Professional Documents

Culture Documents

Islamic Banking

Uploaded by

sallyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Islamic Banking

Uploaded by

sallyCopyright:

Available Formats

Forms Of Financing In Islamic

Banking

1. Murabaha Sales Contract

A method of direct financing through which the clients asks the Bank to purchase a good or an

item, and the client pledges to purchase it from the Bank in case the Bank purchases it.

Thus, the Bank buys this item and it becomes its property, and then the item is sold to the client in

return for the first price and adding a known profit amount.

2. Lease to Own “Leasing”

It is a method of direct financing through which an asset owned by the Bank is leased to a client

who can benefit from the asset in return for a known leasing fee paid on a number of payment.

The Bank might not be the owner of the asset, in this case, the Bank will purchase this asset based

on the request of the client, who will rent it for the specified period, and the client will be

responsible for normal maintenance expenses (operational expenses), and the expenses necessary

for the use of the item is endured by the Lessor. The ownership of asset is transferred to the client

at the end of the contract term in return for a symbolic payment according to a sales or gift

contract. During the leasing period, the client pays the lease amount on a specified number of

installments, which are paid on specific dates. In case the client fails to fulfill his payments, the

contract will be terminated, and the paid amounts are considered lease fees. Any additional

amounts will be returned to the client.

Lease to Own

This arrangement is similar to the declining balance one described

above, except the financial institution puts up most, if not all, of the

money for the house and agrees to sell the house to the eventual

homeowner at the end of a fixed term. A portion of every payment goes

toward the lease and the balance toward the home's purchase price.

Leasing, or Ijarah, involves selling the right to use an object (usufruct)

for a specific time. One condition is that the lessor must own the leased

object for the duration of the lease. A variation on the lease, 'ijarah wa

'iqtina, provides for a lease to be written where the lessor agrees to sell

the leased object at the lease's end at a predetermined residual value.

This promise binds only the lessor. The lessee is not obligated to

purchase the item.

3. Istisna'a:

It is a method of direct financing through which the Bank produces a specific item or constructs a

building based on the request of the client. Istisna’a is a contract of exchange with deferred

delivery, applied to specified made-to-order items. It is a binding contract for both parties, taking

into consideration that it meets the specified requirements, such as defining the item, its type,

quantities, and description, in addition to specifying the price and the terms of payment. Istisna’a

is applied by considering the Bank as the manufacturer and the client as the requester of the asset

that needs to be manufactured for a named price, and then the Bank shall enter into contract with a

specialized manufacturer/contractor to produce the item in the agreed form, without making any

connections between the two contacts (which is known as parallel Istisna’a).

Islamic Forwards (Salam and Istisna)

These are rare forms of financing, used for certain types of business.

These are an exception to gharar. The price for the item is prepaid, and

the item is delivered at a definite point in the future. Because there is a

host of conditions to be met to render such contracts valid, the help of

an Islamic legal advisor is usually required.

4. Musharaka

It is a method of direct financing in which the Bank and the client jointly provide the capital

required for financing a particular project, and the Bank and the client share the profits according

to the agreed percentage, or in an a percentage of each party’s contribution in the capital.

According to the contract, profit is distributed as below:

An agreed share for the partner in return for project management and administration

works, according to a separate contract.

The amount of profit remaining after deducting the partner’s share is distributed according

to the agreed percentage, or according to the contribution of each party in the capital.

In case of loss, the parties distribute the loss according to each party’s contribution in the

capital only. However, the partner loses his management efforts and is not liable for any

financial loss.

The partners have the right to manage the project, and some have the right to waive their

right in management and to limit their role to financial contribution.

5. Mudaraba:

An agreement between two parties where one partner provides the money (the Bank) and the other

uses his efforts and work experience to manage the work (Mudarib), and the profits gained from

this project will be shared according to the agreed terms. In case of loss, the provider of the money

loses the money, and the other party loses his efforts, except in case of negligence from the later

party.

Mudaraba in divided into two types:

Absolut Mudaraba: The money provider does not request the specification of any work

conditions or terms.

Restricted Mudaraba: The money provider requests specific terms and restrictions, and this

is the type used in Islamic banks.

The Islamic bank pools investors' money and assumes a share of the

profits and losses. This process is agreed upon with the depositors.

