Professional Documents

Culture Documents

Elang Mahkota Teknologi: Flash Note

Elang Mahkota Teknologi: Flash Note

Uploaded by

yolandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Elang Mahkota Teknologi: Flash Note

Elang Mahkota Teknologi: Flash Note

Uploaded by

yolandaCopyright:

Available Formats

Flash Note │ August 9, 2021

Elang Mahkota Teknologi Flash Note

DANA divestment to Sinar Mas and OVO chip-in?

What’s new?

According to DealStreetAsia, EMTK is investigating two options for its e-wallet DANA:

1) a merger between OVO and DANA; and 2) selling a stake in DANA to a third party

and buying stakes in OVO. EMTK may pursue the option of selling DANA to a third

party. We believe that the second option was preferable because it may turn out to

be less complicated than a merger in which determining a controlling party will be a

challenge, and EMTK may have received payment from selling DANA shares to help

fund the acquisition of OVO. Also according to the news, Sinarmas Group is in talks

to acquire DANA, though it is unclear which company within Sinarmas Group will be

involved in the transaction. It should be noted that both Smartfren Telecom and Bank

Sinarmas have an e-money license.

BI regulation barred a party to control more than one e-wallet

Looking at each ownership structure, Tokopedia owns 36.1% of OVO through PT Bumi

Cakrawala Perkasa (BCP), while Grab owns 39.2% plus a contractual right to an

additional 5% in BCP. EMTK, on the other hand, owns 49% of DANA through PT Elang

Andalan Nusantara (EAN), while Ant Financial, through API Investment Limited, owns

Heribertus Ariando

45% of EAN. In terms of context, the ownership restructuring initiative between the

heribertus.ariando@trimegah.com

two was prompted by new central bank rules that prohibit a party from controlling

021 - 2924 9060

more than one e-wallet (effective 1 July 2021) and limit foreign ownership to 85%

with a voting power ceiling of 49%. Tokopedia has been forced to divest its stakes in

Richardson Raymond

OVO as a result of the Gojek-Tokopedia merger.

richardson.raymond@trimegah.com

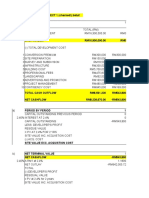

OVO's ownership structure DANA's ownership structure

021 - 2924 9136

Oth ers

Tokyo Centu ry 6%

Corp

Oth ers

7.5%

10% Stock Data & Indices

Li ppo Tokopedia Bloomberg Code EMTK.IJ

7% 36% EMTK

An t Financi al

49%

JCI Member JAKTRAD

45%

MSCI Indonesia No

Grab

39% JII No

LQ45 No

Implication to EMTK and what’s to monitor next? Kompas100 No

The next things to watch from this potential M&A are 1) how much the OVO deal Key Data

value will be, and 2) at what valuation will EMTK divest its DANA stake. During its

2019 deal, OVO was valued at USD2.9bn valuation when GTV was around Issued Shares (mn) 61,197.5

~US3.0bn/IDR41tn, suggesting ~1x EV/GTV valuation. Now with higher user (115mn Free Float (est. in %) 29.7

in 2020, +267% YoY), we could possibly see higher valuation offered, though bear Market Cap. (IDRbn) 159,113.5

in mind that this figure could be inflated due to contribution from Tokopedia, which Market Cap. (USDmn) 11,055.7

will no longer be part of OVO after the deal. Meanwhile, divesting DANA should not ADTV, 6-mo (IDRbn/day) 113.5

be a burden for EMTK as well, considering most of DANA’s transactions are likely 52W Price Range (IDR/sh) 2960/412

coming from Bukalapak. The challenge is how to sell it at an accretive valuation that

can cover the OVO acquisition cost, lest this could be detrimental for EMTK’s Performance

shareholders.

(in %) YTD 1M 3M 12M

Company Data 82.9 -7.2 13.3 422.4

Absolute

Year end Dec (IDRbn) 2019 2020 2021F 2022F 2023F Rel. to JCI 79.3 -9.8 8.8 402.0

Revenue (IDRbn) 11,030 11,936 11,030 11,936 14,704

EBITDA (IDRbn) 725 2,152 2,807 3,129 3,459

Core profit (IDRbn) -780 429 907 1,058 1,188

Core EPS (IDR/sh) -13 7 15 17 19

Core EPS growth (%) nc nc 112% 17% 12%

P/E (x) nc 376.6 178.0 152.6 135.9

P/B (x) 16.3 15.1 13.7 12.4 11.1

Dividend yield (%) 0.2% 0.0% 0.0% 0.0% 0.0%

Source: Company, Bloomberg, Trimegah Research. Pricing per August 6, 2021

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 1

Research Team

Willinoy Sitorus Strategy, Banks & Industrial willinoy.sitorus@trimegah.com +62-21 2924 9107

Fakhrul Fulvian Economics, Fixed Income fakhrul.fulvian@trimegah.com +62-21 2924 9097

Prasetya Gunadi Banks and Financial-related prasetya.gunadi@trimegah.com +62-21 2924 9099

Darien Sanusi Consumer Staples and Retail darien.sanusi@trimegah.com +62-21 2924 9106

Heribertus Ariando Tobacco, Media and Healthcare heribertus.ariando@trimegah.com +62-21 2924 9060

Richardson Raymond Telco, Tower, and Infrastructure richardson.raymond@trimegah.com +62-21 2924 9136

Kharel Devin Fielim Property, Construction and Infra kharel.devin@trimegah.com +62-21 2924 9103

Hasbie Commodities-related and Small Caps hasbie@trimegah.com +62-21 2924 6322

Kenny Vincent Economics, Fixed Income kenny.vincent@trimegah.com +62-21 2924 6325

Kimberly Bianca Generalist kimberly.bianca@trimegah.com +62-21 2924 9088

Corporate Access

Nur Marini Corporate Access marini@trimegah.com +62-21 2924 6323

Institutional Sales Team

Beatrix Susanto Head of Institutional Sales beatrix.susanto@trimegah.com +62-21 2924 9086

Henry Sidarta, CFTe Deputy Head of Institutional Sales henry.sidarta@trimegah.com +62-21 3043 6309

Raditya Andyono Equity Institutional Sales raditya.andyono@trimegah.com +62-21 2924 9146

Calvina Karmoko Equity Institutional Sales calvina.karmoko@trimegah.com +62-21 2924 9080

Dewi Yusnita Equity Institutional Sales dewi.yusnita@trimegah.com +62-21 2924 9082

Morgan Gindo Equity Institutional Sales morgan.gindo@trimegah.com +62-21 2924 9076

Gerry Benedict Equity Institutional Sales gerry.benedict@trimegah.com +62-21 2924 9081

Retail Sales Team

Andrew Jatmiko Head of Retail Equity Sales andrew.jatmiko@trimegah.com +62-21 3043 6310

Hasbie Sukaton Deputy Head of Retail Sales hasbie.sukaton@trimegah.com +62-21 2924 9088

Untung Wijaya Area Manager (Indonesia Timur) untung.wijaya@trimegah.com +62-31 2971 8000

Jakarta Area

Ignatius Candra Perwira Kelapa Gading, Jakarta ignatius.perwira@trimegah.com +62-21 8061 7270

Ariffianto BSD, Jakarta ariffianto@trimegah.com +62-21 5089 8959

Sumatera

Juliana Effendy Medan, Sumatera Utara juliana.effendi@trimegah.com +62-61 4100 0000

Eastern Indonesia

Carlo Ernest Frits Coutrier Makasar, Sulawesi Selatan carlo.coutrier@trimegah.com +62-411 3604 379

East Java

Pandu Wibisono Surabaya, Jawa Timur pandu.wibisono@trimegah.com +62-31 2973 18000

Central Java, Area

Aloysius Primasyah Semarang, Jawa Tengah primasyah.kristanto@trimegah.com +62-24 8600 2310

Laili Ma’muroh Solo, Jawa Tengah laili.mamuroh@trimegah.com +62-271 6775 590

West Java

Bhisma Herlambang Bandung, Jawa Barat bhisma.herlambang@trimegah.com +62-22 8602 6290

Renny Nurhayati Hidayat Cirebon, Jawa Barat renny.nurhayati@trimegah.com +62-231 8851 009

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 2

Disclaimer

This report has been prepared by PT Trimegah Sekuritas Indonesia Tbk on behalf of itself and its affiliated companies and is

provided for information purposes only. Under no circumstances is it to be used or considered as an offer to sell, or a solicitation

of any offer to buy. This report has been produced independently and the forecasts, opinions and expectations contained herein

are entirely those of PT Trimegah Sekuritas Indonesia Tbk.

While all reasonable care has been taken to ensure that information contained herein is not untrue or misleading at the time

of publication, PT Trimegah Sekuritas Indonesia Tbk makes no representation as to its accuracy or completeness and it should

not be relied upon as such. This report is provided solely for the information of clients of PT Trimegah Sekuritas Indonesia Tbk

who are expected to make their own investment decisions without reliance on this report. Neither PT Trimegah Sekuritas

Indonesia Tbk nor any officer or employee of PT Trimegah Sekuritas Indonesia Tbk accept any liability whatsoever for any

direct or consequential loss arising from any use of this report or its contents. PT Trimegah Sekuritas Indonesia Tbk and/or

persons connected with it may have acted upon or used the information herein contained, or the research or analysis on which

it is based, before publication. PT Trimegah Sekuritas Indonesia Tbk may in future participate in an offering of the company’s

equity securities.

This report is not intended for media publication. The media is not allowed to quote this report in any article whether in full or

in parts without permission from PT Trimegah Sekuritas Indonesia Tbk. For further information, the media can contact the

head of research of PT Trimegah Sekuritas Indonesia Tbk.

This report was prepared, approved, published and distributed by PT Trimegah Sekuritas Indonesia Tbk located outside of the

United States (a “non-US Group Company”). Neither the report nor any analyst who prepared or approved the report is subject

to U.S. legal requirements or the Financial Industry Regulatory Authority, Inc. (“FINRA”) or other regulatory requirements

pertaining to research reports or research analysts. No non-US Group Company is registered as a broker-dealer under the

Exchange Act or is a member of the Financial Industry Regulatory Authority, Inc. or any other U.S. self-regulatory organization.

INVESTMENT RATING RULE:

Buy : Share price is expected to exceed more than 10% over the next 12 months

Neutral : Share price is expected to trade within the range of 0%-10% over the next 12 months

Sell : Share price is expected to trade below 0% over the next 12 months

Not Rated : The company is not within Trimegah research coverage

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 3

Analysts Certification

The research analyst(s) of PT Trimegah Sekuritas Indonesia Tbk. primarily responsible for the content of this research report,

in whole or in part, certifies that with respect to the companies or relevant securities that the analyst(s) covered in this report:

(1) all of the views expressed accurately reflect his or her personal views on the company or relevant securities mentioned

herein; (2) no part of his or her remuneration was, is, or will be, directly or indirectly, connected with his or her specific

recommendations or views expressed in the research report; and (3) the report does not contain any material non-public

information.

The disclosure column in the following table lists the important disclosures applicable to each company that has been rated

and/or recommended in this report:

Company Ticker Disclosure (as applicable)

EMTK -

Trimegah Disclosure Data

Trimegah represents that:

1. Within the past year, it has managed or co-managed a public offering for this company, for which it received fees.

2. It had an investment banking relationship with this company in the last 12 months.

3. It received compensation for investment banking services from this company in the last 12 months.

4. It expects to receive or intends to seek compensation for investment banking services from the subject company/ies

in the next 3 months.

5. It beneficially owns 1% or more of any class of common equity securities of the subject company.

6. It makes a market in securities in respect of this company.

7. The analyst(s) or an individual who assisted in the preparation of this report (or a member of his/her household) has

a financial interest position in securities issued by this company. The financial interest is in the common stock of the

subject company, unless otherwise noted.

8. The analyst (or a member of his/her household) is an officer, director, employee or advisory board member of this

company or has received compensation from the company.

PT Trimegah Sekuritas Indonesia Tbk – www.trimegah.com 4

You might also like

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Mckinsey DCF Valuation 2000Document5 pagesMckinsey DCF Valuation 2000tiago.ohori03415150% (2)

- GOTO Initiation 01072022 enDocument22 pagesGOTO Initiation 01072022 ensudah kawinNo ratings yet

- (Duffy, Patricia A. Edwards, William M. Kay, Ron PDFDocument481 pages(Duffy, Patricia A. Edwards, William M. Kay, Ron PDFfikya juandaNo ratings yet

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- CUSPAP-2022 (Canada Appraisal Institute)Document91 pagesCUSPAP-2022 (Canada Appraisal Institute)Rajwinder SIngh100% (1)

