Professional Documents

Culture Documents

Hbjhjhjhujuhj

Uploaded by

njkjh0 ratings0% found this document useful (0 votes)

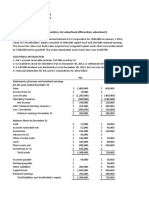

19 views3 pages1) Pop's shares were purchased for $960,000. The fair value of Son's identifiable net assets was $2,000,000. 40% of the net assets' fair value was $800,000. The excess of $160,000 was allocated proportionately to inventories, land, and equipment.

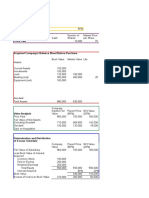

2) Pop's shares were purchased for $640,000. The fair value of Son's net assets was still $2,000,000 but the market price of Pop's shares declined. 40% of the net assets' book value was $800,000 but fair value was only $640,000, resulting in a $160,000 bargain purchase gain.

Original Description:

hbjhjhjhujuhj

Original Title

hbjhjhjhujuhj

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Pop's shares were purchased for $960,000. The fair value of Son's identifiable net assets was $2,000,000. 40% of the net assets' fair value was $800,000. The excess of $160,000 was allocated proportionately to inventories, land, and equipment.

2) Pop's shares were purchased for $640,000. The fair value of Son's net assets was still $2,000,000 but the market price of Pop's shares declined. 40% of the net assets' book value was $800,000 but fair value was only $640,000, resulting in a $160,000 bargain purchase gain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesHbjhjhjhujuhj

Uploaded by

njkjh1) Pop's shares were purchased for $960,000. The fair value of Son's identifiable net assets was $2,000,000. 40% of the net assets' fair value was $800,000. The excess of $160,000 was allocated proportionately to inventories, land, and equipment.

2) Pop's shares were purchased for $640,000. The fair value of Son's net assets was still $2,000,000 but the market price of Pop's shares declined. 40% of the net assets' book value was $800,000 but fair value was only $640,000, resulting in a $160,000 bargain purchase gain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Question:

Answer:

Best Answer

Solution:

1)

Market price for Pop’s shares @24

Cost of investment in Son [40,000 shares * $960,000

$24]

The $80,000 direct costs must be expensed.

BV acquired ($2,000,000 net assets * 40%) $800,000

Excess FV over BV $160,000

Allocation of excess

FV- BV % acquired Allocation

Inventories $200,000 40% $80,000

Land $400,000 40% $160,000

Buildings (Net) - $400,000 40% - $160,000

Equipment (Net) $200,000 40% $80,000

Assigned to identifiable net assets $160,000

Remainder assigned to goodwill $0

Total allocation $160,000

2)

Market price for Pop’s shares @$16

Cost of investment in Son $640,000

(40,000 shares * $16) Other direct costs = $0

BV acquired ($2,000,000 net assets * 40%) $800,000

Excess BV over FV - $160,000

Excess allocated to

FV- BV % acquired Allocation

Inventories $200,000 40% $80,000

Land $400,000 40% $160,000

Buildings (Net) - $400,000 40% - $160,000

Equipment (Net) $200,000 40% $80,000

Bargain purchase gain - $320,000

$160,000

You might also like

- Tugas AklDocument8 pagesTugas AklFebryanthi SNNo ratings yet

- Tugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Document8 pagesTugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Yohanes BagasNo ratings yet

- Tugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049Document4 pagesTugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049AthayaSekarNovianaNo ratings yet

- Bab II Buku Bu IinDocument17 pagesBab II Buku Bu IinAditya Agung SatrioNo ratings yet

- Pembahasan Tugas AKLDocument8 pagesPembahasan Tugas AKLyashmutjabbar25No ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Assignment For Session 3 P 3-2 1. ScheduleDocument2 pagesAssignment For Session 3 P 3-2 1. Schedulemaruti uchihaNo ratings yet

- UntitledDocument2 pagesUntitledTalik StewartNo ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- PREA4Document7 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Total Assets $ 1,520,000 $ 640,000 $ 880,000Document12 pagesTotal Assets $ 1,520,000 $ 640,000 $ 880,000Furi Fatwa DiniNo ratings yet

- Payout Policy MathDocument2 pagesPayout Policy MathAAM26No ratings yet

- Rulona, Kerby Gail P. Bsa-3A Problem 6 1. BDocument12 pagesRulona, Kerby Gail P. Bsa-3A Problem 6 1. BCassandra KarolinaNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- AFA Tut 2Document16 pagesAFA Tut 2Đỗ Kim ChiNo ratings yet

- Uswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Document4 pagesUswatur Rizkiyah - 180422623171 - JJ - Tugas AKL II - P1-3Kiki amaliaNo ratings yet

- Chapter 3 ExamplesDocument2 pagesChapter 3 ExamplesSara CooperNo ratings yet

- What Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Document81 pagesWhat Is The Consolidated Net Income Before Allocation To The Controlling and Noncontrolling Interests?Lê Thiên Giang 2KT-19No ratings yet

- Module 3 - Handout 1 80% Acquisition: Price FMV: ExampleDocument3 pagesModule 3 - Handout 1 80% Acquisition: Price FMV: ExampleChinee CastilloNo ratings yet

- Module 3 Handout 1 Business ComDocument3 pagesModule 3 Handout 1 Business ComChinee CastilloNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- Cost Flow ModelDocument3 pagesCost Flow ModelMae AstovezaNo ratings yet

- Account Debit CreditDocument4 pagesAccount Debit CreditMcKenzie WNo ratings yet

- Soal Jawaban AKL CHP 1Document5 pagesSoal Jawaban AKL CHP 1Allpacino DesellaNo ratings yet

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- AssignmentDocument5 pagesAssignmentJJ JaumNo ratings yet

- Assignment 3 11 6 DreyDocument4 pagesAssignment 3 11 6 DreyAbigail BombalesNo ratings yet

- Latihan Soal Akl CH 1 Dan 2Document12 pagesLatihan Soal Akl CH 1 Dan 2DheaNo ratings yet

- Advanced ACCT PROJECT II FINAL DRAFTDocument3 pagesAdvanced ACCT PROJECT II FINAL DRAFTnoureen sohailNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- Business Combination MergerDocument108 pagesBusiness Combination Mergergojo satoruNo ratings yet

- AFAR C1 MC AnswersDocument39 pagesAFAR C1 MC Answersheyhey84% (19)

- Dari GoogleDocument6 pagesDari Googleabc defNo ratings yet

- E9-8 Dan E9-13 - AKL 1 - Elisabet Siregar - 023001801106Document2 pagesE9-8 Dan E9-13 - AKL 1 - Elisabet Siregar - 023001801106novita sariNo ratings yet

- Citra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Document16 pagesCitra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Citra DewiNo ratings yet

- Cordova, Alexander JR - Individual TaskDocument6 pagesCordova, Alexander JR - Individual TaskAlexander CordovaNo ratings yet

- Module 3-2 Business ComDocument2 pagesModule 3-2 Business ComChinee CastilloNo ratings yet

- AOC 1 Solution - PdfToWordDocument2 pagesAOC 1 Solution - PdfToWordDapeng BuNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Business Combination: Balance Sheet Item Book Value Book Value Fair Value Anchor Corporation Zink CompanyDocument1 pageBusiness Combination: Balance Sheet Item Book Value Book Value Fair Value Anchor Corporation Zink Companyanggie pheonicaNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Adv Assignment 1Document2 pagesAdv Assignment 1BromanineNo ratings yet

- Problems: Fixed Costs BE PR Ice-Variable Cost Per UnitDocument7 pagesProblems: Fixed Costs BE PR Ice-Variable Cost Per UnitPercy JacksonNo ratings yet

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- Unit 4 - Topic 4Document1 pageUnit 4 - Topic 4yzaNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- Assignment 2Document43 pagesAssignment 2Judy ZhangNo ratings yet

- Horngren's Cost Accounting. A Managerial Emphasis 17ed ch2 Problem For Self-StudyDocument3 pagesHorngren's Cost Accounting. A Managerial Emphasis 17ed ch2 Problem For Self-StudyIrakli AmbroladzeNo ratings yet

- Soal 1: Jurnal Penerbitan Satu Lembar Saham BiasaDocument11 pagesSoal 1: Jurnal Penerbitan Satu Lembar Saham Biasakevin phillipsNo ratings yet

- Accounting PresentationDocument12 pagesAccounting Presentationgelly studiesNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Ma 123Document21 pagesMa 123Dean CraigNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument10 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument3 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument51 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument14 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- STUDY CASE Nappy IndustryDocument4 pagesSTUDY CASE Nappy IndustrynjkjhNo ratings yet

- To BiomedikDocument4 pagesTo BiomediknjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Westport ElectricDocument2 pagesWestport ElectricnjkjhNo ratings yet

- The City of Pittsburgh Case StudyDocument5 pagesThe City of Pittsburgh Case StudynjkjhNo ratings yet

- Tutor p2Document6 pagesTutor p2njkjhNo ratings yet

- Tugas Personal 1 MathDocument4 pagesTugas Personal 1 MathnjkjhNo ratings yet

- Tugas EnglishDocument2 pagesTugas EnglishnjkjhNo ratings yet