Professional Documents

Culture Documents

E Newsletter September 2013

Uploaded by

sd naikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E Newsletter September 2013

Uploaded by

sd naikCopyright:

Available Formats

JALGAON DIST.

TAX PRACTITIONERS` ASSOCIATION

e NEWS LETTER

e mail: presidentjdtpa@gmail.com, keswanisu@gmail.com

YEAR 2013-14 SEPTEMBER 2013 No. 5

EDITOR: FROM EDITOR

SURESH KESWANI

Monthly Study Circle Meeting held on 06/09/2013

Sub: E filing of Tax Audit Speaker: CA Kalpesh Patil.

EDITORIAL BOARD:

M.R. SHIRUDE

SAHEBRAO PATIL

N.S. DOSHI

MAGAN PATIL

R.B. CHOPDA

SHIRISH SISODIA

DINAR DAPTARI

R.D. JAIN

From left Shri Sahebrao Patil, Secretary- JDTPA, CA Kalpesh Patil, Speaker and

Adv. M.R. Shirude, President-JDTPA.

Please give your valuable suggestions to improve our e news letter.

Articles, Law updates and other matter on taxation is welcome. Please e mail the

matter in word format to keswanisu@gmail.com Please update your e mail i.d. with

Shri Sahebrao Patil. SAVE PAPER - SAVE TREES hence e Newsletter

Thanks and regard …………… -Suresh Keswani, Editor

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 1

IN THIS ISSUE

Sr. No. PARTICULARS BY

1 Gist of Judgments under Income Tax CA N.S. DOSHI

Act

2 Recent Amendments under Income Tax TP SURESH U. KESWANI

Act

3 Penalty U/s 272A(2)(k)- Recent havoc CA VINAY V. KAWDIYA

created by Department

4 Sales Tax Updates TP R. B. CHOPDA

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 2

SECTION A INCOME TAX

GIST OF JUDGEMENTS

BY: CA N.S. DOSHI

1. Disallowance u/s. 14A - Rule 8D _

Rule 8D- Assessment year 2008-09 - Whether, where Assessing Officer was not

satisfied with correctness of claim made by assessee that no expenditure was

incurred in relation to such income which did not form part of total income, he

could invoke section 14A only after recording satisfaction on that issue with

regard to accounts of assessee - Held, yes - Whether disallowance under section

14A read with rule 8D (2) (iii) can be computed only by taking into consideration

average value of investment appearing in balance sheet asx on first and last day of

previous year from which income not falling within total income has been earned

- Held, yes - Whether, where Assessing Officer had taken into consideration

entire investment made by assessee during relevant year for calculation of

disallowance under rule 8D, matter was to be restored for recompilation. Held yes

See: REI Agro Ltd., Dy CIT

144, ITD 141 (Kol.)

2. Business Income

2.1 Insurance premium on Car - Expenditure on account of first insurance

premium paid at the time of purchase of vehicles used for purposes of

business is capital expenditure.

See: Hero MotoCorp. Ltd., Vs. addl. CIT

(2013) 91, DTR, 1 (Del. C).

2.2 Business income - Benefit or perquisite under sec. 28 (iv) - Liability

shown in the books - Amount including interest accrued thereon,

outstanding as payable in the books could not be brought to tax under Sec.

28 (iv) - Fact that the assessee continued to disclose the impugned amount

as a liability in the balance sheet itself amounts to acknowledgement of the

debt and as such there is no remission of liability.

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 3

See: Hero MotoCorp. Ltd., Vs. Addl. CIT,

(2013) 91, DTR, 1 (Del. C).

2.3 Profits chargeable to tax under Sec. 41 (1) - Rebate allowed to assessee

vis-à-vis losses not set off under Sec. 72 (1) - If the assessee claims

deduction of certain expenditure and ultimately there is a loss, and such

loss cannot be set off under Sec.72. Sec. 41 (1) cannot be invoked in

respect of remission or cessation of liability relating to such expenditure.

See: The Mula Pravara Eloectric Co-operative Society Ltd., Vs. Dy CIT

(2013) 91, DTR, 434 (Pune “B”).

