Professional Documents

Culture Documents

Sa

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sa

Uploaded by

SR TGCopyright:

Available Formats

integrity of management, then the auditor will consider options, as withdrawing from

engagement or disclaiming the opinion

b)

- The services may be provided either as an Agreed Upon Procedures Engagement or as

an Assurance Engagement other than Audit of Historical Financial Information.

- In case of Agreed Upon Procedures, the report will contain the procedures performed

and the results of such procedures in the form of factual findings.

- In case of assurance engagement, the report may take two different forms i.e. a

reasonable assurance report or a limited assurance report.

In the limited assurance report the auditor will provide negative

assurance on the compliance of entity with the framework.

In a reasonable assurance report the auditor will provide a positive

assurance on the compliance of the entity with the framework.

A.6

a)

- Obtain evidence with respect to the financial support from the parent company, such as support

letter/ agreement, etc.

- Review the financial statements of the parent company to assess whether the parent company is in

a position to support LTL.

- Ascertain the form of support i.e. loan or equity injection and ensure that both the companies

would be able to comply with the relevant legal requirements.

- Review the business plans of LTL and assess whether it would be able to continue for the

foreseeable future and generate sufficient future profits/cashflows.

- After performing the above procedures, if there is a doubt about the appropriateness of the going

concern assumption, carryout additional audit procedures (including discussion with

management) depending upon the circumstances.

b) Although the auditors are not required to provide an opinion on other information in documents

containing financial statements, they are required to read the other information and consider its

consistency with the accounts in accordance with ISA 720 The auditor's responsibility in relation

to other information in documents containing audited financial statements.

As there is a material inconsistency between what has been reported in the financial statements

and what is stated in the directors' report, if the directors refuse to make any amendments to the

directors' report so that it is consistent with the accounts, then although an unmodified opinion on

the financial statements can be issued, an emphasis of matter paragraph should also be included to

highlight this inconsistency.

c) The firm’s assurance report should be modified. Lake has made an inappropriate assumption with

respect to revenue in its cash flow forecast which is significant. ISAE 3400 requires the firm to

issue an adverse modification. The report should state that the assumptions do not provide a

reasonable basis for the cash flow forecast and a paragraph describing the matter giving rise to the

modification should also be included and headed ‘basis for adverse conclusion’. The firm may

still be able to give an unmodified opinion that the cash flow forecast is properly prepared on the

basis of the assumptions.

5|Page

You might also like

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Aas 16 Going ConcernDocument5 pagesAas 16 Going ConcernRishabh GuptaNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Audcap2 Unit 5 EssayDocument3 pagesAudcap2 Unit 5 EssaySel BarrantesNo ratings yet

- CA IPCC Auditing Suggested Answer Nov 2015Document12 pagesCA IPCC Auditing Suggested Answer Nov 2015Siva Narayana Phani MouliNo ratings yet

- Audit Conclusion and ReportingDocument49 pagesAudit Conclusion and ReportingLakshmi Narayana Murthy KapavarapuNo ratings yet

- Day 15 - SAs - SADocument3 pagesDay 15 - SAs - SAVarun JoshiNo ratings yet

- AT.2819 - Performing Review and Other Assurance Services Engagements PDFDocument4 pagesAT.2819 - Performing Review and Other Assurance Services Engagements PDFMaeNo ratings yet

- Chapter 12Document4 pagesChapter 12Nicole Anne M. ManansalaNo ratings yet

- DebateDocument9 pagesDebateWed CornelNo ratings yet

- Paper 6 Ipcc Auditing and Assurance Solution Nov 2015Document13 pagesPaper 6 Ipcc Auditing and Assurance Solution Nov 2015ßãbÿ Ðøll ßəʌʋtɣ QʋɘɘŋNo ratings yet

- Week 5Document7 pagesWeek 5Anonymous HlqjrhNo ratings yet

- Acctg 151 - Forming An Opinion On The FSDocument31 pagesAcctg 151 - Forming An Opinion On The FSTressa Salarza PendangNo ratings yet

- AT 11 Completing The AuditDocument4 pagesAT 11 Completing The AuditPrincess Mary Joy LadagaNo ratings yet

- Circumstances For EOM OM by JADocument2 pagesCircumstances For EOM OM by JAAhmed NisarNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Auditing and Assurance Services Understanding The Integrated Audit 1St Edition Hooks Solutions Manual Full Chapter PDFDocument34 pagesAuditing and Assurance Services Understanding The Integrated Audit 1St Edition Hooks Solutions Manual Full Chapter PDFindicterpointingzbqg2100% (13)

- Review Questions For Removal ExamsDocument1 pageReview Questions For Removal ExamsheeeyjanengNo ratings yet

- Class-5 SA-810Document7 pagesClass-5 SA-810kunal3152No ratings yet

- AT.2818 - Reporting On Specialized Audit Engagements PDFDocument2 pagesAT.2818 - Reporting On Specialized Audit Engagements PDFMaeNo ratings yet

- Isa 210 SummaryDocument2 pagesIsa 210 SummaryirmasuryafNo ratings yet

- What It Does:: With PfrssDocument7 pagesWhat It Does:: With PfrssOlive Jean TiuNo ratings yet

- 19 Special Audit & Non-Audit ConsiderationsDocument7 pages19 Special Audit & Non-Audit Considerationsrandomlungs121223No ratings yet

- Chapter 11Document9 pagesChapter 11Em-em ValNo ratings yet

- Going Concern Material Uncertainty Relating To Going ConcernDocument5 pagesGoing Concern Material Uncertainty Relating To Going ConcernJoel LaguitaoNo ratings yet

- Solutions Manual: Company Accounting 10eDocument36 pagesSolutions Manual: Company Accounting 10eLSAT PREPAU1100% (1)

- Chapter 30 AnswerDocument15 pagesChapter 30 AnswerMjVerbaNo ratings yet

- Case 1-Comprehensive Case On Audit Reports (AICPA Adapted) Items (A) To (G) Present Various Independent Factual Situations An Auditor MightDocument2 pagesCase 1-Comprehensive Case On Audit Reports (AICPA Adapted) Items (A) To (G) Present Various Independent Factual Situations An Auditor MightLisetteDelaRosaNo ratings yet

- NajirDocument50 pagesNajirnajirahmad.coxsNo ratings yet

- Going Concern Uncertainty DisclosureDocument4 pagesGoing Concern Uncertainty Disclosurenancy amooNo ratings yet

- Non Audit Engagements0Document23 pagesNon Audit Engagements0Aaron Joy Dominguez PutianNo ratings yet

- Paper - 3: Advanced Auditing and Professional Ethics: (5 Marks)Document15 pagesPaper - 3: Advanced Auditing and Professional Ethics: (5 Marks)ritz meshNo ratings yet

- Rqach 26Document4 pagesRqach 26Helios HexNo ratings yet

- Chapter 11 THE AUDITORS REPORT ON FINANCIALDocument95 pagesChapter 11 THE AUDITORS REPORT ON FINANCIALJay LloydNo ratings yet

- Chapter 11Document45 pagesChapter 11MangoStarr Aibelle VegasNo ratings yet

- 08 Part-7Document7 pages08 Part-7Mary Joy RarangNo ratings yet

- Konrath 14Document11 pagesKonrath 14MaskurNo ratings yet

- B1.3.2 - Lettre de Mission (English Version) PEDocument3 pagesB1.3.2 - Lettre de Mission (English Version) PEPatienNo ratings yet

- CFAP 6 Winter 2021Document10 pagesCFAP 6 Winter 2021os96529No ratings yet

- Module - IsA 580Document5 pagesModule - IsA 580Atif RehmanNo ratings yet

- Bac2664auditing L4Document19 pagesBac2664auditing L4sueernNo ratings yet

- Audit ReportDocument62 pagesAudit ReportPranay NavvulaNo ratings yet

- Psa 580Document11 pagesPsa 580shambiruarNo ratings yet

- SLAuS 705Document5 pagesSLAuS 705naveen pragashNo ratings yet

- 17-BSA 700 and 705Document16 pages17-BSA 700 and 705Sohel Rana100% (1)

- 55067bos44235p6 Iipc ADocument10 pages55067bos44235p6 Iipc AAshutosh KumarNo ratings yet

- Qualified "Except For" GAAP: Justified Departure Gaap Going Concern: (After Opinion Paragraph)Document11 pagesQualified "Except For" GAAP: Justified Departure Gaap Going Concern: (After Opinion Paragraph)Steffan MilesNo ratings yet

- Acctg 163 Auditing Theory Review 6 TmhsDocument11 pagesAcctg 163 Auditing Theory Review 6 TmhsXaviery John Martinez LunaNo ratings yet

- Auditors Report On Financial StatementDocument13 pagesAuditors Report On Financial Statementaffanq86No ratings yet

- Audit Report: Mark Glenn G. Parpan, CpaDocument41 pagesAudit Report: Mark Glenn G. Parpan, CpaChristine Joy Duterte RemorozaNo ratings yet

- Audit Report-Wps OfficeDocument13 pagesAudit Report-Wps Officebarakas764No ratings yet

- Magsayo - Audit OpinionDocument9 pagesMagsayo - Audit OpinionKaren MagsayoNo ratings yet

- Auditing: Module 4 Forming An Opinion and Reporting On Financial StatementsDocument48 pagesAuditing: Module 4 Forming An Opinion and Reporting On Financial StatementsJohn Archie AntonioNo ratings yet

- Audit Summary Chapter 25Document7 pagesAudit Summary Chapter 25bless villahermosaNo ratings yet

- PSA 700, 705, 706, 710, 720 ExercisesDocument11 pagesPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNo ratings yet

- Discussed September 17 - Extract of ISA 570 - Wording Responsibilities of Management and Auditor SeperateDocument4 pagesDiscussed September 17 - Extract of ISA 570 - Wording Responsibilities of Management and Auditor Seperatesarmalarun20No ratings yet

- Chapter 17 - Test BankDocument52 pagesChapter 17 - Test Bankjuan100% (2)

- Chapter 5 Audit of CFSDocument5 pagesChapter 5 Audit of CFSPrinci Singhal GuptaNo ratings yet

- Paper - 2: Auditing and AssuranceDocument10 pagesPaper - 2: Auditing and AssuranceManas Kumar SahooNo ratings yet

- Auditor's Reporting Amid Covid-19Document12 pagesAuditor's Reporting Amid Covid-19Aniket AhireNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

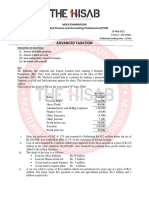

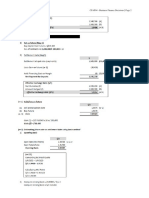

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- Metro Board of Directors Meeting Agenda, January 2021Document21 pagesMetro Board of Directors Meeting Agenda, January 2021Metro Los AngelesNo ratings yet

- What Is Audit MaterialityDocument5 pagesWhat Is Audit MaterialityK.QNo ratings yet

- Project Planning and AnalysisDocument4 pagesProject Planning and Analysisgedisha katolaNo ratings yet

- Ust Global Welfare Foundation Guidelines For Ussociates in IndiaDocument10 pagesUst Global Welfare Foundation Guidelines For Ussociates in IndiaZenk itNo ratings yet

- Auditing Is A Systematic Process of Obtaining and Examining The Transparency and Truth of Financial Records of A Business Entity or The GovernmentDocument3 pagesAuditing Is A Systematic Process of Obtaining and Examining The Transparency and Truth of Financial Records of A Business Entity or The GovernmentAsif RahmanNo ratings yet

- Gros Koch Wallek 2017Document40 pagesGros Koch Wallek 2017EL GHARBAOUINo ratings yet

- Column Fields Field: Additional Navigational AttributesDocument25 pagesColumn Fields Field: Additional Navigational AttributesSajanAndyNo ratings yet

- The Challenges of Whistle Blowing ImplementationDocument22 pagesThe Challenges of Whistle Blowing Implementation146308No ratings yet

- Bfa Issue 47Document96 pagesBfa Issue 47Renato WilsonNo ratings yet

- Fundamentals of Accountancy and Business Management 1Document8 pagesFundamentals of Accountancy and Business Management 1Ms. ArceñoNo ratings yet

- Performing Substatntive TestsDocument18 pagesPerforming Substatntive TestsAlex OngNo ratings yet

- Module 4 - Government AccountingDocument14 pagesModule 4 - Government AccountingJoanna TiuzenNo ratings yet

- Compensation Claims Under WorkmenDocument10 pagesCompensation Claims Under WorkmenBijay Krishna DasNo ratings yet

- Loi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Document2 pagesLoi / Icpo Buyer Profile CIS Ncnd/Imfpa: Proc E DU RE C I F, A SWP: + + + + + +Yrvis100% (1)

- Corporate Governance: Dr. Ir. H. Harry Sutanto, MBADocument58 pagesCorporate Governance: Dr. Ir. H. Harry Sutanto, MBAvieNo ratings yet

- Service TaxDocument24 pagesService TaxkalaswamiNo ratings yet

- Construction Audit SamplesDocument3 pagesConstruction Audit SamplesTuro80% (5)

- MAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Financial Results July 2021Document20 pagesMAHINDRA AND MAHINDRA FINANCIAL SERVICES LTD. Financial Results July 2021mukesh bhattNo ratings yet

- U-Ap-2 - Other IncomeDocument3 pagesU-Ap-2 - Other IncomeJoann Saballero HamiliNo ratings yet

- Statement of FactsDocument32 pagesStatement of FactsThe Ultra IndiaNo ratings yet

- Accounting IA Sample Unit 1Document23 pagesAccounting IA Sample Unit 1CandiceNo ratings yet

- CV - 2Document3 pagesCV - 2Luba GusevaNo ratings yet

- Auditing Theory CabreraDocument23 pagesAuditing Theory CabreraGem Alcos Nicdao100% (2)

- Budgeting and FinancingDocument3 pagesBudgeting and FinancingMondrei TVNo ratings yet

- Innovative and Cost-Effective Solution: With Free Accounting SoftwareDocument4 pagesInnovative and Cost-Effective Solution: With Free Accounting Softwarekloudac accountingNo ratings yet

- About The Co-Operative Society: Karnataka University DharwadDocument62 pagesAbout The Co-Operative Society: Karnataka University DharwadArun SavukarNo ratings yet

- PIChE Panay General AssemblyDocument30 pagesPIChE Panay General AssemblyCharles Arthel ReyNo ratings yet

- SIC Meeting Materials 5-27-14Document213 pagesSIC Meeting Materials 5-27-14Rob NikolewskiNo ratings yet

- Audit of Cash BalancesDocument33 pagesAudit of Cash BalancesLouis ValentinoNo ratings yet

- Chemfab Alkalies PDFDocument118 pagesChemfab Alkalies PDFSoundaryaNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet