Professional Documents

Culture Documents

Financial Management Syllabus

Uploaded by

emmanvillafuerteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management Syllabus

Uploaded by

emmanvillafuerteCopyright:

Available Formats

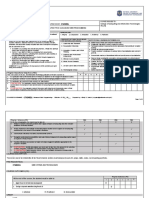

DOCUMENT:SYLLABUS

COURSE: FINANCIAL MANAGEMENT COPIES ISSUED TO:

College of Business and Accountancy

DATE OF EFFECTIVITY: 1 July 2020 COURSE CODE: BFINMAX Learning Resource Center

Faculty

VISION CORE VALUES

We are National University, a dynamic private institution committed to nation 1.Integrity 2. Compassion 3. Innovation 4. Resilience 5. Patriotism

building, recognized internationally in education and research. GRADUATE ATTRIBUTES INTENDED FOR

INSTITUTIONAL LEARNING OUTCOMES (ILOs)

NATIONALIANS (GAINs)

MISSION a. Exhibit the capacity for self-reflection

Guided by the core values and characterized by our cultural heritage of Dynamic 1. Conscientious and Reflective Leader b. Exhibit the willingness to engage in self-appraisal

Filipinism, National University is committed to providing relevant, innovative, and c. Apply moral and ethical standards in leading others

accessible quality education and other development programs. 2. Significant Contributor towards Social d. Participate actively in community-oriented advocacies that

Transformation contribute to nation building

We are committed to our: e. Participate with the long-life opportunities or activities that

STUDENTS, by molding them into life-long learners, ethical and spiritual citizen, and self- have sustainability.

directed agents of change. 3. Possessing an Entrepreneurial mindset f. Applying the business principles of Henry Sy. Sr.

FACULTY and EMPLOYEES, by enhancing their competencies, stimulating g. Produce alternative solutions, processes, and approaches

their passions, cultivating their commitment, and providing a just and fulfilling 4. Knowledge creator h. Apply problem-solving skills

work environment. i. Provide solutions to challenges in respective areas of

specialization

ALUMNI, by strengthening their sense of pride through engagement, loyalty, and love for

5. Competent Communicator and j. Work effectively in teams of different cultures

their alma mater.

Collaborator

INDUSTRY PARTNERS and EMPLOYERS, through active collaboration, by k. Engage in continuing personal and professional development

providing them Nationalians who will contribute to their growth and development. Express ideas effectively

COMMUNITY, by contributing to the improvement of life’s conditions and well-being of its Effectively use various ICT tools to convey ideas

members.

ILO

Program Learning Outcomes (PLO) for Bachelor of Science in Accountancy

a b c d e f g h i j k

1. Student will be able to demonstrate competencies in the development, measurement, analysis, validation ✓ ✓ ✓

✓ ✓ ✓

and communication of financial and other information.

2. Student will develop oral and written communication skills and critical thinking skills. ✓ ✓ ✓ ✓ ✓ ✓

3. Student will develop an appreciation for the role of ethics in both the profession and the business world. ✓ ✓ ✓ ✓ ✓ ✓ ✓

4. Student will be exposed to the unique aspects of global business and accounting issues. ✓ ✓ ✓ ✓ ✓

5. Student will be equipped to understand the use technology. ✓ ✓ ✓ ✓ ✓

6. Student will be exposed to activities that help them work in groups. ✓ ✓ ✓ ✓ ✓ ✓ ✓

COURSE CODE/NAME: BFINMAX _Financial Management

Page 1 of 8

COURSE DESCRIPTION

This course provides an introduction to financial management and finance, cash flows and financial analysis. Topics also include cash flows estimation; operating and

financial leverage; financial planning and forecasting; managing working capital, cash and marketable securities management and accounts receivable and inventory

management.

