Professional Documents

Culture Documents

A.8 A) There Are Two Issues of Which Evaluation Is Below: Inventory

Uploaded by

SR TGOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A.8 A) There Are Two Issues of Which Evaluation Is Below: Inventory

Uploaded by

SR TGCopyright:

Available Formats

- A review of subsequent events for additional evidence on the valuation of the investment

properties

- We can also engage auditor expert for ensuring reasonableness of the assumption and

valuation techniques.

A.8

a) There are two issues of which evaluation is below

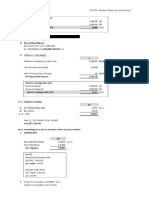

Inventory:

Inventory should be valued at the lower of cost and net realisable value in accordance with IAS 2

Inventories. The overvaluation of 2.7 million was identified in the year ended 30 September 2019

and should have been written off then. It should not be written off over three years.

Inventory is therefore overvalued by Rs. 0.9 million in the year ended 30 September 2020. This

represents 5.6% of Titman’s total assets and 129% of the profit before tax and is therefore clearly

material. In the prior year, inventory would have been overvalued by Rs. 1.8 million, so the

reported profit then should actually have been a loss.

The prior period’s audit report was unqualified, implying that the previous auditor either agreed

with the accounting treatment or issued an inappropriate opinion on the financial statements for

the year ended 30 September 2019. A prior period adjustment is required in accordance with IAS

8 Accounting policies, changes in accounting estimates and errors, so the comparative figures for

the preceding period should be restated in the financial statements and notes and an adjustment

made to the opening balances of reserves for the cumulative effect, as well as being disclosed

appropriately.

Provision

A provision for Rs. 2.3 million has been made in Titman’s accounts for the redundancies and

noncancellable lease payments that would result from the restructuring. This represents 14% of

the total assets for the year and is very material. According to IAS 37 Provisions, contingent

liabilities and contingent assets, a provision should only be recognised if an entity has a present

obligation (legal or constructive) as a result of a past event, it is probable that a transfer of

economic benefits will be required to settle the obligation and a reliable estimate can be made of

the amount of the obligation.

In this case, it is likely that there was a recent obligation at the date of the statement of financial

position, given that Titman was acquired sometime in September 2020 and therefore very close to

the end of the reporting period. Furthermore the provision for restructuring costs should only be

recognised if a formal plan had been prepared and a public announcement made of the plan. If

this had not happened, the provision should not have been recognised in the accounts for the year

ended 30 September 2020. The restructuring should, however, be disclosed in the accounts for the

year ended 30 September 2020 as a non-adjusting event in accordance with IAS 10 Event after

the reporting period.

7|Page

You might also like

- C12 - Interim Financial ReportingDocument65 pagesC12 - Interim Financial ReportingKlare JimenoNo ratings yet

- Revenue Ifrs 15Document24 pagesRevenue Ifrs 15kimuli FreddieNo ratings yet

- Financial Reporting Final AttemptedDocument10 pagesFinancial Reporting Final AttemptedMAGOMU DAN DAVIDNo ratings yet

- Interim ReportingDocument5 pagesInterim ReportingPat QuiaoitNo ratings yet

- Report of The Auditor-General On The Public Accounts of Ghana (General Government) For The Year Ended 31 December 2022Document386 pagesReport of The Auditor-General On The Public Accounts of Ghana (General Government) For The Year Ended 31 December 2022The Independent GhanaNo ratings yet

- Lugait Executive Summary 2018Document4 pagesLugait Executive Summary 2018OZ La NB AnamiNo ratings yet

- What Is GSTR-9C?: ReconciliationDocument7 pagesWhat Is GSTR-9C?: ReconciliationJatin ChoudaryNo ratings yet

- Continous Assignment 2: Mittal School of BusinessDocument8 pagesContinous Assignment 2: Mittal School of BusinessMd UjaleNo ratings yet

- Group Assignments Acc 217Document4 pagesGroup Assignments Acc 217Phebieon MukwenhaNo ratings yet

- Numeric Value of Nomenclature As44Document10 pagesNumeric Value of Nomenclature As44Pramad BhattacharjeeNo ratings yet

- Session 8Document12 pagesSession 8Adil AnwarNo ratings yet

- Interim Financial ReportingDocument20 pagesInterim Financial ReportingToni Rose Hernandez LualhatiNo ratings yet

- FAR - Interim Financial ReportingDocument3 pagesFAR - Interim Financial ReportingDale JimenoNo ratings yet

- Republic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesDocument4 pagesRepublic of The Philippines Commonwealth Avenue, Quezon City, PhilippinesJan Carlo SanchezNo ratings yet

- Issuance of Tax Invoice Credit Note Debit Note After 1st Sept 2018 CKSCP 080519Document14 pagesIssuance of Tax Invoice Credit Note Debit Note After 1st Sept 2018 CKSCP 080519Victoria ChNo ratings yet

- Case Study Fa5Document3 pagesCase Study Fa5ra raNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- 1 Tax Audit ConsolDocument199 pages1 Tax Audit Consolrishi Kr.No ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingBea ChristineNo ratings yet

- Interim Financial ReportingDocument37 pagesInterim Financial ReportingDebbie Grace Latiban LinazaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiaRobinxyNo ratings yet

- FAR.2950 - Interim Financial ReportingDocument3 pagesFAR.2950 - Interim Financial ReportingEdmark LuspeNo ratings yet

- 30 As26Document11 pages30 As26Selvi balanNo ratings yet

- T3 EmployeeDocument4 pagesT3 EmployeeLe YenNo ratings yet

- FAR.2850 - Interim Financial Reporting.Document4 pagesFAR.2850 - Interim Financial Reporting.Ashley LegaspiNo ratings yet

- Indasitfg 42666Document21 pagesIndasitfg 42666sneh bansalNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Mid-Term Revision Exercises (ch4-5)Document3 pagesMid-Term Revision Exercises (ch4-5)Cheuk Ying NicoleNo ratings yet

- Week 9 AuditingDocument2 pagesWeek 9 AuditingYusef ShaqeelNo ratings yet

- IFRS AND IAS of AuditDocument11 pagesIFRS AND IAS of AuditAvinash KumarNo ratings yet

- Chapter 19 Interim ReportingDocument6 pagesChapter 19 Interim ReportingEllen MaskariñoNo ratings yet

- 10-MWSS2020 Part2-Observations and RecommDocument91 pages10-MWSS2020 Part2-Observations and RecommGabriel OrolfoNo ratings yet

- Quarterly Report March 2020 1Document16 pagesQuarterly Report March 2020 1Meera KhanNo ratings yet

- MPRA Paper 36783Document8 pagesMPRA Paper 36783ksmuthupandian2098No ratings yet

- Interim Financial ReportingDocument10 pagesInterim Financial ReportingJoyce Ann Agdippa BarcelonaNo ratings yet

- GST Audit PowerpointDocument62 pagesGST Audit PowerpointBiswakesh PatiNo ratings yet

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument35 pagesDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNo ratings yet

- Question 1Document2 pagesQuestion 1nabayeelNo ratings yet

- ITFG - Bulletin 9Document7 pagesITFG - Bulletin 9TanviNo ratings yet

- (VALIX) InterimDocument22 pages(VALIX) InterimMaeNo ratings yet

- Nov 18 PaperDocument21 pagesNov 18 Paperritz meshNo ratings yet

- NFRS AuditDocument32 pagesNFRS AuditBidhan Sapkota100% (1)

- 2020 - PFRS For SEs NotesDocument16 pages2020 - PFRS For SEs NotesRodelLabor100% (1)

- Press Release Clarification Regarding Annual Returns and Reconciliation StatementDocument3 pagesPress Release Clarification Regarding Annual Returns and Reconciliation StatementSujata OjhaNo ratings yet

- Atok Benguet Source3 PDFDocument4 pagesAtok Benguet Source3 PDFkaye carrancejaNo ratings yet

- National Code: To Inform Yau of and CondudedDocument12 pagesNational Code: To Inform Yau of and CondudedKhush GosraniNo ratings yet

- CR Mock 03.11.2022Document7 pagesCR Mock 03.11.2022George NicholsonNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- Executive Summary: Highlights of Financial OperationsDocument12 pagesExecutive Summary: Highlights of Financial OperationsJaniceNo ratings yet

- Amendments FA 2018 Dec2019 PDFDocument14 pagesAmendments FA 2018 Dec2019 PDFYash GargNo ratings yet

- Final Qualifications For 18-19Document3 pagesFinal Qualifications For 18-19raj pandeyNo ratings yet

- Chapter 8 Tax AdministrationDocument14 pagesChapter 8 Tax AdministrationHazlina Hussein100% (1)

- SBR June 2023 ANSWERS To Revision 4Document14 pagesSBR June 2023 ANSWERS To Revision 4Maria AgathocleousNo ratings yet

- Solutions Tutorial Questions 02 BUSN7050Document5 pagesSolutions Tutorial Questions 02 BUSN7050peter kong100% (1)

- Agusan Del Sur Executive Summary 2018Document8 pagesAgusan Del Sur Executive Summary 2018Sittie Fatma ReporsNo ratings yet

- Auditor ReportDocument3 pagesAuditor ReportMuhd Zulhusni MusaNo ratings yet

- IAS 10 Events After The Reporting Period-A Closer LookDocument7 pagesIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaNo ratings yet

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocument11 pagesAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The Restritz meshNo ratings yet

- Ifric-1 Changes in Existing Decommissioning, Restoration (Prior Knowledge)Document16 pagesIfric-1 Changes in Existing Decommissioning, Restoration (Prior Knowledge)Aounaiza AhmedNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- B) Impact On Audit Report: Effect On The Audit Report of TitmanDocument1 pageB) Impact On Audit Report: Effect On The Audit Report of TitmanSR TGNo ratings yet

- Corporate Laws: Certified Finance and Accounting Professional (CFAP)Document1 pageCorporate Laws: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- D) The Main Differences Between ML and TF AreDocument1 pageD) The Main Differences Between ML and TF AreSR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- SaDocument1 pageSaSR TGNo ratings yet

- Required:: (End of Paper)Document1 pageRequired:: (End of Paper)SR TGNo ratings yet

- RequiredDocument1 pageRequiredSR TGNo ratings yet

- Audit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageDocument1 pageAudit, Assurance and Related Services: Mock Examination Certified Finance and Accounting Professional StageSR TGNo ratings yet

- Vi. Foreign Currency RiskDocument1 pageVi. Foreign Currency RiskSR TGNo ratings yet

- Audit, Assurance and Related Services: A.1 I. Fraud Risk FactorsDocument1 pageAudit, Assurance and Related Services: A.1 I. Fraud Risk FactorsSR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 3Document1 pageCFAP04 - Business Finance Decisions - Page 3SR TGNo ratings yet

- Interest Coverage: CFAP04 - Business Finance Decisions - Page 13Document1 pageInterest Coverage: CFAP04 - Business Finance Decisions - Page 13SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 6Document1 pageCFAP04 - Business Finance Decisions - Page 6SR TGNo ratings yet

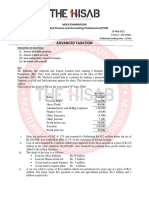

- Advanced Taxation: Certified Finance and Accounting Professional (CFAP)Document1 pageAdvanced Taxation: Certified Finance and Accounting Professional (CFAP)SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 9Document1 pageCFAP04 - Business Finance Decisions - Page 9SR TGNo ratings yet

- Gearing: CFAP04 - Business Finance Decisions - Page 12Document1 pageGearing: CFAP04 - Business Finance Decisions - Page 12SR TGNo ratings yet

- Business Finance Decisions (Solution Set)Document1 pageBusiness Finance Decisions (Solution Set)SR TGNo ratings yet

- Q5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11Document1 pageQ5. Marking Scheme: CFAP04 - Business Finance Decisions - Page 11SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- Rs. Million: The HISAB School of AccountancyDocument1 pageRs. Million: The HISAB School of AccountancySR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 2Document1 pageCFAP04 - Business Finance Decisions - Page 2SR TGNo ratings yet

- The HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4Document1 pageThe HISAB School of Accountancy: CFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 8Document1 pageCFAP04 - Business Finance Decisions - Page 8SR TGNo ratings yet

- CFAP04 - Business Finance Decisions - Page 4Document1 pageCFAP04 - Business Finance Decisions - Page 4SR TGNo ratings yet

- SL AL: The HISAB School of AccountancyDocument1 pageSL AL: The HISAB School of AccountancySR TGNo ratings yet

- Business Finance DecisionsDocument1 pageBusiness Finance DecisionsSR TGNo ratings yet

- BM-Lecture 1-CN-2023-2024-compressedDocument50 pagesBM-Lecture 1-CN-2023-2024-compressedNassiba BenazzouzNo ratings yet

- Topic 3 - IAS 36-SVDocument36 pagesTopic 3 - IAS 36-SVHONG NGUYEN THI KIMNo ratings yet

- 401 Epm QP NDDocument2 pages401 Epm QP NDvipul rathodNo ratings yet

- International BankingDocument20 pagesInternational Bankingamit098765432150% (6)

- University of Cambridge International Examinations International General Certificate of Secondary EducationDocument20 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary EducationYeNo ratings yet

- Chapter FIVEDocument14 pagesChapter FIVEannisaNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasRoghayeh MOUSAVISAGHARCHINo ratings yet

- M and N 1Document1 pageM and N 1DDdNo ratings yet

- Bond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Document3 pagesBond Valuation: Reference: Financial Management Fundamentals by E. Brigham, 12 Edition (Chapter 10)Mary Yvonne AresNo ratings yet

- FRM Part 1 Study PlanDocument6 pagesFRM Part 1 Study PlanLaurent KoolsNo ratings yet

- Bonds QuestionDocument3 pagesBonds QuestionZvioule Ma FuentesNo ratings yet

- Mergers and Acquisitions Toolkit - Overview and ApproachDocument55 pagesMergers and Acquisitions Toolkit - Overview and ApproachMaria AngelNo ratings yet

- Quiz Week 2Document6 pagesQuiz Week 2Riri FahraniNo ratings yet

- Do You Know Your Cost of CapitalDocument12 pagesDo You Know Your Cost of CapitalSazidur RahmanNo ratings yet

- Jaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesDocument72 pagesJaypee Business School: Comparative Analysis of Sharekhan Ltd. With Other Stock Broking HousesLOKESH CHAUDHARYNo ratings yet

- Equity Analysis in Oil & Gas Sector: Summer Internship Report 2019Document87 pagesEquity Analysis in Oil & Gas Sector: Summer Internship Report 2019Abhi PujaraNo ratings yet

- Business Plan ConceptDocument5 pagesBusiness Plan ConceptConflicted YeetusNo ratings yet

- Group Exercises IFRS For SMEs - 2012Document14 pagesGroup Exercises IFRS For SMEs - 2012lorenbeatulalianNo ratings yet

- Graduation Project Report: Modelling Liquidity Dynamics in North America's Stock MarketsDocument66 pagesGraduation Project Report: Modelling Liquidity Dynamics in North America's Stock MarketsKhalil M'hamedNo ratings yet

- Financial Management Assignment 2Document4 pagesFinancial Management Assignment 2BettyNo ratings yet

- ANALISIS WINDOW DRESSING PADA PERUSAHAAN PERTAMBANGAN YANG TERDAFTAR DI BURSA EFEK INDONESIA PERIODE 2018 - 2020 (Jurnal3)Document24 pagesANALISIS WINDOW DRESSING PADA PERUSAHAAN PERTAMBANGAN YANG TERDAFTAR DI BURSA EFEK INDONESIA PERIODE 2018 - 2020 (Jurnal3)Akun Boneka 01No ratings yet

- MGT 201Document7 pagesMGT 201عباس ناناNo ratings yet

- Accrualschap 10Document33 pagesAccrualschap 10Munyaradzi Onismas ChinyukwiNo ratings yet

- Republic Planters v. AganaDocument2 pagesRepublic Planters v. AganaVanya Klarika NuqueNo ratings yet

- Principles of Business Finance Fin 510: Dr. Lawrence P. Shao Marshall University Spring 2002Document23 pagesPrinciples of Business Finance Fin 510: Dr. Lawrence P. Shao Marshall University Spring 2002trillion5No ratings yet

- Handout - Chapter 9 - NPV and Other Investment CriteriaDocument65 pagesHandout - Chapter 9 - NPV and Other Investment CriteriaNhư Quỳnh Dương ThịNo ratings yet

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- Quiz 2 Investments - QuestionsDocument1 pageQuiz 2 Investments - QuestionsJessica Marie MigrasoNo ratings yet

- Equity ValuationDocument18 pagesEquity ValuationsharmilaNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument4 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet