Professional Documents

Culture Documents

Affidavit of Tax Exemption Foreign Status

Uploaded by

Nia PickettOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Affidavit of Tax Exemption Foreign Status

Uploaded by

Nia PickettCopyright:

Available Formats

REGISTERED MAIL# RE 123 456 789 US

AFFIDAVIT OF TAX-EXEMPT FOREIGN STATUS

For the purposes of this Affidavit, the terms "United States" and "U.S." mean only the

Federal Legislative Democracy of the District of Columbia, Puerto Rico, U.S. Virgin

Islands, Guam, American Samoa, and any other Territory within the "United States,"

which entity has its origin and jurisdiction from Article 1, Section 8, Clause 17-18 and

Article IV, Section 3, Clause 2 of the Constitution for the United States of America.

The

terms "United States" and "U.S." are NOT to be construed to mean or include the

sovereign, united 50 states of America.

KNOW ALL MEN BY THESE PRESENT, that I, John Henry Doe Propia Persona,

proceeding sui juris, man upon the land, a follower of the Almighty Supreme Creator,

first and foremost and the laws of man when they are not in conflict (Leviticus 18:3, 4)

Pursuant to Matthew 5:33 - 37 and James 5:12, let my yea be yea and my nay be nay, as

supported by Federal Public Law 97-280, 96 Stat.1211, depose and says:

1. Neither born nor naturalized in the "United States" nor "subject to its

jurisdiction." I am NOT and never have been, as described in 26 CFR 1.1-1(c)

and the 14th Amendment, a "U.S. citizen." Therefore I AM an "alien" with

respect to the "United States."

2. I am NOT and never have been, as described in 26 USC 865(g) (1) (A), a

"resident of the U.S."

3. I have NEVER made, with ANY "knowingly intelligent acts" (Brady v. U.S., 397

U.S. 742, 743), ANY voluntary election under 26 USC 6013 or 26 CFR 1.871-4

to be treated as a U.S. resident alien for any purpose. Further, I have utterly NO

intention of making such election in the future

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

1 of 6

REGISTERED MAIL# RE 123 456 789 US

4. I AM, as described in 26 USC S65(g) (1) (B), a "nonresident alien" of the "United

States.'

5. I am NOT and never have been, as described in 26 USC 7701(a) (30), a "U.S.

person.

6. I am NOT and never have been, as described in 26 USC 7701(a)(14), a taxpayer

7. I do NOT have and never had, as described in 26 USC 911 (d)(3), a "tax home

within the U.S.

8. I AM, therefore, as described in 26 CFR 1.871-2 and 26 USC 7701(b), a

nonresident alien concerning the "United States" and am outside the general.

9. I am NOT and never have been, as described in 26 USC 3401, an "officer," or an

“employee," or an "elected official" (of the "United States," or of a "State" or of any

political subdivision thereof, nor of the District of Columbia, nor of a "domestic"

corporation) earning "wages" from an "employer.

10.I am NOT and never have been, as described in 31 USC 3713, a "fiduciary," or, as

described in 26 USC 6901. a transferee" or a transferee of a transferee.

11.I am Not and never have been, as described in 26 USe Suot B. a dnr or a

"contributor," and as a "nonresident alien" excluded under 26 USC 2501 (a)(2), I

am EXEMPT from any gift tax under 26 USC Subtitle B.

12.As a "nonresident alien" NOT engaged in or effectively connected with any "trade

or business within the United States" I am NOT REQUIRED by law to obtain a

"U.S." Taxpayer Identification Number or a Social Security Number because of

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

2 of 6

REGISTERED MAIL# RE 123 456 789 US

my exemption under 26 CFR 301.6109-1(g). Further, I am NOT REQUIRED

by law to make, as described in 26 CFR 1.6015(a)-1, a "declaration" because I am

exempt under 26 CFR 1.00156-1 and fundamental law.

13. As a "nonresident alien," I have NO "self-employment income," as described in

26 CF 1.1402(9b)-3(d).

14. As a "nonresident alien " I derived NO "gross income... from sources within the

United States,' either "effectively connected" or "not effectively connected with

the conduct of a trade or business in the United States," as described in 26 USC

872(a).

15. As a "nonresident alien. mv private-sector remuneration 15 "from sources

without the United States" as described in 26 CFR 1.1441-3(a), does NOT

constitute 26 USC 3401 "wages," and is therefore NOT "subject to" mandatory

withholding under 26 USC 3402(a), 3101(a), or 26 CFR 1.1441-1, because of its

EXEMPTION under 26 USC 3401(a)(6) and fundamental law.

