Professional Documents

Culture Documents

Gearing: CFAP04 - Business Finance Decisions - Page 12

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gearing: CFAP04 - Business Finance Decisions - Page 12

Uploaded by

SR TGCopyright:

Available Formats

CFAP04 - Business Finance Decisions | Page 12

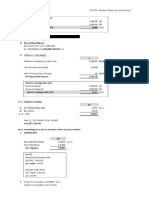

Gearing

WFHL current debt/equity (book value basis) = 30/20 × 100% = 150%

After bond issue debt/equity = 45/20 × 100% = 225%

Average debt/equity = 80%

WFHL is currently very highly geared with a debt to equity ratio based on book values of almost twice

that of the average of similar companies. A bond issue would increase the gearing to even higher levels.

Interest coverage

WFHL interest coverage ratio = 12/3 = 4 times

After bond issue interest coverage ratio = 12/(3 + (1.5) = 2.7 times

Average interest coverage ratio = 8 times

WFHL currently has half the interest coverage of similar companies which indicates a much higher level

of financial risk. The bond issue would further increase this risk and WFHLuld have difficulty making the

interest payments.

The interest on the existing loan notes is Rs.2.4 million (8% × Rs.30 million) and the total interest charge

in the income statement is Rs.3 million. This implies that WFHL also has an overdraft which further

increases the level of financial risk.

Lack of investment opportunities

There are currently no suitable investment opportunities available and the bond issue proceeds would be

invested short-term. The return on short-term investments will be lower than the interest charged on the

loan notes, so there will be an opportunity cost which will decrease shareholder wealth. There is a

significant risk that a suitable investment opportunity requiring exactly Rs.15 million will not be found.

Loan redemption

The current loan notes are due to be redeemed in three years’ time and this would be followed five years

later by a repayment of the bond issue. This raises issues for the financial planning of the company which

needs to consider how best to refinance.

Conclusion

The proposal to make a bond issue should be rejected as the level of financial risk is already too high.

(c)

Proposal C – Rights issue

Rights issue price = Rs.2.30 × 80% = Rs.1.84

Theoretical ex-rights price

Rs.

4 shares @ Rs.2.30 9.20

1 share @ Rs.1.84 1.84

11.04

Theoretical ex-rights price (TERP) = 11.04/5 = Rs.2.21

Number of new shares to be issued = (5/0.5)/4 = 2.5 million

Amount of finance that would be raised = Rs.1.84 × 2.5 million = Rs.4.6 million

Gearing

Current debt/equity = 30/20 = 150%

After rights issue debt/equity = 30/24.6 = 122%

You might also like

- Week 6 Tutorial Answers (PAVLON, DD & ECHO)Document6 pagesWeek 6 Tutorial Answers (PAVLON, DD & ECHO)ZHUN HONG TANNo ratings yet

- Cost CapitalDocument28 pagesCost Capitalaliashour123No ratings yet

- Capital Structure - Chapter 16, Eugene Brigham-GeneralDocument9 pagesCapital Structure - Chapter 16, Eugene Brigham-GeneralMahmud PalashNo ratings yet

- Debt (Or Leverage) Management RatiosDocument4 pagesDebt (Or Leverage) Management RatiosJohn MuemaNo ratings yet

- Financial Management 29Document8 pagesFinancial Management 29sourav113No ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisAnu VenkateshNo ratings yet

- M05 Brooks266675 01 FM C05Document37 pagesM05 Brooks266675 01 FM C05Shanekia Lawson-WellsNo ratings yet

- Financial Management Q&ADocument8 pagesFinancial Management Q&AGracianne Santos- JulitoNo ratings yet

- CH 05Document40 pagesCH 05saeed75.ksaNo ratings yet

- FIN 9781 Midterm 2Document2 pagesFIN 9781 Midterm 2Thabata RibeiroNo ratings yet

- Common Stock ValuationDocument40 pagesCommon Stock ValuationAhsan IqbalNo ratings yet

- Fundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual 1Document36 pagesFundamentals of Corporate Finance 3rd Edition Parrino Solutions Manual 1michaelhooverspnjdgactf100% (19)

- Brooks 3e PPT 05Document40 pagesBrooks 3e PPT 05Vy HoàngNo ratings yet

- Leverages 1Document33 pagesLeverages 1mahato28No ratings yet

- Corporate Finance 4Document2 pagesCorporate Finance 4Mujtaba AhmadNo ratings yet

- LeverageDocument31 pagesLeverageRuchi MalviyaNo ratings yet

- Chapter 13Document9 pagesChapter 13Marki MendinaNo ratings yet

- Selected Tutorial Solutions - Week 8Document4 pagesSelected Tutorial Solutions - Week 8qhayyumNo ratings yet

- Interest Rate and Security ValuationDocument16 pagesInterest Rate and Security ValuationMUYCO RISHELNo ratings yet

- Eep Msree Lec 3 WaccDocument19 pagesEep Msree Lec 3 WaccRamendra KumarNo ratings yet

- Telus Cost of CapitalDocument31 pagesTelus Cost of Capitallogwinner86% (7)

- 4-Time Value of MoneyDocument35 pages4-Time Value of Moneysherif_awad100% (1)

- Finance Chapter4 AnswersDocument4 pagesFinance Chapter4 AnswersyumnaNo ratings yet

- Liquidity Ratios Calculation Formulas and Explanations: Acid Test RatioDocument14 pagesLiquidity Ratios Calculation Formulas and Explanations: Acid Test RatioPavithira MalligaNo ratings yet

- MAE203P 2017 TL+201+-+Memorandum+ASSIGNMENT+2 Semester+1Document8 pagesMAE203P 2017 TL+201+-+Memorandum+ASSIGNMENT+2 Semester+1Matome100% (2)

- Financial Management - Mba Question AnswersDocument40 pagesFinancial Management - Mba Question AnswersVenkata Narayanarao Kavikondala93% (28)

- Unit # 4 Present Value For Cash FlowsDocument8 pagesUnit # 4 Present Value For Cash FlowsZaheer Ahmed SwatiNo ratings yet

- (#3) Basic Concepts of Risk and Return, and The Time Value of MoneyDocument22 pages(#3) Basic Concepts of Risk and Return, and The Time Value of MoneyBianca Jane GaayonNo ratings yet

- Debt Service Coverage Ratio (DSCR) : ValuationDocument17 pagesDebt Service Coverage Ratio (DSCR) : ValuationRh MeNo ratings yet

- Cost of CapitalDocument23 pagesCost of CapitalAsad AliNo ratings yet

- Capital Structure and LeverageDocument19 pagesCapital Structure and Leverageemon hossainNo ratings yet

- Week 1 Calculate Future Value and Present Value of Money: Business FinanceDocument6 pagesWeek 1 Calculate Future Value and Present Value of Money: Business FinanceTwelve Forty-fourNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- Finman Modules Chapter 5Document9 pagesFinman Modules Chapter 5Angel ColarteNo ratings yet

- Lecture 3 - Time Value of MoneyDocument22 pagesLecture 3 - Time Value of MoneyJason LuximonNo ratings yet

- ANSWERS For ExercisesDocument13 pagesANSWERS For ExercisesAlia HazwaniNo ratings yet

- Stock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Document19 pagesStock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Diệu QuỳnhNo ratings yet

- Determinants of Interest Rates (Revilla & Sanchez)Document12 pagesDeterminants of Interest Rates (Revilla & Sanchez)Kearn CercadoNo ratings yet

- Sources of Short-Term Financing: Discussion QuestionsDocument28 pagesSources of Short-Term Financing: Discussion QuestionsДр. ЦчатерйееNo ratings yet

- Ratio AnalysisDocument11 pagesRatio AnalysisPrashant BhadauriaNo ratings yet

- Chapter 8 - End - of - Chapter - Problems - SolDocument18 pagesChapter 8 - End - of - Chapter - Problems - SolGaby TaniosNo ratings yet

- Corporate Finance, Home AssignmentDocument17 pagesCorporate Finance, Home Assignmentsyedsuhail20014u8724100% (9)

- Time Value of MoneyDocument37 pagesTime Value of MoneyNicole PunzalanNo ratings yet

- Discounted Cash Flow - WikipediaDocument6 pagesDiscounted Cash Flow - Wikipediapuput075No ratings yet

- A2b. Sources of FinanceDocument3 pagesA2b. Sources of FinanceVrinda ForbesNo ratings yet

- CF 4Document49 pagesCF 4Siddhartha SharmaNo ratings yet

- 2nd ArticleDocument145 pages2nd ArticleFatima NaeemNo ratings yet

- Answers - Cost of Capital Wallmart Inc.Document11 pagesAnswers - Cost of Capital Wallmart Inc.Arslan HafeezNo ratings yet

- F9 Solution To Crash Course June 2021 (20.5)Document60 pagesF9 Solution To Crash Course June 2021 (20.5)Dodod DididoNo ratings yet

- Chapter 4 SolutionsDocument14 pagesChapter 4 Solutionshassan.murad82% (11)

- Fin 500 Quiz QuestionsDocument14 pagesFin 500 Quiz QuestionsRakesh RaiNo ratings yet

- 07 Capital Structure and LeverageDocument25 pages07 Capital Structure and LeverageRishabh SarawagiNo ratings yet

- Mid Test IB1708 SE161403 Nguyễn Trọng BằngDocument14 pagesMid Test IB1708 SE161403 Nguyễn Trọng BằngNguyen Trong Bang (K16HCM)No ratings yet

- INTERESTDocument25 pagesINTERESTabdiel50% (2)

- SLM Unit 05 Mbf201Document19 pagesSLM Unit 05 Mbf201Pankaj KumarNo ratings yet

- Wrigley Gum 21Document18 pagesWrigley Gum 21Fidelity RoadNo ratings yet

- Business Finance 7Document25 pagesBusiness Finance 7Trisha ElecerioNo ratings yet

- Time Value of Money Ahmed HassanDocument41 pagesTime Value of Money Ahmed HassanKamrul HasanNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- A.8 A) There Are Two Issues of Which Evaluation Is Below: InventoryDocument1 pageA.8 A) There Are Two Issues of Which Evaluation Is Below: InventorySR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- Long Term Finance: Prepared by Dr. Santosh Solanki Lnct-MbaDocument30 pagesLong Term Finance: Prepared by Dr. Santosh Solanki Lnct-MbaShivamNo ratings yet

- Manage Overdue Coustmer AccountDocument19 pagesManage Overdue Coustmer AccountNigussie BerhanuNo ratings yet

- BudgetDocument18 pagesBudgetembiale ayalu100% (1)

- AUDITOFINTANGIBLESDocument5 pagesAUDITOFINTANGIBLESPar Cor0% (1)

- Bank Reconciliation StatementDocument32 pagesBank Reconciliation StatementMuhammad Arslan100% (2)

- Basic Q&A Balance SheetDocument6 pagesBasic Q&A Balance SheetKunal Khaparkar patilNo ratings yet

- Extra Questions - A LevelDocument8 pagesExtra Questions - A LevelMUSTHARI KHANNo ratings yet

- PCTE Group of Institutes, Ludhiana: Presentation Synopsis TopicDocument8 pagesPCTE Group of Institutes, Ludhiana: Presentation Synopsis TopicManmeetNo ratings yet

- Republic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionDocument37 pagesRepublic of The Philippines Congress of The Philippines Metro Manila Fourteenth Congress Third Regular SessionCiara De LeonNo ratings yet

- Audit Objectives: Audipra Substantive Test of CASHDocument5 pagesAudit Objectives: Audipra Substantive Test of CASHGirl langNo ratings yet

- Cash Receipts Journal PDFDocument1 pageCash Receipts Journal PDFMilena AckovicNo ratings yet

- Performance Standard: The Learners Are Able To Define Finance, Describe Who Are Responsible ForDocument37 pagesPerformance Standard: The Learners Are Able To Define Finance, Describe Who Are Responsible ForArjae DantesNo ratings yet

- Unit 7 - Debentures and ChargesDocument2 pagesUnit 7 - Debentures and Chargesgillian soonNo ratings yet

- CSEC POA January 2011 P2Document10 pagesCSEC POA January 2011 P2Jael BernardNo ratings yet

- Law REVIEWERDocument9 pagesLaw REVIEWERJaymie NeriNo ratings yet

- Accounting 1Document146 pagesAccounting 1Touhidul IslamNo ratings yet

- First, The Payment Has Two Requisites, Identity and IntegrityDocument3 pagesFirst, The Payment Has Two Requisites, Identity and IntegrityMa. Ermina Mae CelestraNo ratings yet

- 0 - 297-Accountancy True False QuestionsDocument19 pages0 - 297-Accountancy True False QuestionsMishal60% (5)

- Accounting Process: Unit - 1 Basic Accounting Procedures - Journal EntriesDocument113 pagesAccounting Process: Unit - 1 Basic Accounting Procedures - Journal Entriesyash jain100% (1)

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- 1.all Contract Are Agreements, But All Agreements Are Not Contract-DiscussDocument8 pages1.all Contract Are Agreements, But All Agreements Are Not Contract-DiscussajitncstNo ratings yet

- To Accrue Advertising Expense: I PXRXTDocument6 pagesTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Types of Project ContractsDocument8 pagesTypes of Project ContractsAnkushNo ratings yet

- ACC Final Exam S1 2022 Marking CriteriaDocument10 pagesACC Final Exam S1 2022 Marking CriteriaVikash PatelNo ratings yet

- To Wed Jan 31 23:59:59 IST 2024 Rajakumar PrecellaDocument1 pageTo Wed Jan 31 23:59:59 IST 2024 Rajakumar PrecellaPrecella RajkumarNo ratings yet

- The Merchant of Venice: William ShakespeareDocument9 pagesThe Merchant of Venice: William ShakespearebpxamzNo ratings yet

- Cash and Cash EquivalentsDocument43 pagesCash and Cash EquivalentsInsatiable LifeNo ratings yet

- Chapter 4 - Financial Statements of CompaniesDocument198 pagesChapter 4 - Financial Statements of CompaniesVaidehee MishraNo ratings yet

- Kertas Kerja Siklus AkuntansiDocument13 pagesKertas Kerja Siklus AkuntansiNando Dista SaputraNo ratings yet

- Tutorial 5 QsDocument7 pagesTutorial 5 QsDarren Khew0% (1)