Professional Documents

Culture Documents

Sourabh Kumar Task 3

Uploaded by

Sourabh Kumar0 ratings0% found this document useful (0 votes)

5 views5 pagesThis document compares the financial performance of power generation and infrastructure companies over five years. For power generation, it shows that Tata Power had higher sales, revenue, and market share growth compared to Reliance Power from 2018-2022. It recommends investing in Tata Power for short and long-term profits. For infrastructure, it shows that Larsen & Toubro had higher sales and revenue growth than IRB Infrastructure from 2018-2022, though IRB had lower debt levels. It recommends investing in Larsen & Toubro for future gains.

Original Description:

Original Title

SOURABH KUMAR TASK 3

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document compares the financial performance of power generation and infrastructure companies over five years. For power generation, it shows that Tata Power had higher sales, revenue, and market share growth compared to Reliance Power from 2018-2022. It recommends investing in Tata Power for short and long-term profits. For infrastructure, it shows that Larsen & Toubro had higher sales and revenue growth than IRB Infrastructure from 2018-2022, though IRB had lower debt levels. It recommends investing in Larsen & Toubro for future gains.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views5 pagesSourabh Kumar Task 3

Uploaded by

Sourabh KumarThis document compares the financial performance of power generation and infrastructure companies over five years. For power generation, it shows that Tata Power had higher sales, revenue, and market share growth compared to Reliance Power from 2018-2022. It recommends investing in Tata Power for short and long-term profits. For infrastructure, it shows that Larsen & Toubro had higher sales and revenue growth than IRB Infrastructure from 2018-2022, though IRB had lower debt levels. It recommends investing in Larsen & Toubro for future gains.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

POWER GENTERATION COMPANIES:

5 Years Of Sales Growth (Rs.Cr.)

RELIANCE POWER TATA POWER

YEARS SALES YEARS SALES

March 2022 7,686.73 March 2022 11,107.93

March 2021 8,388.60 March 2021 6,180.59

March 2020 8,202.41 March 2020 7,726.39

March 2019 8,534.26 March 2019 7,932.83

March 2018 9,871.01 March 2018 7,536.59

• 5 Years Of Revenue Growth (Rs.Cr.)

RELIANCE POWER TATA POWER

YEAR REVENUE REVENUE

March 2022 7,695.33 March 2022 43,735.60

March 2021 8,419.88 March 2021 32,907.30

March 2020 8,202.41 March 2020 29,699.00

March 2019 8,534.26 March 2019 30,267.20

March 2018 9,875.76 March 2018 27,272.70

• Market Share Of The Company In The Industry : (Rs.Cr.)

RELIANCE POWER TATA POWER

YEAR SHARES YEAR SHARES

March 2022 3,400 March 2022 320

March 2021 2,805 March 2021 320

March 2020 2,805 March 2020 270

March 2019 2,805 March 2019 270

March 2018 2,805 March 2018 516

• Debt Of The Company: (Rs.Cr.)

RELIANCE POWER TATA POWER

YEAR DEBTS YEAR DEBTS

March 2022 15,353.33 March 2022 86,856.13

March 2021 14,840.40 March 2021 73,601.67

March 2020 15,069.22 March 2020 67,850.09

March 2019 19,730.61 March 2019 63,690.76

March 2018 25,080.33 March 2018 63,594.80

In my opinion , by analyzing the data of 5-year analysis of sales and revenue, TATA

POWER is showing more growth than RELIANCE POWER . By looking at the market capital

also we can say that its good to go for good quality shares of TATA rather than slow and

volatile growth of RELIANCE POWER . If I have to invest then I would prefer to invest in

TATA POWER for short term and long-term profits.

INFRASTRUCTURE COMPANIES:

• 5 Years Of Sales Growth (Rs.Cr.)

LARSEN & TOUBRO LTD. IRB INFRASTRUCTURE LTD

YEARS SALES YEARS SALES

March 2022 101,000.41 March 2022 5,804

March 2021 73,315.59 March 2021 5,299

March 2020 82,383.65 March 2020 6,852

March 2019 82,287.42 March 2019 6,707

March 2018 74,462.55 March 2018 5,694

• 5 Years Of Revenue Growth (Rs.Cr.)

LARSEN & TOUBRO LTD. IRB INFRASTRUCTURE LTD.

