Professional Documents

Culture Documents

Introduction To Management Accounting Group Assignment

Uploaded by

Hằng ĐàoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Management Accounting Group Assignment

Uploaded by

Hằng ĐàoCopyright:

Available Formats

lOMoARcPSD|17008703

Introduction to Management Accounting Group Assignment

Introduction to Management Accounting (Taylor's University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Modular Programme Assignment

List of students (State full name & tutorial group in block capital)

Cover Sheet

(Group and Individual Assignments Only)

1. KOK KE LYN SEC 01

2. LAM JUIN YUEN SEC 01

3. NATALIE TEE YEE TING SEC 01

4. ABDOOL SATAR SHAKEEL SEC 01

Fold corner of EACH copy separately and seal to obscure your

Please complete the form (in capital letters) and attach it securely to the front of your assignment before submitting your assignment.

Student 1 ID: ………0349070………………………………. Student 2 ID: ………0342445……………………………….

Student 3 ID: ………0342486………………………………. Student 4 ID: ………0348710……………………………….

Programme: BACHELOR OF ARTS (HONOURS) ACCOUNTING AND FINANCE

Name of module: INTRODUCTION TO MANAGEMENT ACCOUNTING

Name of tutor: MR SHAZRUL EKHMAR ABDUL RAZAK

A C C 6 0 2 0 4

Module code:

Assignment title: GROUP ASSIGNMENT

Due date & time: 25 OCT 2021 @ 2pm

We have read and understood the TU Dual Award Regulations on cheating, plagiarism and collusion and state that this

piece of work is our own and does not contain any unacknowledged work from any other sources.

We authorise the University to test any work submitted by me, using text comparison software, for instances of plagiarism.

We understand this will involve the University or its contractor copying my work and storing it on a database to be used in

future to test work submitted by others.

Note: The attachment of this statement on any electronically submitted assignments will be deemed to have the same

authority as a signed statement.

Signed: Date:

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

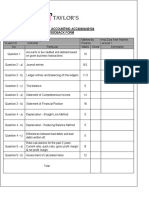

GRADE/ MARK

ASSIGNMENT FEEDBACK FORM

A. A feedback form template needs to be included with each assignment. Please complete all details clearly.

Student ID:

Programme: Dual Award (Accounting & Finance)

Email: Contact No :

Module code and title: ACC60204 – INTRODUCTION TO MANAGEMENT ACCOUNTING

Module Lecturer/ Tutor: MR SHAZRUL EKHMAR ABDUL RAZAK

Assignment number: Due date: 25 OCT 2021 Word Count: 2008

Assignment topic as stated in the guidelines provided:

B. This section will be completed by the lecturer/tutor assessing your assignment:

Key: 1. Outstanding 2. Very Good 3. Good 4. Satisfactory 5. Weak 6. Unsatisfactory

(Lines left blank by the tutor are not relevant to this assignment)

Structure & Presentation 1 2 3 4 5 6

Executive Summary Little relevance to question

Lacking continuity

Introduction

Many Inaccuracies

Findings/ Discussion

Appropriate Headings and subheadings Inappropriate Headings

Appropriate Layout system

Inappropriate numbering

Conclusion (linked to discussion)

Lacks cohesion

Appropriate recommendations Inappropriate recommendation

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Overall presentation Messy presentation

Content

Demonstrate engagement with topic Lacking logical

flow/poorly set out

Good reference of sources Inadequate range

Demonstrates critical thinking Text book response

Clearly identifies problem/ topic Lacks clarity

and provides appropriate

recommendations

Language

Grammatical sentences Weak grammatically

Correct spelling Many incorrect spelling

Effective/accurate use of figures and Use ineffective or

tables inaccurate

Any additional comments (if there is any): Comments:

Strengths:

Weaknesses:

The two main ways to improve this assignment are:

Assessed by: Date:

Sample Moderated by (if any): Date:

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

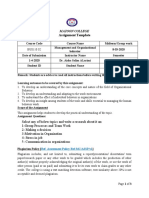

WRITTEN COMMUNICATION SKILLS THROUGH

ASSIGNMENT REPORT (PART C – 30 MARKS)

Traits Performance Score Wt. Marks

levels

Poor (1 2 3) Fair (4 5) Good (6 7) Excellent (8 (%)

9 10)

The The The

1 Purpose/Aim The organization, organization, organization, 25

purpose style, and style, and style, and

and the content content are content are

aim of the sometimes good and excellent and

paper are interfere with explain the explain the

not clear to the purpose purpose and purpose and

the reader. and aim of the aim of the aim of the

paper. paper. paper very

clearly.

