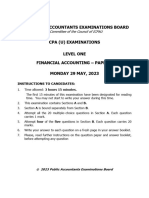

Professional Documents

Culture Documents

Acc Beta

Uploaded by

Hamiz AizuddinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc Beta

Uploaded by

Hamiz AizuddinCopyright:

Available Formats

2

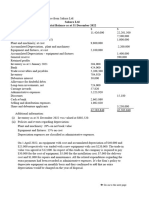

Section A: Financial Accounting

Question 1

Source A1

LC plc provided the following summarised trial balance at 31 December 2020 after the draft gross profit

had been calculated. Depreciation for the year had already been charged.

Summarised trial balance at 31 December 2020

$ $

Gross profit 96 200

Inventory 6 212

Administrative expenses 32 700

Distribution costs 19 405

Finance costs 4 410

Final dividend (2019) 7 000

Interim dividend (2020) 5 000

Ordinary share capital ($1 shares) 100 000

Retained earnings 54 732

Long-term bank loan 50 000

Trade receivables 25 400

Trade payables 16 200

Bank 11 200

Premises 200 000

Provision for depreciation of premises 4 000

Fixtures and fittings 27 600

Provision for depreciation of fixtures and fittings 5 520

Motor vehicles 18 000

Provision for depreciation of motor vehicles 7 875

345 727 345 727

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Calculate the draft profit for the year based on the trial balance figures. [1]

© UCLES 2021 9706/32/INSERT/O/N/21

3

Additional information

The following took place on 31 December 2020 after the trial balance had been prepared.

1 The bank informed the company that its account was being debited with $120 in relation to a

dishonoured cheque from a credit customer, and with $150 and $110 for bank charges and

bank interest.

2 A bonus issue of 10 000 ordinary shares of $1 each was made.

3 It was decided to create a general reserve of $14 000.

4 The premises were revalued to $244 000. The fixtures and fittings and motor vehicles were

deemed to have a recoverable amount of $22 300 and $9200 respectively.

5 It was decided to provide $5000 for compensation to customers arising from the use of

damaged goods sold to them by the company.

6 It was discovered that the trial balance figures included values arising from the supply of

goods to a credit customer on a sale or return basis. The customer had not declared an

intention to buy the goods by the year end. They were included in sales at a value of $4600

and had an original cost of $2100.

(b) Calculate the corrected profit for the year ended 31 December 2020. Start your calculation

with your answer to (a). [5]

(c) Prepare the statement of financial position at 31 December 2020 after taking into account all

necessary information. [17]

(d) Explain how your treatment of the bonus issue might have been different if the trial balance

had contained a balance of $8000 on a share premium account. [2]

[Total: 25]

© UCLES 2021 9706/32/INSERT/O/N/21 [Turn over

4

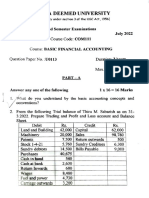

Question 2

Source A2

The AB Club has 200 members who pay an annual subscription of $100 each. It provides social facilities

to its members and also rents and operates two vending machines to sell soft drinks to members. The

statement of financial position at 30 June 2020 showed the following assets and liabilities.

$

Equipment at valuation 2100

Furniture at valuation 1050

Subscriptions in arrears 400

Bank balance 1420

Cash 180

Inventory of soft drinks 210

Owing to suppliers of soft drinks 290

The following information was available.

1 Equipment and furniture were valued on 30 June 2021 at $1700 and $1500 respectively.

2 All subscriptions are received by cheque and banked immediately. On 30 June 2021, there were

no arrears of subscriptions and three members had paid in advance for the coming year.

3 All takings from the vending machines are in cash. Some are used to pay club expenses and

some are paid into the bank. Soft drinks are sold at a mark-up of 100%.

4 The inventory of soft drinks on 30 June 2021 was valued at $490 at selling price. On that date, the

amount owing to suppliers of soft drinks was $305.

5 Cash in hand on 30 June 2021 amounted to $150. The balance on the bank account on that date

was $2290.

6 Payments made through the bank during the year ended 30 June 2021 were:

$

Purchase of new furniture 720

Rent of premises 12 000

Rent of vending machines 6 000

Club expenses 5 140

Payments to suppliers of soft drinks 12 600

Total bank payments 36 460

© UCLES 2021 9706/32/INSERT/O/N/21

5

Answer the following questions in the question paper. Questions are printed here for

reference only.

(a) Calculate the profit from the vending machines for the year ended 30 June 2021. [5]

(b) Calculate for the year ended 30 June 2021:

(i) the value of subscriptions received and banked [3]

(ii) cash takings banked [4]

(iii) club expenses paid by cash. [4]

(c) Prepare the income and expenditure account for the year ended 30 June 2021. [6]

Additional information

It has been suggested to the managing committee that the club starts to rent a third vending

machine selling soft drinks.

(d) Advise the committee whether or not to start renting a third vending machine. Justify your

answer. [3]

[Total: 25]

© UCLES 2021 9706/32/INSERT/O/N/21 [Turn over

6

Question 3

Source A3

Adul and Basha have been in partnership for many years. On 31 December 2020, the partnership

business merged with Carl’s business.

The proposal for the merger was made six months before it took place. One of the conditions for the

merger was that Carl’s accounting system had to be computerised.

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) State four benefits of a computerised accounting system to a business. [4]

Additional information

The draft statements of financial position for both businesses at 31 December 2020 were as

follows.

Adul and

Basha Carl

$ $

Office equipment 564 000 265 000

Motor vehicles 98 200 65 000

Inventory 46 000 28 000

Trade receivables 83 300 36 000

Cash and cash equivalents 21 200 9 000

Total assets 812 700 403 000

Capital account

Adul 360 000

Basha 360 000

Carl 371 100

Current account

Adul 22 000

Basha (5 600)

736 400 371 100

Trade payables 76 300 31 900

Total equity and liabilities 812 700 403 000

1 Profit for the year ended 31 December 2020 was:

$

Adul and Basha 64 000

Carl 21 160

2 The goodwill for the partnership had been valued at $50 000. The goodwill value for Carl’s

business was to be the average profit for the last three years. Carl’s profit had increased by

15% each year for the last three years.

© UCLES 2021 9706/33/INSERT/M/J/21

7

3 All assets and liabilities were valued at their net book value except:

Adul and Basha Carl

$ $

Office equipment 580 000 230 000

Motor vehicles 88 000 62 000

Trade receivables 35 000

4 There was no partnership agreement between Adul and Basha. After the merger, it was

agreed that the profit and loss sharing ratio among Adul, Basha and Carl would be 2 : 2 : 1.

5 All the partners agreed that the combined goodwill would not be maintained in the books of

account of the new partnership.

6 Two motor vehicles had an equal value in the business of Adul and Basha. Immediately after

the merger, Adul would take one of the motor vehicles for his own use.

(b) Calculate the goodwill of Carl’s business. [2]

(c) Explain why the calculation of Carl’s goodwill is based on the profit of the business. [2]

(d) Prepare a statement showing the movement in the capital account for each of Adul, Basha

and Carl immediately after the merger. [6]

(e) Calculate the value of the total assets of the new business immediately after the merger.

Show your workings. [6]

Additional information

Better profitability of the business of Adul and Basha is one of the reasons for Carl’s decision to

merge.

(f) Advise Carl whether or not he has made the correct decision to merge with the partnership

business. Justify your answer using both financial and non-financial factors. [5]

[Total: 25]

© UCLES 2021 9706/33/INSERT/M/J/21 [Turn over

8

Question 4

Source A4

Tan owns a shop in her local town selling ornaments.

Tan and Wang entered a joint venture to sell ornaments in a city festival market in 2020. Tan purchased

goods from her local producers in a small town and Wang sold the products in his local city. Profit will

be shared equally and each party would record their own transactions.

The receipts and payments relating to the joint venture were as follows:

Tan Wang

$ $

Purchases of goods 46 000

Rent of stall 12 000

Cash register 2 600

Transportation 2 450 980

Assistant’s wages 2 770 5 400

Sales 95 400

Packaging 620 4 080

At the end of the joint venture, Wang took over the cash register and unsold ornaments at the value of

$2000 and $3100 respectively.

Answer the following questions in the question paper. Questions are printed here for reference

only.

(a) State three features of a joint venture. [3]

(b) Prepare the following accounts:

(i) the joint venture account [7]

(ii) the joint venture with Tan account in Wang’s books [4]

(iii) the joint venture with Wang account in Tan’s books [3]

Additional information

From Tan’s experience of the joint venture in the city festival market, she has found that the goods

are well accepted by the city people. She now plans to sell the ornaments in the city through

Wang as a consignee.

(c) Explain two benefits to each of Tan and Wang of selling the ornaments in the city on

consignment. [8]

[Total: 25]

© UCLES 2021 9706/33/INSERT/M/J/21

10

Section B: Cost and Management Accounting

Question 5

Source B1

V Limited operates a standard costing system and a system of budgetary control.

The budgeted information and standard costs for March 2020 were as follows.

Budgeted output 2 500 units

Budgeted fixed overheads $48 000

Standard cost per unit

Direct materials $24 (3 kilos at $8 each)

Direct labour $64 (4 hours at $16 each)

V Limited uses labour hours to absorb fixed overheads.

The actual results for March 2020 were as follows.

Output 2 400 units

Fixed overheads $49 800

Direct materials cost $68 340

Direct materials usage 8 040 kilos

Direct labour costs $156 864

Direct labour hours 9 120 hours

Answer the following questions in the Question Paper. Questions are printed here for reference

only.

(a) Prepare a cost statement, in a columnar form, showing the master budget, flexed budget, and

the actual result. [7]

(b) (i) Calculate the direct materials variance. [1]

(ii) Analyse the reasons for the direct materials variance. Support your answer with

calculations. [4]

(c) (i) Calculate the direct labour variance. [1]

(ii) Analyse the reasons for the direct labour variance. Support your answer with calculations.

[4]

(d) (i) Calculate the total fixed overheads variance. [1]

(ii) Calculate the fixed overheads expenditure variance. [1]

(iii) Calculate the fixed overheads volume variance. [1]

© UCLES 2020 9706/32/INSERT/M/J/20

11

Additional information

In a meeting reviewing the April 2020 budget, a director suggested that the production manager

should be fully accountable for the adverse variances of direct materials and direct labour in April

2020. The production manager explained that due to the main supplier’s failure to supply the

required materials, he had to ask the manager of the purchasing department to buy the materials

from another supplier. This had caused a delay in production.

(e) Discuss whether or not the production manager should be fully accountable for the adverse

variances in direct materials and direct labour. Justify your answer. [5]

[Total: 25]

© UCLES 2020 9706/32/INSERT/M/J/20 [Turn over

12

Question 6

Source B2

V Limited manufactures two products, Standard and Premium.

The following budgeted information for 2020 is available.

Standard Premium

Units produced and sold 10 000 4000

Direct materials : unit cost $20 $30

Direct labour : hours per unit 3 5

rate per hour $18 $18

Budgeted factory overheads, $240 000, are to be allocated to the products on the basis of direct labour

hours.

Answer the following questions in the Question Paper. Questions are printed here for reference

only.

(a) Calculate the total production cost and the unit cost for each product. [5]

Additional information

V Limited normally adds 40% to the cost of each product to set the selling price.

(b) Calculate the unit selling price for each product. [2]

Additional information

V Limited is considering implementing an activity based costing (ABC) system. The management

accountant has prepared the following cost analysis.

Overhead Occurrences

Activity costs Cost driver Standard Premium

$

Materials handling 80 000 Number of purchase orders 30 10

Machine setups 90 000 Number of setups 65 25

Inspection 70 000 Number of units produced 10 000 4000

240 000

(c) Define the term ‘cost driver’. [1]

(d) State three benefits of adopting ABC. [3]

(e) Calculate the total production cost and unit cost for each product if ABC is used. [5]

(f) Calculate the unit selling price for each product if ABC is used. [2]

(g) Explain the difference in total production cost for each product in respect of (a) and (e). [3]

© UCLES 2020 9706/31/INSERT/M/J/20

13

Additional information

V Limited plans to manufacture only the Premium product from 2021.

