Professional Documents

Culture Documents

HGFJMH

Uploaded by

charlie tunaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HGFJMH

Uploaded by

charlie tunaCopyright:

Available Formats

https://studylib.net/doc/5871491/chapter-13-homework-solutions#:~:text=8.

,deposits%20being

%20held%20in%20reserve.

Classify each of these transactions as an asset, a liability, or neither for each of the

"players" in the money supply process - the Federal Reserve, banks, and depositors.

a. You get a $10,000 loan from the bank to buy an automobile.

b. You deposit $400 into your checking account at the local bank.

c. The Fed provides an emergency loan to a bank for $1,000,000

d. A bank borrows $500,000 in overnight loans from another bank

e. You use your debit card to purchase a meal at a restaurant for $100.

a. Liability to you (depositor) because you now owe the bank $10,000, asset to the bank

because you owe them principal and interest, neither to Fed Res, bc they play no part

b. Asset to you (depositor), liability to bank bc they owe you $400, neither to Fed Res,

bc they play no part

c. Fed holds an asset to this plus interest, liability to the bank because it owes this much

to Fed, neither to depositors bc they play no part

d. bank that borrows has liability, bank that extended loan holds it as an asset, neither

for Fed

e. neither to depositor, liability for bank, neither to Fed

The First National Bank receives an extra $100 of reserves but decides not to lend out

any of these reserves, How much deposit creation takes place for the entire banking

system?

$0

00:0201:30

Suppose that the Fed buys $1 million of bonds from the First National Bank. If the First

National Bank and all other banks use the resulting increase in reserves to purchase

securities only and not to make loans, what will happen to checkable deposits? Assume

the required reserve ratio is 10 percent.

Change of D = 1 / rr x Change of R

Checkable deposits increase by $10 million.

If a bank depositor withdraws $1,00 of currency from an account, what happens to

reserves, checkable deposits, and the monetary base? Assume that the required

reserve ratio on checkable deposits is 10% and banks do not hold any excess reserves.

Reserves fall by $1,000, checkable deposits fall by $10,000, and the monetary base

remains uncharged.

If a bank sells $10 million of bonds to the Fed to pay back $10 million on the loan it

owes, what is the effect on the level of checkable deposits?

checkable deposits do not change

If you decide to hold $100 less cash than usual and therefore deposit $100 more cash

in the bank, what effect will this have on checkable deposits in the banking system if the

rest of the public keeps its holding of currency constant?

checkable deposits increase by $1,000

"The Fed can perfectly control the amount of reserves in the system" Is this statement

true, false or uncertain?

False. A shift from deposits to currency will affect the amount of reserves, and since

other players are involved in this process, the Fed ultimately cannot control the level of

reserves in the system

"The Fed can perfectly control the amount of the monetary base, but has less control

over the compositions of the monetary base" Is this true, false or uncertain?

False, since the Fed cannot control the amount of discount lending to financial

institutions, it does not have perfect control over the amount of reserves in the banking

system and hence the monetary base

The Fed buys $100 million of bonds from the public and also lowers the reserve

requirement r. What will happen to the money supply?

the money supply will increase

Describe how each of the following can affect the money supply: (a) the central bank,

(b) banks, and (c) depositors

a) central bank: supplies money, changes the non borrowed money base.

b) banks: money supply will increase because of less excess reserves and more loans

c) depositors: a lower money supply for a given monetary base because of the lower

money multiplier.

The money multiplier is necessarily greater than 1. true or flase?

true, because in reality, the required and excess reserve ratios typically add up to less

than one

What effect might a financial panic have on the money multiplier and the money supply?

Why?

In a financial panic, you would expect the money multiplier to decrease and the money

supply to decrease, which would cause the excess reserves ratio to increase. Thus

depositors are likely to increase their holdings of currency.

00:0201:30

During the Great Depression years from 1930-1933 both the currency ratio c and the

excess reserves ration c rose dramatically. What effect did these factors have on the

money multiplier?

An increase in both the currency ratio and the excess reserves ratio resulted in a

dramatic decrease of the money multiplier.

In October 2008, the Federal Reserve began paying interest on the amount of excess

reserves held by banks. How, if at all, might this affect the multiplier process and the

money supply?

Paying interest on reserves gives banks incentive to hold more reserves rather than

lend them out, which should raise the excess reserve ratio, reduce the money multiplier,

and reduce the money supply, holding the monetary base constant.

the money multiplier declined significantly during the period 1930-1933 and also during

the recent financial crisis of 2008-2010. yet the m1 money supply decreased by 25% in

the depression period but increased by more than 20% during the recent financial crisis.

what explains the difference in outcomes?

During the Great Depression, the Federal Reserve did not expand the monetary base

so the decline in the money multiplier resulted in a decrease in the money supply.

During the most recent crisis when the money multiplier decline because of the increase

in excess reserves, the Federal Reserve increased the monetary base to keep the

money supply stable.

If the Fed sells $2 million of bonds to the First National Bank, what happens to reserves

and the monetary base?

Reserves and the monetary base fall by $2 million,

If the fed sells $2 million of bonds to Irving the investor , who pays for the bonds with a

briefcase filled with currency, what happens to the monetary base?

Reserves are unchanged, but the monetary base decreases by $2 million due to the

currency

reduction

If the Fed lends five banks a total of $100 million but depositors withdraw $50 million

and hold it as currency, what happens to reserves and the monetary base?

Reserves increase by $50 million, and the monetary base increases by $100 million.

What happens to checkable deposits in the banking system when the Fed lends an

additional $1 million to the First National Bank, assuming that the required reserve ratio

on checkable deposits is 10%, banks do not hold any excess reserves, and the public's

holdings of currency do not change?

Checkable deposits rise by $10 million.

What happens to checkable deposits in the banking system when the Fed sells $2

million of bonds to the First National Bank?

checkable deposits decline by $20 million.

If the Fed buys $1 million of bonds from the First National Banks, but an additional 10%

of any deposit is held as excess reserves, what is the total increase in checkable

deposits?

...

You might also like

- Group 4 PF tp-10Document1 pageGroup 4 PF tp-10charlie tunaNo ratings yet

- Group 4 PF tp-12Document1 pageGroup 4 PF tp-12charlie tunaNo ratings yet

- Chapter 8Document22 pagesChapter 8charlie tunaNo ratings yet

- SlideDocument3 pagesSlidecharlie tunaNo ratings yet

- Solved ProblemDocument5 pagesSolved Problemcharlie tunaNo ratings yet

- Chapter 8 - Cost Benefit AnalysisDocument40 pagesChapter 8 - Cost Benefit Analysischarlie tunaNo ratings yet

- Chapter 5 MBDocument13 pagesChapter 5 MBcharlie tunaNo ratings yet

- Seven Years Ago The Templeton Company Issued 20Document1 pageSeven Years Ago The Templeton Company Issued 20charlie tunaNo ratings yet

- BRM CH 7Document66 pagesBRM CH 7charlie tunaNo ratings yet

- FinanceDocument6 pagesFinancecharlie tunaNo ratings yet

- Real Number System : Reference: Sanchetti & Kapoor (S&K)Document18 pagesReal Number System : Reference: Sanchetti & Kapoor (S&K)charlie tunaNo ratings yet

- L#02 - Chap 02 - S&K (Including L#01)Document52 pagesL#02 - Chap 02 - S&K (Including L#01)charlie tunaNo ratings yet

- Indices and Surds: Reference: Sancheti & Kapoor (S&K)Document19 pagesIndices and Surds: Reference: Sancheti & Kapoor (S&K)charlie tunaNo ratings yet

- Lec 4Document9 pagesLec 4charlie tunaNo ratings yet

- ALD1203 - Basic Business MathematicsDocument35 pagesALD1203 - Basic Business Mathematicscharlie tunaNo ratings yet

- Consumer Behavior and Individual DemandDocument19 pagesConsumer Behavior and Individual Demandcharlie tunaNo ratings yet

- Exercise QuestionsDocument2 pagesExercise Questionscharlie tunaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAdithi KNo ratings yet

- Chase Credit CardsDocument2 pagesChase Credit CardspauloNo ratings yet

- Gate Ies Psu: New Batches For Gate & Psus 2021Document4 pagesGate Ies Psu: New Batches For Gate & Psus 2021Vijaykumar JatothNo ratings yet

- DPD Invoice SampleDocument18 pagesDPD Invoice SamplelarisaNo ratings yet

- Chapter - 1. IntroductionDocument21 pagesChapter - 1. IntroductionSiddhi PatilNo ratings yet

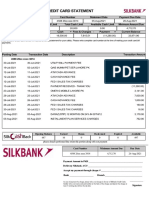

- Credit Card StatementDocument3 pagesCredit Card StatementSaifullah Saifi0% (1)

- Anthem GroupDocument3 pagesAnthem GroupRebuild BoholNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument3 pagesStatement of Account: Credit Limit Rs Available Credit Limit Rsabhishek barmanNo ratings yet

- Coo Inv 06 BHATTDocument2 pagesCoo Inv 06 BHATTIpons Ponaryo100% (1)

- Unit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Document6 pagesUnit - Vii: Money and Banking: Material Downloaded From SUPERCOP 1/6Aasif NengrooNo ratings yet

- Agenda 21 - UNITED NATIONS - SUSTAINABLE DEVELOPMENTDocument678 pagesAgenda 21 - UNITED NATIONS - SUSTAINABLE DEVELOPMENTMariaLeroux100% (1)

- 9 Homework Exercises NCL Sess 9 - StudentsDocument34 pages9 Homework Exercises NCL Sess 9 - StudentsAgustín RosalesNo ratings yet

- Times Values of Money MCQ's Live Class 15-04-2023Document35 pagesTimes Values of Money MCQ's Live Class 15-04-2023Raghav PrajapatiNo ratings yet

- Op Shop Adventures GuideDocument28 pagesOp Shop Adventures GuideRochelle KirkhamNo ratings yet

- Agrani Bank LTD.: Statement of AccountDocument3 pagesAgrani Bank LTD.: Statement of AccountBeximco Computers LTDNo ratings yet

- Astra 2017 Mbr-DrctyDocument92 pagesAstra 2017 Mbr-Drctyday emailNo ratings yet

- Questions - Incoterms 2010 - WA - PDFDocument5 pagesQuestions - Incoterms 2010 - WA - PDFuttamdas79No ratings yet

- Power Saved 2R Alq5 30.11.22Document1 pagePower Saved 2R Alq5 30.11.22aliNo ratings yet

- Bank of TanzaniaDocument268 pagesBank of TanzaniaabdulazizNo ratings yet

- Who Should Register For GST?Document9 pagesWho Should Register For GST?Gitu SinghNo ratings yet

- Test Bank For Financial Reporting and Analysis 13th Edition Charles H GibsonDocument26 pagesTest Bank For Financial Reporting and Analysis 13th Edition Charles H GibsonBrianHarrellednyf100% (32)

- WB Unit 8Document6 pagesWB Unit 8karensNo ratings yet

- Introduction To International BusinessDocument4 pagesIntroduction To International BusinessSimmiSetiaNo ratings yet

- Strayer - Western Europe in The Middle AgesDocument263 pagesStrayer - Western Europe in The Middle AgesIskandar1714No ratings yet

- Financial Planning UploadDocument55 pagesFinancial Planning UploadG sonataNo ratings yet

- MITI Report 2018 PDFDocument162 pagesMITI Report 2018 PDFTuan Pauzi Tuan IsmailNo ratings yet

- Room Bill DemoDocument4 pagesRoom Bill DemoHotel Aditya Mansingh InnNo ratings yet

- Percentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Document1 pagePercentage Tax vs. Value-Added Tax (VAT) : What Are The Reasons To Levy Excise Taxes?Brithney ButalidNo ratings yet

- Location PlanningDocument3 pagesLocation PlanningRahatul IslamNo ratings yet

- The Doha Development Round or Doha Development AgendaDocument8 pagesThe Doha Development Round or Doha Development AgendaDurlov AdnanNo ratings yet