Professional Documents

Culture Documents

Capital Structure Theories

Capital Structure Theories

Uploaded by

SundarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Structure Theories

Capital Structure Theories

Uploaded by

SundarCopyright:

Available Formats

Guiding you today for a better Tomorrow Aaditya Gupta Classes

Phone – 99035-03989

Capital Structure Theories

1. A company provides you with the following information:

Capital structure:

10,000 equity shares of Rs. each 1,00,000

Debenture

EBIT 2,00,000

Tax Rate 50%

Change in EBIT (+-)20%

Show the effect of proposed change in EBIT on EPS and comment on it.

2. One-third of total market value of Vishnu limited consists of loan stock, which has a cost

of 10%. Another company ,Shiva Ltd. is identical in every respect to Vishnu Ltd., except

that its capital structure is all – equity , and its cost of equity is 16%. According to

Modigliani and Miller, if we ignored taxation and tax relief on debt capital, what would

be the cost of equity of Vishnu Limited?

3. KFC Ltd. is an all equity finance company with a market value of RS. 25,00,000 and cost

of equity, K€ = 21%.the company wants to buy-back Equity Shares worth RS. 5,00,000

by issuing and raising 15% Perpetual Debt of the same amount. Rate of tax may be

taken as 30%. After the re-structuring and applying MM Model (with taxes, you are

required to calculate-

a. Market value of KFC Ltd.

b. Cost of equity K(e)

c. Weighted average cost of capital and comment on it.

4. There are two firms U and L having same NOI of Rs. 20,000. Firm L is a levered firm

having Debt of Rs. 1,00,000 @ 7% and cost of equity of U and L are 10% and 18%

respectively. Showhow arbitrage process will work in this case.

1 P a g e Enroll now for B.COM / CA/ CS/ CMA / MBA/ Govt.Exams for all subjects and get

the opportunity to learn from the best. Centres – Bhawanipore- Girish Park – Bangur-

Tollygunj- Howrah.

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Working Capital ManagementDocument2 pagesWorking Capital ManagementSundarNo ratings yet

- Capital Expenditure DecisionsDocument2 pagesCapital Expenditure DecisionsSundarNo ratings yet

- According StandardDocument5 pagesAccording StandardSundarNo ratings yet

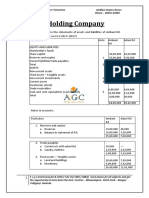

- Holding CompanyDocument3 pagesHolding CompanySundarNo ratings yet

- Accounting Ratios For FSADocument4 pagesAccounting Ratios For FSASundarNo ratings yet

- LeverageDocument2 pagesLeverageSundarNo ratings yet

- Cost of CapitalDocument2 pagesCost of CapitalSundarNo ratings yet

- Aswina Mango From Malda Adv Booking OpenDocument3 pagesAswina Mango From Malda Adv Booking OpenSundarNo ratings yet

- Qmin Kolkata Taj Bengal 2Document21 pagesQmin Kolkata Taj Bengal 2SundarNo ratings yet

- FsaDocument18 pagesFsaSundarNo ratings yet

- Dividend PolicyDocument15 pagesDividend PolicySundarNo ratings yet

- Financial Management SuggestionsDocument7 pagesFinancial Management SuggestionsSundarNo ratings yet

- Last Time Tips by CA Ankit PatwariDocument41 pagesLast Time Tips by CA Ankit PatwariSundarNo ratings yet

- FM Theory 2Document14 pagesFM Theory 2SundarNo ratings yet

- FM TheoryDocument17 pagesFM TheorySundarNo ratings yet

- Fr&Fsa TheoryDocument30 pagesFr&Fsa TheorySundarNo ratings yet