Most ideas Presents ideas Supports Explores

Explanation of are but the most ideas ideas with

2 25

ideas unsupported supports are with good sound

and very inconsistent. evidence and arguments

confusing. Reasoning is reasoning and

The not clear. evidences.

reasoning is Reasoning is

flawed. very

effective.

Develops and Develops Develops

organizes ideas unified and ideas

Does not

in paragraphs coherent cogently and

develop ideas

that are not ideas within logically with

Logic & cogently and

3 well connected. paragraphs very good 20

organization logically,

There is some and the connection

ineffective

evidence of transition between

organization,

organization. from one paragraphs.

unclear

Introduction paragraph to Organization,

introduction,

and conclusions another is introduction,

and

not well good. and

conclusion

focused. Organization, conclusion

introduction, are very

and good.

conclusion

are good.

Uses words Word forms Word forms Employs the

4 that are and sentence and most apt 20

Language usage

unclear, structures are sentence words and

sentence adequate to structures sentence

structure convey basic are structures are

lacks clarity, meaning. effective. concise and

errors are However, There are very

seriously there are errors but effective.

distracting errors that these do not

cause cause

distraction. distraction.

There are

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Writing Frequent errors minor The writing is

5 Spelling & contains in spelling and errors. But error free in 10

grammar numerous grammar the general terms of

spelling and interfere with conventions spelling and

grammatical comprehension. of spelling grammar.

errors. Very and

difficult to grammar

comprehend. have been

followed.

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

A COMPARISON OF TRADITIONAL ABSORPTION COSTING AND ACTIVITY-BASED

COSTING: LIMITATIONS AND RECOMMENDATIONS

Prepared for:

Mr. Tarmizi, Management Accountant

Southern Digital Sdn. Bhd.

Prepared by:

Kok Ke Lyn, Lam Juin Yuen,

Natalie Tee Yee Ting, Abdool Satar Shakeel

Interns of Southern Digital Sdn. Bhd.

October 25, 2021

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Table of Contents

EXECUTIVE SUMMARY.......................................................................................................................9

1.0 INTRODUCTION.................................................................................................................................9

2.0 DISCUSSION OF FINDINGS............................................................................................................10

2.1 COST OF PRODUCT PER UNIT UNDER TRADITIONAL ABSORPTION COSTING AND

ACTIVITY-BASED COSTING............................................................................................................10

2.2 PROFIT OF PRODUCT PER UNIT UNDER TRADITIONAL ABSORPTION COSTING AND

ACTIVITY-BASED COSTING............................................................................................................11

3.0 LIMITATIONS OF COSTING SYSTEM............................................................................................13

3.1 TRADITIONAL ABSORPTION COSTING...................................................................................13

3.2 ACTIVITY-BASED COSTING.......................................................................................................13

4.0 RECOMMENDATIONS.....................................................................................................................15

4.1 IMPROVE PROFITABILITY BY ACTIVITY-BASED COSTING................................................15

4.2 CONCERN ON THE SUPPLY IN SILVER CIRCUIT BOARD.....................................................16

5.0 CONCLUSION...................................................................................................................................17

6.0 APPENDIX.........................................................................................................................................18

CALCULATION: TRADITIONAL ABSORPTION COSTING...........................................................18

CALCULATION: ACTIVITY-BASED COSTING...............................................................................20

7.0 REFERENCE LIST.............................................................................................................................23

LIST OF TABLES

TABLE 1: COMPARISONS OF COSTS UNDER TRADITIONAL ABSORPTION

COSTING AND ACTIVITY-BASED COSTING...…………………………………….10

TABLE 2: COMPARISONS OF REVENUE UNDER TRADITIONAL ABSORPTION

COSTING AND ACTIVITY-BASED COSTING……...………………………….........12

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

EXECUTIVE SUMMARY

This report examines traditional absorption costing and activity-based costing to study the

effectiveness on improving Southern Digital Sdn. Bhd.’s profitability. Due to the distinct

allocation methods of overhead rate, traditional absorption costing tends to provide inaccurate

and misleading data for Southern Digital Sdn. Bhd., whereas activity-based costing that prevents

cost distortion is effective to enhance profitability. Despite the shortcomings that can be

conquered, implementing activity-based costing is beneficial to the company in general.

1.0 INTRODUCTION

Along with the imminent contract renewal with Tech World Sdn. Bhd. and the mission of

sustaining the company’s profitability amid the pandemic outbreaks, Sothern Digital Sdn. Bhd.

are required to evaluate the company’s current costing system.

This report into the costing system of Sothern Digital Sdn. Bhd is designated to compare

and analyze the different results of cost and revenue of the three circuit boards by integrating the

traditional absorption costing and activity-based costing system. In this report, limitations and

recommendations are proposed, which attempts to address and tackle the current issues faced.

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

2.0 DISCUSSION OF FINDINGS

2.1 COST OF PRODUCT PER UNIT UNDER TRADITIONAL ABSORPTION COSTING

AND ACTIVITY-BASED COSTING

Table 1: Comparisons of cost under traditional absorption costing and activity-based costing

Table 1 indicates the differences in cost per unit between the three boards, showing that

gold and platinum boards have higher cost under activity-based costing, while silver board has

higher cost under traditional absorption costing. Although both costing systems allocate direct

costs to the cost objects in the same way, the distinct approaches of determining the overhead

rate used result in different indirect costs and costs per unit.

Under traditional absorption costing, RM 195,270 of total overhead costs are treated as a

single pool of indirect costs and prorated based on the portion of direct cost. Besides, there is

only a single predetermined overhead rate and cost allocation are applied consistently across the

production activities, which is RM 28.30 per labour hour and a total of 6,900 direct labour hours

respectively.

In comparison, activity-based costing identifies the different activities involved, breaking

down the indirect costs precisely with multiple cost drivers and activity pools [ CITATION SAY15 \l

1033 ]. Moreover, the overhead rates in activity-based costing are determined depending on the

activities and assigned uniformly based on the actual consumption of the resources. Therefore,

the two costing systems often provide different pictures of the cost per unit.

10

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Likewise, the high accuracy in activity-based costing accentuates the differences in cost

data. Traditional absorption-costing tends to over cost silver board, which is reported more cost

with a low level of resources, demonstrating a difference of RM 0.94 per unit. On the other

hand, the gold and platinum board are reported with an under-costed value, where the high level

of resources has a lower cost per unit. In traditional absorption costing, the cost per unit of the

gold board is RM 1.05 lower, whereas the cost per unit of the platinum board is RM 0.10 lower.

2.2 PROFIT OF PRODUCT PER UNIT UNDER TRADITIONAL ABSORPTION COSTING

AND ACTIVITY-BASED COSTING

Table 2: Comparisons of revenue under traditional absorption costing and activity-based costing

Comparisons between the profit of board in traditional absorption costing and activity-

based costing are made in table 2. Under traditional absorption costing, the gold board has

revenue of RM 0.29 per unit. However, the gold board’s revenue drops to a deficit value in

activity-based costing due to the failure of providing accurate information on the cost per unit by

traditional absorption costing.

Product cost plays a significant role in determining the sales revenue. As traditional

absorption costing was utilized to allocate indirect cost during the 20 th century, its uncomplicated

single allocation base and overhead rate applied uniformly provides limited

accuracy[ CITATION Ath10 \l 1033 ]. The simplistic manner to align the cost allocation base

leads to distortions in product costs and impedes the ability on establishing appropriate

measurement of the cost[ CITATION Sha97 \l 1033 ]. Therefore, the gold board is not profitable

11

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

as expected because it is under-costed and underpriced in traditional absorption costing. The

under-costed products will generate lesser revenue and cause a loss to the company, which is

conflicted with the objective of sustaining the company’s profitability.

In addition, selling price is also one of the chief determinants for revenue. In general, an

increase in the selling price will lead to a higher product margin and revenue obtained from each

board, and vice versa. However, there is also a possibility for the over-priced silver board to

decrease the revenue as it will lose its competency to the lower price’s competitors [CITATION

BHU03 \l 1033 ].

12

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

3.0 LIMITATIONS OF COSTING SYSTEM

3.1 TRADITIONAL ABSORPTION COSTING

Instead of using multiple cost drivers to establish the cost outcome accurately, the

traditional absorption costing system offers a limited accuracy in cost data and information

compared to activity-based costing. Since the traditional absorption costing system uses a single

rate for overhead allocation that applies across the entire company operations, it is not

appropriate for large corporations that involves several operations in the manufacturing

process[ CITATION Ras111 \l 1033 ]. The widely applied and arbitrary manner in allocating

indirect cost to the products will lead the costs per unit to be either understated or overstated,

which steers the company to make wrong decisions about the profitability based on the incorrect

information. For example, the gold board holds a loss of RM 0.76 instead of a profit of RM 0.29

by using traditional absorption costing.

Furthermore, traditional costing system tends to disregard and neglect the unforeseen and

additional costs [ CITATION Mol18 \l 1033 ]. There seems to be no means for this system to

account the fact that it may cost our firm higher or lower to produce goods. Therefore, the

product mix, pricing, cost control, and other decisions made by managers using those distorted

costs can result in significant long-term losses [ CITATION Mis02 \l 1033 ]. For instance, the

company will continue losing more money if the fact that the production of gold circuit is loss-

making is not discovered.

3.2 ACTIVITY-BASED COSTING

Although activity-based costing provides companies with comprehensive information in

formulating business decisions, activity-based costing still should not be implemented as the sole

strategic tool to achieve profit maximization as it has its shortcomings as well.

The first limitation of initiating activity-based costing is the difficulties that emerged in

identifying the most accurate cost drivers for a variety of production activities. Unlike

traditional absorption costing, activity-based costing involves a diversity of cost pools and cost

drivers to determine the respective overhead rates. Due to the varying cost allocation bases,

activity-based costing is likely to increase the odds of making errors during the measurement of

13

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

allocation rate and the assignment of production cost if the cost drivers are not selected

accurately [ CITATION Nam16 \l 1033 ]. For instance, the product cost for three circuit boards

will differ if the production run is selected as the cost driver instead of production hours per unit.

The mistakes made will provide misleading information to establish the incorrect selling prices

of the three circuit boards and further influence the company’s profitability.

The second limitation is derived from the multiple cost drivers in which the

implementation of activity-based costing is time-consuming and cost-ineffective. As all source

data are indirectly linked to the three circuit boards, which costs are unable to allocate straight to

the circuit boards, activity-based costing involves more lengthy process, complex calculations,

and heavier workload to determine allocation rates[ CITATION Mah15 \l 1033 ]. Moreover,

although activity-based costing provides more precise and accurate information for the company,

the accuracy of allocation rates for diverse production activities has to be ascertained constantly.

Activity-based costing requires a costly and strenuous accumulating and analyzing process to

ensure the allocation rates of every production activity are regularly up to date. The absence of

correct and latest information might lead to erroneous decisions on product costs and

significantly exacerbate the concerns on profitability.

14

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

4.0 RECOMMENDATIONS

4.1 IMPROVE PROFITABILITY BY ACTIVITY-BASED COSTING

Activity-based costing is advocated as a powerful tool for reducing product cost due to its

ability to reveal the embedded cost. As the silver board consists of the highest product cost, the

implementation of activity-based costing helps to reduce the cost of the silver board by

identifying the accurate and logical overhead costs. When multiple overhead costs are traced and

spread uniformly to all product activities, managers can differentiate between efficient

production and unnecessary cost incurred. Therefore, actions can be taken to minimize the waste

during production activities and eliminate the non-value adding or costly activities, leading the

production activity to be more streamlined. By doing so, the cost of the silver board will be

reduced and significantly contribute more revenue and greater profitability to the company.

In addition, activity-based costing helps to resolve the cost distortions caused by

traditional absorption costing. As there is only a single overhead rate and allocation base applied

across the production activity, the cost information is easy to be distorted. For example, the

golden board is under-costed and the silver board over-costed when traditional absorption

costing is used to calculate the product cost per unit. It leads the management to erroneously

expect that the gold board is profitable, yet the silver board is unprofitable, which shifts their

attention to the wrong profitable products and results in suffering significant financial losses. By

integrating the activity-based costing, it is capable of monitoring the hidden losses and hidden

profit. An activity-based costing system offers an accurate costing mechanism, providing

accurate cost data and useful information to management to establish appropriate selling prices

and profitable operating decisions.

With the implementation of activity-based costing, Southern Digital Sdn. Bhd. able to

manage better manufacturing performance, improve profitability, and maximize returns as a

result of more accurate product pricing and effective resource allocation.

15

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

4.2 CONCERN ON THE SUPPLY IN SILVER CIRCUIT BOARD

After the analysis between traditional absorption costing and activity-based costing, the

good of continuing supply in the silver board has far outweighed the bad. Due to the less

accurate and misleading cost information provided by traditional absorption costing, the silver

board is over-costed, showing a loss of RM 0.42 per unit in revenue after subtracting with the

selling price. However, activity-based costing that distinguishes multiple indirect costs based on

the cost drivers helps increase the accuracy of cost data and reduce the likelihood of cost

distortions, indicating the production of the silver board brings revenue of RM 0.52 per unit to

the company [CITATION Yan12 \l 1033 ]. Moreover, silver board has the highest units sold

among the three circuit boards, which is 18,000 units. Therefore, the supply of silver boards is

not encouraged to be terminated.