2.4 EPF and ESI contribution - Assessment year 2008-09. Whether, EPF and

ESI contribution collected and remaining payable at year end, but paid

before due date of filing return, is allowable - Held - Yes.

See: Gobindpada Bhanja Chowdhury V. ITO

58, SOT, 135 (Cuttak) (URO)

2.5 Employee’s contribution to provident fund - Assessment year 2006-07 -

Whether where employee’s contribution to provident fund was paid before

due dae of filing of return of income, same could not be disallowed under

section 43B - Held yes.

See: Patni Telecom Solutions Pvt. Ltd., V. ITO

58, SOT, 146 (Hyd.) (URO)

2.6 Capital or revenue expenditure - Expenses towards designing and lay out,

temporary partition and construction for making leased business premises

functional - Revenue expenditure - Income tax Act, 1961.

See: CIT V. Armour Consultants Pvt. Ltd.,

355, ITR, 418 (Mad.)

3. Method of Accounting

Percentage of completion method - Assessment years 2008-09 and 2009-10.

Whether it is not mandatory for all real estate developers to follow percentage of

completion method as prescribed by Institute of Chartered Accountants of India

under AS 7; it is option of assessee to follow either completed contract method or

percentage completion method - held yes - Whether, therefore, where assessee, a

real estate developer, maintained its accounts on mercantile basis by regularly

applying project completion method, there was no justification in rejection of its

accounts by application of provisions of section 145 (3) and changing method

from project completion to percentage completion method by Assessing Officer -

Held, yes.

See: Krish Infrastructure Pvt. Ltd., V. Asst. CIT

58, SOT, 127 (Jaipur) (URO).

4. Assessment

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 4

4.1 Assessing Officer - Powers - Reassessment - Effect of explanation 3 to

section 147 - Assessing Officer not making additions with respect to

ground on basis of which notice issued - Cannot in a fresh assessment

make additions on other issues which did not form part of reasons

recorded.

See: CIT V. Mohmed Juned Dadani,

355, ITR, 172 (Guj.)

4.2 Best Judgment Assessment - Addition : Where books of account had not

been rejected, addition of amounts shown in audited account was not

sustainable.

See: CIT V. Shakti Industries

(2013) 36, Taxmann.com16/ 217 Taxman 77 (Gujrat)

5. Co.Op. Society

Section 80P of the Income tax Act, 1961 - Deductions - Income of cooperative

societies (Banking Societies) - An assessee banking society is not eligible for

deduction under section 80P (2) (a) (i) on interest on income-tax refund -

(Assessment year 2003-04) (in favour of Revenue).

See: Kollam District Co-opetative Bank ltd., V. Dy. CIT,

(2013) 36, Taxmann.com 91 (Cochin - Trib.)

6. Interest u/s. 234A

Return - Delay in filing return - Interest under section 234A - part of tax paid

before return was due - Interest could not be levied on such part payment.

See: Bharatbhai B. Shah V. ITO,

355, ITR, 373, (Guj.)

7. Penalty u/s. 271 (1) (c)

Section 271 (1) (c), read with section 132, of the Income tax Act, 1961 - Penalty -

For concealment of income (Surrender of Income) - Where assessee offered

amount in question as additional income to buy peace and to avoid prolonged

litigation, addition made on basis of such offer of assessee did not call for levy of

penalty under section 271 (1) (c) (Assessment year 2005-06) (in favour of

Assessee)

See: Marathon Nextgen Reality & Textiles Ltd., V. Dy. CIT,

(2013) 36, Taxmann.com 3 (Mumbai - Trib.)

8. Recovery

Recovery - Stay - Pendency of appeal - Assessee’s assessed income being more

than twice the returned income, recovery of outstanding demand is stayed tll the

disposal of the pending appeals.

See: J. R. Tantia Charitable Trust Vs. Asst. CIT

(2013) 91, DTR, 463 (Jd.).

