Professional Documents

Culture Documents

27 June 2022

27 June 2022

Uploaded by

Ankit KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

27 June 2022

27 June 2022

Uploaded by

Ankit KumarCopyright:

Available Formats

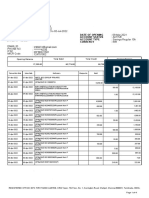

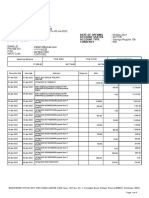

27 June 2022 ANKIT K DHIMAN & ASSOCIATES

ANKIT K DHIMAN

CA, BCOM(HONS)

+91-9915180676

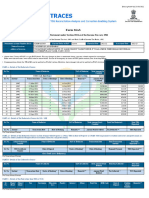

194R wef

TDS UNDER

1st July

SECTION 194R

Is it really promoting

2022

EODB by Govt?

WHAT 194R SAYS?

Applicability:

1. To all persons other than Individual and HUF

2. To Individual and HUF having turnover / sales more than 1 crore or Rs. 50 Lacs in case

of professional in F.Y. 2021-22

Rate:

TDS @ 10%, by any person, providing any benefit or perquisite, exceeding Rs. 20,000 in

value, in a financial year, to a resident, arising from the business or profession of such

resident and such benefit or perquisite is in the nature of income from profits and gains

from Business or Profession.

WHO WILL BE

AFFECTED BY THIS?

1. Pharmaceutical Manufacturer/ Supplier who supplies free medicines / perks to

doctors.

2. Gifting Gold coins etc to business professionals or others in business.

3. Domestic/Foreign Tours including Air Tickets, Hotels etc.

4. Quantity Discount given by Manufacturer/Trader will also come under ambit of

this and will have to deduct TDS accordingly.

You might also like

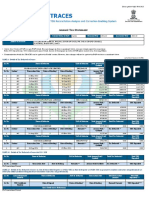

- 26as - Aerpj3512rDocument5 pages26as - Aerpj3512rRama Prasad PadhyNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- Gasbill 6296551000 202107 20210808011855Document1 pageGasbill 6296551000 202107 20210808011855Muhammad TouseefNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Shivansh BansalNo ratings yet

- Section 194R - Guidelines & ClarificationsDocument2 pagesSection 194R - Guidelines & Clarificationsbansaladitya1708No ratings yet

- SSGC Duplicate Bill20210123 090016Document1 pageSSGC Duplicate Bill20210123 090016Ghulam Baqir MazariNo ratings yet

- Rajasekar M 13228: ConfidentialDocument2 pagesRajasekar M 13228: Confidentialvijaykataria1989No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ashutosh SinhaNo ratings yet

- Kotak GokulDocument3 pagesKotak GokulHimalayan MandererNo ratings yet

- ATUPA8667Q-2022 (1) - EditedDocument6 pagesATUPA8667Q-2022 (1) - EditedDharamjot singhNo ratings yet

- Premium Statement: For The Period Sept 1 2022 To Sept 30 2022Document9 pagesPremium Statement: For The Period Sept 1 2022 To Sept 30 2022bsablanchardNo ratings yet

- SSGC Duplicate Bill20210323 132303Document1 pageSSGC Duplicate Bill20210323 132303toseef ul islamNo ratings yet

- Consolidated Policy ScheduleDocument3 pagesConsolidated Policy ScheduleSUNIL SHARMANo ratings yet

- Bodhi S Hair Beauty CHOO LI ZI - Aged Payables DetailDocument1 pageBodhi S Hair Beauty CHOO LI ZI - Aged Payables DetailChoo Li ZiNo ratings yet

- Fixed Income Market Report - 30.05.2022Document1 pageFixed Income Market Report - 30.05.2022Fuaad DodooNo ratings yet

- Revised TDS Wef 14.05.20Document7 pagesRevised TDS Wef 14.05.20MANAN KOTHARINo ratings yet

- Trading Statement: Corporate NewsDocument2 pagesTrading Statement: Corporate NewsAsan ClanNo ratings yet

- DMXPK9005F 2021Document4 pagesDMXPK9005F 2021sonuNo ratings yet

- Adlpn2283n 2022Document4 pagesAdlpn2283n 2022SUNIL GAIKWADNo ratings yet

- Fixed Income Market Report - 13.06.2022Document1 pageFixed Income Market Report - 13.06.2022Fuaad DodooNo ratings yet

- Ctaa040 - Exam - 2022 - Scenario (Final)Document6 pagesCtaa040 - Exam - 2022 - Scenario (Final)Given RefilweNo ratings yet