16

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

5.0 CONCLUSION

For Southern Digital Sdn. Bhd. to resume their contract with Tech World Sdn. Bhd. and

achieve the goal of sustaining profit during the pandemic outbreak, determining the accurate

costing system plays a vital role in addressing those issues. According to the comparisons and

findings above, activity-based costing has greater benefits than traditional absorption costing.

While traditional absorption costing is likely to increase the odds of cost distortions, activity-

based costing successfully provides accurate cost information, enabling the company to gain

competitive advantages and improve profitability. Thus, the introduction of activity-based

costing is the solution to overcome the difficulties encountered. Although the limitations of

multiple cost pool selection and time-consuming workload might hinder the implementation of

activity-based costing, but these shortcomings can be resolved effectively when company

management is strongly committed and supportive [ CITATION Kon12 \l 1033 ].

17

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

6.0 APPENDIX

CALCULATION: TRADITIONAL ABSORPTION COSTING

18

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

19

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

CALCULATION: ACTIVITY-BASED COSTING

20

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

21

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

7.0 REFERENCE LIST

Athikah, N., 2010. Utilization of Activity-Based Costing System in Manufacturing Industries –

Methodology, Benefits and Limitations. International Review of Business Research Papers,

February, 6(1), pp. 1-17.

HUGHES, S. B. & GJERDE, K. A., 2003. Do Different Cost Systems Make a Difference?.

Management accounting quarterly, 5(1), pp. 22-30.

Konan, N. C., 2012. PROBLEMS ENCOUNTERED WITH THE IMPLEMENTATION OF AN

ACTIVITY-BASED COSTING SYSTEM. December .p. 87.

Mahal, I. & Hossain, M. A., 2015. Activity-Based Costing (ABC) – An Effective Tool for Better

Management. Research Journal of Finance and Accounting, 6(4).

Mishra, B. & Vaysman, I., 2002. Cost-System Choice and Incentives—Traditional vs. Activity-

Based Costing. Journal of Accounting Research, 39(3), pp. 619-641.

Molis, J., 2018. Advantages & Disadvantages of Traditional Costing. [Online]

Available at: https://bizfluent.com/info-8645304-advantages-disadvantages-traditional-

costing.html

[Accessed 2021].

Namazi, M., 2016. Time-driven activity-based costing: Theory, applications and limitations.

Iranian Journal of Management Studies (IJMS), 9(3), pp. 457-482.

Rasiah, D., 2011. Why activity based costing (ABC) is still tagging behind the traditional costing

in Malaysia?. Journal of Applied Finance & Banking, 1(1), pp. 83-106.

SAYGILI, A. T. & KAYALI, C. A., 2015. A COMPARISON OF ABSORPTION COSTING

AND ACTIVITY BASED COSTING SYSTEMS THROUGH AN OPTIMIZATION

PROBLEM. International Journal of Research In Social Sciences, July.5(5).

22

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

lOMoARcPSD|17008703

Sharma, R. & Ratnatunga, J., 1997. Teaching note: Traditional and activity based costing system.

Accounting Education, 6(4), pp. 337-345.

Yanpirat, P. & Maneewan, J., 2012. Employing Fuzzy-Based CVP Analysis for Activity-Based

Costing for Maintenance Service Providers. Proceedings of the International MultiConference of

Engineers and Computer Scientists, Volume 2.

23

Downloaded by ?ào H?ng (daohang092k3@gmail.com)

You might also like

- Teaching and Learning in STEM With Computation, Modeling, and Simulation Practices: A Guide for Practitioners and ResearchersFrom EverandTeaching and Learning in STEM With Computation, Modeling, and Simulation Practices: A Guide for Practitioners and ResearchersNo ratings yet

- Oumh1203 - English For Written CommunicationDocument7 pagesOumh1203 - English For Written CommunicationzabedahibrahimNo ratings yet

- OUMH1203-English For Written Communication TaskDocument11 pagesOUMH1203-English For Written Communication TaskMUHAMMAD NAJIB BIN HAMBALI STUDENTNo ratings yet

- OUMH1203Document14 pagesOUMH1203NOOR AZIZAH BINTI ALI STUDENTNo ratings yet

- Soalan Assignment OUMH1203Document7 pagesSoalan Assignment OUMH1203Nur Suhailah Abd RahimNo ratings yet

- Assignment OUMH1203 English For Written Communication May 2021 SemesterDocument7 pagesAssignment OUMH1203 English For Written Communication May 2021 SemesterManisha SharmaNo ratings yet

- Assignment OUMH1203 English For Written Communication September 2020 SemesterDocument6 pagesAssignment OUMH1203 English For Written Communication September 2020 SemesternannomansaranghaeNo ratings yet

- Oumh1203-English For Written CommunicationDocument18 pagesOumh1203-English For Written CommunicationSimon RajNo ratings yet

- Assignment OUMH1203 English For Written Communication May 2022 Semester Specific InstructionDocument8 pagesAssignment OUMH1203 English For Written Communication May 2022 Semester Specific InstructionNanthiniNo ratings yet

- Assignment OUMH1203 English For Written Communication January 2021 SemesterDocument6 pagesAssignment OUMH1203 English For Written Communication January 2021 SemesterchuinksiewyenNo ratings yet

- Soalan HMEF5083 Instructional TechnologyDocument8 pagesSoalan HMEF5083 Instructional TechnologyCikgu Azry Azeem PetronessaNo ratings yet

- Case Study With Rubric Dbm30033 Sesi I 2023 2024Document6 pagesCase Study With Rubric Dbm30033 Sesi I 2023 2024ainunnajwaNo ratings yet

- Introduction To Computing Syllabus 2022 2023Document9 pagesIntroduction To Computing Syllabus 2022 2023beverly arevaloNo ratings yet

- I. Ii. Iii. Iv. v. 4. 5. 6Document7 pagesI. Ii. Iii. Iv. v. 4. 5. 6nurain farhahNo ratings yet

- ENGI 9420 Engineering Analysis - Course Outline PDFDocument4 pagesENGI 9420 Engineering Analysis - Course Outline PDFSuprio100% (2)

- UEME1132/UEME1323 Statics Assignment (30%)Document20 pagesUEME1132/UEME1323 Statics Assignment (30%)shintanNo ratings yet

- Assignment OUMH2103 English For Science and Technical Purposes September 2021 SemesterDocument7 pagesAssignment OUMH2103 English For Science and Technical Purposes September 2021 SemesterAndrea FilippiniNo ratings yet

- Ass1 - S012016070002 - Assignment 1 - SEPT2022 - FTDocument6 pagesAss1 - S012016070002 - Assignment 1 - SEPT2022 - FTAbdul raifNo ratings yet

- Assignment - TMF1214 Computer Architecture Sem 2 2020 2021Document4 pagesAssignment - TMF1214 Computer Architecture Sem 2 2020 2021John DruoNo ratings yet

- Assignment OUMH1203 English For Written Communication May 2020 SemesterDocument5 pagesAssignment OUMH1203 English For Written Communication May 2020 SemesterJason Lao0% (1)

- BEE1023 QS - Assignment EEEPDocument8 pagesBEE1023 QS - Assignment EEEPdaboa614No ratings yet

- Applied MathematicsDocument7 pagesApplied Mathematics24Vaishnavi KhambayateNo ratings yet

- 311302-Basic Maths SyllabusDocument9 pages311302-Basic Maths SyllabusSuriRawatNo ratings yet

- 311302-BASIC MATHEMATICS (K-Scheme-Syllabus)Document8 pages311302-BASIC MATHEMATICS (K-Scheme-Syllabus)jacksparrowcom4No ratings yet

- Bwcs Updated Assignment May 2023 Along With Solution Arsal SaeedDocument137 pagesBwcs Updated Assignment May 2023 Along With Solution Arsal Saeedrrehmanali1974No ratings yet

- COMP534 - Final Project (Lab) 2nd Tri 2020-2021Document9 pagesCOMP534 - Final Project (Lab) 2nd Tri 2020-2021hamzaNo ratings yet

- Finance Individual AssignmentDocument13 pagesFinance Individual AssignmentDylan Rabin PereiraNo ratings yet

- Assignment OUMH1203 English For Written Communication September 2023 SemesterDocument15 pagesAssignment OUMH1203 English For Written Communication September 2023 SemesterFaiz MufarNo ratings yet

- Individual Assignment Question AUG 2021 MGT2044 DRGDocument5 pagesIndividual Assignment Question AUG 2021 MGT2044 DRGneesha catzyNo ratings yet

- Group Assignment Jan 2020 BEAMDocument6 pagesGroup Assignment Jan 2020 BEAM郭思凱No ratings yet

- Santo ESP 1Document6 pagesSanto ESP 1Bhushan BhoyeNo ratings yet

- Assignment HMEF5083 - V2 Instructional Technology January 2022 SemesterDocument11 pagesAssignment HMEF5083 - V2 Instructional Technology January 2022 Semesterkavitha7111No ratings yet

- Rubrik For BETP1323 LAB ACTIVITYDocument2 pagesRubrik For BETP1323 LAB ACTIVITYHairul Effendy Ab MaulodNo ratings yet

- Lei 2014 Project Paper Based On Case Study 1 40%Document3 pagesLei 2014 Project Paper Based On Case Study 1 40%20b543No ratings yet

- Final Project-Comp626 Instructions:: Student's Signature: .. Date: .Document4 pagesFinal Project-Comp626 Instructions:: Student's Signature: .. Date: .hawra mohammedNo ratings yet

- Oumh1203 English For Written CommunicationDocument15 pagesOumh1203 English For Written CommunicationSimon RajNo ratings yet

- Applied Mathematics (K Scheme Syllabus)Document6 pagesApplied Mathematics (K Scheme Syllabus)pagareaaryan.2007No ratings yet

- Operations Research Applications and Algorithms, Wayne L. Winston, 4 Edition, 2004, Cengage Learning, ISBN-13: 9780534380588Document10 pagesOperations Research Applications and Algorithms, Wayne L. Winston, 4 Edition, 2004, Cengage Learning, ISBN-13: 9780534380588Raghuveer ChandraNo ratings yet

- Wa0003.Document13 pagesWa0003.utkarshdeshmukhNo ratings yet

- Lai Zhe Fan 20WBR07883 RMK3S3 IndividualDocument17 pagesLai Zhe Fan 20WBR07883 RMK3S3 Individualsithaarthun-wp21No ratings yet

- Basic MathematicsDocument7 pagesBasic MathematicskirankumarNo ratings yet

- Project Title: Master of Technology inDocument18 pagesProject Title: Master of Technology inAnsuman MishraNo ratings yet

- Template For A2 MTCA3003 Aero UpdatedDocument9 pagesTemplate For A2 MTCA3003 Aero UpdatedShihab Al-risiNo ratings yet

- Principle of Accounting AssignmentDocument15 pagesPrinciple of Accounting AssignmentFAIZAN ASGHARNo ratings yet

- Lab Report Rubric - Unit Operation Lab 1920 IDocument4 pagesLab Report Rubric - Unit Operation Lab 1920 IMuhammad Taufik RahmanNo ratings yet

- Subject Code(s) : Subject Description: Qualification Code(s) : Paper Type: Submission Date: Total Marks: Assessor: Internal Moderator InstructionsDocument5 pagesSubject Code(s) : Subject Description: Qualification Code(s) : Paper Type: Submission Date: Total Marks: Assessor: Internal Moderator InstructionsThandoNo ratings yet

- Technical Format CBEA Thesis 1Document27 pagesTechnical Format CBEA Thesis 1JOSHUA MiraflorNo ratings yet

- Assignment Content: Dueon1 March 2023Document3 pagesAssignment Content: Dueon1 March 2023Jaleel SheikhaNo ratings yet

- English For Written AssgnmtDocument15 pagesEnglish For Written Assgnmtvanikalai134No ratings yet

- Title of The Project: A Mini Project ReportDocument12 pagesTitle of The Project: A Mini Project ReportDiptesh ThakareNo ratings yet

- Assignment Template: Mazoon CollegeDocument3 pagesAssignment Template: Mazoon CollegeHaseeb AshrafNo ratings yet

- Natural Language Processing CS 1462: Computer Science 3 Semester - 1444 Dr. Fahman Saeed Faesaeed@imamu - Edu.saDocument15 pagesNatural Language Processing CS 1462: Computer Science 3 Semester - 1444 Dr. Fahman Saeed Faesaeed@imamu - Edu.saHamad AbdullahNo ratings yet

- CW1 Questions and TemplateDocument9 pagesCW1 Questions and TemplateJessie YapNo ratings yet

- AIS 2-Group Assignment Jul2023Document8 pagesAIS 2-Group Assignment Jul2023劉瑋傑No ratings yet

- Military Technological College: MTC Academic Integrity and Misconduct PolicyDocument7 pagesMilitary Technological College: MTC Academic Integrity and Misconduct PolicyMorsaleen ChowdhuryNo ratings yet

- ECA HarpaleeeeeeeeDocument6 pagesECA HarpaleeeeeeeeBhushan BhoyeNo ratings yet

- Title of The Project: A Mini Project ReportDocument12 pagesTitle of The Project: A Mini Project ReportDiptesh ThakareNo ratings yet

- Documentation Format 1Document4 pagesDocumentation Format 1Hitoshi B LibunganNo ratings yet

- Tanjung Manis HowDocument7 pagesTanjung Manis Howramen28No ratings yet

- Change in Accounting Policy and EstimatesDocument6 pagesChange in Accounting Policy and EstimatesMark IlanoNo ratings yet

- R12 Ap Theory: We Maintain The Following Things at Accounts Payables ModuleDocument22 pagesR12 Ap Theory: We Maintain The Following Things at Accounts Payables ModulerajaNo ratings yet

- Submission 1 - Project IntegrationDocument28 pagesSubmission 1 - Project IntegrationAkshay JoshiNo ratings yet

- Assingment N Case StudiesDocument5 pagesAssingment N Case StudiesArun VermaNo ratings yet

- Saln-Form - Jan Bryan M. EslavaDocument2 pagesSaln-Form - Jan Bryan M. EslavaJan Bryan EslavaNo ratings yet

- EduMple Learning Slide DeckDocument14 pagesEduMple Learning Slide Deckarun kumarNo ratings yet

- The Power of Selling, V. 1.0 - AttributedDocument683 pagesThe Power of Selling, V. 1.0 - AttributedAlfonso J Sintjago100% (2)

- Importance:: Running FollowsDocument4 pagesImportance:: Running FollowsNiizamUddinBhuiyanNo ratings yet

- Saudi Arabia Cement Sector AnalysisDocument5 pagesSaudi Arabia Cement Sector AnalysisNeeraj ChawlaNo ratings yet

- Introduction of EmigallDocument2 pagesIntroduction of EmigallJetNo ratings yet

- Quality Engineer Skills Competencies 1671770511Document8 pagesQuality Engineer Skills Competencies 1671770511AlfiNo ratings yet

- Executive Track: Week No CourseDocument4 pagesExecutive Track: Week No CoursebullworthinNo ratings yet

- Revenue From ContractsDocument92 pagesRevenue From ContractssharifNo ratings yet

- Case Study of Dell Computers EcommerceDocument9 pagesCase Study of Dell Computers EcommerceRaj DubeyNo ratings yet

- IDC Retail Insights Worldwide Retail Technology Strategies - 2023 JulyDocument1 pageIDC Retail Insights Worldwide Retail Technology Strategies - 2023 JulyMD ABUL KHAYERNo ratings yet

- Armin Ravoof (TVS Motors)Document18 pagesArmin Ravoof (TVS Motors)armeena falakNo ratings yet

- Internship Report On GSK. Nabila Alam 09104121Document63 pagesInternship Report On GSK. Nabila Alam 09104121prospereducationNo ratings yet

- 2Document3 pages2gurdev1825No ratings yet

- Assignment Front SheetDocument17 pagesAssignment Front SheetQuynh Doan Nguyen XuanNo ratings yet

- What - If Using ExcelDocument17 pagesWhat - If Using ExcelcathycharmedxNo ratings yet

- Adp CH.2Document11 pagesAdp CH.2RK HassanNo ratings yet

- Asian Paints 2013Document172 pagesAsian Paints 2013Abhishek TripathiNo ratings yet

- March Month Bill PDFDocument1 pageMarch Month Bill PDFPronceNo ratings yet

- The Provisions of Sections 28 To 44D Deal With The Method of Computing Income Under HeadDocument4 pagesThe Provisions of Sections 28 To 44D Deal With The Method of Computing Income Under HeadTwinkling starNo ratings yet

- Alpha BetaDocument13 pagesAlpha BetaJoel Christian MascariñaNo ratings yet

- 2022-2023-1st-Quarter-Exam-Computer Programming Grade 11-1920Document5 pages2022-2023-1st-Quarter-Exam-Computer Programming Grade 11-1920Edeson John CabanesNo ratings yet

- Exam Syllabus For DAE ExamDocument46 pagesExam Syllabus For DAE Examykr007No ratings yet

- Unit 1-Lesson 4 - Market Need AnalysisDocument11 pagesUnit 1-Lesson 4 - Market Need AnalysisElixa HernandezNo ratings yet

- Assignment DFA6127Document3 pagesAssignment DFA6127parwez_0505No ratings yet