Professional Documents

Culture Documents

Assignment - Journal (P1)

Uploaded by

MD. Arif HossainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment - Journal (P1)

Uploaded by

MD. Arif HossainCopyright:

Available Formats

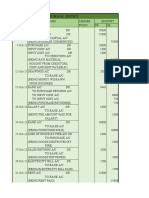

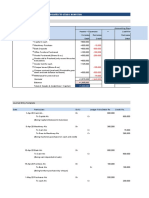

Problem 1

Mr. Hook

Journal Entries

Date Particulars Ref. Debit Taka Credit Taka

Cash A/C Dr. 100,000

1-Dec-21 Capital A/C Cr. 100,000

(Mr. Hook started business with cash)

Cash A/C Dr. 50,000

5-Dec-21 Owner's equity A/C Cr. 50,000

(Invested additional cash)

Fixed Asset (Land) A/C Dr. 48,000

9-Dec-21 Cash A/C Cr. 48,000

(Paid for new constructed land)

Cash A/C Dr. 10,800

12-Dec-21 Accounts receivable A/C Cr. 10,800

(Collected receivable amount)

Miscellaneous expense A/C Dr. 1,600

13-Dec-21 Cash A/C Cr. 1,600

(Paid for miscellaneous expense)

Supplies expense A/C Dr. 2,200

17-Dec-21 Accounts payable A/C Cr. 2,200

(Purchased supplies on credit)

Accounts Payable A/C Dr. 1,600

19-Dec-21 Supplies expense A/C Cr. 1,600

(Paid for supplies on account)

Drawings A/C Dr. 1,400

22-Dec-21 Cash A/C Cr. 1,400

(Withdrew cash)

Salaries expense A/C Dr. 3,200

24-Dec-21 Cash A/C Cr. 3,200

(Paid salary)

Accounts receivable A/C Dr. 7,200

25-Dec-21 Service revenue A/C Cr. 7,200

(Billed to customer for riding & lesson fees)

Accounts receivable A/C Dr. 9,000

31-Dec-21 Service revenue A/C Cr. 9,000

(Billed to customer for boarding fees)

235,000 235,000

You might also like

- Economy Lecture HandoutDocument38 pagesEconomy Lecture HandoutEdward GallardoNo ratings yet

- GL, TB - D. MaputimDocument11 pagesGL, TB - D. MaputimJasmine Acta67% (3)

- LA017617 - Assn2 - BSBSMB406A - Ed5 1Document28 pagesLA017617 - Assn2 - BSBSMB406A - Ed5 1Leesa JaneNo ratings yet

- Journal Date Particulars L.F. Amt. (DR.) Amt. (CR.) : Solution Class 11 - Accountancy Test 2Document9 pagesJournal Date Particulars L.F. Amt. (DR.) Amt. (CR.) : Solution Class 11 - Accountancy Test 2BHS PRAYAGRAJNo ratings yet

- San MiguelDocument9 pagesSan MiguelAngel Buitizon100% (1)

- Bank Audit Check List & Procedure (Concurrent Audit) : IndexDocument12 pagesBank Audit Check List & Procedure (Concurrent Audit) : IndexCA Jay ThakurNo ratings yet

- LC PC ConfigurationDocument2 pagesLC PC ConfigurationmoorthykemNo ratings yet

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Journal Problems For AssignmentDocument2 pagesJournal Problems For AssignmentMD. Arif HossainNo ratings yet

- Assignment - Journal (P2)Document1 pageAssignment - Journal (P2)MD. Arif HossainNo ratings yet

- UntitledDocument15 pagesUntitledTanmay JainNo ratings yet

- 14 - Accounting 4 DepreciationDocument22 pages14 - Accounting 4 DepreciationKAMAL POKHRELNo ratings yet

- Business Account WordDocument11 pagesBusiness Account Wordbiggboss 15No ratings yet

- Best Buy Electronics Assignment IPER AFMDocument8 pagesBest Buy Electronics Assignment IPER AFMBharat Singh Gour MBA21No ratings yet

- Assignment No 1 FinalDocument13 pagesAssignment No 1 FinalMuhammad AwaisNo ratings yet

- CIA 1.2 AccountsDocument6 pagesCIA 1.2 AccountsMeghnaNo ratings yet

- Accounts CIA 1.2Document15 pagesAccounts CIA 1.2I Am legendNo ratings yet

- Date Particulars DR Amount CR Amount Ledger Folio NoDocument23 pagesDate Particulars DR Amount CR Amount Ledger Folio NoHarmeet kapoorNo ratings yet

- FINANCE AssignmentDocument8 pagesFINANCE AssignmentpranaviNo ratings yet

- Ledger 23 07 1Document10 pagesLedger 23 07 1Arman AhmedNo ratings yet

- Branch AccountsDocument9 pagesBranch AccountsKalpana SinghNo ratings yet

- Soft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Document1 pageSoft Byte Company Journal Book: Date Description Ref. Debit (TK.) Credit (TK.)Siam FarhanNo ratings yet

- Assignment QuestionDocument2 pagesAssignment QuestionARYAN GUPTANo ratings yet

- CCP102Document19 pagesCCP102api-3849444No ratings yet

- Accounts Pre Board IiDocument9 pagesAccounts Pre Board IiNihalSoniNo ratings yet

- Week 2 Tutorial Question 2 - Double Entry SolutionDocument2 pagesWeek 2 Tutorial Question 2 - Double Entry SolutionDragosNo ratings yet

- Problem 10Document2 pagesProblem 10ela kikayNo ratings yet

- JournalDocument2 pagesJournalAnkur AryaNo ratings yet

- Journal Entries: Date Particular Debit CreditDocument10 pagesJournal Entries: Date Particular Debit CreditHarshit SinglaNo ratings yet

- Working SheetDocument10 pagesWorking SheetVeronica BaileyNo ratings yet

- GE 01.FCAB - .L Solution JUNE 2020 ExamDocument5 pagesGE 01.FCAB - .L Solution JUNE 2020 ExamTameemmahmud rokibNo ratings yet

- Uas DdaDocument20 pagesUas DdaTegarNo ratings yet

- Cash A/C Amount ($) Amount ($)Document12 pagesCash A/C Amount ($) Amount ($)Bhagath VarenyaNo ratings yet

- Pass The Necessary Journal Entries and Post The Entries in The Ledger AccountsDocument28 pagesPass The Necessary Journal Entries and Post The Entries in The Ledger Accountskarunakar vNo ratings yet

- Chapter 1 - Recording Business TransactionDocument14 pagesChapter 1 - Recording Business TransactionThủy NguyễnNo ratings yet

- Journal, Ledger, Subsidiary Books and Trial BalanceDocument16 pagesJournal, Ledger, Subsidiary Books and Trial Balancetmenterprise cbeNo ratings yet

- CCP102Document22 pagesCCP102api-3849444No ratings yet

- Fa2 Assignment - Ic201248Document7 pagesFa2 Assignment - Ic201248Lavisha GoyalNo ratings yet

- W 12 Receivables2344Document8 pagesW 12 Receivables2344DaddyNo ratings yet

- 04 Branch Accounts PQ SolDocument24 pages04 Branch Accounts PQ Soltyagivansh1200No ratings yet

- CLASS WORK 2 (7 DEC) CHP 6Document10 pagesCLASS WORK 2 (7 DEC) CHP 6Isha KatiyarNo ratings yet

- Paper2 Set1 SolutionDocument5 pagesPaper2 Set1 Solutionadityatiwari122006No ratings yet

- 01 Laboratory Exercise 1Document40 pages01 Laboratory Exercise 1mabelle100% (1)

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Preparation of Trial Balance and Financial StatementsDocument14 pagesPreparation of Trial Balance and Financial StatementsZoe FormosoNo ratings yet

- Accounts Class 12Document167 pagesAccounts Class 12Utkarsh Navandar100% (1)

- Jagjeet NotesDocument12 pagesJagjeet NotesPawan TalrejaNo ratings yet

- 01 Laboratory Exercise 1 - PAYUANDocument41 pages01 Laboratory Exercise 1 - PAYUANPhilip Dan Jayson LarozaNo ratings yet

- Chapter 2: Financing Company Operations Practice Questions Vienna LTD General JournalDocument8 pagesChapter 2: Financing Company Operations Practice Questions Vienna LTD General Journalsyed rahmanNo ratings yet

- BRANCH ACCOUNTS - Assignment SolutionsDocument9 pagesBRANCH ACCOUNTS - Assignment SolutionsNaveen C GowdaNo ratings yet

- REVIEW Chap 1 - 2 - 3Document9 pagesREVIEW Chap 1 - 2 - 3Khánh AnNo ratings yet

- Paper - 2 - Answer - E - NormalDocument191 pagesPaper - 2 - Answer - E - NormalJhianne Mae AlbagNo ratings yet

- Lembar Jawaban YAC 2019Document14 pagesLembar Jawaban YAC 201910. Janu Achirul HidayatNo ratings yet