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 5

RECENT AMENDMENTS

BY: SURESH U. KESWANI

1) Extention of due date of furnishing Report of Audit Electronically:-

Order under Section 119 of the Income-tax Act, 1961 Dt. 26/09/2013:- CBDT in

exercise of power under section 119(2)(a) of the Income-tax Act, 1961 read with section

139 and rule 12, has decided to relax the requirement of furnishing the Report of Audit

electronically as prescribed under the proviso to sub-rule (2) of Rule 12 of the IT Rules

for the Assessment Year 2013-14 as under-

a) The assessees, who are presently finding it difficult to upload the prescribed

Report of Audit (as referred to above) in the system electronically may also

furnish the same manually before the jurisdictional Assessing Officer within the

prescribed due date.

b) The said Report of Audit should however be furnished electronically on or before

31.10.2013.

(F.No. 225/117/2013/ITA.II Dt. 26/09/2013

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 6

3] ARTICLE: …

PENALTY U/S 272A(2)(k)- Recent havoc created by Department

BY: CA VINAY V. KAWDIYA

A) Background:

It has been reliably learnt that dept. have levied penalty u/s 272A(2)(k) [ i.e. penalty for

delay in furnishing the quarterly TDS statements] in hundreds of cases in recent past under

Nasik range. To make the situation worse, approximately 500+ appeals have been admitted by

CIT (A)-I & II, Nasik on the subject matter, only in the month of April 13!!!

Such kind of hasty and unfortunate attempt by dept, especially in respect of procedural &

technical breach of provisions of I.T Act could have been avoided so as to leave CIT (A) to

concentrate on the other deserving high revenue & quality matters!

We as professionals often witness such rigid & belated approach of dept. especially when the Act

or any provision thereof is on the verge of omission from the statute book. One of such recent

instances is sudden awakening of the department about applicability of Wealth Tax Act, 1957

amongst the large class of assessees’. Same was the story about the draconian Fringe Benefit Tax

in 2009-10.

Let’s come back on the subject matter. Surprisingly, the authority levying the penalty [Jt. CIT

(TDS)], passed stereotype orders in almost all cases, irrespective of peculiar facts and

circumstances of each case, I myself have gone through at least 10 of such orders in respect of

assessee’s from Jalgaon, Dhulia & Nasik. Majority of aggrieved parties are various Govt./semi

Govt. departments such as collector office, land acquisition authority, PWD, various state Govt.

scheme offices, schools, post offices etc.

Anyway, since the orders have been passed we have no other option but to find the way out &

save the aggrieved appellants in deserving matters.

B) Penalty u/s 272A(2)(k):

The bare provision reads as under (relevant extracts only):

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 7

Penalty for failure to answer questions, sign statements, furnish information, returns or

statements, allow inspections, etc.

272A. (1) If any person…………..

(2) If any person fails—

(a)…

(b)….

.

.

.

(k) to deliver or cause to be delivered a copy of the statement within the time specified in sub-

section (3) of section 200 or the proviso to sub-section (3) of section 206C;]

he shall pay, by way of penalty, a sum [of one hundred rupees] for every day during which the

failure continues:

Provided that the amount of penalty for failures in relation to ……………. statements under sub-

section (3) of section 200 or the proviso to sub-section (3) of section 206C shall not exceed the

amount of tax deductible or collectible, as the case may be:

Provided further that no penalty shall be levied under this section for the failure referred to in

clause (k), if such failure relates to a statement referred to in sub-section (3) of section 200 or

the proviso to sub-section (3) of section 206C which is to be delivered or caused to be delivered

for tax deducted at source or tax collected at source, as the case may be, on or after the 1st day

of July, 2012.

Thus, the provisions u/s 272A(2) deals with levy of penalty for default of a continuing nature and

penalty of Rs. 100/- maybe levied for everyday during which the default continues.

Clause (k) of section 272A(2) deals with levy of penalty for delay in filing the TDS/TCS

statements (commonly known as Quarterly TDS returns) beyond statutory deadlines.

However, the first proviso to Sec. 272A places a ceiling on the penalty for failures in relation to

various compliances including statements to be filed under sub- section (3) of S. 200 and the

proviso to sub- section (3) of section 206C, and clarifies that, penalty shall not exceed the

amount of tax deductible or collectible, under these sections, as the case maybe.

Further, sub-section (3) of Sec. 272A provides that penalty under this section can only be levied

by a tax authority of the rank of Joint Commissioner/Joint Director of Income Tax or above.

Alert: In case of belated TDS/TCS statements filed on or after 01.07.12 [returns for Q-

1/F.Y. 12-13 & onwards] fees u/s 234E is payable @ 200 per day of default & penal

provisions u/s 272A(2)(k) shall not apply. Currently no one is authorized under the act to

reduce or waive the said fees.

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 8

C) Time Limit for completing the penalty proceedings:

The time limit for the purpose of initiating and levy of penalty under the provisions of S. 272A,

is provided under S. 275(1)(c), i.e. no penalty can be levied after the expiry of the financial year

in which the proceeding, in the course of which action for imposition of penalty has been

initiated, are completed, or six months from the end of the month in which action for imposition

of penalty is initiated, whichever period expires later.

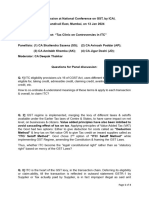

D) Recent Judicial Trends:

In the following para, I have tried to summarize the important judicial decisions on the subject

matter in favour of assessees’:

- Penalty under S. 272A cannot be levied in cases of failure and default where the same

occurred due to a bonafide act, [CIT vs. Schell International 278 ITR 630 (Bom)]

- IT : Where non-furnishing of PAN by payee caused delay in filing of e-TDS return,

penalty for such late filing not to be levied [2012] 21 taxmann.com 22 (Chandigarh -

Trib.) Collector Land Acquisition vs. Add. CIT (TDS), Range

- Honorable ITAT, Lucknow bench in the case of Branch Manager, Punjab National

Bank vs. Add. CIT (2011) 140 TTJ (Lucknow) 622, held that ‘There was only a

technical and venial breach of the provisions contained in rule 31A in belated furnishing

of quarterly statements of TDS for which no penalty under section 272A(2)(k) can be

levied as the assessee could not collect PAN from all the deductees.

- Section 272A, read with section 273B, of the Income-tax Act, 1961 - Penalty - For failure

to answer questions, sign statements, etc. - Assessment year 2007-08 - Assessing Officer

imposed penalty under section 272A(2)(c) upon assessee for delay in filing of quarterly

TDS returns - Assessee contended that it was not aware of amended provisions about

filing of quarterly TDS returns which came into effect only during year under

consideration and, thus, it was under bona fide belief that returns had to be filed annually

which was one of causes for delay in filing of quarterly returns - Whether delay was

supported by reasonable cause and, therefore, penalty levied by Assessing Officer under

section 272A(2)(c) was to be cancelled - Held, yes [Royal Metal Printers (P.) Ltd vs.

Add. CIT(TDS) [2010] 37 SOT 139 (MUM.) (A.Y. 2007-08)]

- IT : Where requirement of filing Form No. 24Q was new one being first year of filing

such return and, moreover, tax had been duly deducted by assessee, penalty could not be

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 9

levied under section 272A for delay in filing E-TDS returns [The Manager, Union Bank

of India vs. Add. CIT [2012] 26 taxmann.com 347 (Agra - Trib.)]

- The penalty was levied by the department in a mechanical manner. The assessee would

have filed the hard-copy of the quarterly statements but this is not accepted by the

department. The computer has to generate a number for acknowledging receipt of such

statements. The number is not generated till the computer tallies the PAN and the

information available on 26 AS. The late filing is caused by an administrative glitch. The

delay occurs because the assessee-deductors are dependent on information of TDS and its

deposit from the sub treasury of the Government and the filing of the e-return through the

designated service provider of the Income-tax Department. The assessee-deductors have

no technical competency to file the return by themselves without external aid. They are

also not competent to do so by themselves as per rule 37B and “Filing of Return of Tax

deducted at source” scheme 2003, which requires the submission of quarterly statement

through NSDL or other approved agencies which are third parties and not under the

control of the assessees. Penalty u/s 272(A)(2) cannot be levied in a routine manner. The

late filing of TDS return cannot be said to be intentional or willful. It is only a technical

or venial breach. [UCO Bank vs. Add. CIT (ITAT Cuttack) /[2013] 58 SOT 78]

- Apropos deletion of penalty for late filing of quarterly e-TDS returns, it has not been

disputed that assessee paid the due tax and interest thereon. Due to delayed TDS

payments, the e-returns got consequently delayed. The late filing of e-return assumes a

character of technical default and delay in filing such return without any loss of

revenue cannot be a held as a deliberate default looking at the facts and

circumstances and pleas raised by the assessee. CIT(A) has rightly considered it to be

a reasonable cause. Hon'ble Supreme Court in the case of Hindustan Steels Ltd. (supra)

has emphatically held that penalty should not be imposed merely because it is lawful

to do so and technical and venial breaches should not be visited with the penalties.

We uphold the order of CIT(A) on this issue. Apropos penalty for A.Y. 2009-10 also we

find no infirmity in the order of CIT(A) who has considered the reasons put forth by the

assessee i.e. incapacity and absence of the accountant and the director being not

aware of the intricacies. Consequently, we uphold the orders of CIT(A) deleting

penalties levied u/s 272A(2)(k) for A.Y. 2006/07 and u/s 271C for A.Y. 2009-10. [ITO,

Vs. Amcon Engineers (P) Ltd., ITA Nos. 2253 & 2254/Del/2011]

E) In case of failure on the part of assessee to prove the reasonable cause within the meaning

of section 273B, the rigor of penalty u/s 272A(2)(k) may be diluted to some extent in

case of delayed deduction of tax/non deduction of tax/delayed deposit of TDS in Govt.

A/c by arguing the case in following manner:

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 10

- Penalty-s. 272A(2)(k) Delay in filing TDS return – Penalty for Delay leviable only from

date of payment of taxes – [Porwal creative Vision (P) Ltd. V. ACIT (2011) 139 TTJ 1

(mum)]

In the above decision Hon’ble Tribunal held that, as regards the default of nonpayment of the tax

to the Central Government in time or for non-deducting the tax at source, there are other

provisions for ensuring compliance. In case the assessee fails to deduct the tax at source or after

deducting, fails to pay the same to the Central Government, the assessee is deemed to be in

default under section 201(1) and is liable for penalty. The assessee is also liable to pay interest

for the period of default till the payment of tax under section 201(1A). Therefore, the period

for levying the penalty under section 272A(2)(k) has to be counted from the date of

payment of tax.

Penalty under section 272A(2)(k ) could be levied only from the date of payment of tax, as the

statement under section 200(3) was required to be filed only after payment of tax to the Central

Government. Section 200(3) clearly provides that after paying the tax deducted at source to the

credit of the Central Government within the prescribed time, the assessee shall prepare a

statement as prescribed and submit to the authority concerned within the prescribed time-limit.

The assessee, therefore, can file the TDS return only after paying the tax to the Central

Government. Therefore, the penalty under section 272A(2)(k ) for the delay in submission

of TDS return has to be levied upon the assessee only from the date of payment of tax by

assessee to the Central Government.

CONTRARY VIEW:

Penalty under s. 272A —Failure to submit TDS return—Penalty under s. 272A for failure to

submit TDS return is imposable even though the assessee has not deducted tax at source

under s. 194C—The two legal obligations cast upon the assessee under ss. 194C and 206 are

separate and independent—Nowhere under the law or the rules is it provided that the statement

under s. 206 should be filed only when tax at source has been deducted— Further, assessee being

obliged to deduct tax at source under s. 194C from payment to sub-contractor, it was not

competent not to deduct the tax at source on the basis of the request of the sub-contractor without

obtaining the exemption certificate from the AO for purpose. [ACME Construction Co. vs.

DCIT (1999) 68 ITD 1 (PAT)]

While deciding as above, Hon’ble ITAT observed that, nowhere in the law or rule it is mentioned

that the statement under s. 206 should be filed only when tax at source had been deducted.

To conclude, on the subject matter, one can use the ratio laid down by various judicial

decisions to support his case. However, case laws should be quoted carefully having regard

to the facts and circumstances of each case & utmost care should be taken so that the

appellate authority should not be able to distinguish the same on facts.

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 11

SECTION B M VAT/ CST

SALES TAX UPDATES

Compiled BY: SHRI R.B. CHOPDA

After going through observations from audits conducted for the F.Y. 2008-09 by the

functional officers, they have given feedback of practical problems of the dealers regarding

mismatches and un-matches of annual figures of sales and purchases in Annexure J2 and J1.

Findings for mismatches and un-matches by the functional officers:

1. The year-end transactions of sellers are accounted for by buyers in subsequent years.

2. The big LTU dealers are not able to consolidate their Depot-wise sales while filling their

Annexure J1

3. In some cases the sellers have not captured TINs of buyers being it was not the statutory

requirement for them and they could not upload their correct J1 with buyers’ TINs.

4. Sometime goods returned are shown in Annexure J1 by the buyers without reducing ITC

clime in annexure J2 whereas sellers reduce sales in their Annexure J1

Considering the above practical problems, some relaxations have been given in cases of those

dealers who have filled full Annexure J1.

Full Annexure J1 means where tax collection in Annexure J1 is equal to or more than tax

collection shown in the part I of form e-704. However it is necessary to verify the correctness of

ITC claimed by the annexure J2 filers who have shown their purchases from incomplete filers of

annexure J1.

Procedure for cross checks of transactions of the sellers framed for the F.Y. 2009-10 and 2010-

11:

a) EIU shall select incomplete J1 filers, which are generating huge mismatches and un-

matches.

b) The cross check branches/LTU shall be given this data by the EIU.

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 12

c) The Cross check branches/LTU shall compare such ITC claims of buyers with actual

sales shown in the Sales registers of Sellers. Also they will verify the returns to compare

the Sales as per Sales Register.

d) If any claim of ITC in Annexure J2 of the buyer is not found in Sales Registers and if the

seller accepts sales suppression then such seller shall have to pay the tax on such sales

suppression by filling revised return.

e) In case of denial of sales by the seller where ITC is claimed by buyer the cross

check/LTU officer shall send such information in the prescribed form to the EIU for

initiating IBA of buyers for disallowance of ITC.

f) In respect of the F.Y. 2009-10, such information shall be sent to EIU latest by 30-11-

2013 and for the F.Y.2010-11 by 31-01-2014 so that the IBA officers shall get enough

time to initiate IBA of such buyers.

This is welcome administrative relief to the dealers facing the genuine practical problems.

MVAT Cir No. 9A of 2013 dt. 01-10-2013.

JDTPA e-NEWS LETTER (SEPTEMBER 2013) 13

You might also like

- Walt Disney Yen FinancingDocument10 pagesWalt Disney Yen FinancingAndy100% (3)

- Account Statement - 2022 09 01 - 2023 01 31 - en GB - A9250cDocument7 pagesAccount Statement - 2022 09 01 - 2023 01 31 - en GB - A9250cRosca ConstantinNo ratings yet

- Summary of Project Assumptions: Construction CostsDocument5 pagesSummary of Project Assumptions: Construction CostsjowacocoNo ratings yet

- E NEWSLETTER May 2013Document9 pagesE NEWSLETTER May 2013sd naikNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- TDS Year of Receipt 26asDocument8 pagesTDS Year of Receipt 26asDr G D PadmahshaliNo ratings yet

- Show Cause NoticeDocument8 pagesShow Cause NoticeinfoNo ratings yet

- Nation: MarketDocument9 pagesNation: MarketDebashis MitraNo ratings yet

- Shree Karthik Papers Ltdvs Deputy Commissionerof Income TDocument4 pagesShree Karthik Papers Ltdvs Deputy Commissionerof Income TKaran GannaNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Brains Trust PPT - MR Gautam DoshiDocument31 pagesBrains Trust PPT - MR Gautam DoshiIshanNo ratings yet

- TapanDocument6 pagesTapanDebashis MitraNo ratings yet

- Eturns: This Chapter Will Equip You ToDocument52 pagesEturns: This Chapter Will Equip You ToShowkat MalikNo ratings yet

- GST Returns: BackgroundDocument3 pagesGST Returns: BackgroundPrakash PalanisamyNo ratings yet

- 0bba0 GSTR 9 Booklet HiregangeDocument113 pages0bba0 GSTR 9 Booklet HiregangeAMIT SHARMANo ratings yet

- AssessmentDocument3 pagesAssessmentSWETCHCHA MISKANo ratings yet

- AAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Document2 pagesAAAJT1833E - Issue Letter - 1049437802 (1) - 06022023Basavaraj KorishettarNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Perfetti Van Melle IndiaDocument18 pagesPerfetti Van Melle IndiaramitkatyalNo ratings yet

- Eturns: After Studying This Chapter, You Will Be Able ToDocument70 pagesEturns: After Studying This Chapter, You Will Be Able ToChandan ganapathi HcNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Bhati Axa Life InsuranceDocument40 pagesBhati Axa Life InsuranceshashankNo ratings yet

- TS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDDocument5 pagesTS 333 ITAT 2013DEL TS 333 ITAT 2013DEL SPX India PVT LTDbharath289No ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- 15 04 16 Case2Document26 pages15 04 16 Case2tamanna.vkacaNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- ShowfileDocument4 pagesShowfileMkNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- Annexure-X - Waiver of SCN & PenaltyDocument3 pagesAnnexure-X - Waiver of SCN & Penaltyvishnuprakash1990No ratings yet

- GSTR ReturnDocument136 pagesGSTR Returnyoyorikee0% (1)

- 1652426740-447 & 8168 HCL Comnet Systems & Services LTDDocument7 pages1652426740-447 & 8168 HCL Comnet Systems & Services LTDArulnidhi Ramanathan SeshanNo ratings yet

- DRC03Document2 pagesDRC03sumitsharmaNo ratings yet

- Priyanka Tungidwar - 21036Document1 pagePriyanka Tungidwar - 21036Anonymous 5l219Y7Iu1No ratings yet

- Do You Know GST - July 2022Document17 pagesDo You Know GST - July 2022CA Ranjan MehtaNo ratings yet

- Return Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)Document30 pagesReturn Formats (Sahaj Return - FORM GST RET-2) (Quarterly) (Including Amendment)ch7utiyapa9No ratings yet

- Dcw-Circular-07 10 2021Document12 pagesDcw-Circular-07 10 2021Kombaiah PandianNo ratings yet

- Gateway Technolabs P LTDDocument4 pagesGateway Technolabs P LTDDayavanti Nilesh RanaNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- आयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Document8 pagesआयकर अपीलीय अिधकरण " यायपीठ पुणे म । (Through Virtual Court)Saksham ShrivastavNo ratings yet

- 2002 83 ITD 151 Delhi SB 2002 77 TTJ 387 Delhi SB 01 08 2002highlightedDocument12 pages2002 83 ITD 151 Delhi SB 2002 77 TTJ 387 Delhi SB 01 08 2002highlightedSnigdha MazumdarNo ratings yet

- 3a Notices Ysk Amar SubDocument1,066 pages3a Notices Ysk Amar SubKrishna ReddyNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Sunil ShahNo ratings yet

- Roll No C 17 Prakash Ochwanni Sem XDocument10 pagesRoll No C 17 Prakash Ochwanni Sem XPRAKASH OCHWANINo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- GST Circulars Issued On 6th July - A SummaryDocument8 pagesGST Circulars Issued On 6th July - A SummaryVijaya ChandNo ratings yet

- Shri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 DocumentDocument8 pagesShri Vedavyas Co Operative Credit Society LTD Vs Income Tax Officer 6aeaa3c543bd92250fef9d363c6aa9 Documentbharath289No ratings yet

- Return Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Document32 pagesReturn Formats (Sugam Return - FORM GST RET-3) (Quarterly) (Including Amendment)Puneet PrajapatiNo ratings yet

- 2023 152 Taxmann Com 312 Bombay 14 07 2023 Bombay Dyeing Manufacturing Co LTD VsDocument1 page2023 152 Taxmann Com 312 Bombay 14 07 2023 Bombay Dyeing Manufacturing Co LTD VsSricharan RNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- Value of SupplyDocument16 pagesValue of Supplyhariom bajpaiNo ratings yet

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700No ratings yet

- 1588756021-1693-Allegis Servicses Final PrintDocument9 pages1588756021-1693-Allegis Servicses Final PrintDehradun MootNo ratings yet

- Tax ProjectDocument19 pagesTax Projectsanskarbarekar789No ratings yet

- UntitledDocument5 pagesUntitledharsh hgNo ratings yet

- AACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Document1 pageAACCK3258R - Demand Notice Us 156 - 1052866885 (1) - 16052023Hitesh DhingraNo ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Adobe Scan Nov 27, 2023-CompressedDocument7 pagesAdobe Scan Nov 27, 2023-Compressedswainsachidananda1950No ratings yet

- Gstr-2A: TH TH THDocument1 pageGstr-2A: TH TH THTejaswi J DamerlaNo ratings yet

- Integra Engineering India LTDDocument9 pagesIntegra Engineering India LTDByomkesh PandaNo ratings yet

- Amount Owed by The Business AccountingDocument3 pagesAmount Owed by The Business Accountingelsana philipNo ratings yet

- Classification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-BaiDocument25 pagesClassification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-Baiatifkhan890572267% (3)

- Financial Statement Analysis - Jollibee and MaxDocument21 pagesFinancial Statement Analysis - Jollibee and MaxRemNo ratings yet

- General Mathematics: Second Quarter Module 3: Simple and General AnnuitiesDocument15 pagesGeneral Mathematics: Second Quarter Module 3: Simple and General AnnuitiesJelrose SumalpongNo ratings yet

- The 2013 Capital Requirements Directive IV and Capital Requirements Regulation: Implications and Institutional EffectsDocument49 pagesThe 2013 Capital Requirements Directive IV and Capital Requirements Regulation: Implications and Institutional EffectsbobmezzNo ratings yet

- Emerging Markets Strategy DashboardsDocument26 pagesEmerging Markets Strategy DashboardsqeneibwrNo ratings yet

- Ch-5 MONEYDocument6 pagesCh-5 MONEYYoshita ShahNo ratings yet

- 2016 Nomura Summer Internship ProgramDocument25 pages2016 Nomura Summer Internship ProgramTing-An KuoNo ratings yet

- Sap Guide 2 0 1Document13 pagesSap Guide 2 0 1api-359265393No ratings yet

- Adobe Scan Feb 11, 2024Document20 pagesAdobe Scan Feb 11, 2024DEVIL RDXNo ratings yet

- Deepak Eduworld PVT LTD: Receipt AmountDocument22 pagesDeepak Eduworld PVT LTD: Receipt AmountSupriya BoseNo ratings yet

- Winter 2007 Midterm With SolutionsDocument13 pagesWinter 2007 Midterm With Solutionsupload55No ratings yet

- Notes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Document10 pagesNotes On Mishkin Chapter 8 (Econ 353, Tesfatsion)Karthikeyan PandiarasuNo ratings yet

- Jul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearDocument32 pagesJul-21 Company Name Claim Buddy Numbers From Ir Base Year Below (In Consistent Units) This YearProtyay ChakrabortyNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementNickNo ratings yet

- Cash System and Procedure Part 1Document8 pagesCash System and Procedure Part 1Rohit BhaduNo ratings yet

- Brooks Financial mgmt14 PPT ch08Document85 pagesBrooks Financial mgmt14 PPT ch08Jake AbatayoNo ratings yet

- Chap 009Document20 pagesChap 009Ela PelariNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicyAshish MisraNo ratings yet

- Ch. 31 Forecasting and Managing Cash FlowsDocument4 pagesCh. 31 Forecasting and Managing Cash FlowsRosina KaneNo ratings yet

- Gul OzerolDocument74 pagesGul OzerolMimma afrinNo ratings yet

- Chapter 9 Interest and DepreciationDocument24 pagesChapter 9 Interest and Depreciationluca.castelvetere04No ratings yet

- 1 - Decentralization-Responsibility AccountingDocument40 pages1 - Decentralization-Responsibility AccountingZedie Leigh VioletaNo ratings yet

- 4002CBS Glossary English To Samoan 6-5-16 2Document51 pages4002CBS Glossary English To Samoan 6-5-16 2Angie Milford (Teph)No ratings yet

- Chapter 10 Part A and Part B ReviewDocument9 pagesChapter 10 Part A and Part B ReviewNhi HoNo ratings yet

- Liquidation ReportDocument3 pagesLiquidation Reportkabataansulong2023No ratings yet

- Soal Un Bahasa InggrisDocument7 pagesSoal Un Bahasa InggrisFauzi AzhariNo ratings yet