PRE-REQUISITE(S)

BAFACR4X

COURSE LEARNING OUTCOMES (CLO)

PROGRAM LEARNING OUTCOMES

At the end of the course, the student must be able to (CLO): (BSA)

1 2 3 4 5 6

1. Evaluate financial management practices, financial system, financial statements and analyze of financial statements

2. Perform ratio analysis, CVP analysis, leverage, financial planning and financial forecasting.

3. Evaluate financial statements, cash flows, operating and financial leverage, and working capital

4. Perform analysis of cash and marketable securities, accounts receivable and inventory management

CREDIT

3 Units

TIME ALLOTMENT

3 hours synchronous

1 hours asynchronous

COURSE REQUIREMENTS

QUIZZES (40%) CLASS STANDING (10%) PERIODIC DEPARTMENTAL EXAMINATIONS (50%)

- Minimum of 4 major quizzes per grading period

Midterms: Finals: 1. Assignment - Midterm Departmental Examination

Quiz No. 1 Quiz No. 3 2. Attendance - Final Departmental Examination

Quiz No. 2 Quiz No. 4 3. Other learning activities:

i. Seatwork

ii. Recitation

iii. Board work

iv. Practice Set

v. Portfolio of Activities

CLASS POLICIES

1. Familiarize yourself with the organization of remote class, including the terminologies, tools, and the primary platform to be used.

2. Be aware that activities for RAL are stated in the course syllabus or course outline.

COURSE CODE/NAME: BFINMAX _Financial Management

Page 2 of 8

3. Access MS Teams and download all available course materials.

4. Communicate with your instructor regularly. Be as responsive as possible.

5. Notify your instructor in case there is difficulty in accessing course materials.

6. Inform your instructor if there is something vague, preferably after initially consulting with a classmate or 2.

7. Set a regular study time for each course. Make sure to follow the suggested weekly course materials.

8. Have an active presence in discussions by responding to posts. Avoid short, generic replies such as, “I agree.” It should include why you agree or should add to the previous point.

9. Maximize opportunities to learn with classmates through group assignments, peer review, collaborative documents, and more.

10. Observe virtual class (or office) hours. While you may post your questions at any time of the day, expect a delay in the response after the defined virtual class or office hours.

11. Know that the provisions in the Student Handbook and other University policies concerning you will remain in effect unless suspended by the Academic Council or by thePresident.

GRADING SYSTEM

MIDTERM GRADE COMPUTATION: TENTATIVE FINAL GRADE COMPUTATION: FINAL GRADE:

Quizzes 30% Quizzes 30%

Class Recitation 30% Class Recitation 30% Midterm Grade = 50%

Assignments / Assignments Tentative Finals Grade = 50%

Seatwork / Seatwork / Final Grade = 100%

Board work / Other Board work / Other learning

learning activities activities

Periodic Examination 40% Periodic examination 40%

Midterm Grade 100% Tentative Final Grade 100%

COURSE CONTENTS

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

At the end of the session, the

learners will be able to:

1. Oriented to the school

policies and the course. Goal Setting and Proper Planning

2. Explain institutional - University and College

philosophies, values vision and mission • Syllabus

• Discussion

and policies, examine - Classroom policies • University Manual and

1 the goal setting created - Goal setting and course Handbook

in the light of planning

undertakings in this - Computation of grade and

course, and apply the the NU Grading System

institutional values in the

life–long pursuit of the

professional career.

CLO1 At the end of the session, the Topic 1: Introduction to Financial » Lecture » PowerPoint » Recitation

1-2

CLO2 students should be able to: Management » Discussion Presentation » Seatwork

COURSE CODE/NAME: BFINMAX _Financial Management

Page 3 of 8

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

1. Describe the nature, goal 1. The nature, goal and scope of » Demonstration » Syllabus » Quiz

and basic scope of financial financial management » Textbook » On-line assignments

management. 2. Types of financial decisions

2. Explain briefly the three 3. Significance of financial

major types of decisions management

that the finance manager 4. Relationship between financial

makes. management and accounting

3. Discuss the importance or 5. Strategic financial management

significance of financial 6. Financial objectives of a

management. business organization

4. Describe the relationship 7. Responsibilities to achieve the

between financial financial objectives

management and 8. Role of Finance Manager

accounting. 9. The Finance Organization

5. Discuss the importance of

objective setting in a

business enterprise.

6. Describe the primary

financial objectives of a

business firm.

7. Explain the responsibilities

of a Finance Manager to

Achieve the firm’s financial

objectives.

8. Describe the role of

Financial Manager in

achieving the primary goal

of the firm.

9. Understand how finance fits

in the organizational

structure of the firm.

At the end of the session, the Topic 2: Business Organization » Lecture » PowerPoint » Recitation

students should be able to: 1. Legal forms of business » Discussion Presentation » Seatwork

1. Explain the basic legal organization » Demonstration » Syllabus » Quiz

forms of business 2. Advantages and disadvantages » Textbook » On-line

3. Important business trends assignments

organizations.

2. Know the advantages and

3 CL02 disadvantages of adopting

the

a. Sole proprietorship

b. Partnership

c. Corporation

Forms of business

organization

COURSE CODE/NAME: BFINMAX _Financial Management

Page 4 of 8

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

3. Understand the important

business trends

At the end of the session, the Topic 3: Understanding Financial

students should be able to: Statements

1. Understand how business 1. How business activities are

activities are reported reported

through the financial 2. General objectives of Financial

statements Statements

2. Appreciate the general 3. Demand for financial accounting

objectives of financial information

statements. 4. Sources of financial information

3. Enumerate and identify the about a business enterprise

needs of various users that

demand financial

accounting information.

4. Enumerate the sources of

information about a

business enterprise.

At the end of the session, the Topic 4: Financial Statements » Lecture » PowerPoint » Recitation

students should be able to: Analysis » Discussion Presentation » Seatwork

1. Define financial statements 1. Financial analysis defined » Demonstration » Syllabus » Quiz

analysis. 2. Analyze the broader business » Problem solving » Textbook » On-line assignments

2. Understand the need to environment

analyze the broader 3. Basics of profitability analysis

business environment. 4. Limitations of financial statement

3. Know the basics of analysis

profitability analysis. 5. Financial ratio analysis

CLO2

4-5 4. Realize the limitations of

CLO3

financial statements

5. Analyze a business firm’s

short-term financial position,

asset liquidity and

management, long-term

financial position and

profitability using financial

ratios.

At the end of the session, the Topic 5: Cash Flow Analysis » Lecture » PowerPoint » Recitation

students should be able to: 1. Usefulness of the Statement of » Discussion Presentation » Seatwork

6 CLO3 1. Understand the usefulness Cash Flows » Demonstration » Syllabus » Quiz

of the statement of cash 2. How the Statement of Cash » Problem solving » Textbook » On-line assignments

flows as far as decision Flows is used in measuring the

COURSE CODE/NAME: BFINMAX _Financial Management

Page 5 of 8

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

making is concerned. firm’s financial liquidity and

2. Know the classifications of financial flexibility

the cash flow activities. 3. Classification of cash flow

3. Identify various sources and activities

application of cash. 4. Calculating cash flows

4. Calculate cash flows.

7 MIDTERM EXAMINATION

At the end of the session, the Topic 6: Operating Leverage » Lecture » PowerPoint » Recitation

students should be able to: 1. Leverage in a business » Discussion Presentation » Seatwork

1. Understand the concept 2. CVP analysis » Demonstration » Syllabus » Quiz

and application of leverage 3. Operating leverage » Problem solving » Textbook » On-line assignments

in business.

2. Know how cost-volume-

profit relationship is applied.

CLO2 3. Understand the

8

assumptions and limitations

of the CVP analysis.

4. Explain the meaning of

operating leverage.

5. Calculate and interpret the

firm’s degree of operating

leverage.

At the end of the session, the Topic 7: Financial Forecasting, » Lecture » PowerPoint » Recitation

students should be able to: Planning and Control » Discussion Presentation » Seatwork

1. Understand the concept 1. Concept of financial planning » Demonstration » Syllabus » Quiz

and perspective of financial 2. Perspective of financial planning » Problem solving » Textbook » On-line

planning. 3. Benefits from financial planning assignments

2. Explain the benefits that 4. Financial planning models

can be derived from 5. Projected Financial Statement

financial planning. Method

3. Know the elements of a

9 CL02

basic financial planning

model.

4. Understand the

determinants of a firm’s

growth rate.

5. Know and apply the

financial planning process

using the Projected

Financial Statement

COURSE CODE/NAME: BFINMAX _Financial Management

Page 6 of 8

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

Method.

