Professional Documents

Culture Documents

Bond Pricing

Bond Pricing

Uploaded by

An NguyễnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bond Pricing

Bond Pricing

Uploaded by

An NguyễnCopyright:

Available Formats

BOND PRICING

1. C = Coupon = 10%, r = YTM = 12%, N = Maturity = 10 years, Par = $1,000

What is the bond’s price using semi-annual compounding?

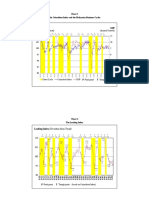

2. a) The graph below depicts the yields on 3-month LIBOR and T-bills. Explain

why is one always on top of the other? What happen to the spread around 2008?

7

6

09/08/2007

5

4 LIBOR

3 T-BILL

15/09/2008

2

1

0

01/02/02

01/08/02

01/08/03

01/08/04

01/02/05

01/08/05

01/02/06

01/02/07

01/02/08

01/08/08

01/08/09

01/08/01

01/02/03

01/02/04

01/08/06

01/08/07

01/02/09

b) Given the information provided in the table below, what is the spread between

the 10-year bond yields between that of Germany and Greece?

Coupon rate Current Price Par Value

Greece 6.00% 24.00 100.00

Germany 2.00% 100.00 100.00

3. a) The yield to maturity on one-year zero-coupon bonds is 9%. The yield to

maturity on two-year zero-coupon bonds is 10%. What is the forward rate of

interest for the second year?

b) What is expectation hypothesis? If you believe in the expectation hypothesis,

what is your best guess as to the expected value of the short-term interest rate

(described in (a)) next year?

c) If you believe in the liquidity preference theory, is your best guess as to next

year’s short-term interest rate higher or lower in (b)? Explain your answer.

d) Discuss the likely reasons underlying an inverted Treasury yield curve in which

the short rates are higher than the long rates.

4. Bond A has a coupon rate of 9% per year paying semi-annually. It has 3 years to

maturity and par value $1,000. Compare the losses incurred by the bondholder if

market interest rates rise by 1% where

i) The current market interest rate is 8%

ii) The current market interest rate is 1%.

Explain the comparative difference in percentage level of loss between the two

circumstances, and discuss the implications of this for bond holders in a low

interest rate marketplace, such as the UK.

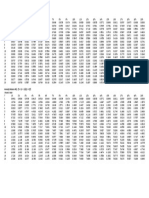

Bond Pricing (equivalent formulas)

P=Coupon×( AnnuityF( y , T ) ) + Parvalue×( PvF ( y , T ) )

T

CouponParvalue

P =∑ T

+

t=1 (1+r ) (1+r )T

P=Coupon

([

1

r

1−

1

( 1+r) T ]) +Parvalue

( )

1

(1+r )

T

You might also like

- Stephane Reverre - The Complete Arbitrage Deskbook PDFDocument527 pagesStephane Reverre - The Complete Arbitrage Deskbook PDFlucacastagna83% (6)

- Chapter 3 SolutionsDocument16 pagesChapter 3 SolutionsEdmond ZNo ratings yet

- Toyota Maintanence Schedule PDFDocument10 pagesToyota Maintanence Schedule PDFcod22050% (2)

- CLEP Principles of Macroeconomics Practice TestDocument15 pagesCLEP Principles of Macroeconomics Practice Testsundevil2010usa4605No ratings yet

- Bonds 2 Questions UweDocument1 pageBonds 2 Questions UweAshok ShresthaNo ratings yet

- SQI and Drops Improvement of Silchar City Airtel ASSAM BY Muddasar NPI AssamDocument9 pagesSQI and Drops Improvement of Silchar City Airtel ASSAM BY Muddasar NPI AssamgauravmakhlogaNo ratings yet

- MCA Trend Assistant 32171300a-EnDocument5 pagesMCA Trend Assistant 32171300a-EnFábio LeiteNo ratings yet

- Base Metals Q2 2010 - OutlookDocument14 pagesBase Metals Q2 2010 - Outlookkoderi100% (1)

- HA MonoEstación Andamarca TempMaxMensual 1hidroañoDocument6 pagesHA MonoEstación Andamarca TempMaxMensual 1hidroañoHeidy E. MendozaNo ratings yet

- The Stock Market in MarchDocument2 pagesThe Stock Market in MarchJohn Paul GroomNo ratings yet

