Professional Documents

Culture Documents

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 3

Uploaded by

YOHANNES WIBOWOOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 3

Uploaded by

YOHANNES WIBOWOCopyright:

Available Formats

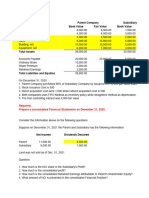

Determine Arb's investment income from Tee Corporation for the year ended December 31

December 31 October 31

Sales 1,200,000 900,000 300,000

Expenses (including cost of goods sold) 800,000 600,000 200,000

100,000

% acquired 25%

Investment Income (October 1 - December 31) 25,000

Journal :

Investment in Tee 25,000

Income from Tee 25,000

Compute the correct balance of Arb's investment in Tee account in December 31

Investment cost October 1 600,000

Add : Income from Tee 25,000

Less : Diviend -

Investment in Tee account, December 31 625,000

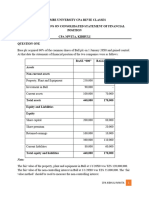

Prepare a journal entry to adjust the Investment in Son account to the equity method on January 2, 2017

Goodwill fromfirst 10% interest :

Cost of investment 25,000

Book Value acquired

Current assets 50,000

Plant assets 200,000

Liabilities - 40,000

Net assets 210,000

Interest acquired 10%

21,000

Excess fair value over book value 4,000

Goodwill from second 10% interest :

Cost of investment 50,000

Book value acquired

Current assets 60,000

Plant assets 240,000

Liabilities - 50,000

Net assets 250,000

Interest acquired 10%

25,000

Excess fair value over book value 25,000

Correcting entry as of January 2, 2017 to convert investment to the equity method

Journal :

Accumulated gain/loss on stock available for sale 25,000

Valuation allowance to record Son at fair value 25,000

To remove the valuation allowance entered on December 31, 2016 under the fair value method for

an available for sale security.

Journal :

Investment in Son 4,000

Retained earnings 4,000

To adjust investment account to an equity basis computed as follows :

Share of Son's income for 2016 10,000

Less share of dividends for 2016 6,000

4,000

Determine Pop's income from Son for 2017

Income from Son on original 10% investment 5,000

Income from Son on second 10% investment 5,000

Income from Son for 2017 10,000

You might also like

- Discussion and Solutions For Investment in Associate - Hand - Out 1Document19 pagesDiscussion and Solutions For Investment in Associate - Hand - Out 1Teresa AlbertoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- POF Class Activity - 1Document1 pagePOF Class Activity - 1Muhammad MansoorNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Intermediate Accounting Unit4 - Topic4Document8 pagesIntermediate Accounting Unit4 - Topic4Lea Polinar100% (1)

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- Quiz 1 SolutionsDocument4 pagesQuiz 1 SolutionsLJ BNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Investment in Equity Securities (Prob 28-31)Document4 pagesInvestment in Equity Securities (Prob 28-31)Lorence Patrick LapidezNo ratings yet

- Partnership Formation 46A 46JDocument11 pagesPartnership Formation 46A 46JRaella FernandezNo ratings yet

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Document2 pages(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNo ratings yet

- Introduction To MerchandisingDocument34 pagesIntroduction To MerchandisingayeerahcaliNo ratings yet

- MBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionDocument5 pagesMBAZC415 - Quiz 3: Periodicity Is Also Known As The Time Period AssumptionrudypatilNo ratings yet

- FS Consolidation at The Date of Acquisition v2Document16 pagesFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.No ratings yet

- Sample Illustration Financial StatementDocument3 pagesSample Illustration Financial StatementJuvy Jane DuarteNo ratings yet

- Reporting Intercorporate InterestDocument21 pagesReporting Intercorporate Interestwahyu dirosoNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Additional Exercise On Cash Flows With Relative SolutionsDocument2 pagesAdditional Exercise On Cash Flows With Relative Solutionspratama aditara100% (1)

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet

- Case 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookDocument3 pagesCase 1: ABC Co Acquired The Net Assets of XYZ Co For P800,000. All The Assets and Liabilities BookkimkimNo ratings yet

- Abuscom Final Output 4Document3 pagesAbuscom Final Output 4Mac b IBANEZNo ratings yet

- Modul Jawaban Koeliah: Akuntansi Keuangan 1Document12 pagesModul Jawaban Koeliah: Akuntansi Keuangan 1darwas darwasNo ratings yet

- Investment in AssociateDocument5 pagesInvestment in AssociateLorence Patrick LapidezNo ratings yet

- Consolidated Statement of Financial Position Part 1Document16 pagesConsolidated Statement of Financial Position Part 1Frank AlexanderNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Chap 17 1 3 SolutionsDocument5 pagesChap 17 1 3 Solutionspdmallari12No ratings yet

- Homework CH 3Document12 pagesHomework CH 3LNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Steps in Consolidation Working Papers On The Date of AcquisitionDocument3 pagesSteps in Consolidation Working Papers On The Date of AcquisitionPinky DaisiesNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Document9 pagesCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine ActaNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- FS-Practice QuestionDocument2 pagesFS-Practice QuestionNinh Thị Ánh NgọcNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- Acc For Business CombinationDocument4 pagesAcc For Business CombinationBabyann BallaNo ratings yet

- ConsolidationDocument25 pagesConsolidationAEDRIAN LEE DERECHONo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- One God One People February 2013Document297 pagesOne God One People February 2013Stig DragholmNo ratings yet

- Tip Sheet March 2017Document2 pagesTip Sheet March 2017hoangvubui4632No ratings yet

- CalculusDocument101 pagesCalculuskusnoNo ratings yet

- Pe8 Mod5Document16 pagesPe8 Mod5Cryzel MuniNo ratings yet

- 10 Problem For The Topic 9 & 10 Hicao GroupDocument4 pages10 Problem For The Topic 9 & 10 Hicao GroupArvin ArmojallasNo ratings yet

- CV Old NicDocument4 pagesCV Old NicTensonNo ratings yet

- Avanquest Perfect Image V.12 User GuideDocument174 pagesAvanquest Perfect Image V.12 User GuideShafiq-UR-Rehman Lodhi100% (1)

- Pesud Abadi Mahakam Company Profile Abdul Basith-DikonversiDocument48 pagesPesud Abadi Mahakam Company Profile Abdul Basith-DikonversiAndi HafizNo ratings yet

- VRF Mv6R: Heat Recovery Outdoor UnitsDocument10 pagesVRF Mv6R: Heat Recovery Outdoor UnitsTony NguyenNo ratings yet

- Bell Single-Sleeve Shrug Crochet PatternDocument2 pagesBell Single-Sleeve Shrug Crochet PatternsicksoxNo ratings yet

- Loan Agreement: Acceleration ClauseDocument2 pagesLoan Agreement: Acceleration ClauseSomething SuspiciousNo ratings yet

- Micro Fibra Sintetica at 06-MapeiDocument2 pagesMicro Fibra Sintetica at 06-MapeiSergio GonzalezNo ratings yet

- Data Analyst Chapter 3Document20 pagesData Analyst Chapter 3Andi Annisa DianputriNo ratings yet

- College Invitation Letter - Managedia 2023Document2 pagesCollege Invitation Letter - Managedia 2023Sandeep DeyNo ratings yet

- KirbyDocument3 pagesKirbyNorhassanah UtosabuayanNo ratings yet

- January 11, 2019 Grade 1Document3 pagesJanuary 11, 2019 Grade 1Eda Concepcion PalenNo ratings yet

- SRM 7 EHP 4 Release Notes PDFDocument18 pagesSRM 7 EHP 4 Release Notes PDFMOHAMMED SHEHBAAZNo ratings yet

- RCD ManagementDocument6 pagesRCD ManagementPindoterONo ratings yet

- 234567890Document37 pages234567890erppibuNo ratings yet

- Part 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each AnswerDocument13 pagesPart 1. Question 1-7. Complete The Notes Below. Write NO MORE THAN THREE WORDS AND/OR A NUMBER For Each Answerahmad amdaNo ratings yet

- Police Cranston School Committee Member Stole PTO FundsDocument1 pagePolice Cranston School Committee Member Stole PTO FundsashaydelineNo ratings yet

- Unseen Passage 2Document6 pagesUnseen Passage 2Vinay OjhaNo ratings yet

- COSO DefinEDDocument21 pagesCOSO DefinEDRefdy AnugrahNo ratings yet

- Trend Trading StocksDocument64 pagesTrend Trading Stockssasi717100% (1)

- Arrhythmia - WikipediaDocument76 pagesArrhythmia - WikipediaJamesNo ratings yet

- Rotc Reviewer FinalsDocument11 pagesRotc Reviewer FinalsAngel Atienza100% (1)

- Components of Vectors Prepared By: Victor Rea OribeDocument17 pagesComponents of Vectors Prepared By: Victor Rea OribeGerone Tolentino AtienzaNo ratings yet

- Job Sheet 1Document5 pagesJob Sheet 1Sue AzizNo ratings yet

- Manual Bms8n2 e LowDocument58 pagesManual Bms8n2 e Lowzoranbt80_324037655No ratings yet

- Damask: by ChenoneDocument17 pagesDamask: by ChenoneYasir IjazNo ratings yet