Professional Documents

Culture Documents

Applewood - Eng

Uploaded by

Emai TetsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Applewood - Eng

Uploaded by

Emai TetsCopyright:

Available Formats

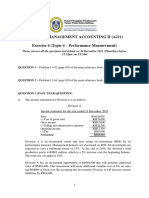

Applewood Electronics, a division of Elgin Corporation, manufactures two large-screen

television models: The Monarch, which has been produced since 2010, and sells for

R2 000, and the Regal, a newer model introduced in early 2012 that sells for R4 500. Based

on the following Income Statement for the year ended 31 March 2013, senior management

at Elgin have decided to concentrate Applewood’s marketing resources on the Regal model

and to begin to phase out the Monarch model.

Applewood Electronics

Statement of profit or loss and other comprehensive income

For the financial year ended 31 March 2013

Monarch Regal Total

Revenues R19 800 00 R4 560 000 R24 360 000

Cost of goods sold 12 540 000 3 192 000 15 732 000

Gross margin 7 260 000 1 368 000 8 628 000

Selling and administrative expense 5 830 000 978 000 6 808 000

Operating income R1 430 000 R390 000 R1 820 000

Units produced and sold (budgeted and 22 000 4 000

actual)

Net income per unit sold R65 R97.50

Budgeted machine hours (hours) 176 000 16 000 192 000

Actual machine hours (hours) 165 000 22 000 187 000

Primary unit costs for Monarch and Regal are as follows:

Monarch Regal

Direct materials R408 R2 084

Direct manufacturing labour

Monarch (1.5 hours x R50) R75

Regal (3.5 hours x R50) R175

Total primary cost per unit R483 R2 259

The company currently allocates manufacturing overhead costs to products using machine

hours as allocation base. Budgeted total manufacturing overhead of R8 256 000 is

applicable, but actual total manufacturing overhead for the year ended 31 March 2013

amounted to R9 325 000.

REQUIRED:

1. By making use of traditional cost principles, calculate the profitability of Regal and

Monarch models. (5.5)

2. Calculate the over or under allocated overheads and based on your answer also

indicate if the amount calculated should increase or decrease cost of sales. (2)

3. Show with the help of calculations, what caused the above over or under allocation.

(3.5)

You might also like

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryFrom EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryNo ratings yet

- Afm 311 A - 2013Document8 pagesAfm 311 A - 2013Dolly VongweNo ratings yet

- Introduction To Financial Management Main ProjectDocument5 pagesIntroduction To Financial Management Main ProjectMelissa KleinNo ratings yet

- Management Accounting Final OSADocument9 pagesManagement Accounting Final OSAAthiNo ratings yet

- Source - Bookletfull and Final Accoujting - 2 - Mcok - 1-MergedDocument12 pagesSource - Bookletfull and Final Accoujting - 2 - Mcok - 1-MergedAnonymous hrjVVKNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Handout - CHAPTER 2Document15 pagesHandout - CHAPTER 2Merveille SadyNo ratings yet

- Costing Series 2-2009Q6Document2 pagesCosting Series 2-2009Q6May CcmNo ratings yet

- EXTRA QUESTIONS FOR CHAPTER 7 To EndDocument34 pagesEXTRA QUESTIONS FOR CHAPTER 7 To EndSooXueJiaNo ratings yet

- Multiple Choice Questions: Job CostingDocument9 pagesMultiple Choice Questions: Job CostingTamaraNo ratings yet

- Example 2 - Overheads Allocation Over and Under AllocationDocument2 pagesExample 2 - Overheads Allocation Over and Under AllocationPhomolo StoffelNo ratings yet

- Tactical DecisionDocument2 pagesTactical DecisionLovely Del MundoNo ratings yet

- Decision MakingDocument5 pagesDecision Makingconstruction omanNo ratings yet

- Me2612 Business Planning WorksheetDocument6 pagesMe2612 Business Planning Worksheetrizwanwakil999No ratings yet

- Acorn AAT L4 ManagementAccountingDecisionAndControl MockExamOneDocument49 pagesAcorn AAT L4 ManagementAccountingDecisionAndControl MockExamOneBos BosNo ratings yet

- Paper - 5: Advanced Management Accounting Questions CVP AnalysisDocument20 pagesPaper - 5: Advanced Management Accounting Questions CVP AnalysisRohit KasbeNo ratings yet

- MA-II Assignment V - Short Run Decision AnalysisDocument4 pagesMA-II Assignment V - Short Run Decision Analysisshriya2413No ratings yet

- Problem Set Last ClassDocument3 pagesProblem Set Last Classmalena muloniaNo ratings yet

- Question Bank Test 1Document12 pagesQuestion Bank Test 1bolai.lethabo19No ratings yet

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- Marginal CostingDocument4 pagesMarginal CostingFareha Riaz100% (3)

- Class Test Dec 10Document6 pagesClass Test Dec 10trudes100No ratings yet

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- Management Accounting Exam Paper August 2012Document23 pagesManagement Accounting Exam Paper August 2012MahmozNo ratings yet

