Professional Documents

Culture Documents

D. Be Included As A Component of Income From. Continuing Operations For

D. Be Included As A Component of Income From. Continuing Operations For

Uploaded by

Spade XOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D. Be Included As A Component of Income From. Continuing Operations For

D. Be Included As A Component of Income From. Continuing Operations For

Uploaded by

Spade XCopyright:

Available Formats

45.

An entity denominated a December 15, 20x4, purchase of goods' in a currency other than its

functional currency. The transaction resulted in a payable fixed in terms of the amount of

foreign currency; and was paid on the settlement date, January 20, 20x5: The exchange rates

between the functional currency and the currency in which the transaction was denominated

changed at December 31, 20x4, resulting in a loss that should:

a. Not be reported until January 20, 20x5, the settlement date.

b. Be included as a separate component of stockholders' equity at December 31, 20x4.

c. Be included as a deferred charge at December 31, 20x4.

d. Be included as a component of income from. continuing operations for

Choose the correct answer for each of the following questions.

46. On October 1, 20x4 XY Company, a Philippine company, contracted to purchase foreign

goods requiring payment in pesos one month after their receipt in XY's factory. Title to the

goods passed on December 15, 20x4. The goods were still in transit on December 31, 20x4.

Exchange rates were 1 peso to 22 foreign currency units (FCUs), 20 FCUs, and 21 FCUs on

October 1, December l. 15, and December 31, 20x4, respectively. XY should account for the

exchange rate fluctuations in 20x4 as

a. A loss included in net income before extraordinary items.

b. A gain included in net income before extraordinary items.

c. An extraordinary gain.

d. An extraordinary loss.

47. On October 2, 20x4, LL Co., a Philippine company, purchased machinery from ST, a

foreign company, with payment due on April 1, 20x5. If LL's 20x4 operating income

included no foreign exchange gain or loss, then the transaction could have

a. Resulted in an extraordinary gain.

b. Been denominated in U.S. dollars.

c. Caused a foreign currency gain to be reported as a contra account against

machinery.

d. Caused a foreign currency translation gain to be reported as a separate

component of stockholders' equity.

48. Philippine based Corporation X has a number of importing transactions with companies

based in UK. Importing activities result in payables. If the settlement currency is the British

Pound, which of the following will happen by changes in the direct or indirect exchange

rates?

Direct Exchange Rate Indirect Exchange Rate

Increases Decreases Increases

Decreases

a. NA NA NA NA

b. Loss Gain Gain Loss

c. Loss Gain NA NA

d. Gain Loss Loss Gain

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Macroeconomics 8th Edition Abel Test Bank 1Document35 pagesMacroeconomics 8th Edition Abel Test Bank 1rose98% (54)

- Five Paragraph OrderDocument8 pagesFive Paragraph OrderBMikeNo ratings yet

- True or False: Documentary Stamp TaxDocument6 pagesTrue or False: Documentary Stamp Taxjanelle asiong50% (2)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDocument6 pagesAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Investment Test BankDocument9 pagesInvestment Test BankSherri BonquinNo ratings yet

- Engineering StaticsDocument355 pagesEngineering StaticsA. D. A.No ratings yet

- Final Exam FarDocument7 pagesFinal Exam FarReyna Joy SebialNo ratings yet

- AFAR - ForexDocument4 pagesAFAR - ForexJoanna Rose DeciarNo ratings yet

- Ch11 The Balance of PaymentsDocument11 pagesCh11 The Balance of PaymentsSagar100% (1)

- Telephone Directory 2020Document126 pagesTelephone Directory 2020Divyesh Makwana100% (1)

- Java JDBC TutorialDocument23 pagesJava JDBC TutorialRiyaNo ratings yet

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Document71 pagesCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNo ratings yet

- Toaz - Info Quiz On Foreign Transactions PRDocument4 pagesToaz - Info Quiz On Foreign Transactions PRoizys131No ratings yet

- Intermediate Accounting 1: Following? A. PAS 1 B. PAS 2 C. Pas 7 D. PAS 8Document20 pagesIntermediate Accounting 1: Following? A. PAS 1 B. PAS 2 C. Pas 7 D. PAS 8Ginoong OsoNo ratings yet

- Reviewer On Inter Accounting CH 1 6 1Document19 pagesReviewer On Inter Accounting CH 1 6 1Roseyy Galit43% (7)

- Derivatives QuizDocument5 pagesDerivatives QuizAllyssa Kassandra Luces0% (1)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosNo ratings yet

- Dailylesson Plan in P.E & Health 12: Preventing It Combat Barriers On Physical Activity, and On One's DietDocument10 pagesDailylesson Plan in P.E & Health 12: Preventing It Combat Barriers On Physical Activity, and On One's DietChelsea Quinn Mesa100% (1)

- Direct Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalDocument14 pagesDirect Quotation Indirect Quotation: Foreign Exchange Rate Theory & ComputationalGwen Sula Lacanilao67% (3)

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationRena Rose Malunes11% (9)

- Foreign CurrencyDocument6 pagesForeign CurrencyLJ AggabaoNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- My Salvation Bewitched and Bewildered 14 - Alanea AlderDocument198 pagesMy Salvation Bewitched and Bewildered 14 - Alanea Aldercoutinholivdalb50% (2)

- Answer Key Inter Acctg 2Document66 pagesAnswer Key Inter Acctg 2URBANO CREATIONS PRINTING & GRAPHICS100% (2)

- Batohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossDocument7 pagesBatohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossivankingbachoNo ratings yet

- Finals-Business CombiDocument5 pagesFinals-Business Combijhell de la cruzNo ratings yet

- BagnpesDocument3 pagesBagnpesShiela Marie Sta AnaNo ratings yet

- Forex - Part 1Document4 pagesForex - Part 1foracademicfiles.01No ratings yet

- AFAR-12 (Foreign Currrency)Document22 pagesAFAR-12 (Foreign Currrency)MABI ESPENIDONo ratings yet

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- Final Exam PrintingDocument11 pagesFinal Exam PrintingRhea Mae CoronelNo ratings yet

- International Financial Management Chapter 3Document14 pagesInternational Financial Management Chapter 31954032027cucNo ratings yet

- 207B 3rd Preboard ActivityDocument12 pages207B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Investment Intangible Wasting Assets 1 PDFDocument8 pagesInvestment Intangible Wasting Assets 1 PDFMeldwin C. Gutierrez50% (2)

- Macroeconomics Canadian 7th Edition Abel Test Bank 1Document36 pagesMacroeconomics Canadian 7th Edition Abel Test Bank 1marychaveznpfesgkmwx100% (20)

- If Internatioanl FinanceDocument6 pagesIf Internatioanl FinanceDahagam SaumithNo ratings yet

- ExamintaccDocument19 pagesExamintaccCris TineNo ratings yet

- Chapter 11 Test Bank PDFDocument29 pagesChapter 11 Test Bank PDFYing LiuNo ratings yet

- Macroeconomics 8Th Edition Abel Test Bank Full Chapter PDFDocument36 pagesMacroeconomics 8Th Edition Abel Test Bank Full Chapter PDFjames.coop639100% (11)

- A. The Supply of Dollars Is Likely To Exceed The ParibusDocument12 pagesA. The Supply of Dollars Is Likely To Exceed The ParibusTran Pham Quoc ThuyNo ratings yet

- p1 Quiz With Theory 1Document15 pagesp1 Quiz With Theory 1lana del reyNo ratings yet

- Level 2 AfarDocument7 pagesLevel 2 AfarDarelle Hannah MarquezNo ratings yet

- SDDocument19 pagesSDNitinNo ratings yet

- Prelim Answer Key: Redemption of Certificates Lapse of CertificatesDocument8 pagesPrelim Answer Key: Redemption of Certificates Lapse of CertificatesNikky Bless LeonarNo ratings yet

- Macroeconomics Canadian 7Th Edition Abel Test Bank Full Chapter PDFDocument36 pagesMacroeconomics Canadian 7Th Edition Abel Test Bank Full Chapter PDFkevin.reider416100% (11)

- Xii Ni Ui4 QBDocument35 pagesXii Ni Ui4 QBMishti GhoshNo ratings yet

- Macroeconomics 8th Edition Abel Test Bank 1Document12 pagesMacroeconomics 8th Edition Abel Test Bank 1todddoughertygswzfbjaon100% (30)

- University of Luzon College of AccountancyDocument3 pagesUniversity of Luzon College of AccountancyJonalyn May De VeraNo ratings yet

- Current Liabilities: Redemption of Certificates Lapse of CertificatesDocument3 pagesCurrent Liabilities: Redemption of Certificates Lapse of CertificatesGrezel NiceNo ratings yet

- Quiz #4Document4 pagesQuiz #4Erine ContranoNo ratings yet

- ADFINA 2 - Preweek 1Document13 pagesADFINA 2 - Preweek 1Kenneth Bryan Tegerero TegioNo ratings yet

- International Macro - Final Study GuideDocument48 pagesInternational Macro - Final Study GuideMohamad BizriNo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- Own Mock QualiDocument10 pagesOwn Mock QualiDarwin John SantosNo ratings yet

- Fixed Assets ReviewerDocument20 pagesFixed Assets ReviewernarvasakayzienashleyNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- Eppe3023 Tuto 6QDocument3 pagesEppe3023 Tuto 6QMUHAMMAD AIMAN ZAKWAN BIN ROZANINo ratings yet

- Document - 2347 - 107download International Economics 16Th Edition Carbaugh Solutions Manual Full Chapter PDFDocument46 pagesDocument - 2347 - 107download International Economics 16Th Edition Carbaugh Solutions Manual Full Chapter PDFcemeteryliana.9afku100% (9)

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- Advanced Accounting 11th Edition Fischer Test BankDocument38 pagesAdvanced Accounting 11th Edition Fischer Test Bankestelleflowerssgsop100% (17)

- Final Revision - Lec 5 - InternationalDocument5 pagesFinal Revision - Lec 5 - InternationalMariam AbdelalimNo ratings yet

- Depreciates Against The U.S. DollarDocument8 pagesDepreciates Against The U.S. DollarTran Pham Quoc ThuyNo ratings yet

- 1 Acc-ExamDocument10 pages1 Acc-Examsachin2727No ratings yet

- Ab 33Document1 pageAb 33Spade XNo ratings yet

- Ab 9Document1 pageAb 9Spade XNo ratings yet

- B 52Document1 pageB 52Spade XNo ratings yet

- B 54Document1 pageB 54Spade XNo ratings yet

- Ab 8Document1 pageAb 8Spade XNo ratings yet

- Ab 14Document1 pageAb 14Spade XNo ratings yet

- Ab 6Document1 pageAb 6Spade XNo ratings yet

- Ab 30Document1 pageAb 30Spade XNo ratings yet

- Ab 7Document1 pageAb 7Spade XNo ratings yet

- Ab 19Document1 pageAb 19Spade XNo ratings yet

- Ab 11Document1 pageAb 11Spade XNo ratings yet

- Ab 18Document1 pageAb 18Spade XNo ratings yet

- Ab 17Document1 pageAb 17Spade XNo ratings yet

- Ab 16Document1 pageAb 16Spade XNo ratings yet

- Ab 27Document1 pageAb 27Spade XNo ratings yet

- Ab 28Document1 pageAb 28Spade XNo ratings yet

- Ab 10Document1 pageAb 10Spade XNo ratings yet

- Ab 29Document1 pageAb 29Spade XNo ratings yet

- Ab 21Document1 pageAb 21Spade XNo ratings yet

- Ab 26Document1 pageAb 26Spade XNo ratings yet

- Ab 25Document1 pageAb 25Spade XNo ratings yet

- Ab 22Document1 pageAb 22Spade XNo ratings yet

- Ab 24Document1 pageAb 24Spade XNo ratings yet

- Ab 20Document1 pageAb 20Spade XNo ratings yet

- Ab 1Document1 pageAb 1Spade XNo ratings yet

- Ab 23Document1 pageAb 23Spade XNo ratings yet

- Balance Sheet Date Is Based On The Difference Between The Spot Rate and The Forward at That DateDocument1 pageBalance Sheet Date Is Based On The Difference Between The Spot Rate and The Forward at That DateSpade XNo ratings yet

- Ab 2Document1 pageAb 2Spade XNo ratings yet

- Effective DateDocument1 pageEffective DateSpade XNo ratings yet

- Will Be Exchanged Until The Date The Forward Contract Matures Forward Contract Is EstablishedDocument1 pageWill Be Exchanged Until The Date The Forward Contract Matures Forward Contract Is EstablishedSpade XNo ratings yet

- Python - Pandas - Beginner To IntermediateDocument115 pagesPython - Pandas - Beginner To IntermediateName SurnameNo ratings yet

- DacMagic Plus Technical SpecificationsDocument2 pagesDacMagic Plus Technical SpecificationsDaniel TapiaNo ratings yet

- Fascia Repair DetailsDocument2 pagesFascia Repair DetailsPatricia TicseNo ratings yet

- Introduction To Mental RetardaDocument6 pagesIntroduction To Mental RetardadrumeshozaNo ratings yet

- Road Traffic SafetyDocument11 pagesRoad Traffic SafetySakthivel ShanmugamNo ratings yet

- 01 Gen Prov With GPP OverviewOct2019Document110 pages01 Gen Prov With GPP OverviewOct2019Jay TeeNo ratings yet

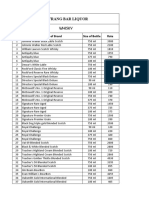

- Hotel Navrang Liquor NON-1Document6 pagesHotel Navrang Liquor NON-1gourav.damadeNo ratings yet

- Overview of Modeling Studies in HDS, HDN, HDO CatalysisDocument16 pagesOverview of Modeling Studies in HDS, HDN, HDO Catalysisnguyennha1211No ratings yet

- Circulatory SystemDocument3 pagesCirculatory Systemapi-521781723No ratings yet

- Red London Photos Travel BrochureDocument2 pagesRed London Photos Travel BrochureEllyza SerranoNo ratings yet

- Prof Ed 1Document26 pagesProf Ed 1Jenelyn GafateNo ratings yet

- Blue Ocean BrainDocument2 pagesBlue Ocean BrainJeffrey LodenNo ratings yet

- GU Syllabus B.TECH. (ECE) LatestDocument6 pagesGU Syllabus B.TECH. (ECE) LatestME VideoNo ratings yet

- English Workshop TIME & DATEDocument28 pagesEnglish Workshop TIME & DATEyezt0826No ratings yet

- Securing Cloud Framework From Application Ddos Attacks: N. P. Ponnuviji, M. Vigilson PremDocument4 pagesSecuring Cloud Framework From Application Ddos Attacks: N. P. Ponnuviji, M. Vigilson PremRAOUIA EL NAGGERNo ratings yet

- ACL WorkbookDocument69 pagesACL WorkbookOyM Campo R4No ratings yet

- Anytime A-Star AlgorithmDocument4 pagesAnytime A-Star AlgorithmDisha SharmaNo ratings yet

- LGUserCSTool LogDocument207 pagesLGUserCSTool LogJosué Betancourt HernándezNo ratings yet

- Transport Layer - Computer Networks Questions & Answers - SanfoundryDocument4 pagesTransport Layer - Computer Networks Questions & Answers - SanfoundryMd Rakibul Islam100% (1)

- English Quiz: 1. Complete The Information in Brackets About Simple PastDocument9 pagesEnglish Quiz: 1. Complete The Information in Brackets About Simple Pastchristian cubillosNo ratings yet

- BFX89 BFY90: - ConductorDocument2 pagesBFX89 BFY90: - ConductorAcesNo ratings yet

- SVAR Assessment Prep GuideDocument4 pagesSVAR Assessment Prep GuidePious Beltran100% (1)

- Tara Cara Presentasi Dalam Bahasa InggrisDocument3 pagesTara Cara Presentasi Dalam Bahasa InggrisSayed RidwanNo ratings yet

- Negotiating A Managed Care ContractDocument1 pageNegotiating A Managed Care ContractPremium GeeksNo ratings yet