(h) Explain why V Limited would find ABC useful in 2020 but not in 2021. [4]

[Total: 25]

© UCLES 2020 9706/31/INSERT/M/J/20

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32shanti teckchandaniNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/31SaiNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32muhammadxiaullahgNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/33Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/33gibbamanjexNo ratings yet

- MAN1068 Exam Paper 2021-22Document16 pagesMAN1068 Exam Paper 2021-22Praveena RavishankerNo ratings yet

- Tee 1as Level QP Acc 2021Document10 pagesTee 1as Level QP Acc 2021Kalash JainNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- B7AF102 Financial Accounting May 2023Document11 pagesB7AF102 Financial Accounting May 2023gerlaniamelgacoNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/32gibbamanjexNo ratings yet

- SA1 - Grade AS CAIE Accounting Paper 2Document7 pagesSA1 - Grade AS CAIE Accounting Paper 221ke23b15089No ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- ACY 53 Summative Exam 2 CH 26 28 Answer KeyDocument3 pagesACY 53 Summative Exam 2 CH 26 28 Answer KeyAMIKO OHYANo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- HI5020 Final AssessmentDocument15 pagesHI5020 Final AssessmentTauseef AhmedNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/32caiexpertcontactNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- 2022 AC202 SummerDocument4 pages2022 AC202 Summermollymgonigle1No ratings yet

- UOL ExamDocument11 pagesUOL ExamThant Hayman ThwayNo ratings yet

- Chapter 3-4 Lab Problems 9.14.2021Document1 pageChapter 3-4 Lab Problems 9.14.2021Abdullah alhamaadNo ratings yet

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- HPS 2202HBC 2104 Financial Accounting Iiintroduction To Accounting IiDocument6 pagesHPS 2202HBC 2104 Financial Accounting Iiintroduction To Accounting IiFRANCISCA AKOTHNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32alanmuchenjeNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- Practice Question For Midterm Test - FA - 28.03Document4 pagesPractice Question For Midterm Test - FA - 28.03TRANG NGUYỄN THỊ HÀNo ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- AP W1 Correction of ErrorsDocument4 pagesAP W1 Correction of ErrorsALYZA ANGELA ORNEDONo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- HaloCrypto Cumulative Case Tutorial QuestionsDocument6 pagesHaloCrypto Cumulative Case Tutorial QuestionsLim ShawnNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Problem Solving ISB GP Thi TH 2Document6 pagesProblem Solving ISB GP Thi TH 2Chi PhanNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- April AssignmentDocument9 pagesApril AssignmentMehrunisaChNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document8 pagesCambridge International AS & A Level: ACCOUNTING 9706/32Saram Shykh PRODUCTIONSNo ratings yet

- 2021-22 F5 BAFS Mid-Year Exam (Question)Document7 pages2021-22 F5 BAFS Mid-Year Exam (Question)Anna TungNo ratings yet

- PartnershipDocument2 pagesPartnershiplearningcantstop561No ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- Cpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesDocument15 pagesCpa Review School of The Philipines Manila Financial Accounting and Reporting JULY 2021 First Preboard Examination SITUATION 1 - Three Unrelated EntitiesSophia PerezNo ratings yet

- A2 Accounting Adeel PaperwalaDocument5 pagesA2 Accounting Adeel PaperwalazubairNo ratings yet

- 2022 Sem 1 ACC10007 Lecture IllustrationsDocument8 pages2022 Sem 1 ACC10007 Lecture IllustrationsJordanNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254No ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- FAC612S - Test 3 2023Document5 pagesFAC612S - Test 3 2023simaneka.shilongoNo ratings yet

- FAR PreBoard (1) CPAR BATCH90Document18 pagesFAR PreBoard (1) CPAR BATCH90Bella ChoiNo ratings yet

- Dac1102 Past Examination Paper 11.04.2023 1Document10 pagesDac1102 Past Examination Paper 11.04.2023 1marumoduberemofilwerethabilevaNo ratings yet

- Accountancy Pre Board 2Document5 pagesAccountancy Pre Board 2Akshit kumar 10 pinkNo ratings yet

- AccrDocument2 pagesAccrlearningcantstop561No ratings yet

- Sem 2 - End Sem PapersDocument23 pagesSem 2 - End Sem Paperslalith sasankaNo ratings yet

- CPA Paper 1 Financial Accounting 2Document9 pagesCPA Paper 1 Financial Accounting 2philipisingomaNo ratings yet

- PA T22WSB 3 Group Assignment 1Document4 pagesPA T22WSB 3 Group Assignment 1Pham Minh Thu NguyenNo ratings yet

- Economics Paper 3Document10 pagesEconomics Paper 3Hamiz AizuddinNo ratings yet

- Answer Mock PPR 2 Econs PDFDocument14 pagesAnswer Mock PPR 2 Econs PDFHamiz AizuddinNo ratings yet

