sometimes only delivers the bricks about two weeks after

the time originally arranged with his client.

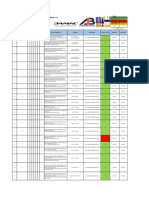

The business made the following purchases of cement during the year:

Date Number of kg Cost per kg

15 January 2018 200kg R50 per kg

27 January 2018 200kg R53 per kg

17 February 2018 250kg R60 per kg

Big Bricks experienced some cash flow issues in February and made a special arrangement

with the supplier to only make payment on 17 February 2019 for purchases made on

17 February 2018. An appropriate discount rate of 8% before tax, is applicable.

He issued the following quantities of cement to production:

Date Kg issued

20 January 2018 200kg

28 January 2018 150kg

15 February 2018 100kg

Bog Bricks makes use of the first-in-first-out method of valuation and carries his inventory at

the lowest of cost or net realisable value.

On 1 January 2018, both the sand and rock stores were full of inventory purchased at a cost

of R20/kg sand and R25/kg rock. Only 50kg of cement at a cost of R52/kg was on hand on

1 January 2018.

There were 500 completed bricks in inventory on 1 January 2018 of which the cost

amounted to R14 per brick and there were 600 completed bricks on hand on

28 February 2018.

No work in progress was on hand on 1 January 2018 or on 28 February 2018.

Big Bricks sells bricks for R15 each. Louis has also received a lot of queries from clients who

want to buy concrete blocks. After conducting some research, it appears that there is a

demand for around 1 000 concrete blocks per month which Louis will be able to sell for R125

each.

Louis has decided from next year to rather produce the concrete blocks instead of the bricks.

The bricks on hand at year ended 28 February 2018 will just be in his way and he is

prepared to sell them at a discount of 20% on the normal selling price to free up some

space. The production of concrete blocks makes use of the same type of raw material as the

production of bricks.

MARKS

REQUIRED:

Subtotal Total

(a) Prepare the following general ledger accounts for Big Bricks for the

two months ended 28 February 2018:

Round prices per unit to two decimal places. 32

ACCC271 2018 Class test 1 2/4

i. Sand; 4

ii. Rock; 3.5

iii. Cement; 7

iv. Work in progress;

7

v. Fixed manufacturing overheads; and

vi. Finished goods. 3

7.5

TOTAL MARKS 32

ACCC271 2018 Class test 1 3/4

You might also like

- Terminology Used in Construction TechnologyDocument3 pagesTerminology Used in Construction TechnologyAnantha Wijesinghe50% (2)

- Concrete Block Manufacturing ReportDocument45 pagesConcrete Block Manufacturing ReportSandeep Choudhury100% (2)

- Shipping Container Homes: A complete guide to designing and building a container homeFrom EverandShipping Container Homes: A complete guide to designing and building a container homeRating: 5 out of 5 stars5/5 (1)

- A Project Report On Finance of Stone CrusherDocument34 pagesA Project Report On Finance of Stone Crusherjockernitu69% (16)

- Fly Ash Building BricksDocument12 pagesFly Ash Building BricksBabor HossainNo ratings yet

- Project Report - Makan BricksDocument10 pagesProject Report - Makan BricksPraveen Kumar RoyNo ratings yet

- Project Report - Fly Ash BricksDocument8 pagesProject Report - Fly Ash BricksRohit Viegas60% (5)

- Executive SummaryDocument14 pagesExecutive Summaryfaraz khanNo ratings yet

- The Complete Outdoor Builder PDFDocument563 pagesThe Complete Outdoor Builder PDFAnonymous S3VjSTY100% (6)

- Bricks ManufacturingDocument4 pagesBricks Manufacturingpradip_kumarNo ratings yet

- Cement Production PlantDocument24 pagesCement Production PlantaazaidiNo ratings yet

- Business Plan Fly Ash BricksDocument8 pagesBusiness Plan Fly Ash Bricksrcool_rahul0039341No ratings yet

