Professional Documents

Culture Documents

Weekly-Ship-Recycling-Report 16 September 2022

Uploaded by

THOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly-Ship-Recycling-Report 16 September 2022

Uploaded by

THCopyright:

Available Formats

Weekly

Ship Recycling

Report #PartneringWithTheBest

9 September - 16 September 2022

Visit : www.best-oasis.com Head Office: 3201, Saba Tower 1, Cluster E, Jumeirah Lake Towers, Dubai, U.A.E

Email: bol@bol.ae Contact: +971 4575 4667

Highlights of the Week

Global ferrous scrap market is experiencing a downward pull due to sluggish demand from the end-user industries. Despite the ongoing volatility in

steel prices, ship recyclers from all the major recycling destinations are maintaining stable offer prices due to the prevailing scarcity of units available

in the recycling market. However, the end buyers are more inclined towards acquiring smaller tonnage as the rising inflation, economic slowdown, and

shortage of dollars have lowered their purchasing power and risk appetite. Among the major subcontinent players, Bangladesh is leading the price

board, closely followed by India and Pakistan.

Europe’s energy crisis is hammering it's metal producers, driving up costs while simultaneously curbing demand from key consumers. While

steelmakers have been less affected than more power-intensive metals like aluminum and zinc, they’re still being forced to idle capacity due to weak

demand and high energy costs.

The iron ore prices are expected to stabilize around USD 100/MT on signs of improving housing market in China as the nation is stepping up its efforts

to support the housing sector, with more cities announcing credit support and subsidies for home purchases.

Germany seized the local unit of Russian oil major Rosneft PJSC to take sweeping control of its energy industry, secure supplies and sever decades of

deep dependence on Moscow for fuel. Berlin is also nearing a decision to take over Uniper SE and two other large gas importers as it tries to avoid a

collapse of its energy industry.

The Federal Reserve is likely to get more aggressive and raise interest rates faster and further than previously expected after data showed underlying

inflation broadening out rather than cooling as expected. Global markets are expecting another rate hike of 0.75%- 1% in the Fed meeting scheduled

on September 20-21.

Exchange Rates:

USD / INR USD / BDT USD / PKR USD / TL

This Week : 79.82 This Week : 104.13 This Week : 236.60 This Week : 18.27

Previous Week : 79.62 Previous Week : 94.81 Previous Week : 228.11 Previous Week : 18.24

Lost : 0.25 % Lost : 8.95 % Lost : 3.58 % Lost : 0.16 %

Best Oasis Limited Weekly Ship Recycling Report 02

India Price for Recycling Ships in India

Previous Week This Week

Offer prices remain stable 750

605 605

575 575 565 565

Market sentiments remained stable in India as steel mills have started

500

restocking ahead of the upcoming festive season in October. Alongwith the

steady growth in the domestic front, the export market is also picking up

steam as the intensifying energy crisis and consequent inflation in EU has 250

pushed the mills to cut down production, forcing them to explore import

options from Southeast Asia.

0

Container Tanker Bulker

The 15% export duty imposed in May on a range of items covering around

95% of the finished steel export basket is likely to stay till December 2022

as the Steel Ministry feels that any roll-back of the duty at this stage may

Price of HMS 1&2 (80:20) and Shredded

suppress domestic prices and also give unintended signals to market to

prefer exports over domestic demand. The ministry is confident that the Previous Week This Week

domestic demand will go up after the monsoon, particularly because of 500

455 460 450

445

governments thrust to building infrastructure across the country, and this

400

will put upward pressure on prices.

300

Beaching Dates

200

24 September to 2 October 2022

100

7 October to 15 October 2022

25 October to 31 October 2022 0

HMS 1&2 (80:20) Shredded

Best Oasis Limited Weekly Ship Recycling Report 03

Bangladesh Price for Recycling Ships in Bangladesh

Previous Week This Week

BDT weakens to a record low 750

630

620 600

590 575 585

Recyclers of Chattogram are cautiously placing their bids as the domestic

500

steel prices have not yet seen any uptrend despite stable demand in the

local market. With very few vessels available in the recycling market, offer

prices are expected to remain steady as the end buyers need to remain

250

competitive with the neighboring markets of India and Pakistan.

Bangladesh loosened its grip on BDT and allowed taka to weaken to a 0

record low by finally embracing a floating exchange rate as the Central Container Tanker Bulker

Bank adjusted its interbank foreign exchange rate in line with the market

realities. The country is struggling to protect its foreign-exchange reserves

as surging import costs erode the stockpile. Authorities have implemented Price of HMS 1&2 (80:20) and Shredded

power cuts throughout the country and are cracking down on money

hoarders amid a dollar shortage. Previous Week This Week

495

500 465 475

450

400

300

Beaching Dates

200

25 September to 28 September 2022

8 October to 11 October 2022 100

24 October to 27 October 2022 0

HMS 1&2 (80:20) Shredded

Best Oasis Limited Weekly Ship Recycling Report 04

Pakistan Price for Recycling Ships in Pakistan

Previous Week This Week

750

PKR continues its downtrend 610 610

590 590 580 580

In Pakistan, the aftermath of heavy rains and flash floods has left the 500

market in a state of chaos. The recyclers are unable to make firm offers

and buying decisions in the current scenario as there is no certainty

regarding the domestic steel demand due to transportation issues. 250

The Pakistani rupee continued its downward trajectory this week.

0

Several factors have contributed to the currency's decline, such as an Container Tanker Bulker

increased import bill caused by flooding and delays in funding from

friendly countries who have made prior commitments, apart from the

delay in the multilateral and bilateral loans expected.

Price of HMS 1&2 (80:20) and Shredded

Imported scrap offers have softened by about USD 15-20/MT due to Previous Week This Week

limited end-user demand and weak market sentiments. The country 500 465

445

430

expects a 2% cut in the GDP growth figure due to a combination of 415

400

crises, chief among which were the floods, the delayed approval of IMF

funds, and the economic situation emerging in the wake of the Russia- 300

Ukraine war.

200

100

Beaching Dates

Throughout the month 0

HMS 1&2 (80:20) Shredded

Best Oasis Limited Weekly Ship Recycling Report 05

Türkiye Price for Recycling Ships in Türkiye

Previous Week This Week

300

Imported scrap prices softened further 270 270

260 260 250 250

One semi-submersible of about 16,000 LWT arrived under tow in Aliaga this 200

week.

Imported scrap prices have softened by USD 20/MT and are likely to fall 100

further owing to less interest from steel mills and prevailing negative

market sentiments caused by recent increase in energy prices.

0

Container Tanker Bulker

Turkey's annual inflation climbed to a fresh 24-year high of 80.21% in

August, after the central bank unexpectedly cut interest rates and stoked a

nearly year-long cost-of-living crisis. Price of HMS 1&2 (80:20) and Shredded

US and EU have increased pressure on Turkey to impose sanctions on Previous Week This Week

400 390

370 370

Russia, warning against cooperation between Ankara and Moscow. 350

Washington and its allies will be focusing their efforts on sanctioning

300

Turkey for its banking system’s adoption of the Russian Mir payment

system.

200

100

Beaching Dates

Throughout the month 0

HMS 1&2 (80:20) Shredded

Best Oasis Limited Weekly Ship Recycling Report 06

Bunker Prices at Port

MGO - Previous Week MGO - This Week WTI Crude

Brent Crude

1,500

1333

This Week : 91.25 This Week : 85.40

1303

Previous Week : 89.39 Previous Week : 83.65

1218

Movement : +2.04 % Movement : +2.05 %

1125

1094 1092

1062 1055

1032

994

1,000 970

927

Oil prices witnessed high volatility this week with

multiple factors simultaneously acting on it. For the

near term, we remain cautious on oil prices as the

global economy is under pressure from rising rates,

undermining fuel demand.