- Als Sumire 1018e Load Scan Plan (Colour)Document1 pageAls Sumire 1018e Load Scan Plan (Colour)Anonymous WnxskULNo ratings yet

- Where Are We in The Global Crisis?Document14 pagesWhere Are We in The Global Crisis?charudhall164217No ratings yet

- The Oil Market Through The Lens of The Latest Oil Price CycleDocument22 pagesThe Oil Market Through The Lens of The Latest Oil Price CycleAnkit BirharuaNo ratings yet

- VR16 URG-I CQB GBB Parts ListDocument1 pageVR16 URG-I CQB GBB Parts Listthrow away100% (1)

- Oklahoma Budget Overview: Trends and Outlook, August 2010Document45 pagesOklahoma Budget Overview: Trends and Outlook, August 2010dblattokNo ratings yet

- MGFB10Midterm W2014 SolutionOnlyV1 PDFDocument7 pagesMGFB10Midterm W2014 SolutionOnlyV1 PDFSarah KNo ratings yet

- 08 TLResultDocument2 pages08 TLResultUmair AhmedNo ratings yet

- 08 TLResultDocument2 pages08 TLResultUmair AhmedNo ratings yet

- Oati 30 enDocument48 pagesOati 30 enerereredssdfsfdsfNo ratings yet

- Introduction To The Fifth Power Plan: Figure 1-1 - Daily Average Firm Prices at Mid ColumbiaDocument11 pagesIntroduction To The Fifth Power Plan: Figure 1-1 - Daily Average Firm Prices at Mid Columbiawildan irfansyahNo ratings yet

- TheArgentineEconomy IAE - Marzo 2011Document43 pagesTheArgentineEconomy IAE - Marzo 2011norbertoNo ratings yet

- Previous Pageblock Return To Previous Menu Next PageblockDocument4 pagesPrevious Pageblock Return To Previous Menu Next PageblockRobin JacketNo ratings yet

- Cable NIDocument1 pageCable NIGaber3No ratings yet

- Political Economy in Shambles Some Additions To The Marxist-Leninist Crisis TheoryDocument52 pagesPolitical Economy in Shambles Some Additions To The Marxist-Leninist Crisis TheorypweispfenningNo ratings yet

- HA MonoEstación Andamarca PrecipMensual EnerDic 1Document6 pagesHA MonoEstación Andamarca PrecipMensual EnerDic 1Heidy E. MendozaNo ratings yet

- The Stock Market in MayDocument2 pagesThe Stock Market in MayJohn Paul GroomNo ratings yet

- Forex PDFDocument76 pagesForex PDFjeet bagdaiNo ratings yet

- Trading Journal Template 34Document2 pagesTrading Journal Template 34Dery AnggaraNo ratings yet

- Optimal Group, Inc.: Company BackgroundDocument10 pagesOptimal Group, Inc.: Company BackgroundMeester KewpieNo ratings yet

- FX Money MGT (Performance) v2Document1 pageFX Money MGT (Performance) v2Alex WongNo ratings yet

- HEINEKEN NV (Beverages) : Earnings & Estimates Market DataDocument3 pagesHEINEKEN NV (Beverages) : Earnings & Estimates Market DataDrag MadielNo ratings yet

- The Trendpointers Report: Advance Signals For Economic Expectations and ConsumptionDocument19 pagesThe Trendpointers Report: Advance Signals For Economic Expectations and ConsumptionmarcycapronNo ratings yet

- Master-2008-09-Rrp Calculation SheetDocument52 pagesMaster-2008-09-Rrp Calculation Sheetstructuredes.1No ratings yet

- World Bank Commodity Price Data (The Pink Sheet)Document166 pagesWorld Bank Commodity Price Data (The Pink Sheet)Vincent LauNo ratings yet

- Status of National Effort To Enhance Road Safety in EthiopiaDocument19 pagesStatus of National Effort To Enhance Road Safety in EthiopiaPulkitSainiDbspNo ratings yet

- Chart 3 The Coincident Index and The Malaysian Business CyclesDocument8 pagesChart 3 The Coincident Index and The Malaysian Business Cyclessmazadamha sulaimanNo ratings yet

- Bulk Denstiy CalculationDocument65 pagesBulk Denstiy CalculationFrank VargasNo ratings yet

