Professional Documents

Culture Documents

Acma - CH 1

Uploaded by

meseret0 ratings0% found this document useful (0 votes)

10 views48 pagesThe document discusses key concepts in cost accounting terminology and cost estimation methods. It defines different types of costs such as actual, budgeted, direct, and indirect costs. It also explains cost behavior as fixed or variable and how costs are accumulated and assigned. Quantitative cost estimation methods like the high-low method and regression analysis are introduced for objectively estimating cost functions from historical data.

Original Description:

advanced cost and management accounting: chapter 1 basic cost terminologies

Original Title

ACMA- CH 1-PPT

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses key concepts in cost accounting terminology and cost estimation methods. It defines different types of costs such as actual, budgeted, direct, and indirect costs. It also explains cost behavior as fixed or variable and how costs are accumulated and assigned. Quantitative cost estimation methods like the high-low method and regression analysis are introduced for objectively estimating cost functions from historical data.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views48 pagesAcma - CH 1

Uploaded by

meseretThe document discusses key concepts in cost accounting terminology and cost estimation methods. It defines different types of costs such as actual, budgeted, direct, and indirect costs. It also explains cost behavior as fixed or variable and how costs are accumulated and assigned. Quantitative cost estimation methods like the high-low method and regression analysis are introduced for objectively estimating cost functions from historical data.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 48

16 December 2018 Tamrat G 1

1.1 Basic Cost Terminology

• Cost—sacrificed resource to achieve a specific objective

• Actual cost—a cost that has occurred

• Budgeted cost—a predicted cost

• Cost object—anything of interest for which a cost is desired

16 December 2018 Tamrat G 2

Basic Cost Terminology……

• Cost accumulation—a collection of cost data in an organized

manner

• Cost assignment—a general term that includes assigning

accumulated costs to a cost object.

• This includes:

• Tracing accumulated costs with a direct relationship to the

cost object and

• Allocating accumulated costs with an indirect relationship to

a cost object

16 December 2018 Tamrat G 3

Direct and Indirect Costs

• Direct costs can be conveniently and economically traced

(tracked) to a cost object.

• Indirect costs cannot be conveniently or economically traced

(tracked) to a cost object.

• Instead of being traced, these costs are allocated to a cost

object in a rational and systematic manner.

16 December 2018 Tamrat G 4

BMW: Assigning Costs to a Cost

Object

16 December 2018 Tamrat G 5

1.2 Cost Behavior

• Variable costs—changes in total in

proportion to changes in the related level of

activity or volume.

• Fixed costs—remain unchanged in total

regardless of changes in the related level

of activity or volume.

• Costs are fixed or variable only with respect to a

specific activity or a given time period.

16 December 2018 Tamrat G 6

Cost Behavior . . .

• Variable costs are constant on a per-unit basis.

If a product takes 5 pounds of materials each, it

stays the same per unit regardless of one, ten,

or a thousand units are produced.

• Fixed costs change inversely with the level of

production. As more units are produced, the same

fixed cost is spread over more and more units,

reducing the cost per unit.

16 December 2018 Tamrat G 7

16 December 2018 Tamrat G 8

16 December 2018 Tamrat G 9

Other Cost Concepts

16 December 2018 Tamrat G 10

16 December 2018 Tamrat G 11

16 December 2018 Tamrat G 12

16 December 2018 Tamrat G 13

16 December 2018 Tamrat G 14

16 December 2018 Tamrat G 15

16 December 2018 Tamrat G 16

16 December 2018 Tamrat G 17

16 December 2018 Tamrat G 18

16 December 2018 Tamrat G 19

16 December 2018 Tamrat G 20

16 December 2018 Tamrat G 21

16 December 2018 Tamrat G 22

16 December 2018 Tamrat G 23

16 December 2018 Tamrat G 24

16 December 2018 Tamrat G 25

16 December 2018 Tamrat G 26

16 December 2018 Tamrat G 27

16 December 2018 Tamrat G 28

16 December 2018 Tamrat G 29

16 December 2018 Tamrat G 30

16 December 2018 Tamrat G 31

16 December 2018 Tamrat G 32

Cost Estimation Methods

1. Industrial engineering method

2. Conference method

3. Account analysis method

4. Quantitative analysis methods

1. High-low method

2. Regression analysis

16 December 2018 Tamrat G 33

16 December 2018 Tamrat G 34

Conference Method

Estimates cost functions on the basis of

analysis and opinions about costs and their

drivers gathered from various departments of

a company

Pools expert knowledge

Reliance on opinions still makes this method

subjective

16 December 2018 Tamrat G 35

Account Analysis Method

Estimates cost functions by classifying various

cost accounts as variable, fixed, or mixed with

respect to the identified level of activity

Is reasonably accurate, cost-effective, and

easy to use, but is subjective

16 December 2018 Tamrat G 36

Quantitative Analysis

Uses a formal mathematical method to fit

cost functions to past data observations

Advantage: results are objective

16 December 2018 Tamrat G 37

Steps in Estimating a Cost Function Using

Quantitative Analysis

1. Choose the dependent variable (the cost to be predicted).

2. Identify the independent variable or cost driver.

3. Collect data on the dependent variable and the cost driver.

4. Plot the data.

5. Estimate the cost function using the high-low method or

regression analysis.

6. Evaluate the cost driver of the estimated cost function.

16 December 2018 Tamrat G 38

16 December 2018 Tamrat G 39

High High-Low Method

• Simplest method of quantitative analysis

• Uses only the highest and lowest observed values

16 December 2018 Tamrat G 40

16 December 2018 Tamrat G 41

16 December 2018 Tamrat G 42

Regression Analysis

• Regression analysis is a statistical method that measures the

average amount of change in the dependent variable

associated with a unit change in one or more independent

variables.

• Is more accurate than the high-low method because the

regression equation estimates costs using information from

all observations; the high-low method uses only two

observations.

16 December 2018 Tamrat G 43

Types of Regression

• Simple—estimates the relationship between the

dependent variable and one independent

variable

• Multiple—estimates the relationship between

the dependent variable and two or more

independent variables

16 December 2018 Tamrat G 44

16 December 2018 Tamrat G 45

16 December 2018 Tamrat G 46

Terminology

• Goodness of fit—indicates the strength of the relationship

between the cost driver and costs

• Residual term—measures the distance between actual cost

and estimated cost for each observation

16 December 2018 Tamrat G 47

End of Chapter One

Next

CH II Multi-Product CVP Analysis

16 December 2018 Tamrat G 48

You might also like

- CSE 6023 Machine Learning Tree Based MethodsDocument35 pagesCSE 6023 Machine Learning Tree Based MethodsIstiaq AkbarNo ratings yet

- Northern Company AnalysisDocument23 pagesNorthern Company AnalysisDilsa JainNo ratings yet

- 5 AppraisalProcess MBC2015 PDFDocument70 pages5 AppraisalProcess MBC2015 PDFRoy John MalaluanNo ratings yet

- ICDS - 2 InventoryDocument21 pagesICDS - 2 Inventorykavita.m.yadavNo ratings yet

- Aa12 Evidencia 1 Aa12 Evidence 1 Writing and Essay About Logistics CostsDocument5 pagesAa12 Evidencia 1 Aa12 Evidence 1 Writing and Essay About Logistics CostsRJ ThebigNo ratings yet

- Managerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreDocument35 pagesManagerial Economics in A Global Economy Ninth Edition: by Dominick SalvatoreRAHUL SINGHNo ratings yet

- SuRe - The Standard For Sustainable and Resilient InfrastructureDocument197 pagesSuRe - The Standard For Sustainable and Resilient InfrastructureALINANo ratings yet

- Mutually Exclusive ProjectsDocument39 pagesMutually Exclusive ProjectsRAMRAJ CHIMOURIYANo ratings yet

- Standard CostsDocument23 pagesStandard CostsZoya KhanNo ratings yet

- 18CS42-Design and Analysis of Algorithms Feb-May 2020 1Document94 pages18CS42-Design and Analysis of Algorithms Feb-May 2020 1Bhanuranjan S BNo ratings yet

- Final Report of Hitachi InzamamDocument62 pagesFinal Report of Hitachi Inzamamlemillion68No ratings yet

- Oil and Gas ElectricalDocument40 pagesOil and Gas Electricalparameshvkr100% (1)

- Project For Development of Low-Carbon City Through City-to-City Collaboration Between Batam and Yokohama Since 2015Document10 pagesProject For Development of Low-Carbon City Through City-to-City Collaboration Between Batam and Yokohama Since 2015Pak Ngah LebayNo ratings yet

- Random - Motors - Presentation DeckDocument10 pagesRandom - Motors - Presentation DeckNishant AroraNo ratings yet

- BMIS 685 Midterm Houcheimi Rayak Summer 2017 2018Document18 pagesBMIS 685 Midterm Houcheimi Rayak Summer 2017 2018TAREK536281No ratings yet

- Accounting Lesson 2 Fixed Assets NotesDocument10 pagesAccounting Lesson 2 Fixed Assets NotesGift SimumbaNo ratings yet

- DR Amit Kumar SinhaDocument29 pagesDR Amit Kumar SinhaMudit MisraNo ratings yet

- Master of Business Analytics: BA 3003 - Computational Social ScienceDocument30 pagesMaster of Business Analytics: BA 3003 - Computational Social Scienceakhi 2021No ratings yet

- FLSmidth. AGA Sampling Solution RevDocument16 pagesFLSmidth. AGA Sampling Solution RevHidalgo0284No ratings yet

- Management Accounting OverviewDocument27 pagesManagement Accounting Overviewfreya cuevasNo ratings yet

- Analysis of Old Cars DataDocument32 pagesAnalysis of Old Cars Datapriyankapriyanka90856No ratings yet

- 28 - 09 Logistics Performance MetricsDocument25 pages28 - 09 Logistics Performance MetricsSiddharth JawaleNo ratings yet

- Key Investment PointsDocument2 pagesKey Investment PointsDanikaLiNo ratings yet

- Gartner-Market Guide For Real-Time Visibility ProvidersDocument27 pagesGartner-Market Guide For Real-Time Visibility ProvidersTilakesh N M100% (1)

- December 2020 Module 3.03 (Suggested Solutions)Document32 pagesDecember 2020 Module 3.03 (Suggested Solutions)GeorgeChooNo ratings yet

- AKI 03 AKI Fundamentals ShortTemCostsDocument41 pagesAKI 03 AKI Fundamentals ShortTemCostsFia NiqlaNo ratings yet

- Business PowerpointDocument24 pagesBusiness PowerpointNadia Zahira Putri RachmadiNo ratings yet

- IJCRT1892153Document4 pagesIJCRT1892153Lakshmi vanahalliNo ratings yet

- Random Motors Project - Rajeev RanjanDocument10 pagesRandom Motors Project - Rajeev RanjanRajeev RanjanNo ratings yet

- Designing Cost Effective Ocean Freight Strategy NewDocument1 pageDesigning Cost Effective Ocean Freight Strategy NewDennis DuNo ratings yet

- Ir Eur 2018-1211Document951 pagesIr Eur 2018-1211Florent Tardivel100% (1)

- Investments in Noncurrent Operating Assets - Utilization and RetirementDocument42 pagesInvestments in Noncurrent Operating Assets - Utilization and Retirementhashimhash100% (1)

- Horngren Ca16 PPT 16Document30 pagesHorngren Ca16 PPT 16sofikhdyNo ratings yet

- Robotics Unit5 SlidesDocument35 pagesRobotics Unit5 SlidesJanarthanan BalakrishnasamyNo ratings yet

- CFD Workshop: Day Two and Three Backward Facing StepDocument24 pagesCFD Workshop: Day Two and Three Backward Facing StepAckim MvulaNo ratings yet

- Lecture Notes 1 National Income Accounting and Balance of PaymentsDocument42 pagesLecture Notes 1 National Income Accounting and Balance of PaymentsRandhir kumarNo ratings yet

