Professional Documents

Culture Documents

JD Under para 26 (6) of EPF Scheme

Uploaded by

SkillTree PayrollOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JD Under para 26 (6) of EPF Scheme

Uploaded by

SkillTree PayrollCopyright:

Available Formats

JOINT DECLARATION UNDER PARA 26(6) OF THE EPF SCHEME, 1952

[Form to be used for : 1. Enrolling an ‘excluded employee’ as a member of EPF Scheme, 1952; and

2.Remitting Voluntary PF Contribution by a member – i.e to allow an existing

member to contribute towards PF on more than Rs.15000/- of his ‘pay’ .]

(Refer Paragraphs 2, 26, 26A, 29, 69 of Employees’ Provident Funds Scheme,

1952)

*******

To

The Regional P.F. Commissioner,

Regional Office, Bengaluru (Central)

Declaration by the Employee

I, , son/ daughter of

hereby declare the following.

(Strike-off whichever is not applicable/ Print only whichever is applicable)

1. For enrolment:

(a) I have read and understood Para 26(6) and definitions of ‘pay’, ‘excluded employee’

under Para 2 of EPF Scheme, 1952. Accordingly, I declare that I am an ‘excluded

employee’ as per Para 2(f)(ii) of the Scheme and is not enrolled as a member to the

Scheme till now as my ‘pay ’/ ‘PF wage’ from the date of joining an EPF covered

establishment has been above the statutory wage ceiling of Rs.15,000/-. Now, I wish to

become a member of EPF Scheme, 1952 w.e.f. and hereby exercise my option for

the same.

OR

(For those members who join employment again after superannuation)

(b) I have read and understood Para 26(6), definitions of ‘pay’, ‘excluded employee’ under

Para 2 and Para 69 (1) of the Scheme. Accordingly, I declare that I am an ‘ excluded

employee’ as per Para 2(f)(i) of EPF Scheme, 1952 as I have already withdrawn my full

PF accumulations in the Fund under Para 69 (1) (a)/ (c). Now that I have again joined

a EPF covered establishment, I hereby exercise my option to become a member of EPF

Scheme, 1952 w.e.f. .

2. For voluntary contribution on higher wages

(a) I am an existing member of EPF Scheme, 1952 bearing PF Account Number

BG/BNG/ / ) under UAN . I have read and

understood Para 26(6)/ 26A/ Para 29 and definition of ‘pay ’ under Para 2 of the

Scheme. I wish to contribute towards PF on higher wages/ at higher rate and hereby

exercise my option to contribute to Employees’ Provident Fund on more than

Rs.15,000/- (statutory wage ceiling) of my pay per month w.e.f. .

(b) Rate of contribution :

(i) I exercise to contribute on 12% of my entire ‘pay’ / ‘Gross wages’ as in ECR; OR

(ii) I exercise to contribute on 12% of my entire ‘PF wage’ as in ECR; OR

(iii) I exercise to contribute on % (can only be higher than 12%) of my ‘pay’ / ‘PF

wage’/ Rs.15,000/- under Para 29 of the Scheme.

3. For enrolment and voluntary contribution – Fill up both 1 & 2 as applicable.

I agree to abide by/ comply with all the statutory provisions of EPF Act, 1952 and

Schemes framed thereunder. Therefore, kindly approve the option exercised by me under

Para 26(6) of the Scheme along with my employer. I also understand that the option

exercised by me becomes valid only after it is approved by the competent authority.

Place :

Date : Name and Signature of the Employee

Undertaking by the Employer

I / We, as the employer of the above-mentioned employee hereby undertake to :

(i) Pay the administrative charges payable at prescribed rates towards EPF/EPS

contribution made by/ in respect of the said employee (including that of his/ her

voluntary contribution); and also to

(ii) Comply with all the statutory provisions under EPF & MP Act, 1952 and Schemes

framed thereunder in respect of such employee with effect from the date of option

mentioned above as exercised by the employee.

2. Copy of Form-11 submitted by the member at the time of his/ her joining and Salary

Slip/ statement in respect of the member for wage month (both duly attested) are

also enclosed herewith for verification. (Ex : if Date of Option by member is 01.06.2021

(May paid in June contribution), enclose salary slip for wage month May 2021).

Place : Name and Signature of the Employer/

Date : Authorised Official with Seal.

For EPFO Office Use

The Joint Declaration in respect of Shri/ Smt/Ms. [UAN :

; PF Account No. : BG/BNG/ / ) under Para

26(6) of the Scheme for enrolment/ voluntary contribution is accepted herewith w.e.f .

Regional/ Assistant PF Commissioner (Accounts)

(Name and Signature with Seal)

To

1. Shri/Smt/Ms. (Through the employer)

2. M/s.

3. RPFC/ APFC (Enforcement)

You might also like

- QCC+Application Registration+FormDocument4 pagesQCC+Application Registration+FormrajaabidNo ratings yet

- IATF 16949 Sanctioned Interpretations 1 9 SIs FinalDocument8 pagesIATF 16949 Sanctioned Interpretations 1 9 SIs FinalOdagil BanzatoNo ratings yet

- Employee Suggestion SchemeDocument6 pagesEmployee Suggestion SchemeAnand Singh RathoreNo ratings yet

- Esic Case StudyDocument8 pagesEsic Case StudyNishant BaroliaNo ratings yet

- Rules 5 Edition Changes Presenter: Mrs. Michelle Maxwell, IAOBDocument20 pagesRules 5 Edition Changes Presenter: Mrs. Michelle Maxwell, IAOBsmallik3No ratings yet

- 020 Mock Drill Report Khetusar Aug-22 - Snake BiteDocument2 pages020 Mock Drill Report Khetusar Aug-22 - Snake BiteJaswant SutharNo ratings yet

- Procedure For Verification of Purchase DocumentationDocument2 pagesProcedure For Verification of Purchase Documentationmrugeshj100% (2)

- Factories Act 1948Document70 pagesFactories Act 1948akanungoNo ratings yet

- Exercise OhsmsDocument5 pagesExercise OhsmsHR CONSULTING JobNo ratings yet

- Design and Validation of A Low-Cost MicroscopeDocument3 pagesDesign and Validation of A Low-Cost Microscopeyousrazeidan1979No ratings yet

- 5 S For Shop Floor 01Document52 pages5 S For Shop Floor 01sachinNo ratings yet

- WI For 4M Change ManagementDocument2 pagesWI For 4M Change ManagementSwagatNo ratings yet

- Vendor Rejection and Debit PolicyDocument6 pagesVendor Rejection and Debit PolicysharanNo ratings yet

- Amfori BSCI System Manual GuidesDocument78 pagesAmfori BSCI System Manual GuidesTuan VietNo ratings yet

- Format Issue RecordDocument4 pagesFormat Issue RecordBharatNo ratings yet

- CILT score optimization for refinery processesDocument82 pagesCILT score optimization for refinery processesDiky RiansyahNo ratings yet

- Curriculum L1Document8 pagesCurriculum L1Haftamu HailuNo ratings yet

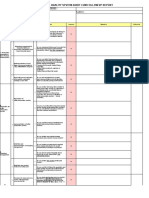

- QMS Audit Check-HR R2-ControlledDocument3 pagesQMS Audit Check-HR R2-Controlledkumarkk1969No ratings yet

- 2017 USFDA Warning LetterDocument7 pages2017 USFDA Warning Letterdrs_mdu48No ratings yet

- Is.1606.1979. AUTOMOBILE LAMPS PDFDocument67 pagesIs.1606.1979. AUTOMOBILE LAMPS PDFRENJITHNo ratings yet

- Dis 6 W 2 HDocument14 pagesDis 6 W 2 HBalachandar SathananthanNo ratings yet

- SOP - For - HygieneDocument1 pageSOP - For - HygieneELITE INDUSTRIAL CONSULTNo ratings yet

- Month Wise Compliance ChecklistDocument2 pagesMonth Wise Compliance ChecklistDevrupam SHNo ratings yet

- Why analysis root cause manufacturing defectsDocument4 pagesWhy analysis root cause manufacturing defectsmaulikgadaraNo ratings yet

- Dosage Forms - Development - Manufacturing - Quality/Gmps - Analytics - Outsourcing - Pharma MarketplaceDocument5 pagesDosage Forms - Development - Manufacturing - Quality/Gmps - Analytics - Outsourcing - Pharma MarketplaceMahin patelNo ratings yet

- CARA NC Management Tool Instructions For Client: IATF OversightDocument8 pagesCARA NC Management Tool Instructions For Client: IATF OversightAvinash CCMSNo ratings yet

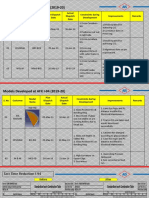

- Models developed at AFX I-95 and I-94 (2019-20) yield improvementsDocument4 pagesModels developed at AFX I-95 and I-94 (2019-20) yield improvementssunil kumarNo ratings yet

- Job Hazard Analysis for Pneumatic Conveying OperationDocument1 pageJob Hazard Analysis for Pneumatic Conveying OperationShahid RazaNo ratings yet

- Fsms-Sop-14 - Procedure For Control of Non-Conforming ProductsDocument5 pagesFsms-Sop-14 - Procedure For Control of Non-Conforming ProductsSanthosh VelusamyNo ratings yet

- Ehs Committee - NewDocument4 pagesEhs Committee - NewNand KumarNo ratings yet

- WMM1Document94 pagesWMM1Reymart SangalangNo ratings yet

- Telangana Labour Inspection ReportDocument7 pagesTelangana Labour Inspection ReportVishal NannaNo ratings yet

- 2nd Internal Audit ResultsDocument10 pages2nd Internal Audit Resultsalimustafa2786No ratings yet

- Verifier Guidance v1.4-1.0Document75 pagesVerifier Guidance v1.4-1.0Bayu Irawan sgiNo ratings yet

- Establishing Man Machine RatioDocument5 pagesEstablishing Man Machine RatioMadeleine Jennifer AyosoNo ratings yet

- October - 20 Monthly Meeting PresentationDocument17 pagesOctober - 20 Monthly Meeting PresentationMahmud Al HasanNo ratings yet

- SOP For Official & Personal Car UsageDocument2 pagesSOP For Official & Personal Car UsageAroojNo ratings yet

- 7.process Wise Level Wise Required OKDocument3 pages7.process Wise Level Wise Required OKPrakash kumarTripathiNo ratings yet

- Injection Molding SOP for Mini-Jector #55.1 MachineDocument12 pagesInjection Molding SOP for Mini-Jector #55.1 MachineYusuf SethNo ratings yet

- Training New Employees SOPDocument2 pagesTraining New Employees SOPPrince MoniNo ratings yet

- PUR - OI - 01 - Supplier Performance RatingDocument2 pagesPUR - OI - 01 - Supplier Performance RatingAbhinav SinghNo ratings yet

- WFTO Living Wage Calculation ToolDocument12 pagesWFTO Living Wage Calculation Tooldinesh_haiNo ratings yet

- Meenakshi Polymers rework inspection reportDocument1 pageMeenakshi Polymers rework inspection reportKaran MalhiNo ratings yet

- SPC ArticleDocument3 pagesSPC ArticleThanapoom BoonipatNo ratings yet

- 5.43 Purchasing Procedure PDFDocument6 pages5.43 Purchasing Procedure PDFSidney100% (1)

- 8.19 Poster Unusual SituationsDocument1 page8.19 Poster Unusual Situationsedumm001No ratings yet

- Preventive MaintenanceDocument145 pagesPreventive Maintenancesabar nhfdiNo ratings yet

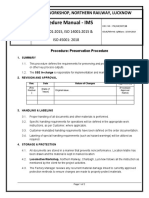

- Procedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowDocument2 pagesProcedure Manual - IMS: Locomotive Workshop, Northern Railway, LucknowMarjorie Dulay DumolNo ratings yet

- MARATHAN MOTOR SOP Recruitment ProcedureDocument4 pagesMARATHAN MOTOR SOP Recruitment Procedurerishi gautamNo ratings yet

- ISCC EU 202-01checklist For The Control of The Requirements 2.3 EngDocument11 pagesISCC EU 202-01checklist For The Control of The Requirements 2.3 Eng20sd12No ratings yet

- Implementing Total Productive Maintenance in Electronics IndustryDocument24 pagesImplementing Total Productive Maintenance in Electronics IndustryUmang SoniNo ratings yet

- Supplier Name Auditors: Vendor Attendees:: JudgmentDocument4 pagesSupplier Name Auditors: Vendor Attendees:: Judgment3A System SolutionNo ratings yet

- Social Factors - HIRADocument8 pagesSocial Factors - HIRARS MANIKANDANNo ratings yet

- Difference between Rework & Repair as per IATF 16949Document19 pagesDifference between Rework & Repair as per IATF 16949Danang Widoyoko100% (1)

- Sop For Good Manufacturing Practices: Written by Verified by Function Name Signature DateDocument17 pagesSop For Good Manufacturing Practices: Written by Verified by Function Name Signature DateSreelakshmi RakeshNo ratings yet

- Control of Documented Information ProcedureDocument3 pagesControl of Documented Information Proceduremahm.taha0% (1)

- HEMPADUR ZINC 15360 15360 en-GB PDFDocument2 pagesHEMPADUR ZINC 15360 15360 en-GB PDFErwin MalmsteinNo ratings yet

- FSSC 22000 Scheme Version 6 WORDDocument84 pagesFSSC 22000 Scheme Version 6 WORDKawtar FAOUZYNo ratings yet

- JD KRA LAB TeamDocument27 pagesJD KRA LAB TeamANILNo ratings yet

- Higher Wager Form 26Document2 pagesHigher Wager Form 26White knight 209 gamingNo ratings yet

- Joint Declaration FormatDocument1 pageJoint Declaration FormatSkillTree Payroll100% (1)

- Specimen SigncardDocument1 pageSpecimen SigncardHarshit Honey Gola100% (2)

- Esic Form-1Document1 pageEsic Form-1SkillTree PayrollNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Cost of Capital Optimization ModelingDocument71 pagesCost of Capital Optimization ModelingAhmed Mostafa ElmowafyNo ratings yet

- Ben and Jerry's Homemade Ice Cream IncDocument8 pagesBen and Jerry's Homemade Ice Cream IncHashim Ayaz KhanNo ratings yet

- FY14 IRS Form 990Document33 pagesFY14 IRS Form 990National Association of the DeafNo ratings yet

- Company Profile TNSBDocument13 pagesCompany Profile TNSBMoktar BakarNo ratings yet

- SWOT-based marketing strategyDocument20 pagesSWOT-based marketing strategyRIDHO CAHYADINo ratings yet

- Worth Telecom Advisors and SBA Communications Announce PartnershipDocument3 pagesWorth Telecom Advisors and SBA Communications Announce PartnershipPR.comNo ratings yet

- Lesson Plan Example: Subject Lesson Title Lesson SynopsisDocument2 pagesLesson Plan Example: Subject Lesson Title Lesson SynopsisJaysonGayumaNo ratings yet

- Cement Distribution Proposal for Addis AbabaDocument21 pagesCement Distribution Proposal for Addis AbabaTesfaye Degefa100% (5)

- XDocument6 pagesXBoogii EnkhboldNo ratings yet

- ICAEW Professional Level Business Strategy & Technology Question & Answer Bank March 2016 To March 2020Document475 pagesICAEW Professional Level Business Strategy & Technology Question & Answer Bank March 2016 To March 2020Optimal Management SolutionNo ratings yet

- Template Organizational ChartDocument11 pagesTemplate Organizational ChartJess SidadologNo ratings yet

- Principles of AccountingDocument183 pagesPrinciples of AccountingJoe UpZone100% (1)

- Customs ValuationDocument7 pagesCustoms ValuationJulliane Love A. Garcia100% (1)

- Accounting Information SystemDocument6 pagesAccounting Information SystemSamia Shahid100% (1)

- Engineering Ethics CodesDocument18 pagesEngineering Ethics CodesdanishakimiNo ratings yet

- Karim Ibrahim: Legal ConsultantDocument3 pagesKarim Ibrahim: Legal ConsultantKarim Mamdouh fahmyNo ratings yet

- International Trade From Islamic PerspectiveDocument3 pagesInternational Trade From Islamic PerspectiveMuhammad HashirNo ratings yet

- Basic Elements of Planning and Decision MakingDocument21 pagesBasic Elements of Planning and Decision MakingMd. Atiqul Hoque NiloyNo ratings yet

- Working Capital Management of Nepal Doorsanchar Company LimitedDocument48 pagesWorking Capital Management of Nepal Doorsanchar Company LimitedSovit Subedi100% (2)

- Relocation Cover Letter TemplateDocument5 pagesRelocation Cover Letter Templatefgwsnxvhf100% (1)

- Final Report WestsideDocument12 pagesFinal Report Westsidejshah_232933No ratings yet

- Tax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDocument1 pageTax Invoice for ACSR ZEBRA CONDUCTOR, UNGREASED from APAR INDUSTRIES LIMITED to KEC International LtdDoita Dutta ChoudhuryNo ratings yet

- T D M S T: HE Emand Anagement Trategies OF OyotaDocument4 pagesT D M S T: HE Emand Anagement Trategies OF OyotaTamim ChowdhuryNo ratings yet

- Anna University MBA Time Table August-September 2019 ExamsDocument8 pagesAnna University MBA Time Table August-September 2019 ExamssriNo ratings yet

- Metro HR PoliciesDocument15 pagesMetro HR PoliciesSadeeq KhanNo ratings yet

- Case Analysis 1Document6 pagesCase Analysis 1Fu Maria JoseNo ratings yet

- Additional Eco Mcqs-1Document42 pagesAdditional Eco Mcqs-1MunibaNo ratings yet

- Chapter 7Document34 pagesChapter 7selmanirisNo ratings yet

- Magi Case StudyDocument6 pagesMagi Case StudylingzenpauliNo ratings yet

- Latest Provisions TDS and CSDocument74 pagesLatest Provisions TDS and CShimesh amibrokerNo ratings yet