16. As a "nonresident alien," I did NEVER intentionally make, with ANY

"knowingly intelligent acts, ANY voluntary withholding agreement as described

in 26 USC 3402 (p).

17. As a "nonresident alien," my income is NOT included in "gross income" under

Subtitle A and is EXEMPT from withholding according to 26 CFR 1.441-3(a)

and 26 CFR 31.3401 (a) (6)-1(b).

18. As a "nonresident alien," with NO income "from sources within the

UnitedStates,' " my private-sector, non-"U.S." income is FREE from all federal tax

under fundamental law (see Treasury Decisions 3146 and 3640, and United

States v. Morris, 125 F.Rept. 322, 331).

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

3 of 6

REGISTERED MAIL# RE 123 456 789 US

19. As a "nonresident alien " my estate and/or trust is as described in 26

USC7701(a)(31), a TAX-EXEMPT "foreign estate or trust.

20. As a "natural born Citizen" (see 11:1:5 of the Constitution), free Sovereign,

American Citizen , and "nonresident alien concerning the federal United States,"

I did NEVER voluntarily, intentionally waive, with ANY "knowingly intelligent

acts" ANY of my unalienable rights, and have utterly NO intention of doing so in

the future. Any prima facie evidence or presumption to the contrary 19 hereby

rebutted. Any past signatures on DEPARTMENT OF THE UNITED STATES

TREASURY ", INTERNAL REVENUE SERVICE (IRS) and SOCIAL

SECURITY ADMINISTRATION (SSA) forms, statements, etc., were in error

and involuntarily made under threat, duress, and coercion. I hereby revoke,

cancel and render void. Nunc Pro I unc. both currently and retroactively to the

time of signing any such signatures. I reserve mv Common Law right NOT to be

compelled to perform under any agreement that I have not entered into

knowingly, voluntarily, and intentionally. I DO NOT accept the liability of the

"compelled benefit" of any unrevealed adhesion contract. commercial security

agreements, or bankrupted.

21. I am NOT a 26 USC 7203 "person required." I am a "nontaxpayer" outside both

general and tangential venues and the jurisdiction of Title 26. United States

Code.

I am not an expert in the law however I do know right from wrong. If there is

any human

being damaged by any statements herein, if he will inform me by facts I will

sincerely

make every effort to amend my ways. I, hereby and herein reserve the right to

amend and

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

4 of 6

REGISTERED MAIL# RE 123 456 789 US

make amendment to this document as necessary in order that the truth may be

ascertained

and proceedings justly determined. If the parties given notice by means of this

document

have information that would controvert and overcome this Affidavit, please

advise me in

WRITTEN AFFIDAVIT FORM within thirty/ (30) days from receipt hereof

proving me

with your counter-affidavit, proving with particularity by stating all requisite

actual law,

that this Affidavit Statement is substantially and materially false sufficiently

to change

materially my status and factual declarations. Your silence stands as consent to,

and tacit

approval of, the factual declarations herein being established as fact as a

matter of law.

Reserving Alt Natural God - Given Unalienable Birthrights, Waiving None

Ever under

28 USC $1746 rights and without prejudice to ANY of those rights

(U.C.C.1-207)

I declare under penalty of perjury under the law of the United States of

America that the

foregoing is true and correct Pursuant 28 USC $ 1746 and executed "without

the United

States"

FURTHER THIS AFFIANT SAITH NOT

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

5 of 6

REGISTERED MAIL# RE 123 456 789 US

Subscribed, sealed, and affirmed to this day of , ,month,

,and year of 2022 , I hereby affix my own signature and seal to all of the above

affirmations with explicit reservation of ALL my unalienable rights and

without prejudice to ANY of those rights Under U.C.C $ 1-103, 1-105,

1-207,1-308,3-419.

By: ,

John Henry Doe, Affiant

Secured Party /Executor / Administrator / Trustee

Let this document stand as trih before the Almighty Supreme Creator

and let it be established before men according as the scriptures saith*But

if they will not listen, take one or two others along, so that every matter

may be established by the testimony of two or three witnesses." Matthew

18:16. "In the mouth of two or three witnesses, shall every word be

established" 2 Corinthians 13:1.