YEARS SALES YEARS SALES

March 2022 1,58,885.24 March 2022 6,355.45

March 2021 1,47,646.30 March 2021 5,487.53

March 2020 1,48,467.83 March 2020 7,104.56

March 2019 1,37,920.90 March 2019 6,902.62

March 2018 1,21,442.84 March 2018 5,989.46

• Market Share Of The Company In The Industry (Rs.Cr.)

LARSEN & TOUBRO LTD. IRB INFRASTRUCTURE LTD.

YEARS SALES YEARS SALES

March 2022 33.78B March 2022 604.90

March 2021 35.78B March 2021 351.45

March 2020 24.72B March 2020 351.45

March 2019 25.55B March 2019 351.45

March 2018 28.82B March 2018 351.45

• Debt Of The Company (Rs.Cr.)

LARSEN & TOUBRO LTD. IRB INFRASTRUCTURE LTD

YEARS SALES YEARS SALES

March 2022 1,25,292 March 2022 16,697

March 2021 1,33,505 March 2021 19,219

March 2020 1,41,770 March 2020 9,205

March 2019 1,24,579 March 2019 16,599

March 2018 1,06,619 March 2018 13,832

In my opinion , by analyzing the data of 5-year analysis of sales and revenue, Larsen &

Toubro Infrastructure Ltd is showing more growth than IRB infrastructure . L&T

Infrastructure sales and revenue growth is little bit better than IRB infrastructure but

there is a vast difference in debt. If I have to make good fortune then I would invest in L&T

Infrastruture Ltd for future.

You might also like

- Economics ReportDocument10 pagesEconomics Reportdeekshith gowdaNo ratings yet

- Business CommunicationDocument16 pagesBusiness CommunicationHarsh ManralNo ratings yet

- Group 10Document22 pagesGroup 10Mohammed NazeerNo ratings yet

- Tata Motors .Document14 pagesTata Motors .Shweta MaltiNo ratings yet

- India Direct SellingDocument1 pageIndia Direct SellingGurbhej Singh Brar (Brar)No ratings yet

- Financial Statement Analyses of Tata Motors LimitedDocument12 pagesFinancial Statement Analyses of Tata Motors LimitedKanishk KhandelwalNo ratings yet

- Linde Bangladesh Final 635Document17 pagesLinde Bangladesh Final 635Kowshik Singha Chowdhury 2025020660No ratings yet

- Bis PresentationDocument12 pagesBis PresentationPratiksha TiwariNo ratings yet

- Book 1Document3 pagesBook 1riyadh al kamalNo ratings yet

- Savings TrackerDocument34 pagesSavings TrackerVedant MahajanNo ratings yet

- Tata Consultancy Services LTDDocument13 pagesTata Consultancy Services LTDArkodoy RoyNo ratings yet

- Book 2Document4 pagesBook 2Aniket KolheNo ratings yet

- TASCODocument13 pagesTASCOsozodaaaNo ratings yet

- BMG704 (16432)Document20 pagesBMG704 (16432)EhinomenNo ratings yet

- Godawari PowerDocument6 pagesGodawari PowerKanika ChaddaNo ratings yet

- Vadilal Industries LTD.: ContentDocument10 pagesVadilal Industries LTD.: ContentSachin NaikNo ratings yet

- Bangladesh and Development Related Data For Focus WritingDocument8 pagesBangladesh and Development Related Data For Focus WritingKAMRUN NAHERNo ratings yet

- Financial Statement Analysesof TataDocument10 pagesFinancial Statement Analysesof Tataganesh kNo ratings yet

- Shubham Moon Marketing 4.0 Final Assignment MBA 1Document26 pagesShubham Moon Marketing 4.0 Final Assignment MBA 1shubham moonNo ratings yet

- Feasibility of Establishing "Outdoor Advertising" in Meycauayan City, BulacanDocument27 pagesFeasibility of Establishing "Outdoor Advertising" in Meycauayan City, BulacanNicodeo IgnacioNo ratings yet

- Year Ratio in TimesDocument6 pagesYear Ratio in TimesDilshadNo ratings yet

- FADM TrackerDocument69 pagesFADM TrackerLOHIT JAINNo ratings yet

- EnergyBalance CPDocument3 pagesEnergyBalance CPLiora Vanessa DopacioNo ratings yet

- MM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIDocument8 pagesMM5004 - Final Exam - Berlin Novanolo Gulo (29123112) - BBRIcatatankotakkuningNo ratings yet

- H Ps://Forms - Gle/Q6Pg4V5J2Pwvvwr59: Issue No. 34 Page No.: 1Document29 pagesH Ps://Forms - Gle/Q6Pg4V5J2Pwvvwr59: Issue No. 34 Page No.: 1SUJIT KUMAR GHOSHNo ratings yet

- Financial Statement Analysesof TataDocument12 pagesFinancial Statement Analysesof TataSwati soniNo ratings yet

- Udayshivakumar Infra Limited: All You Need To Know AboutDocument8 pagesUdayshivakumar Infra Limited: All You Need To Know AboutShreyclassNo ratings yet

- Financial Overview Net SalesDocument4 pagesFinancial Overview Net Salesnisarga tdaryaNo ratings yet

- Top Glove Group AssignmentDocument24 pagesTop Glove Group AssignmentvithyaNo ratings yet

- Annual Production Capacity of Steel CompaniesDocument3 pagesAnnual Production Capacity of Steel Companiesparitosh gaurNo ratings yet

- Shantanu FadmDocument12 pagesShantanu FadmHimanshuNo ratings yet

- Financial Statement Analyses of Tata Motors LimitedDocument12 pagesFinancial Statement Analyses of Tata Motors Limitedabel johnNo ratings yet

- Excel RezaDocument6 pagesExcel RezaArif Nur MuntohaNo ratings yet

- Repayment Schedule: Agreement DetailsDocument2 pagesRepayment Schedule: Agreement DetailsNikhilesh MallickNo ratings yet

- Analysis NewDocument12 pagesAnalysis NewFairooz AliNo ratings yet

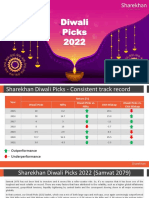

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- Subject: Islamic Finance: Assignment: 3Document9 pagesSubject: Islamic Finance: Assignment: 3AimeeNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Investor Release For December 31, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Investor Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- IPO Diary January'2021Document19 pagesIPO Diary January'2021Rakshan ShahNo ratings yet

- FINMDocument7 pagesFINMSakshi KshirsagarNo ratings yet

- Organique Heaven Sweets: Business ProposalDocument45 pagesOrganique Heaven Sweets: Business ProposalEzzz VeriNo ratings yet

- Managerial Economics-CIA 3Document8 pagesManagerial Economics-CIA 3ABHISHEKA SINGH 2127201No ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Nishant Kumar Singh Aditya Saxena Jai Lalit Mishra Ankesh AwasthiDocument9 pagesNishant Kumar Singh Aditya Saxena Jai Lalit Mishra Ankesh AwasthiNISHANT SINGHNo ratings yet

- Prashant Sharma BudgetDocument24 pagesPrashant Sharma BudgetPrashant SharmaNo ratings yet

- Gail Project Phase 1Document17 pagesGail Project Phase 1S.K. PraveenNo ratings yet

- Bab IVDocument44 pagesBab IVIlyasa YusufNo ratings yet

- PCBLDocument2 pagesPCBLSubir BhuniaNo ratings yet

- Jindal SawDocument2 pagesJindal SawSubir BhuniaNo ratings yet

- Chapter 4Document22 pagesChapter 4PreethaSureshNo ratings yet

- Vedanta LimitedDocument16 pagesVedanta LimitedtanyaNo ratings yet

- Ratio Analysis in Muthoot Finance LTD Aurad: March 2022Document8 pagesRatio Analysis in Muthoot Finance LTD Aurad: March 2022Nice NameNo ratings yet

- Shower Bath Fullpagedownload StatistaDocument11 pagesShower Bath Fullpagedownload StatistafadNo ratings yet

- India'S Most: Valuable CompaniesDocument15 pagesIndia'S Most: Valuable CompaniesHarsh DabasNo ratings yet

- FIN201 Termpaper SubmissionDocument19 pagesFIN201 Termpaper Submissionsohan hossainNo ratings yet

- Null 1Document1 pageNull 1Vijaybhaskar ReddyNo ratings yet

- Tata Finanacial RatiosDocument8 pagesTata Finanacial RatiosshivamNo ratings yet

- Micro, Small and Medium Enterprise: Submitted By:-Manish Goswami Taochila Aochenlar Shiv Shankar Thakur Aman GuptaDocument13 pagesMicro, Small and Medium Enterprise: Submitted By:-Manish Goswami Taochila Aochenlar Shiv Shankar Thakur Aman GuptaNISHANT SINGHNo ratings yet

- FRA Assignment DraftDocument11 pagesFRA Assignment Draftsuvek venugopalNo ratings yet

- Transforming Bangladesh’s Participation in Trade and Global Value ChainFrom EverandTransforming Bangladesh’s Participation in Trade and Global Value ChainNo ratings yet

- Book StockDocument1 pageBook StockSourabh KumarNo ratings yet

- Registration DocumentsDocument12 pagesRegistration DocumentsSourabh KumarNo ratings yet

- Mit PuneDocument1 pageMit PuneSourabh KumarNo ratings yet

- Sourabh Kumar 2Document4 pagesSourabh Kumar 2Sourabh KumarNo ratings yet

- Task 5Document1 pageTask 5Sourabh KumarNo ratings yet

- Sourabh Kumar Task 4Document9 pagesSourabh Kumar Task 4Sourabh KumarNo ratings yet

- BronchiolitisDocument5 pagesBronchiolitisreshianeNo ratings yet

- ASWP Manual - Section 1 - IntroductionDocument17 pagesASWP Manual - Section 1 - Introductionjmvm56No ratings yet

- Focus GroupDocument20 pagesFocus GroupItzel H. ArmentaNo ratings yet

- Description Features: Maximizing IC PerformanceDocument1 pageDescription Features: Maximizing IC Performanceledaurora123No ratings yet

- BIO SCI OsmosisDocument10 pagesBIO SCI OsmosisJoy FernandezNo ratings yet

- Catalogo Repetidor EnergyAxisDocument2 pagesCatalogo Repetidor EnergyAxisolguita22No ratings yet

- Battle Cry Zulu WarDocument4 pagesBattle Cry Zulu WarPat RisNo ratings yet

- Webinar WinCC SCADA NL 29052018Document62 pagesWebinar WinCC SCADA NL 29052018AlexNo ratings yet

- TTC 1000Document2 pagesTTC 1000svismaelNo ratings yet

- Catalogue Colorants TextilesDocument5 pagesCatalogue Colorants TextilesAs Des As BenedictionNo ratings yet

- Proplanner Assembly Planner PFEPDocument5 pagesProplanner Assembly Planner PFEPAya MdimeghNo ratings yet

- Mitsubishi IC Pneumatic Forklift PDFDocument5 pagesMitsubishi IC Pneumatic Forklift PDFfdpc1987No ratings yet

- ExamDocument12 pagesExamAidar MukushevNo ratings yet

- 310 311 320 321 Toilet Warranty Codes PDFDocument11 pages310 311 320 321 Toilet Warranty Codes PDFTerri MartinNo ratings yet

- Samsung WF8500NMW8Document180 pagesSamsung WF8500NMW8Florin RusitoruNo ratings yet

- Bike LanesDocument12 pagesBike LanesChitikala RajeshNo ratings yet

- LIP Reading Using Facial Feature Extraction and Deep LearningDocument5 pagesLIP Reading Using Facial Feature Extraction and Deep LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Jean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Document10 pagesJean-Louis Cohen - Exhibitionist Revisionism - Exposing Architectural History (September 1999)Javier PerezNo ratings yet

- Banana Stem Patty Pre Finale 1Document16 pagesBanana Stem Patty Pre Finale 1Armel Barayuga86% (7)

- Quantum Data-Fitting: PACS Numbers: 03.67.-A, 03.67.ac, 42.50.DvDocument6 pagesQuantum Data-Fitting: PACS Numbers: 03.67.-A, 03.67.ac, 42.50.Dvohenri100No ratings yet

- Catalogue of Palaearctic Coleoptera Vol.4 2007Document471 pagesCatalogue of Palaearctic Coleoptera Vol.4 2007asmodeus822No ratings yet

- The London SchoolDocument3 pagesThe London SchoolKhawla Adnan100% (5)

- Ecological Building: Term Project For ME 599Document32 pagesEcological Building: Term Project For ME 599Junaid AnwarNo ratings yet

- Definite NessDocument398 pagesDefinite NessKbraNo ratings yet

- 34P S4hana1909 BPD en UsDocument18 pages34P S4hana1909 BPD en UsBiji RoyNo ratings yet

- Downloaded From Manuals Search EngineDocument14 pagesDownloaded From Manuals Search EngineAl AlNo ratings yet

- Logical Database Design ModelingDocument2 pagesLogical Database Design ModelingGio Agudo100% (1)

- Wincam TornoDocument3 pagesWincam Tornocaballerillo100% (1)

- Hitachi VSP Pricelist PeppmDocument57 pagesHitachi VSP Pricelist PeppmBahman MirNo ratings yet

- Lazard Levelized Cost of Storage v20Document46 pagesLazard Levelized Cost of Storage v20macNo ratings yet