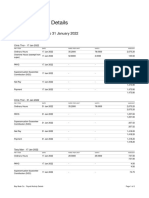

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- Fixed Income Market Report - 20.06.2022Document1 pageFixed Income Market Report - 20.06.2022Fuaad DodooNo ratings yet

- Research PaperDocument1 pageResearch PaperRed BullNo ratings yet

- Latest Provisions TDS and CSDocument74 pagesLatest Provisions TDS and CShimesh amibrokerNo ratings yet

- Circular 14 2022Document3 pagesCircular 14 2022shantXNo ratings yet

- Ekxps0001n 2022Document5 pagesEkxps0001n 2022SiddharthNo ratings yet

- Fixed Income Market Report - 22.08.2022Document1 pageFixed Income Market Report - 22.08.2022Fuaad DodooNo ratings yet

- Salary CertificateDocument1 pageSalary Certificatemohin100% (1)

- Tribal Cultural CentreDocument3 pagesTribal Cultural Centrechinmoy patraNo ratings yet

- AINO Communique 105th Edition - July 2022Document13 pagesAINO Communique 105th Edition - July 2022Swathi JainNo ratings yet

- SSGC Bill JunDocument1 pageSSGC Bill Junshahzaib azamNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- BJZPS4348J 2023Document4 pagesBJZPS4348J 2023Sai NarayananNo ratings yet

- Aabfh0358k Q1 2023-24Document4 pagesAabfh0358k Q1 2023-24pushpa GeoNo ratings yet

- Date: February 19.2021: Premium Paid Certificate For The Financial Year 2020 - 2021Document2 pagesDate: February 19.2021: Premium Paid Certificate For The Financial Year 2020 - 2021Nihar Ranjan NikuNo ratings yet

- IDFC-AMC 2021 Annual-ReportDocument63 pagesIDFC-AMC 2021 Annual-ReportvinitNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- GAS Bill 29-Jul-2021Document1 pageGAS Bill 29-Jul-2021Noman ShahNo ratings yet

- Top 10 Picks For 2023Document13 pagesTop 10 Picks For 2023MittapalliUdayKumarReddyNo ratings yet

- Economic Letter 12-February-2021Document7 pagesEconomic Letter 12-February-2021fahad haxanNo ratings yet

- 2312100737675700000MH04HB6400 InsuranceDocument3 pages2312100737675700000MH04HB6400 InsuranceSHAILENDRANo ratings yet

- CBFPS9716K 2022Document4 pagesCBFPS9716K 2022Hritik SinghNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Mr. Devnath DivakarDocument4 pagesStatement of Account: Date of Opening Account Status Account Type Currency Mr. Devnath DivakarPunam PanditNo ratings yet

- Lapkeu Q1 2022 ENG RevDocument2 pagesLapkeu Q1 2022 ENG RevAdriel ChristopherNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Mr. Rohit RanjanDocument4 pagesStatement of Account: Date of Opening Account Status Account Type Currency Mr. Rohit RanjanPunam PanditNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Mr. Nabajit BoraDocument4 pagesStatement of Account: Date of Opening Account Status Account Type Currency Mr. Nabajit BoraPunam PanditNo ratings yet

- Allowable and Non Allowable Expenses SlideDocument24 pagesAllowable and Non Allowable Expenses Slideyi yi wiNo ratings yet

- Cxopa8338n 2022Document4 pagesCxopa8338n 202218veera98No ratings yet

- Fixed Income Market Report - 06.06.2022Document1 pageFixed Income Market Report - 06.06.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 12.07.2022Document1 pageFixed Income Market Report - 12.07.2022Fuaad DodooNo ratings yet

- ComputationDocument2 pagesComputationBike World BangaloreNo ratings yet

- February 2022 ExampunditDocument281 pagesFebruary 2022 ExampunditIshang SharmaNo ratings yet

- Fixed Income Market Report - 18.07.2022Document1 pageFixed Income Market Report - 18.07.2022Fuaad DodooNo ratings yet

- 4Q 2021 PresentationDocument15 pages4Q 2021 PresentationPrasoon PalNo ratings yet

- Statement of Account: Date of Opening Account Status Account Type Currency Ms. Punam DeviDocument4 pagesStatement of Account: Date of Opening Account Status Account Type Currency Ms. Punam DeviPunam PanditNo ratings yet

- GodrejIndustriesLtdQ4FY2022 23PerformanceUpdateDocument18 pagesGodrejIndustriesLtdQ4FY2022 23PerformanceUpdatePrity KumariNo ratings yet

- Annual Tax Statement: F F F F F F F F FDocument4 pagesAnnual Tax Statement: F F F F F F F F FDaman SharmaNo ratings yet

- Aging Receivable Detail: Resa Harisma 195154024Document1 pageAging Receivable Detail: Resa Harisma 195154024Bikin OrtubanggaNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet