Professional Documents

Culture Documents

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4

Uploaded by

SR TGCopyright:

Available Formats

CFAP04 - Business Finance Decisions | Page 4

iv. It is estimated that it will take approximately four months to complete factory set-up and labour

recruitment and training, after which production will commence. Forecast production volumes are

based on construction activity information supplied by the Malaysian Government with 15,000

units in the first year, rising to 32,000 units in second year, 40,000 units in third year and 50,000

units in the final year.

v. The following average price, cost per unit and total fixed costs are forecasted to apply in the first

year of operation:

a. Each AD-1 will be sold for MYR 8,500 per unit.

b. The variable cost to manufacture each AD-1 device will be MYR 5,000 per unit. This

cost comprises locally sourced materials, labour and other variable costs of production

but excludes accounting depreciation relating to plant and machinery.

c. Total fixed costs for the first year of production will be MYR 30 million.

vi. From year 2 onwards, revenue is expected to increase by Malaysia's general rate of inflation of

2% per annum, but variable and fixed costs are expected to rise by 4% per annum due to the

specialist nature of skilled labour required which is in short supply.

vii. Malaysian tax ex expected to closely follow Pakistan tax rules with applicable tax rate of 29%.

viii. Allowable initial and normal tax depreciation of 25% and 10% respectively for plant and

machinery. Land and buildings will not be eligible for tax depreciation allowances.

ix. The current commercial borrowing rate in Pakistan is 9% but the Malaysian Government has

offered PEM a 5% subsidised loan for the MYR 300 million required plus the value of the

working capital required at the beginning of the project. The Malaysian Government has agreed

that it will not ask for the loan to be repaid until year 4 on condition that PEM undertakes to

manufacture AD-1 in Malaysia for the next four years.

x. LAL has 100 million shares currently trading at Rs. 325 per share and Rs. 15,000 million 7%

corporate bond trading at a 20% premium to their nominal value. LAL's most recently quoted

equity beta is 1.87.

xi. The current risk-free rate of return is estimated at 3.1% and the market risk premium is 5.75%.

xii. Due to the international nature of the project, it is estimated that currency risk premium of 0.88%

would apply to the project if it is all-equity financed

xiii. The current spot rate between the Malaysian ringgit and the Pakistan rupee is MYR 0.029 per

rupee. Annual general inflation rate in Pakistan is currently 5%. It may be assumed that general

inflation rates in both countries will not change for the foreseeable future.

xiv. All net cash flows arising from the project will be remitted back to PEM at the end of each year.

Required:

a) Evaluate whether the offer from Malaysian Government must be accepted or not using APV

method. (All cash flows arise at the end of the year unless otherwise specified) (20)

b) Comment on the appropriateness of:

LAL using APV method to evaluate the project; and

The other assumptions made in determining the base case NPV. (08)

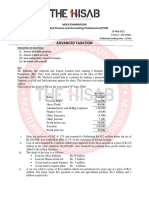

Q5. The following financial information relates to Work From Home Limited (WFHL).

Income statement information for the last year.

Rs.

Million

Profit before interest and tax 12

Interest expense (3)

Profit before tax 9

Tax Expense (3)

Profit after tax 6

Dividends 2

Retained earnings 4

The HISAB School of Accountancy

You might also like

- Corporate Bond Underwriting ProcessDocument27 pagesCorporate Bond Underwriting ProcessRich100% (2)

- Computer Applications (ICSE) Sample Paper 5Document4 pagesComputer Applications (ICSE) Sample Paper 5Guide For School83% (6)

- Household Statement W - Summary For December 2023Document12 pagesHousehold Statement W - Summary For December 2023Randy WrightNo ratings yet

- Chapter 6Document38 pagesChapter 6Kad Saad100% (5)

- Financial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Document7 pagesFinancial Management 2: Capital Budgeting Problems and Exercises PART 1 Problems Problem 1Robert RamirezNo ratings yet

- Toaz - Info Partnership Dissolution PRDocument16 pagesToaz - Info Partnership Dissolution PRNil Justeen GarciaNo ratings yet

- Liquidity Management in BanksDocument11 pagesLiquidity Management in BanksPoonam SannakeNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Study Notes First Intuition AccaDocument147 pagesStudy Notes First Intuition AccaRanjisi chimbanguNo ratings yet

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- BFD W15Document5 pagesBFD W15Ahmed Raza Mir NewNo ratings yet

- CA Inter FM SM Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Inter FM SM Q MTP 2 May 2024 Castudynotes ComsaurabhNo ratings yet

- IRR of The ProjectDocument9 pagesIRR of The Projectsamuel kebedeNo ratings yet

- Notes On Capital BudgetingDocument3 pagesNotes On Capital BudgetingCheshta Suri100% (1)

- Past Paper - BFDDocument73 pagesPast Paper - BFDarifgillcaNo ratings yet

- CAF 8 CMA Autumn 2019 PDFDocument4 pagesCAF 8 CMA Autumn 2019 PDFbinuNo ratings yet

- Tutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangDocument4 pagesTutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangLee HansNo ratings yet

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- Problems On Cash FlowsDocument4 pagesProblems On Cash FlowsDeepakNo ratings yet

- F18 BFDDocument4 pagesF18 BFDHaiderRazaNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- Paper 8 Financial Management & Economics For Finance PDFDocument5 pagesPaper 8 Financial Management & Economics For Finance PDFShivam MittalNo ratings yet

- FM MTP MergedDocument330 pagesFM MTP MergedAritra BanerjeeNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- BEA3008 Tutorial 8 Finance For ManagersDocument2 pagesBEA3008 Tutorial 8 Finance For ManagersInésNo ratings yet

- CapbudgetingproblemsDocument3 pagesCapbudgetingproblemsVishal PaithankarNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- Investment Appraisal-Fm AccaDocument11 pagesInvestment Appraisal-Fm AccaCorrinaNo ratings yet

- Su - 018Document5 pagesSu - 018AbdulAzeemNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- Tutorial 3 WHT DiscussDocument6 pagesTutorial 3 WHT DiscussAqila Syakirah IVNo ratings yet

- Cfap 4 BFD Summer 2018Document4 pagesCfap 4 BFD Summer 2018nafees ahmedNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingEdmon ManalotoNo ratings yet

- Ba Fin430finalDocument4 pagesBa Fin430finalIzzy BbyNo ratings yet

- AFM Capital Budgeting AssignmentDocument5 pagesAFM Capital Budgeting Assignmentmahendrabpatel100% (1)

- Financial Management-P III - Nov 08Document4 pagesFinancial Management-P III - Nov 08gundapolaNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1Document5 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1GODWIN VIJUNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- 15 Af 503 sfm61Document4 pages15 Af 503 sfm61magnetbox8No ratings yet

- Tutorial 3a-Cash Flow EstimationDocument3 pagesTutorial 3a-Cash Flow EstimationPrincessCC20No ratings yet

- Paper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingDocument33 pagesPaper - 2: Strategic Financial Management Questions Project Planning and Capital BudgetingShyam virsinghNo ratings yet

- Assignment 3/0/2016 Financial Strategy MAC4865: Additional InformationDocument8 pagesAssignment 3/0/2016 Financial Strategy MAC4865: Additional InformationdevashneeNo ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Acc 305 Assessment 1 June 2020Document5 pagesAcc 305 Assessment 1 June 2020SharonNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Business Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsDocument4 pagesBusiness Finance Decisions: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- RTP CA Final Old Course Paper 2 Management Accounting and FinDocument38 pagesRTP CA Final Old Course Paper 2 Management Accounting and FinSajid AliNo ratings yet

- MAF603-QUESTION TEST 2 - Dec 2018Document4 pagesMAF603-QUESTION TEST 2 - Dec 2018fareen faridNo ratings yet

- Tutorial 2 (1) Q1 - Q4Document8 pagesTutorial 2 (1) Q1 - Q4Shan JeefNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- BIR Ruling 101-18 wPEDocument8 pagesBIR Ruling 101-18 wPEKathyrn Ang-ZarateNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- Mbac 2001Document6 pagesMbac 2001sujithNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2Vundi RohitNo ratings yet

- Unit-3: Project SelectionDocument101 pagesUnit-3: Project SelectionMandeep Singh BhatiaNo ratings yet

- Income Taxes For Corporations Solution 2Document2 pagesIncome Taxes For Corporations Solution 2Katelyn Mae SungcangNo ratings yet

- 8 RTP Nov 21 1Document27 pages8 RTP Nov 21 1Bharath Krishna MVNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- DC 16 15431Document41 pagesDC 16 15431goodmoineNo ratings yet

- SST Chapterwise PYQs Shobhit NirwanDocument29 pagesSST Chapterwise PYQs Shobhit NirwanMaydhansh Kadge100% (1)

- Sources of FinanceDocument12 pagesSources of FinanceJay Patel100% (2)

- Book F01 - Question BankDocument294 pagesBook F01 - Question Bankthotasravani 1997No ratings yet

- Solution Manual For Auditing The Art and Science of Assurance Engagements Fourteenth Canadian Edition Plus Mylab Accounting With Pearson Etext Package 14th EditionDocument16 pagesSolution Manual For Auditing The Art and Science of Assurance Engagements Fourteenth Canadian Edition Plus Mylab Accounting With Pearson Etext Package 14th EditionJerry Ball100% (39)

- Eseneco L2Document5 pagesEseneco L2Jennifer Elizabeth Yambao100% (1)

- Abbreviation DefinitionDocument14 pagesAbbreviation DefinitionsaluruNo ratings yet

- Internship Presentation On: Credit Management of Standard Bank Limited: A Study On Kumira Branch, ChittagongDocument16 pagesInternship Presentation On: Credit Management of Standard Bank Limited: A Study On Kumira Branch, ChittagongMS Sojib ChowdhuryNo ratings yet

- Introduction To Financial Services MarketingDocument14 pagesIntroduction To Financial Services MarketingJitender Kaushal100% (1)

- FIM Exercise AnsDocument6 pagesFIM Exercise AnsSam MNo ratings yet

- NOVATIONDocument18 pagesNOVATIONmarlon baltazarNo ratings yet

- Assignment No.9Document5 pagesAssignment No.9rheNo ratings yet

- Indiabulls Ventures (Dhani Services)Document4 pagesIndiabulls Ventures (Dhani Services)Kushagra KejriwalNo ratings yet

- 32 Etcherla Auction NoteDocument15 pages32 Etcherla Auction Notepandu123456No ratings yet

- Cambridge International General Certificate of Secondary EducationDocument24 pagesCambridge International General Certificate of Secondary EducationSeong Hun LeeNo ratings yet

- Final ResearchDocument39 pagesFinal ResearchDereje BelayNo ratings yet

- Rate of Return AnalysisDocument54 pagesRate of Return AnalysisChro AbdalwahidNo ratings yet

- Spontaneous FinancingDocument3 pagesSpontaneous Financingmohi80% (1)

- Bonds and Long Term LiabilitiesDocument5 pagesBonds and Long Term LiabilitiesDivine CuasayNo ratings yet

- Reviewer in Cfas - PFRS 11 - 15Document4 pagesReviewer in Cfas - PFRS 11 - 15geyb awayNo ratings yet

- Issue of SharesDocument26 pagesIssue of SharesPriyanka GargNo ratings yet

- Simple AnnuityDocument17 pagesSimple AnnuityAllaine BenitezNo ratings yet

- Dung - HDTD - Nguyen Thi Kim Loan p8-14Document7 pagesDung - HDTD - Nguyen Thi Kim Loan p8-14nguyenthihoaivietnamNo ratings yet