- Cement Based Products: Nsic Project ProfilesDocument3 pagesCement Based Products: Nsic Project ProfilesAshish KohaleNo ratings yet

- A Project ReportDocument24 pagesA Project ReportshariquesayeedNo ratings yet

- Converted Document 001Document16 pagesConverted Document 001Tochi Krishna AbhishekNo ratings yet

- Clay Bricks ManufacturingDocument15 pagesClay Bricks ManufacturingSabhaya ChiragNo ratings yet

- Clay Bricks ManufacturingDocument9 pagesClay Bricks ManufacturingParesh SomaniNo ratings yet

- Cement Paints: Profile No.: 239 NIC Code: 20221Document13 pagesCement Paints: Profile No.: 239 NIC Code: 20221Sabhaya ChiragNo ratings yet

- Project SummaryDocument6 pagesProject Summaryramana powerolNo ratings yet

- Clay Bricks ManufacturingDocument16 pagesClay Bricks ManufacturingMaddu Janak RaoNo ratings yet

- Fly Ash BricksDocument29 pagesFly Ash BricksSashankPsNo ratings yet

- Geopolymer BricksDocument6 pagesGeopolymer BricksVIVA-TECH IJRI100% (1)

- Tax267 July22 QQDocument9 pagesTax267 July22 QQSYAZWINA SUHAILINo ratings yet

- Ms ProDocument2 pagesMs ProTri Deny MolanaNo ratings yet

- Entrepreneure BusenissDocument19 pagesEntrepreneure BusenisstseguNo ratings yet

- M60 Grade of Concrete - Durga ShresDocument4 pagesM60 Grade of Concrete - Durga ShresMishal LimbuNo ratings yet

- PP On Fly AshDocument7 pagesPP On Fly AshshariquesayeedNo ratings yet

- Concrete Business in A BOXDocument35 pagesConcrete Business in A BOXDessalegn GaminiNo ratings yet

- Monthly Ahead Planning (From 1St April 2018 - 30Th April 2018)Document4 pagesMonthly Ahead Planning (From 1St April 2018 - 30Th April 2018)Poru ManNo ratings yet

- Rice Husk ResearchDocument6 pagesRice Husk Researchmarlon matusalemNo ratings yet

- Gyproc Plasters: Product CatalogueDocument12 pagesGyproc Plasters: Product CatalogueRohan BagadiyaNo ratings yet

- Chpter One: Civil Engineering Youth Company, Plc. Business PlanDocument18 pagesChpter One: Civil Engineering Youth Company, Plc. Business PlanInfinity SonNo ratings yet

- Ijce V3i2p103Document6 pagesIjce V3i2p103Happy YadavNo ratings yet

- Brick V AACDocument1 pageBrick V AACbopayyaNo ratings yet

- Study On Porotherm Brick Using Granite Powder: Ardra Suseelan, Guruvinder SinghDocument6 pagesStudy On Porotherm Brick Using Granite Powder: Ardra Suseelan, Guruvinder SinghBaseem FajilNo ratings yet

- Sand Lime BricksDocument2 pagesSand Lime Bricksmaguvu100% (1)

- Paramesh CivilDocument25 pagesParamesh CivilSai kumarNo ratings yet

- Work Schedule For Modification of Additional Lift - P474 ProjectDocument2 pagesWork Schedule For Modification of Additional Lift - P474 ProjectkrvprasadNo ratings yet

- Production of Hardened Body by Direct Bonding of Sand ParticlesDocument9 pagesProduction of Hardened Body by Direct Bonding of Sand ParticlesErica MagnagoNo ratings yet

- Cement Concrete Hollow BlocksDocument10 pagesCement Concrete Hollow Blocksjohn koraNo ratings yet

- Project Profile On Fly Ash BricksDocument15 pagesProject Profile On Fly Ash BricksHarshit JajuNo ratings yet

- Industrial Visit Report Crusher DeptDocument40 pagesIndustrial Visit Report Crusher DeptRahwaRechoNo ratings yet

- Executive SummaryDocument4 pagesExecutive Summarysuk25No ratings yet

- Correspondence LetterDocument5 pagesCorrespondence LetterVesheto HesuhNo ratings yet

- Unit Rate Build - Up Concrete 1Document36 pagesUnit Rate Build - Up Concrete 1tiepblackNo ratings yet

- GST CiaDocument9 pagesGST CiaESTUTI AgarwalNo ratings yet

- Fly Ash BricksDocument18 pagesFly Ash BricksMS PMNo ratings yet

- ConcreteDocument812 pagesConcreteARUN CHATURVEDINo ratings yet

- Engl 100-Assignment 2Document2 pagesEngl 100-Assignment 2Kezel AtangenNo ratings yet

- A Study On Market Research On Acc CementDocument57 pagesA Study On Market Research On Acc Cementsanju789No ratings yet

- MILESTONE - Ferrexpo-C KDocument2 pagesMILESTONE - Ferrexpo-C KLevel InteriorsNo ratings yet

- Lego BlocksDocument7 pagesLego BlocksHugo Leautaud SNo ratings yet

- Cost Center AnshikaDocument1 pageCost Center AnshikaNeha MahajanNo ratings yet

- Topic: Cementitious Grouts Assignment: 2 Done By: 18BCL023 18BCL025 Guided By: Prof. Vineet KothariDocument10 pagesTopic: Cementitious Grouts Assignment: 2 Done By: 18BCL023 18BCL025 Guided By: Prof. Vineet KothariKaran DalalNo ratings yet

- Bath Room Waterproofing Quotation1-AnanthapurDocument3 pagesBath Room Waterproofing Quotation1-AnanthapurYellaturi Siva Kishore ReddyNo ratings yet

- How Bricks Are ProducedDocument2 pagesHow Bricks Are ProducedCẩm TiênNo ratings yet

- Monthly Reports July 2018 09-10-18Document53 pagesMonthly Reports July 2018 09-10-18L. A. PatersonNo ratings yet

- ACF WASH - GFS Module 4 - Construction - 01-2008 - enDocument59 pagesACF WASH - GFS Module 4 - Construction - 01-2008 - enAccion Contra El HambreNo ratings yet

- Concrete Crafts: Making Modern Accessories for the Home and GardenFrom EverandConcrete Crafts: Making Modern Accessories for the Home and GardenRating: 4 out of 5 stars4/5 (3)

- The end of concrete: Pros and cons of an unsuccesful technologyFrom EverandThe end of concrete: Pros and cons of an unsuccesful technologyRating: 1 out of 5 stars1/5 (1)

- Applewood MemoDocument1 pageApplewood MemoEmai TetsNo ratings yet

- Applewood - EngDocument1 pageApplewood - EngEmai TetsNo ratings yet

- Overhead ExamplesDocument3 pagesOverhead ExamplesEmai TetsNo ratings yet

- Revaluation Reserve TransferDocument4 pagesRevaluation Reserve TransferEmai TetsNo ratings yet

- Study Guide - IAS 16Document2 pagesStudy Guide - IAS 16Emai TetsNo ratings yet

- CT1 2017Document1 pageCT1 2017Emai TetsNo ratings yet

- Cervilos QuestionDocument2 pagesCervilos QuestionEmai TetsNo ratings yet

- CT1 2017 MemoDocument4 pagesCT1 2017 MemoEmai TetsNo ratings yet

- AMA3660 - Man Acc 1 - 2022 Work Program - Circulated To StudentsDocument2 pagesAMA3660 - Man Acc 1 - 2022 Work Program - Circulated To StudentsEmai TetsNo ratings yet

- AMA3660 - Man Acc 1 - 2022 Course Outline - Circulated To StudentsDocument5 pagesAMA3660 - Man Acc 1 - 2022 Course Outline - Circulated To StudentsEmai TetsNo ratings yet