- HOLT Wealth Creation Principles Don't Suffer From A Terminal Flaw, Add Fade To Your DCF Document-807204250Document13 pagesHOLT Wealth Creation Principles Don't Suffer From A Terminal Flaw, Add Fade To Your DCF Document-807204250tomfriisNo ratings yet

- CMA Final: Paper - 20: Strategic Performance Management & Business ValuationDocument3 pagesCMA Final: Paper - 20: Strategic Performance Management & Business ValuationDharshini AravamudhanNo ratings yet

- SAP - C - TFIN52 - 66 (SAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP4)Document16 pagesSAP - C - TFIN52 - 66 (SAP Certified Application Associate - Financial Accounting With SAP ERP 6.0 EHP4)Nahit100% (1)

- Fixing of Sum Insured Under Fire Insurance PoliciesDocument17 pagesFixing of Sum Insured Under Fire Insurance PoliciesShayak Kumar GhoshNo ratings yet

- Bukalapak (Online With A Purpose) 20210829Document27 pagesBukalapak (Online With A Purpose) 20210829Yohannie LinggasariNo ratings yet

- Lucky PreviewDocument1 pageLucky PreviewTughral HilalyNo ratings yet

- Telecommunication: OverweightDocument4 pagesTelecommunication: Overweightmuhamad fadzirNo ratings yet

- LIT FactsheetDocument2 pagesLIT FactsheetAlex MilarNo ratings yet

- PT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsDocument9 pagesPT Telekomunikasi Indonesia, TBK: Fairly Steady 1Q20 ResultsSugeng YuliantoNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Larsen & Toubro: Performance HighlightsDocument14 pagesLarsen & Toubro: Performance HighlightsrajpersonalNo ratings yet

- MicroWatch Issue 59 - Q1 2021Document20 pagesMicroWatch Issue 59 - Q1 2021Entertainment worldNo ratings yet

- Goto 1702966919Document5 pagesGoto 1702966919Anonymous XoUqrqyuNo ratings yet

- Reliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39Document31 pagesReliance Communications: Group 8 Presented By: Nichelle Kamath Mitali Mistry Komal Tambade - F65 Mansi Morajkar - F39sachinborade11997No ratings yet

- Notion Vtec Berhad: Worse Than Feared - 06/08/2010Document3 pagesNotion Vtec Berhad: Worse Than Feared - 06/08/2010Rhb InvestNo ratings yet

- Telkom Indonesia: Equity ResearchDocument6 pagesTelkom Indonesia: Equity ResearchMochamad IrvanNo ratings yet

- Tech Sector Update 01122022Document4 pagesTech Sector Update 01122022VictorioNo ratings yet

- TLKM 9M23 Info MemoDocument19 pagesTLKM 9M23 Info Memorudyjabbar23No ratings yet

- Bank Jago: Execution On Track TP Raised 14% To IDR20,250Document5 pagesBank Jago: Execution On Track TP Raised 14% To IDR20,250Tasya AngelineNo ratings yet

- Ciptadana Company Update GOTO 11 Dec 2023 - Buy TP Rp150Document8 pagesCiptadana Company Update GOTO 11 Dec 2023 - Buy TP Rp150financialshooterNo ratings yet

- Research On CAMS by HDFC Securities - Nov 2020Document22 pagesResearch On CAMS by HDFC Securities - Nov 2020Sanjeet SahooNo ratings yet

- Quity Esearch: FY12 Result: Bitter and SweetDocument2 pagesQuity Esearch: FY12 Result: Bitter and SweetDarwin TjongNo ratings yet

- Adi Sarana Armada TBK: Call Takeaways: Continue To DeliverDocument8 pagesAdi Sarana Armada TBK: Call Takeaways: Continue To DeliverPutri CandraNo ratings yet

- Mobile World Investment Corporation (MWG - HSX) BUY: Dien May XanhDocument20 pagesMobile World Investment Corporation (MWG - HSX) BUY: Dien May XanhThư TrầnNo ratings yet

- Telekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Document6 pagesTelekomunikasi Indonesia (TLKM) : Target Price: RP 75.000Hamba AllahNo ratings yet

- CF MARI - Make Some NOICEDocument13 pagesCF MARI - Make Some NOICENicholas PratamaNo ratings yet