500

The recent correction in oil prices is being considered

a short-term event as the Fed is expected to raise

interest rates next week, causing market uncertainty.

0

Houston Rotterdam Gibraltar Malta Fujairah Singapore

Best Oasis Limited Weekly Ship Recycling Report 07

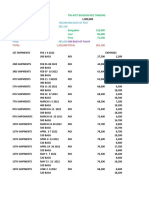

List of Vessels Sold this Week

Year

Type of Country of Location of Sale Price/LDT

Vessel Name IMO No. of LDT Term of Sale

Vessel Build Delivery (USD)

Build

SEARICH TANKER 9044085 1992 S. KOREA 1,778.27 DELIVERED BANGLADESH 672.00

DAWN LUCK TANKER 9004097 1991 JAPAN 2,012.00 DELIVERED BANGLADESH 672.00

JIN SHING TANKER 9046746 1991 JAPAN 1,711.00 AS-IS BATAM 505.00

Best Oasis Limited Weekly Ship Recycling Report 08

Contact Us

Germany U.A.E.

Mr. Gerd Leopold Mr. Naren Sampath

S&P Consultant Ship Broker - Purchase

Phone: +49 417 188 0204 Phone: +971 4575 4667

Mobile: +49 172 370 1021 Mobile: +971 55 836 9147

Mr. Asif Ali

Ship Broker - Purchase

Greece Phone: +971 4575 4667

Mr. Yiannis Kourkoulis Mobile: +971 58 645 0162

Vice President - Purchase

China

Phone: +30 210 0101 450

Capt. Steven Xu

Mobile: +30 694 258 3977

Company Representative

Ms. Irini Mylona

Mobile: +86 136 6600 0719

Commerical Executive

Phone: +30 210 0101 450

Mobile: +30 694 484 3136

Japan

Mr. T Ishii

Company Representative

Work: +81 354 522 405

Mobile: +81 901 536 1497

Disclaimer: While every care has been taken to ensure that the information in this publication is accurate, Best Oasis Limited can accept no responsibility for any error or omissions or any

consequences arising therefrom. Figures are based on latest available information, which is subject to subsequent revisions and corrections. Reproducing any material from this report without

permission from Best Oasis Limited is strictly prohibited.

You might also like

- A Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)From EverandA Hierarchy of Turing Degrees: A Transfinite Hierarchy of Lowness Notions in the Computably Enumerable Degrees, Unifying Classes, and Natural Definability (AMS-206)No ratings yet

- Weekly Ship Recycling Report WEEK35Document7 pagesWeekly Ship Recycling Report WEEK35Sandesh Tukaram GhandatNo ratings yet

- Weekly Ship Recycling Report 33Document7 pagesWeekly Ship Recycling Report 33Sandesh Tukaram GhandatNo ratings yet

- Weekly-Ship-Recycling-Report W42 - 21Document7 pagesWeekly-Ship-Recycling-Report W42 - 21Sandesh Tukaram GhandatNo ratings yet

- Weekly Ship Recycling Report W40 21Document7 pagesWeekly Ship Recycling Report W40 21Sandesh Tukaram GhandatNo ratings yet

- Weekly Ship Recycling Report Week 38pdfDocument7 pagesWeekly Ship Recycling Report Week 38pdfSandesh Tukaram GhandatNo ratings yet

- Weekly Ship Recycling ReportDocument7 pagesWeekly Ship Recycling ReportMohammed FaruqueNo ratings yet

- Weekly Ship Recycling Report WEEK37Document7 pagesWeekly Ship Recycling Report WEEK37Sandesh Tukaram GhandatNo ratings yet

- Weekly Ship Recycling Report Week36Document6 pagesWeekly Ship Recycling Report Week36Sandesh Tukaram GhandatNo ratings yet

- Weekly-Ship-Recycling-Report W41 - 21Document7 pagesWeekly-Ship-Recycling-Report W41 - 21Sandesh Tukaram GhandatNo ratings yet

- MMRW11 09 2023Document20 pagesMMRW11 09 2023Suresh Kumar100% (1)

- Week45 Market ReportDocument35 pagesWeek45 Market Reportmahdi fathabadiNo ratings yet

- ADRO 20210901 Materi Public Expose 2021 FinalDocument36 pagesADRO 20210901 Materi Public Expose 2021 FinalFendy HendrawanNo ratings yet

- Adani Wilmar LTD Sept 22Document10 pagesAdani Wilmar LTD Sept 22Sunil BhunejaNo ratings yet

- The Resilience of Steel Navigating The Crossroads VFDocument11 pagesThe Resilience of Steel Navigating The Crossroads VFMiguel DlgNo ratings yet

- MMRW 15.11.2021Document20 pagesMMRW 15.11.2021shrinath bhatNo ratings yet

- Usda CanolaDocument1 pageUsda CanolabouttakNo ratings yet

- 2023 06 23 5 Years Forward GIBSONDocument8 pages2023 06 23 5 Years Forward GIBSONMai PhamNo ratings yet

- BIMBSec Corp Day - 2022 OG OutlookDocument9 pagesBIMBSec Corp Day - 2022 OG Outlookmuhammad ihsanNo ratings yet

- Report H12016 Eng FinalDocument29 pagesReport H12016 Eng FinalTy BorjaNo ratings yet

- Tata Steel 22sep2022Document18 pagesTata Steel 22sep2022jagadeeshNo ratings yet

- Asn HBD230081 - Bronson SH00022448Document1 pageAsn HBD230081 - Bronson SH00022448Kings NoyNo ratings yet

- FER-White Paper-Sulphur Market VolatilityDocument4 pagesFER-White Paper-Sulphur Market VolatilityvhlmNo ratings yet

- Livestock - Poultry - Cleaned Jan24Document16 pagesLivestock - Poultry - Cleaned Jan24José VmNo ratings yet

- OZL ASX Release Q3 2021 ReportDocument24 pagesOZL ASX Release Q3 2021 ReportStephen C.No ratings yet

- International Coal Prices: Port Port (In Kcal) GCV ($/MT) Freight ($/MT) (RS/MT)Document4 pagesInternational Coal Prices: Port Port (In Kcal) GCV ($/MT) Freight ($/MT) (RS/MT)SANDESH GHANDATNo ratings yet

- Early Warning & Signals Through Charts: JULY 2022Document17 pagesEarly Warning & Signals Through Charts: JULY 2022jayadeep akasamNo ratings yet

- MMRW04 10 2021Document20 pagesMMRW04 10 2021shrinath bhatNo ratings yet

- MM Inv Opp Scorecard HQ Hot Rolled Coil Production PlantDocument5 pagesMM Inv Opp Scorecard HQ Hot Rolled Coil Production Plantsohail ghaznaviNo ratings yet

- Construction of Major Hydraulic Structures Lot 1A Mitigation PlanDocument12 pagesConstruction of Major Hydraulic Structures Lot 1A Mitigation Planoseni momoduNo ratings yet

- GetarchreportpathDocument6 pagesGetarchreportpathAbuNo ratings yet

- Indian Power MarketDocument4 pagesIndian Power MarketratishbalachandranNo ratings yet

- 2022.Q3 GR Market CommentaryDocument22 pages2022.Q3 GR Market CommentaryAitor LongarteNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportResearch SaigalseatradeNo ratings yet

- Argus COA Sample Report Coal (2021!01!19)Document16 pagesArgus COA Sample Report Coal (2021!01!19)郭建麟No ratings yet

- Energy For: ChangeDocument27 pagesEnergy For: Changedidit nur arifNo ratings yet

- Aluminum Building and Construction Usage Study: April 2021Document25 pagesAluminum Building and Construction Usage Study: April 2021Anver AkperovNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- MF Precious Metals Weekly Issue 534Document14 pagesMF Precious Metals Weekly Issue 534warrior3421No ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- BRS Morning Shout - 01.11.2022Document2 pagesBRS Morning Shout - 01.11.2022yaiNo ratings yet