- High Probability Trading Slide - Kathy Lien (Part 1)Document57 pagesHigh Probability Trading Slide - Kathy Lien (Part 1)IsabelNogales100% (2)

- GraphsDocument3 pagesGraphsJohn Paul GroomNo ratings yet

- HMW 3 - AnswersDocument5 pagesHMW 3 - Answersbrahim.safa2018No ratings yet

- 7 16 10TheWrongDebateDocument3 pages7 16 10TheWrongDebaterichardck30No ratings yet

- Empirical Results: 1.1 Data OverviewDocument11 pagesEmpirical Results: 1.1 Data Overviewapi-444401653No ratings yet

- The Non-Deliverable Forward (NDF) Market For The Indian RupeeDocument9 pagesThe Non-Deliverable Forward (NDF) Market For The Indian RupeeandrewpereiraNo ratings yet

- Lmo Io 390 A1a6Document407 pagesLmo Io 390 A1a6Daniel MkandawireNo ratings yet

- Governors Third Quarter Media Brief 2008Document16 pagesGovernors Third Quarter Media Brief 2008Chola MukangaNo ratings yet

- Forex Good PDFDocument80 pagesForex Good PDFsudheeraryaNo ratings yet

- Defiance Cap - The Week That Just Passed Mar 19, 2010Document6 pagesDefiance Cap - The Week That Just Passed Mar 19, 2010WallstreetableNo ratings yet

- Pirates of The ComexDocument10 pagesPirates of The Comexgaoup100% (1)

- Hex 3Document123 pagesHex 3CatastrioNo ratings yet

- Car ShowroomDocument20 pagesCar ShowroomDanish ShakeelNo ratings yet

- ACFrOgAaY3q8hxmvSYm2VdzJeC0r D-KNsXYeGg81Mss12NUcOa9 TC4RZ3hmcYBqG1uY6Hc1Aw4Fd Kwa2bnYfc0oc1nAoGZu4PuPA4in3 ZI EpMq7zImn5jyx9uE VgnCHiXlnlVKV9qeIE3ADocument51 pagesACFrOgAaY3q8hxmvSYm2VdzJeC0r D-KNsXYeGg81Mss12NUcOa9 TC4RZ3hmcYBqG1uY6Hc1Aw4Fd Kwa2bnYfc0oc1nAoGZu4PuPA4in3 ZI EpMq7zImn5jyx9uE VgnCHiXlnlVKV9qeIE3Asergiu petreaNo ratings yet

- Self Unit Commitment To Centralized Unit CommitmentDocument28 pagesSelf Unit Commitment To Centralized Unit CommitmenteinerNo ratings yet

- Mortgage Risk On The RiseDocument2 pagesMortgage Risk On The RiseCreditTraderNo ratings yet

- 19336888, Chan Ken WaiDocument68 pages19336888, Chan Ken WaiFarhana MizaNo ratings yet

- The Week That Just Passed March 12, 2010Document4 pagesThe Week That Just Passed March 12, 2010WallstreetableNo ratings yet

- Darren Weekly Report 47Document6 pagesDarren Weekly Report 47DarrenNo ratings yet

- The Power of The Royalty Business Model: Gold vs. Gold Miners vs. Franco NevadaDocument7 pagesThe Power of The Royalty Business Model: Gold vs. Gold Miners vs. Franco NevadaTodd SullivanNo ratings yet

- SM - New YearDocument2 pagesSM - New YearJohn Paul GroomNo ratings yet

- Air MinumDocument4 pagesAir MinumNabila Maulidina WidyarahmahNo ratings yet

- Pack 6 Books in 1 - Flash Cards Pictures and Words English Spanish: 400 Cards - Spanish vocabulary learning flash cards with pictures for beginnersFrom EverandPack 6 Books in 1 - Flash Cards Pictures and Words English Spanish: 400 Cards - Spanish vocabulary learning flash cards with pictures for beginnersNo ratings yet

- Week 4.2 - Writing MinutesDocument7 pagesWeek 4.2 - Writing MinutesQuỳnh Linh NgôNo ratings yet

- Present Value FactorDocument1 pagePresent Value FactorQuỳnh Linh NgôNo ratings yet

- Present Value FactorDocument1 pagePresent Value FactorQuỳnh Linh NgôNo ratings yet

- Reading 2 Alaska Is Melting!Document2 pagesReading 2 Alaska Is Melting!Quỳnh Linh NgôNo ratings yet

- Effective Interest RatesDocument2 pagesEffective Interest RatesZaid Tariq AlabiryNo ratings yet

- Macroeconomic Aims and Policies and Trade 5 June 2012 (Students)Document21 pagesMacroeconomic Aims and Policies and Trade 5 June 2012 (Students)ragul96No ratings yet

- Chapter 7 - International Arbitrage and IRPDocument30 pagesChapter 7 - International Arbitrage and IRPPháp NguyễnNo ratings yet

- L3 Essay Institutional Investors QuestionsDocument7 pagesL3 Essay Institutional Investors QuestionsBero TapoleroNo ratings yet

- Blades Case StudyDocument3 pagesBlades Case StudyKhánh LoanNo ratings yet

- Ray Dalio - The CycleDocument20 pagesRay Dalio - The CyclePhương LộcNo ratings yet

- Greed IS Back: Business With PersonalityDocument36 pagesGreed IS Back: Business With PersonalityCity A.M.No ratings yet

- NYSERDA AnalysisDocument145 pagesNYSERDA AnalysisNick PopeNo ratings yet

- Term Paper - CB 604 - Section A - Financial Institutions and MarketsDocument22 pagesTerm Paper - CB 604 - Section A - Financial Institutions and MarketsISTIAK Mahmud MitulNo ratings yet

- Prelim Math InveDocument2 pagesPrelim Math InveARON PAUL SAN MIGUELNo ratings yet

- Time Value of Money: Abm5 - Business FinanceDocument34 pagesTime Value of Money: Abm5 - Business FinanceBarbie BleuNo ratings yet

- The Effect of Selected Macro-Economic Variables On The Performance of Smes in Kebbi StateDocument15 pagesThe Effect of Selected Macro-Economic Variables On The Performance of Smes in Kebbi StatesonyNo ratings yet

- Financial Management Theory and Practice 3rd Edition Brigham Solutions ManualDocument21 pagesFinancial Management Theory and Practice 3rd Edition Brigham Solutions ManualIanGaymkaf100% (57)

- GRADE 11 BUSINESS MATH (Gross and Net Earning)Document7 pagesGRADE 11 BUSINESS MATH (Gross and Net Earning)Jesmar SitaoNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelZayed BoodhooNo ratings yet

- Harshad Mehta Case StudyDocument12 pagesHarshad Mehta Case Studysimran agarwalNo ratings yet

- Chapter 2 - Determinants of Interest RatesDocument36 pagesChapter 2 - Determinants of Interest RatesMai Lan AnhNo ratings yet

- How To Get Collateral Free Business Loan Under CGTMSE SchemeDocument6 pagesHow To Get Collateral Free Business Loan Under CGTMSE Schemeshweta guptaNo ratings yet

- 99Document14 pages99gb_shaik03No ratings yet

- CFPB Discount Points Guidence PDFDocument3 pagesCFPB Discount Points Guidence PDFdzabranNo ratings yet

- FR ACCA Test FullDocument16 pagesFR ACCA Test Fullduducchi2308No ratings yet

- Test Bank With Answers Intermediate Accounting 12e by Kieso Chapter 14Document36 pagesTest Bank With Answers Intermediate Accounting 12e by Kieso Chapter 14Nicolas ErnestoNo ratings yet

- Lecture 6 - Interest Rates and Bond ValuationDocument56 pagesLecture 6 - Interest Rates and Bond Valuationabubaker janiNo ratings yet

- Chap 008Document6 pagesChap 008Haris JavedNo ratings yet

- R.P 32, 2018Document25 pagesR.P 32, 2018sajid bhattiNo ratings yet

- International Business The Challenges of Globalization 8th Edition Wild Solutions ManualDocument17 pagesInternational Business The Challenges of Globalization 8th Edition Wild Solutions Manualalanfideliaabxk100% (31)

- Ps Na Bago Sa ECONDocument10 pagesPs Na Bago Sa ECONJonelou CusipagNo ratings yet

- BP2BT, FLPP, SSB ComparisonsDocument12 pagesBP2BT, FLPP, SSB ComparisonsTawakkalNo ratings yet