- Tutorial 6 AcmcDocument4 pagesTutorial 6 Acmcsarahayeesha1No ratings yet

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Document3 pagesA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanNo ratings yet

- Equired Answer Each of The Following Questions IndependentlyDocument2 pagesEquired Answer Each of The Following Questions IndependentlyJan Christopher CabadingNo ratings yet

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocument24 pagesPaper - 5: Advanced Management Accounting Questions Limiting FactorSrihariNo ratings yet

- Paper - 5: Advanced Management Accounting Questions Limiting FactorDocument24 pagesPaper - 5: Advanced Management Accounting Questions Limiting FactorMohit MaheshwariNo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- Chapter 04Document8 pagesChapter 04Md. Saidul Islam0% (1)

- Chapter 11 Relevant Costing ExercisesDocument3 pagesChapter 11 Relevant Costing ExercisesNCT100% (1)

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- Cordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsDocument3 pagesCordillera Career Development College College of Accountancy Buyagan, Poblacion, La Trinidad, Benguet Acctg 154-Strategic Cost Management Final ExamsMichelle BayacsanNo ratings yet

- International BusinessDocument10 pagesInternational BusinessTerryDemetrioCesarNo ratings yet

- 1.a. Divisional Performance Revision Questions ROI V RIDocument3 pages1.a. Divisional Performance Revision Questions ROI V RIK Lam LamNo ratings yet

- Assignment DFA6127Document3 pagesAssignment DFA6127parwez_0505No ratings yet

- Questn WK 2 & WK 3 Assgn Case StudyDocument8 pagesQuestn WK 2 & WK 3 Assgn Case StudykonosubaNo ratings yet

- Marginal Costing Chapter Satelite Centers PDFDocument17 pagesMarginal Costing Chapter Satelite Centers PDFSwasNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Financial Management 300: An Overview of The Standard Costing SystemDocument19 pagesFinancial Management 300: An Overview of The Standard Costing SystemTaelo mbizaNo ratings yet

- Manufacturing Accounts FormatDocument7 pagesManufacturing Accounts Formatlaguda babajide100% (10)

- ACC20020 Management - Accounting Exam - 15-16-2Document11 pagesACC20020 Management - Accounting Exam - 15-16-2Anonymous qRU8qVNo ratings yet

- Tutorial 5 Absorption Costing and Marginal Costing Q N A PDFDocument16 pagesTutorial 5 Absorption Costing and Marginal Costing Q N A PDFFatin AdlinaNo ratings yet

- DIM2183 Exam Jan 2024 Set 1Document4 pagesDIM2183 Exam Jan 2024 Set 1Yus LindaNo ratings yet

- Case Study: Programme Year Intake Total MarksDocument3 pagesCase Study: Programme Year Intake Total MarksMina MooNo ratings yet

- ExamDocument5 pagesExamDoristradeNo ratings yet

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino Makoni100% (1)

- Practice Questions For Cuac217Document11 pagesPractice Questions For Cuac217Tino MakoniNo ratings yet

- Chapter 7 Cost ReportingDocument19 pagesChapter 7 Cost Reportingmarizemeyer2No ratings yet

- Wahyudi 29123005 Case6 Syndicate1 YP69BDocument5 pagesWahyudi 29123005 Case6 Syndicate1 YP69Bwahyudimba69No ratings yet

- Management InformationDocument2 pagesManagement InformationMahediNo ratings yet

- Problem-42: RequiredDocument7 pagesProblem-42: RequiredRADHIKA V HNo ratings yet

- Unit 2 - Question BankDocument34 pagesUnit 2 - Question BankTamaraNo ratings yet

- CMAC Section A, B Mid-Term Q.PaperDocument5 pagesCMAC Section A, B Mid-Term Q.PaperWaseim khan Barik zaiNo ratings yet

- Smart Accounting PSPM 20112017Document5 pagesSmart Accounting PSPM 20112017Nurfarhana JufriNo ratings yet

- 2-4 2005 Jun QDocument10 pages2-4 2005 Jun QAjay TakiarNo ratings yet

- Overhead ExamplesDocument3 pagesOverhead ExamplesEmai TetsNo ratings yet

- CH 26 Exercises ProblemsDocument5 pagesCH 26 Exercises ProblemsAhmed El KhateebNo ratings yet

- Applewood MemoDocument1 pageApplewood MemoEmai TetsNo ratings yet

- Overhead ExamplesDocument3 pagesOverhead ExamplesEmai TetsNo ratings yet

- Revaluation Reserve TransferDocument4 pagesRevaluation Reserve TransferEmai TetsNo ratings yet

- Study Guide - IAS 16Document2 pagesStudy Guide - IAS 16Emai TetsNo ratings yet

- CT1 2017Document1 pageCT1 2017Emai TetsNo ratings yet

- CT1 2017 MemoDocument4 pagesCT1 2017 MemoEmai TetsNo ratings yet

- ACCC271 Class Test 1 2018Document3 pagesACCC271 Class Test 1 2018Emai TetsNo ratings yet

- AMA3660 - Man Acc 1 - 2022 Course Outline - Circulated To StudentsDocument5 pagesAMA3660 - Man Acc 1 - 2022 Course Outline - Circulated To StudentsEmai TetsNo ratings yet

- Cervilos QuestionDocument2 pagesCervilos QuestionEmai TetsNo ratings yet

- AMA3660 - Man Acc 1 - 2022 Work Program - Circulated To StudentsDocument2 pagesAMA3660 - Man Acc 1 - 2022 Work Program - Circulated To StudentsEmai TetsNo ratings yet

- CS-6777 Liu AbsDocument103 pagesCS-6777 Liu AbsILLA PAVAN KUMAR (PA2013003013042)No ratings yet

- EVOM ManualDocument2 pagesEVOM ManualHouston WhiteNo ratings yet

- Iaea Tecdoc 1092Document287 pagesIaea Tecdoc 1092Andres AracenaNo ratings yet

- UM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Document154 pagesUM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Antony Jacob AshishNo ratings yet

- Colorfastness of Zippers To Light: Standard Test Method ForDocument2 pagesColorfastness of Zippers To Light: Standard Test Method ForShaker QaidiNo ratings yet

- How To Launch Remix OS For PCDocument2 pagesHow To Launch Remix OS For PCfloapaaNo ratings yet

- Ritesh Agarwal: Presented By: Bhavik Patel (Iu1981810008) ABHISHEK SHARMA (IU1981810001) VISHAL RATHI (IU1981810064)Document19 pagesRitesh Agarwal: Presented By: Bhavik Patel (Iu1981810008) ABHISHEK SHARMA (IU1981810001) VISHAL RATHI (IU1981810064)Abhi SharmaNo ratings yet

- CAA Safety Plan 2011 To 2013Document46 pagesCAA Safety Plan 2011 To 2013cookie01543No ratings yet

- EN 50122-1 January 2011 Corrientes RetornoDocument81 pagesEN 50122-1 January 2011 Corrientes RetornoConrad Ziebold VanakenNo ratings yet

- Data Sheet Eldar Void SpinnerDocument1 pageData Sheet Eldar Void SpinnerAlex PolleyNo ratings yet

- All Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaDocument7 pagesAll Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaBryan KuoKyNo ratings yet

- Agency Canvas Ing PresentationDocument27 pagesAgency Canvas Ing Presentationkhushi jaiswalNo ratings yet

- A Medium-Rise Residential Building: A B C E D F G HDocument3 pagesA Medium-Rise Residential Building: A B C E D F G HBabyjhaneTanItmanNo ratings yet

- Gracie Warhurst WarhurstDocument1 pageGracie Warhurst Warhurstapi-439916871No ratings yet

- Logiq v12 SM PDFDocument267 pagesLogiq v12 SM PDFpriyaNo ratings yet

- Conservation Assignment 02Document16 pagesConservation Assignment 02RAJU VENKATANo ratings yet

- I I Formularies Laundry Commercial Liquid Detergents 110-12-020 USDocument6 pagesI I Formularies Laundry Commercial Liquid Detergents 110-12-020 USfaissalNo ratings yet

- Introduction To Atomistic Simulation Through Density Functional TheoryDocument21 pagesIntroduction To Atomistic Simulation Through Density Functional TheoryTarang AgrawalNo ratings yet

- Solubility Product ConstantsDocument6 pagesSolubility Product ConstantsBilal AhmedNo ratings yet

- Stentofon Pulse: IP Based Intercom SystemDocument22 pagesStentofon Pulse: IP Based Intercom SystemCraigNo ratings yet

- 2-1. Drifting & Tunneling Drilling Tools PDFDocument9 pages2-1. Drifting & Tunneling Drilling Tools PDFSubhash KediaNo ratings yet

- Automatic Gearbox ZF 4HP 20Document40 pagesAutomatic Gearbox ZF 4HP 20Damien Jorgensen100% (3)

- S4 HANALicensing Model External V19Document28 pagesS4 HANALicensing Model External V19Edir JuniorNo ratings yet

- CSE 202.04 Inspection of Concrete StructuresDocument67 pagesCSE 202.04 Inspection of Concrete StructuresJellyn BaseNo ratings yet

- Faa Data On B 777 PDFDocument104 pagesFaa Data On B 777 PDFGurudutt PaiNo ratings yet

- ETAP Power Station ErrorDocument5 pagesETAP Power Station ErroryogacruiseNo ratings yet

- Standard Test Methods For Rheological Properties of Non-Newtonian Materials by Rotational (Brookfield Type) ViscometerDocument8 pagesStandard Test Methods For Rheological Properties of Non-Newtonian Materials by Rotational (Brookfield Type) ViscometerRodrigo LopezNo ratings yet

- Mechanical Engineering - Workshop Practice - Laboratory ManualDocument77 pagesMechanical Engineering - Workshop Practice - Laboratory Manualrajeevranjan_br100% (4)

- Item Analysis and Test BankingDocument23 pagesItem Analysis and Test BankingElenita-lani Aguinaldo PastorNo ratings yet

- CORP2165D Lecture 04Document26 pagesCORP2165D Lecture 04kinzi chesterNo ratings yet