Professional Documents

Culture Documents

Aavas Financiers IC

Aavas Financiers IC

Uploaded by

darshanmaldeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aavas Financiers IC

Aavas Financiers IC

Uploaded by

darshanmaldeCopyright:

Available Formats

5 April 2021

INDIA | NBFC | COVERAGE INITIATION

Aavas Financiers

A premium affordable play

Disciplined growth Sector leading return Initiate with BUY & TP

strategy with asset quality ratios with c.4% ROAs of INR 2,750, implying

at its core 14% Upside

5 April 2021

INDIA|NBFC | COVERAGE INITIATION

TABLE OF CONTENTS

Introduction ....................................................................................... 3

Key focus charts ................................................................................. 4

Investment Rationale ......................................................................... 5

Valuation and Recommendation ...................................................... 21

Key Risks ......................................................................................... 22

Company Background ..................................................................... 23

Peer Comparison.............................................................................. 26

Financial Tables ................................................................................ 28

Aavas Financiers is a low- and middle- income, self-employed focused

(~65% of book) housing finance company with presence in 10 states via

263 branches (Dec’20). The lender is focused on semi-urban and rural

locations with limited presence of large HFCs or banks with an aim to drive

~85% tehsil level penetration in states it enters. With T1 of 51%, Aavas is

well-capitalized to clock in 24% AUM CAGR over FY21-23E generating

sector leading ROAs of 4% (vs. 2% for peers).

RECENT REPORTS

NBFCs - scale based NBFC - FY21 Q3 - FY23 NBFCs Liability Profile 2020 NBFC crisis -COVID

NBFC - 2021 Outlook

approach Estimates Analysis measures

JM Financial Institutional Securities Limited Page 2

5 April 2021

INDIA | NBFC | COVERAGE INITIATION

Aavas Financiers

A premium affordable play

Niche focus offers long runway for growth: With a focus on LIG/MIG segment

We initiate coverage on Aavas Financiers (Aavas) with a BUY predominantly self-employed (~65% of book) and living in semi-urban/ rural

rating and a target price of INR 2,750. Coming from the locations, Aavas has tapped into a market where mortgage penetration is a mere

parentage of AU Financiers (now AUSFB), which has built a ~1%. With presence in 10 states via 263 branches with overall tehsil penetration

successful bottom-up, service-led model for vehicle financing, of ~60% (vs. target of 85%), we believe Aavas can deliver 24% AUM CAGR

Aavas (earlier called AU Housing Finance) was founded to over FY21-23E as it brings its successful credit delivery model to newer markets

provide home loans to low income borrowers. Since its and goes deeper into existing markets. We see its market share in affordable

separation from AUSFB in Jun’16, Aavas has built its business housing improving to 2.8% by FY23E vs 2.0% as of FY20.

in a well-defined, calibrated fashion with asset quality at its

core. With a motto of helping customers move from kuccha to

Margins to remain healthy aided by favourable COF and lower negative carry:

pucca homes, Aavas today services c.118,400 loan accounts –

With increased use of data analytics, Aavas is increasingly able to offer sharper

CAGR of c.46% over FY15-21, with a loan book of INR88

risk adjusted pricing which has managed to keep book yields c.14% in recent

billion – CAGR of c.48%.

years. However, with falling wholesale rates, we foresee some pressure on yields

The robust asset growth has been supported by a conservative –already announced 25bps of cuts since Jan’21, but this is expected to be offset

liability side - ~80% banks (incl DA) and NHB, zero CPs despite by favourable funding costs – incremental COF at 7.04% as of Dec’20, and

strong short term rating of A1+. Significant investment in reduction in negative carry as BS liquidity comes down to 3-4mth buffer vs 5-

hyper-local presence and underwriting (“4 eyes approach”) has 6mth now. We build in NII CAGR of 21% over FY21-23E with NIMs of ~8%.

helped Aavas perfect its risk pricing resulting in consistent 5%+

spreads. We expect investment into geographic expansion Best in class asset quality: Aavas reported 0.5% GS3 ratio in FY20 vs 1.8% for

(expected to identify atleast 4 new states for development over peers with credit costs of 23bps vs 60bps for peers. This was driven by, a) a

2021-26 in keeping with past trend) and going deeper will strong underwriting team (~400 people) consisting of MBAs and CAs and b)

continue to be aided by strong PPOP (22% CAGR) over FY21- stringent screening with high rejection rates of c.70%.

23E. Aavas’s unrelenting focus on asset quality, non-metro

focus, and rigorous customer profiling using 60+ templates has To generate ROAs of c.4% vs 2% for peers; deserves premium valuation:

helped the model withstand the COVID19 disruption. Current valuations of 6.0x FY23E P/B are justified given granular book, long

growth runway and best in class asset quality. Initiate coverage with a BUY

Aavas deserves a premium valuation which is justified in light

rating and target price of INR 2,750, valuing Aavas at 50x FY23E EPS (implied

of its super-granular asset mix, long growth runway and best

P/B 6.9x) for PAT CAGR of 26% over FY21-23E with ROEs of c.15% (on low

in class asset quality with 0.5% GS3 ratio in FY20 vs 1.8% for

leverage of less than 4x).

peers. Protracted COVID-19 disruption and inability to

successfully scale up newer states remain key risks.

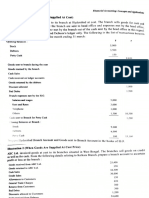

Recommendation and Price Target Financial Summary (INR mn)

Recommendation and Price Target

Y/E March FY19 FY20 FY21E FY22E FY23E

Current Reco. BUY

Net Profit 1,760 2,491 2,758 3,495 4,359

Current Price Target (12M) 2,750

Net Profit (YoY) (%) 89.2% 41.5% 10.7% 26.7% 24.7%

Upside/(Downside) 13.7% Assets (YoY) (%) 39.3% 36.1% 15.9% 16.4% 22.1%

ROA (%) 3.6% 3.8% 3.3% 3.6% 3.8%

ROE (%) 11.6% 12.7% 12.3% 13.7% 14.8%

Key Data – AAVAS IN EPS (INR) 22.5 31.8 35.2 44.6 55.7

Current Market Price INR2,418 EPS (YoY) (%) 67.6% 41.1% 10.7% 26.7% 24.7%

Market cap (bn) INR189.8/US$2.6 PE (x) 107.4 76.1 68.8 54.3 43.5

Shares in issue (mn) 78.3 BV (INR) 235 268 303 348 403

BV (YoY) (%) 36.7% 13.9% 13.1% 14.7% 16.0%

52-week range 2,675/936

P/BV (x) 10.29 9.04 7.99 6.96 6.00

Sensex/Nifty 50,030/14,867

Source: Company data, JM Financial. Note: Valuations as of 01/Apr/2021

INR/US$ 73.4

JM Financial Research is also available on: Bloomberg - JMFR <GO>, Thomson Publisher & Reuters, S&P Capital IQ,

FactSet and Visible Alpha

Price Performance You can also access our portal: www.jmflresearch.com

Please see Appendix I at the end of this report for Important Disclosures and Disclaimers and Research Analyst

% 1M 6M 12M

Certification.

Absolute 6.8 70.2 102.9

Bunny Babjee Karan Singh Anuj Narula

Relative* 7.3 31.6 14.6 bunny.babjee@jmfl.com karan.uberoi@jmfl.com anuj.narula@jmfl.com

* To the BSE Sensex Tel: (91 22) 66303263 Tel: (91 22) 66303082 Tel: (91 22) 62241877

Sameer Bhise Akshay Jain Ankit Bihani

sameer.bhise@jmfl.com akshay.jain@jmfl.com ankit.bihani@jmfl.com

Tel: (91 22) 66303489 Tel: (91 22) 66303099 Tel: (91 22) 62241881

JM Financial Institutional Securities Limited Page 3

Aavas Financiers 5 April 2021

Key Charts

Exhibit 1. AUM – expect 24% CAGR over FY21-23E Exhibit 2. AUM mix – stable product mix

AUM (INR bn) YoY Growth (%) Home loan Other mortgage loans

160 143.7 70%

100%

140 60% 18%

115.7 22% 24% 27% 26% 26% 26%

120 80%

50%

93.4

100

78.0 40% 60%

80

59.4 30%

60 40% 82% 78% 76%

40.7 74% 74% 74% 74%

40 20%

26.9

20%

20 10%

0 0% 0%

FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

th

Exhibit 3. AUM mix – self-employed to remain mainstay of business Exhibit 4. AUM mix* – over 3/4 book controlled by top 4 states

Rajasthan Maharashtra Gujarat

Self employed Salaried

Madhya Pradesh Delhi 2015-20 states

100%

100% 5%

4% 5% 4%

36% 36% 36% 35% 35% 8% 9% 10%

80% 39% 14%

80% 16% 18% 17%

60% 60% 27%

20% 19% 20%

40% 40%

61% 64% 64% 64% 65% 65%

20% 51% 49% 48% 46%

20%

0% 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY15 FY16 FY17 FY18

Source: Company, JM Financial Source: Company, JMFL; *FY20 Rajasthan ~42% of overall AUM while other top 3 states ~15-17%.

Exhibit 5. NIMs to remain healthy Exhibit 6. Superior asset quality aided by data analytics, tech

NIM (%) Spread (%) Gross NPLs (%) Net NPLs (%) Coverage (RHS) (%)

10.0% 2.0% 35%

8.8%

9.0% 8.0% 30%

7.9% 7.7% 7.9% 8.1%

8.0% 1.5% 25%

6.9%

7.0% 6.0% 6.3% 20%

1.0%

6.0% 15%

6.1%

5.0% 5.8% 6.1% 10%

5.4% 5.4% 5.5% 5.5% 0.5%

4.0% 4.6% 4.4% 5%

3.0% 0.0% 0%

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 7. Expect PAT CAGR of 26% over FY21-23E Exhibit 8. Highest return ratios in sector with ROAs of 4%

PAT (INR bn) YoY Growth (%) ROA (%) ROE (RHS) (%)

5.0 100%

4.4

35.0% 3.6% 3.8% 3.6% 3.8% 4.0%

4.5 3.3%

4.0 3.5 80% 30.0% 3.0% 2.9% 2.9% 3.5%

3.5 2.6% 3.0%

2.8 25.0%

3.0 2.5 60% 2.5%

2.5 20.0%

1.8 2.0%

2.0 40% 15.0%

1.5 1.5%

0.9 10.0%

1.0 0.6 20% 1.0%

0.2 0.3 5.0%

0.5 0.5%

0.0 0% 0.0% 0.0%

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 4

Aavas Financiers 5 April 2021

Niche focus offers long runway for growth

Within a highly commoditised mortgage business, Aavas has identified to differentiate itself

by choosing to focus on the undocumented and unbanked segment specifically on the self-

employed. With formal mortgage penetration ~10%, the company has chosen to target the

c.1 billion population living outside India’s top 50 cities where mortgage penetration is ~1%.

Even a 100bps increase in this penetration implies atleast 1 million incremental homes - as of

Dec’20, Aavas has financed ~142,420 housing units.

Affordable housing poised to clock in double-digit growth over FY21-25

Affordable housing defined as HFCs disbursing housing loans with ticket size (at the time of

disbursement) of less than INR1.5 million make up c.20% of overall housing market as of

Mar’20 and are c.INR 4 trillion in size. As per RBI & CRISIL study, aggregate housing finance

demand based on projected housing unit demand (2022) stands at INR5 trillion in EWS

category and INR30 trillion in the LIG category – the key target segments for players like

Aavas.

Exhibit 9. The affordable housing sector is expected to clock 10% CAGR over FY21-25

A ffordable housing loan outstanding (INR billion)

7,000

6,242

Sep’18 IL&FS, Dewan

6,000 “Housing for HFC triggered a liquidity

All” scheme crisis

launched

5,000

4,223

3,870 3,965

4,000 3,652

3,000

2,376

2,000

1,000

0

FY15 FY18 FY19 FY20 FY21E FY25E

Source: CRISIL

While the market has grown at a tepid pace over FY18-21 i.e. at 5% CAGR, some of the

macro tailwinds to drive future growth include:

Recovery in GDP growth post COVID19 disruption

Government support in the form of budgetary allocation to PMAY alongside state specific

incentives like lower stamp duties

Increased supply of affordable homes

Rising demand for affordable homes from Tier 2/3/4 cities as some WFH continues to stay

post-COVID19

Attractive home loan interest rates driving preference for ownership

JM Financial Institutional Securities Limited Page 5

Aavas Financiers 5 April 2021

Exhibit 10. Aavas Financiers – In a league of its own…

Source: Company, JM Financial

Aavas Financiers – niche focus on self-employed segment in the hinterlands

Aavas’s focus customer can be categorised as a) low and middle income, b) self-employed, c)

living in a semi-urban or rural location and d) with or without documented income proofs.

Hence, bottom-of-the-pyramid customers normally identified as chaiwallah, sabziwallah,

chauffeur, local tradesmen, daily wage labourers, domestic assistants, cooks, car washers,

garage mechanics and shopfloor workers, among others. Aavas helps fill the home financing

gap for this segment that large NBFCs/HFC/banks normally do not cater to because of

operational costs and lack of proven credit history. With its proprietary credit underwriting

and assessment tools, the company has helped ~118,400 customers own a home since its

inception in 2012.

In terms of products, Aavas offers

a) Home loans consisting of repairs and renovation loans (~2-3% of volumes),

construction loans (~58% of volumes but lower in value terms) and purchase loans

(~40% of volumes); and

b) Other mortgage loans consisting of LAP (~16% of AUM), top-up loans (INR0.2-0.4

million) for customers with 18-24yr vintage (~3-4% of AUM), and fee/insurance

products (~3-4% of AUM)

Given the customer segment (average income level of c.INR50,000 p.m.), the ticket size focus

for Aavas is under INR 1 million for both home loans and LAP.

Exhibit 11. Product portfolio

Products ATS Share of Key features Yields Target customer

book base

Purchase loans End use single unit houses

Home Construction loans ATS: under End use single unit houses; loan capped at ~INR ~12.5-

~75% 1,000 per sqft; atleast 85-95% completion

Loans INR1.0 million 13.0%

Repairs & renovation Majorly EWS and

Fees and insurance ~3-4% LIG earning less

Top loans ATS: ~INR0.2- Pre-approved product 18-24yrs vintage customer than INR 50,000

Other 0.4 million ~3-4% for home extension / business space expansion per month

mortgage and miscellaneous needs

loans LAP ATS: ~INR0.75 Used for expansion of business, working capital 15.5-

million ~16% needs 16.0%

Source: Company

JM Financial Institutional Securities Limited Page 6

Aavas Financiers 5 April 2021

Over FY14-20, Aavas has delivered a robust AUM CAGR of 64% on the back of

disbursement CAGR of 48% with loan accounts growing 57% over the same period.

Accordingly, the company improved its market share to 2.0% of affordable housing loans in

FY20 from 0.4% in FY15. In the overall housing loans market, Aavas is a very small player

with a share of 0.4% in FY20.

Exhibit 12. Market share – overall housing loans Exhibit 13. Market share – affordable housing loans

Aav as market share - ov erall Aav as market share - affordable

0.6% 0.5% 3.0% 2.8%

0.5% 2.5%

0.5% 0.4% 2.5% 2.2%

0.4% 2.0%

0.4% 0.3% 2.0% 1.5%

0.3% 0.3% 1.5%

0.2% 1.1%

0.1% 0.9%

0.2% 1.0% 0.6%

0.1% 0.4%

0.1% 0.5%

0.0% 0.0%

FY21E

FY22E

FY23E

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

FY15

FY16

FY17

FY18

FY19

FY20

Source: Company, JM Financial, RBI, CRISIL Source: Company, JM Financial, CRISIL

The book remains c.100% retail with a 65:35 self-employed:salaried mix. Product wise, home

loans account for c.75% of AUM while the high-yielding other mortgage business which was

started in June’17, is expected to be capped at 25%.

Exhibit 14. AUM mix – by occupation Exhibit 15. Loan accounts – by occupation

Self employed Salaried Self employed Salaried

100% 100%

80% 39% 36% 36% 36% 35% 35% 80% 41% 38% 38% 37% ~35% ~35%

60% 60%

40% 40%

61% 64% 64% 64% 65% 65% 59% 62% 62% 63% ~65% ~65%

20% 20%

0% 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY15 FY16 FY17 FY18 FY19 FY20

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 16. AUM mix – by credit history Exhibit 17. Loan accounts – by credit history

New to credit With credit history New-to-credit

100% 60%

52%

80% 43% 41% 40-45% 40-45%

58% 38%

67% 71% 65% 40%

60%

40%

20%

20% 42% 35%

33% 29%

0% 0%

FY15 FY16 FY17 FY18 FY15 FY16 FY17 FY18 FY19 FY20

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 7

Aavas Financiers 5 April 2021

Exhibit 18. AUM mix – by product Exhibit 19. AUM mix – by borrower type

Home loan Other mortgage loans Retail Corporate

100% 100% 0.2% 0.5% 0.6% 0.6% 0.5% 0.5% 0.5%

18% 22% 24% 27% 26% 26% 26%

80% 80%

60% 60%

99.8% 99.5% 99.4% 99.4% 99.5% 99.5% 99.5%

40% 82% 78% 76% 40%

74% 74% 74% 74%

20% 20%

0% 0%

FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

The focus will remain on borrowers making c.INR50,000 per month in rural and semi-urban

locations with ticket sizes capped at under INR1.0 million.

Exhibit 20. AUM mix – by income category Exhibit 21. AUM mix – by ticket sizes

EWS - <INR0.3m pa LIG - INR0.3-0.6m pa <INR0.2m INR0.2-1.0m INR1.0-2.5m INR2.5-5.0m >INR5.0m

MIG - INR0.6-1.8m pa HIG - >INR1.8m pa 100% 2%

100% 6% 6% 6% 8%

10% 13% 14% 13% 9% 10% 10%

80% 80%

32%

35% 32% 28% 26% 37% 37% 35%

60% 60%

40% 39% 39% 40%

40% 39% 58%

48% 47% 46%

20% 20%

15% 16% 19% 21%

0% 0% 1% 1% 1% 1%

FY15 FY16 FY17 FY18 FY15 FY16 FY17 FY18

Source: Company, JM Financial Source: Company, JM Financial

The company has identified branch expansion and customer addition as two pillars of growth

going ahead given the low penetration. District wise, as of FY20, Aavas was present in only

45% of the 295 total districts in the 10 states that the company has operations. Population

wise, out an addressable market of c.620 million in the 10 states, as of FY20, Aavas’s

network only covers c.360 million. In terms of tehsil penetration, as of FY20, Aavas had an

overall presence in c.57% tehsils across the 10 states – Aavas targets 10% incremental

penetration per year; with a target of 60-75% tehsil penetration for existing branches over

coming years.

Given the company’s DNA, it is not expected to deviate from the INR0.9m ticket size or the

50% LTVs in order to chase growth. Moreover, another wheel for growth is customer

retention. In this context, and given the high new-to-credit (NTC) customer share (~40-45%

of live accounts), Aavas has to tackle the threat of on-boarded borrowers moving to formal/

banking channels 24-36 months into the loan cycle. To address this, Aavas has taken the

following potent initiatives which have been able to reduce BT-out to 0.3% per month

during FY21 vs 0.8% per month levels during FY18.

The company has engaged a dedicated team for customer retention. Further, it provides

training to cluster heads, branch heads in the field of customer retention apart from sales

and collections

Data analytics: The company maps customer journey within and outside Aavas with a

quarterly tracking of the same. Once the customer starts exhibiting signs of significantly

improved credit worthiness or achieves a high score on the company’s proprietary

scorecard, Aavas proactively reaches out to the customer to assess needs in order to pre-

empt BTs.

JM Financial Institutional Securities Limited Page 8

Aavas Financiers 5 April 2021

Market intelligence: The company uses data analytics to divide markets by population –

above 1 million and below 1 million. This information is then used to frame customized

customer offerings. For example, in mature markets (population above 1 million), a

seasoned borrower will normally look for lower interest rates given higher presence of

competitors (banks and HFCs). In such situations, Aavas is able to pass on some of its

funding cost advantage to increase retention. For smaller markets, borrowers are normally

looking for high loan amounts. Here, Aavas uses data analytics designed scorecard to

make preapproved loan offers.

We are building in AUM CAGR of 24% over FY21-23E driven by a) branch expansion, b)

higher customer acquisition implying a rise in affordable market share for Aavas from 2.0%

as of FY20 to 2.8% as of FY23E.

Exhibit 22. Trend in AUM Exhibit 23. Trend in loan book

AUM (INR bn) YoY Growth (%) Loan book (INR bn) YoY Growth (%)

160 143.7 70% 140 70%

140 114.3

60% 120 60%

115.7

120 50% 100 92.1 50%

93.4

100 74.4

78.0 40% 80 40%

80 61.8

59.4 30% 60 47.2 30%

60

40.7 34.4

40 20% 40 20%

26.9 21.3

20 10% 20 10%

0 0% 0 0%

FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 9

Aavas Financiers 5 April 2021

Well-defined, hyper-local distribution strategy

Taking a leaf out of the FMCG industry, the distribution strategy of Aavas is based on going

where its core customer lives which has resulted in a hyper-local rural and semi-urban

presence. As of Dec’20, Aavas had 263 branches spread out across 10 states in India.

High-touch model demands borrower proximity; targets ~85% tehsil level

penetration per state

Given the rigorous underwriting model, Aavas follows a thumb-rule of 4/5 in terms of

geographic expansion i.e. four states to be developed in five years with a target to achieve a

tehsil level penetration of 60-75% before the next cohort of 5 states is selected. During the

first cycle, from 2011-15, Aavas developed Rajasthan, Gujarat, Maharashtra, MP and Delhi

nd

NCR. During the 2 cycle, i.e. from 2015-20, the company is developing Chhattisgarh,

Haryana, UP, Uttarakhand and Himachal Pradesh.

Within a state, Aavas follows a data-driven branch placement i.e. analyse census patterns and

CIBIL data to map prospective markets – low delinquency and low penetration (under 5%).

Each branch does sourcing and appraisal work within a 50 kms radius going as deep as

village clusters with population levels of ~2,000. This tehsil level targeting will be a key factor

in allaying competition from larger players – Aavas targets a tehsil level penetration of ~ 85%

in all the states in which it operates. Currently, Aavas services 1,073 tehsils (~57% overall

penetration) across its 10 states and has active loans in 10,928 villages/towns. However,

despite the hyper-local presence, Aavas has ensured look, feel and processes in the branches

are institutionalised to ensure same standards across states.

Exhibit 24. Branch network as of Dec’20

State Branches as Dec'20 Operations Commenced in

Rajasthan 88 2012 1st cycle

Maharashtra 44 2012 1st cycle

Gujarat 37 2012 1st cycle

Madhya Pradesh 39 2013 1st cycle

Delhi NCR 6 2013 1st cycle

Haryana & Punjab 15 2017 2nd cycle

Chhattisgarh 5 2017 2nd cycle

Uttar Pradesh 16 2018 2nd cycle

Uttarakhand 9 2018 2nd cycle

Himachal Pradesh 4 2020 2nd cycle

263

Source: Company, JM Financial

The company has grown branch network by c.40% over FY14-20, with a target to add 35-40

branches annually in a contiguous way. We expect the branch network to reach 365 by

FY23E with the overall branch productivity improving to INR10 million disbursement/ month/

branch after dropping to c.INR8 million level in FY21E – the company has a target of INR15

million disbursement per branch per month.

Exhibit 25. Trend in branch network Exhibit 26. Branch geographic mix

Rajasthan Maharashtra Gujarat

Branches YoY Madhya Pradesh Delhi 2015-20 states

400 365 120%

114% 100% 2% 1%

350 325 1% 13% 17%

100% 10% 11% 17% 15%

285 1%

300 80% 15% 2%

250 17% 16% 14%

80% 17% 16%

250 210 15%

60% 19% 20% 15%

200 165 60% 19% 20%

18% 17%

150 40%

94 40%

100 27% 50% 48%

42 44 20% 44% 44% 37% 35%

50 19% 14% 14% 12% 20%

0 0% 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY15 FY16 FY17 FY18 FY19 FY20

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 10

Aavas Financiers 5 April 2021

Hiring strategy - “hire young, hire fresh, hire local”

Not just branch location, Aavas’s hiring strategy also revolves around its core customer. It

follows a philosophy of “hire young, hire fresh, hire local” ensuring the employees have an

open mind and fresh to the mortgage finance business (no biases from previous mortgage

company experience) and are well-versed with ground realities include dialect, customs, social

norms etc.

With a 100% in-house sourcing model, Aavas has one of the largest employee bases among

peers with 3,545 employees as of Dec’20. In terms of split, business:credit/operations ratio is

2:1. However on an employee cost-to-asset or cost-to-income ratio, Aavas is in line with

peers.

We are building in 23% growth in employee count to 4,380 – lower than 46% growth in

branch network, as higher technology integration increases productivity.

Exhibit 27. Trend in employee count Exhibit 28. Employee base vs peers (FY20)

Employees YoY Employees (#)

5000 4,550 4,380 120%

4,000 3,564

98% 3,990 100%

4000 3,564 3,500

80% 3,000

3000 2,500 2,097

34% 2,384 60%

2,000

1,862 49% 40%

2000 1,500 994

13% 696 838

940 28% 20% 1,000

1000 623 704 12% 14% -4% 0% 500

0

0 -20% Aavas HomeFirst Aadhar HFC CanFin Repco

FY15 FY16 FY17 FY18 FY19 FY20 FY21EFY22EFY23E

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 29. Employee cost to assets Exhibit 30. Employee cost to assets vs peers (FY20)

Emp. cost to assets (%) Employee Cost to Assets (%)

4.0%

3.44%

3.5% 2.5% 2.21%

2.05%

3.0% 2.0%

2.40% 2.30% 2.43% 1.53%

2.5% 2.21% 2.12% 2.17% 2.13%

2.07% 1.5%

2.0%

1.5% 1.0%

0.58%

1.0% 0.5% 0.27%

0.5% 0.0%

0.0% Aavas HomeFirst Aadhar HFC CanFin Repco

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial

Source: Company, JM Financial

Exhibit 31. Employee cost to income (%) Exhibit 32. Employee cost to income vs peers (FY20, %)

Emp. cost to income (%) Employee Cost to Income (%)

40.0% 37.4% 28.2%

30.0% 27.1% 27.0%

35.0%

29.8%31.3% 25.0%

30.0% 26.5% 25.9%27.1%26.4%26.4%25.3%

20.0%

25.0%

15.0% 12.6%

20.0%

15.0% 10.0% 7.9%

10.0% 5.0%

5.0% 0.0%

0.0% Aavas HomeFirst Aadhar HFC CanFin Repco

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 11

Aavas Financiers 5 April 2021

Diversified borrowing mix

Aavas has a very conservative approach to borrowing given its presence in the highly niche

customer segment. It has panel of ~30 lenders including marquee names like Asian

Development Bank (ADB), CDC group plc (CDC) and International Finance Corporation (IFC).

Broadly, c.80% of borrowings are sourced from term loans, assignment, NHB financing and

cash credit facility with only c.20% funds coming from capital market. Despite the recent

credit rating upgrade (long term AA- by both ICRA and CARE) the company continues to

steer clear of raising commercial paper (short term rating A1+ by both ICRA and CARE).

ALM profile has improved since its separation from AU reaching a peak of 24% (positive

mismatch in under-1yr bucket) in FY19 during the IL&FS crisis. In light of COVID19, the

company increased on-BS cash and CE to 5-6mths buffer at INR21bn as of Dec’20 vs 3-4

mths buffer ranging INR8-10bn.

This liability strategy has survived major liquidity events facing the NBFC sector – IL&FS and

COVID19 with support from a focussed business model - c.100% retail franchise with over

95% funded customers living in the property, ~50% LTVs and ticket sizes under INR1m. With

incremental funding costs hovering around 7% as of Dec’20, we expect funding costs to

remain at 7.5% levels into FY23E.

Exhibit 33. Trend in borrowings growth Exhibit 34. Trend in borrowing mix

Borrowing (INR bn) YoY growth (%) Term loans DA NHB NCDs Cash credit/ others

100 91 120%

90 100%

80 73 100% 17% 14% 13% 11% 18% 18% 19% 17%

21%

70 63 80% 19%

80% 2% 13% 24% 10% 14% 14% 14% 15%

60 54

60% 25% 28% 17%

50 60% 25% 23% 20%

37

40

27 40% 40% 74% 69%

30 62%

18

20 14

20% 46% 42% 43% 45% 47% 52%

7 20%

10

0 0% 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 35. Trend in funding costs Exhibit 36. Healthy ALM profile

Cost of funds

11.0% Upto 1yr mismatch

30.0% 23.6%

10.0% 20.0%

12.3%

10.0%

9.0% 10.0% 4.1% 3.3%

9.0% 0.0%

8.8% 8.7%

8.0% -3.7%

8.1% 8.0% -10.0%

7.8% 7.7%

7.0% 7.5%

-20.0%

-19.7%

6.0% -30.0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY15 FY16 FY17 FY18 FY19 FY20

Source: Company, JM Financial

Source: Company, JM Financial

Given the rural, semi-urban locations,

Exhibit 37. Fixed/Floating rate BS view

certain borrowers prefer to opt for fixed

FY15 FY16 FY17 FY18 FY19 FY20

rates given the low volatility. The

Assets

company has a conservative policy where

Fixed 23% 32% 40% 45% 44% 41%

it lends fixed rate loans with fixed rate

Floating 77% 68% 60% 55% 56% 59% liabilities and same for floating rates.

Liabilities Further, the fixed rate loan products are

Fixed 28% 32% 28% 29% 43% 33% repriced every three years thus

Floating 72% 68% 72% 71% 57% 67% cushioning the margins/ spreads.

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 12

Aavas Financiers 5 April 2021

Margins to remain healthy despite some pressure on yields

Presence in a niche segment, capability to offer risk-adjusted pricing, deep understanding of

core customer segment alongside continuous engagement with lenders has supported

spreads which have historically remained close to the management guided range of 5%

through crises. The company’s yields have become more refined as the underwriting models

have improved – delta between self-employed and salaried improved to 185bps in FY18 vs

10bps in FY15 while delta for new-to-credit yields vs borrowers with credit history improved

to c.240bps in FY18 vs 41bps in FY15. This differentiation has been possible with scorecard

based sourcing and higher use of data analytics.

With wholesale rates falling and incremental funding costs at 7%, Aavas has announced two

rate cuts 10bps in Jan’21 and 15bps in Feb’21. However, spreads are expected to improve to

6% by FY23E aided by funding cost benefit. Similarly, margins (incl DA) remain healthy

reaching 8.1% aided by excess capital, healthy DA income and reduction in negative carry.

We expect NII CAGR of 21% over FY21-23E with margins improving to 8.1% by FY23E.

Exhibit 38. Trend in spreads and NIMs (incl DA) Exhibit 39. Trend in NII income

NII (INR bn) YoY Growth (%)

NIM (%) Spread (%)

10.0% 10.0 120%

8.8% 9.0

9.0% 8.0% 9.0

7.9% 7.7% 7.9% 8.1% 100%

8.0% 6.9% 8.0 7.3

7.0% 6.0% 6.3% 7.0 6.1 80%

6.0% 6.0 5.0

5.0% 6.1% 6.1%

4.0% 5.4% 5.4% 5.5% 5.5% 5.8% 5.0

4.1

60%

4.6% 4.4% 4.0

3.0% 2.6 40%

3.0

2.0%

1.0% 2.0 1.3

0.8 20%

1.0 0.4

0.0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E 0.0 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21EFY22EFY23E

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 40. Yield mix – by credit history Exhibit 41. Yield mix – by occupation

Yield - New to credit Yield - With credit history Yield - total Yield - salaried Yield - self employed Yield - total

18.9%

18.8%

18.8%

18.7%

18.7%

18.7%

18.5%

20.0% 20.0%

18.0%

18.0%

18.0%

17.9%

17.3%

19.0% 19.0%

16.9%

16.5%

16.3%

18.0% 18.0%

15.9%

15.9%

15.3%

15.1%

17.0% 17.0%

14.9%

14.8%

14.8%

14.1%

16.0% 16.0%

13.5%

15.0% 15.0%

14.0% 14.0%

13.0% 13.0%

12.0% 12.0%

FY15 FY16 FY17 FY18 FY15 FY16 FY17 FY18

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 42. Average yield – by product Exhibit 43. High yield mortgage share to be ~25%

Yield - Home Loan Yield - Other Mortgage Loan Yield - Total Home loan Other mortgage loans

100%

16.6%

16.5%

18% 22% 24% 27% 26% 26% 26%

17.0% 80%

15.6%

15.5%

15.4%

15.1%

15.1%

15.0%

14.7%

16.0%

14.5%

60%

14.0%

13.8%

13.6%

15.0%

13.6%

40% 82% 78% 76% 74% 74% 74% 74%

14.0%

20%

13.0%

12.0% 0%

FY15 FY16 FY17 FY18 FY19 FY20 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 13

Aavas Financiers 5 April 2021

Stable opex ratios as investment in growth continues

Given the 100% in-house sourcing model, the company has higher fixed cost base (~65%),

as such as growth accelerates operating leverage is expected to play out. However, given the

expansion blueprint including the recent foray into brand-building – we expect cost-to-asset

ratio to stabilise at ~3.4% levels into FY23E. Management has internally targeted to work

towards reducing cost-to-asset ratio by c.40bps annually. Technology will be the centrepiece

of the improving productivity as the company uses machine learning and automation to

improve TATs – a key moat in a unbanked low income segment.

Exhibit 44. Trend in opex growth Exhibit 45. Trend in cost-to-asset ratio

Opex (INR bn) YoY growth (%) Cost to Assets (%)

5.0 160% 6.0%

140% 5.0%

3.9 5.0%

4.0

3.3 120% 3.8%

2.8 4.0% 3.4% 3.4% 3.5% 3.4%

3.0 100% 3.1% 3.2% 3.2%

2.3 80% 3.0%

1.9

2.0 1.6 60%

2.0%

40%

1.0 0.7

0.4 1.0%

0.2 20%

0.0 0% 0.0%

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

Data analytics is another key focus area as Aavas aims to become “more intelligent” about

sourcing, underwriting, asset quality and retention. The management’s serious intent on

being a data driven firm is evident in ‘Data Science’ being a separate department reporting

directly to the CEO. The use of analytics has moderated customer attrition, which fell to

0.3% per month currently vs 0.8% per month during FY18 thereby reducing the cost of

customer acquisition.

Together, the company employs 80 people under technology and 15 people under data

analytics in-house.

Exhibit 46. Snapshot of recent tech initiatives

Technology initiatives Operational area Results

Robotics Replaced manual intervention in Reduced time taken to log

credit assessment information from 45-60 minutes

to just 5 minutes through robot-

induced automation

Default model algorithm Leveraged bureau report Algorithm helped in generating

information, capturing static and cases vulnerable to defaults

dynamic information which was shared with the

collections team for proactive

redressal

Automated underwriting Created a differentiated Accelerated the process and

underwriting model suited reduced the TAT. During FY20,

for automatic approvals Aavas disbursed loans to 55%

customers within 10 days

Bounce prediction model Provides data of cases that can Pre-emptive action aided 6%

potentially default in 3 months decline in bounce incidence

Source: Company, JM Financial

With 100% data geo-tagged, the company has converted its whole portfolio into a “Heat

Map”, where at the touch of a finger, the MIS will display real-time within a 5km radius of

the click, the number of customers funded by Aavas and their demographic and collection

patterns for the last seven years. Such real time mapping has transformed an erstwhile highly

risky, unpredictable segment into manageable “patterns” where the company can apply

analytics and predict bounce rates with ~85% accuracy – during COVID19, the accuracy had

fallen to 30-40%, however as on-the-ground normalcy returns, the accuracy is expected to

go back to 75-80% levels going into FY22.

JM Financial Institutional Securities Limited Page 14

Aavas Financiers 5 April 2021

Data analytics is also making collections more targeted to ensure higher efficiencies.

Emerging from the COVID19 lockdown/ moratorium, all the above investments into tech and

data resulted in Aavas witnessing 1+ DPD levels of 6-8% against management expectation of

c.10%.

Apart from operations, even the customer facing side has been digitised where the

borrower/customer can find solutions to c.85% of their queries via an app. This has improved

productivity by freeing up employees to focus on customer acquisition and retention.

Moreover, the company has made significant investment into cyber security as well to ensure

data protection.

All of the above are creating a clear competitive advantage for Aavas, where the level of

attention and detail shown by the company for ATS INR0.9 million (similar to the analysis a

big financier would do for an ATS INR10 million+) will be very difficult to replicate for a new

player and very uneconomic for a larger player.

Exhibit 47. TAT Exhibit 48. Target TAT of 10days

TAT (Days) % of cases processed within 10 days

25 70.0%

21

20

60.0% 55.00%

54.22%

14

15 13

12

10 50.0%

10

40.0%

5

0 30.0%

FY14 FY18 FY19 FY20 Target FY18 FY20

Source: Company, JM Financial Source: Company, JM Financial

In FY18, the company set itself an ambitious target of a TAT of 10 days vs a month taken

historically. Aavas is driving its team in the achievement of this target by penalising delays in

processing files and linking incentives to delivery improving TATs. Alongwith, indepth

customer data which will give Aavas an edge over competitors in risk-adjusted pricing,

superior TATs in a segment with undocumented, cashflow based underwriting, will be

another moat for the ‘bottom-of-the-pyramid” financier.

JM Financial Institutional Securities Limited Page 15

Aavas Financiers 5 April 2021

Unrelenting focus on asset quality

Coming from AU’s parentage, Aavas has prioritised a robust collection system over

underwriting model. The company exhibits single-minded focus on asset quality from the

beginning i.e. the branch set-up phase where Aavas first sets up its underwriting and

collections teams in a new state before sales given the high fixed costs involved (~65%).

Prospective markets are selected based on the data analytics looking at delinquency levels

and mortgage penetration (preferably under 5%).

Some business model features that work to ensure better asset quality are:

Borrower mix: Aavas runs a 100% retail book, staying away from loan to corporates,

builder funding or funding for investment purposes and higher ticket sizes in general. For

~95% of borrowers funded by the company, it is their first house and they reside in it

too.

Product mix: Sticky LTVs at ~50% with ATS capped at under INR 1.0 million with FOIR

ratio ~40% (on average EMIs come to INR12,000). The company does not underwrite

construction risk by refusing to fund properties that are not 85-95% complete or ready to

move in. Moreover, loan in the construction category is capped around INR 1,000 per

square feet. Further, top-up loans are only offered to existing customers with 18-24mth

of spotless credit record with the company, and the purpose too is thoroughly

investigated.

Sourcing: Distribution/sourcing is done using 100% in-house model – ensuring quality

leads. Moreover, geographically, the company sets up presence in areas where top five

companies are absent and where housing penetration is less than 5% - ensuring Aavas is

the first choice for a home loan and not appraising rejected cases of the other lenders.

Further, referral based sourcing to tap into society structure in T3-6 cities via “Saathi”

interface is another source to generate high-quality leads.

Stringent screening: The company runs rejection rates of ~70% - indication of both the

latent demand and the company’s stringent underwriting. In this context, it has to be

noted the proprietary “Scorecard” filters out non-fundable cases immediately at pre-

sourcing thereby improving the quality of the rejection rate.

‘Four Eyes’ approach involves dual underwriting, in-house and an empanelled/ external

agency: The company has made significant investment in creating a credit delivery model

with robust risk processes along four verticals, 1) underwriting risk, 2) legal risk, 3)

technical risk, and 4) operational risk. Aavas has accordingly employed, a) c.400

underwriters of which 150 are CAs, b) almost 100 civil engineers in-house alongside 250

external engineering firms, c) c.120 lawyers in-house alongside 200 external law firms for

the security creation processes and d) a very strong operational risk framework. Further, a

high touch model where employees make regular and surprise visits to the customer

throughout the lending process.

“Smart” collections: Use of technology like geo-tagging (for effective collections) and

predictive analytics (identifying potential bounce rates with 75-80% accuracy) has aided

the company in taking corrective actions early.

This conservative approach has allowed Aavas to reduce net bouncing rate by 5%, keep 1+

DPD ratio within comfort level of 5% and reporting GNPA of <1% over close to 30 quarters.

Exhibit 49. Credit appraisal framework

Source: Company

JM Financial Institutional Securities Limited Page 16

Aavas Financiers 5 April 2021

Exhibit 50. 1+ DPD ratio trend Exhibit 51. Stage 1&2 ratio trend

1+ DPD Stage 1 Stage 2

0.08 120.0%

6.8% 98%

0.07 6.2% 97% 98%

100.0%

0.06 5.1% 4.8% 80.0%

0.05

0.04 3.4% 60.0%

0.03 2.4%

40.0%

0.02

20.0%

0.01 2% 2% 1%

0 0.0%

FY15 FY16 FY17 FY18 FY19 FY20 FY18 FY19 FY20

Source: Company, JM Financial Source: Company, JM Financial

Mortgage loan GNPAs are lower than home loans as the business was only stared in June’17

and hence vintage effects are yet to playout, however management expects the same to be

under the guided range of 1%.

Exhibit 52. NPA – by product Exhibit 53. NPA – by customer segment

Home loan - NPA Mortgage loans - NPA Salaried NPA Self employed NPA

1.0% 0.9% 1.0% 0.9%

0.8% 0.8%

0.6% 0.6% 0.6% 0.6% 0.6% 0.6%

0.6% 0.5% 0.6%

0.6% 0.5% 0.6%

0.4% 0.4% 0.5%

0.4%

0.4% 0.4% 0.3% 0.3%

0.3% 0.3% 0.2%

0.2% 0.1% 0.1% 0.2%

0.0%

0.0% 0.0%

FY15 FY16 FY17 FY18 FY19 FY20 FY15 FY16 FY17 FY18 FY19 FY20

Source: Company, JM Financial Source: Company, JM Financial; Data for FY20 as of Dec’19.

COVID19 was the most-rigorous stress test of the company’s underwriting till date, with

24% morat book as of April’20 crystallising into a 1+ DPD ratio of 8.2% by Dec’20 – below

management estimates of 10%. Moreover, the company undertook detailed

customer/portfolio slicing by 60+ customer’s categorization (in SENP), FOIR cut, and LTV cut

to make positive and negative lists in order to curtail fresh exposures to the most affected

segments such as hospitality, taxis and school related businesses. As such on a fully baked

basis, the company reported GS3 ratio of 1% as of Dec’20 with 1.07% GS3 ratio in home

loans.

Exhibit 54. Quarterly movement of asset quality

Gross S3 (%) Net S3 (%) Coverage Ratio (RHS)

1.2% 50.0% 3QFY21 includes outstanding

1.0%

45.0% amount of INR413.8 million (~

1.0% 0.59%) which has not been

0.8%

40.0%

declared NPA on account of SC

35.0%

0.6%

0.8% order.

0.6%

0.6%

0.6%

0.6%

0.6%

30.0%

0.5%

0.5%

0.5%

0.5%

0.5%

0.6% 25.0%

20.0%

0.4%

15.0%

10.0%

0.2%

5.0%

0.0% 0.0%

4Q18

1Q19

3Q19

4Q19

2Q20

3Q20

1Q21

2Q21

3Q18

2Q19

1Q20

4Q20

3Q21

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 17

Aavas Financiers 5 April 2021

Credit costs jumped to 33bps in 4QFY20 (vs 8bps in 3QFY20 and 24bps in 4QFY19) and

further jumped to 75bps as of Dec’20 as the company revised its PD, LGD assumptions and

added a 25% contingent buffer - overall additional provision for COVID19 impact stands at

INR190.3m Dec’20 with Stage 1&.2 cover improving to 41bps as of Dec’20 vs 18bps last

year. We build in credit costs of 44bps in FY21E vs 23bps in FY20 which will taper off to

c17bps by FY23E.

Exhibit 55. Stage 3 mix – by LTV Exhibit 56. Asset quality trends

0%-40% 41%-60% 61%-80% More than 80% Gross NPLs (%) Net NPLs (%) Coverage (RHS) (%)

2.0% 35%

100%

30%

80% 1.5% 25%

59% 49%

20%

60% 1.0%

15%

40% 10%

33% 0.5%

24% 5%

20%

15% 13% 0.0% 0%

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

0%

FY19 FY20

Source: Company, JM Financial

Source: Company, JM Financial

Aavas has demonstrated far superior asset quality vs a) other affordable HFCs – 0.5% vs 6%

average for peers and b) for ticket sizes under INR0.75 million – 0.5% vs 5% for peers

offering same ticket size. This has resulted from the hyper-local, high-touch model with a

collections engine powered by tech and data analytics.

Exhibit 57. Trend in credit costs Exhibit 58. CC – lower vs peers owing to stringent underwriting

Provision-to-assets (%) Provision-to-assets

0.50%

0.44%

0.45% 1.2%

0.40% 0.37%

IndAS 1.00%

1.0%

0.35%

0.28% 0.8%

0.30%

0.24% 0.23% 0.55%

0.25% 0.6% 0.52%

0.18% 0.17%

0.20%

0.13% 0.4% 0.30%

0.15% 0.23%

0.08% 0.2%

0.10%

0.05% 0.0%

0.00% Aavas HomeFirst Aadhar HFC CanFin Repco

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial, CIBIL, CRISIL

Exhibit 59. Superior asset quality vs sector peers Exhibit 60. GNPA – lowest 90DPD vs peers (FY20)

GNPA - Affordable HFCs GNPA - ATS under INR0.75mn

GNPA - Aavas GNPA

6.60% 5.0% 4.35%

7.0%

6.0% 5.40% 4.0%

5.20% 5.30%

5.0% 4.50%

4.00% 3.0%

4.0%

3.0% 2.0% 1.47%

2.0% 0.78% 0.76%

1.0% 0.46%

1.0% 0.45% 0.47% 0.46%

0.0%

0.0%

Aavas HomeFirst Aadhar HFC CanFin Repco

FY18 FY19 FY20

Source: Company, JM Financial, CIBIL, CRISIL Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 18

Aavas Financiers 5 April 2021

Robust capital adequacy to support growth

With a T1 ratio of 51% Aavas is currently significantly overcapitalised which will easily

support growth over the next 3-5 yrs. We forecast T1 of 49% in FY23 with leverage of 4x.

With a capital efficient model, where the company raises ~20% of borrowings using

assignment, we believe Aavas is well-capitalised to capture growth for the foreseeable future.

Exhibit 61. Capital adequacy Exhibit 62. Leverage

Leverage (x)

Tier I (%) Tier II (%)

90% 10.0

8.4 8.4

9.0

80% 8.0

68%

70% 62% 7.0

60% 56% 54% 53% 6.0

50% 4.3

47% 5.0 3.7 3.7 3.8 3.9

50% 3.4

4.0 3.1

40% 3.0

27%

30% 21% 2.0

20% 1.0

0.0

10% FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

FY15 FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 63. HFC Tier-1 vs peers

HFC Tier-1 FY20 FY21E

Aavas 53.7% 52.7%

Can Fin Homes 20.1% 22.4%

Repco 25.9% 27.4%

Home First 47.7% 51.0%

HDFC 16.5% 20.0%

LICHF 12.2% 13.9%

PNBHF 15.2% 17.4%

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 19

Aavas Financiers 5 April 2021

Right focus translates into highest return ratios in sector

Aavas has delivered a strong 67% CAGR in PAT over FY15-20 driven by single-minded focus

on correct risk pricing and asset quality. We expect Aavas to deliver 26% CAGR in earnings

over FY21-23E with ROAs of c.4% levels on the back of a niche business model, proven asset

quality prowess and massive opportunity size in the under INR1.0 million ATS.

Exhibit 64. Trend in earnings Exhibit 65. Trend in return ratios

PAT (INR bn) YoY Growth (%) ROA (%) ROE (RHS) (%)

5.0 100%

4.4

35.0% 3.6% 3.8% 3.6% 3.8% 4.0%

4.5 3.3%

4.0 3.5 80% 30.0% 3.0% 2.9% 2.9% 3.5%

3.5 2.6% 3.0%

2.8 25.0%

3.0 2.5 60% 2.5%

2.5 20.0%

1.8 2.0%

2.0 40% 15.0%

1.5 1.5%

0.9 10.0%

1.0 0.6 20% 1.0%

0.2 0.3 5.0%

0.5 0.5%

0.0 0% 0.0% 0.0%

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

FY21E

FY22E

FY23E

FY15

FY16

FY17

FY18

FY19

FY20

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 66. Aavas – Dupont view

Dupont Analysis (%) FY16 FY17 FY18 FY19 FY20 FY21E FY22E FY23E

NII / Assets (%) 5.90% 6.17% 7.91% 8.54% 7.58% 7.39% 7.60% 7.80%

Other income / Assets (%) 1.43% 1.65% 1.28% 0.81% 0.60% 0.67% 0.61% 0.59%

Total Income / Assets (%) 7.34% 7.82% 9.19% 9.35% 8.18% 8.05% 8.22% 8.40%

Cost to Assets (%) 3.16% 3.24% 4.98% 3.83% 3.40% 3.39% 3.48% 3.42%

PPP / Assets (%) 4.18% 4.58% 4.22% 5.52% 4.78% 4.66% 4.74% 4.98%

Provisions / Assets (%) 0.28% 0.24% 0.08% 0.18% 0.23% 0.44% 0.13% 0.17%

PBT / Assets (%) 3.90% 4.35% 4.14% 5.33% 4.55% 4.22% 4.61% 4.81%

Tax Rate (%) 34.38% 33.64% 30.70% 31.73% 17.52% 21.00% 21.00% 21.00%

ROA (%) 2.56% 2.88% 2.87% 3.64% 3.75% 3.34% 3.64% 3.80%

Leverage (%) 8.4 5.4 3.7 3.2 3.4 3.7 3.8 3.9

ROE (%) 21.5% 15.6% 10.6% 11.6% 12.7% 12.3% 13.7% 14.8%

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 20

Aavas Financiers 5 April 2021

Initiate coverage with BUY and TP of INR 2,750

Aavas is currently trading at 6.0x FY23E BV and 43x EPS FY23E. We are valuing Aavas at 50x

FY23E EPS (implied P/B of 6.9x) implying TP of INR2,750 for AUM CAGR of 24% with PAT

CAGR of 26% and ROA/ROEs of c.4/15% by FY23E as the company continues to invest into

distribution and brand-building.

We believe the premium valuation - target multiple of 50x P/E FY23E vs peers is justified

given a) strong growth story as Aavas is only 0.4/2.0% of the overall housing/ affordable

housing market, b) robust asset quality even with ~40% new-to-credit borrower share, c)

right investment focus on tech, data analytics and building moat around TATs and d) highest

return ratios with ROAs of c.4% vs 2% for peers.

Exhibit 67. HFC Comps

HFC comps RoA RoE P/E (x) P/B (x)

FY20 FY21E FY22E FY23E FY20 FY21E FY22E FY23E FY20 FY21E FY22E FY23E FY20 FY21E FY22E FY23E

Aavas 3.8% 3.5% 3.8% 4.0% 12.7% 13.0% 14.3% 15.4% 76.1 68.8 54.3 43.5 9.0 7.9 6.9 6.0

Can Fin Homes* 1.9% 2.1% 2.1% 2.1% 19.8% 19.0% 17.6% 17.1% 20.4 17.8 16.1 14.1 3.7 3.1 2.6 2.2

Repco* 2.5% 2.3% 2.4% 2.5% 17.5% 15.0% 14.5% 14.2% 7.0 7.2 6.5 5.8 1.2 1.1 0.9 0.8

Home First 2.7% NA NA NA 10.9% NA NA NA 55.9 NA NA NA 4.8 NA NA NA

HDFC 3.6% 2.1% 2.2% 2.2% 21.7% 11.8% 11.8% 12.3% 10.7 17.2 14.7 12.8 2.2 1.8 1.7 1.5

LICHF 1.2% 1.3% 1.4% 1.4% 13.9% 15.2% 14.4% 14.2% 9.1 7.3 6.7 6.0 1.2 1.0 0.9 0.8

PNBHF 0.8% 1.3% 1.4% 1.5% 8.3% 10.6% 9.2% 9.0% 10.2 9.1 8.8 8.2 0.8 0.8 0.8 0.7

Source: Bloomberg, Company, JM Financial; * as per BBG estimates

Exhibit 68. P/B trend Exhibit 69. P/E trend

Aavas Fwd. P/BV (x) SD+1 SD-1 Average Aavas Fwd. P/E (x) SD+1 SD-1 Average

8.0x 60x

7.0x 50x

6.0x

5.0x 40x

4.0x 30x

3.0x 20x

2.0x

1.0x 10x

0.0x 0x

Dec-18

Dec-19

Dec-20

Dec-18

Dec-19

Dec-20

Jun-19

Jun-20

Jun-19

Jun-20

Apr-19

Apr-20

Apr-21

Apr-19

Apr-20

Apr-21

Feb-19

Feb-20

Feb-21

Oct-18

Oct-20

Aug-19

Oct-19

Aug-20

Oct-18

Aug-19

Oct-19

Aug-20

Oct-20

Feb-19

Feb-20

Feb-21

Source: Company, JM Financial, Bloomberg Source: Company, JM Financial, Bloomberg

JM Financial Institutional Securities Limited Page 21

Aavas Financiers 5 April 2021

Key risks

Ability to raise cost-effective funds from banks and capital markets: The company’s

survival depends on its ability to raise funds from banks, capital markets on competitive

terms and in a timely manner. They currently raise funds using a variety of sources

including term loans and working capital facilities, assignment / securitisation (target level

20-25%), NCDs and NHB refinancing. In terms of lenders, the company has relationships

with ~30 banks and after recent credit rating upgrade to AA-, is now eligible to raise

funds from the insurance sector and provident fund sector (targets 10-20% share in

borrowing mix going forward).

Asset quality shocks: Aavas is primarily focused on serving low and middle income

customers in semi-urban and rural areas that have limited access to formal banking credit.

Additionally, often they do not have credit histories (new-to-credit) supported by tax

returns and other documents. Self-employed customers are often considered to be higher

credit risk due to their increased exposure to fluctuations in cash flows. As such, a player

like Aavas’s balance sheet is more vulnerable to vagaries of the income streams of its

borrowers. The company has taken several steps to mitigate the same including relying on

a system of customer referrals and the value of the property provided as underlying

collateral rather than focusing solely on the credit profile of borrower while sanctioning

loans. The company has further improved its collections with the use of tech and data

analytics that enables it to assess real-time creditworthiness of its customers.

Concentration risks: Three-fourths of the book remains concentrated in the top 4 states –

Rajasthan, Gujarat, MP and Maharashtra i.e. mainly western India. The real estate and

housing finance markets in these states may perform differently from, and may be subject

to market conditions that are different from, the housing finance markets in other regions

of India. Consequently, any significant social, political or economic disruption, or natural

calamities or civil disruptions in this region, or changes in the policies of the state or local

governments of this region, could disrupt the company’s business operations. However,

given Aavas’s tehsil distribution strategy, geographic diversification of book is expected to

be slower than peers focused on district level presence.

Heightened competition risks: The housing finance industry is highly competitive. Aavas’s

primary competitors are banks, other HFCs, small finance banks, NBFCs well as private

unorganized lenders who typically operate in semi-urban and rural markets. Competitors

may have more resources, a wider branch and distribution network, access to cheaper

funding, superior technology and may have a better understanding of and relationships

with customers in these markets. This may make it easier for competitors to expand and

to achieve economies of scale at a faster pace than Aavas. In addition, its competitors

may be able to rely on group synergies i.e. retail presence of group companies or banks.

Aavas has primarily relied on data analytics to reduce BT-out to 0.3% per month in FY21

vs 0.8% per month in FY18. Further, considering competition from AUSFB’s home loan

business, it is pertinent to note the non-compete agreements signed between the parties

during seperation, which includes among other things;

- Top 50 employees of Aavas and top 50 employees of AU cannot work for each other

in during their lifetime.

- Outside top 50, employees of a company, AU or Aavas, cannot work for the other for

5 years.

- Any customer of Aavas and AU cannot do balance transfer with each other for a

lifetime.

JM Financial Institutional Securities Limited Page 22

Aavas Financiers 5 April 2021

Company Background

Aavas Financiers Limited (formerly known as AU Housing Finance Limited) started operations

in 2011 in Jaipur, Rajasthan. The Company was promoted by AU Small Finance Bank (earlier

AU Financiers) until 2016. Currently, it is backed by marquee PE investors Kedaara Capital

and Partners Group holding 30% and 21% equity share respectively. The Company is a retail

affordable housing finance company primarily serving low and middle income salaried, self-

employed customers in semi-urban and rural areas of India. A majority of these borrowers

have limited access to formal banking credit. Aavas’s product offering consists of home loan

for purchase, loan for construction of residential properties and loan for extension and repair

of existing housing units. The Company has 263 branches, and is spread across 10 states as

on Dec’20.

Exhibit 70. Timeline

Source: Company, JM Financial

Exhibit 71. Organisation structure

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 23

Aavas Financiers 5 April 2021

Highly experienced management team

Aavas is led by a qualified and experienced management team, who are supported by a

capable and motivated pool of managers and other employees. Further, the company has an

attractive ESOP plan to motivate employees – as of Dec’20, management and employees own

7% equity stake in the company.

Exhibit 72. Key management personnel

Name Position Background

Mr. Agarwal He has been associated with Aavas since its incorporation in 2011. He was

previously associated with AU SFB as its Business Head-'SME and Mortgages'. Prior to that he

Sushil Kumar Agarwal Managing Director and CEO has worked with ICICI Bank as its Chief Manager and with Kotak Mahindra Primus Limited as

an Assistant Manager. He has more than 19 years of experience in the field of retail financial

services. He is a qualified Chartered Accountant and Company Secretary.

Mr. Rawat has been associated with Aavas since 2013. He presently heads finance and

treasury; accounts; internal audit; compliance; budget and analytics departments. He has been

previously associated with First Blue Home Finance Limited, Accenture India Private Limited and

Ghanshyam Rawat CFO

Deutsche Postbank Home Finance Limited. Further, he has also worked with Pan Asia Industries

Limited and Indo Rama Synthetics (I) Limited. He is a fellow member of the Institute of

Chartered Accountants of India.

Prior to CRO, Mr. Atre was serving as Chief Credit Officer. He has developed effective

underwriting methodologies in a high risk customer segment. He has over 31 years of

experience in sales, credit and risk across retail and SME products. Prior to joining Aavas, he

worked with leading banks, NBFCs and HFCs including Equitas Housing Finance Private

Ashutosh Atre Chief Risk Officer

Limited, Equitas Micro Finance India Private Limited, ICICI Bank Limited, ICICI Personal Financial

Services Company Limited, Cholamandalam Investment & Finance Company Limited. He holds

a Diploma in Finance and Engineering from NMIMS and from M.P. Board of Technical

Education respectively.

Mr. Naresh is responsible for building an effective sales team at Aavas. He has experience in

distribution and has been instrumental in setting up the rural distribution model for Aavas. He

Sunku Ram Naresh Chief Business Officer has over 23 years of experience across FMCG and Financial Services. He has experience in

working with reputed brands like Nestle India Limited, ICICI Bank Ltd, GE money and Bajaj

Finance limited. He holds an MBA from Sri Krishnadevaraya University, Andhra Pradesh.

Mr. Sinhag has experience in implementing techniques and procedures for maintaining end to

end collections including legal filings. He started his career with law firm initially, and then he

Senior Vice President-

Surendra Kumar Sinhag joined Cholamandalam in 2004. His stint before Aavas was with Bajaj Finance, where he

Collection

served as 'National Head of Collections'. He holds a Degree in Law from University of Rajasthan

and an MBA from Periyar University.

Mr. Srivastava has been instrumental in introducing cutting edge solutions that have enabled

Aavas to move towards a data driven decision making ecosystem by making disruptive

interventions in areas of Customer Acquisition, Credit Risk Assessment, Collections

Senior Vice President-Data Management, Alternate Channel Sales, and Customer Life-Cycle Management He is an

Anurag Srivastava

Science analytics professional with over 14 years of experience in Housing Finance, Banking, Other

Financial Services, Insurance, Healthcare, Utilities and Market Research domains. Prior to

joining Aavas, he has been associated with companies like Deloitte, WNS and American

Express.

Mr. Sinha is responsible for Operations and Alternate Business Channels at Aavas.

Through his tenure, he has helped established many operational efficiency operations including

digital disbursements, regional center processing and development of alternate channels. He

Senior Vice President-

Rajeev Sinha has 19 years of experience in the field of Banking and Financial Services. Prior to joining Aavas,

Operations

he was associated with Cointribe Technologies and with Indiabulls Housing Finance as

'National Operations Head'. He holds a Degree in Physics and holds a Certificate in Customer

Relationship Management from IIM Ahmedabad.

Mr. Pathak has been previously associated with Star Agriwarehousing & Collateral

Management Limited as its Company Secretary. He has been associated with Aavas since its

Sharad Pathak Company Secretary

inception, having experience of more than 9 years in corporate sector. He holds a bachelor’s

degree in commerce from the Rajasthan University and is a qualified company secretary.

Source: Company

JM Financial Institutional Securities Limited Page 24

Aavas Financiers 5 April 2021

Shareholding Pattern

Exhibit 73. Shareholding as of Dec’20

Others

3%

FII Kedaara

31% 30%

Partners Group

DII

21%

8%

Management,

Employees and

BoD

7%

Source: Company

JM Financial Institutional Securities Limited Page 25

Aavas Financiers 5 April 2021

Peer Comparison – FY20

Exhibit 74. Peer size comparison

AUM (INR bn)

250

207.1

200 181.2

150

115.9 114.3

100

78.0

50 36.2

0

Canfin GRUH Repco Aadhar HFC Aavas HomeFirst

Source: Company, JM Financial

Home loan share for Aavas seems lower than peers as the company does not include 4-3% in

fee and insurance as part of home loans. Including the same, home loan share comes to

~80% level – similar to peers.

Exhibit 75. Loan mix – by product Exhibit 76. Loan mix – by customer

Home loans LAP / other mortgage Developer loan Salaried Self employed

100% 100%

9% 6% 14% 17% 17%

27% 27% 35% 29%

80% 80% 44% 52%

65%

60% 60%

40% 87% 90% 85% 83% 83% 40%

74% 73% 65% 71%

56% 48%

20% 20% 35%

0% 0%

Aavas GRUH HomeFirst Aadhar CanFin Repco Aavas GRUH HomeFirst Aadhar CanFin Repco

HFC HFC

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 77. Ticket sizes Exhibit 78. LTV

ATS (INRm) LTV

2.00 80.0% 68%

1.65 67%

1.50 70.0% 60%

56% 53%

1.50 60.0%

47%

0.95 1.01 50.0%

1.00 0.84 0.84 40.0%

30.0%

0.50 20.0%

10.0%

0.00 0.0%

Aavas GRUH HomeFirst Aadhar CanFin Repco Aavas GRUH HomeFirst Aadhar CanFin Repco

HFC HFC

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 26

Aavas Financiers 5 April 2021

Exhibit 79. Employee base Exhibit 80. Branches

Employees (#) Branches (#)

4,000 3,564 350 294

3,500 300 250

3,000 250 195 198

2,500 2,097 200 177

2,000 150

1,500 994 100 68

696 838

1,000 50

500 0

0 Aavas GRUH HomeFirst Aadhar CanFin Repco

Aavas HomeFirst Aadhar HFC CanFin Repco HFC

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 81. NIMs Exhibit 82. Cost to assets

NIMs Cost-to-assets

10.0% 4.0% 3.42%

3.40%

7.86% 3.5%

8.0%

3.0%

5.54% 2.33%

6.0% 2.5%

4.74% 4.31% 2.0%

4.0% 3.41%

1.5% 0.93%

1.0% 0.54%

2.0%

0.5%

0.0% 0.0%

Aavas HomeFirst Aadhar HFC CanFin Repco Aavas HomeFirst Aadhar HFC CanFin Repco

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 83. Provisions to assets Exhibit 84. GNPA

Provision-to-assets GNPA

1.2% 5.0% 4.35%

1.00%

1.0% 4.0%

0.8%

0.55% 3.0%

0.6% 0.52%

0.30% 2.0% 1.47%

0.4% 0.23% 0.78% 0.76%

0.2% 1.0% 0.46%

0.0% 0.0%

Aavas HomeFirst Aadhar HFC CanFin Repco Aavas HomeFirst Aadhar HFC CanFin Repco

Source: Company, JM Financial Source: Company, JM Financial

Exhibit 85. ROA Exhibit 86. ROE

ROA ROE

4.0% 3.75% 25.0%

3.5% 19.1%

2.67% 20.0% 16.9%

3.0% 2.44%

2.5% 15.0% 12.7%

1.73% 1.89% 10.9% 11.8%

2.0%

1.5% 10.0%

1.0%

5.0%

0.5%

0.0% 0.0%

Aavas HomeFirst Aadhar HFC CanFin Repco Aavas HomeFirst Aadhar HFC CanFin Repco

Source: Company, JM Financial Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 27

Aavas Financiers 5 April 2021

Financial Tables

Income Statement (INR mn) Balance Sheet (INR mn)

Y/E March FY19A FY20A FY21E FY22E FY23E Y/E March FY19A FY20A FY21E FY22E FY23E

Net Interest Income (NII) 4,129 5,033 6,106 7,303 8,953 Equity Capital 781 783 783 783 783

Non Interest Income 391 401 550 588 682 Reserves & Surplus 17,589 20,196 22,954 26,449 30,808

Total Income 4,521 5,434 6,657 7,891 9,635 Stock option outstanding 0 0 0 0 0

Operating Expenses 1,853 2,260 2,804 3,342 3,926 Borrowed Funds 36,533 53,520 62,619 73,264 91,140

Pre-provisioning Profits 2,667 3,174 3,852 4,549 5,710 Deferred tax liabilities 0 0 0 0 0

Loan-Loss Provisions 56 115 161 125 191 Preference Shares 0 0 0 0 0

Others Provisions 33 13 0 0 0 Current Liabilities & Provisions 1,366 2,081 2,412 2,807 3,428

Total Provisions 89 153 361 125 191 Total Liabilities 56,269 76,580 88,768 103,303 126,160

PBT 2,578 3,020 3,491 4,424 5,518 Net Advances 47,245 61,808 74,374 92,099 114,340

Tax 818 529 733 929 1,159 Investments 147 45 74 92 114

PAT (Pre-Extra ordinaries) 1,760 2,491 2,758 3,495 4,359 Cash & Bank Balances 6,838 11,921 11,156 7,368 8,004

Extra ordinaries (Net of Tax) 0 0 0 0 0 Loans and Advances 0 0 0 0 0

Reported Profits 1,760 2,491 2,758 3,495 4,359 Other Current Assets 1,810 2,201 2,461 2,926 2,703

Dividend 0 0 0 0 0 Fixed Assets 229 606 702 817 998

Retained Profits 1,760 2,491 2,758 3,495 4,359 Miscellaneous Expenditure 0 0 0 0 0

Source: Company, JM Financial Deferred Tax Assets 0 0 0 0 0

Total Assets 56,269 76,580 88,768 103,303 126,160

Source: Company, JM Financial

Key Ratios Dupont Analysis

Y/E March FY19A FY20A FY21E FY22E FY23E Y/E March FY19A FY20A FY21E FY22E FY23E

Growth (YoY) (%) NII / Assets 8.54% 7.58% 7.39% 7.60% 7.80%

Borrowed funds 33.4% 46.5% 17.0% 17.0% 24.4% Other Income / Assets 0.81% 0.60% 0.67% 0.61% 0.59%

Advances 37.3% 30.8% 20.3% 23.8% 24.1% Total Income / Assets 9.35% 8.18% 8.05% 8.22% 8.40%

Total Assets 39.3% 36.1% 15.9% 16.4% 22.1% Cost / Assets 3.83% 3.40% 3.39% 3.48% 3.42%

NII 60.9% 21.9% 21.3% 19.6% 22.6% PPP / Assets 5.52% 4.78% 4.66% 4.74% 4.98%

Non-interest Income -6.1% 2.4% 37.3% 6.8% 16.1% Provisions / Assets 0.18% 0.23% 0.44% 0.13% 0.17%

Operating Expenses 14.8% 22.0% 24.1% 19.2% 17.4% PBT / Assets 5.33% 4.55% 4.22% 4.61% 4.81%

Operating Profits 94.9% 19.0% 21.4% 18.1% 25.5% Tax rate 31.7% 17.5% 21.0% 21.0% 21.0%

Core Operating profit 119.2% 22.1% 20.3% 18.5% 26.2% ROA 3.64% 3.75% 3.34% 3.64% 3.80%

Provisions 243.7% 72.4% 135.5% -65.5% 53.5% Leverage 3.1 3.7 3.7 3.8 4.0

Reported PAT 89.2% 41.5% 10.7% 26.7% 24.7% ROE 11.6% 12.7% 12.3% 13.7% 14.8%

Yields / Margins (%) Source: Company, JM Financial

Interest Spread 6.14% 5.50% 5.54% 5.85% 6.11%

NIM 7.09% 6.67% 6.25% 6.47% 6.62%

Profitability (%) Valuations

ROA 3.64% 3.75% 3.34% 3.64% 3.80% Y/E March FY19A FY20A FY21E FY22E FY23E

ROE 11.6% 12.7% 12.3% 13.7% 14.8% Shares in Issue 78.1 78.3 78.3 78.3 78.3

Cost to Income 41.0% 41.6% 42.1% 42.4% 40.7% EPS (INR) 22.5 31.8 35.2 44.6 55.7

Asset quality (%) EPS (YoY) (%) 67.6% 41.1% 10.7% 26.7% 24.7%

Gross NPA 0.47% 0.46% 1.02% 1.01% 1.04% P/E (x) 107.4 76.1 68.8 54.3 43.5

LLP 0.06% 0.08% 0.24% 0.15% 0.19% BV (INR) 235 268 303 348 403

Capital Adequacy (%) BV (YoY) (%) 36.7% 13.9% 13.1% 14.7% 16.0%

Tier I 64.25% 53.67% 52.39% 51.65% 49.07% P/BV (x) 10.29 9.04 7.99 6.96 6.00

CAR 67.77% 55.85% 54.27% 53.27% 50.40% DPS (INR) 0.0 0.0 0.0 0.0 0.0

Source: Company, JM Financial Div. yield (%) 0.0% 0.0% 0.0% 0.0% 0.0%

Source: Company, JM Financial

JM Financial Institutional Securities Limited Page 28

Aavas Financiers 5 April 2021

APPENDIX I

JM Financial Inst itut ional Secur ities Lim ited

Corporate Identity Number: U67100MH2017PLC296081

Member of BSE Ltd., National Stock Exchange of India Ltd. and Metropolitan Stock Exchange of India Ltd.

SEBI Registration Nos.: Stock Broker - INZ000163434, Research Analyst – INH000000610

Registered Office: 7th Floor, Cnergy, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025, India.

Board: +9122 6630 3030 | Fax: +91 22 6630 3488 | Email: jmfinancial.research@jmfl.com | www.jmfl.com

Compliance Officer: Mr. Sunny Shah | Tel: +91 22 6630 3383 | Email: sunny.shah@jmfl.com

Definition of ratings

Rating Meaning

Buy Total expected returns of more than 10% for large-cap stocks* and REITs and more than 15% for all other stocks, over the next twelve

months. Total expected return includes dividend yields.

Hold Price expected to move in the range of 10% downside to 10% upside from the current market price for large-cap* stocks and REITs and

in the range of 10% downside to 15% upside from the current market price for all other stocks, over the next twelve months.

Sell Price expected to move downwards by more than 10% from the current market price over the next twelve months.

* Large-cap stocks refer to securities with market capitalisation in excess of INR200bn. REIT refers to Real Estate Investment Trusts.

Research Analyst(s) Certification

The Research Analyst(s), with respect to each issuer and its securities covered by them in this research report, certify that:

All of the views expressed in this research report accurately reflect his or her or their personal views about all of the issuers and their securities; and

No part of his or her or their compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed in this research

report.

Important Disclosures

This research report has been prepared by JM Financial Institutional Securities Limited (JM Financial Institutional Securities) to provide information about the

company(ies) and sector(s), if any, covered in the report and may be distributed by it and/or its associates solely for the purpose of information of the select

recipient of this report. This report and/or any part thereof, may not be duplicated in any form and/or reproduced or redistributed without the prior written

consent of JM Financial Institutional Securities. This report has been prepared independent of the companies covered herein.

JM Financial Institutional Securities is registered with the Securities and Exchange Board of India (SEBI) as a Research Analyst and a Stock Broker having trading

memberships of the BSE Ltd. (BSE), National Stock Exchange of India Ltd. (NSE) and Metropolitan Stock Exchange of India Ltd. (MSEI). No material disciplinary

action has been taken by SEBI against JM Financial Institutional Securities in the past two financial years which may impact the investment decision making of the

investor.

JM Financial Institutional Securities renders stock broking services primarily to institutional investors and provides the research services to its institutional

clients/investors. JM Financial Institutional Securities and its associates are part of a multi-service, integrated investment banking, investment management,

brokerage and financing group. JM Financial Institutional Securities and/or its associates might have provided or may provide services in respect of managing

offerings of securities, corporate finance, investment banking, mergers & acquisitions, broking, financing or any other advisory services to the company(ies)

covered herein. JM Financial Institutional Securities and/or its associates might have received during the past twelve months or may receive compensation from

the company(ies) mentioned in this report for rendering any of the above services.

JM Financial Institutional Securities and/or its associates, their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell