Professional Documents

Culture Documents

SAPM Sheet

Uploaded by

Mridav GoelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SAPM Sheet

Uploaded by

Mridav GoelCopyright:

Available Formats

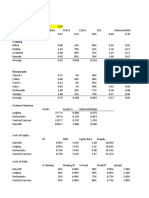

SMALL-CAP STOCK PORTFOLIO CALCULATION

T Bill Rate

Increase in % expected

Beginning

Securities Weights purchase price at the end of holding Projected price Dividend HPR

period

Apollo finvest 4% 660.0 9% 719.40 0 9.0%

Aarti drugs 6% 415.0 10% 456.50 0 10.0%

Karur Vyasa 8% 59.1 9% 64.42 0 9.0%

KPI green 10% 690.6 8% 745.79 0 8.0%

LT Foods 7% 88.7 7% 94.91 0 7.0%

Maharastra scooter 8% 3965.0 10% 4361.50 0 10.0%

Marksans Pharma 7% 48.9 10% 53.79 0 10.0%

Meghmani Organics 9% 130.0 7% 139.10 0 7.0%

Prudent corp. advisory 7% 548.3 7% 586.68 0 7.0%

Pudumjee papers 6% 41.6 14% 47.37 0 14.0%

Venkys 9% 2230.1 8% 2408.45 0 8.0%

VST tillers tractors 9% 2647.0 10% 2911.70 0 10.0%

Zen Tech. 10% 193.3 11% 214.56 0 11.0%

9.2%

OLIO CALCULATION

Expected Return/Value

6.26% 0.06 (Mean ) 0.0915 9.15%

Portfolio

Risk

SD Weighted Variance Excess Return premium Sharpe Ratio

Return

0.03 0.001 2.8%

0.21 0.043 3.8%

0.04 0.002 2.8%

0.36 0.132 1.8%

0.57 0.324 0.8%

0.24 0.058 3.8%

0.22 1.35 0.051 3.8% 2.9% 0.0167

0.65 0.416 0.8%

0.57 0.324 0.8%

1.19 1.411 7.8%

0.35 0.119 1.8%

0.26 0.065 3.8%

0.59 0.342 4.8%

1.81 3.29

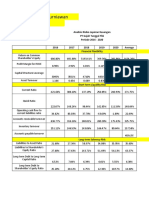

SMALL-CAP STOCK PORT

Increase in % expected

Beginning

Securities Weights purchase price at the end of holding

period

Apollo finvest 4% 660.0 9%

Aarti drugs 6% 415.0 10%

Karur Vyasa 8% 59.1 9%

KPI green 10% 690.6 8%

LT Foods 7% 88.7 7%

Maharastra scooter 8% 3965.0 10%

Marksans Pharma 7% 48.9 10%

Meghmani Organics 9% 130.0 7%

Prudent corp. advisory 7% 548.3 7%

Pudumjee papers 6% 41.6 14%

Venkys 9% 2230.1 8%

VST tillers tractors 9% 2647.0 10%

Zen Tech. 10% 193.3 11%

SMALL-CAP STOCK PORTFOLIO CALCULATION

Expected Return/Value

T Bill Rate

6.26% 0.06 (Mean )

Portfolio

Projected price Dividend HPR SD Weighted Variance

Return

719.40 0 9.0% 0.03 0.001

456.50 0 10.0% 0.21 0.043

64.42 0 9.0% 0.04 0.002

745.79 0 8.0% 0.36 0.132

94.91 0 7.0% 0.57 0.324

4361.50 0 10.0% 0.24 0.058

53.79 0 10.0% 0.22 1.35 0.051

139.10 0 7.0% 0.65 0.416

586.68 0 7.0% 0.57 0.324

47.37 0 14.0% 1.19 1.411

2408.45 0 8.0% 0.35 0.119

2911.70 0 10.0% 0.26 0.065

214.56 0 11.0% 0.59 0.342

9.2% 1.81 3.29

0.0915 9.15%

Risk

Excess Return premium Sharpe Ratio

2.8%

3.8%

2.8%

1.8%

0.8%

3.8%

3.8% 2.9% 0.0167

0.8%

0.8%

7.8%

1.8%

3.8%

4.8%

You might also like

- (EXCERPT) 2013 Duff Phelps Risk Premium Report PDFDocument124 pages(EXCERPT) 2013 Duff Phelps Risk Premium Report PDFUdit BhargavaNo ratings yet