- Bridge Railing Manual PDFDocument65 pagesBridge Railing Manual PDFJesús Rodríguez RodríguezNo ratings yet

- Pervious ConcreteDocument31 pagesPervious ConcreteYaangki Moqktan100% (1)

- Masteremaco - S 348 v2Document2 pagesMasteremaco - S 348 v2shahzadNo ratings yet

- World Record in Long Distance Pumping - Case Study V1Document28 pagesWorld Record in Long Distance Pumping - Case Study V1Kaleeswari GNo ratings yet

- Honey Comb - Treatment MethodologyDocument4 pagesHoney Comb - Treatment MethodologyR.ThangarajNo ratings yet

- RFCDocument788 pagesRFCArslan AkbarNo ratings yet

- MS For Chipping and Concrete Works On GIS Zone-C WaterproofingDocument8 pagesMS For Chipping and Concrete Works On GIS Zone-C Waterproofingmohammed faraazNo ratings yet

- Significance of Test and Properties of Concrete and Concrete Making MaterialDocument220 pagesSignificance of Test and Properties of Concrete and Concrete Making MaterialHarun Alrasyid78% (9)

- CET 385 Final Exam Study Guide - Rev-233Document25 pagesCET 385 Final Exam Study Guide - Rev-233Gupta GurunadhGuptaNo ratings yet

- IR-Inspection Request LogDocument17 pagesIR-Inspection Request Loggsydagcqg euidedegdNo ratings yet

- Highway Engineering: by RangwalaDocument3 pagesHighway Engineering: by RangwalaAndrew CalingasanNo ratings yet

- Characterization of Various Cement GA and Their Impact On Grindability and Cement PerformanceDocument6 pagesCharacterization of Various Cement GA and Their Impact On Grindability and Cement PerformanceNam HuynhNo ratings yet

- A Review in High Early Strength Concrete and Local PDFDocument10 pagesA Review in High Early Strength Concrete and Local PDFAgikx ChabeNo ratings yet

- Citation 11Document3 pagesCitation 11Jericko Allen ResusNo ratings yet

- Structural Abstract (2C+G+10 Floors)Document5 pagesStructural Abstract (2C+G+10 Floors)bsudhareddyNo ratings yet

- RCD LabDocument17 pagesRCD LabLaw Soriano Sto DomingoNo ratings yet

- Concrete Business in A BOXDocument35 pagesConcrete Business in A BOXDessalegn GaminiNo ratings yet

- Lyon ConfluenceDocument6 pagesLyon ConfluenceScott M B GustafsonNo ratings yet

- Industrial Training Presentation BY Vaibhav Singh (Mechanical Engineering)Document10 pagesIndustrial Training Presentation BY Vaibhav Singh (Mechanical Engineering)Vaibhav SinghNo ratings yet

- WWF Paper PDFDocument7 pagesWWF Paper PDFniharNo ratings yet

- OK CardDocument1 pageOK CardRamdeep Gowtham50% (2)

- Cebex 100 PDFDocument2 pagesCebex 100 PDFBijaya RaulaNo ratings yet

- Gang Rel 1Document6 pagesGang Rel 1Jitendra NakkaNo ratings yet

- Glenium 105 Suretec TdsDocument2 pagesGlenium 105 Suretec TdsGabriel LimNo ratings yet

- Concrete TechnologyDocument214 pagesConcrete Technologycheersbeer01No ratings yet

- British Residency 2Document15 pagesBritish Residency 2Syeda Sameeha MaryamNo ratings yet

- Shear Strength Compressive Strength and Workability Characteristics of Concretes Reinforced With Steel Fibres IJERTV8IS060035Document4 pagesShear Strength Compressive Strength and Workability Characteristics of Concretes Reinforced With Steel Fibres IJERTV8IS060035hasshosNo ratings yet

- A Practical Summer Training Report FINALDocument48 pagesA Practical Summer Training Report FINALKalpesh Goswami75% (4)