- BudgetsDocument2 pagesBudgetsHamiz AizuddinNo ratings yet

- Break-Even AnalysisDocument1 pageBreak-Even AnalysisHamiz AizuddinNo ratings yet

- Acc DeltaDocument10 pagesAcc DeltaHamiz AizuddinNo ratings yet

- Absorption CostingDocument4 pagesAbsorption CostingHamiz AizuddinNo ratings yet

- Deltap 1Document8 pagesDeltap 1Hamiz AizuddinNo ratings yet

- Betap 1Document11 pagesBetap 1Hamiz AizuddinNo ratings yet

- Delta Paper1 FinalDocument10 pagesDelta Paper1 FinalHamiz AizuddinNo ratings yet

- Screenshot 2023-06-27 at 20.18.42Document6 pagesScreenshot 2023-06-27 at 20.18.42Farshid Ahoora100% (1)

- Energy EconomicsDocument26 pagesEnergy Economicsluz fernandezNo ratings yet

- Case StudyDocument6 pagesCase StudyAvice BronsNo ratings yet

- Carrefour Q1 2023 Presentation 1Document16 pagesCarrefour Q1 2023 Presentation 1FaIIen0nENo ratings yet

- Dawn + 11 July, 2020 by Rabia Kalhoro and M.UsmanDocument20 pagesDawn + 11 July, 2020 by Rabia Kalhoro and M.UsmanmdmsNo ratings yet

- Chapter 7Document22 pagesChapter 7anis abdNo ratings yet

- UPS PNLDocument63 pagesUPS PNLAprieza NurizkiNo ratings yet

- Wise Transaction Invoice Transfer 751293515 1421066003 Fr-1Document2 pagesWise Transaction Invoice Transfer 751293515 1421066003 Fr-1Larbi doukara OussamaNo ratings yet

- Petron-Corporation SwotDocument25 pagesPetron-Corporation SwotAhnJello100% (3)

- Power of Attorney & Instructions: BackgroundDocument4 pagesPower of Attorney & Instructions: BackgroundSwapnil MoreNo ratings yet

- Group Assignment - Tea MarketDocument7 pagesGroup Assignment - Tea Marketkelly aditya japNo ratings yet

- IP - Chapter1 - Foreign Exchange and Currency Risk Management - StudentDocument22 pagesIP - Chapter1 - Foreign Exchange and Currency Risk Management - Studentđan thi nguyễnNo ratings yet

- Chapter One Introduction To Financial Modeling and ValuationDocument6 pagesChapter One Introduction To Financial Modeling and ValuationBobasa S AhmedNo ratings yet

- CIBSE Winners Brochure 2016 Lowres Final2Document23 pagesCIBSE Winners Brochure 2016 Lowres Final2lotszNo ratings yet

- Economic Impact of TourismDocument22 pagesEconomic Impact of TourismBalachandar PoopathiNo ratings yet

- Chapter 2 Measuring The Cost of LivingDocument25 pagesChapter 2 Measuring The Cost of LivingHSE19 EconhinduNo ratings yet

- Minimum Alternate Tax Section 115JbDocument17 pagesMinimum Alternate Tax Section 115JbEmeline SoroNo ratings yet

- Cost Management Cloud: Receipt AccountingDocument14 pagesCost Management Cloud: Receipt Accountinghaitham ibrahem mohmedNo ratings yet

- SCM 1Document71 pagesSCM 1Abdul RasheedNo ratings yet

- Business Ethics and Corporate GovernanceDocument55 pagesBusiness Ethics and Corporate GovernanceVaidehi ShuklaNo ratings yet

- Module 3 BAC 6Document33 pagesModule 3 BAC 6Shela Mae Plaza TanqueNo ratings yet

- Profile On Dairy Processing EquipmentDocument20 pagesProfile On Dairy Processing Equipmentbiniam meazaneh100% (1)

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- Closing Remarks - Dr. Deepali Pant JoshiDocument14 pagesClosing Remarks - Dr. Deepali Pant JoshiKavithaNo ratings yet

- Chapter 1-Forms and InterpretationDocument14 pagesChapter 1-Forms and InterpretationSteffany RoqueNo ratings yet

- 11 Essential Procurement KPIs You CanDocument6 pages11 Essential Procurement KPIs You Canahmed morsi100% (1)

- CFA Level II Mock Exam 5 - Solutions (PM)Document61 pagesCFA Level II Mock Exam 5 - Solutions (PM)Sardonna FongNo ratings yet

- Module 4 Estate Taxation 2Document4 pagesModule 4 Estate Taxation 2Melanie SamsonaNo ratings yet

- MacEcon Mod 3 PretestDocument3 pagesMacEcon Mod 3 PretestAleihsmeiNo ratings yet

- Ramdev - Notes of WCS - May2020Document90 pagesRamdev - Notes of WCS - May2020ravi_405No ratings yet

- TEF Canada Expression Écrite : 150 Topics To SucceedFrom EverandTEF Canada Expression Écrite : 150 Topics To SucceedRating: 4.5 out of 5 stars4.5/5 (17)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideFrom Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideRating: 3.5 out of 5 stars3.5/5 (7)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningFrom EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningRating: 4.5 out of 5 stars4.5/5 (55)

- ATI TEAS Study Guide: The Most Comprehensive and Up-to-Date Manual to Ace the Nursing Exam on Your First Try with Key Practice Questions, In-Depth Reviews, and Effective Test-Taking StrategiesFrom EverandATI TEAS Study Guide: The Most Comprehensive and Up-to-Date Manual to Ace the Nursing Exam on Your First Try with Key Practice Questions, In-Depth Reviews, and Effective Test-Taking StrategiesNo ratings yet

- IELTS Speaking Vocabulary Builder (Band 5-6): Master Phrases and Expressions for the IELTS Speaking ExamFrom EverandIELTS Speaking Vocabulary Builder (Band 5-6): Master Phrases and Expressions for the IELTS Speaking ExamRating: 5 out of 5 stars5/5 (1)

- Straight-A Study Skills: More Than 200 Essential Strategies to Ace Your Exams, Boost Your Grades, and Achieve Lasting Academic SuccessFrom EverandStraight-A Study Skills: More Than 200 Essential Strategies to Ace Your Exams, Boost Your Grades, and Achieve Lasting Academic SuccessRating: 3.5 out of 5 stars3.5/5 (6)

- RBT Registered Behavior Technician Exam Audio Crash Course Study Guide to Practice Test Question With Answers and Master the ExamFrom EverandRBT Registered Behavior Technician Exam Audio Crash Course Study Guide to Practice Test Question With Answers and Master the ExamNo ratings yet

- 700 Driving Theory Test Questions & Answers: Updated Study Guide With Over 700 Official Style Practise Questions For Cars - Based Off the Highway CodeFrom Everand700 Driving Theory Test Questions & Answers: Updated Study Guide With Over 700 Official Style Practise Questions For Cars - Based Off the Highway CodeNo ratings yet

- The Everything Guide to Study Skills: Strategies, tips, and tools you need to succeed in school!From EverandThe Everything Guide to Study Skills: Strategies, tips, and tools you need to succeed in school!Rating: 4.5 out of 5 stars4.5/5 (6)

- 71 Ways to Practice English Reading: Tips for ESL/EFL LearnersFrom Everand71 Ways to Practice English Reading: Tips for ESL/EFL LearnersRating: 5 out of 5 stars5/5 (2)

- Practice Makes Perfect Mastering GrammarFrom EverandPractice Makes Perfect Mastering GrammarRating: 5 out of 5 stars5/5 (21)

- Concept Based Practice Questions for AWS Solutions Architect Certification Latest Edition 2023From EverandConcept Based Practice Questions for AWS Solutions Architect Certification Latest Edition 2023No ratings yet

- Learning Outside The Lines: Two Ivy League Students With Learning Disabilities And Adhd Give You The Tools For Academic Success and Educational RevolutionFrom EverandLearning Outside The Lines: Two Ivy League Students With Learning Disabilities And Adhd Give You The Tools For Academic Success and Educational RevolutionRating: 4 out of 5 stars4/5 (19)

- LMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamFrom EverandLMSW Passing Score: Your Comprehensive Guide to the ASWB Social Work Licensing ExamRating: 5 out of 5 stars5/5 (1)

- Learning Outside The Lines: Two Ivy League Students with Learning Disabilities and ADHD Give You the Tools for Academic Success and Educational RevolutionFrom EverandLearning Outside The Lines: Two Ivy League Students with Learning Disabilities and ADHD Give You the Tools for Academic Success and Educational RevolutionRating: 4 out of 5 stars4/5 (17)