- Equity Research HANDBOOKDocument29 pagesEquity Research HANDBOOKbolsaovejuna100% (8)

- Asset Pricing and Financial Markets: R. PayneDocument243 pagesAsset Pricing and Financial Markets: R. PayneAishwarya PotdarNo ratings yet

- Convertible StructuresDocument82 pagesConvertible Structureshitokiri8No ratings yet

- Fatca Strawman v1.15Document18 pagesFatca Strawman v1.15sauravhwasiaNo ratings yet

- Stock Screener203229Document3 pagesStock Screener203229Sde BdrNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Ratio Project of Atlas and HondaDocument1 pageRatio Project of Atlas and HondaShuja HashmiNo ratings yet

- GAWARVALADocument31 pagesGAWARVALAgurudev21No ratings yet

- Lyxor Chinah Lyxor Msindia Existing Portfolio Product of Deviation From The MeanDocument3 pagesLyxor Chinah Lyxor Msindia Existing Portfolio Product of Deviation From The MeanChin Yee LooNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- NadiDocument7 pagesNadisamikriteshNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Stock Screener002709Document2 pagesStock Screener002709Parikshit KunduNo ratings yet

- Alimento Requerido en B.S (KG)Document4 pagesAlimento Requerido en B.S (KG)carmen7yadiraNo ratings yet

- Estimari Dividende 2019 22.11.2019Document4 pagesEstimari Dividende 2019 22.11.2019Bogdan BoicuNo ratings yet

- Anexo 1. Resumen Valorización - Estimaciones BiceDocument1 pageAnexo 1. Resumen Valorización - Estimaciones BiceRicardo CarrilloNo ratings yet

- Name Logged Hours Prod. Per Call Calls AHT (Min) Quality Audits Impact %Document2 pagesName Logged Hours Prod. Per Call Calls AHT (Min) Quality Audits Impact %MariReyes0110No ratings yet

- M.09.c. - The Standard Capital Asset Pricing Model Efficient PorfolioDocument2 pagesM.09.c. - The Standard Capital Asset Pricing Model Efficient PorfolioLuciana FischmannNo ratings yet

- Análisis de Datos para PortafolioDocument8 pagesAnálisis de Datos para PortafolioAlberto Elías Gómez PalacioNo ratings yet

- PT AmfgDocument29 pagesPT AmfgPinasti PutriNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- AnswersDocument15 pagesAnswerslika rukhadzeNo ratings yet

- Advanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDDocument4 pagesAdvanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDJayesh PurohitNo ratings yet

- FIM TPDocument7 pagesFIM TPAfroza VabnaNo ratings yet

- 93 Optimal Risky PortfolioDocument6 pages93 Optimal Risky Portfoliomridul tiwariNo ratings yet

- Rekapan PerusahaanDocument2 pagesRekapan PerusahaanPinasti PutriNo ratings yet

- Particulars CMP Purchase Price Purchase Value Current Value Return (%) Purchase Weightage (%) Current No of Shares Current Weightage (%)Document31 pagesParticulars CMP Purchase Price Purchase Value Current Value Return (%) Purchase Weightage (%) Current No of Shares Current Weightage (%)gurudev21No ratings yet

- Marriott Cost of CapitalDocument3 pagesMarriott Cost of Capitalanmolsaini01No ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- 077 - UBAID DHANSAY Financial Accounting AasgnDocument15 pages077 - UBAID DHANSAY Financial Accounting Aasgniffu rautNo ratings yet

- Bolter 06Document2 pagesBolter 06Jose BravoNo ratings yet

- Defaultable Fixed Coupon Bond: PricingDocument10 pagesDefaultable Fixed Coupon Bond: PricinggiulioNo ratings yet

- Genetics Cull eDocument1 pageGenetics Cull eAhmed KECHROUDNo ratings yet

- Genetics-Cull eDocument1 pageGenetics-Cull eAhmed KECHROUDNo ratings yet

- Geneticsff Cull eDocument1 pageGeneticsff Cull eAhmed KECHROUDNo ratings yet

- Portfolio Assignment: InstructionsDocument9 pagesPortfolio Assignment: InstructionsAntariksh ShahwalNo ratings yet

- Skema TeknikalDocument4 pagesSkema TeknikalBastian Calvin DeranggaNo ratings yet

- Dashboard KpiDocument5 pagesDashboard KpiHR GANo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- EBLSL Daily Market Update 4th August 2020Document1 pageEBLSL Daily Market Update 4th August 2020Moheuddin SehabNo ratings yet

- Net Income Based Operating Income Based EBITDA Based Gross Income BasedDocument2 pagesNet Income Based Operating Income Based EBITDA Based Gross Income BasedAl-Quran DailyNo ratings yet

- Bitumen Extraction Test: Gradation of Aggregate of BC WT of SampleDocument6 pagesBitumen Extraction Test: Gradation of Aggregate of BC WT of Sampleamit singhNo ratings yet

- Data MixmrktDocument9 pagesData MixmrktRavi David UllahNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Portfolio 1Document10 pagesPortfolio 1gurudev21No ratings yet

- Update Harga: Real-Time: QualityDocument40 pagesUpdate Harga: Real-Time: Qualitymatumbaman 212No ratings yet

- PayrollDocument4 pagesPayrolljrtlimNo ratings yet

- Portfolio Performance PresentationDocument9 pagesPortfolio Performance Presentationharshwardhan.singh202No ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocument9 pagesDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNo ratings yet

- 1.524 (Assumption) Relevered BDocument3 pages1.524 (Assumption) Relevered BAhmad AliNo ratings yet

- Causas de Descartes de Vacas Leiteiras CanadáDocument1 pageCausas de Descartes de Vacas Leiteiras Canadájleao_450104401No ratings yet

- ER ProjectDocument25 pagesER ProjectGunjan AhujaNo ratings yet

- Stock Portfolio Tracker PDFDocument20 pagesStock Portfolio Tracker PDFDean DsouzaNo ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Analisis Laporan KeuanganDocument26 pagesAnalisis Laporan KeuanganAnanda LukmanNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Efficient Frontier and Capital Allocation Line (CAL) TemplateDocument6 pagesEfficient Frontier and Capital Allocation Line (CAL) TemplateBEATRICE SOPHIA PARMANo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Main Course Reading 2 - A More Rational Approach To NPDDocument7 pagesMain Course Reading 2 - A More Rational Approach To NPDMridav GoelNo ratings yet

- 19-7-2022 Class Work HeroMoto DataDocument16 pages19-7-2022 Class Work HeroMoto DataMridav GoelNo ratings yet

- Main Course Reading 1 - How The Software Industry Redefines Product ManagementDocument2 pagesMain Course Reading 1 - How The Software Industry Redefines Product ManagementMridav GoelNo ratings yet

- First Class 18-7-2022 Chapter - 1 Introduction To Financial Statement AnalysisDocument47 pagesFirst Class 18-7-2022 Chapter - 1 Introduction To Financial Statement AnalysisMridav GoelNo ratings yet

- Financial Analysis of Eicher MotorsDocument1 pageFinancial Analysis of Eicher MotorsMridav GoelNo ratings yet

- Optimised Stock WeightsDocument6 pagesOptimised Stock WeightsMridav GoelNo ratings yet

- Markowitz AnalysisDocument2 pagesMarkowitz AnalysisMridav GoelNo ratings yet

- Equidam Valuation MethodologyDocument11 pagesEquidam Valuation MethodologyTolga BilgiçNo ratings yet

- Valuation of GoodwillDocument34 pagesValuation of GoodwillGamming Evolves100% (1)

- Risk Adjusted Discount RateDocument3 pagesRisk Adjusted Discount RateHoney KullarNo ratings yet

- Equity Valuation and Analysis ManualDocument147 pagesEquity Valuation and Analysis ManualHarsh Kedia100% (1)

- 2008 13 Financial Statements Samsung 2007Document26 pages2008 13 Financial Statements Samsung 2007Wilson Edilber ValenciaNo ratings yet

- Bisnews Technical AnalysisDocument33 pagesBisnews Technical AnalysisWings SVNo ratings yet

- Part A: Multiple Choice Questions (20 Marks)Document18 pagesPart A: Multiple Choice Questions (20 Marks)Anonymous f5ZhkfZmk9100% (1)

- Coetsee - The Role of Accounting Theory - HighlightDocument17 pagesCoetsee - The Role of Accounting Theory - HighlightThanaa LakshimiNo ratings yet

- Summers-Barsky Gold ThesisDocument4 pagesSummers-Barsky Gold Thesisdwk3zwbx100% (2)

- Venture Capital Review Fair ValueDocument12 pagesVenture Capital Review Fair ValueStefanoMannaNo ratings yet

- Business Accounting and Finance (Tony Davies, Ian Crawford)Document801 pagesBusiness Accounting and Finance (Tony Davies, Ian Crawford)ursisNo ratings yet

- All Salford PDFDocument41 pagesAll Salford PDFParker CelsioNo ratings yet

- Brand Finance Telecoms 150 2022 Preview - 23Document25 pagesBrand Finance Telecoms 150 2022 Preview - 23Ly Hung LaiNo ratings yet

- Companies and Financial Accounting: CEGE0016 - Financial Aspects of Project EngineeringDocument64 pagesCompanies and Financial Accounting: CEGE0016 - Financial Aspects of Project EngineeringRiccardo PappalardoNo ratings yet

- Sven Carlin 20210405 Baidu Stock AnalysisDocument35 pagesSven Carlin 20210405 Baidu Stock AnalysisEric Octavio Mayoral GarinianNo ratings yet

- Reconstitution of A Partnership Firm Retirement Death of A PartnerDocument193 pagesReconstitution of A Partnership Firm Retirement Death of A PartnerMohammad Tariq AnsariNo ratings yet

- Premium - CH - 27 - The Basic Tools of FinanceDocument43 pagesPremium - CH - 27 - The Basic Tools of Financewanda refitaNo ratings yet

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsVishal JoshiNo ratings yet

- Lecture 5 - Ratio AnalysisDocument37 pagesLecture 5 - Ratio AnalysisnopeNo ratings yet

- 3m ReportDocument22 pages3m Reportapi-321324040No ratings yet

- Cwopa Sers Comprehensive Annual Financial Report 2003Document96 pagesCwopa Sers Comprehensive Annual Financial Report 2003EHNo ratings yet

- Equity Investment 2 - ValuationDocument34 pagesEquity Investment 2 - Valuationnur syahirah bt ab.rahmanNo ratings yet

- FIN 502 SyllabusDocument5 pagesFIN 502 Syllabusasantosh10% (1)

- SR 123Document36 pagesSR 123Fanteri Aji DharmaNo ratings yet

- Investment Analysis and Portfolio Management-KRISTINA L PDFDocument166 pagesInvestment Analysis and Portfolio Management-KRISTINA L PDFWahyu S. Furqonnanto100% (2)