Professional Documents

Culture Documents

D) The Main Differences Between ML and TF Are

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D) The Main Differences Between ML and TF Are

Uploaded by

SR TGCopyright:

Available Formats

d) The main differences between ML and TF are:

- For ML to occur, the funds involved must be the proceeds of criminal conduct, and the

mental element is normally for profit.

- For TF to occur, the source of funds is irrelevant, i.e. the funds can be from a legitimate

or illegitimate source, and the mental element is normally ideology or cause driven.

- TF occurs before the physical act of terrorism, while ML occurs after the predicate

offence physical act has been completed.

Responsibilities of reporting firm:

Enterprise Risk Assessment

AML / CFT programme, policies and procedures

Appointment of Compliance Officer and determining the TOR’s,

Make comprehensive plan for Staff vetting and training relating to development in AML

Conduct of ongoing CDD, including business relationship monitoring

when establishing a client relationship

when carrying out an occasional transaction

where there is a suspicion of money laundering or terrorist financing\

where there are doubts concerning the veracity of previous identification information.

Suspicious transaction report(STR) and currency transaction report (CTR) to FMU

Record keeping

Independent audit

A.7

- We will evaluate the competence, capabilities and objectivity of that expert, for this we

will check whether his name is available in list of PBA or SBP, further we will check

whether he has the Pakistan Engineering Council Certificate.

- Obtain an understanding of the work of that expert, for the purpose we can meet with

management expert, further we can check the previous experience with same valuer.

- Evaluate the appropriateness of that expert’s work as audit evidence for the relevant

assertion.

- Inspection of the written instructions given to the valuer by Poppy Co which should

include the objectives and scope of the work, the intended use of the valuer's work and

the extent of the valuer's access to records and files

- Consideration of the assumptions and methods used by the valuer to ensure they are

reasonable based on other audit evidence and the auditor's previous knowledge of Poppy

Co

- An evaluation of the method used to measure fair value to ensure consistency with IAS

40

- Examination of the valuation report to ensure each property has been valued consistently

and that the date of valuation is reasonably close to Poppy Co's year-end

- Physical inspection of the valuation properties to ensure their condition is in line with the

valuation report

- Inspection of purchase documentation for the investment properties to ensure that any

revaluations made in the year of purchase are reasonable and not significantly different

from the purchase price

6|Page

You might also like

- Going Concern Valuation: For Real Estate Appraisers, Lenders, Assessors, and Eminent DomainFrom EverandGoing Concern Valuation: For Real Estate Appraisers, Lenders, Assessors, and Eminent DomainNo ratings yet

- Tenderloin Housing Clinic Review 3-23-12Document6 pagesTenderloin Housing Clinic Review 3-23-12auweia10% (1)

- Gathering Evidences and Forms of Evidence1Document12 pagesGathering Evidences and Forms of Evidence1gokul ramananNo ratings yet

- Scope of AuditDocument20 pagesScope of AuditSuneelNo ratings yet

- Audit of Property, Plant, and EquipmentDocument19 pagesAudit of Property, Plant, and EquipmentTracy Miranda BognotNo ratings yet

- CFI 3 Statement Model Complete in ClassDocument10 pagesCFI 3 Statement Model Complete in ClassThiện NhânNo ratings yet

- Internal Audit Checklist of Real EstateDocument41 pagesInternal Audit Checklist of Real Estatemaahi781% (43)

- 162.material.011 InventoryDocument7 pages162.material.011 InventoryAngelli LamiqueNo ratings yet

- CPA Handbook CoverageDocument10 pagesCPA Handbook CoverageMadison DolnyNo ratings yet

- Credit Investigation, Property Appraisal, Code of Ethics & Credit Evaluation PDFDocument75 pagesCredit Investigation, Property Appraisal, Code of Ethics & Credit Evaluation PDFelizabeth bernales100% (1)

- Lecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020Document7 pagesLecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020MaeNo ratings yet

- PMP Rapid ReviewDocument270 pagesPMP Rapid Reviewtrau-nuoc100% (33)

- 6ea69ba1a0bd7f6fb72976eefb2d4afcDocument264 pages6ea69ba1a0bd7f6fb72976eefb2d4afcPiyal Hossain100% (2)

- REA-REB Reviewer 2021Document402 pagesREA-REB Reviewer 2021Jheovane Sevillejo LapureNo ratings yet

- 08 - Advances, Deposits, Prepayments and Other ReceivablesDocument4 pages08 - Advances, Deposits, Prepayments and Other ReceivablesAqib SheikhNo ratings yet

- AT - Understand The EntityDocument7 pagesAT - Understand The EntityRey Joyce AbuelNo ratings yet

- Audit Procedure On InvestmentDocument5 pagesAudit Procedure On InvestmentYogeswari RavindranNo ratings yet

- Audit Theory SummaryDocument17 pagesAudit Theory SummaryMarriz Bustaliño TanNo ratings yet

- Handout - Concept and Situs of IncomeDocument27 pagesHandout - Concept and Situs of Incomesosexyme123No ratings yet

- Balaji CVDocument3 pagesBalaji CVshabareshv692No ratings yet

- Chapter One Fundamentals of Assurance Services I. The Concept of AssuranceDocument11 pagesChapter One Fundamentals of Assurance Services I. The Concept of AssuranceJeremy Lorenzo Teodoro VirataNo ratings yet

- At 02Document5 pagesAt 02Mitch PacienteNo ratings yet

- 10 Overview of The Financial Statement Audit Process PDFDocument21 pages10 Overview of The Financial Statement Audit Process PDFUnnamed homosapienNo ratings yet

- خطوات المراجعة الخارجية مترجمDocument34 pagesخطوات المراجعة الخارجية مترجمAbduh AfifNo ratings yet

- Audit EvidenceDocument5 pagesAudit Evidencecvgp1298No ratings yet

- International Standards On AuditingDocument16 pagesInternational Standards On AuditingTushar VoiceNo ratings yet

- Shubam KeswaniDocument175 pagesShubam KeswaniDhruv GolyanNo ratings yet

- Chapter 7 EvidenceDocument6 pagesChapter 7 Evidencerishi kareliaNo ratings yet

- Understanding The Entity and Its EnvironmentDocument4 pagesUnderstanding The Entity and Its EnvironmentIrish SanchezNo ratings yet

- Aas 5 Audit EvidenceDocument4 pagesAas 5 Audit EvidenceRishabh GuptaNo ratings yet

- PSA 220 Quality Control For Historical Info SummaryDocument6 pagesPSA 220 Quality Control For Historical Info SummaryAbraham ChinNo ratings yet

- Fundamentals of Auditing and Assurance Services OverviewDocument8 pagesFundamentals of Auditing and Assurance Services OverviewSkye LeeNo ratings yet

- Audit Toolbox - Part 1: Property, Plant and Equipment & CashDocument16 pagesAudit Toolbox - Part 1: Property, Plant and Equipment & CashuserNo ratings yet

- ObjectiveDocument15 pagesObjectiveAhmad UsmanNo ratings yet

- Pre-Test - Performing The EngagementDocument2 pagesPre-Test - Performing The EngagementSHARMAINE CORPUZ MIRANDANo ratings yet

- AUDITINGDocument27 pagesAUDITINGGenie Gonzales DimaanoNo ratings yet

- Understanding The Entity: and Its EnvironmentDocument53 pagesUnderstanding The Entity: and Its EnvironmentRoseyy GalitNo ratings yet

- PNP Iasiidppt 140425001437 Phpapp01Document8 pagesPNP Iasiidppt 140425001437 Phpapp01sibi.sheenalyn.08.04.1996No ratings yet

- Ip Due DiligenceDocument2 pagesIp Due DiligenceAnchalNo ratings yet

- Audit I CH IIIDocument8 pagesAudit I CH IIIAhmedNo ratings yet

- Definition of AuditingDocument7 pagesDefinition of AuditingChristen HerceNo ratings yet

- 05 - Long Term Loans and AdvancesDocument5 pages05 - Long Term Loans and AdvancesAqib SheikhNo ratings yet

- Auditing Exam Revision Notes PDFDocument3 pagesAuditing Exam Revision Notes PDFJonalyn GabrilloNo ratings yet

- Writingcompletesarnarrative 1103Document25 pagesWritingcompletesarnarrative 1103Maahi ChoudharyNo ratings yet

- Audit Procedures CompleteDocument9 pagesAudit Procedures CompleteOmer PirzadaNo ratings yet

- At 01 Assurance Engagements and Related ServicesDocument7 pagesAt 01 Assurance Engagements and Related ServicesJobby JaranillaNo ratings yet

- Notes FSUU AccountingDocument18 pagesNotes FSUU AccountingRobert CastilloNo ratings yet

- International Standard On Auditing 620 Using The Work of An ExpertDocument4 pagesInternational Standard On Auditing 620 Using The Work of An ExpertMuhammad SubhaniNo ratings yet

- Lesson 7 - Audit Evidence PDFDocument7 pagesLesson 7 - Audit Evidence PDFAllaina Uy BerbanoNo ratings yet

- Aud 689Document14 pagesAud 689Rabiatul Adawiyah67% (3)

- Research Analyst ActionablesDocument5 pagesResearch Analyst ActionablesLouis NoronhaNo ratings yet

