Professional Documents

Culture Documents

Shriram New Shri Vidya plan for child's education

Uploaded by

Surekha HolagundiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shriram New Shri Vidya plan for child's education

Uploaded by

Surekha HolagundiCopyright:

Available Formats

Shriram New Shri Vidya

A Non-Linked Participating Life Insurance Individual Savings Plan

UIN: 128N051V02

Shriram New Shri Vidya 1

Your child’s future is the most important concern

for you. With the soaring educational expenses

in today’s life, giving good education will be

tough unless it is planned. We have Shriram

New Shri Vidya plan designed for you to make

your child’s aspirations come true. The plan

offers survival benefits to adjust according to

your child’s education requirements and also

insurance cover in case of any unfortunate event

happens to you.

2 Shriram New Shri Vidya

Key Features

Reversionary Sum assured plus Additional sum Attractive high sum Additional

Bonuses to stream of monthly assured to suit your assured rebates protection

enhance your income on death child’s educational through riders

savings and life to offset monetary requirements

cover losses

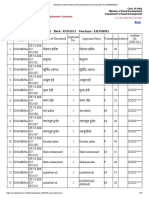

Plan Eligibility

Eligibility Conditions Limits

Minimum: 18 years (age last birthday)

Age at Entry

Maximum: 50 years (age last birthday)

Minimum: 28 years (age last birthday)

Maturity Age

Maximum: 70 years (age last birthday)

Policy Term 10 15 20 25

Premium Paying Term 10 8, 10, 15 20 25

Minimum: Rs. 1,00,000

Sum Assured

Maximum: No limit, subject to Board approved underwriting policy.

Minimum Annualised Premium Rs. 8,000

Mode of Premium Payment Yearly, Half yearly, Quarterly, Monthly

Shriram New Shri Vidya 3

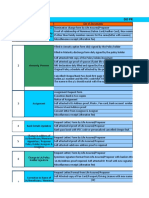

Sample Illustration

Arun, a 30 year old man with a 6 year old daughter, saves money with Shriram New Shri Vidya. He saves to ensure

he has sufficient funds for his daughter’s higher education once she turns 18 years old. He opts for a Policy Term of 15

years, with Premium Payment Term of 10 years and a Sum Assured of Rs. 4 lakhs for which he pays an Annual Premium

of Rs. 49,480 + taxes.

The following illustrations explain the 2 possible scenarios that can occur provided the policy is in force –

1) If Arun survives till the end of the Policy Term (Maturity)

Survival Benefit

`1 `1 `1 `1

Paid Rs. 49,480 p.a. for 10 years lakh lakh lakh lakh

Maturity Benefit

@ 4% - Rs. 1,20,000

@ 8% - Rs. 3,51,000

Policy year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

End Policy

Policy of Premium Maturity

Starts Payment Term

Total Benefits

@4% - Rs. 5,20,000

@8% - Rs. 7,51,000

Daughter’s

Age 6 18 21

Arun will get a Survival Benefit* of Rs. 1,00,000 at the end of each of the last 4 policy years. In addition, he will get

Accrued Reversionary Bonus plus Terminal Bonus on Maturity*. The total benefits he will receive over these 15 years

will be Rs. 5,20,000 (@4%) / Rs. 7,51,000(@8%). In case of his death anytime during the Policy Term, the nominee(s)/

beneficiary(ies) will get the Death Benefit* and the policy terminates.

2) If Arun dies during 1st policy year (Death during the Policy Term)

2) If Arun dies during 1st policy year (Death during the Policy Term)

Death Benefit `1 `1 `1 `1

Paid @4% - Rs. 4,08,000 lakh lakh lakh lakh

Rs. 49,480 @8% - Rs. 4,18,000

Policy year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Policy End of

Starts Policy Term

Family inome Benefit of Rs. 4,000 (1% of S.A.) is paid every month

Total Benefits

@4% - Rs. 15,04,000

Daughter’s @8% - Rs. 15,14,000

Age 6 18 21

4 Shriram New Shri Vidya

Arun paid 1 annual premium and dies during the 7th Terminal Bonus

month of the policy. His nominee(s)/beneficiary(ies) will The Company may pay a Terminal Bonus on death or

receive the following as death benefit* - maturity. The Terminal Bonus will be declared based on

• A lump sum amount of Rs. 4,08,000 (@4%) / Rs. the underlying experience of the participating fund and

4,18,000 (@8%) is paid immediately on death asset shares of the policies.