What does the bank invest in? A group of mutual funds screened for

Sharia compliance has arisen. The filter parses company balance

sheets to determine whether any sources of income to the corporation

are prohibited. Companies holding too much debt or engaged in

forbidden lines of business are excluded. In addition to actively

managed mutual funds, passive funds exist as well. They are based on

such indexes as the Dow Jones Islamic Market Index and

the FTSE Global Islamic Index.

Declining Balance Shared Equity

Declining balance shared equity calls for the bank and the investor to

purchase the home jointly. It is commonly used to finance a home

purchase. The bank gradually transfers its equity in the house to the

individual homeowner, whose payments constitute the homeowner's

equity.

You might also like

- Islamic Financial Transaction TerminologyDocument6 pagesIslamic Financial Transaction Terminologyaries_1984No ratings yet

- Technical and Service RequirementsDocument136 pagesTechnical and Service RequirementssallyNo ratings yet

- Case 17 - Chemical Brothers InternationalDocument4 pagesCase 17 - Chemical Brothers InternationalachighamNo ratings yet

- Islamic FinanceDocument5 pagesIslamic Financeahsand123No ratings yet

- Islamic Banking PrinciplesDocument3 pagesIslamic Banking PrinciplesMd ArqamNo ratings yet

- Islamic Finance TermsDocument7 pagesIslamic Finance TermsShahin RahmanNo ratings yet

- Introduction To Islamic Finance FMDocument5 pagesIntroduction To Islamic Finance FMAriba ChodhryNo ratings yet

- Sources of Funds: Unit IiDocument36 pagesSources of Funds: Unit IiFara HameedNo ratings yet

- Islamic Banking and Conventional BankingDocument4 pagesIslamic Banking and Conventional BankingSajjad AliNo ratings yet

- Hbl-Islamic Banking (Hbl-Ib) Business ProductsDocument18 pagesHbl-Islamic Banking (Hbl-Ib) Business ProductsNaughty PrinceNo ratings yet

- Islamic Modes of FinancingDocument17 pagesIslamic Modes of FinancingALI SHER HaidriNo ratings yet

- Basic Concepts of Islamic FinanceDocument5 pagesBasic Concepts of Islamic FinanceSaifullahMakenNo ratings yet

- M204-19 Vishakha KateDocument8 pagesM204-19 Vishakha KatevishakhaNo ratings yet

- Pursuit of Islamic FinanceDocument3 pagesPursuit of Islamic FinanceShamim IqbalNo ratings yet

- Yasaar Glossary of TermsDocument5 pagesYasaar Glossary of TermsFatin MetassanNo ratings yet

- Financial Services - Unit 1Document72 pagesFinancial Services - Unit 1Darshini Thummar-ppmNo ratings yet

- Products and Services Offered by Islamic Banks.Document6 pagesProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniNo ratings yet

- Islamic Banking Working Capital ModesDocument5 pagesIslamic Banking Working Capital ModesMd AzizNo ratings yet

- FM Chapter 2: Source of FinanceDocument11 pagesFM Chapter 2: Source of FinancePillows GonzalesNo ratings yet

- Nature of Contracts in IBFDocument9 pagesNature of Contracts in IBFAtta BaigNo ratings yet

- Assignment No 2Document4 pagesAssignment No 2Basit KhanNo ratings yet

- Contract MuamalatDocument16 pagesContract MuamalatHarizul RafiqNo ratings yet

- Islamic Banking TermDocument2 pagesIslamic Banking TermAli Akbar MalikNo ratings yet

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- Islamic Banking ProductsDocument13 pagesIslamic Banking ProductsZeeshan KhanNo ratings yet

- Introduction To Islamic Finance: The Main Principles of Islamic Finance Are ThatDocument5 pagesIntroduction To Islamic Finance: The Main Principles of Islamic Finance Are ThatMariam NzNo ratings yet

- Islamic Economics Law: The Concept of Murabaha and Musyarakah MutanaqishahDocument8 pagesIslamic Economics Law: The Concept of Murabaha and Musyarakah MutanaqishahSabita AnjaningNo ratings yet

- Corporate BondsDocument4 pagesCorporate BondsWaseem ManshaNo ratings yet

- Debt ManagementDocument9 pagesDebt ManagementAngelie AnilloNo ratings yet

- E7 Introduction To Islamic FinanceDocument5 pagesE7 Introduction To Islamic FinanceTENGKU ANIS TENGKU YUSMANo ratings yet