- Audit Term Paper 2Document3 pagesAudit Term Paper 2Yani IanNo ratings yet

- AUD 04 Act 1 RamirezDocument2 pagesAUD 04 Act 1 RamirezVann RamirezNo ratings yet

- Audit of PPEDocument1 pageAudit of PPEAlexis BagongonNo ratings yet

- Activity 6Document4 pagesActivity 6Isabell CastroNo ratings yet

- ReviewerDocument3 pagesReviewerChristiandale Delos ReyesNo ratings yet

- TYPES AND TESTS OF EVIDENCE and AUDIT PROCEDURESDocument6 pagesTYPES AND TESTS OF EVIDENCE and AUDIT PROCEDURESShady RainNo ratings yet

- Due Diligence NoteDocument3 pagesDue Diligence NoteBrena GalaNo ratings yet

- Audit and Assurance PrincipleDocument2 pagesAudit and Assurance PrincipleIsabell CastroNo ratings yet

- L7 Audit Evidence Apr22Document30 pagesL7 Audit Evidence Apr22Botta TemerbayevaNo ratings yet

- Auditing 10Document10 pagesAuditing 10Rose Mae RubioNo ratings yet

- Werabe University Collage of Business and EconomicsDocument5 pagesWerabe University Collage of Business and EconomicsshersfaNo ratings yet

- PSQC 1Document35 pagesPSQC 1Airah Abcede FajardoNo ratings yet

- Permanent Secretary Retreat.Document24 pagesPermanent Secretary Retreat.ChibuzoNo ratings yet

- Mahesh CVDocument4 pagesMahesh CVRj GuptaNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

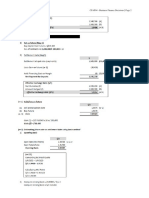

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- F2 Past Paper - Question12-2005Document13 pagesF2 Past Paper - Question12-2005ArsalanACCA100% (1)

- PBL Task IV - Audit II - Group 4Document3 pagesPBL Task IV - Audit II - Group 4Diva GunawanNo ratings yet

- Chapter One 1.1 Background of The StudyDocument34 pagesChapter One 1.1 Background of The StudyChidi EmmanuelNo ratings yet

- Auditing Problems Test Banks - SHE Part 1Document5 pagesAuditing Problems Test Banks - SHE Part 1Alliah Mae ArbastoNo ratings yet

- Privatization Commission Ordinance 2000Document13 pagesPrivatization Commission Ordinance 2000Mudassar InamNo ratings yet

- 2012 Annual ReportDocument66 pages2012 Annual ReportJesus SanchezNo ratings yet

- Aei Enterprise, Inc.: Cash Allowance Report of Empployees For The Period April 2019Document29 pagesAei Enterprise, Inc.: Cash Allowance Report of Empployees For The Period April 2019Ritchelle Quijote DelgadoNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaNo ratings yet

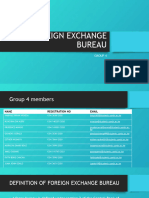

- Foreign Exchange BureauDocument48 pagesForeign Exchange BureauevakairigoNo ratings yet

- OGC Gateway Process Review 5:: Operations Review and Benefits RealisationDocument32 pagesOGC Gateway Process Review 5:: Operations Review and Benefits RealisationMOFENNo ratings yet

- Jasa Raharja PuteraDocument10 pagesJasa Raharja PuteraFiqriNo ratings yet

- 6ahic-76 Final PaperDocument41 pages6ahic-76 Final PaperPooja Ujjwal JainNo ratings yet

- Earning - Management AnalysisDocument16 pagesEarning - Management AnalysisShuvo HowladerNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Extended Definition Essay - Risk ManagementDocument8 pagesExtended Definition Essay - Risk ManagementDarlyn Jasmin MagnoNo ratings yet

- CG & Corp Failure-ScidirectDocument8 pagesCG & Corp Failure-ScidirectindahmuliasariNo ratings yet

- Metro Board of Directors Meeting Agenda, January 2021Document21 pagesMetro Board of Directors Meeting Agenda, January 2021Metro Los AngelesNo ratings yet

- Local Government Job Description PDFDocument482 pagesLocal Government Job Description PDFMawanda Ssekibuule Suudi100% (2)

- Accounting Information Systems The Processes and Controls Turner 2nd Edition Solutions ManualDocument13 pagesAccounting Information Systems The Processes and Controls Turner 2nd Edition Solutions ManualKellyMorenootdnj100% (93)

- Operating and Financial Leverage Operating and Financial LeverageDocument64 pagesOperating and Financial Leverage Operating and Financial Leverageabir1986No ratings yet

- Ca MemberDocument59 pagesCa Membercap3classesNo ratings yet