Professional Documents

Culture Documents

Business Tax (Chapter 10)

Uploaded by

Desiree Galleto0 ratings0% found this document useful (0 votes)

30 views10 pagesTAX

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views10 pagesBusiness Tax (Chapter 10)

Uploaded by

Desiree GalletoTAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

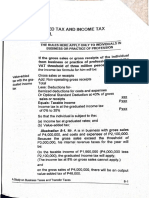

Chapter 10

PERCENTAGE TAXES - 2

The tax ies beet fe

A. 3% percentage tax Gross sales! e

: Grose rece’

B. Domestic common carriers tax; i a

Intemational common carrier's tax Sioss eee’

©: Franchise tax on:

Gas and water facities o

Radio and/or broadcasting companies | Gross receipts

whose gross receipts in the preceding

year did not exceed P10,000,000 108

. Overseas communications tax ‘Amount paid we

E. Tax on banks and non-bank finan- Gross receipts, | 1%

ial intermediaries performing from lendinafir | 3

quesi judicial functions ancial lees a

Gross receipts ™%

from other gross

income items

Dividends oe

F.‘Tax on other non-bank financial Gross receipts. | | 1%

intermediaries font ee oe

nancial leasing” | 5%

Gross receipts 5%

from other gross

” Taxon life insurance companies

Income items

Premiums

Collected —

HH. Tax on agents of foreign insurance Premiums 4%

companies collected

1, Amusement taxes on:

Boxing exhibitions Gross receipts 10%

Professional basketball games Gross receipts 18%

Ce , cabarets and night clubs Gross receipts 18%

Jai-alai and race tracks Gross receipts 30%

I. Tax on winnings:

On winnings or dividends of persons

in horse races or jai-alai ‘Winnings 10%

but if from double, forcast, quinelta

and trifecta bets ‘Winnings 4%

On winnings of owners of winning horses | _ Winnings 10%

K. Stock transaction tax (second- Selling price 6/10

ary offering) __ of 1%

10-1

‘A Study on Business Taxes and Transfer Taxes

7

2% and 3% on franchises.

ain't i thorizes a certain person, nati

hise is 2 law. It authoriz iis

‘ aes Je hip or corporation), to operate a public utity

juridical (Pr ration that will operate a railway system, or

ell electricity will need a franchise.

are subject to a percentage tax commonly called

Tax of

The following

sfranchise tax -

.d water utilities ‘ ; 2%

eas andlor television broadcasting companies whose

annual gross receipts of the preceding year did not

exceed P1 0,000,000

3%

grantees are subject to the value-added tax on

Other franchise

sale of services.

is on gross receipts from

The franchise tax of 2% or 3% i

activities covered by the franchise. Other gross receipts may

be subject to the value-added tax.

Special rule on radio/television broadcasting.

in the preceding

y 10,000,000,

(b) If gross receipts in the preceding ’

year did not exceed P10,000,000, Percentage tax

(but may opt to be. registered under

the VAT system)

IMlustration 10-1. H Co. is a holder of a franchise to sell and

distribute water. In a month, it had gross receipts from the sale

of water of P5,000,000 and rent income from heavy equip-

ment (received from subdivision owners) of P50,000. The fran-

chise tax was 2% of P5,000,000, or P100,000.

Mustration 10-2. | Co. is a holder of a franchise to operate a

radio/television network. Its gross receipts in 2018 was

9,000,000. In the first month of 2019, it had gross receipts of

(a) If gross receipts ir

ear exceeded Value-added tax

A Study or ir

ly on Business Taxes and Transfer Taxes a

1P700,000 and total payments to VA’

i ‘T-suppliers

peor of P250,000, taxes not included It Maanot abe a6

i ye i tax since the gross receipts did not oe J

40,000,000 in a year. The percentage tax for the month w i

have been P700,000 x 3%, or P21,000. ee

IMlustration 10-3. In the preceding illustration of | Co., if | Co.

opted to be a value-added taxpayer in 2019, the value-ad

5 add

le for the ‘first month would have involved compte

tax payabl

tations, as follows: :

Output taxes (P700,000 x 12%) P84,000

Less: Input taxes, (P250,000 x 12%) 30,000

Value-added tax payable P54,000:

PROBLEMS. Solve Problems 10-1 and.10-2

Amusement tax.

is of amusement places, but not all are

nt taxes. There are many activities for

amusement, but-not all are subject to the amusement taxes. At

present there is an amusement tax which is a local tax. This is

the amusement tax on ‘admissions to theaters, cinematographs,

coricert halls, circuses and other. places of amusement. 3

Tax base.