• A monthly income of Rs. 4,000 is paid till the end of To enjoy maximum benefits and receive all the bonuses

the Policy Term it is advisable to pay all the premiums for the full premium

• Rs. 1,00,000 is paid at the end of each of the last four paying term.

years of the Policy Term Death Benefit

The total benefits received by nominee(s)/beneficiary(ies) In case of death of the life assured during the policy

from this plan will be Rs. 15,04,000 (@4%) / Rs. 15,14,000 term, provided all the due premiums have been paid,

the following benefits are paid to the nominee or

(@8%)

beneficiary.

*As mentioned in section “Benefits under the Plan” 1. Sum assured on death

Note – The benefits mentioned @4% and @8% 2. Accrued Reversionary Bonuses plus Terminal

investment scenarios are only indicative and may vary Bonus, if any, immediately on death.

based on company’s experience Sum assured on death shall be higher of

• 10 times the annual premium if age is less than 45

years and 7 times the annual premium if age is 45

Benefits under the Plan

years and above.

• basic sum assured plus additional death benefit

Reversionary Bonuses

Where

The policy will share in the experience of the Company’s ‘Annualized premium’ means the premium payable

participating business through the declaration of Simple in a year chosen by the policyholder excluding taxes,

underwriting extra premiums, rider premiums and

Reversionary Bonuses, if any, including Interim Bonuses

loadings for modal premiums, if any.

attached to the policy to date. Reversionary Bonus rates

Additional death benefit is the discounted value at the

may vary from year to year and will depend on actual end of the year of death of

experience and prevailing and expected economic a) 25% of basic sum assured paid at the end of each

conditions. Simple Reversionary Bonuses (as a % of Sum of the last four years of the policy and

Assured) shall be declared every year after conducting b) Family income benefit i.e the monthly income benefit

valuation exercise. The bonus declared shall be added of 1% of the basic sum assured at the end of every

to the Sum Assured and guaranteed to become payable month following the date of death till the end of the

either on death or maturity. Future Bonuses are not policy term but not less than 36 monthly payments.

guaranteed and will depend upon future experience The benefit payment may extend beyond the term

in case of death during the last 3 years.

and expected economic conditions.

Shriram New Shri Vidya 5

The additional death benefit can be taken in any one of i) Accident Benefit Rider (UIN 128B001V03)

the following options. In case of death or total and permanent disability due

to accident during the rider term, we will pay 100%

1. Lump sum at the time of death, or

of the rider sum assured. Also, if the life assured

2. 25% of basic sum assured paid at the end of each of becomes totally and permanently disabled in an

the last four years of the policy and Family income accident, we will waive off all the future premiums

benefit i.e the monthly income benefit of 1% of under the policy.

the basic sum assured at the end of every month

ii) Shriram Extra Insurance Cover Rider

following the date of death till the end of the policy

(UIN 128B009V03)

term but not less than 36 monthly payments.

In case of death of the life assured during the rider

However the death benefit will be at least 105% of Total cover term, sum assured under rider will be paid to

Premiums Paid till the date of death excluding any extra the nominee(s)/beneficiary(ies).

and rider premiums and taxes.

iii) Shriram Life Critical Illness Plus Rider

‘Total Premiums Paid’ is the total of all the premiums (UIN 128B016V01)

received excluding any extra premium, any rider

If you are diagnosed to be suffering from any of the

premium, and taxes.

24 specified Critical Illnesses, we will pay 100% of the

The policy will not accrue any future bonuses after rider Sum Assured on survival of 30 days following

death. the date of first confirmed diagnosis. This rider also

Survival Benefit gives you an upside of increments in your rider Sum

In case of survival of the life assured up to the end of Assured through Loyalty Additions.

each of the last four years of the policy, provided all the Please refer the Rider Brochure for further details.

due premiums have been paid, 25% of Sum Assured at

the end of each of the last four years will be paid. High Sum Assured Rebates

Maturity Benefit For high sum assured policies, the premium rebates are

Accrued Reversionary Bonuses and Terminal Bonus (if given as below.

any) will be paid at Maturity.

