Professional Documents

Culture Documents

Recording Depreciation in The Accounting Books

Recording Depreciation in The Accounting Books

Uploaded by

Victoria VirgoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recording Depreciation in The Accounting Books

Recording Depreciation in The Accounting Books

Uploaded by

Victoria VirgoCopyright:

Available Formats

RECORDING DEPRECIATION IN THE ACCOUNTING BOOKS

Double entry to write off Depreciation:

Debit Profit and Loss Account

Credit Provision for Depreciation Account

The Provision for Depreciation Account is a contra- asset account which shows the

amount by which the fixed asset is being depreciated each year as well as the

accumulated depreciation* after each year.

*Recall that accumulated depreciation refers to the total amount by which the

fixed asset has been depreciated for the time that it has been in use.

In order to show a fixed assets bought and its subsequent depreciation in the

books, you must prepare the following:

1. The fixed asset account – this account records the date, detail and cost

price of the asset bought.

2. The Provision for depreciation account – this account records the yearly

amount that is written off as depreciation. It also shows the accumulated

depreciation after each year of use (when it is balanced off).

3. The Profit and Loss Account Extract – this shows the yearly depreciation

amount being written off as an expense. DEPRECIATION IS AN EXPENSE.

4. The Balance Sheet Extract – this shows the net book value (current value)

of the fixed assets by deducting accumulated depreciation from the cost of

the fixed asset.

You might also like

- Establish & Maintain An Accural Accounting SystemDocument34 pagesEstablish & Maintain An Accural Accounting SystemMagarsaa Hirphaa100% (2)

- Audit of Income and Expenditure Account 1.1Document27 pagesAudit of Income and Expenditure Account 1.1Akshata Masurkar100% (1)

- ACCOUNTINGDocument3 pagesACCOUNTINGAllyza Mae Matibag Gallivo100% (1)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Practical Accounting 2 Review: Installment SalesDocument22 pagesPractical Accounting 2 Review: Installment SalesJason BautistaNo ratings yet

- Accounting Standard 6 - DepreciationDocument34 pagesAccounting Standard 6 - DepreciationSarthak Gupta100% (2)

- Depreciation Is Computed As FollowsDocument2 pagesDepreciation Is Computed As FollowsAnna MaeNo ratings yet

- Accumulated Depreciation: Everything You Need To KnowDocument7 pagesAccumulated Depreciation: Everything You Need To KnowhieutlbkreportNo ratings yet

- Accounting 12 Chapter 8Document30 pagesAccounting 12 Chapter 8cecilia capiliNo ratings yet

- Capital vs. RevenueDocument23 pagesCapital vs. RevenueAjay Prakash VermaNo ratings yet

- Rev Acc 11 SampleDocument28 pagesRev Acc 11 Sampledlaminifanele903No ratings yet

- Acc201 Su4Document12 pagesAcc201 Su4Gwyneth LimNo ratings yet

- L6 DepreciationDocument35 pagesL6 DepreciationVall Halla100% (1)

- 4.2 Accounting For Depreciation and Disposal of Non-Current AssetsDocument10 pages4.2 Accounting For Depreciation and Disposal of Non-Current Assetsnoahsilva374No ratings yet

- What Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodDocument23 pagesWhat Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodShamarat RahmanNo ratings yet

- Introduction To Presentation of Final AccountsDocument36 pagesIntroduction To Presentation of Final AccountsSoumya GhoshNo ratings yet

- Chapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRDocument14 pagesChapter - 7 Income Statements Learning Objectives: Dr. Trading A/C CRSaket_srv2100% (1)

- Afm Mod 2Document4 pagesAfm Mod 2Manas MohapatraNo ratings yet

- Chapter - 6: © The Institute of Chartered Accountants of IndiaDocument56 pagesChapter - 6: © The Institute of Chartered Accountants of IndiaAyyappa KattamuriNo ratings yet

- CHAPTER 2-Statement of Comprehensive IncomeDocument4 pagesCHAPTER 2-Statement of Comprehensive IncomeDan GalvezNo ratings yet

- Completing The Accounting Cycle For A Merchandising BusinessDocument11 pagesCompleting The Accounting Cycle For A Merchandising BusinessRhea BernabeNo ratings yet

- DEPRECIATIONDocument6 pagesDEPRECIATIONShivaniNo ratings yet

- Acctg 1Document39 pagesAcctg 1Clarize R. MabiogNo ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- 11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkDocument5 pages11 Accountancy - Depreciation, Provisions and Reserves - Notes & Video LinkAmit GuptaNo ratings yet

- What Is A Plant AssetDocument23 pagesWhat Is A Plant AssetMiton AlamNo ratings yet

- 28898cpt Fa SM cp6Document0 pages28898cpt Fa SM cp6వెంకటరమణయ్య మాలెపాటిNo ratings yet

- 15 1312MH CH09 PDFDocument17 pages15 1312MH CH09 PDFAntora HoqueNo ratings yet

- Final Accouts SPDocument74 pagesFinal Accouts SPASHIR GANDHI100% (1)

- Chapter 11Document26 pagesChapter 11ENG ZI QINGNo ratings yet

- Depreciation account-WPS OfficeDocument11 pagesDepreciation account-WPS Officegbengayusuf167No ratings yet

- Completing The Merchandising Accounting CycleDocument40 pagesCompleting The Merchandising Accounting CycleChloe LynnesseNo ratings yet

- Matter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDocument7 pagesMatter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDanica MamontayaoNo ratings yet

- © Ncert Not To Be Republished: Accounts From Incomplete RecordsDocument38 pages© Ncert Not To Be Republished: Accounts From Incomplete RecordsIas Aspirant AbhiNo ratings yet

- Chapter Two: Stock Investments-Investor Accounting & ReportingDocument83 pagesChapter Two: Stock Investments-Investor Accounting & ReportingFackallofyouNo ratings yet

- Long-Term Assets: Study GuideDocument19 pagesLong-Term Assets: Study GuideJaspreet GillNo ratings yet

- Keac 211Document38 pagesKeac 211vichmegaNo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- Chap 10-Preparing Financial StatementDocument4 pagesChap 10-Preparing Financial Statementsyuhada zakiNo ratings yet

- 61809bos50279 cp7 U1Document61 pages61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- Single EntryDocument38 pagesSingle EntryAbhishek MlshraNo ratings yet

- Cost Accounting 1-7 Lessons PDFDocument130 pagesCost Accounting 1-7 Lessons PDFRupak ChandnaNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- Unit - 4 Final AccountDocument39 pagesUnit - 4 Final AccountHusain BohraNo ratings yet

- Reviewer in AccountingDocument5 pagesReviewer in AccountingK ByeNo ratings yet

- Financial Reporting: Othm Level 5 Diploma in Accounting and BusinessDocument33 pagesFinancial Reporting: Othm Level 5 Diploma in Accounting and BusinessDime PierrowNo ratings yet

- Abm 003 - ReviewerDocument12 pagesAbm 003 - ReviewerMary Beth Dela CruzNo ratings yet

- Books of Original EntriesDocument21 pagesBooks of Original EntriesMohamed Adil GibreelNo ratings yet

- Accounting Final ExamDocument6 pagesAccounting Final ExamKarim Abdel Salam Elzahby100% (1)

- Asset AccountingDocument9 pagesAsset AccountingPrabhu Ramanathan R100% (1)

- Financial StatementsDocument12 pagesFinancial StatementsShrutika MoreNo ratings yet

- Retained Earnings Account in SapDocument3 pagesRetained Earnings Account in SapAnanthakumar ANo ratings yet

- Financial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%Document10 pagesFinancial Accounting - Review: HUL Q4 Misses Estimates, Profit Dips 1% To Rs 1,519 Crore, Volume Shrinks 7%anishjoseph007No ratings yet

- E-Book - Final Accounts - PDF OnlyDocument34 pagesE-Book - Final Accounts - PDF OnlyAshish GuptaNo ratings yet

- 55008bosfndnov19 p1 Cp7u1Document62 pages55008bosfndnov19 p1 Cp7u1Jammigumpula Priyanka100% (1)

- Master BudgetDocument6 pagesMaster BudgetPacir QubeNo ratings yet

- Fa I Chapter 2Document5 pagesFa I Chapter 2Hussen AbdulkadirNo ratings yet

- FA-SEM-I-4 - Adjustment EntriesDocument20 pagesFA-SEM-I-4 - Adjustment EntriesGagan Deep SinghNo ratings yet

- Chapter6 - Trial balance and Preparation of Final Accounts яDocument13 pagesChapter6 - Trial balance and Preparation of Final Accounts яshreya taluja100% (1)

- PolymersDocument36 pagesPolymersVictoria VirgoNo ratings yet

- Response and Stimulus UpdatedDocument54 pagesResponse and Stimulus UpdatedVictoria VirgoNo ratings yet

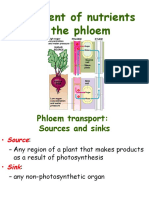

- Translocation in The Phloem and Storage OrgansDocument11 pagesTranslocation in The Phloem and Storage OrgansVictoria VirgoNo ratings yet

- Electronic Structure 3Document41 pagesElectronic Structure 3Victoria VirgoNo ratings yet

- 2018osmosis - DiffusionDocument11 pages2018osmosis - DiffusionVictoria VirgoNo ratings yet

- Uptake of Water in PlantsDocument12 pagesUptake of Water in PlantsVictoria VirgoNo ratings yet

- KS4 What Is BloodDocument40 pagesKS4 What Is BloodVictoria VirgoNo ratings yet

- Paper ChromatographyDocument18 pagesPaper ChromatographyVictoria VirgoNo ratings yet

- Separation Techniques NotesDocument4 pagesSeparation Techniques NotesVictoria VirgoNo ratings yet

- MatterDocument15 pagesMatterVictoria VirgoNo ratings yet

- Isotopes 2018Document18 pagesIsotopes 2018Victoria VirgoNo ratings yet