The-tax is based on gross receipts.

“Gross receipts’ embraces all the receipts of the proprietor,

sement place. It includes income

lessee or operator of the amu!

from television, radio and motion picture rights, if any.

-There are many kind:

subject to the amusemer

Taxable amusement places and activities (See Figure 10-1).

Figure 10-1. Amusement Tax

Tax

Amusement Place

Place for boxing exhibition 10%

Place for professional basketball games (which isin

lieu of all percentage taxes of whatever name

A Study on Business Taxes and Transfer Taxes

15%

and description) 1

Cockpits, cabarets, night or day clubs 1%

id or Oriental Champion.

it ‘pitions where Worl

Boxing exhibitions W"" veake will be aeaiigl fom

i i ivisi is

ee ed of one of the contenders is a citizen of

the Philippines and said ‘exhibitions are promoted by cite

zens of the Philippines oF by a corporation oF association

i nt (60%) ‘of the capital of which is

at least sixty perce!

‘owned by such citizens.

stration 10-4. The PNBA is 2 professional basketball or-

ae om within a month, it had gross

ji ketball series

senza th 2 gates ‘of P1,000,000. In addition, television

coverage gave it additional gross receipts of P 1,000,000. Ad-

vertisements in streamers inside the coliseum where the

games were conducted gave it additional gross receipts of

1,000,000. The amusement tax was 45% of P3,000,000, or

450,000,

Mustration 10-5. Sports, Unlimited, @ domestic corpo-

ration wholly owned by citizens of the Philippines, sponsored

a world boxing event for World Championship in the

lightweight division between @ Korean boxer and a Filipino

| boxer. Gate receipts amounted to 10,000,000. Satellite co-

gave the corporation an additional gross receipts of

1,200,000. The gross receipts of Sports, Unlimited was

11,200,000. There is no amusement tax. All the require-

ments for the exemption ‘of the boxing exhibition from the

amusement tax were present.

Mustration 10-6, The Total Entertainment, a domestic cor-

poration had the following gross receipts from championship

events it conducted in the Philippines:

ed 9 P 500,000

Tennis 4,000,000

4,200,000

Noteybal 600,000

Baseball 800.000

Basketball !

a azo

There was no amusement tax because the activities were not

‘A Study on Business Taxes and Transfer Taxes

8 £ 10-4

among those mentioned in the law which are subject to a-

musement tax.

PROBLEMS. Solve Problems 10-3 and 10-4

taxon winnings.

Figure 10-2. Tax on winnings

Winnings in horse races or jai-alai 10%

but if from:

Double, forecast, quinella and trifecta bets 4%

Owner of winning horse. 10%

Daily double is an event wherein the bettor selects a number in

each of two consecutive races and the selection in each race must

finish first. Extra double is an event wherein the bettor selects a

number in each of wo races and the selection in each race

must finish first. Forecast is an event wherein the bettor selects two

numbers in a selected race, and the selection must finish first and i!

second in the correct order. Double quinella is an event wherein the 7

bettor selects the numbers in each of two selected races, and the :

selection in each race must finish first arid second in either order.

Trifecta is an event wherein the bettor ‘selects three. numbers in 2

selected race and the selections must finish first, second and third

in the correct order.

Who is the taxpayer of the tax on winnings?

(a) The person who wins in horse races and jai-alai, based on

his winnings or “dividends” (the tax to be based on the ac-

tual amount paid to him for every winning ticket, after de-

ducting the cost of ticket); and

{b) The owner of winning race horses, ased on the prize.

How is the tax paid?

The tax will be withheld from the “dividends” or “prize”, by

the operator, manager or person in charge of the horse races

or jai-alai.

Mlustration 10-7. Mr. Lis an owner of a race horse who, on

June 12, from a Special Independence Day Race won a prize

‘

a — ea

the winnings would

in the amount of P5,000,000 .The tax on nw

have been withheld at 10% of P5,000,000, or P500,000.

PROBLEMS. Solve Problems 10-5

Tax on stock transactions.

This percentage tax is called “stock transaction tax”,

i ition of shares

On a sale, barter, exchange or other disposi

* listed and traded thru a local stock exchange, other than

by adealer in securities;

The tax base: Gross selling price or gross value in money of

the shares sold, bartered, exchanged or other-

wise disposed of;

The tax rate: Six tenth of one percent (6/10 of 1%).

The taxpayer: The seller.

{b) On the sale, barter, exchange or other disposition thru initial

rE public offering of shares of stock in a closely held corporation:

. The tax base: Gross selling price.

The tax rates: In accordance with the proportion of the shares

. sold, bartered, exchanged or otherwise disposed

of to the total outstanding shares of stock after

the listing in the local stock exchange, as fol

lows:

Up to twenty-five percent (25%) 4%

Over twenty-five percent (25%), but

not over thirty-three and one-third

percent (33-1/3%) 2%

Over thirty-three and one-third percent 1%

‘The taxpayer: The issuing corporation in primary offering, and

the seller in secondary offering.

ea Sait eh gi (MGR a as wR A

“Closely-held Corporation” means any corporation at least fifty

oe (50%) in value of the outstanding capital stock or

least fifty percent (50%) of the total combined voting power

‘a s

Study on Business Taxes and Transfer Taxes =

NS

of all classes of stock entitled to vote, is owned directly or in

directly by or for not more than twenty individuals

Mustration 10-8. Mr. M sold shares of stock of domestic

corporations listed and traded in the Philippine Stock

Exchange, thru his stock broker, as follows

(a) Shares of N Co, with a cost of 2,000,000 and a selling

price of P2,800,000

(b) Shares of O Co. with a cost of P2,500,000 and a selling

price of P2,000,000

How much is the aggregate of the separate stock transact-

ion tax payments?

On the shares of N Co.

(P2,800,000 x 6/10 of 1%) P'14,000

On the shares of O Co.

(P2,000,000 x 6/10 of 1%) 10,000

Total 24,000

Mustration 10-9. P Co. was a closely held corporation. In

opening itself to the public, it made an initial public offering

(IPO) of its shares of stock on a selling price of P5,000,000

for shares of stock which would give the buying public an

interest after the listing of 30% in the corporation. How much

was the stock transaction tax? The tax was P5,000,000 x 2%,

or P100,000.

PROBLEMS. Solve Problems 10-6 and 10-7. ‘

Return and payment of percentage taxes.

The taxpayer may file a separate return for each branch or

place of business, or a consolidated return for all.

General rule: Every person liable to pay a percentage tax will

file a monthly return of the amount of his gross receipts and

pay the tax thereon, within twenty (20) days after the end of

each taxable month.

Exceptions: Of those

6 discussed in this Chapter.

Overseas communica- Within twenty (20) days after the end of

tions tax the quarter

Amusement tax Within twenty (20) days after the end of

ASudy on Business Taxes and Transfer Taxes 107

* the quarter.

Remitted to the Bureau of Internal Rey

within twenty (20) days from the d: ft

held rm

Remitted to the Bureau of Internal Reve.

Tax on winnings

Stock transaction tax ted

6/10 of 1% nue within five (5) banking days from th

date withheld by the broker. .

Stock transaction tax On primary offering, within 30 days of from

A%, 2% and 1% from the date of listing in the loca} stock

exchange

ne

A Study on Business Taxes and Transfer Taxes. -

PROBLEMS

40-1.The Z Co. isa holder of several franchises to ope-

rate essential public utitities. Gross receipts, VAT

ot included, from activities covered by the fran-

chise were:

For selling electricity P. 2,000,000

For selling water 4,800,000

For operating a stretch of superhighway 2,300,000

and in addition had gross receipts from:

Rent of heavy equipment 500,000

Percentage tax?

Output value-added tax? sede

40-2.The A Co. and the G Co. are stiff competitors in radio

and television broadcasting, one against the govern-

ment administration, and the other 2 defender of

the government administration. In 2018, the gross

receipts of the two companies were:

ACo. P 4,800,000

BCo. 41,000,000

In January 2019, the two companies had gross re-

ceipts of. }

ACo. P 300,000

BCo. 4,000,000

Percentage tax for January, 2019?

Output value-added tax?

40-3.Mr. SP, a citizen of the Philippines, is a sports promo-

ter, promoting sports competitions and events in the

Philippines. He had the following data in a month, any

tax not included:

Gross receipts, professional boxing, with

MPqio as defending world champion P 3,000,000

Gross receipts, intemational football 4,500,000

Gross receipts, Asian swimming meet 4,000,000

Gross receipts, world chess championship 4,300,000

Gross receipts, Philippine professional

basketball 900,000

The percentage tax?

10-4.Mr, NC operates a cabaret. Gross receipts were:

Study on Business Taxes and Transfer Taxes 10-9

Received by Mr. NC from patrons dancing on 600,000

\ the dance floor

i Received by Mr. NC from alcoholic beverages 300,000

‘and soft drinks purchased by patrons

Rewaived by Mr. XY, for food purchased from ae

him and served to patrons of Mr. NC )'

The percentage tax of Mr. NC? ee

40-5.Horse racing on Independence Day gave the

1 following gross receipts (winnings)

To Mr. A, winnings on his tickets, net of

) is winning tit P 29,000

P1,000 cost of his winning tickets / sgg000

To Mr, B, owner of the winning

‘ The percentage tax of Mr. A?

i The percentage tax of Mr. B? estat

40-6.Mr. SE is actively trading in a stock exchange thru

his stock broker. (na month he fad the following

tL sales: Gain

\ Sold for Cost (Loss)

1 ‘ ACo. shares P 120,000 P 80,000 P 40,000

B Co. shares 900,000 400,000 500,000

C Co. shares 1,000,000 1,200,000 (200,000)

How much was the percentage tax?

40-7.The F Co. is a family corporation, with shares of stock owned

by the five members of the family. With authority for initial public

offering (1PO) from the Securities and Exchange Commission, it

sot: selto the pub shares of stock for P5,000,000.

je il ji i

Piigln penne, x ifthe IPO would give to the public:

(b) 30% control?

(c) 40% control?

A Study on Business Taxes and Transfer Taxes

10-10

You might also like

- Standard CostingDocument26 pagesStandard CostingDesiree GalletoNo ratings yet

- Business Tax (Chapter 9)Document9 pagesBusiness Tax (Chapter 9)Desiree GalletoNo ratings yet

- Business Tax (Chapter 8)Document2 pagesBusiness Tax (Chapter 8)Desiree GalletoNo ratings yet

- Business Tax (Chapter 2)Document16 pagesBusiness Tax (Chapter 2)Desiree GalletoNo ratings yet

- STS Module 1Document59 pagesSTS Module 1Desiree GalletoNo ratings yet

- STS Module 3Document54 pagesSTS Module 3Desiree GalletoNo ratings yet

- STS Module 11Document64 pagesSTS Module 11Desiree GalletoNo ratings yet

- STS Module 13+finalDocument59 pagesSTS Module 13+finalDesiree GalletoNo ratings yet

- STS Module 2Document68 pagesSTS Module 2Desiree GalletoNo ratings yet

- Business Tax (Chapter 1)Document6 pagesBusiness Tax (Chapter 1)Desiree GalletoNo ratings yet

- STS Module 12Document65 pagesSTS Module 12Desiree GalletoNo ratings yet

- Lesson - Bonds PayableDocument18 pagesLesson - Bonds PayableDesiree GalletoNo ratings yet

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoNo ratings yet

- Lesson - CorporationDocument31 pagesLesson - CorporationDesiree GalletoNo ratings yet

- Assignment Activity - Financial Statement AnalysisDocument2 pagesAssignment Activity - Financial Statement AnalysisDesiree GalletoNo ratings yet

- Business SimulationDocument11 pagesBusiness SimulationDesiree GalletoNo ratings yet

- 8&10&11&27 Theo ReportingDocument8 pages8&10&11&27 Theo ReportingDesiree GalletoNo ratings yet

- ASS 4 Understanding Financial StatementsDocument2 pagesASS 4 Understanding Financial StatementsDesiree GalletoNo ratings yet

- Excel Report Problem and ExercisesDocument9 pagesExcel Report Problem and ExercisesDesiree GalletoNo ratings yet

- Finals ReviewerDocument7 pagesFinals ReviewerDesiree GalletoNo ratings yet

- ASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDocument2 pagesASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDesiree GalletoNo ratings yet

- ASS 2 - Business Organization and TrendsDocument2 pagesASS 2 - Business Organization and TrendsDesiree GalletoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)