At the end of the session, the Topic 8: Working Capital » Lecture » PowerPoint » Recitation

students should be able to: Management » Discussion Presentation » Seatwork

1. Understand the concept of 1. Reasons why working capital » Demonstration » Syllabus » Quiz

working capital management is important. » Problem solving » Textbook » On-line assignments

management. 2. The operating cycle

2. Know the importance of 3. The cash conversion cycle.

working capital 4. Alternative strategies in financial

management. working capital

10 CLO3

3. Understand and calculate

the operating cycle and

cash conversion cycle of a

business.

4. Know the alternative

policies in financing

investment in current

assets.

At the end of the session, the Topic 9: Cash and Marketable » Lecture » PowerPoint » Recitation

students should be able to: Securities Management » Discussion Presentation » Seatwork

1. Understand the concept of 1. Objective of cash management » Demonstration » Syllabus » Quiz

cash management. 2. Reasons for holding cash » Problem solving » Textbook » On-line

2. Learn the objectives of cash balances assignments

management. 3. Determining the target cash

3. Identify the reasons for balance

holding cash balances. 4. Marketable securities

CLO1 4. Know how to determine the 5. Reasons for holding marketable

11 -12

CLO4 target cash balance. securities

5. Understand the objective of 6. Types of marketable securities

marketable securities

management.

6. Realize the reason for

holding marketable

securities.

7. Learn the types of

marketable securities.

At the end of the session, the Topic 10: Accounts Receivable and » Lecture » PowerPoint » Recitation

CLO1 students should be able to: Inventory Management » Discussion Presentation » Seatwork

CLO4 1. Understand the need to 1. Objectives of accounts » Demonstration » Syllabus » Quiz

manage accounts receivable management » Problem solving » Textbook » On-line assignments

12-13 receivable. 2. Credit policy

2. Know the objectives of 3. Summary of trade-offs in credit

receivable management. and collection policies

3. Explain the nature of credit 4. Objective of inventory

policy and understand its management

COURSE CODE/NAME: BFINMAX _Financial Management

Page 7 of 8

COURSE TOPIC

WEEK LEARNING LEARNING TOPICS METHODOLOGY RESOURCES ASSESSMENT

OUTCOMES OUTCOMES

elements. 5. Functions of inventories

4. Understand the need to 6. Cost associated with inventory

manage inventories know

the objective of inventory

management.

5. Explain the functions of

inventories.

6. Identify the cost associated

with investment in

inventory.

13.5 FINAL EXAMINATION

PRESCRIBED TEXTBOOK

Cabrera, M. and Cabrera, G. (2019) Financial Management, Manila: GIC Enterprises and Co. Inc.

RECOMMENDEDRESOURCES

Chandra, P. (2015) Financial Management: Theory and Practice . USA: McGraw Hill

Brigham, Eugene F. and Ehrhardt, Michael C. (2013) Financial Management: Theory & Practice.Usa: Cengage Learning

Anastacio, F., Dacanay, R., and Aliling, L. (2010) Fundamentals of Financial Management : with Industry-based Perspective. Manila: Rex Bookstore

PREPARED BY: REVIEWED BY: NOTED BY: RECOMMENDING APPROVAL: APPROVED BY:

MICHAEL ANGELO M. FRANCIS ALLAN BERNALES, MBA

MANAYAO, CPA JOMAR V. VILLENA, CPA, MBA

OIC Dean, College of Accountancy, ARNEL A DIEGO, PhD Cand.

Program Chair, Accountancy CHARMAINE VELASQUEZ

Faculty-in-charge Business and Management Academic Director

LRC Coordinator

COURSE CODE/NAME: BFINMAX _Financial Management

Page 8 of 8

You might also like

- BAIACC3X - Intermediate Accounting 3Document7 pagesBAIACC3X - Intermediate Accounting 3Mitchie FaustinoNo ratings yet

- 11-25-22-Syllabus-Balawrex-Business Laws and RegulationsDocument8 pages11-25-22-Syllabus-Balawrex-Business Laws and RegulationsMitchie FaustinoNo ratings yet

- 2Y1T BALOBCOX Obligations and ContractsDocument8 pages2Y1T BALOBCOX Obligations and ContractsMitchie FaustinoNo ratings yet

- BAINTE1X - SyllabusDocument10 pagesBAINTE1X - SyllabusReymark SadoyNo ratings yet

- BADVAC2X - Accounting For Special TransactionsDocument11 pagesBADVAC2X - Accounting For Special TransactionsJack Herer100% (1)

- BADVAC1X - Accounting For Business CombinationsDocument11 pagesBADVAC1X - Accounting For Business CombinationsJack HererNo ratings yet

- 3Y1T BAGOBUSx GOVERNANCE BUSINESS ETHICSDocument11 pages3Y1T BAGOBUSx GOVERNANCE BUSINESS ETHICSemmanvillafuerteNo ratings yet

- Purposive Communication - Course SyllabusDocument7 pagesPurposive Communication - Course SyllabusChester AtacadorNo ratings yet

- BAFAC12X - Intermediate Accounting 1 & 2 - UpdatedDocument12 pagesBAFAC12X - Intermediate Accounting 1 & 2 - UpdatedNicole Daphne FigueroaNo ratings yet

- BALOBCOX-Obligations-and-Contracts SyllabusDocument9 pagesBALOBCOX-Obligations-and-Contracts SyllabusKeycie Ann ArevaloNo ratings yet

- 3y2t Bastatsl Statistical Analysis With SoftwareDocument8 pages3y2t Bastatsl Statistical Analysis With SoftwareMitchie FaustinoNo ratings yet

- Pe11 Physical Fitness Syllabus 2021 2022Document6 pagesPe11 Physical Fitness Syllabus 2021 2022toni tesoroNo ratings yet

- Advanced Communication 2022Document8 pagesAdvanced Communication 2022Jose Eduardo GumafelixNo ratings yet

- Document:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToDocument10 pagesDocument:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToIm Nayeon100% (1)

- Syllabus Obe - Operations Management-Tqm Revised Flex 823221Document17 pagesSyllabus Obe - Operations Management-Tqm Revised Flex 823221Jayar DimaculanganNo ratings yet

- 0.0 Syllabus - BAREBUSX - Regulatory Framework and Legal IssuesDocument10 pages0.0 Syllabus - BAREBUSX - Regulatory Framework and Legal IssuesIm NayeonNo ratings yet

- Physed11 Pathfit 1Document11 pagesPhysed11 Pathfit 1Mitchie FaustinoNo ratings yet

- Document:Syllabus Course: Cost Accounting and Control Copies Issued ToDocument8 pagesDocument:Syllabus Course: Cost Accounting and Control Copies Issued ToBernadette PalermoNo ratings yet

- Syllabus Bainctax Income Taxationpdf PDF FreeDocument8 pagesSyllabus Bainctax Income Taxationpdf PDF FreePaul Edward GuevarraNo ratings yet

- GEMMW01X-Math in The Modern World SyllabusDocument13 pagesGEMMW01X-Math in The Modern World SyllabusMaria Jenin DominicNo ratings yet

- Advanced Communication SyllabusDocument9 pagesAdvanced Communication SyllabusNICE ONENo ratings yet

- STS SyllabusDocument6 pagesSTS Syllabusthena sanchezNo ratings yet

- ENITV21D 1 Intervention For ChemistryDocument8 pagesENITV21D 1 Intervention For ChemistryMateo HernandezNo ratings yet

- Pilipinong Identidad College of Education, Arts and Sciences Learning Resource Center FacultyDocument8 pagesPilipinong Identidad College of Education, Arts and Sciences Learning Resource Center FacultyJun Reyes RamirezNo ratings yet

- GESTS01X Syllabus v2Document5 pagesGESTS01X Syllabus v2Febie DNo ratings yet

- Revised Syllabus Filipino 2 PAGSASALINDocument8 pagesRevised Syllabus Filipino 2 PAGSASALINErza Scarler100% (4)

- New Syllabus FormatDocument5 pagesNew Syllabus FormatIsko JuanatasNo ratings yet

- Document: Syllabus Course Code: Memael20 Copies Issued To: Date of Effectivity / Revision: Course Title: Machine Elements - LectureDocument7 pagesDocument: Syllabus Course Code: Memael20 Copies Issued To: Date of Effectivity / Revision: Course Title: Machine Elements - LectureArvin VillanuevaNo ratings yet

- SYLLABUS - The Contemporary World Course PlanDocument11 pagesSYLLABUS - The Contemporary World Course PlanKath MoranNo ratings yet

- AHISTOR3_2023-24Document9 pagesAHISTOR3_2023-24Martin NavarrozaNo ratings yet

- Advanced Communication 2022Document8 pagesAdvanced Communication 2022Mitchie FaustinoNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Teacher Education ProgramDocument8 pagesRamon Magsaysay Memorial Colleges Office of The Teacher Education ProgramShiela MantillaNo ratings yet

- FPPENO2Document4 pagesFPPENO2Aldrin Esplana SardillaNo ratings yet

- Fundamentals of Mixed Signals SensorsDocument7 pagesFundamentals of Mixed Signals SensorsJonrey RañadaNo ratings yet

- Ge201 - Readings in Philippine History A. B. C. DDocument11 pagesGe201 - Readings in Philippine History A. B. C. DShiela MantillaNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument10 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- Eccom31L Data Communications - LabDocument6 pagesEccom31L Data Communications - LabJonrey RañadaNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument8 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument6 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument7 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- 2015 1st Trim Software EngineeringDocument6 pages2015 1st Trim Software EngineeringJonrey RañadaNo ratings yet

- RMMC Syllabus for Family Resource ManagementDocument6 pagesRMMC Syllabus for Family Resource ManagementGladys Gen MalitNo ratings yet

- Anthropological Foundation (BPE)Document8 pagesAnthropological Foundation (BPE)Shiela MantillaNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument6 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument8 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- MCNAT01R SyllabusDocument9 pagesMCNAT01R SyllabusMitchie FaustinoNo ratings yet

- Irs10 (Administration and Management of Physical Education and Health Program)Document8 pagesIrs10 (Administration and Management of Physical Education and Health Program)Jaype MedidaNo ratings yet

- Anatomy and Physiology (BPE)Document8 pagesAnatomy and Physiology (BPE)Shiela MantillaNo ratings yet

- ENENDA30 CourseSyllabusDocument5 pagesENENDA30 CourseSyllabusDaniel S. MacaraegNo ratings yet

- College of Accountancy Pioneer Avenue, General Santos City: Ramon Magsaysay Memorial CollegesDocument21 pagesCollege of Accountancy Pioneer Avenue, General Santos City: Ramon Magsaysay Memorial CollegesGarp BarrocaNo ratings yet

- RMMC Syllabus for School Food Services ManagementDocument8 pagesRMMC Syllabus for School Food Services ManagementGladys Gen MalitNo ratings yet

- COURSE OUTLINEDocument3 pagesCOURSE OUTLINEIsko JuanatasNo ratings yet

- Teaching Arts in Elementary Grades SyllabusDocument7 pagesTeaching Arts in Elementary Grades SyllabusDoejejejNo ratings yet

- Ramon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsDocument6 pagesRamon Magsaysay Memorial Colleges Office of The Executive Director For Academic AffairsGladys Gen MalitNo ratings yet

- AHISTOR1_AY-2020-21-2nd-TermDocument11 pagesAHISTOR1_AY-2020-21-2nd-Termxppen78No ratings yet

- CPC 6 Philippine Traditional GamesDocument7 pagesCPC 6 Philippine Traditional GamesJaype MedidaNo ratings yet

- Nursing Informatics 2nd Term 2019-2020Document11 pagesNursing Informatics 2nd Term 2019-2020Jek Dela CruzNo ratings yet

- OBE-Syllabus-Technology-for-Teaching-and-LearningDocument13 pagesOBE-Syllabus-Technology-for-Teaching-and-LearningApril Lourdes Punzalan AragonNo ratings yet

- Purposive Communication Syllabus TemplateDocument14 pagesPurposive Communication Syllabus TemplateAdrian LequironNo ratings yet

- Week 7 Course Material For Corporate GovernanceDocument15 pagesWeek 7 Course Material For Corporate GovernanceemmanvillafuerteNo ratings yet

- 3Y1T BAGOBUSx GOVERNANCE BUSINESS ETHICSDocument11 pages3Y1T BAGOBUSx GOVERNANCE BUSINESS ETHICSemmanvillafuerteNo ratings yet

- Science Reviewer 9Document4 pagesScience Reviewer 9emmanvillafuerteNo ratings yet

- Fin Week 9 Course Material For Corporate GovernanceDocument17 pagesFin Week 9 Course Material For Corporate GovernanceemmanvillafuerteNo ratings yet

- CM Week 5 For Corporate GovernanceDocument13 pagesCM Week 5 For Corporate GovernanceemmanvillafuerteNo ratings yet

- CM Week 4 For Corporate Governance PART 1Document17 pagesCM Week 4 For Corporate Governance PART 1emmanvillafuerteNo ratings yet

- CM Week 1 and 2 ACT 102Document20 pagesCM Week 1 and 2 ACT 102emmanvillafuerteNo ratings yet

- Module 9 - Cash and Marketable Securities ManagementDocument26 pagesModule 9 - Cash and Marketable Securities ManagementemmanvillafuerteNo ratings yet

- The Midline TheoremDocument6 pagesThe Midline TheorememmanvillafuerteNo ratings yet

- Module 3 - Understanding Financial Statements PDFDocument25 pagesModule 3 - Understanding Financial Statements PDFemmanvillafuerteNo ratings yet

- Grade 7 4th Periocial Test ScienceDocument4 pagesGrade 7 4th Periocial Test ScienceemmanvillafuerteNo ratings yet

- Mathematics 7Document5 pagesMathematics 7emmanvillafuerteNo ratings yet

- CM Week 3 For Corporate GovernanceDocument14 pagesCM Week 3 For Corporate GovernanceemmanvillafuerteNo ratings yet

- Module 2 - Business Organization PDFDocument22 pagesModule 2 - Business Organization PDFemmanvillafuerteNo ratings yet

- Module 7 - Financial Forecasting, Planning and ControlDocument32 pagesModule 7 - Financial Forecasting, Planning and ControlemmanvillafuerteNo ratings yet

- Parallelism, Voice, Agreement Grammar TestsDocument1 pageParallelism, Voice, Agreement Grammar TestsemmanvillafuerteNo ratings yet

- Quiz 01Document3 pagesQuiz 01emmanvillafuerteNo ratings yet

- Science Reviewer 9Document4 pagesScience Reviewer 9emmanvillafuerteNo ratings yet

- Module 5 - Cash Flow AnalysisDocument24 pagesModule 5 - Cash Flow AnalysisemmanvillafuerteNo ratings yet

- Grade 7 4th Periocial Test ScienceDocument4 pagesGrade 7 4th Periocial Test ScienceemmanvillafuerteNo ratings yet

- Operating and Financial Leverage ExplainedDocument30 pagesOperating and Financial Leverage ExplainedemmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week9Document10 pagesCourse Materials BAFINMAX Week9emmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week10 PDFDocument7 pagesCourse Materials BAFINMAX Week10 PDFemmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week6Document7 pagesCourse Materials BAFINMAX Week6emmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week4 5Document9 pagesCourse Materials BAFINMAX Week4 5emmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week8Document8 pagesCourse Materials BAFINMAX Week8emmanvillafuerteNo ratings yet

- Module 4 - Financial Statement Analysis (Part 2) PDFDocument44 pagesModule 4 - Financial Statement Analysis (Part 2) PDFemmanvillafuerte100% (1)

- Course Materials BAFINMAX Week3Document11 pagesCourse Materials BAFINMAX Week3emmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week1Document8 pagesCourse Materials BAFINMAX Week1emmanvillafuerteNo ratings yet

- Course Materials BAFINMAX Week2Document6 pagesCourse Materials BAFINMAX Week2emmanvillafuerteNo ratings yet

- Reading Lesson 1 - Matching Paragraph Headings: Strategies To Answer The QuestionsDocument4 pagesReading Lesson 1 - Matching Paragraph Headings: Strategies To Answer The QuestionsNgọc Anh Nguyễn LêNo ratings yet

- CPIO Vs SUBHASH AGGARWALDocument2 pagesCPIO Vs SUBHASH AGGARWALvaibhav joshiNo ratings yet

- Brain-Ring "What? Where? When?"Document4 pagesBrain-Ring "What? Where? When?"Оксана ГорькаяNo ratings yet

- Curcuma y MetforminaDocument8 pagesCurcuma y MetforminaJorge Luis Plasencia CubaNo ratings yet

- Scada/Ems/Dms: Electric Utilities Networks & MarketsDocument12 pagesScada/Ems/Dms: Electric Utilities Networks & MarketsdoquocdangNo ratings yet

- Analyzing Customer Support at eSewa FonepayDocument50 pagesAnalyzing Customer Support at eSewa FonepayGrishma DangolNo ratings yet

- GSDocument26 pagesGSkarinadegomaNo ratings yet

- Review Article: Neurophysiological Effects of Meditation Based On Evoked and Event Related Potential RecordingsDocument12 pagesReview Article: Neurophysiological Effects of Meditation Based On Evoked and Event Related Potential RecordingsSreeraj Guruvayoor SNo ratings yet

- Assignment Fundamentals of Book - Keeping & AccountingDocument19 pagesAssignment Fundamentals of Book - Keeping & AccountingmailonvikasNo ratings yet

- National Register of Large Dams -2019: Government of India Central Water CommissionDocument300 pagesNational Register of Large Dams -2019: Government of India Central Water CommissionPrabhjeet BaidNo ratings yet

- Milk Borne Disease 2 (Eng) - 2012Document46 pagesMilk Borne Disease 2 (Eng) - 2012seviandha100% (1)

- BS EN ISO 14253 12017 (The British Standards Institution) (Z-Library) PDFDocument32 pagesBS EN ISO 14253 12017 (The British Standards Institution) (Z-Library) PDFMohammed SirelkhatimNo ratings yet

- Faith and Fascination of A or Ammonite FossilsDocument3 pagesFaith and Fascination of A or Ammonite FossilsRavi UpadhyaNo ratings yet

- RobertHalf UK Salary Guide 2016Document46 pagesRobertHalf UK Salary Guide 2016Pablo RuibalNo ratings yet

- Lesson Plan and ProductDocument4 pagesLesson Plan and Productapi-435897192No ratings yet

- Rufino Luna, Et - Al V CA, Et - Al (G.R. No. 100374-75)Document3 pagesRufino Luna, Et - Al V CA, Et - Al (G.R. No. 100374-75)Alainah ChuaNo ratings yet

- G.R. No. 202976 February 19PEOPLE OF THE PHILIPPINES, Plaintiff - Appellee, MERVIN GAHI, Accused-AppellantDocument13 pagesG.R. No. 202976 February 19PEOPLE OF THE PHILIPPINES, Plaintiff - Appellee, MERVIN GAHI, Accused-AppellantjbandNo ratings yet

- Lo Visual en YourcenarDocument272 pagesLo Visual en YourcenarJosé Ignacio Herrera LamasNo ratings yet

- St. Mary'S University School of Graduate Studies: OCTOBER 2013, Addis Ababa, EthiopiaDocument88 pagesSt. Mary'S University School of Graduate Studies: OCTOBER 2013, Addis Ababa, EthiopiaRachel HaileNo ratings yet

- Kombai DogsDocument5 pagesKombai Dogschandan.belagundaNo ratings yet

- Agricultural Crop Monitoring Using IOTDocument6 pagesAgricultural Crop Monitoring Using IOTJunaidNo ratings yet

- BadjaoDocument3 pagesBadjaochristianpauloNo ratings yet

- Uworld 2Document3 pagesUworld 2samNo ratings yet

- Circulatory System QuestionsDocument4 pagesCirculatory System QuestionsJohn Vincent Gonzales50% (2)

- MATHS Revision DPP No 1Document8 pagesMATHS Revision DPP No 1ashutoshNo ratings yet

- Kurdonia Structural Design ReportDocument341 pagesKurdonia Structural Design ReportAnonymous nQ9RqmNo ratings yet

- Talent Is Overrated-Summary PDFDocument9 pagesTalent Is Overrated-Summary PDFCarlos Washington Mercado100% (1)

- Knockspell Issue3Document68 pagesKnockspell Issue3Donald Marks100% (3)

- Sample Paper 3 Answer PDFDocument58 pagesSample Paper 3 Answer PDFAhhh HahahaNo ratings yet

- Tort of Negligence Modefied 1Document20 pagesTort of Negligence Modefied 1yulemmoja100% (2)