Professional Documents

Culture Documents

E 3313p054407f3e5

Uploaded by

Kiran Jaware0 ratings0% found this document useful (0 votes)

7 views1 pageThis document provides customer and loan details for a borrower named Reshma Sukram More. [1] It includes the borrower's name, ID, age, address, loan amount details such as principal amount of Rs. 39,110, interest of Rs. 5,891.47, and other upfront charges of Rs. 1,247. [2] The loan has a term of 75 weeks with weekly repayments of Rs. 600 and an annual interest rate of 24.46%. [3] No penalty charges will be applied for prepayment of the loan.

Original Description:

Original Title

E_3313P054407f3e5

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides customer and loan details for a borrower named Reshma Sukram More. [1] It includes the borrower's name, ID, age, address, loan amount details such as principal amount of Rs. 39,110, interest of Rs. 5,891.47, and other upfront charges of Rs. 1,247. [2] The loan has a term of 75 weeks with weekly repayments of Rs. 600 and an annual interest rate of 24.46%. [3] No penalty charges will be applied for prepayment of the loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageE 3313p054407f3e5

Uploaded by

Kiran JawareThis document provides customer and loan details for a borrower named Reshma Sukram More. [1] It includes the borrower's name, ID, age, address, loan amount details such as principal amount of Rs. 39,110, interest of Rs. 5,891.47, and other upfront charges of Rs. 1,247. [2] The loan has a term of 75 weeks with weekly repayments of Rs. 600 and an annual interest rate of 24.46%. [3] No penalty charges will be applied for prepayment of the loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

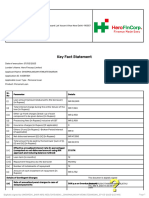

CUSTOMER AND LOAN DETAILS

Name of the Centre GIRNADYAM Date of application 24-05-2022

Client ID 33:13:056:04:007 Client Age as per KYC document 39

Name of the Borrower Reshma Sukram More Marital status Married

Sukhram Bhika More , Malgaon,girnadam Maharashtra

423106

Father/ Husband’s Name Address of the Borrower

Proposal Code/ ID 33:13:P054407 Loan type and Cycle MFI-3

PAN Contact Number 7620201475

Member of SHG Staff ID 80492

CKYC Identifier

KEY FACTSHEET

Sr. No. Parameter Amount in Rs.

(i) Loan amount (Gross amount disbursed to the borrower) 39110

(ii) Total interest charge during the entire tenure of the loan 5891.47

(iii) Other up-front charges (break-up of each component given below) 1247

a Processing fees @ 1% 391

b GST on processing fees 70

c Insurance charges 786

d Others (if any) 0

(iv) Net disbursed amount ((i)-(iii)) 37863

(v) Total amount to be paid by the borrower (sum of (I), (ii) and (iii)) 46248.47

(vi) Effective annualized interest rate (in percentage) 24.46

(computed on net disbursed amount using IRR approach and reducing balance method)

(vii) Loan term (in weeks) 75

(viii) Repayment frequency by the borrower Weekly

(ix) Number of instalments of repayment 75

(x) Amount of each instalment of repayment 600

Details about Contingent Charges

(xi) Borrower shall not be charged any penalty on prepayment of loan at any time

(xii) Penal charges in case of delayed payments (if any)

(xiii) Other charges (if any)

(xiv) Effective annualized interest rate (in percentage)

21.2

(Net-off processing fees excluding GST using IRR approach and reducing balance method)

“The above calculations have been done considering the loan disbursement date”

You might also like

- Jawala Bajar 17-06-2022 26:10:057:10:008 31 Married, Jawla Bajar Jawala Bajar, Maharashtra 431705Document1 pageJawala Bajar 17-06-2022 26:10:057:10:008 31 Married, Jawla Bajar Jawala Bajar, Maharashtra 431705निशब्द मेघNo ratings yet

- AgreementDocument16 pagesAgreementakashdas0765No ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfspoojameher644No ratings yet

- Sanction LetterDocument16 pagesSanction LetterKiran Kumar DevajjiNo ratings yet

- Key Fact Sheet Your Loan Application Number: C02310191077218238Document2 pagesKey Fact Sheet Your Loan Application Number: C02310191077218238vkintouch1987No ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With KfsibtfaizabadNo ratings yet

- Sanction Letter 1Document16 pagesSanction Letter 1girishbabuv817No ratings yet

- Kfs Agreement PDFDocument2 pagesKfs Agreement PDFkeerthi achantiNo ratings yet

- Kfs AgreementDocument2 pagesKfs AgreementSeema NairNo ratings yet

- Loan Sanction Letter SC301K9T4U7DE216TDocument6 pagesLoan Sanction Letter SC301K9T4U7DE216Tskjadhav099No ratings yet

- Key Fact StatementDocument5 pagesKey Fact StatementYash PorwalNo ratings yet

- Agreement 0001014450001319648Document4 pagesAgreement 0001014450001319648bullbear240No ratings yet

- Loan Sanction - 6Document2 pagesLoan Sanction - 6sidvikventuresNo ratings yet

- Sanction Letter INST8177866385255823 136174897781782Document7 pagesSanction Letter INST8177866385255823 136174897781782joy211096No ratings yet

- Loan Sanction-Letter With kfs3323231543124847618Document4 pagesLoan Sanction-Letter With kfs3323231543124847618ajay PrajapatNo ratings yet

- Mohammad Salim Khan Garments - Working Capital Loan Key Fact StatementDocument2 pagesMohammad Salim Khan Garments - Working Capital Loan Key Fact Statementswapnilmaher43No ratings yet

- Kulkarni Sarang MilindDocument21 pagesKulkarni Sarang MilindSarang KulkarniNo ratings yet

- SR - No Parameter DetailsDocument1 pageSR - No Parameter DetailsChinni ChinniNo ratings yet

- Key Fact SheetDocument4 pagesKey Fact SheetRazzak KathatNo ratings yet

- TermsAndConditions 9687 04112023153427Document3 pagesTermsAndConditions 9687 04112023153427Jeetu WadhwaniNo ratings yet

- Loan Sanction-Letter With kfs345937221866371454Document4 pagesLoan Sanction-Letter With kfs345937221866371454Palaka PrasanthNo ratings yet

- Key Fact StatementDocument6 pagesKey Fact StatementAnkit KumarNo ratings yet

- PL Application FormDocument10 pagesPL Application FormsujitNo ratings yet

- TermsAndConditions 8667 31032024153855Document3 pagesTermsAndConditions 8667 31032024153855siwax63285No ratings yet

- Key Fact Sheet: DelhiDocument3 pagesKey Fact Sheet: Delhisales.kayteeautoNo ratings yet

- Signed Agreement PDFDocument6 pagesSigned Agreement PDFAaqib MushtaqNo ratings yet

- Loan AgreementDocument19 pagesLoan AgreementR GautamNo ratings yet

- Key Facts Piramal FinanceDocument3 pagesKey Facts Piramal Financejitendrakumar.dj0No ratings yet

- AgreementDocument18 pagesAgreementVaishnaviNo ratings yet

- Digital E-Stamp: Government of Uttar PradeshDocument29 pagesDigital E-Stamp: Government of Uttar PradeshPrabhat DangwalNo ratings yet

- Sanction Letter FAST7651617444854859 371328176989144Document7 pagesSanction Letter FAST7651617444854859 371328176989144hm7072302No ratings yet

- Agreement 0001013870002231610Document3 pagesAgreement 0001013870002231610SatyaNo ratings yet

- Loan Agreement SahilDocument17 pagesLoan Agreement SahilitsmesahilshahhNo ratings yet

- Sanction Letter FAST7186877785851539 775883241168816Document4 pagesSanction Letter FAST7186877785851539 775883241168816yogeshmepindiaNo ratings yet

- Loan Sanction LetterDocument4 pagesLoan Sanction Lettermk9778225No ratings yet

- LAI-122470246 - DRF - Key Fact Statement - SignedDocument4 pagesLAI-122470246 - DRF - Key Fact Statement - Signedgamersingh098123No ratings yet

- KB231212CZRZY - KFS & Sanction LetterDocument9 pagesKB231212CZRZY - KFS & Sanction Letterthummaudaykiran123No ratings yet

- Kfs DocumentDocument2 pagesKfs DocumentNayan ShindeNo ratings yet

- Soa 1700471159825Document5 pagesSoa 1700471159825grv50215No ratings yet

- Loan Agreement 010002735477Document16 pagesLoan Agreement 010002735477vinay chinniNo ratings yet

- Key Fact StatementDocument3 pagesKey Fact Statementdheerajpa009No ratings yet

- Zxjyofen9v50s0s8dohy Mu9ivmmmitsrtebivbody7vf Zqei7oupc 6km4m6oqiswctyqwfsdbwigmzy7aDocument5 pagesZxjyofen9v50s0s8dohy Mu9ivmmmitsrtebivbody7vf Zqei7oupc 6km4m6oqiswctyqwfsdbwigmzy7aprasadboppana88No ratings yet

- WTL PLCC Application FormDocument7 pagesWTL PLCC Application Formarunjh2No ratings yet

- keyFactStatement 1Document8 pageskeyFactStatement 1naga srinuNo ratings yet

- AgreementDocument11 pagesAgreementManish KumarNo ratings yet

- Key Fact StatementDocument3 pagesKey Fact StatementVicky VimalNo ratings yet

- Mauli Krishi Seva Kendra - KFSDocument4 pagesMauli Krishi Seva Kendra - KFSswapnilmaher43No ratings yet

- Kfs DocumentDocument2 pagesKfs Documentshaiksubhani00407No ratings yet

- Statement of Account For 4080cdip750417: Bajaj Finance LimitedDocument3 pagesStatement of Account For 4080cdip750417: Bajaj Finance LimitedN BanuNo ratings yet

- KFS - Mohammad Salim Khan GarmentsDocument4 pagesKFS - Mohammad Salim Khan Garmentsswapnilmaher43No ratings yet

