Professional Documents

Culture Documents

ASS 4 Understanding Financial Statements

Uploaded by

Desiree Galleto0 ratings0% found this document useful (0 votes)

5 views2 pagesThe document contains responses to two questions about income statements. For the first question, the response explains that an income statement reports on a company's operations over a period of time, such as a month, quarter, or year, while a statement of financial position provides a snapshot of the company's assets, liabilities, and equity at a point in time. For the second question, the response lists the items in proper order for an income statement, from sales down to taxes, and explains the order and calculation of each item.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains responses to two questions about income statements. For the first question, the response explains that an income statement reports on a company's operations over a period of time, such as a month, quarter, or year, while a statement of financial position provides a snapshot of the company's assets, liabilities, and equity at a point in time. For the second question, the response lists the items in proper order for an income statement, from sales down to taxes, and explains the order and calculation of each item.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesASS 4 Understanding Financial Statements

Uploaded by

Desiree GalletoThe document contains responses to two questions about income statements. For the first question, the response explains that an income statement reports on a company's operations over a period of time, such as a month, quarter, or year, while a statement of financial position provides a snapshot of the company's assets, liabilities, and equity at a point in time. For the second question, the response lists the items in proper order for an income statement, from sales down to taxes, and explains the order and calculation of each item.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Name: Desiree A.

Galleto BSA_2

1. Explain the following statement: “While the statement of

financial position can be thought of as a snapshot of a firm’s

financial position at a point in time, the income statement

reports on operations over a period of time.”

ANSWER:

Income statements include the company’s income and

expenses in their operations over a period of time, it means that it

could be a month, quarter, a year-to-date period or a calendar or

fiscal year. While the balance sheet or the statement of a financial

statement is the overview of a company's assets, liabilities, and

equity at a point in time because it only gives us a snapshot in terms

of what a company owns, owes and equity after the flows of income

and expenses.

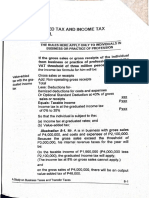

2. Arrange and explain the following income statement items so

they are in proper order of an income statement:

Taxes

Gross Profit

Interest Expense

Depreciation Expense

Selling and administrative Expense

Sales

Sales Discount

Cost of Goods sold

Purchases

Purchase Discount

ANSWER:

The arrangements of the given items in the income statement are the

following:

Sales

Sales Discount

Cost of Goods sold

Purchases

Purchase Discount

Gross Profit

Interest Expense

Depreciation Expense

Selling and administrative Expense

Taxes

In the statement of comprehensive income or the income

statement, the first item in line is the net sales revenue (sales less

sales discount). The answer will be deducted to the cost of goods

sold (purchases less purchases discount). The difference between

the net sales revenue and the cost of goods sold will be our gross

profit. After getting the gross profit, you will less the expenses which

are based on the given, it includes Interest expense, Depreciation

Expense, and Selling and administrative Expense. Its total is what we

called income before tax. The last step is you need to get the

difference between income before tax and the taxes which will lead

you to the net income.

You might also like

- Explain The Difference Between Sales Revenue and Net Sales. Sales RevenueDocument3 pagesExplain The Difference Between Sales Revenue and Net Sales. Sales RevenueHuda waseemNo ratings yet

- Fabm 121.week 6-10 ModuleDocument22 pagesFabm 121.week 6-10 Modulekhaizer matias100% (1)

- Week 006 - Module Statement of Comprehensive Income Part IIDocument7 pagesWeek 006 - Module Statement of Comprehensive Income Part IIJulia AcostaNo ratings yet

- Income Statement 2Document7 pagesIncome Statement 2Jonabed PobadoraNo ratings yet

- Chapter # 8: Financial StatementsDocument18 pagesChapter # 8: Financial Statementsfahad BataviaNo ratings yet

- Accounting Slides Income StatmentDocument20 pagesAccounting Slides Income StatmentEdouard Rivet-BonjeanNo ratings yet

- Accounting 1 Module 5Document15 pagesAccounting 1 Module 5Rose Marie Recorte100% (1)

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Document10 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Tumamudtamud, JenaNo ratings yet

- Income STDocument23 pagesIncome STKholoud LabadyNo ratings yet

- Lesson 2: Statement of Comprehensive Income Statement of Comprehensive Income Is A Statement That Reports The Results of Operations of TheDocument10 pagesLesson 2: Statement of Comprehensive Income Statement of Comprehensive Income Is A Statement That Reports The Results of Operations of TheMae Joy EscanillasNo ratings yet

- FABM2-Chapter 2Document31 pagesFABM2-Chapter 2Marjon GarabelNo ratings yet

- CH2 Fabm2Document27 pagesCH2 Fabm2Crisson FermalinoNo ratings yet

- Acctng NotesDocument13 pagesAcctng NotesJeremae EtiongNo ratings yet

- Cfa3 1Document2 pagesCfa3 1Trinh NguyễnNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- PART 5 - Statement of Comprehensive Income and Its ElementsDocument6 pagesPART 5 - Statement of Comprehensive Income and Its ElementsHeidee BitancorNo ratings yet

- Textbook SolutionDocument61 pagesTextbook SolutionmmNo ratings yet

- Fundamentalsofabm2statementofcomprehensiveincomeabmspecializedsubject 171210045513Document12 pagesFundamentalsofabm2statementofcomprehensiveincomeabmspecializedsubject 171210045513Aira Nhaira MecateNo ratings yet

- 2 Statement of Comprehensive IncomeDocument27 pages2 Statement of Comprehensive IncomeMichael Lalim Jr.No ratings yet

- Paniqui SciDocument27 pagesPaniqui Scival floresNo ratings yet

- Act 202 SS4Document21 pagesAct 202 SS4estherNo ratings yet

- Fabm ReviewerDocument16 pagesFabm Reviewersab lightningNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- ACCTG1 Chapter 5Document6 pagesACCTG1 Chapter 5Mark Kevin JavierNo ratings yet

- Contabilitate COURSE 4Document47 pagesContabilitate COURSE 4Raluca ToneNo ratings yet

- FABM 2 Module 3 Statement of Comprehensive IncomeDocument10 pagesFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskieNo ratings yet

- Week 004 - Module Statement of Comprehensive Income IDocument7 pagesWeek 004 - Module Statement of Comprehensive Income IJulia AcostaNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- LECTURE NOTES - Measurement of Business IncomeDocument12 pagesLECTURE NOTES - Measurement of Business Incomehua chen yuNo ratings yet

- Cee 108 ReportDocument9 pagesCee 108 ReportMisael Masauring BasiaNo ratings yet

- Chapter 3Document28 pagesChapter 3Kibrom EmbzaNo ratings yet

- Merchandising Financial StatementsDocument7 pagesMerchandising Financial Statementskochanay oya-oy100% (1)

- Income Statement (Daisy)Document4 pagesIncome Statement (Daisy)Daisy jane cunananNo ratings yet

- ACC 103 Ch5 Lecture Part3Document8 pagesACC 103 Ch5 Lecture Part3Muhammad Farhan AliNo ratings yet

- Shs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeDocument14 pagesShs Abm Gr12 Fabm2 q1 m2 Statement-Of-comprehensive-IncomeKye RauleNo ratings yet

- Topic 3 - Statement of Comprehensive IncomeDocument8 pagesTopic 3 - Statement of Comprehensive Incomesab lightningNo ratings yet

- Chapter 2Document50 pagesChapter 2najmulNo ratings yet

- Accounting Common TermsDocument4 pagesAccounting Common TermsMa. Catherine PaternoNo ratings yet

- Lesson 7Document46 pagesLesson 7Quyen Thanh NguyenNo ratings yet

- Income Statement 1Document8 pagesIncome Statement 1Jonabed PobadoraNo ratings yet

- Akuntansi Perusahaan DagangDocument25 pagesAkuntansi Perusahaan DagangCholis LatteNo ratings yet

- Abm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesDocument8 pagesAbm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesJUDITH PIANONo ratings yet

- Synthesis Report FinaleDocument23 pagesSynthesis Report FinalearianasNo ratings yet

- Report - Basic Financial Statements-EriveDocument18 pagesReport - Basic Financial Statements-Eriveevita eriveNo ratings yet

- Accounts Theory-1Document16 pagesAccounts Theory-1jka242000No ratings yet

- ACCT 102 Chapter 22 Handout DecentralizationDocument3 pagesACCT 102 Chapter 22 Handout DecentralizationxxxcxxxNo ratings yet

- LAS ABM - FABM12 Ic D 7 Week 3Document9 pagesLAS ABM - FABM12 Ic D 7 Week 3ROMMEL RABONo ratings yet

- Module 4 Statement of Financial Performance For LMSDocument15 pagesModule 4 Statement of Financial Performance For LMSGAZA MARY ANGELINENo ratings yet

- Discussion Guide - Chapter 5Document7 pagesDiscussion Guide - Chapter 5Khoi NguyenNo ratings yet

- Intro To Economics Lecture 1 - Elements of FSDocument28 pagesIntro To Economics Lecture 1 - Elements of FSАлихан МажитовNo ratings yet

- Financial-Accounting-Analysis Dec2021Document11 pagesFinancial-Accounting-Analysis Dec2021Chief MaxNo ratings yet

- CHAPTER 2-Statement of Comprehensive IncomeDocument4 pagesCHAPTER 2-Statement of Comprehensive IncomeDan GalvezNo ratings yet

- Q1 LAS FABM2 12 5 Week 3Document9 pagesQ1 LAS FABM2 12 5 Week 3Flare ColterizoNo ratings yet

- Equity Capital: Shari WatersDocument6 pagesEquity Capital: Shari WatersMirza ShoaibbaigNo ratings yet

- Financial Accounting & AnalysisDocument10 pagesFinancial Accounting & Analysisdeval mahajanNo ratings yet

- Financial Statements Point PresentationDocument34 pagesFinancial Statements Point PresentationRabie Haroun100% (1)

- Statement of Comprehensive IncomeDocument8 pagesStatement of Comprehensive IncomeSalvie Angela Clarette UtanaNo ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- AccountancyDocument45 pagesAccountancyBRISTI SAHANo ratings yet

- 2 Template PPT2Document16 pages2 Template PPT2ダイ アンNo ratings yet

- Business Tax (Chapter 9)Document9 pagesBusiness Tax (Chapter 9)Desiree GalletoNo ratings yet

- Business Tax (Chapter 2)Document16 pagesBusiness Tax (Chapter 2)Desiree GalletoNo ratings yet

- Business Tax (Chapter 8)Document2 pagesBusiness Tax (Chapter 8)Desiree GalletoNo ratings yet

- Standard CostingDocument26 pagesStandard CostingDesiree GalletoNo ratings yet

- Business Tax (Chapter 10)Document10 pagesBusiness Tax (Chapter 10)Desiree GalletoNo ratings yet

- STS Module 13+finalDocument59 pagesSTS Module 13+finalDesiree GalletoNo ratings yet

- STS Module 12Document65 pagesSTS Module 12Desiree GalletoNo ratings yet

- Lesson - CorporationDocument31 pagesLesson - CorporationDesiree GalletoNo ratings yet

- Business Tax (Chapter 1)Document6 pagesBusiness Tax (Chapter 1)Desiree GalletoNo ratings yet

- STS Module 11Document64 pagesSTS Module 11Desiree GalletoNo ratings yet

- STS Module 3Document54 pagesSTS Module 3Desiree GalletoNo ratings yet

- STS Module 2Document68 pagesSTS Module 2Desiree GalletoNo ratings yet

- STS Module 1Document59 pagesSTS Module 1Desiree GalletoNo ratings yet

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoNo ratings yet

- Lesson - Bonds PayableDocument18 pagesLesson - Bonds PayableDesiree GalletoNo ratings yet

- 8&10&11&27 Theo ReportingDocument8 pages8&10&11&27 Theo ReportingDesiree GalletoNo ratings yet

- Business SimulationDocument11 pagesBusiness SimulationDesiree GalletoNo ratings yet

- Finals ReviewerDocument7 pagesFinals ReviewerDesiree GalletoNo ratings yet

- ASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDocument2 pagesASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDesiree GalletoNo ratings yet

- Assignment Activity - Financial Statement AnalysisDocument2 pagesAssignment Activity - Financial Statement AnalysisDesiree GalletoNo ratings yet

- ASS 2 - Business Organization and TrendsDocument2 pagesASS 2 - Business Organization and TrendsDesiree GalletoNo ratings yet

- Excel Report Problem and ExercisesDocument9 pagesExcel Report Problem and ExercisesDesiree GalletoNo ratings yet