Additional Protection Through Riders Sum Assured Band Premium Discount

3% of the basic

You can opt any of the following Riders by paying Rs 5, 00,000 to Rs 9, 99,999

premium

additional premium. The riders can be opted at the

inception of the policy or subsequently on any policy 4% of the basic

Rs 10, 00,000 and above

premium

anniversary.

6 Shriram New Shri Vidya

Premium Payment Mode Paid up Value

You can pay your premiums in Yearly, Half yearly, Policies which have acquired surrender value will

Quarterly and Monthly modes. Where the premiums are become paid up if no further premiums have been

paid in other than yearly mode the installment premium

paid. The basic sum assured will be reduced as defined

would be the annual premium multiplied by the modal

factor as given below:- below.

Reduced paid up sum assured = Basic Sum Assured x

Mode Factor No. of Premiums paid / Total No. of Premiums payable

Half yearly 0.520

Reduced paid up sum assured on death = Sum Assured

Quarterly 0.265 on death x No. of Premiums paid / Total No. of Premiums

Monthly 0.090 payable

Premiums are excluding extra, rider premiums and taxes.

Grace Period A paid up policy will not accrue any future bonuses. Any

Bonus payable in the year of premium discontinuance

A grace period of 30 days is allowed for payment of

due premium for non-monthly modes and 15 days for shall be reduced proportionately to the unpaid premiums

monthly mode. If the death of the life assured occurs in that policy year. Paid up value will be paid on maturity

within the grace period but before the payment of or on death if it occurs earlier.

premium then due, the life cover will be available and

If the policy is in paid up state the following benefits are

the death benefit shall be paid after deducting the said

unpaid premium. payable.

If the premium remains unpaid at the expiry of the Grace i. Death benefit under a paid up policy:

Period, the policy will lapse provided the policy doesn’t In case of death of the life assured during the policy

acquire the paid up value. If the policy has acquired the term and if the policy is in paid up state, the following

paid up value, the policy will not lapse but will continue benefits are payable to the nominee or beneficiary.

with the reduced paid up benefits.

1. Reduced paid up sum assured on death

Lapse

2. Bonuses accrued on the policy till the policy

If at least two full years premiums have not been paid becomes paid up immediately on death

and the premium due is not paid till the end of the grace

period, the policy will lapse and no benefits will be

payable under the policy.

Shriram New Shri Vidya 7

ii. Survival Benefit under a paid up policy: policy is the sum of guaranteed surrender value of

In case of the survival of the life assured up to the total premiums paid and surrender value of total bonus

end of each of the last four years of the policy, 25% of accrued less survival benefits already paid as per the

Paid up Sum Assured will be paid. In case the policy table below:

becomes paid up after the start of survival benefits,

25% of the paid up sum assured will be paid for the Guaranteed Surrender value (As % of Total Premiums Paid)

remaining instalments.

Term 10 15 20 25 15 15

iii. Maturity Benefit under a paid up policy:

PPT →

In case of survival of the life assured up to the end 10 15 20 25 8 10

Year ↓

of the policy term, accrued Reversionary bonuses till

1 0% 0% 0% 0% 0% 0%

the policy becomes paid up will be payable to the

policy holder. 5 56% 53% 52% 51% 54% 54%

Revival of Lapsed and Paid-up Policies

10 89% 68% 62% 60% 75% 74%

You can revive a lapsed or paid-up policy within a 15 86% 72% 70% 103% 95%

revival period of five years from the date of first unpaid

premium, by paying all outstanding premiums along 20 84% 80%

with interest as declared by the Company from time

25 90%

to time along with other revival requirements as per

the Board approved underwriting policy. Upon revival, GSV Table for Accrued Bonus

your benefits shall be restored to full value. The current Surrender Value Factors

revival interest rate is 9% p.a. (As % of Total Bonus Accrued till the date of surrender)

Outstanding Term (OT) GSV Factor

Surrender Value

24 8%

Your policy will acquire a Surrender Value after all due 20 10%

premiums for at least two full years been paid. On 15 13%

surrendering the policy, the policyholder will receive

10 17%

Surrender Value, which is higher of Guaranteed Surrender

5 23%

Value (GSV) and Special Surrender Value (SSV).

1 28%

Guaranteed Surrender Value (GSV)

*where Outstanding Term = Policy Term - Completed

The Guaranteed Surrender Value payable under this Years -1

8 Shriram New Shri Vidya

Special Surrender Value (SSV) Alterations

The Special Surrender Value will depend on actual Alteration of Premium Payment Frequency is allowed

experience and prevailing and expected economic under this plan.

conditions.

The policy will terminate once the surrender value has Suicide Exclusion

been paid.

In case of death due to suicide within 12 months from

the date of commencement of risk under the policy or

Loans from the date of revival of the policy, as applicable, the

nominee(s) or beneficiary(ies) of the policyholder shall

Facility of loan is available under this plan. The maximum

loan allowable is 80% of the Surrender Value. Interest be entitled to 80% of the total premiums paid till the date

will accrue on the outstanding loan balance at a rate as of death or the surrender value available as on the date

approved by IRDA. Any outstanding loan balance will of death whichever is higher, provided the policy is in

be recovered from policy proceeds before any benefit force.

is paid on the policy.

Tax Benefits

Terms and Conditons Tax benefits may be available as per prevailing tax laws.

Tax benefits are subject to changes according to the tax

Free Look Period laws from time to time; please consult your tax advisor

The policyholder has a period 15 days from the date of for details.

receipt of the policy document to review the terms and

conditions of the policy and where the insured disagrees Taxes (GST)

to any of those terms or conditions , he has the option

to return the policy stating the reasons for his objection, Premiums are exclusive of taxes.

when he shall be entitled to a refund of the premium

paid, subject only to a deduction of a proportionate All Premiums are subject to applicable taxes, cesses

risk premium for the period on cover and the expenses and levies which shall be paid by you along with the

incurred by the Company on medical examination of the Premium. If any additional Taxes/Cesses/Levies are

proposer, if any and stamp duty charges. imposed by any statutory or administrative body of this

A request received by the Company for free look country under this Policy, we reserve the right to claim

cancellation of the policy shall be processed and the same from policyholder.

premium shall be refunded within 15 days of receipt of

the request. Nomination

For any delay, the Company shall pay penal interest at The life assured, where he is the policyholder, can at

a rate, which is 2% above bank rate from the date of

any time during the policy term make a nomination as

request or last necessary document if any whichever is

later, from the insured/claimant as stated above. per Section 39 of Insurance Act, 1938 as amended from

time to time to receive benefits in the event of his death.

Shriram New Shri Vidya 9

Where the nominee is a minor, the policyholder shall Any person making default in complying with the

also appoint a person to receive the policy monies provisions of this section shall be liable for penalty

during the minority of the nominee. which may extend to ten lakh rupees.

Section 45 of the insurance Act, 1938 as amended from

Assignment

time to time

Assignment is transferring the title and rights of policy

(1) No policy of life insurance shall be called in

absolutely or conditionally. Assignment of the policy

question on any ground whatsoever after the

may be made as per Section 38 of The Insurance Act,

expiry of three years from the date of the policy,

1938 as amended form time to time by an endorsement

i.e. from the date of issuance of the policy or the

upon the policy itself or by a separate instrument.

date of commencement of risk or the date of

Fraud or misrepresentation revival of the policy or the date of the rider to the

policy, whichever is later.

In case of fraud or misrepresentation, action shall be

initiated in accordance with Section 45 of the Insurance (2) A policy of life insurance may be called in

Act, 1938 as amended from time to time. question at any time within three years from

the date of issuance of the policy or the date of

Important Sections of Insurance Act commencement of risk or the date of revival of

Prohibition of Rebates - Section 41 of the Insurance Act, the policy or the date of the rider to the policy,

1938 as amended from time to time whichever is later, on the ground of fraud.

No person shall allow, or offer to allow, either directly Provided that the insurer shall have to

or indirectly as an inducement to any person to take communicate in writing to the insured or the legal

out or renew or continue an insurance in respect of representatives or nominees or assignees of the

any kind of risk relating to lives or property in India, any insured the grounds and materials on which such

rebate of the whole or part of the commission payable decision is based.

or any rebate of the premium shown on the policy, nor (3) Notwithstanding anything contained in sub-

shall any person taking out or renewing or continuing a section (2), no insurer shall repudiate a life

policy accept any rebate, except such rebate as may be insurance policy on the ground of fraud if the

allowed in accordance with the published prospectuses, insured can prove that the mis-statement of or

or tables of the insurer. suppression of a material fact was true to the

Provided that acceptance by an insurance agent of best of his knowledge and belief or that there

commission in connection with a policy of life insurance was no deliberate intention to suppress the fact

taken out by himself on his own life shall not be deemed or that such mis-statement of or suppression of

to be acceptance of a rebate of premium within a material fact are within the knowledge of the

the meaning of this sub-section if at the time of such insurer:

acceptance the insurance agent satisfies the prescribed Provided that in case of fraud, the onus of

conditions establishing that he is a bonafide insurance disproving lies upon the beneficiaries, in case

agent employed by the insurer. the policyholder is not alive

10 Shriram New Shri Vidya

(4) A policy of life insurance may be called in

question at any time within three years from

the date of issuance of the policy or the date of

commencement of risk or the date of revival of

the policy or the date of the rider to the policy,

whichever is later, on the ground that any

statement of or suppression of a fact material

to the expectancy of the life of the insured

was incorrectly made in the proposal or other

document on the basis of which the policy was

issued or revived or rider issued:

Provided that the insurer shall have to

communicate in writing to the insured or the legal

representatives or nominees or assignees of the

insured the grounds and materials on which such

decision to repudiate the policy of life insurance

is based:

Provided further that in case of repudiation of

the policy on the ground of misstatement or

suppression of a material fact, and not on the

ground of fraud, the premiums collected on the

policy till the date of repudiation shall be paid

to the insured or the legal representatives or

nominees or assignees of the insured within

a period of ninety days from the date of such

repudiation.

(5) Nothing in this section shall prevent the insurer

from calling for proof of age at any time if he is

entitled to do so, and no policy shall be deemed

to be called in question merely because the terms

of the policy are adjusted on subsequent proof

that the age of the life insured was incorrectly

stated in the proposal.

Shriram New Shri Vidya 11

About the Company

With a pan India presence with over 400+ offices, Shriram Life is your trusted partner for

prosperity. At Shriram Life we strive to provide our customers with elegant solutions tailored

to individual needs.

SHRIRAM LIFE INSURANCE COMPANY LIMITED

The Trade logo displayed above belongs to Shriram Value Services Limited (“SVS”)

and used by Shriram Life Insurance Company Limited under a license agreement.

For further assistance you can contact us in the following ways:

Visit your nearest branch office for details.List Write to Shriram Life Insurance Company Limited,

of our branches is available on our website Plot No. 31-32, 5th Floor, Ramky Selenium, Financial District,

www.shriramlife.com Gachibowli, Hyderabad, Telangana – 500032.

Call our toll free number : 1800 3000 6116 Phone : +91 40 23009400 (Board)

Mail us at customercare@shriramlife.in Fax : +91 40 23009456

ARN – SLIC/BROC/June 2021/91

Visit our website www.shriramlife.com

IRDAI Regn No. 128

CIN: U66010TG2005PLC045616

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

Public receiving such phone calls are requested to lodge a police complaint.

12 Shriram New Shri Vidya

You might also like

- Historical Background of AuditingDocument15 pagesHistorical Background of AuditingTinoManhangaNo ratings yet

- Fundamentalsof Magnon-BasedcomputingDocument66 pagesFundamentalsof Magnon-Basedcomputingአስምሮ ላቂያዉNo ratings yet

- SGPT SgotDocument1 pageSGPT SgotSumit AgrawalNo ratings yet

- Anatomy of A Failed Deal - Apollo Cooper Merger - CaseDocument12 pagesAnatomy of A Failed Deal - Apollo Cooper Merger - CaseRishabh sharmaNo ratings yet

- 75 January Month Current Affairs Questions PDF Eng 19Document41 pages75 January Month Current Affairs Questions PDF Eng 19Sailo AimolNo ratings yet

- Funding Organizations List - 09-03Document10 pagesFunding Organizations List - 09-03LukhanyoNo ratings yet

