Professional Documents

Culture Documents

Intro To ACC - Assignment

Uploaded by

KING LOK NG (CBT2241P)Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intro To ACC - Assignment

Uploaded by

KING LOK NG (CBT2241P)Copyright:

Available Formats

YPC INTERNATIONAL COLLEGE

CBT31073 Introduction to Accounting

Group Assignment

Intake: CBT2241

Prepared By:

NG KING LOK CBT2204042

SHELDON LIM YU XIN CBT2204044

Lecturer: Ms. Mariam

Questions:

1. State whether the items below are asset, liability, equity, income, or

expenses. (10 marks)

a) Loan from JJ Shop l) Mortgage loan

b) Cash in hand m) Repair and maintenance

c) Other receivable n) Bad debt

d) Property o) Laptop

e) Marketing expenses p) Accrued rental expenses

f) Sales q) Prepaid insurance expenses

g) Payables r) Bank overdraft

h) Interest received s) Short-term investments

i) Office equipment t) Fixed Deposits

j) Closing inventory

k) Capital

Answer:

a) Loan from JJ Shop – liability

b) Cash in hand – asset

c) Other receivable – asset

d) Property – asset

e) Marketing expenses – expenses

f) Sales – income

g) Payables – liability

h) Interest received – income

i) Office equipment – asset

j) Closing inventory – asset

k) Capital – equity

l) Mortgage loan – liability

m) Repair and maintenance – expenses

n) Bad debt – expenses

o) Laptop – asset

p) Accrued rental expenses – asset

q) Prepaid insurance expenses – asset

r) Bank overdraft – liability

s) Short-term investments – asset

t) Fixed Deposits – asset

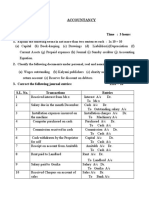

2. Tick the correct answer. To increase the balance in the following accounts,

would you debit or credit the account? (20 marks)

Accounts Debit Credit

RM RM

a) Accounts Receivable /

b) Bank /

c) Motor Vehicles /

d) Interest payable /

e) Long-term loan /

f) Capital /

g) Advertising expense /

h) Prepaid salary /

i) Sales /

j) Drawings /

k) Machinery /

l) Unearned rental income /

m) Miscellaneous expenses /

n) Sales return /

o) Bank overdraft /

p) Bad debt /

q) Depreciation – Machinery /

r) Commission received /

s) Wages expense /

t) Discount allowed /

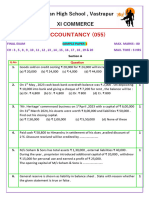

3. Zam Zam Trading is a business selling souvenirs. The following transactions

took place in the month of September 2020.

Dates Transactions

2020

Sep 1 Owner invested RM80,000 cash into the business bank account

3 Purchased a machine from Go-Tractor costing RM70,000 paid by

cheque

6 Received invoices RM7,800 from Wong for goods purchased

8 Sold goods on credit to Ravi for RM6,100

20 Received a cheque from Supplier AA for commission received of

RM300

23 Paid RM150 by cheque to Takaful M for insurance expense

26 Received a cheque for cash sales amounting to RM850

29 The owner withdrew goods worth RM700 and bank account

RM8,000 for personal use.

30 Purchased stationery of RM35 by cash.

Required:

State which accounts should be debited and which accounts to be credited for

each transaction. (20 marks)

Answer:

Date Account Debit (RM) Credit (RM)

2020

Sep 1 Bank 80,000

Cash 80,000

3 Machinery 70,000

Bank 70,000

6 Purchase 7,800

Invoice 7,800

Received

8 Trade Receivable- 6,100

Ravi 6,100

Sales

20 Bank 300

Commission 300

Received

23 Insurance Expenses 150

Bank 150

26 Bank 850

Sales 850

29 Drawings 8,000

Bank 8,000

30 Stationery 35

Purchases 35

You might also like

- Corporate Bonds and Structured Financial ProductsFrom EverandCorporate Bonds and Structured Financial ProductsRating: 5 out of 5 stars5/5 (1)

- Model-Financial Accounting - Set1 - CZ21ADocument4 pagesModel-Financial Accounting - Set1 - CZ21AJuli SunNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- S1 BookKeep 2nd Sem Final ExamDocument3 pagesS1 BookKeep 2nd Sem Final ExamTan Shu YuinNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Chapter 11 Financial Accounting With Adjustment: Question 1 FuguangDocument15 pagesChapter 11 Financial Accounting With Adjustment: Question 1 FuguangClaudia WongNo ratings yet

- Untitled FgapqDocument5 pagesUntitled FgapqSusovan SirNo ratings yet

- AccountsDocument5 pagesAccountsvenessaNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- Mudio Islamic Examination Board (Mieb) : InstructionsDocument2 pagesMudio Islamic Examination Board (Mieb) : InstructionsMmaryNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- AccountingDocument2 pagesAccountingwindell arth MercadoNo ratings yet

- Costing and AccountancyDocument3 pagesCosting and AccountancyDeepakNo ratings yet

- Assignment BAAD2033 Feb 2017Document5 pagesAssignment BAAD2033 Feb 2017RubanNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Proforma of Trading ADocument11 pagesProforma of Trading ASneha AgrawalNo ratings yet

- Chapter 1 - Correction of ErrorsDocument3 pagesChapter 1 - Correction of ErrorsHairizal Harun100% (1)

- .Archivetemp8 - Financial Accounting (Old Syllabus)Document2 pages.Archivetemp8 - Financial Accounting (Old Syllabus)aneebaNo ratings yet

- MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingDocument7 pagesMTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial Accountingvikash guptaNo ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- MBA-Final AccountsDocument4 pagesMBA-Final AccountskanikaNo ratings yet

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- DISSLUTIONDocument3 pagesDISSLUTIONomgarg2714No ratings yet

- Case E 1.1 Solution: Which Elements Should Not Be Recognized in The Balance Sheet?Document2 pagesCase E 1.1 Solution: Which Elements Should Not Be Recognized in The Balance Sheet?Tamim HasanNo ratings yet

- Befa Important Questions For Mid-IiDocument6 pagesBefa Important Questions For Mid-IiSAI PAVANNo ratings yet

- Accounting Question 1st PaperDocument3 pagesAccounting Question 1st Paperakber62No ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Accounting MockDocument6 pagesAccounting MockGSNo ratings yet

- Internal Exam January 2020 - Pre-Test 1Document6 pagesInternal Exam January 2020 - Pre-Test 1Vinetha KarunanithiNo ratings yet

- Company Financial StatementsDocument6 pagesCompany Financial StatementsHasnain MahmoodNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- Homework 2Document2 pagesHomework 2SudeepNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Extra Exercises ErrorsDocument6 pagesExtra Exercises ErrorsMohd Rafi Jasman100% (1)

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- SET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirDocument5 pagesSET E XI ACCOUNTS Unit Test MTP 2023-24 by Praful SirnisharvishwaNo ratings yet

- Revision Sheet - 2023 - 2024Document27 pagesRevision Sheet - 2023 - 2024Yuvraj Chaudhari100% (1)

- Tutorial-Double EntryDocument3 pagesTutorial-Double EntryElayana SyafiqahNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Acc Nov2012 P2Document13 pagesAcc Nov2012 P2gibbamanjexNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- Tutorial Chapter 4 (TRIAL BALANCE)Document2 pagesTutorial Chapter 4 (TRIAL BALANCE)azra balqisNo ratings yet

- 18U1CM01Document8 pages18U1CM01Manoj MJNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- Bbse II 2021 - EseDocument7 pagesBbse II 2021 - Esesmlingwa100% (1)

- Job Analysis and Resumes - Assignment (Intro To HRM)Document7 pagesJob Analysis and Resumes - Assignment (Intro To HRM)KING LOK NG (CBT2241P)No ratings yet

- Intro To Internet & Multimedia - AssignmentDocument23 pagesIntro To Internet & Multimedia - AssignmentKING LOK NG (CBT2241P)No ratings yet

- Basic Business LawDocument4 pagesBasic Business LawKING LOK NG (CBT2241P)No ratings yet

- Assignment 1 - Intro To DDocument9 pagesAssignment 1 - Intro To DKING LOK NG (CBT2241P)No ratings yet

- Consultancy Agreement: Study Visa - SingleDocument4 pagesConsultancy Agreement: Study Visa - SingleMikaela Kariz Catral100% (1)

- Procurement Management and Performance of Construction Projects in Government-Aided Secondary SchoolsDocument60 pagesProcurement Management and Performance of Construction Projects in Government-Aided Secondary SchoolsFidelika MlelwaNo ratings yet

- Midterm EIP KastratiDocument4 pagesMidterm EIP KastratiYllka KastratiNo ratings yet

- Smart Locker Inc Final Business PlanDocument29 pagesSmart Locker Inc Final Business Planapi-449150694100% (5)

- SN No Name Contact Email WEB: Info@ritikagallerystonehttps://ritikagallerystoDocument2 pagesSN No Name Contact Email WEB: Info@ritikagallerystonehttps://ritikagallerystoSHAJU GOPALAKRISHNANNo ratings yet

- Realism ExcerptsDocument15 pagesRealism ExcerptsEmma Kate LaubscherNo ratings yet

- 1968 CPCDocument16 pages1968 CPCAastha AgnihotriNo ratings yet

- ARTI Publication EnglishDocument60 pagesARTI Publication EnglishIcaios AcehNo ratings yet

- EHS 3 Months Look Ahead Plan - Lodha ParkDocument2 pagesEHS 3 Months Look Ahead Plan - Lodha ParkSachin Yashwant kumbharNo ratings yet

- Compare and Contrast The Theme of Elusiveness in Lamia and La Belle Dame Sans MerciDocument3 pagesCompare and Contrast The Theme of Elusiveness in Lamia and La Belle Dame Sans Mercirzz01No ratings yet

- Criminal Law 3 (State of Maharashtra V. Tapas Neogy)Document16 pagesCriminal Law 3 (State of Maharashtra V. Tapas Neogy)harsh sahuNo ratings yet

- CVD EmailSecurityUsingCiscoESADesignGuide AUG14Document36 pagesCVD EmailSecurityUsingCiscoESADesignGuide AUG14zxkiwiNo ratings yet

- WritDocument4 pagesWritKathryn20% (1)

- Challenge 7.1Document5 pagesChallenge 7.1JamRickNo ratings yet

- Pa 1400 SeriesDocument7 pagesPa 1400 SeriessonyalmafittNo ratings yet

- Specification For Installation of Underground Conduit Systems (Fortis BC)Document92 pagesSpecification For Installation of Underground Conduit Systems (Fortis BC)Trevor FarrenNo ratings yet

- Superintendent's Summer Newsletter 2016Document7 pagesSuperintendent's Summer Newsletter 2016Fauquier NowNo ratings yet

- Flying Tiger CopenhagenDocument3 pagesFlying Tiger CopenhagenWan ShahrilNo ratings yet

- Consti Law Cases Chapters 1 To 3Document6 pagesConsti Law Cases Chapters 1 To 3Gervilyn Macarubbo Dotollo-SorianoNo ratings yet

- Classical and Human Relations Approaches To ManagementDocument10 pagesClassical and Human Relations Approaches To ManagementDhanpaul OodithNo ratings yet

- Mortgage ProjectDocument8 pagesMortgage Projectrmbj94_scribd100% (1)

- Economy of Pakistan NotesDocument93 pagesEconomy of Pakistan NotesHamid Naveed50% (4)

- Grade Card (Pabitra)Document1 pageGrade Card (Pabitra)TSEYSETSENo ratings yet

- Important Stanzas For ComprehensionDocument39 pagesImportant Stanzas For ComprehensionCybernet BroadbandNo ratings yet

- Term PaperDocument9 pagesTerm PaperAlyssa EspinosaNo ratings yet

- 1 SMDocument7 pages1 SMTya Asih Puji LestyaNo ratings yet

- Practice Final ExamDocument9 pagesPractice Final ExamAcir ElbidercniNo ratings yet

- Credit Suisse IWM Summer Associate ProgramDocument1 pageCredit Suisse IWM Summer Associate ProgramWilson Guillaume ZhouNo ratings yet

- M.Ed Entrance Sample Model Question Paper Ans ErsDocument19 pagesM.Ed Entrance Sample Model Question Paper Ans Erssubhas9804009247No ratings yet

- IndexCardSheetDocument1 pageIndexCardSheetAnirudh BhandariNo ratings yet