- Soa 1709649014998Document2 pagesSoa 1709649014998PrasadNo ratings yet

- IDFC FIRST Bank - Credit Card - Statement - 22062023Document5 pagesIDFC FIRST Bank - Credit Card - Statement - 22062023Udaya KumarNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterDipak BagadeNo ratings yet

- KPR Bajaj PL Account STMNTDocument3 pagesKPR Bajaj PL Account STMNTVara Prasad AvulaNo ratings yet

- Key Fact StatementDocument3 pagesKey Fact Statementamansingh21031992No ratings yet

- Bajaj PL StatementDocument7 pagesBajaj PL Statementsrinivas rao kNo ratings yet

- Signed AgreementDocument8 pagesSigned Agreementsushilkumarstm9608No ratings yet

- Kfs DocumentDocument2 pagesKfs DocumentSaqib IsmailNo ratings yet

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- Derivative Instruments: A Guide to Theory and PracticeFrom EverandDerivative Instruments: A Guide to Theory and PracticeRating: 5 out of 5 stars5/5 (1)

- Promissory NoteDocument4 pagesPromissory NoteSatbir TalwarNo ratings yet

- Indian Financial SystemDocument20 pagesIndian Financial SystemDivya JainNo ratings yet

- RCBC V CADocument2 pagesRCBC V CAhmn_scribdNo ratings yet

- Questions - Obligations - Articles 1291 To 1330Document23 pagesQuestions - Obligations - Articles 1291 To 1330Lourd CellNo ratings yet

- HARI - SHANKAR U - Resume - 23Document1 pageHARI - SHANKAR U - Resume - 23eg0mqx80No ratings yet

- Black Book 102Document71 pagesBlack Book 102Rishika BafnaNo ratings yet

- Cuyahoga County Executive Armond Budish End of Term ReportDocument28 pagesCuyahoga County Executive Armond Budish End of Term ReportWKYC.comNo ratings yet

- DCLetter 12705 CH - Papaiah PDFDocument2 pagesDCLetter 12705 CH - Papaiah PDFanil kumar ChinthalapatiNo ratings yet

- Petition For Hospitalization of Insane Person: PetitionerDocument29 pagesPetition For Hospitalization of Insane Person: PetitionerClee Ayra Sangual CarinNo ratings yet

- 4 - Home Loan TerminolgyDocument210 pages4 - Home Loan Terminolgypurit83No ratings yet

- Shadow Banking and The Rise of Capitalism in ChinaDocument206 pagesShadow Banking and The Rise of Capitalism in ChinaJózsef PataiNo ratings yet

- Intellectual PropertyDocument28 pagesIntellectual PropertycassiopieabNo ratings yet

- Motion in Limine To Exclude All Evidence and Judicial NoticeDocument12 pagesMotion in Limine To Exclude All Evidence and Judicial Noticetim754580% (5)

- Case Digest 2Document1 pageCase Digest 2Zyreen Kate BCNo ratings yet

- METROBANK v. LIBERTY CORRUGATEDDocument3 pagesMETROBANK v. LIBERTY CORRUGATEDJoey DenagaNo ratings yet

- T4 Other Income Q 1-2020-2021Document2 pagesT4 Other Income Q 1-2020-2021Putri Nurin Hasnida HassanNo ratings yet

- Maria Zarah - Villanueva - Castro: Banking LawsDocument15 pagesMaria Zarah - Villanueva - Castro: Banking LawsNiel Edar BallezaNo ratings yet

- The Impact of Credit ScoringDocument4 pagesThe Impact of Credit ScoringMahmoud NassefNo ratings yet

- Accession PropertyDocument161 pagesAccession PropertyJawwada Pandapatan MacatangcopNo ratings yet

- An Internship Report On 22Document38 pagesAn Internship Report On 22Sanjeela JoshiNo ratings yet

- Winston Industries and Ewing Inc Enter Into An Agreement That PDFDocument1 pageWinston Industries and Ewing Inc Enter Into An Agreement That PDFAnbu jaromiaNo ratings yet

- Chapter 5 Percentage TaxDocument11 pagesChapter 5 Percentage Taxmy miNo ratings yet

- Respondent: (Express or Implied) of A Legal Right or Advantage."Document7 pagesRespondent: (Express or Implied) of A Legal Right or Advantage."dk0895No ratings yet

- How 2 Setup TrustDocument3 pagesHow 2 Setup TrustRebel X97% (237)

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjaberyemeniNo ratings yet

- Cred Risk (07-9 Alternate)Document61 pagesCred Risk (07-9 Alternate)Farrukh JunaidNo ratings yet

- DBP Vs NLRCDocument8 pagesDBP Vs NLRCJalo Val Marinius SantanderNo ratings yet

- Attendee List For Aarmr 28th Annual RegulatoryDocument26 pagesAttendee List For Aarmr 28th Annual Regulatoryranjith123No ratings yet

- Full Bond Markets Analysis and Strategies 8Th Edition Fabozzi Solutions Manual PDFDocument52 pagesFull Bond Markets Analysis and Strategies 8Th Edition Fabozzi Solutions Manual PDFwilliam.ely879100% (14)

- Functions of BanksDocument12 pagesFunctions of BankskarendanganNo ratings yet