- BUY ITC: On A Steady PathDocument19 pagesBUY ITC: On A Steady PathTatsam VipulNo ratings yet

- Ex I Com Tele System 280224Document9 pagesEx I Com Tele System 280224jainam jainNo ratings yet

- Media Chinese Int'l: Corporate HighlightsDocument4 pagesMedia Chinese Int'l: Corporate HighlightsRhb InvestNo ratings yet

- GOTO IJ - MNC Sekuritas Equity Report (170323)Document28 pagesGOTO IJ - MNC Sekuritas Equity Report (170323)Anonymous XoUqrqyuNo ratings yet

- DIWALI PICK 2022-12-October-2022-904894269Document12 pagesDIWALI PICK 2022-12-October-2022-904894269RamNo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- Jasa Marga Upgrade Jul28 v2Document6 pagesJasa Marga Upgrade Jul28 v2superrich92No ratings yet

- Indopremier Company Update GOTO 11 Dec 2023 Maintain Buy TP Rp125Document5 pagesIndopremier Company Update GOTO 11 Dec 2023 Maintain Buy TP Rp125financialshooterNo ratings yet

- Telecommunications Sector Update: 2QFY10 Report Card - 03/09/2010Document8 pagesTelecommunications Sector Update: 2QFY10 Report Card - 03/09/2010Rhb InvestNo ratings yet

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniNo ratings yet

- Zomato Limited. F: SubscribeDocument9 pagesZomato Limited. F: SubscribePrasun SharmaNo ratings yet

- UOB Company Results 4Q23 JSMR 8 Mar 2024 Maintain Buy TP Rp7,300Document5 pagesUOB Company Results 4Q23 JSMR 8 Mar 2024 Maintain Buy TP Rp7,300prima.brpNo ratings yet

- Increasing Estimates On Improving Earnings Outlook: First Gen CorporationDocument7 pagesIncreasing Estimates On Improving Earnings Outlook: First Gen Corporationskynyrd75No ratings yet

- APM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Document7 pagesAPM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Rhb InvestNo ratings yet

- Delta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyDocument6 pagesDelta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyJatin SoniNo ratings yet

- (Mirae Asset Sekuritas Indonesia) TLKM FMC and DigiCo Update PDFDocument12 pages(Mirae Asset Sekuritas Indonesia) TLKM FMC and DigiCo Update PDFrudyjabbar23No ratings yet

- PT XL Axiata TBK: Digital FocusDocument8 pagesPT XL Axiata TBK: Digital FocusTeguh PerdanaNo ratings yet

- Samuel Company Update GOTO 12 Dec 2023 Upgrade To Buy TP Rp120Document5 pagesSamuel Company Update GOTO 12 Dec 2023 Upgrade To Buy TP Rp120financialshooterNo ratings yet

- MTAR Technologies LTD: Subscribe For Long Term Price Band: INR 574-575Document10 pagesMTAR Technologies LTD: Subscribe For Long Term Price Band: INR 574-575falconNo ratings yet

- 1Q21 Core Earnings Up 19% Y/y Meet Estimates: GT Capital Holdings, IncDocument8 pages1Q21 Core Earnings Up 19% Y/y Meet Estimates: GT Capital Holdings, IncJajahinaNo ratings yet

- XL Axiata TBK: (EXCL)Document4 pagesXL Axiata TBK: (EXCL)Hamba AllahNo ratings yet

- Mirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Document9 pagesMirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Ira KusumawatiNo ratings yet

- 2020 10 19 PH S Tel PDFDocument7 pages2020 10 19 PH S Tel PDFJNo ratings yet

- KBVS Company Report GOTO 12 Dec 2023 - Maintain Buy TP Rp97Document4 pagesKBVS Company Report GOTO 12 Dec 2023 - Maintain Buy TP Rp97financialshooterNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Diwali Dhamaka 2020Document25 pagesDiwali Dhamaka 2020Prachi PatwariNo ratings yet

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainNo ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- Ciptadana PT. Telkom Indonesia TBK TLKM Positive Outlook For 2H21FDocument8 pagesCiptadana PT. Telkom Indonesia TBK TLKM Positive Outlook For 2H21Fbobby prayogoNo ratings yet

- HSL - IT PAck Report - 2021-202108182348354902869Document9 pagesHSL - IT PAck Report - 2021-202108182348354902869SHAIK AHMEDNo ratings yet

- Tata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Document5 pagesTata Motors LTD: Result Update Aiming Near Net Debt Free (Automotive) by FY24Shiv NarangNo ratings yet

- Zomato IPO NoteDocument9 pagesZomato IPO NoteCrest WolfNo ratings yet

- Jarir GIB 2023.6Document3 pagesJarir GIB 2023.6robynxjNo ratings yet

- 'KQHK NhikoyhDocument12 pages'KQHK NhikoyhGiri BabaNo ratings yet

- Ciptadana Sekuritas MAIN Favorable Chicken Prices Lead To Profitable Business UnitDocument7 pagesCiptadana Sekuritas MAIN Favorable Chicken Prices Lead To Profitable Business Unitroy95121No ratings yet

- Japfa Comfeed Indonesia: Equity ResearchDocument7 pagesJapfa Comfeed Indonesia: Equity Researchroy95121No ratings yet

- Cardiovascular Effects of Psychotropic Drugs: 190 Curr Probl Cardiol, May 2002Document51 pagesCardiovascular Effects of Psychotropic Drugs: 190 Curr Probl Cardiol, May 2002roy95121No ratings yet

- LiverDocument6 pagesLiverroy95121No ratings yet

- MBA Case StudyDocument10 pagesMBA Case StudyPhilip JosephNo ratings yet

- Finance Batch 2022-24Document20 pagesFinance Batch 2022-24LAKHAN TRIVEDINo ratings yet

- Bond Price Volatility - Problem SetDocument3 pagesBond Price Volatility - Problem SetHitesh JainNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsGolamMostafaNo ratings yet

- Employee Benefits: Accounting Standard (AS) 15Document67 pagesEmployee Benefits: Accounting Standard (AS) 15hanumanthaiahgowdaNo ratings yet

- Valuation Report 3Document35 pagesValuation Report 3emmanuelNo ratings yet

- Exercise 3 - Nur Aina AdrianaDocument9 pagesExercise 3 - Nur Aina AdrianaHannan Bt HizamNo ratings yet

- The City of Calgary 2020 Infrastructure Status Report - Early VersionDocument30 pagesThe City of Calgary 2020 Infrastructure Status Report - Early VersionAdam ToyNo ratings yet

- PR E7 Capitalization of EarningsDocument13 pagesPR E7 Capitalization of EarningsJasmin De CastroNo ratings yet

- Covid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovDocument8 pagesCovid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovSang PhamNo ratings yet

- Fortune Maxima V4 BrochureDocument16 pagesFortune Maxima V4 BrochureSubhadip GhoshNo ratings yet

- The Value of Common Stocks: Principles of Corporate FinanceDocument43 pagesThe Value of Common Stocks: Principles of Corporate FinanceMakar FilchenkoNo ratings yet

- ERP Configuration Using GBI Phase II Handbook (A4) en v3.3Document102 pagesERP Configuration Using GBI Phase II Handbook (A4) en v3.3Adi SulistyoNo ratings yet

- Mutual Funds: Concept and CharacteristicsDocument179 pagesMutual Funds: Concept and CharacteristicssiddharthzalaNo ratings yet

- Egypt Book 2008Document161 pagesEgypt Book 2008campon_macNo ratings yet

- Brealey - Principles of Corporate Finance - 13e - Chap18 - SMDocument10 pagesBrealey - Principles of Corporate Finance - 13e - Chap18 - SMShivamNo ratings yet

- Project FilehjhjhjDocument98 pagesProject FilehjhjhjJabir Mohammed T RNo ratings yet

- Market Valuation Multiples Bucharest Stock Exchange 2021Document35 pagesMarket Valuation Multiples Bucharest Stock Exchange 2021Andreea Bianca NeacșuNo ratings yet

- Geneva Tax AssessmentsDocument99 pagesGeneva Tax AssessmentscherylwaityNo ratings yet

- A Dissertation Report On Merger and AcquDocument87 pagesA Dissertation Report On Merger and AcquGULAM HUSSNAINNo ratings yet

- Articulo EdizDocument13 pagesArticulo EdizEvaristo DizNo ratings yet

- Corporate Governance and Cost of Capital in Oecd Countries: Aws AlharesDocument21 pagesCorporate Governance and Cost of Capital in Oecd Countries: Aws AlharesOZZYMANNo ratings yet