- Fruit Roll Ups - Google SearchDocument1 pageFruit Roll Ups - Google Searchrona abrianaNo ratings yet

- ItineraryDocument2 pagesItineraryJosé Fonte BoaNo ratings yet

- Government Financial Reports and Government Accounting StandardsDocument14 pagesGovernment Financial Reports and Government Accounting StandardsPutri SariNo ratings yet

- Abhishek Kumar Bharti: Manduadih, Varanasi (U.P.) Pincode-221103Document3 pagesAbhishek Kumar Bharti: Manduadih, Varanasi (U.P.) Pincode-221103Abhishek SiddhartNo ratings yet

- Market and Pricing - Monopolistic Competition and OligopolyDocument40 pagesMarket and Pricing - Monopolistic Competition and OligopolyDaksh AnejaNo ratings yet

- Impact of Merger On Financial Performance of Nepalese Commercial BankDocument4 pagesImpact of Merger On Financial Performance of Nepalese Commercial BankShrestha Photo studioNo ratings yet

- Kasongan - STOCK FREE (23 Des)Document30 pagesKasongan - STOCK FREE (23 Des)Pusat CurhatNo ratings yet

- Philippine Canadian Inquirer #508Document32 pagesPhilippine Canadian Inquirer #508canadianinquirerNo ratings yet

- Biomedical Log Indices and CalculusDocument19 pagesBiomedical Log Indices and CalculusAgape StanleyNo ratings yet

- Business LawDocument119 pagesBusiness LawHiNo ratings yet

- Physics Problems on Units, Measurements, Forces and MotionDocument7 pagesPhysics Problems on Units, Measurements, Forces and MotionAR DreamerNo ratings yet

- HBS Case Roche Pakistan (A)Document23 pagesHBS Case Roche Pakistan (A)Faryal AmirNo ratings yet

- Aiml Online BrochureDocument16 pagesAiml Online BrochureKarthikNo ratings yet

- B. Inggris Tentang AdverbDocument14 pagesB. Inggris Tentang AdverbM JodinNo ratings yet

- Popular Mechanics South Africa #10 (2017)Document105 pagesPopular Mechanics South Africa #10 (2017)Lester SaquerNo ratings yet

- CASE4Document3 pagesCASE4Saumya UpadhyayNo ratings yet

- A Comparative Study of Customer Perception Towards Customer Relationship Management in Selected Public and Private Sector Bank in South MumbaiDocument7 pagesA Comparative Study of Customer Perception Towards Customer Relationship Management in Selected Public and Private Sector Bank in South MumbaiAkash NagareNo ratings yet

- Lecture 5Document33 pagesLecture 5aNo ratings yet

- Display PDFDocument7 pagesDisplay PDFSomu ShekarNo ratings yet

- 1 s2.0 S0892687522005891 MainDocument11 pages1 s2.0 S0892687522005891 MainERICK JESUS MUÑOZ HERNANDEZNo ratings yet

- TP 05 Occurrence Reporting in Civil AviationDocument69 pagesTP 05 Occurrence Reporting in Civil AviationchidinmaNo ratings yet

- Terms&Conditions PDFDocument7 pagesTerms&Conditions PDFneha khanNo ratings yet

- Advance CalculusDocument67 pagesAdvance CalculusDr. Lucy AnningNo ratings yet

- 6.2.2.c Annexure IV - H1 FY15Document6 pages6.2.2.c Annexure IV - H1 FY15Vipasha SanghaviNo ratings yet

- FILM330 Problems 2Document5 pagesFILM330 Problems 2Raisya febiyaneeeNo ratings yet

- UK hydrogen economy planDocument45 pagesUK hydrogen economy plantopspeed1No ratings yet

- 10th RMLNLU-SCC Online International Media Law Competition, 2022 - RulesDocument23 pages10th RMLNLU-SCC Online International Media Law Competition, 2022 - RulesAnay MehrotraNo ratings yet

- Group Personal Accident-Claim FormDocument4 pagesGroup Personal Accident-Claim FormVipul SharmaNo ratings yet

- Japanparts Eco Oil Filters FO-ECODocument14 pagesJapanparts Eco Oil Filters FO-ECOPopa DanielNo ratings yet

- The Effective of Geothermal Energy in BuDocument8 pagesThe Effective of Geothermal Energy in BuMeziane YkhlefNo ratings yet

- ASUS TF600T Tablet ManualDocument78 pagesASUS TF600T Tablet ManualMagaly ConradoNo ratings yet

- Cambridge International AS & A Level: Mathematics 9709/12Document20 pagesCambridge International AS & A Level: Mathematics 9709/12Thiru VeleyudhamNo ratings yet

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)Document17 pagesMahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)Ghanshyam ChaudharyNo ratings yet

- 3122-Article Text-6458-1-10-20210709Document23 pages3122-Article Text-6458-1-10-20210709epiphaneNo ratings yet

- Standards For Trade BDDocument3 pagesStandards For Trade BDRasel777No ratings yet

- Biznis Liga Banaka I Osiguranja Br.26 3.KOLODocument35 pagesBiznis Liga Banaka I Osiguranja Br.26 3.KOLOilijac79_625773792No ratings yet

- Stereo Chemistry PDFDocument23 pagesStereo Chemistry PDFHarsh MewadaNo ratings yet

- Laws of Motion ExplainedDocument37 pagesLaws of Motion ExplainedCMA Afsal AlungalNo ratings yet

- IB Security Assistant Exam Syllabus 2022Document6 pagesIB Security Assistant Exam Syllabus 2022Mundhe SameerNo ratings yet

- 1-Introducing Split Orders and Optimizing Operational Policies in Robotic-2020Document18 pages1-Introducing Split Orders and Optimizing Operational Policies in Robotic-2020archan renNo ratings yet

- RPD Daily Incident Report 8/15/23Document5 pagesRPD Daily Incident Report 8/15/23inforumdocsNo ratings yet

- 31.08.2021 CIC DataDocument153 pages31.08.2021 CIC Datakanishka sharmaNo ratings yet

- CahgsbtaDocument164 pagesCahgsbtaamalraj kuniyilNo ratings yet

- Q1#4 To Q1&2Document3 pagesQ1#4 To Q1&2rona sumodioNo ratings yet

- Lean-On Bracing Reference GuideDocument96 pagesLean-On Bracing Reference GuideRafael Alburquerque CruzNo ratings yet

- Epidemiology of Anterior Cruciate Ligament Injury in Italian First Division Soccer PlayersDocument10 pagesEpidemiology of Anterior Cruciate Ligament Injury in Italian First Division Soccer PlayersVeronica LopezNo ratings yet

- OBTD EngUrpDocument74 pagesOBTD EngUrpRakibul HassanNo ratings yet

- Book 1Document3 pagesBook 1Saju VargheseNo ratings yet

- 4030CDIE509530CONSUMERDURABLELOANDocument1 page4030CDIE509530CONSUMERDURABLELOANmech nareshNo ratings yet

- Momo's WorkDocument77 pagesMomo's WorkEne AideyanNo ratings yet

- Depositories Act PDFDocument5 pagesDepositories Act PDFSUNNY BHATIANo ratings yet

- DH Rulebook v3Document20 pagesDH Rulebook v3GerwaldanNo ratings yet

- Profile Essay PDFDocument10 pagesProfile Essay PDFapi-608527336No ratings yet

- MSPP LeafletDocument4 pagesMSPP LeafletChayan MukherjeeNo ratings yet

- CRM Requests - Discrepancies in Documents SubmissionDocument16 pagesCRM Requests - Discrepancies in Documents SubmissionSurekha HolagundiNo ratings yet

- Addendum to Proposal Form DetailsDocument1 pageAddendum to Proposal Form DetailsSurekha HolagundiNo ratings yet

- Diabeties QuestionnaireDocument2 pagesDiabeties QuestionnaireSurekha HolagundiNo ratings yet

- Covid 19 Recovery Questionnaire LatestDocument2 pagesCovid 19 Recovery Questionnaire Latestsharad.neoNo ratings yet

- Basic DocumentationDocument1 pageBasic DocumentationSurekha HolagundiNo ratings yet

- Scribd 4Document1 pageScribd 4Churrita de OroNo ratings yet

- Extra Exercises Past Simple Past PerfectDocument1 pageExtra Exercises Past Simple Past PerfectjurgitaNo ratings yet

- Chapter 4 Case Study Southwestern University's Options: Game 1 Attendance ForecastDocument3 pagesChapter 4 Case Study Southwestern University's Options: Game 1 Attendance ForecastFathul Crusher55No ratings yet

- ICSE Literature Question Papers 2012Document9 pagesICSE Literature Question Papers 2012Anish JainNo ratings yet

- Court ObservationDocument2 pagesCourt Observationjobert cortez100% (1)

- ECO 1 - Basic Microeconomics - NewDocument89 pagesECO 1 - Basic Microeconomics - NewSeth DivinagraciaNo ratings yet

- 121 - St. Jerome - Commentary On Galatians Translated by Andrew Cain The Fathers of The Church SerieDocument310 pages121 - St. Jerome - Commentary On Galatians Translated by Andrew Cain The Fathers of The Church SerieSciosis HemorrhageNo ratings yet

- 2.tutorial - D V SDocument2 pages2.tutorial - D V SVivek MenonNo ratings yet

- MadagascarDocument32 pagesMadagascarTeodora PantiruNo ratings yet

- Understanding Different Political and Legal Systems for International BusinessDocument4 pagesUnderstanding Different Political and Legal Systems for International BusinessMaireNo ratings yet

- R Giggs Income Statement and Balance Sheet for 2007Document2 pagesR Giggs Income Statement and Balance Sheet for 2007Arman ShahNo ratings yet

- Rehabili-Tation of THE Surround - Ings of Santa Maria de Alcobaça MonasteryDocument2 pagesRehabili-Tation of THE Surround - Ings of Santa Maria de Alcobaça MonasteryTashi NorbuNo ratings yet

- Adjective Clause ExerciseDocument4 pagesAdjective Clause ExerciseRindha WidyaningsihNo ratings yet

- Population: Lebanon State of The Environment Report Ministry of Environment/LEDODocument7 pagesPopulation: Lebanon State of The Environment Report Ministry of Environment/LEDO420No ratings yet

- Alint Rsa BD 2006Document1 pageAlint Rsa BD 2006Hasnain AftabNo ratings yet

- Marketing Planning & Application: Submitted To Sir Bilal KothariDocument20 pagesMarketing Planning & Application: Submitted To Sir Bilal KothariSAIF ULLAHNo ratings yet

- Qualys Gateway Service User GuideDocument39 pagesQualys Gateway Service User Guideshiv kumarNo ratings yet

- Heavenly Nails Business Plan: Heaven SmithDocument13 pagesHeavenly Nails Business Plan: Heaven Smithapi-285956102No ratings yet

- 24 January 2024 Private/Confidential: Absa Bank LTDDocument2 pages24 January 2024 Private/Confidential: Absa Bank LTDtaxisalesNo ratings yet

- Britannia Field ReportDocument6 pagesBritannia Field Reportdaul93No ratings yet

- Strategic ManagementDocument60 pagesStrategic ManagementShafie Ali ahmedNo ratings yet

- Ma'aden Aluminium Complex WaterproofedDocument3 pagesMa'aden Aluminium Complex WaterproofedSHAIK ASIMUDDINNo ratings yet

- Animal Farm WebquestDocument8 pagesAnimal Farm Webquestapi-388806678No ratings yet

- Group 5 Regular-1Document33 pagesGroup 5 Regular-1SKY StationeryNo ratings yet

- Velasquez Business Ethics - Short VersionDocument69 pagesVelasquez Business Ethics - Short VersionIndraNo ratings yet

- Humana_Impact Report 2022Document125 pagesHumana_Impact Report 2022Raj KishoreNo ratings yet

- Crude Oil Price Dynamics & FactorsDocument39 pagesCrude Oil Price Dynamics & Factorsparmeshwar mahatoNo ratings yet

- Windows Server 2019 Administration CourseDocument590 pagesWindows Server 2019 Administration CourseTrần Trọng Nhân100% (2)

- Edoc - Pub - The Polar Express Updated ScriptDocument28 pagesEdoc - Pub - The Polar Express Updated ScriptGiuseppe Giacomazzo100% (4)

- Assessment of Sustainable Agro-Dealer NetworksDocument64 pagesAssessment of Sustainable Agro-Dealer NetworksfrancesterNo ratings yet