- Gartnet Toolkit - One Page IT Strategic Plan Template Visualizes The Links To Business ObjectivesDocument10 pagesGartnet Toolkit - One Page IT Strategic Plan Template Visualizes The Links To Business ObjectivesapzoepiaNo ratings yet

- Dominion Motor CompnayDocument16 pagesDominion Motor Compnayanon_116013318No ratings yet

- Drive Cost Optimization and Efficiencies With It Vendor Portfolio RationalizationDocument11 pagesDrive Cost Optimization and Efficiencies With It Vendor Portfolio RationalizationmwhaliNo ratings yet

- Released, September 2019: To Download or To Access Additional AnalysisDocument64 pagesReleased, September 2019: To Download or To Access Additional AnalysisDark WarriorNo ratings yet

- EE S Week1 11 - 15 JulyDocument48 pagesEE S Week1 11 - 15 JulyMahmoud HussamNo ratings yet

- Discussion: CR1 Report of SCM-X Session 2 Held On 3-Oct-2017Document2 pagesDiscussion: CR1 Report of SCM-X Session 2 Held On 3-Oct-2017Aditya HridayNo ratings yet

- Sweta - Random Motors ProjectDocument10 pagesSweta - Random Motors ProjectSatendra DhakarNo ratings yet

- Project TemplateDocument10 pagesProject TemplatesukhvindertaakNo ratings yet

- Strategic Thinking & Decision Making: Game Theory Value NetDocument19 pagesStrategic Thinking & Decision Making: Game Theory Value NetPrateek NyatiNo ratings yet

- Application of Genetic Algorithms To CFD Cameron MccartneyDocument33 pagesApplication of Genetic Algorithms To CFD Cameron MccartneyygzylmzNo ratings yet

- Depreciation' NatureDocument21 pagesDepreciation' NatureKristia AnagapNo ratings yet

- Logistics Subsystem Prince Dudhatra 9724949948Document19 pagesLogistics Subsystem Prince Dudhatra 9724949948pRiNcE DuDhAtRa50% (2)

- Back Bay Battery Simulation ReportDocument6 pagesBack Bay Battery Simulation ReportPiyush WasonNo ratings yet

- Project Proposal (9 - 29)Document2 pagesProject Proposal (9 - 29)윤성전No ratings yet

- Course Assignment ME-GTIDocument2 pagesCourse Assignment ME-GTIAdam KuryłaNo ratings yet

- Slides 1Document21 pagesSlides 1Mutaz M BanatNo ratings yet

- Ch5 - Demand Based Planning2022Document77 pagesCh5 - Demand Based Planning2022Maalmalan KeekiyyaaNo ratings yet

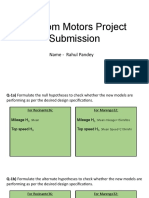

- Random Motors Project Submission: Name - Rahul PandeyDocument10 pagesRandom Motors Project Submission: Name - Rahul PandeyRahul PandeyNo ratings yet

- SCM Module 1Document5 pagesSCM Module 1Maxine ConstantinoNo ratings yet

- MIAE 380 Project ReportDocument38 pagesMIAE 380 Project ReportAhmed alnajjariNo ratings yet

- 7 - Chapter Seven - SCBADocument20 pages7 - Chapter Seven - SCBAmeseretNo ratings yet

- Acma Assignment Material & WorksheetsDocument12 pagesAcma Assignment Material & WorksheetsmeseretNo ratings yet

- Chapter One - Investment and SecurityDocument44 pagesChapter One - Investment and SecuritymeseretNo ratings yet

- Sciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaDocument8 pagesSciencedirect: A. Almeida, J. Cunha A. Almeida, J. CunhaNavneet NandaNo ratings yet

- 6 - Chapter Six - Project AppraisalDocument31 pages6 - Chapter Six - Project AppraisalmeseretNo ratings yet

- Developing Mental Health-Care Quality Indicators: Toward A Common FrameworkDocument6 pagesDeveloping Mental Health-Care Quality Indicators: Toward A Common FrameworkCarl FisherNo ratings yet

- VW Golf 2 Sam Naprawiam PDFDocument3 pagesVW Golf 2 Sam Naprawiam PDFScottNo ratings yet

- Management of Breast CancerDocument53 pagesManagement of Breast CancerGaoudam NatarajanNo ratings yet

- 1.Gdpr - Preparation Planning GanttDocument6 pages1.Gdpr - Preparation Planning GanttbeskiNo ratings yet

- SakalDocument33 pagesSakalKaran AsnaniNo ratings yet

- 1 Relative Maxima, Relative Minima and Saddle PointsDocument3 pages1 Relative Maxima, Relative Minima and Saddle PointsRoy VeseyNo ratings yet

- Potential Nursing Diagnosis Problem Fdar / NCP: Activity # 2Document2 pagesPotential Nursing Diagnosis Problem Fdar / NCP: Activity # 2Karl KiwisNo ratings yet

- Portel's Value Chain AnalysisDocument3 pagesPortel's Value Chain AnalysisNivedNo ratings yet

- The Concepts and Principles of Equity and HealthDocument18 pagesThe Concepts and Principles of Equity and HealthPaulo César López BarrientosNo ratings yet

- PG 19 - 20 GROUP 5Document2 pagesPG 19 - 20 GROUP 5Kevin Luis Pacheco ZarateNo ratings yet

- Eaap Critical Approaches SamplesDocument2 pagesEaap Critical Approaches SamplesAcsana LucmanNo ratings yet

- Nicolopoulou-Stamati - Reproductive Health and The EnvironmentDocument409 pagesNicolopoulou-Stamati - Reproductive Health and The EnvironmentGiorgos PapasakelarisNo ratings yet

- Tutorial Getting Started With Code Aster PDFDocument12 pagesTutorial Getting Started With Code Aster PDFEnriqueNo ratings yet

- SunEdison Pancho Perez Complaint As FiledDocument47 pagesSunEdison Pancho Perez Complaint As FiledLizHoffmanNo ratings yet

- Sample DCCM, DLHTM and DCLRDocument38 pagesSample DCCM, DLHTM and DCLREagle100% (5)

- LP.-Habitat-of-Animals Lesson PlanDocument4 pagesLP.-Habitat-of-Animals Lesson PlanL LawlietNo ratings yet

- Universal Prayers IIDocument3 pagesUniversal Prayers IIJericho AguiatanNo ratings yet

- Perception On The Impact of New Learning Tools in Humss StudentDocument6 pagesPerception On The Impact of New Learning Tools in Humss StudentElyza Marielle BiasonNo ratings yet

- Phrygian Gates and China Gates RecordingsDocument1 pagePhrygian Gates and China Gates RecordingsCloudwalkNo ratings yet

- MagellansssdsaDocument2 pagesMagellansssdsaPrincess NaleNo ratings yet

- Educational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbDocument31 pagesEducational Psychology EDU-202 Spring - 2022 Dr. Fouad Yehya: Fyehya@aust - Edu.lbLayla Al KhatibNo ratings yet

- How Death Came To The CityDocument3 pagesHow Death Came To The City789863No ratings yet

- Exercise Reported SpeechDocument3 pagesExercise Reported Speechapi-241242931No ratings yet

- Checkpoint PhysicsDocument12 pagesCheckpoint PhysicsRishika Bafna100% (1)

- Rousseau NotesDocument4 pagesRousseau NotesAkhilesh IssurNo ratings yet

- Rule Against Multiplicity and Child PornoDocument3 pagesRule Against Multiplicity and Child PornoHouston Criminal Lawyer John T. FloydNo ratings yet

- An Aging Game Simulation Activity For Al PDFDocument13 pagesAn Aging Game Simulation Activity For Al PDFramzan aliNo ratings yet

- Theater - The View ArticleDocument2 pagesTheater - The View ArticleRishi BhagatNo ratings yet

- USA V Rowland - Opposition To Motion To End Probation EarlyDocument12 pagesUSA V Rowland - Opposition To Motion To End Probation EarlyFOX 61 WebstaffNo ratings yet

- Info Cad Engb FestoDocument14 pagesInfo Cad Engb FestoBayu RahmansyahNo ratings yet