Professional Documents

Culture Documents

Benefit Illustration

Uploaded by

Kushal BhatiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration

Uploaded by

Kushal BhatiaCopyright:

Available Formats

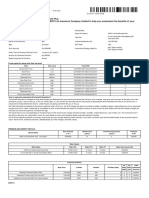

Benefit Illustration for HDFC Life Click 2 Wealth

This illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your HDFC Life Click 2 Wealth

Details

Nam e of the Prospect /Policyholder: m aya bhatia Proposal No:

Age: 54 Nam e of Product HDFC Life Click 2 W ealth

Nam e of the Life Assured: m aya bhatia Tag Line: A Unit Link ed Non-par Life Insurance Plan

Age: 54 Unique Identification 101L133V02

Sum Assured: 10,00,000 No:

Policy Term & Prem ium Paym ent Term : 10 year(s) and 5 year(s) GST Rate: 18%

Plan O ption: Invest Plus Investm ent Strategy 0 % Debt oriented, 0 % Hybrid oriented,100 %

Am ount of Instalm ent Prem ium : 1,00,000 opted for: Equity oriented

Mode of Paym ent of Prem ium : Yearly

Funds opted for along with their risk level:

Fund Risk Level Fund SFIN Fund A llocation (%)

Diversified Equity Fund High ULIF05501/08/13DivrEqtyFd101 0

Blue Chip Fund High ULIF03501/01/10BlueChipFd101 0

Balanced Fund Medium ULIF03901/09/10BalancedFd101 0

Bond Fund Low ULIF05601/08/13Bond Funds101 0

Discovery Fund High ULIF06618/01/18DiscvryFnd101 0

Equity Advantage Fund High ULIF06723/03/18EqtyAdvtFd101 0

O pportunities Fund High ULIF03601/01/10O pprtntyFd101 100

Liquid Fund Low ULIF00102/01/04LiquidFund101 0

Bond Plus Fund Medium ULIF06814/06/19BondPlusFd101 0

Secure Advantage Fund Low ULIF06914/06/19SecAdvFund101 0

How to read and understand this benefit illustration?

This benefit illustration is intended to show what charges are deducted from your prem ium s and how the unit fund, net of charges, m ay grow over the years of the policy term if the

fund earns a gross return of 8% p.a. or 4% p.a. These rates, i.e., 8% p.a. and 4% p.a. are assum ed only for the purpose of illustrating the flow of benefits if the returns are at this

level. It should not be interpreted that the returns under the plan are going to be either 8% p.a. or 4% p.a. Net Yield m entioned corresponds to the gross investm ent return of 8%

p.a., net of all charges but does not consider m ortality, m orbidity charges, underwriting ex tra, if any, guarantee charges and cost of riders, if deducted by cancellation of units. It

dem onstrates the im pact of charges and tax es on the net yield. Please note that the m ortality charges per thousand sum assured in general, increases with age. The actual returns

can vary depending on the perform ance of the chosen fund, charges towards m ortality, m orbidity, underwriting ex tra, cost of riders, etc. The investm ent risk in this policy is borne by

the policyholder, hence, for m ore details on term s and conditions please read sales literature carefully. Part A of this statem ent presents a sum m ary view of year-by-year charges

deducted under the policy, fund value, surrender value and the death benefit, at two assum ed rates of return. Part B of this statem ent presents a detailed break -up of the charges,

and other values.