- CCP102Document23 pagesCCP102api-3849444No ratings yet

- Mehta AutoCare Pvt. Ltd.Document30 pagesMehta AutoCare Pvt. Ltd.Shashank PatelNo ratings yet

- Journal, Ledger Trial BalanceDocument15 pagesJournal, Ledger Trial BalanceOmar Galal100% (1)

- Date Transaction: 1. Journalize and Post To The LedgerDocument5 pagesDate Transaction: 1. Journalize and Post To The LedgerArlyn Ragudos BSA1No ratings yet

- Latihan UjikomDocument3 pagesLatihan UjikomSitaNo ratings yet

- Journal - Ledger in Class WorksheetDocument9 pagesJournal - Ledger in Class WorksheetAnurag KapoorNo ratings yet

- Problem 7 ACCA101Document26 pagesProblem 7 ACCA101Nicole Fidelson100% (1)

- Susquehanna Equipment RentalsDocument17 pagesSusquehanna Equipment RentalsFaiza SattiNo ratings yet

- General JournalDocument7 pagesGeneral JournalAbigail RososNo ratings yet

- AC223 - E - Assignment 1 - 2021.01Document4 pagesAC223 - E - Assignment 1 - 2021.01Num Num TastyNo ratings yet

- Real Estate Mortgage CasesDocument14 pagesReal Estate Mortgage CasesMatthew WittNo ratings yet

- Management & Entrepreneurship Development NotesDocument20 pagesManagement & Entrepreneurship Development NotesSHREENo ratings yet

- Bank Statement 1 2024Document2 pagesBank Statement 1 2024joelschwartzllcNo ratings yet

- OFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfDocument3 pagesOFFICIAL RATES 2020 PRINCESS GOLDEN BEACH INDpdfMocanu AdrianNo ratings yet

- Prof. Massimo Guidolin: 20192 - Financial EconometricsDocument17 pagesProf. Massimo Guidolin: 20192 - Financial EconometricsDewi Setyawati PutriNo ratings yet

- Based On Internship Report Submitted To SBI in Completion of The Requirement of Summer Internship atDocument5 pagesBased On Internship Report Submitted To SBI in Completion of The Requirement of Summer Internship atDevesh MishraNo ratings yet

- Turkey GenDocument285 pagesTurkey GenMuhammad Talha TalhaNo ratings yet

- Ishares Barclays 10-20 Year Treasury Bond FundDocument0 pagesIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezNo ratings yet

- British American TobaccoDocument121 pagesBritish American TobaccoShubro Barua100% (6)

- 1342018013071212Document16 pages1342018013071212CoolerAdsNo ratings yet

- RealmeDocument1 pageRealmePíyûshGuptaNo ratings yet

- (Jpia) Chapter 1 - New Conceptual Framework Lecture & ExerciseDocument3 pages(Jpia) Chapter 1 - New Conceptual Framework Lecture & ExerciseMaureen Derial PantaNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- Format of Purchase OrderDocument2 pagesFormat of Purchase OrdersbpathiNo ratings yet

- 361 Chapter 9 MC SolutionsDocument24 pages361 Chapter 9 MC SolutionsLouie De La TorreNo ratings yet

- CA Final Law Notes by Gurukripa - AUDITORSDocument56 pagesCA Final Law Notes by Gurukripa - AUDITORSYogesh KumarNo ratings yet

- Compound Interest Practice QuesDocument12 pagesCompound Interest Practice QuesKothapalli VinayNo ratings yet

- 2024 01 04 0.11373189178667009Document137 pages2024 01 04 0.11373189178667009imdipendrNo ratings yet

- Deed of PartitionDocument2 pagesDeed of PartitionRagul SivanandNo ratings yet

- Lecture 11 Higher Financing AgenciesDocument10 pagesLecture 11 Higher Financing AgenciesNEERAJA UNNINo ratings yet

- Hilton Case1Document2 pagesHilton Case1Ana Fernanda Gonzales CaveroNo ratings yet

- 03P Accounting For Subsequent Share Capital TransactionsDocument11 pages03P Accounting For Subsequent Share Capital TransactionsjulsNo ratings yet

- Granite Inn Business Plan PresentationDocument44 pagesGranite Inn Business Plan PresentationalemeNo ratings yet

- Resume of TsschallDocument3 pagesResume of Tsschallapi-28913588No ratings yet

- Case (Renminbi) - Discussion QuestionsDocument2 pagesCase (Renminbi) - Discussion QuestionsAnimesh ChoubeyNo ratings yet

- Administrative Order No 243aDocument4 pagesAdministrative Order No 243amsw0wNo ratings yet