- TheSun 2009-09-15 Page18 Rollout of Projects Bolster Steel Millers Botton-LinesDocument1 pageTheSun 2009-09-15 Page18 Rollout of Projects Bolster Steel Millers Botton-LinesImpulsive collectorNo ratings yet

- Insight - Cement Sector Update - 07-Apr-22Document4 pagesInsight - Cement Sector Update - 07-Apr-22ShujaatAhmedNo ratings yet

- Portal Shipments Bigasan (Rice Trading)Document3 pagesPortal Shipments Bigasan (Rice Trading)Tin SoriaoNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportResearch SaigalseatradeNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- Solid Mettle CRISILDocument40 pagesSolid Mettle CRISILRamanan ChandrasekaranNo ratings yet

- Market Report Week 31Document18 pagesMarket Report Week 31Mai PhamNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- Dalmia Bharat 3R Sept20 2021Document8 pagesDalmia Bharat 3R Sept20 2021nitinmuthaNo ratings yet

- JS-OMCs 04OCT22Document3 pagesJS-OMCs 04OCT22shahjahanabdulrehmanNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportSandesh GhandatNo ratings yet

- Dry Bulk Shipping: Bi-Weekly ReportDocument2 pagesDry Bulk Shipping: Bi-Weekly ReportResearch SaigalseatradeNo ratings yet

- Tanker Monthly - July 2023Document9 pagesTanker Monthly - July 2023Mai PhamNo ratings yet

- Automobiles SectorDocument45 pagesAutomobiles SectorTejesh GoudNo ratings yet

- Post Market Report 20th Oct 2010 Your Stock SolutionsDocument5 pagesPost Market Report 20th Oct 2010 Your Stock SolutionsyourstocksolutionsNo ratings yet

- Antm 070307 DBSDocument3 pagesAntm 070307 DBSCristiano DonzaghiNo ratings yet

- MM Inv Opp Scorecard Copper Tube V2Document6 pagesMM Inv Opp Scorecard Copper Tube V2regallydivineNo ratings yet

- Atalanta Maritime Security Threat Update Red Sea - ModDocument3 pagesAtalanta Maritime Security Threat Update Red Sea - ModTHNo ratings yet

- gd38 Pocket PlanDocument4 pagesgd38 Pocket PlanTHNo ratings yet

- 39k Pocket Plan r1Document4 pages39k Pocket Plan r1THNo ratings yet

- BCA Digital BAR2021 UKDocument65 pagesBCA Digital BAR2021 UKTHNo ratings yet

- Barclays Bank PLC Terms April 2021 - Ibim10360Document12 pagesBarclays Bank PLC Terms April 2021 - Ibim10360THNo ratings yet

- Barclays Personal Savings AccountsDocument10 pagesBarclays Personal Savings AccountsTHNo ratings yet

- Barclays Collect Terms and Conditions - Bi May 2018Document3 pagesBarclays Collect Terms and Conditions - Bi May 2018THNo ratings yet

- BMB Terms and Conditions 21 October 2013Document5 pagesBMB Terms and Conditions 21 October 2013THNo ratings yet

- JWLA027 Dated 29th April 2021Document2 pagesJWLA027 Dated 29th April 2021THNo ratings yet

- Credit Card Terms 04 19Document11 pagesCredit Card Terms 04 19THNo ratings yet

- JWLA-028 - Black Sea - and - Sea - of - AzovDocument4 pagesJWLA-028 - Black Sea - and - Sea - of - AzovTHNo ratings yet

- United States v. Scott Manning, Claimant-Appellant, 107 F.3d 5, 2d Cir. (1997)Document2 pagesUnited States v. Scott Manning, Claimant-Appellant, 107 F.3d 5, 2d Cir. (1997)Scribd Government DocsNo ratings yet

- Car ValuationDocument1 pageCar ValuationShiraz VijNo ratings yet

- Manual For DealersDocument23 pagesManual For DealersSheilaMaeBernaldezNo ratings yet

- Level 11 Passage 1Document5 pagesLevel 11 Passage 1ngotrancheetahNo ratings yet

- Building Regulations NotesDocument6 pagesBuilding Regulations NotesElliot Wells100% (1)

- Corporate Governance: M. Jaffar Abbas NaqviDocument9 pagesCorporate Governance: M. Jaffar Abbas NaqviAli Hailian'sNo ratings yet

- Copley TPK 2007Document15 pagesCopley TPK 2007MatthewNo ratings yet

- Mafatlal Inds LTD 500264 March 2009Document64 pagesMafatlal Inds LTD 500264 March 2009Sanjeev Kumar SinghNo ratings yet

- DBA ChecklistDocument3 pagesDBA ChecklistBhuvnesh PandeyNo ratings yet

- Project Report Group 4 Demand Forecasting at Apollo HospitalsDocument34 pagesProject Report Group 4 Demand Forecasting at Apollo HospitalsNitin VermaNo ratings yet

- Scoring of 16PFDocument50 pagesScoring of 16PFKhristina Anne Ama80% (5)

- Determination of ZIP Parameters With Least Squares Optimization MethodDocument6 pagesDetermination of ZIP Parameters With Least Squares Optimization MethodEmmanuel PugaNo ratings yet

- Arduino - MotorKnobDocument4 pagesArduino - MotorKnobJavier Fernando Vásquez GómezNo ratings yet

- The Theory of Stock Market EfficiencyDocument21 pagesThe Theory of Stock Market EfficiencyMario Andres Rubiano RojasNo ratings yet

- Bomba Denison PVDocument34 pagesBomba Denison PVEdwin Quispe CarlosNo ratings yet

- Da 7p Instruction For Installation and UseDocument14 pagesDa 7p Instruction For Installation and UseEmmanuel GómezNo ratings yet

- GR 169889 Sps Yap & Guevarra V First E-Bank CorporationDocument7 pagesGR 169889 Sps Yap & Guevarra V First E-Bank CorporationXyriel RaeNo ratings yet

- Sbi - Clerk English Exam 2009Document8 pagesSbi - Clerk English Exam 2009somjit_21No ratings yet

- E147478 BMW 5GT F07 NF FpoDocument9 pagesE147478 BMW 5GT F07 NF FpoInventyourselfNo ratings yet

- Raising FinanceDocument17 pagesRaising FinanceJephthah BansahNo ratings yet

- Dynamic Replication in Data-Centers Connected Over IPFSDocument3 pagesDynamic Replication in Data-Centers Connected Over IPFSNilesh RathiNo ratings yet

- TQMDocument6 pagesTQMHamza Dawid HamidNo ratings yet

- Cereals and Pasta CookeryDocument48 pagesCereals and Pasta CookeryJoshua Guiriña100% (3)

- How Do I Coordinate DesignDocument8 pagesHow Do I Coordinate DesignjvwzyxktuvnjohdkbjNo ratings yet

- Problem Set 1 Man - EconDocument2 pagesProblem Set 1 Man - EconDW Waters100% (1)

- 2022, Altay Brusan, Aytac Durmaz, Git For Electronic Circuit Design - CAD and Version Control For Electrical EngineersDocument247 pages2022, Altay Brusan, Aytac Durmaz, Git For Electronic Circuit Design - CAD and Version Control For Electrical EngineersKoay FTNo ratings yet

- Geography 1 29.03.2021Document4 pagesGeography 1 29.03.2021JOHNNo ratings yet

- Beijing Review - August 06, 2020 PDFDocument54 pagesBeijing Review - August 06, 2020 PDFAnanya SaikiaNo ratings yet

- Normas Editadas Netamentes NacionalesDocument245 pagesNormas Editadas Netamentes NacionalesJosé EstorchNo ratings yet

- Financial Performance of State Bank of India: Dr.G. KanagavalliDocument13 pagesFinancial Performance of State Bank of India: Dr.G. KanagavalliANKIT GUPTANo ratings yet