Part A (A mount in Rupees)

A t 4% p.a. Gross Investment Return A t 8% p.a. Gross Investment Return Commission/

Policy A nnualized Mortality, Mortality, Payable to

Year Premium Morbidity Other GST Fund at End Surrender Death Morbidity Other GST Fund at End Surrender Death Intremediary

Charges Charges* of Year Value Benefit Charges Charges* of Year Value Benefit (Rs)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1 1,00,000 6,775 323 1,458 95,284 95,284 10,00,000 6,762 351 1,460 99,108 99,108 10,00,000 0

2 1,00,000 6,654 1,628 1,671 1,92,957 1,92,957 10,00,000 6,593 1,737 1,679 2,04,658 2,04,658 10,00,000 0

3 1,00,000 6,381 2,966 1,862 2,93,258 2,93,258 10,00,000 6,224 3,214 1,879 3,17,299 3,17,299 10,00,000 0

4 1,00,000 5,937 4,343 2,030 3,96,453 3,96,453 10,00,000 5,625 4,792 2,055 4,37,760 4,37,760 10,00,000 0

5 1,00,000 5,309 5,760 2,172 5,02,829 5,02,829 10,00,000 4,762 6,482 2,204 5,66,854 5,66,854 10,00,000 0

6 0 5,657 6,831 2,248 5,07,916 5,07,916 10,00,000 4,798 7,874 2,281 5,96,672 5,96,672 10,00,000 0

7 0 6,015 6,897 2,324 5,12,696 5,12,696 10,00,000 4,776 8,291 2,352 6,28,392 6,28,392 10,00,000 0

8 0 6,389 6,959 2,403 5,17,141 5,17,141 10,00,000 4,691 8,735 2,417 6,62,211 6,62,211 10,00,000 0

9 0 6,789 7,016 2,485 5,21,213 5,21,213 10,00,000 4,537 9,208 2,474 6,98,346 6,98,346 10,00,000 0

10 0 7,225 7,068 2,573 5,87,991 5,87,991 10,00,000 4,303 9,715 2,523 7,90,111 7,90,111 10,00,000 0

*See Part B for details.

IN THIS PO LICY, THE INVESTMENT RISK IS BO RNE BY THE PO LICYHO LDER AND THE ABO VE INTEREST RATES ARE O NLY FO R ILLUSTRATIO N PURPO SE

I, _____________ (nam e), have ex plained the prem ium s, charges and I, _____________ (nam e), having received the inform ation with respect to the above,

benefits under the policy fully to the prospect / policyholder. have understood the above statem ent before entering into the contract.

Place : Signature of Agent/ Interm ediary / O fficial

Date : Date : Signature of Prospect/ Policyholder

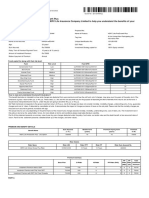

Part B Gross Yield 8% pa Net Yield 5.84% (A mounts in Rupees)

A nnualized

A nnualized Premium Premium- Policy A dditions Fund Fund at

Policy Premium A llocation Premium Mortality GST A dmin. Guarantee Other to before FMC End Surrender Death

Year (A P) Charge A llocation Charge Charge Charge Charges the fund FMC of Year value Benefit

(PA C) Charges

(A P) - (PA C)

1 1,00,000 (1,000) 1,01,000 6,762 1,460 0 0 351 0 1,00,459 1,351 99,108 99,108 10,00,000

2 1,00,000 (1,000) 1,01,000 6,593 1,679 0 0 1,737 0 2,07,394 2,737 2,04,658 2,04,658 10,00,000

3 1,00,000 (1,000) 1,01,000 6,224 1,879 0 0 3,214 0 3,21,513 4,214 3,17,299 3,17,299 10,00,000

4 1,00,000 (1,000) 1,01,000 5,625 2,055 0 0 4,792 0 4,43,553 5,792 4,37,760 4,37,760 10,00,000

5 1,00,000 (1,000) 1,01,000 4,762 2,204 0 0 6,482 0 5,74,336 7,482 5,66,854 5,66,854 10,00,000

6 0 (0) 0 4,798 2,281 0 0 7,874 0 6,04,546 7,874 5,96,672 5,96,672 10,00,000

7 0 (0) 0 4,776 2,352 0 0 8,291 0 6,36,683 8,291 6,28,392 6,28,392 10,00,000

8 0 (0) 0 4,691 2,417 0 0 8,735 0 6,70,946 8,735 6,62,211 6,62,211 10,00,000

9 0 (0) 0 4,537 2,474 0 0 9,208 0 7,07,554 9,208 6,98,346 6,98,346 10,00,000

10 0 (0) 0 4,303 2,523 0 0 9,715 53,071 7,99,826 9,715 7,90,111 7,90,111 10,00,000

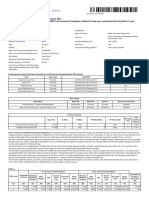

Part B Gross Yield 4% pa (A mounts in Rupees)

A nnualized

A nnualized Premium Premium- Policy A dditions Fund at

Policy Premium A llocation Premium Mortality GST A dmin. Guarantee Other to Fund before FMC End Surrender Death

Policy Premium A llocation Premium Mortality GST A dmin. Guarantee Other to Fund before FMC End Surrender Death

Year (A P) Charge A llocation Charge Charge Charge Charges the fund FMC of Year value Benefit

(PA C) Charges

(A P) - (PA C)

1 1,00,000 (1,000) 1,01,000 6,775 1,458 0 0 323 0 96,607 1,323 95,284 95,284 10,00,000

2 1,00,000 (1,000) 1,01,000 6,654 1,671 0 0 1,628 0 1,95,585 2,628 1,92,957 1,92,957 10,00,000

3 1,00,000 (1,000) 1,01,000 6,381 1,862 0 0 2,966 0 2,97,225 3,966 2,93,258 2,93,258 10,00,000

4 1,00,000 (1,000) 1,01,000 5,937 2,030 0 0 4,343 0 4,01,795 5,343 3,96,453 3,96,453 10,00,000

5 1,00,000 (1,000) 1,01,000 5,309 2,172 0 0 5,760 0 5,09,589 6,760 5,02,829 5,02,829 10,00,000

6 0 (0) 0 5,657 2,248 0 0 6,831 0 5,14,747 6,831 5,07,916 5,07,916 10,00,000

7 0 (0) 0 6,015 2,324 0 0 6,897 0 5,19,593 6,897 5,12,696 5,12,696 10,00,000

8 0 (0) 0 6,389 2,403 0 0 6,959 0 5,24,100 6,959 5,17,141 5,17,141 10,00,000

9 0 (0) 0 6,789 2,485 0 0 7,016 0 5,28,229 7,016 5,21,213 5,21,213 10,00,000

10 0 (0) 0 7,225 2,573 0 0 7,068 63,131 5,95,060 7,068 5,87,991 5,87,991 10,00,000

*Specify details, if any.

Notes:

1. Refer the Sales Literarure for ex plaination of term s used in this illustration.

2. Fund Managem ent Charge is based on the specific fund option(s) chosen.

3. In case rider charges are collected ex plicitely through collection of rider prem ium , and not by way of cancellation of units, then, such charges are not considered in this illustration.

In other cases, rider charges are included in other charges.

I, _____________ (nam e), have ex plained the prem ium s, charges and I, _____________ (nam e), having received the inform ation with respect to the above,

benefits under the policy fully to the prospect / policyholder. have understood the above statem ent before entering into the contract.

Place : Signature of Agent/ Interm ediary / O fficial

Date : Date : Signature of Prospect/ Policyholder

Channel Name : Direct - Online

Note: Kindly note that nam e of the com pany has changed from "HDFC Standard Life Insurance Com pany Lim ited" to "HDFC Life Insurance Com pany Lim ited".

You might also like

- IllustrationDocument5 pagesIllustrationabhayNo ratings yet

- HDFC Life Click 2 Invest benefit illustrationDocument3 pagesHDFC Life Click 2 Invest benefit illustrationHimanshu AgrawalNo ratings yet

- Illustration Qc2ozcvux82jpDocument4 pagesIllustration Qc2ozcvux82jpnaveenchand_a6No ratings yet

- Benefit Illustration for HDFC Life Click 2 WealthDocument3 pagesBenefit Illustration for HDFC Life Click 2 WealthUraj RaiNo ratings yet

- IllustrationDocument3 pagesIllustrationPaluri GowthamNo ratings yet

- IllustrationDocument3 pagesIllustrationFuse BulbNo ratings yet

- Benefit Illustration for HDFC SL ProGrowth FlexiDocument3 pagesBenefit Illustration for HDFC SL ProGrowth FlexiFuse BulbNo ratings yet

- HDFC Life InsuranceDocument2 pagesHDFC Life Insuranceestrade1112No ratings yet

- HDFC Life Click 2 Invest - ULIP benefit illustrationDocument3 pagesHDFC Life Click 2 Invest - ULIP benefit illustrationgirlsbioNo ratings yet

- IllustrationDocument3 pagesIllustrationPaluri GowthamNo ratings yet

- Dear Ms. Rashi Chaubal: Key FeaturesDocument5 pagesDear Ms. Rashi Chaubal: Key FeaturesRenu BrijeshNo ratings yet

- Fortune MaximaDocument6 pagesFortune MaximaAshishNo ratings yet

- Illustration (13) - 1Document3 pagesIllustration (13) - 1prabu80959No ratings yet

- IllustrationDocument3 pagesIllustrationMahesh AgrawalNo ratings yet

- Illustration - 2024-03-28T115434.538Document3 pagesIllustration - 2024-03-28T115434.538rm3650910No ratings yet

- 622 Fortune Pro ComboDocument4 pages622 Fortune Pro ComboShahrukh HussainNo ratings yet

- Tata AIA Life Insurance Fortune Pro: Benefit IllustrationDocument6 pagesTata AIA Life Insurance Fortune Pro: Benefit IllustrationTechnical AkashNo ratings yet

- 44 ProDocument4 pages44 Proderoztrade7777No ratings yet

- Tata AIA Life Insurance Fortune Pro: Benefit IllustrationDocument4 pagesTata AIA Life Insurance Fortune Pro: Benefit IllustrationNavaneethakrishnan GanesanNo ratings yet

- Tata AIA Life Insurance Fortune Pro: Benefit IllustrationDocument4 pagesTata AIA Life Insurance Fortune Pro: Benefit IllustrationSunil MahantyNo ratings yet

- Tata AIA Life Insurance Fortune Pro: Benefit IllustrationDocument4 pagesTata AIA Life Insurance Fortune Pro: Benefit IllustrationAbhishek BadalNo ratings yet

- Tata AIA Life Insurance Fortune Pro: Benefit IllustrationDocument4 pagesTata AIA Life Insurance Fortune Pro: Benefit IllustrationBhaiyalal YadavNo ratings yet

- Illustration (17) - 2023-12-16T143609.487Document2 pagesIllustration (17) - 2023-12-16T143609.487shailendra.goswamiNo ratings yet

- Maximize savings and protection with Tata AIA Life Insurance Fortune ProDocument4 pagesMaximize savings and protection with Tata AIA Life Insurance Fortune ProPawan KumarNo ratings yet

- Benefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Document3 pagesBenefit Name Sum A Ssured (In RS.) Benefit Term (Years) Premium Paying Term (Years) Premium (In RS.)Vasanth VasantNo ratings yet

- HDFC Life Click 2 Invest ULIP policy illustrationDocument3 pagesHDFC Life Click 2 Invest ULIP policy illustrationVasanth VasantNo ratings yet

- Benefit illustration for Tata AIA Life Insurance Fortune ProDocument4 pagesBenefit illustration for Tata AIA Life Insurance Fortune ProSài TejaNo ratings yet

- SmartElite19072022 8468161Document3 pagesSmartElite19072022 8468161manishNo ratings yet

- Benefit IllustrationDocument6 pagesBenefit IllustrationUniqueNo ratings yet

- IllustrationDocument4 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- Benefit IllustrationDocument5 pagesBenefit IllustrationPrabaKaranNo ratings yet

- Smart Wealth Assure - BrochureDocument16 pagesSmart Wealth Assure - BrochureIswarya SelvarajNo ratings yet

- Pension Plus v2 Arn Slic Brochure WithdrawnDocument10 pagesPension Plus v2 Arn Slic Brochure WithdrawnNitin MishraNo ratings yet

- BenefitIllustration 1700979499329Document6 pagesBenefitIllustration 1700979499329abhishekshriramlife23No ratings yet

- SBI - Life - Smart - Wealth - Assure - V03 - Brochure - 20 - 1Document15 pagesSBI - Life - Smart - Wealth - Assure - V03 - Brochure - 20 - 1sunder vermaNo ratings yet

- Variable Life Insurance ProposalDocument11 pagesVariable Life Insurance ProposalRoumel GalvezNo ratings yet

- Retire - Smart - Brochure - Brand ReimagineDocument16 pagesRetire - Smart - Brochure - Brand Reimagineneop lopianNo ratings yet

- Benefit IllustrationDocument5 pagesBenefit IllustrationKushal BhatiaNo ratings yet

- FWAP LeafletDocument16 pagesFWAP LeafletsatishbhattNo ratings yet

- Shriram Life Pension Plus PDFDocument10 pagesShriram Life Pension Plus PDFprakhar28_priyadarshiNo ratings yet

- Variable Life Insurance ProposalDocument7 pagesVariable Life Insurance ProposalAljunBaetiongDiazNo ratings yet

- SBI Life - Retire Smart - Brochure - Ver03Document16 pagesSBI Life - Retire Smart - Brochure - Ver03Vishal kaushalendra Kumar singhNo ratings yet

- SECURING YOUR FAMILY'S FUTUREDocument4 pagesSECURING YOUR FAMILY'S FUTUREAniNo ratings yet

- Variable Life Insurance Proposal BreakdownDocument12 pagesVariable Life Insurance Proposal BreakdownRoumel GalvezNo ratings yet

- INVESTMENT RISK BORNE BY POLICYHOLDERDocument19 pagesINVESTMENT RISK BORNE BY POLICYHOLDERHardik BajajNo ratings yet

- Ulip Products: Group Members:-Anupama Kumari (09FC011) Nutan Kumari (09FC012) Indraneel Choudhury (09FC041)Document17 pagesUlip Products: Group Members:-Anupama Kumari (09FC011) Nutan Kumari (09FC012) Indraneel Choudhury (09FC041)indraneel18No ratings yet

- Benefits of Aegon Life iMaximize Insurance PlanDocument2 pagesBenefits of Aegon Life iMaximize Insurance PlanShobha RaniNo ratings yet

- LyndonBasc 0894220504221237Document7 pagesLyndonBasc 0894220504221237LyndonNo ratings yet

- Illustration PDFDocument3 pagesIllustration PDFoth_pklNo ratings yet

- HDFC Life Click 2 Invest ULIP illustrationDocument3 pagesHDFC Life Click 2 Invest ULIP illustrationanon_315406837No ratings yet

- Group Employee Benefit: Bajaj Allianz LifeDocument9 pagesGroup Employee Benefit: Bajaj Allianz LifeRithvickNo ratings yet

- Monthly fund updates for September 2020Document59 pagesMonthly fund updates for September 2020dideshsNo ratings yet

- Prem Financing AlternativeDocument2 pagesPrem Financing AlternativeBill BlackNo ratings yet

- L52K en-GBDocument3 pagesL52K en-GBravinder936No ratings yet

- Lagnajit Ayaskant Sahoo Gourab Biswas Suchismita Das Santanu Rath Ranjeet Kumar September, 2010Document23 pagesLagnajit Ayaskant Sahoo Gourab Biswas Suchismita Das Santanu Rath Ranjeet Kumar September, 2010Lagnajit Ayaskant SahooNo ratings yet

- Fund Factsheets IndividualDocument60 pagesFund Factsheets IndividualCA RAHUL KHANDELWALNo ratings yet

- Fund Factsheets - IndividualDocument57 pagesFund Factsheets - IndividualRam KumarNo ratings yet

- IllustrationDocument4 pagesIllustrationInvest Aaj for kal Life insuranceNo ratings yet

- MorningDocument66 pagesMorningKushal BhatiaNo ratings yet

- FormsDocument21 pagesFormsKushal BhatiaNo ratings yet

- BHATIA Kushal Assessment Report BPI NCVDocument28 pagesBHATIA Kushal Assessment Report BPI NCVKushal BhatiaNo ratings yet

- International Residency Training Brochure 2023Document22 pagesInternational Residency Training Brochure 2023Kushal BhatiaNo ratings yet

- Benefit IllustrationDocument5 pagesBenefit IllustrationKushal BhatiaNo ratings yet

- PolicyDocument6 pagesPolicyKushal BhatiaNo ratings yet

- Bahrain Shelf LabelDocument1 pageBahrain Shelf LabelKushal BhatiaNo ratings yet

- PDFDocument2 pagesPDFDeepak ThakurNo ratings yet

- Announcement: T I C A IDocument3 pagesAnnouncement: T I C A IKushal BhatiaNo ratings yet

- Gleim Cma 2017 by Mohamed AdliDocument500 pagesGleim Cma 2017 by Mohamed AdliKushal BhatiaNo ratings yet

- Cantabil Retail India Limited Annual Report 2016-2017Document112 pagesCantabil Retail India Limited Annual Report 2016-2017Kushal BhatiaNo ratings yet

- Premium Benefit DetailsDocument13 pagesPremium Benefit DetailsKushal BhatiaNo ratings yet

- TP 16 v1 1 User Agreement - LaptopDocument1 pageTP 16 v1 1 User Agreement - LaptopKushal BhatiaNo ratings yet

- ProposalformDocument5 pagesProposalformKushal BhatiaNo ratings yet

- PROPOSAL-SINGLE LIFE INSURANCEDocument5 pagesPROPOSAL-SINGLE LIFE INSURANCEKushal BhatiaNo ratings yet

- CMA Gleim 2016 Part 2Document196 pagesCMA Gleim 2016 Part 2Kushal BhatiaNo ratings yet

- Bank StatementDocument3 pagesBank StatementKushal BhatiaNo ratings yet

- Nainital Details of Participants at Guide Training Programme 1Document8 pagesNainital Details of Participants at Guide Training Programme 1Kushal BhatiaNo ratings yet

- The Avenues Shopping Marathon 2019Document1 pageThe Avenues Shopping Marathon 2019Kushal BhatiaNo ratings yet

- Uterine Cancer: Pedro T. Ramirez, M.DDocument46 pagesUterine Cancer: Pedro T. Ramirez, M.DIsabel Barredo Del MundoNo ratings yet

- Final Upsc Ar 2016-17-EngDocument192 pagesFinal Upsc Ar 2016-17-EngKushal BhatiaNo ratings yet

- Bank Specialism and Location FormDocument1 pageBank Specialism and Location FormKushal BhatiaNo ratings yet

- CV Jai Johar - Chartered AccountantDocument2 pagesCV Jai Johar - Chartered AccountantKushal BhatiaNo ratings yet

- Tissue Pathways For Cardiovascular PathologyDocument30 pagesTissue Pathways For Cardiovascular PathologyKushal BhatiaNo ratings yet

- NBA1920 Training-Draft-TipOff NonPricing Catalog DIGITALDocument72 pagesNBA1920 Training-Draft-TipOff NonPricing Catalog DIGITALKushal BhatiaNo ratings yet

- MBA Operations Expert Seeks Challenging RoleDocument3 pagesMBA Operations Expert Seeks Challenging RoleKushal BhatiaNo ratings yet

- Reim Pre-Uat-User GuideDocument68 pagesReim Pre-Uat-User GuideKushal BhatiaNo ratings yet

- Ratika CVDocument2 pagesRatika CVKushal BhatiaNo ratings yet

- Anatomical Pathology Saq Sample Exam eDocument7 pagesAnatomical Pathology Saq Sample Exam eKushal BhatiaNo ratings yet

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- SSRN Id3887570Document8 pagesSSRN Id3887570Angelita YosecaNo ratings yet

- HDFC Life InsuranceDocument12 pagesHDFC Life Insurancesaswat mohantyNo ratings yet

- HDFC Life Assured Pension Plan Retail Brochure Dec 2109Document16 pagesHDFC Life Assured Pension Plan Retail Brochure Dec 2109Tarun BarveNo ratings yet

- Final Internship Report: Customer Buying BehaiourDocument60 pagesFinal Internship Report: Customer Buying BehaiourEe ggbbNo ratings yet

- Toaz - Info HR Contacts Details Rajasthan PRDocument27 pagesToaz - Info HR Contacts Details Rajasthan PRSATISH WORDBOXNo ratings yet

- Finance 2021 23Document16 pagesFinance 2021 23GAURAV UPADHYAYNo ratings yet

- HDFC MergerDocument18 pagesHDFC MergerRishabh RakeshNo ratings yet

- GUARANTEEDPENSIONPLANDocument2 pagesGUARANTEEDPENSIONPLANSatyajeet AnandNo ratings yet

- HDFC Life Insurance ProjectDocument18 pagesHDFC Life Insurance Projectshubham moonNo ratings yet

- New Joinee Handbook FlowDocument21 pagesNew Joinee Handbook Flowakash agarwalNo ratings yet

- BA Data FinalDocument44 pagesBA Data Finalsajeev georgeNo ratings yet

- HDFC LifeDocument11 pagesHDFC LifeViral MehtaNo ratings yet

- HDFC Life Launches Sampoorn Samridhi Insurance PlanDocument10 pagesHDFC Life Launches Sampoorn Samridhi Insurance PlanShailendra MauryaNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- Mba Project AxiesDocument55 pagesMba Project Axiespavan kumarNo ratings yet

- BancassuranceDocument10 pagesBancassuranceShruti DesaiNo ratings yet

- Comp/Feb/Int/5034 | PSRF245009032007 NACH mandate instructionDocument2 pagesComp/Feb/Int/5034 | PSRF245009032007 NACH mandate instructionAnithaNo ratings yet

- Impact of Covid-19 On Insurance Industry Group 3Document38 pagesImpact of Covid-19 On Insurance Industry Group 3HaroonNo ratings yet

- Unique Life Solution HandbookDocument5 pagesUnique Life Solution HandbookPaluri GowthamNo ratings yet

- 14 - Apoorv SharmaDocument20 pages14 - Apoorv Sharmasiddhi NakhateNo ratings yet

- A Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarDocument56 pagesA Study On The Awareness of Life Insurance Policy Among The Residents in UlhasnagarManoj MondalNo ratings yet

- CCD MID/Declaration: Application DetailsDocument1 pageCCD MID/Declaration: Application DetailsSuryateja ArangiNo ratings yet

- Aditya Birla Sun Life Insurance: Submitted ToDocument56 pagesAditya Birla Sun Life Insurance: Submitted ToArjunNo ratings yet

- Santosh Gurudas Haldankar: Us/investor-Relations/financial-ResultsDocument23 pagesSantosh Gurudas Haldankar: Us/investor-Relations/financial-ResultskevinNo ratings yet

- Benefit Illustration For HDFC Life Guaranteed Pension PlanDocument2 pagesBenefit Illustration For HDFC Life Guaranteed Pension PlannrameshecmNo ratings yet

- Mini Project 2 AshishDocument51 pagesMini Project 2 AshishAman SinghNo ratings yet

- Company Profile of HDFC LifeDocument19 pagesCompany Profile of HDFC LifeNazir HussainNo ratings yet

- A Project Report HDFC Standard Life InsuDocument68 pagesA Project Report HDFC Standard Life InsuSneha PandeyNo ratings yet

- ET JD - Bancassurance ChannelsDocument1 pageET JD - Bancassurance ChannelsWireNo ratings yet