By: ,

Elisecured Party / Executor / Administrator / Trustee

(FIRST WITNESS)

By: ,

Elisecured Party / Executor / Administrator / Trustee

(SECOND WITNESS)

By: ,

EVisecured Party / Executor / Administrator / Trustee

(THIRD WITNESS)

AFFIDAVIT TAX EXEMPT STATUS-01 Secured Party: John Henry Doe

6 of 6

You might also like

- Identification Credentials: Mandatory or Voluntary?From EverandIdentification Credentials: Mandatory or Voluntary?Rating: 5 out of 5 stars5/5 (2)

- 1-Declaration of StatusDocument3 pages1-Declaration of Statushalcino94% (16)

- (Template) Citizenship Evidence AffidavitDocument2 pages(Template) Citizenship Evidence AffidavitWayne Lyles100% (5)

- Affidavit of Status To IRS SampleDocument6 pagesAffidavit of Status To IRS SampleNeoCreditor100% (2)

- Affidavit of Doe, John Henry Page 1Document2 pagesAffidavit of Doe, John Henry Page 1John Sutphin88% (8)

- Conditional Acceptance: Your-Name: Here Your Address Here City, State Spelled Out ZipDocument8 pagesConditional Acceptance: Your-Name: Here Your Address Here City, State Spelled Out ZipJesse Gibson0% (1)

- Sample Affidavitof Status-2013Document16 pagesSample Affidavitof Status-2013Bhakta Prakash100% (7)

- RECISSIONDocument12 pagesRECISSIONj weiss100% (10)

- Revocation of Election Established by The US CongressDocument11 pagesRevocation of Election Established by The US CongressJames neteru100% (2)

- Affidavit of StatusDocument2 pagesAffidavit of StatusTroy K OistadNo ratings yet

- Voter CancellationDocument1 pageVoter Cancellationpmfn3No ratings yet

- Affidavit of Your Name - Only For Natural Persons - Inapplicable To Artificial PersonsDocument2 pagesAffidavit of Your Name - Only For Natural Persons - Inapplicable To Artificial Personstoddharringer100% (6)

- Silver Bullet To Your Rights Secured by The ConstitutionDocument21 pagesSilver Bullet To Your Rights Secured by The ConstitutionGlenn-anthony Sending-State Horton100% (4)

- Copyright NoticeDocument3 pagesCopyright NoticeI Am.100% (2)

- Declaration of StatusDocument8 pagesDeclaration of StatusJohn Kronnick100% (12)

- Affidavit Repudiation To Dept of StateDocument32 pagesAffidavit Repudiation To Dept of Statepaula_morrill668100% (3)

- Passport Explanatory StatementsDocument2 pagesPassport Explanatory Statements?? ??100% (1)

- Yes There Is A Citizen of A StateDocument13 pagesYes There Is A Citizen of A StateDan GoodmanNo ratings yet

- Affidavit of Reservation of Rights UCC 1Document1 pageAffidavit of Reservation of Rights UCC 1Antoinne FritzNo ratings yet

- Decoration of Status of Matthew Joseph QuinteroDocument5 pagesDecoration of Status of Matthew Joseph QuinteroAut Beat100% (3)

- Certificate of ownershipDocument3 pagesCertificate of ownershipKenny100% (4)

- Repudiation PublicDocument20 pagesRepudiation PublicjuandurfilNo ratings yet

- Affidavit of AffianceDocument3 pagesAffidavit of AffianceNat WilliamsNo ratings yet

- Common Law Copyright NoticeDocument4 pagesCommon Law Copyright Noticerhonda JamesNo ratings yet

- Copyright Notice InstructionsDocument9 pagesCopyright Notice InstructionsCee100% (5)

- Affidavit of StatusDocument6 pagesAffidavit of StatusLamont RylandNo ratings yet

- Affidavit of Birth: FurthermoreDocument3 pagesAffidavit of Birth: FurthermoreAashi50% (2)

- Revocation of Election KJ Mine 12 14 22Document13 pagesRevocation of Election KJ Mine 12 14 22James neteru100% (3)

- 1779 & 928 American States Assembly Document Check ListDocument6 pages1779 & 928 American States Assembly Document Check ListLaLa Banks100% (2)

- Ethnicity and Race-Sf181Document2 pagesEthnicity and Race-Sf181:Ankh-Heru:El©®™No ratings yet

- US National ID Affidavit202Document1 pageUS National ID Affidavit202Jaz CiceroSantana BoyceNo ratings yet

- Sara Judith Yarbrough - Recorded LND 300-001-SJY at EFCA 2020002521 BROOME COUNTY NYDocument32 pagesSara Judith Yarbrough - Recorded LND 300-001-SJY at EFCA 2020002521 BROOME COUNTY NYYoPatronaNo ratings yet

- Affidavit of Truth: VerificationDocument3 pagesAffidavit of Truth: VerificationRon Ferlingere100% (2)

- Affidavit Resolution Revocation and Termination of FranchiseDocument5 pagesAffidavit Resolution Revocation and Termination of FranchiseNia Pickett100% (11)

- Revocation of Election RF 340 910 042 USDocument13 pagesRevocation of Election RF 340 910 042 USDonald L. Wise100% (2)

- Affidavit of StatusDocument2 pagesAffidavit of StatusCharlene Anderson100% (2)

- Druanna Cheri Johnston© 1975 Druanna-Cheri: JohnstonDocument4 pagesDruanna Cheri Johnston© 1975 Druanna-Cheri: Johnstonlyocco1100% (2)

- Authentication of The Birth Certificate StepsDocument5 pagesAuthentication of The Birth Certificate StepsBob JohnsonNo ratings yet

- Certificate of Assumed Name Notice of Transfer of Reserved NameDocument3 pagesCertificate of Assumed Name Notice of Transfer of Reserved NameAntwain Utley100% (3)

- Affidavit of Revocation and RescissionDocument13 pagesAffidavit of Revocation and RescissionJohn Foster100% (6)

- 1779 Declaration of 7 Year Undocumented Immigrants - SSNotaryDocument1 page1779 Declaration of 7 Year Undocumented Immigrants - SSNotaryOsei Tutu Agyarko100% (1)

- Affidavit Reservation RightsDocument3 pagesAffidavit Reservation RightsWayne SmithNo ratings yet

- AMR CorrectYourPoliticalStatusDocument4 pagesAMR CorrectYourPoliticalStatusjoe75% (4)

- Revocation of Power of Attorney FormDocument2 pagesRevocation of Power of Attorney FormLord Mr. Sasa Alexander VugloveckiNo ratings yet

- Diplomatic Immunity: Silver Bullet To Your Rights Secured by The Constitution. A Treatise On State CitizenshipDocument22 pagesDiplomatic Immunity: Silver Bullet To Your Rights Secured by The Constitution. A Treatise On State CitizenshipAreoh100% (7)

- Certificates of Non Citizen Nationality PASSPORTDocument4 pagesCertificates of Non Citizen Nationality PASSPORTLei Lak100% (2)

- Sovereign Filings BrochureDocument2 pagesSovereign Filings Brochurepreston_4020030% (1)

- Affidavit of Ownership ExampleDocument2 pagesAffidavit of Ownership Examplehpvnsxngkh100% (2)

- SF-181 Ethnicity Forms, Supporting Documents and Confirmations For JaelDocument20 pagesSF-181 Ethnicity Forms, Supporting Documents and Confirmations For JaelTiffany Hamilton100% (7)

- Declaration of StatusDocument7 pagesDeclaration of StatusLindaStith100% (11)

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- The Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeFrom EverandThe Artificial Person and the Color of Law: How to Take Back the "Consent"! Social Geometry of LifeRating: 4.5 out of 5 stars4.5/5 (9)

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- To Hell, with the Irs!: To the Kingdom of Christ, It Cannot Come!From EverandTo Hell, with the Irs!: To the Kingdom of Christ, It Cannot Come!No ratings yet

- Land of the Free: The Most Important Legal Documents That Built America We Know Today: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyFrom EverandLand of the Free: The Most Important Legal Documents That Built America We Know Today: Key Civil Rights Acts, Constitutional Amendments, Supreme Court Decisions & Acts of Foreign PolicyNo ratings yet

- Fee Schedule TemplateDocument16 pagesFee Schedule TemplateNia Pickett100% (4)

- The Right To Practice LawDocument12 pagesThe Right To Practice LawNia PickettNo ratings yet

- Adverse ActionDocument1 pageAdverse ActionNia Pickett100% (1)

- We Were Never Told Government SecretsDocument3 pagesWe Were Never Told Government SecretsNia PickettNo ratings yet

- Notice of Secured CreditorDocument1 pageNotice of Secured CreditorNia PickettNo ratings yet

- Public NoticeDocument7 pagesPublic NoticeNia Pickett100% (1)

- Affidavit Resolution Revocation and Termination of FranchiseDocument5 pagesAffidavit Resolution Revocation and Termination of FranchiseNia Pickett100% (11)

- ABA Constitution and Bylaws GuideDocument90 pagesABA Constitution and Bylaws GuideNia PickettNo ratings yet

- Commercial Security Agreement SummaryDocument26 pagesCommercial Security Agreement SummaryNia Pickett100% (8)

- Precoro Capture (Autosaved)Document264 pagesPrecoro Capture (Autosaved)Steffany NoyaNo ratings yet

- Training Courses 2022-TUV NORD MalaysiaDocument12 pagesTraining Courses 2022-TUV NORD MalaysiaInstitute of Marketing & Training ALGERIANo ratings yet

- 5 Characteristics-Defined ProjectDocument1 page5 Characteristics-Defined ProjectHarpreet SinghNo ratings yet

- Dax Tate Term PaperDocument5 pagesDax Tate Term Paperapi-301894375No ratings yet

- Aws D14.4 D14.4MDocument134 pagesAws D14.4 D14.4Mgeorgadam198380% (5)

- Mcs Industries v. Hds TradingDocument5 pagesMcs Industries v. Hds TradingPriorSmartNo ratings yet

- DWM - Basic - Updated - R1 (Autosaved)Document27 pagesDWM - Basic - Updated - R1 (Autosaved)lataNo ratings yet

- Response To Non Motion DocumentDocument5 pagesResponse To Non Motion DocumentLaw&CrimeNo ratings yet

- Class Program 2023-2024Document1 pageClass Program 2023-2024Cheryl Jane A. MusaNo ratings yet

- An Interview with Novelist Anita BrooknerDocument12 pagesAn Interview with Novelist Anita BrooknerlupearriegueNo ratings yet

- Sin Missing The MarkDocument2 pagesSin Missing The MarkCeray67No ratings yet

- Palawan: Philippines's Last FriontierDocument25 pagesPalawan: Philippines's Last Friontierlayykaa jayneeNo ratings yet

- Introduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedDocument56 pagesIntroduction: Mobile Phone and Mobile Banking: 1.1 Problems To Be Evaluated and AssessedAbhay MalikNo ratings yet

- Triple broadband invoice duplicateDocument1 pageTriple broadband invoice duplicateJatin BansalNo ratings yet

- Hurricanes Katrina and Rita BibliographyDocument20 pagesHurricanes Katrina and Rita Bibliographyamericana100% (2)

- Checklist For Construction and Rehabilitation of Small Dams: Social & Environmental Management Unit (Semu)Document10 pagesChecklist For Construction and Rehabilitation of Small Dams: Social & Environmental Management Unit (Semu)Muhammad imran LatifNo ratings yet

- HolaDocument5 pagesHolaioritzNo ratings yet

- Profile Creation CA2Document15 pagesProfile Creation CA2AarizNo ratings yet

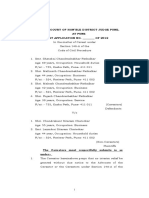

- In The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012Document2 pagesIn The Court of Hon'Ble District Judge Pune, at Pune CAVEAT APPLICATION NO. - OF 2012AniketNo ratings yet

- Employee Stock Option SchemeDocument6 pagesEmployee Stock Option Schemezenith chhablaniNo ratings yet

- REBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39Document15 pagesREBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39yhusofiNo ratings yet

- Zacks Marijuana Innovators GuideDocument13 pagesZacks Marijuana Innovators GuideEugene GalaktionovNo ratings yet

- TNNLU National Med-Arb CompetitionDocument12 pagesTNNLU National Med-Arb CompetitionAkhil SreenadhNo ratings yet

- Indian Initiatives in Traceability Approaching Towards Single Window CertificationDocument55 pagesIndian Initiatives in Traceability Approaching Towards Single Window CertificationAman KhannaNo ratings yet

- Liveloud SongsheetDocument20 pagesLiveloud SongsheetMhay Lee-VillanuevaNo ratings yet

- Woolworth 2015 Integrated ReportDocument71 pagesWoolworth 2015 Integrated ReportOlalekan SamuelNo ratings yet

- Smoke Values and Cut-Off Speeds Per Engine Type: en-GBDocument7 pagesSmoke Values and Cut-Off Speeds Per Engine Type: en-GBruanNo ratings yet

- Massachusetts District Attorneys Agreement To Suspend Use of Breathalyzer Results in ProsecutionsDocument10 pagesMassachusetts District Attorneys Agreement To Suspend Use of Breathalyzer Results in ProsecutionsPatrick Johnson100% (1)

- Analysis of The Documentary Sarhad: Submitted By: Muhammad Anees Sabir CheemaDocument5 pagesAnalysis of The Documentary Sarhad: Submitted By: Muhammad Anees Sabir CheemaAbdullah Sabir CheemaNo ratings yet

- Moises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Document8 pagesMoises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet