Professional Documents

Culture Documents

Hbjhjhjhujuhj

Uploaded by

njkjh0 ratings0% found this document useful (0 votes)

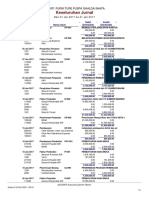

12 views3 pagesThis document contains accounting journal entries for investments in Sheon Co. using the cost and equity methods for the years 2016 and 2017. In 2016, $200,000 was invested in Sheon using the cost method, with $2,500 in dividend income recorded in March and September. In 2017, $1,000,000 was invested using the equity method, with dividend income and a share of $120,000 net income recorded.

Original Description:

hbjhjhjhujuhj

Original Title

hbjhjhjhujuhj

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains accounting journal entries for investments in Sheon Co. using the cost and equity methods for the years 2016 and 2017. In 2016, $200,000 was invested in Sheon using the cost method, with $2,500 in dividend income recorded in March and September. In 2017, $1,000,000 was invested using the equity method, with dividend income and a share of $120,000 net income recorded.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesHbjhjhjhujuhj

Uploaded by

njkjhThis document contains accounting journal entries for investments in Sheon Co. using the cost and equity methods for the years 2016 and 2017. In 2016, $200,000 was invested in Sheon using the cost method, with $2,500 in dividend income recorded in March and September. In 2017, $1,000,000 was invested using the equity method, with dividend income and a share of $120,000 net income recorded.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Question:

Answer:

Best Answer

Solution:

Jan- 1- 2016 cash paid

200,000

Percentage of interest 10%

Jan- 1- 2017 cash paid 1,000,000

Percentage of interest 7%

Dec- 31- 2015 Common stock 1,500,000

Retained earnings

500,000

March- 1- 2016 Dividends

25,000

Sep- 1- 2016 Dividends

25,000

March- 1- 2017 Dividends

25,000

Sep- 1- 2017 Dividends

25,000

YEAR - 2016 Net income

100,000

YEAR - 2017 Net income

150,000

COST METHOD

2016

01- Jan Investment in Sheon

200,000

Cash

200,000

01- Mar Cash

2,500

Dividends Income

2,500

01- Sep cash

2,500

Dividends Income

2,500

31- Dec NO ENTRY

(cost method doesn't recognize net

income)

EQUITY METHOD

2017

01- Jan Investment in Sheon 1,000,000

Cash 1,000,000

Dividends Income

5,000

investment in Sheon

5,000

01- Mar Cash

20,000

investment in Sheon

20,000

01- Sep Cash

20,000

investment in Sheon

20,000

31- Dec Investment in Sheon

120,000

income from Sheon

120,000

You might also like

- HbjhjhjhujuhjDocument14 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Tugas Novita Putri Tesalonika (A031191105)Document1 pageTugas Novita Putri Tesalonika (A031191105)Novita Putri TesalonikaNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- CH 2 - Investasi SahamDocument42 pagesCH 2 - Investasi SahamJulia Pratiwi ParhusipNo ratings yet

- Problem 3 Chapter1 (Accounting in Action)Document4 pagesProblem 3 Chapter1 (Accounting in Action)Amelia LarasatiNo ratings yet

- Investment in Equity Securities (Prob 28-31)Document4 pagesInvestment in Equity Securities (Prob 28-31)Lorence Patrick LapidezNo ratings yet

- Soal Bab 12 InvestmentsDocument5 pagesSoal Bab 12 InvestmentsGogo LinaNo ratings yet

- Interest Bearing Note Problems Day 2 NotesDocument5 pagesInterest Bearing Note Problems Day 2 NotesPATRICIA ALVAREZNo ratings yet

- Advance Payment of Revenues: Liability MethodDocument9 pagesAdvance Payment of Revenues: Liability MethodDan Ryan100% (1)

- Liabilities Part 2Document43 pagesLiabilities Part 2Luisa Janelle BoquirenNo ratings yet

- IIMK - FA - SectionB - Assignment 4Document4 pagesIIMK - FA - SectionB - Assignment 4Jay PatelNo ratings yet

- ASGMT4 - Vanessa PieterszDocument4 pagesASGMT4 - Vanessa PieterszPietersz, Vanessa Patricia HenyNo ratings yet

- Jurnal Umum PT. Jasa Konsultan Keuangan Tanggal Keterangan Ref Saldo DebitDocument4 pagesJurnal Umum PT. Jasa Konsultan Keuangan Tanggal Keterangan Ref Saldo DebitAdella PradhitaNo ratings yet

- E 16.3 Date Account Ref DR CRDocument13 pagesE 16.3 Date Account Ref DR CRNicolas ErnestoNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Book Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17Document9 pagesBook Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17jose.labianoNo ratings yet

- Valdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesDocument5 pagesValdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesAfrielin ValdeviesoNo ratings yet

- Midsemester Exam-C Problem 1: Show Your CalculationsDocument5 pagesMidsemester Exam-C Problem 1: Show Your CalculationsMario KaunangNo ratings yet

- Chapter 12. InvestasiDocument7 pagesChapter 12. InvestasiJaneNo ratings yet

- Jawaban 3.1 SD 3.7Document16 pagesJawaban 3.1 SD 3.7KaitoNo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- AX Computer ShopDocument1 pageAX Computer ShopCherry Jana RobianesNo ratings yet

- AJE Yr End - 725106223Document20 pagesAJE Yr End - 725106223Nichole TanNo ratings yet

- BSA12 Special Class Bank Reconciliation PCF NP Discounting 110422Document35 pagesBSA12 Special Class Bank Reconciliation PCF NP Discounting 110422NwjwNo ratings yet

- ACCOUNTS RECEIVABLES 7-8 - Sheet1-2Document3 pagesACCOUNTS RECEIVABLES 7-8 - Sheet1-2Astrid AboitizNo ratings yet

- AKL - Tugas Pertemuan Ke 10Document4 pagesAKL - Tugas Pertemuan Ke 10Zephyra ViolettaNo ratings yet

- How To Journalize DividendsDocument2 pagesHow To Journalize DividendsJay Eaon JayNo ratings yet

- Tutorial AdjustmentDocument13 pagesTutorial AdjustmentnoorhanaNo ratings yet

- Jurnal Umum Clening ServiceDocument1 pageJurnal Umum Clening ServiceKhoirunisaNo ratings yet

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburNo ratings yet

- Ratio and InventoryDocument38 pagesRatio and InventoryMusfequr Rahman (191051015)No ratings yet

- Financial Markets and Instruments: Assignment - 1Document3 pagesFinancial Markets and Instruments: Assignment - 1Navya MohankaNo ratings yet

- ARIAMAN 191011200573-Digabungkan CompressedDocument18 pagesARIAMAN 191011200573-Digabungkan CompressedArya GiawaNo ratings yet

- Notes ReceivableDocument17 pagesNotes ReceivableMichael JimNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 3Document7 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 3YOHANNES WIBOWONo ratings yet

- ObiasGrpLtd WorksheetDocument24 pagesObiasGrpLtd WorksheetRuann Albete FernandezNo ratings yet

- Problem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Document2 pagesProblem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Katrina Dela Cruz100% (1)

- PA2 X ESP HW10 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW10 G1 Revanza TrivianRevan KonglomeratNo ratings yet

- Problem 14-1: Bonds As Trading 2005Document18 pagesProblem 14-1: Bonds As Trading 2005Yen YenNo ratings yet

- Accounting Principles: Assignment - 02Document28 pagesAccounting Principles: Assignment - 02qasimtenNo ratings yet

- Muhammad Zidan Akbar - Morgan Company - 1EB09Document12 pagesMuhammad Zidan Akbar - Morgan Company - 1EB09rully.movizarNo ratings yet

- Assignment 22 23 26 39Document4 pagesAssignment 22 23 26 39Georgina Francheska RamirezNo ratings yet

- Lessor AccountingDocument4 pagesLessor AccountingShinny Jewel VingnoNo ratings yet

- TB 1 - AklanDocument5 pagesTB 1 - AklanKkaNo ratings yet

- Investment in AssociateDocument5 pagesInvestment in AssociateLorence Patrick LapidezNo ratings yet

- Session 2 - ProblemsDocument3 pagesSession 2 - ProblemsIbnu WibowoNo ratings yet

- Problem 2Document9 pagesProblem 2Caila Nicole ReyesNo ratings yet

- Minority InterestDocument28 pagesMinority InterestKevin Leonel ManurungNo ratings yet

- Additional ProblemsDocument6 pagesAdditional ProblemsClair De luneNo ratings yet

- Advanced Accounting 1A Quiz 3 Name: Seat No: Calculate Pat Investment in Saw and Controlling Interest OnDocument6 pagesAdvanced Accounting 1A Quiz 3 Name: Seat No: Calculate Pat Investment in Saw and Controlling Interest OnJeferly DengahNo ratings yet

- A. General Journal Date Account Title Ref DebitDocument4 pagesA. General Journal Date Account Title Ref DebitFriska AvriliaNo ratings yet

- Activity Notes ReceivableDocument2 pagesActivity Notes ReceivableBernadeth Adelaine DomingoNo ratings yet

- Lesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersDocument18 pagesLesson 10 Intercompany Transactions Exercise 2 - Suggested AnswersjvNo ratings yet

- Buscom Subsequent MeasurementDocument6 pagesBuscom Subsequent MeasurementCarmela BautistaNo ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Assignment#2Document10 pagesAssignment#2hae1234No ratings yet

- TGL Client DR CR Should Be DR CR Paje DR CRDocument5 pagesTGL Client DR CR Should Be DR CR Paje DR CRALICE NADINE KURNIA SURYANo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Adjusting Entries Discussion and SolutionDocument6 pagesAdjusting Entries Discussion and SolutionGarp BarrocaNo ratings yet

- Keseluruhan Jurnal 2Document2 pagesKeseluruhan Jurnal 2PUSPA Ghalda ShafaNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument3 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument10 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument2 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- HbjhjhjhujuhjDocument51 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- STUDY CASE Nappy IndustryDocument4 pagesSTUDY CASE Nappy IndustrynjkjhNo ratings yet

- To BiomedikDocument4 pagesTo BiomediknjkjhNo ratings yet

- HbjhjhjhujuhjDocument4 pagesHbjhjhjhujuhjnjkjhNo ratings yet

- Westport ElectricDocument2 pagesWestport ElectricnjkjhNo ratings yet

- The City of Pittsburgh Case StudyDocument5 pagesThe City of Pittsburgh Case StudynjkjhNo ratings yet

- Tutor p2Document6 pagesTutor p2njkjhNo ratings yet

- Tugas Personal 1 MathDocument4 pagesTugas Personal 1 MathnjkjhNo ratings yet

- Tugas EnglishDocument2 pagesTugas EnglishnjkjhNo ratings yet