Professional Documents

Culture Documents

Business Tax (Chapter 2)

Uploaded by

Desiree Galleto0 ratings0% found this document useful (0 votes)

82 views16 pagesTAX

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

82 views16 pagesBusiness Tax (Chapter 2)

Uploaded by

Desiree GalletoTAX

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

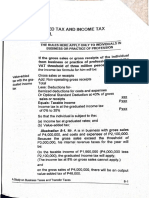

Chapter 2

VALUE-ADDED TAX ON SALE OF GOODS

OR PROPERTIES

Preliminary Statements.

. The value-added tax is a consumption tax. It is imposed on a seller,

but the seller passes it on to the buyer;

2. The value-added tax must be shown on the official invoice or receipt

issued to the buyer, as a separate item;

The value-added tax is 12%, 5% or 0% of the selling price;

While each sale has a value-added tax, and separate recording in the

books of accounts is on a per transaction basis, reporting and payment

of the value-added tax to the government is made monthly, on the tran-

sactions of the month.

Pe

THE TAXPAYER

Any person who sells, barters or exchanges goods or pro-

perties in the course of trade or business will be subject to

the value-added tax. (The law exempts certain transactions from

the value-added tax.)

The taxable tran- Whatis a sale, barter or exchange?

sactions are sale,

barter and ex- Asale is the transfer of ownership of property in

chage. Whenever consideration of money received or to be received. For

inarulethe word the expanded meaning of “sale”, see Figure 2-1 on

“sale” is used, it transactions “deemed sales”.

must be under-

stood to include A barter or exchange is the transfer of ownership of

barter and ex- property in consideration of property received or tobe

change. received.

An isolated transaction of sale or exchange of pri-

vate property is not in the course of trade or business,

and is not subject to the value-added tax.

Mustration 2-1. Mr. Amade a cash sale of his mer

A Study on Business Taxes and Transfer Taxes 24

¥

chandise inventory. The sale is subject to the value-agq,

ed tax.

Mustration 2-2. Mr. B sold his three-year old family car

This is not subject to the value-added tax.

Figure 2-1. Transactions deemed sales

The following are considered “sales” in the course of trade or

business subject to the value-added tax (Statutory enumera.

tion):

(a) Transfer, use or consumption, not in the ordinary course of

business, of goods or properties ordinarily intended for sale

or in the course of business;

(b) Distribution or transfer of inventory to shareholders or in-

vestors for their shares in the profits of a VAT-registered

person;

(c) Distribution or transfer of inventory to creditors in payment

of debt;

(d) Consignment of goods if actual sale is not made within sixty

days following the date such goods were consigned;

(e) Retirement from or cessation of business, with respect to

inventories of taxable goods as of the date of such retire-

ment or cessation.

Mustration 2-3. Mr. C sells household furniture. He re-

moved from his store a living rootm set for use in his resi-

dential house. This is deemed a sale.

Mustration 2-4. D Co. declared and paid a dividend out of

merchandise inventory. This is deemed a sale.

Ilustration 2-5. E Co. is indebted to F Co. for raw ma-

terials. When E Co. could not pay in money, F Co. agreed

to receive the finished goods of E Co. in payment. This

is deemed a sale by E Co.

Mustration 2-6. G Co., a manufacturer, made sales, 25

follows: To Mr. H, on credit, with title to the goods passing

{0 Mr. H, and to Mr. 1, on consignment, with title to the

goods to pass only upon actual sale of the consigned goods

fo a buyer. The goods consigned to Mr. | are still in the

Shelves of Mr. |. The sale to Mr. H is subject to the valu

added tax because title to the goods has passed to Mr. H.

The consignment to Mr. 1, although title to the goods has

A Study on Business Taxes and Transfer Taxes 2

not yet passed, will b to the value-added tax

ree ctually sold by Mr. |, or after sixty days from the

date of consignment (Provision of lav)

e subject

was a partnership in trade. J&K

M was formed to continue the

‘JeK was dissolved, the books

‘andise inventory of P100,000,

ry. The inventory will

1d will be sub-

Mlustration 2-7. J&K

was dissolved and L&

business of J&K. At the time

of accounts showed a merch’

which was also the physical invento

be deemed sold by J&K Co. to L&M Co., an

ject to the value-added tax.

WHAT ARE GOODS OR PROPERTIES?

Sales of movable “Goods or properties” are all tangible and intangible

and immovable objects which are capable of pecuniary (moriey) es-

properties are timation. (The law has a provision that states what are

taxable within the meaning of “goods or properties”.)

What are “goods”? Goods are movable properties.

Thus, sales by a car dealer are sales of goods in the

conduct of trade or business, subject to the value-

added tax.

What is within the meaning of “properties"? Inclu-

ded in the term “properties” are real properties. Thus,

sales by a real estate dealer are sales of properties in

the conduct of trade or business, subject to the value-

added tax.

THE TAX BASE

The tax base (the amount on which the rate of value-added

tax is applied) is gross selling price.

Meaning of gross selling price.

By statutory definition: “Gross selling price” means

the total amount of money or its equivalent which the

purchaser pays or is obligated to pay to the seller in

consideration of the sale, barter, or exchange, exclu-

‘A Study on Business Taxes and Transfer Taxes 23

¥

ding the value-added tax. The excise tax, if any, o

such goods, will form part of the gross selling price,’ °

Stated briefly, gross selling price includes everythin

that the buyer pays the seller, except the Value-addeg

tax shifted to the buyer.

“Gross selling price” does not mean gross sales. The

law and regulations allow downward adjustments for.

(a) Sales returns and allowances;

(b) Sales discounts agreed upon at the time of sale

(the granting of which does not depend on the

happening of a future event) indicated on the sales

invoice, and availed of by the buyer.

Mustration 2-8. Mr. A sold an article to Mr. B. The

quoted selling price was P10,000, not including freight

and value-added tax. Mr. B has to pay P10,500 (addi-

tional P500 for the freight) and the value-added tax be-

fore title to the goods passes to him upon delivery at his

place. The gross selling price was P10,500.

In an “actual sale”, the Mlustration 2-9. Mr. C produced articles at a product.

selling price of the jon cost of P50,000. The articles are subject to an ex-

seller is: cise tax of P5,000. The articles became subject to the

(a) Recovery of cost excise tax the moment they came into existence, a-

and expenses; and though payment of the tax will be made only upon re-

(b) Desired profit. moval of the goods from the place of production. The

share of the articles in the operating expenses is cal-

culated at P8,000. The desired profit is P37,000. The

selling price was P100,000, which was:

The VAT billed to the + Recovery of:

buyer, and received Production cost P 50,000

by the seller, is not part Operating expenses 8,000

of the selling price. Excise tax 5,000

Desired profit 37,000

Selling price 100,000

Value-added tax at 12% 12,000

Total, to be paid by the buyer 112,000

The gross selling price does not include the valv™

added tax.

Mlustration 2-10. In a taxable period, Mr. D had 5.

sales, value-added tax not included, of P425,000-

4 Study on Business Taxes and Transfer Taxes 2

retums and allowances for the same period, and sales

discounts, stated on the invoice, availed of by cus-

tomers, were P20,000 and P5,000, respectively. The

gross selling price tax base was:

Gross sales 425,000

Less:

Sales returns and allowances 20,000

Sales discounts 5,000 25,000

Gross selling price tax base 400,000

The Commissioner of Internal Revenue will deter-

mine the appropriate tax base in cases where the

transactions are deemed sales, or where the gross

selling price is unusually lower than the actual market

value.

Mustration 2-11. Mr. D sold an article for P50,000,

when the prevailing market value was P100,000. The

Commissioner of Internal Revenue will determine the

amount on which to compute the output value-added tax.

Mustration 2-12. E Co. is a lumber sawmill. It used

lumber from its production to construct the residential

house of its President. This transaction is deemed a

sale. The Commissioner of Internal Revenue will deter-

mine the amount on which to compute the output value-

added tax.

THE TAX RATES

se

The tax rates are:

(a) Twelve percent (12%), if domestic sale;

(b) Five percent (5%), if sales to the Government (and cer-

tain entities);

(c) Zero percent (0%), if export sale.

The law states zero-rated tax on exports (and cer-

tain other transactions).

Goods exported are “Export sales” means the sales and actual ship-

taxed at 0%, whether ments or exportations of goods from the Philippines

title to the goods to a foreign country, irrespective of any shipping

passed to the buyer arrangement that may be agreed upon which may in-

A Study on Business Taxes and Transfer Taxes 25

in the Philippines or fluence or determine the transfer of ownership of t

abroad, but paid in goods so exported, and paid for in acceptable fo.

acceptable foreign reign currency or its equivalent in goods or Servi.

currency ces, and accounted for in accordance with the Tules

and regulations of the Banko Sentral Ng Pilipinas

Mlustration 2-13. Mr. E exported his _manufactureg

goods to F Co. in the United States, under terms of ship.

ment F.O.B. California, United States. Payment was jn

dollars remitted thru the Philippine National Bank, Caj,

fornia, U.S.A., branch. Since title to the goods was trans.

ferred, and hence, the sale was consummated, in the

United States, the sale was an export sale.

Mlustration 2-14. G Co. exported its manufactured

goods to H Co. in the United States, under terms of

shipment F.O.B. Manila, Philippines. Payment was in

dollars remitted thru the Philippine National Bank, Cali-

fornia, U.S.A., branch. Even as title to the goods was

transferred, and hence, the sale was consummated, in

the Philippines, the sale was still an export sale.

THE TAX FORMULA.

Output taxes (seller’s value-added tax on sales)

Less: Input taxes (seller’s value-added taxes paid on pur-

chases, etc.)

Equals: Value-added tax payable of seller (See Figure 2-2)

What is output tax? It is the value-added tax on a sale.

What is input tax? It is value-added taxes paid:

Cn local purchases from VAT-registered persons, and on impor

ations, of goods:

(2) For sale;

(b) For conversion into or intended to form part of a finished

product for sale, including packaging materials;

(c) For use as supplies; .

(d) For use in trade or business, for which depreciation (or 27)

tization) is allowed for income tax purposes (capital 90045)

26

A Study on Business Taxes and Transfer Taxes

except automobiles, aircrafl and yachts;

(e) Value-added taxes paid on purchases of real property;

(f) Value-added taxes paid on purchases of services;

(g) Transitional input tax (See Chapter 6); and

(h) Presumptive input tax (See page 2-14 of this Chapter),

Figure 2-2. Tax formula

ee ae, 6 oe WW ee AT eg

Output taxes

Input taxes

Real nennary Siinnliae

Grove Canital nande

Sanviinee Matariale

Braciimntive Trancitinnal

Value-added tax payable

Mlustration. Mr. W, a VAT

taxpayer, made domestic

sales of P600,000 and ex-

port sales of P1,400,000.

The output taxes on do-

mestic sales would have

been P600,000 x 12%, or

P72,000, and the output

taxes on exports would

have been P1,400,000 x

0%, or PO.

Mustration. Mr. 0. import-

ed goods to be sold, with a

landed cost of P40,000

(Chapter 7). He sold the

goods to Mr. P for P90,000

Mr. P sold the goods to Mr. Q for P170,000, for use by Mr. Q as raw

materials. Mr. Q secured the services of Mr. R, a service contractor

and paid Mr. R P50,000. Mr. Q sold his products for P400,000. All

taxpayers involved are VAT-registered persons and all selling prices

mentioned do not include the value-added tax. The computations for

the value-added taxes in the series of transactions involving VAT

taxpayers would have been as shown in Figure 2-4.

Figure 2-3. The tax formula on a purchase-sale transaction:

Mr. A, a VAT taxpayer

Output tax on a sale here

Mr. B, a VAT taxpayer

Output tax ona sale here

to Mr. B+ Less: Input tax on purchase

A Study on Business Taxes and Transfer Taxes

from Mr. A

VAT payable here

27

i

Cascading

effect of

the VAT

A Study on Business Taxes and Transfer Taxes

Cascading effect of the value-added tax. (See Figure 2-4 )

Figure 2-4. Value-added taxes in a series of transactions

involving VAT taxpa}

For Mr. O:

Upon importation:

Landed cost of imported article P 40,000

Value-added tax (P40,000 x 12%) P 4,800

Upon the sale:

Selling price P 90,000

Output tax (P90,000 x 12%) 10,800

Less: Input tax (upon importation) 4,800

Value-added tax payable P 6,000

For Mr. P:

Selling price P170,000

Output tax (P170,000 x 12%) P20,400

Less: Input tax (On purchase from Mr. O) 19.800

Value-added tax payable P 9,600

For Mr. Q:

Selling price P400,000

Output tax (P400,000 x 12%) P48,000

Less: Input taxes —

(On purchase from Mr. P P 20,400

‘On purchase from Mr. R — below) 6,000

Total input taxes 26,400

Value-added tax payable P21,601

For Mr. R:

Value-added tax — Output tax (P50,000 x 12%) P 6,000

Mustration 2-15. Mr. R, a VAT taxpayer, made a sale at

P100,000, value-added tax not included, of goods that he

bought at P3,000 from a non-VAT taxpayer. The value-

added tax payable was P12,000, computed as follows:

Output tax (100,000 x 12%) 12,000

Less: Input tax ae

Value-added tax payable 2,000

Mustration 2-16, Mr. S, a VAT tax de a sale at

8, payer, made a

P100,000, value-added tax not included, of goods that he

28

bought at P3,000 from a VAT taxpayer, value-added tax

not included. The value-added tax payable was P11,640,

computed as follows:

Output tax (P100,000 x 12%) P 12,000

Less: Input tax (P3,000 x 12%) 360

Value-added tax payable Pite40

Mlustration 2-17. On assumed data:

Gross sales 200,000

Less:

Sales returns and allowances 20,000

Sales discounts 4,200 21,200

Net sales 178,800

Output tax (P178,800 x 12%) P 21,456

On assumed data:

Gross purchases P 100,000

Less:

Purchase retums and allowances 10,000

Purchase discounts 500 10,500

Net purchases 89,500

Input tax (P89,500 x 12%) 10,740

From the preceding computations:

Output tax P21,456

Less: Input tax 10.740

P10,716

Value-added tax payable

VERY IMPORTANT.

ustrations in the pages in this chapter, and succeeding chap-

ig sot of circumstances, such circumstances

ithin a month. It must be stated

While th

ters, may be on a concurrins

must be understood as all occurring w

now:

That the value-added tax is paid after the

transactions of, a month.

end of, and on all VAT-related

iustration 2-18. Mr. A is a VAT trader, selling goods

purchased from VAT suppliers. He had the following tran-

actions in March 2019, value-added tax not included:

P 42,000

29

June 2 Purchases on account

‘A Study on Business Taxes and Transfer Taxes

3 Purchase returns and allowances 1709

June 5 Sales on account 100,099,

June 6 Purchase discount 300

june 7 Sales returns and allowances 10,008

lune 15 Sales discount 1,809

How much was the value-added tax payable for the

month?

Computations:

Sales P 100,009

Less: Sales returns and

allowances P 10,000

Sales discount 1,800 14,800

Net sales P 88.209 88,209

Purchases P42,000

Less: Purchase returns

and allowances P 1,700

Purchase discount 300 2,000

Net purchases 40,000

Output tax (P88,200 x 12%) P 10,584

Less: Input tax (P40,000 x 12%) 4.800

Value-added tax payable P 5.784

(See Appendix B on Books of Accounts on Value-Added

Tax)

Mlustration 2-19. in March 2019, Mr. H, a VAT taxpayer,

had:

3/2 Purchase of goods for sale from | Co.,

VAT taxpayer, VAT not included P 300,000

3/4 Purchase of goods for sale from Mr. J,

anon-VAT taxpayer 200,000

3/10 Purchase of supplies from Mr. K, VAT

taxpayer, VAT not included 50,000

3/15 Purchase of services from Mr. L, VAT

taxpayer, VAT not included 60,000

3/17 Purchase of office equipment from M

Co., VAT taxpayer, VAT not included 40,000

3/19 Purchase of land for use in business,

from VAT taxpayer, VAT not included 500.000

3/20 Sales, VAT not included 4,500,000

3/31, Payment of rent to O Co., VAT taxpayer,

VAT not included 50,000

A Study on Business Taxes and Transfer Taxes 5210

How much was the value-added tax payable for March?

P60,000, computed, as follows:

Output taxes (P1,500,000 x 12%) P180,000

Less: Input taxes

On goods (P300,000 x 12%) 36,000

On supplies (P50,000 x 12%) 6,000

On services (P60,000 x 12%) 7,200

On office equipment (P40,000 x 12%) 4.800

On land (P500,000 x 12%) 60,000

On rent (P50,000 x 12%) 6,000 120,000

Value-added tax payable P’ 60,000

Mlustration 2-20. \n the preceding illustration, how much

would have been the net income for the period if the office

equipment had a useful life of three years and four

months, and there were operating expenses paid to non-

VAT taxpayers of P200,000? The computation:

Sales 1,500,000

Less: Cost and expenses:

Purchase of goods - VAT suppliers ~P300,000

Purchase of goods -

Non-VAT suppliers 200,000

Purchase of supplies 50,000

Purchase of services 60,000

Depreciation of office equipment

(P40,000/40 months) 1,000

Rent 50,000

Other operating expenses 200,000 861,000

Net income 639,000

The output taxes and input taxes do not go into the com-

putation of the net income. They are not treated as expenses

because they are credited or offset against each other. Any

excess of output taxes over the input taxes in the same

taxable period will be a Value-added Tax Payable for the pe-

riod, and will be a liability in the Statement of Financial

Position. On the other hand, any excess of the input taxes

over the output taxes of the same period will be a Deferred

Input Tax for use in the next taxable period, which will appear

in the assets section of the Statement of Financial Position.

PROBLEMS. Solve problems 2-1 to 2-4.

A Study on Business Taxes and Transfer Taxes 24

THE REAL ESTATE DEALER

The tax base is

the considera-

tion stated in the

deed of sale, or

the zonal value,

or the fair mar-

ket value in the

assessment

rolts, whichever

is the highest

perty by a real estate dealer will by

A sale of real pro}

at 12% of the gross seit,

subject to the value-added tax

ing price.

Who is a real estate dealer? A real estate dealer js

any person engaged in the business of buying, develop.

ing, selling, or exchanging real property as principal ang

holding himself out as a full or part-time dealer of reaj

estate.

What is gross selling price? Gross selling price is which.

ever is higher between the consideration stated in the

contract of sale and the fair market value.

What is fair market value? It is whichever is higher bet.

ween the fair market value as determined by the Comis-

sioner of Internal Revenue (zonal value), and the fair

market value as shown in the schedule of values of the

Provincial or City Assessor (real property tax deciara-

tion). In the absence of zonal value/fair market value as

determined by the Commissioner of Internal Revenue,

fair market value refers to the market value shown in the

latest real property tax declaration.

Mustration 2-21. Case 1 Case2 Case3

In pesos

Consideration stated in :

the deed of sale 3,000,000 4,200,000 3,000,000

Zonal value 3,500,000 4,500,000 2,500,000

Fair market value in the é

assessment rolls 2,000,000 '-4#700,000 2,500,000

Gross selling price 3,500,000 4,700,000 3,000,000

Value-added tax at 12% 420,000 564,000 360,000

Stated in another Way, gross selling price is whichever 'S

highest of the:

(a) Consideration stated in the deed of sale;

(b) con value, per Commissioner of Internal Revenue:

an

(c) Fair market value per Real Property Declaration with

the Provincial or City Assessor.

2A2

A Study on Business Taxes and Transfer Taxes

Installment pay-

ments of the va-

lue-added tax is

allowed if the ini-

tial payments do

not exceed 25%

of selling price

in the deed of

sale

Installment sale by the real estate dealer.

In case of a sale by a real estate dealer in installments,

can the value-added tax be computed in installments (as

output value-added tax for the real estate dealer and in-

put value-added tax for the buyer)? Yes, if the initial pay-

ments do not exceed twenty-five percent (25%) of the

selling price stated in the deed of sale (not which-

ever is highest of the three values looked into). Initial

payments will include all payments scheduled in the

year of sale.

Figure 2.5 Installment value-added tax of a real estate dealer.

When the initial payments do not exceed -twenty-five percent

(25%) of the selling price:

Step 1. Compute the value-added tax at twelve percent (12%) on the tax

base (whichever is highest of three values);

Step 2. Determine the value-added tax on the installment payment, as

follows:

Agreed

VAT not included x Computed VAT

Collection on the selling price, 1d

VAT not included in Step 1

selling price,

The official receipt issued must clearly state on what the VAT

component is based.

Mustration 2-22. Sale of real property in installments by

a real estate dealer.

Consideration in the deed of sale P 1,800,000

Zonal value 2,000,000

Fair market value in the assessment

rolls of the city 4,700,000

Payments on the consideration:

‘July 1, 2018 (date of sale) 225,000

December 1, 2018 225,000

July 1, 2019 1,350,000

Value-added tax on highest of three values

(P2,000,000 x 12%) P 240,000

Down payment, July 4, 2018 P 225,000

Payment, December 1, 2018 225,000

Installment payments, year of sale P 450,000

Initial payments of P450,000 do not

2-13

A Study on Business Taxes and Transfer Taxes

ee

exceed 25% of the consideration of P1,800,000

Installment value-added tax:

July 1, 2018:

P225,000/P 1,800,000 x P240,000 P 30 09

December 1, 2018: “NO

P225,000/P 1,800,000 x P240,000 P 29 om

July 1, 2019: A809

P14,350,000/P 1,800,000 x P240,000 P 180 009

The deed of sale and each official receipt showing pa,

ment on the installment price must state that the yay,"

added tax is based on the zonal value. .

Mustration 2-23. Mr. B is a real estate dealer. He soly ,

piece of land in installments. Data were as follows:

Installment selling price, VAT not included 4,000.09)

Zonal value 2,000,009

Fair market value 5,000,009

Installment selling price 4,000,009

Terms of payment: .

May 2, 2018 (date of sale) 4,000,000

May 2, 2019 3.000.009

Total 4,000,000

He had expenses of operations paid to VAT taxpayers,

value-added tax not included, as follows:

May 2, 2018 20,000

May 2, 2019 60,000

Output tax? Input tax? Value-added tax payable?

Value-added tax on the sale

(on highest three values)

(P5,000,000 x 12%) P 600,000

May 2, 2018

Output tax (1,000,000/P4,000,000 x P600,000)P 150,000

Less: Input tax on expenses (P20,000 x 12%) 2,400

Value-added tax payable P 147,600

May 2, 2019

Output tax (P3,000,000/P4,000,000 x P600,000) 450,000

Less: Input tax (P60,000 x 12%) 7,200

Value-added tax payable P 442,800

PROBLEMS. Solve problems 2-5 to 2-8.

PRESUMPTIVE INPUT TAX.

A Sludy on Business Taxes and Transfer Taxes

2d

Agricultural pro-

ducts, previously

VAT exempt,

give input tax

to the preferred

taxpayer

Persons or firms engaged in processing sardines, ma-

ckerel, and milk, and in manufacturing refined sugar

and cooking oil, and packed noodle-based instant

meals will be allowed a presumptive input tax, equi-

valend to four percent (4%) of the gross value in mo-

ney of their purchases of:

primary agricultural products

which are used as inputs to their production. Primary

agricultural products are agricultural products in their

original state.

(Are original marine products within the meaning of

original agricultural products? The author thinks no. The

law at times mentions “agricultural” and “marine” pro-

ducts separately.)

The term “processing” means pasteurization, canning

and activities which through physical or chemical pro-

cess alters the exterior texture or form or inner sub-

stance of a product in such a manner as to prepare it

for special use to which it could not have been put in its

original form and condition (this present definition of

“processing” was the old definition of “manufacturing” in

the law).

Iustration 2-24. Mr. ST purchases sardines from fisher-

_men and processes them into canned sardines. Going to

processing in a certain taxable period were the following

purchases, value-added tax not included:

Fish (from fishermen) P100,000

Tin cans 20,000

Tomato paste (in cans) 5,000

Olive oil (in plastic bottles) 2,500

Pepper (from farmers) 1,800

Paper labels (from printers) 500

Sales during the period, value-added tax not included,

amounted to P400,000. The value-added tax payable would

have been:

Output taxes (P400,000 x 12%) P 48,000

Less: Input taxes -

Actual value-added taxes on purchases —

On tin cans (P20,000 x 12%) 2,400

‘A Study on Business Taxes and Transfer Taxes 245

\'!

On tomato parte (P5,000 # 17%) 600

On olive oll (2,500 1 12%) WO

OO

On paper babel (P500 4 12%)

Presummiplive input tar

On popper (91,800 44%) 12

Value-added tax payable

PROBLEM. Solve problem 24.

JOURNAL ENTRIES.

On (assumed amounts)

(a) Purchase at P100,000, VAT not included, for cash

(Debit) Purchases P100,000

(Debit) Input taxes 12,000

(Credit) Cash P1120

(b) Sales at P200,000, VAT not included, for cash

(Debit) Cash P224,000

(Debit) Output taxes 2A,

(Credit) Sales 200,000

(c) Recognition of VAT to pay:

P24,000

(Debit) Output taxes

(Credit) Input taxes P12,000

(Credit) Value-added tax payable 12,000

PROBLEM. Solve problem 2-10.

A Study on Business Taxes and Transfer Taxes 246

You might also like

- Standard CostingDocument26 pagesStandard CostingDesiree GalletoNo ratings yet

- Business Tax (Chapter 9)Document9 pagesBusiness Tax (Chapter 9)Desiree GalletoNo ratings yet

- Business Tax (Chapter 10)Document10 pagesBusiness Tax (Chapter 10)Desiree GalletoNo ratings yet

- Business Tax (Chapter 8)Document2 pagesBusiness Tax (Chapter 8)Desiree GalletoNo ratings yet

- STS Module 1Document59 pagesSTS Module 1Desiree GalletoNo ratings yet

- STS Module 3Document54 pagesSTS Module 3Desiree GalletoNo ratings yet

- STS Module 11Document64 pagesSTS Module 11Desiree GalletoNo ratings yet

- STS Module 13+finalDocument59 pagesSTS Module 13+finalDesiree GalletoNo ratings yet

- STS Module 2Document68 pagesSTS Module 2Desiree GalletoNo ratings yet

- Business Tax (Chapter 1)Document6 pagesBusiness Tax (Chapter 1)Desiree GalletoNo ratings yet

- STS Module 12Document65 pagesSTS Module 12Desiree GalletoNo ratings yet

- Lesson - Bonds PayableDocument18 pagesLesson - Bonds PayableDesiree GalletoNo ratings yet

- Lesson Employee BenefitDocument18 pagesLesson Employee BenefitDesiree GalletoNo ratings yet

- Lesson - CorporationDocument31 pagesLesson - CorporationDesiree GalletoNo ratings yet

- Assignment Activity - Financial Statement AnalysisDocument2 pagesAssignment Activity - Financial Statement AnalysisDesiree GalletoNo ratings yet

- Business SimulationDocument11 pagesBusiness SimulationDesiree GalletoNo ratings yet

- 8&10&11&27 Theo ReportingDocument8 pages8&10&11&27 Theo ReportingDesiree GalletoNo ratings yet

- ASS 4 Understanding Financial StatementsDocument2 pagesASS 4 Understanding Financial StatementsDesiree GalletoNo ratings yet

- Excel Report Problem and ExercisesDocument9 pagesExcel Report Problem and ExercisesDesiree GalletoNo ratings yet

- Finals ReviewerDocument7 pagesFinals ReviewerDesiree GalletoNo ratings yet

- ASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDocument2 pagesASS3-Relationship of Financial Objectives To Organizational Strategies and ObjectivesDesiree GalletoNo ratings yet

- ASS 2 - Business Organization and TrendsDocument2 pagesASS 2 - Business Organization and TrendsDesiree GalletoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)