- Diminishing Musharakah Presentation 02-06-08Document32 pagesDiminishing Musharakah Presentation 02-06-08AlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- E BusinessfinanceDocument15 pagesE BusinessfinanceDipannita RoyNo ratings yet

- Term Descriptions: Glossary of TermsDocument2 pagesTerm Descriptions: Glossary of TermsabdellaNo ratings yet

- Bank Al Habib Car FinanceDocument9 pagesBank Al Habib Car Financefatima rahimNo ratings yet

- Fund Based Financial ServicesDocument45 pagesFund Based Financial Servicesamitsingla19No ratings yet

- Contract of WadiahDocument4 pagesContract of WadiahMuhammadAzeemKhanNo ratings yet

- Assignment No 2Document4 pagesAssignment No 2Basit KhanNo ratings yet

- Modes of Islamic Finance AssignmentDocument4 pagesModes of Islamic Finance AssignmentSohaib AsifNo ratings yet

- Assignment No. 1: Financial ManagementDocument6 pagesAssignment No. 1: Financial ManagementmandeepNo ratings yet

- Islamic Modes of Financing: Musharakah ContractDocument34 pagesIslamic Modes of Financing: Musharakah ContractAbdul HafeezNo ratings yet

- Diminishing Musharakah ExplainedDocument32 pagesDiminishing Musharakah ExplainedAli KhanNo ratings yet

- 1.2 and Short TermDocument18 pages1.2 and Short TermDeeNo ratings yet

- Financial ManagementDocument5 pagesFinancial Managementsowmya chalumuruNo ratings yet

- Finance GlossaryDocument10 pagesFinance GlossaryhumaidjafriNo ratings yet

- Case StudyDocument2 pagesCase StudyJazmine Anne ManilaNo ratings yet

- NotesDocument5 pagesNotesRishabh SinghviNo ratings yet

- ISBF NotesDocument13 pagesISBF Notesmuneebmateen01No ratings yet

- Types of Corporate BondsDocument2 pagesTypes of Corporate BondsBarno NicholusNo ratings yet

- Where Businesses Get FundsDocument14 pagesWhere Businesses Get FundsJohn Paul GonzalesNo ratings yet

- BBA2030493Document14 pagesBBA2030493Saad AhmedNo ratings yet

- Meaning of Borrowing CostDocument5 pagesMeaning of Borrowing CostRituNo ratings yet

- Chapter 8Document54 pagesChapter 8Bishounen 42No ratings yet

- Types of SukukDocument6 pagesTypes of Sukuknawel mezighecheNo ratings yet

- Topic 4 - Sources of Finance - BasicsDocument36 pagesTopic 4 - Sources of Finance - BasicsSandeepa KaurNo ratings yet

- Long Term Financing SourcesDocument7 pagesLong Term Financing SourcesKennedy Waweru100% (1)

- Mnss Eoif ReportDocument9 pagesMnss Eoif ReportM.Nabeel Shahzad SiddiquiNo ratings yet

- Islamic Banking AssignmentDocument7 pagesIslamic Banking AssignmentFarjad AliNo ratings yet

- Assignment On Diminishing Musharakah by Malik SaeedDocument3 pagesAssignment On Diminishing Musharakah by Malik SaeedIbne- -AadamNo ratings yet

- SEBI WriteUpDocument4 pagesSEBI WriteUpTeja ChilukotiNo ratings yet

- Islamic Banks Fund Sources: Capital, Deposits, FinancingDocument2 pagesIslamic Banks Fund Sources: Capital, Deposits, FinancingAkma AseriNo ratings yet

- DepositDocument6 pagesDepositアユミ ガナデンNo ratings yet

- Islamic BankingDocument3 pagesIslamic BankingsallyNo ratings yet

- Being Digital at The Core: Finacle Core Banking SolutionDocument24 pagesBeing Digital at The Core: Finacle Core Banking SolutionAhaisibwe GeofreyNo ratings yet

- Genting&PUC PartnerPresentationGuide ConvertDocument13 pagesGenting&PUC PartnerPresentationGuide ConvertsallyNo ratings yet

- Malaysia's Major Payment Networks Managed by PayNetDocument3 pagesMalaysia's Major Payment Networks Managed by PayNetsallyNo ratings yet

- 10 InvestmentDocument2 pages10 InvestmentPaula Mae DacanayNo ratings yet

- Milestone 2 - Prompt 2Document12 pagesMilestone 2 - Prompt 2Peter PapelNo ratings yet

- 2nd PT-Applied Economics-Final Exam-2022-2023Document4 pages2nd PT-Applied Economics-Final Exam-2022-2023Diane GuilaranNo ratings yet

- Principles of Marketing Course Syllabus 2020-2021Document312 pagesPrinciples of Marketing Course Syllabus 2020-2021TONY MACUMUNo ratings yet

- Annual Financial Statements of Volkswagen AG As of December 31, 2022Document307 pagesAnnual Financial Statements of Volkswagen AG As of December 31, 2022Karen NinaNo ratings yet

- Capitulo 11Document26 pagesCapitulo 11Daniel Adrián Avilés VélezNo ratings yet

- Y Combinator Guide To Seed FundraisingDocument12 pagesY Combinator Guide To Seed FundraisingOluwasegun OluwaletiNo ratings yet

- Strategic Swing Trading (PDFDrive)Document98 pagesStrategic Swing Trading (PDFDrive)geokennyNo ratings yet

- MARKETING 4.0 and B4B: The New Marketing Models P I E R R E S A I D 2 0 2 3 - 2 0 2 4Document38 pagesMARKETING 4.0 and B4B: The New Marketing Models P I E R R E S A I D 2 0 2 3 - 2 0 2 4Salwa.fakhirNo ratings yet

- HLB Receipt-2023-03-08 2Document2 pagesHLB Receipt-2023-03-08 2zu hairyNo ratings yet

- AMM - Midwest Aluminum PremiumDocument13 pagesAMM - Midwest Aluminum Premiumnerolf73No ratings yet

- LAW-resa-corporation Flashcards Study GuideDocument27 pagesLAW-resa-corporation Flashcards Study Guiderose annNo ratings yet

- Instructions For Profit & Loss Distribution and Pool Management For Islamic Banking Institutions (Ibis)Document9 pagesInstructions For Profit & Loss Distribution and Pool Management For Islamic Banking Institutions (Ibis)Alhamd ShariahNo ratings yet

- Business Studies Project 2022-23Document19 pagesBusiness Studies Project 2022-23goplo singhNo ratings yet

- 2024 GIO - APAC Report - Final - CompressedDocument24 pages2024 GIO - APAC Report - Final - Compressedbotoy26No ratings yet

- SM - Skull CandyDocument11 pagesSM - Skull CandyRidhi BagariNo ratings yet

- SMMS Ch. 1 08.24.2017Document12 pagesSMMS Ch. 1 08.24.2017Maruf ReevesNo ratings yet

- Fundamentals of ABMDocument4 pagesFundamentals of ABMMadriñan Wency M.No ratings yet

- BOIMF NFO Cobranded One Pager - CompressedDocument2 pagesBOIMF NFO Cobranded One Pager - CompressedBig DickNo ratings yet

- MP Solomon Chapter 11Document42 pagesMP Solomon Chapter 11Annisa zata ismahNo ratings yet

- Stanley (DeWalt) Annual Report 2021-22Document140 pagesStanley (DeWalt) Annual Report 2021-22tamoghno sahaNo ratings yet

- Entrep Module 6 Market Share and ValueDocument58 pagesEntrep Module 6 Market Share and ValueCzenia BarroNo ratings yet

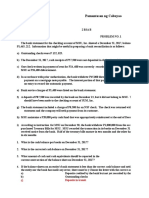

- Solution To Quiz 1Document2 pagesSolution To Quiz 1Carmi FeceroNo ratings yet

- ENAT BANK - Prodacts Final.1111Document58 pagesENAT BANK - Prodacts Final.1111yalewgetaye844No ratings yet

- Item No. Informal Default Resolution AnalysisDocument15 pagesItem No. Informal Default Resolution AnalysisLakshayNo ratings yet

- Bank and Banking System of BangladeshDocument49 pagesBank and Banking System of BangladeshCONTENT TUBENo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Indian Economybefore 1991, Linear Trendsand AgricultureDocument29 pagesIndian Economybefore 1991, Linear Trendsand Agriculturefocusahead.broNo ratings yet

- CH 12 - PA 2Document2 pagesCH 12 - PA 2lisahuang2032No ratings yet