Professional Documents

Culture Documents

Current Revised Circle Rates of Noida, Stamp Duty Rate in Noida Dec 2021

Uploaded by

Bunty SainiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Current Revised Circle Rates of Noida, Stamp Duty Rate in Noida Dec 2021

Uploaded by

Bunty SainiCopyright:

Available Formats

!

☰ *

6

Income Tax

Calculator

Home Loan

@ 6.50%*

LAP

@ 6.90%*

Personal Loan

@ 10.25%* ›

CIRCLE RATE IN NOIDA DEC 2021

Last Updated 27th Dec 2021

Revised Circle Rates, Current Stamp Duty Rates in Noida

➤Circle rates in Noida refer to the minimum rate notified by the

government through the registrar or sub-registrar office of Noida

for registration of property transactions.

➤The government decides the circle rates based on the type of

property. For instance, the registrar value of flats and apartments

in Noida is different from that of plots and independent houses,

even in the same area.

➤Stamp duty is to be paid on the higher of the declared

transaction value and the value calculated as per the circle rate

chart applicable for the sector or area of Noida.

➤Registration charges are an additional levy over and above the

stamp duty. While registering property in Noida, you will need to

pay a registration fee of ₹ 10,000 plus tax.

GET FREE CREDIT REPORT

Gender *

Male Female

Occupation *

Salaried Self Employed

! Full

EnterName (As

Full per PAN Card) *

Name

" PAN

PANCard

CardNo.No.

eg. (AAAPA1234X) *

eg. (AAAPA1234X)

# Date of Birth *

yyyy-mm-dd

$ Current Residence Pincode *

Enter Pincode

% EmailIDID*

Email

& Mobile

MobileNo.

No.*

' Choose

SelectYour Employer type

Employer Type *

IConsent

allow MyLoanCare.in to access my credit information from Credit Information

Companies (Experian) in order to understand my creditworthiness and curate

personalized values for me. I hereby consent to and instruct bureau to provide

GET FREE REPORT

What are Circle Rates in Noida?

Circle rates refer to the minimum rate notified by the government

through the registrar or sub-registrar office of Noida for registration of

property transactions. It is the minimum value at which any commercial

or residential property in Noida can be sold or transferred. The

government revises the circle rates in Noida from time to time based on

factors such as demand & supply of land, development of the area etc.

Circle Rates

Know More

All About Home Loan

Explore More

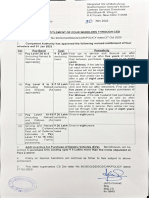

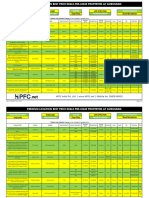

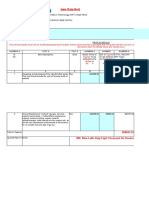

Noida Authority Circle Rate for Flats and Apartments

Sectors Builders

Flats

(per sq

meter)

Sector 11, 12, 16, 16A, 16B, 22, 24, 42, 43, 70, 71, 72, 73, ₹ 40,000

74, 75, 76, 77, 78, 79, 104, 107, 110, 115, 117, 118, 119,

120, 121, 130, 133, 143, 143B, 144, 150, 151, 168

Sector 14, 14A, 15A, 17, 25A, 30, 32, 35, 36, 38A, 39, 44, ₹ 55,000

50, 51, 52, 92, 93, 93A, 93B, 96, 97, 98

Sector 15, 19, 20, 21, 23, 25, 26, 27, 28, 29, 31, 33, 34, 37, ₹ 50,000

38, 40, 41, 45, 46, 47, 48, 49, 53, 55, 56, 61, 62, 82, 99,

100, 105, 108, 122, 128, 129, 131, 134, 135, 137

Sector 63A, 86, 112, 113, 116 ₹ 35,000

Sector 102, 158, 162 ₹ 32,000

➤Noida Circle rate for EWS Flats is ₹ 28,000 per square meter.

➤Circle rate for Shramik Flats in Noida is ₹ 25,000 per square

meter.

Circle Rates in Noida for Residential Floors

Residential Floors ( per sq meter )

Sectors Circle Circle Circle Circle

rate rate rate rate

for for for for

12m 12m- 18m- above

road 18m 24m 24m

road road road

Sector 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, ₹ ₹ ₹ ₹

12, 22, 42, 43, 45, 70, 71, 72, 73, 74, 52,500 55,150 57,750 60,400

75, 76, 77, 78, 79, 107, 110, 119,

120, 121, 123, 125, 126, 127, 128,

129, 130, 131, 132, 133, 134, 135,

136, 137, 142, 143, 143B, 144, 151,

152, 153, 154, 155, 156, 157

Sector 14, 14A, 15A, 16, 16A, 16B, ₹ 1.03 ₹ 1.09 ₹ 1.14 ₹ 1.19

17, 18, 30, 35, 36, 38, 38A, 39, 44, Lakh Lakh Lakh Lakh

50, 51, 52, 94, 124

Sector 15, 19, 20, 21, 23, 24, 25, ₹ ₹ ₹ ₹

25A, 26, 27, 28, 29, 31, 32, 33, 34, 72,000 75,600 79,200 82,800

37, 40, 41, 46, 47, 48, 49, 53, 55, 56,

61, 62, 82, 92, 93, 93A, 93B, 96, 97,

98, 99, 100, 105, 108, 122

Sector 54, 57, 58, 59, 60, 63, 63A, ₹ ₹ ₹ ₹

64, 65, 67, 68, 69, 80, 81, 83, 84, 85, 44,000 46,200 48,400 50,600

86, 87, 88, 89, 90, 91, 95, 101, 103,

106, 109, 111, 112, 113, 114, 116,

117, 118

Sector 66, 102, 138, 139, 140, 140A, ₹ ₹ ₹ ₹

141, 145, 146, 147, 148, 149, 150, 40,000 42,000 44,000 46,000

158, 159, 160, 161, 162, 163, 164,

165, 166, 167, Noida Phase 2, NEPZ

Sector 104 ₹ ₹ ₹ ₹

44,000 55,150 57,750 60,400

Sector 115 ₹ ₹ ₹ ₹

44,000 42,000 44,000 50,600

Sector 168 ₹ ₹ ₹ ₹

52,500 52,500 57,750 60,400

What Does Circle Rate In Noida Depend Upon? Are The

Rates Same Across Noida?

➤Circle rates tend to vary across various areas of Noida depending

upon the market value of the area and the facilities that are

available in that area

➤Typically, government tends to assign higher circle rate to

commercial properties and lower rates for residential properties

➤Circle rates also depend upon the type of the property. Registrar

value of flats and apartments in Noida is different from that of plots

and independent houses even in the same area

➤Luxury apartments in Noida with amenities such as security,

power back-up, covered car parking, open car parking, lift,

swimming pool have to bear an additional loading for calculating

circle rates. Maximum loading is capped at 15% of the basic value

Covered Parking ₹ 3 Lakh

Open Parking ₹ 1.50 Lakh

Power Backup 3%

Security Guard 3%

Community Centre/Club 3%

Swimming Pool 3%

Gym 3%

Lift 3%

➤In case of high rise apartments, the government allows for a floor

relief at the rate of 2% per floor rise for flats on 4th floor and

above. However, the maximum floor relief is capped at 20% of the

basic value

➤For constructed property such as houses, bungalows, and row

houses, the value of construction is linked to the age of the

construction. Rate for first class RCC construction is taken as ₹

15,000 per square meter and that for second class RCC

construction is taken as ₹ 14,000 per square meter. Formula for

calculating value of construction is:

Rate of construction per square meter less (Rate of construction)

multiplied by (age of construction) multiplied by 0.9 (divided by

80).

What Is The Stamp Duty Rate In Noida Payable For

Registering Property?

➤Stamp duty is payable as a percentage of the higher of declared

agreement value and assessed value as per circle rate chart.

Current stamp duty rates in Noida

Stamp Duty Rate Rates

Males 7%

Females 7%

Male and Female Joint Owners 7%

Registry Charges in Noida

➤Registration charges are an additional levy over and above the

stamp duty and are levied to cover the cost of running registration

offices by the government.

➤While registering property in Noida you will need to pay a

registration fee of ₹ 10,000 plus tax.

How to calculate value of a property for payment of stamp

duty in Noida using circle rates?

Simply follow the following steps to calculate the value at which stamp

duty is payable on purchase of property in Noida

➤Check the built up area of the property, its other features like

floor, amenities, age of construction and plot area

➤Select the applicable property type from among all the listed

property types (e.g., is the property a flat or a plot or a house or a

builder floor or a shop or a commercial unit)

➤Select the locality or area where the property is located from the

classification available on registrar office website or on

MyLoanCare

➤Calculate the minimum assessed value as per current circle rate

as below:

Builder Sum of:

floors built ➤Proportionate share in area of plot in square

on meter multiplied by applicable circle rate for

independent land in the locality in Rs. per square meter.

plots

➤Built up area multiplied by minimum cost

of construction in Rs. per square meter.

Residential For Noida authority flats, EWS flats and Shramik

apartments flats, sum of:

➤Built up area of flat in square meter

multiplied by applicable circle rate for flats in

Rs. per square meter * (1+ total % loading for

amenities) * (1 – floor relief)

➤Number of open car parking slots

multiplied by ₹ 1,50,000

➤Number of covered car parking slots

multiplied by ₹ 3,00,000

Plot Area of plot in square meter multiplied by

applicable circle rate for land in the locality in Rs.

per square meter

House Sum of:

Constructed ➤Area of plot in square meter multiplied by

on Plot applicable circle rate for land in the locality in

Rs. per square meter

➤Built up area in square meter multiplied by

per square meter construction cost adjusted

for age, which is calculated as [(Rate of

construction per square meter less (Rate of

construction) multiplied by (age of

construction) multiplied by 0.9 divided by

80)]

How To Check Noida Circle Rates Online?

To check Noida Circle Rates online, follow the below-mentioned steps:

➤Login the official website of the Stamps & Registration

department of UP at

https://igrsup.gov.in/igrsup/welcomeAction.action.

➤Click on Enter Here.

➤On the redirected page, enter details of Evaluation List.

➤Click on view details to view the circle rates.

What Is The Difference Between Market Rate And Circle

Rates?

➤Circle rates are notified by the government and are used as

reference point for payment of stamp duty on property transaction

registrations in Noida.

➤Market prices refer to the actual price at which property sale-

purchase transactions are transacted between buyers and sellers.

➤In most cases, circle rates tend to be slightly lower than market

prices. However, in some cases it is seen that the circle rates may

even be higher than market prices.

Sector In Noida

➤Sector 1

➤Sector 2

➤Sector 3

➤Sector 4

➤Sector 5

➤Sector 6

➤Sector 7

➤Sector 8

➤Sector 9

➤Sector 10

➤Sector 11

➤Sector 12

➤Sector 14

➤Sector 14A

➤Sector 15

➤Sector 15A

➤Sector 16

➤Sector 16A

➤Sector 16B

➤Sector 17

➤Sector 18

➤Sector 19

➤Sector 20

➤Sector 21

➤Sector 22

➤Sector 23

➤Sector 24

➤Sector 25

➤Sector 25A

➤Sector 26

➤Sector 27

➤Sector 28

➤Sector 29

➤Sector 30

➤Sector 31

➤Sector 32

➤Sector 33

➤Sector 34

➤Sector 35

➤Sector 36

➤Sector 37

➤Sector 38

➤Sector 38A

➤Sector 39

➤Sector 40

➤Sector 41

➤Sector 42

➤Sector 43

➤Sector 44

➤Sector 45

➤Sector 46

➤Sector 47

➤Sector 48

➤Sector 49

➤Sector 50

➤Sector 51

➤Sector 52

➤Sector 53

➤Sector 54

➤Sector 55

➤Sector 56

➤Sector 57

➤Sector 58

➤Sector 59

➤Sector 60

➤Sector 61

➤Sector 62

➤Sector 63

➤Sector 63A

➤Sector 64

➤Sector 65

➤Sector 66

➤Sector 67

➤Sector 68

➤Sector 69

➤Sector 70

➤Sector 71

➤Sector 72

➤Sector 73

➤Sector 74

➤Sector 75

➤Sector 76

➤Sector 77

➤Sector 78

➤Sector 79

➤Sector 80

➤Sector 81

➤Sector 82

➤Sector 83

➤Sector 84

➤Sector 85

➤Sector 86

➤Sector 87

➤Sector 88

➤Sector 89

➤Sector 90

➤Sector 91

➤Sector 92

➤Sector 93

+

➤Sector 93A

CONTENT ON PAGE

➤Sector 93B

➤Sector 94

➤Sector 95

➤Sector 96

➤Sector 97

➤Sector 98

➤Sector 99

➤Sector 100

➤Sector 101

➤Sector 102

➤Sector 103

➤Sector 104

➤Sector 105

➤Sector 106

➤Sector 107

➤Sector 108

➤Sector 109

➤Sector 110

➤Sector 111

➤Sector 112

➤Sector 113

➤Sector 114

➤Sector 115

➤Sector 116

➤Sector 117

➤Sector 118

➤Sector 119

➤Sector 120

➤Sector 121

➤Sector 122

➤Sector 123

➤Sector 124

➤Sector 125

➤Sector 126

➤Sector 127

➤Sector 128

➤Sector 129

➤Sector 130

➤Sector 131

➤Sector 132

➤Sector 133

➤Sector 134

➤Sector 135

➤Sector 136

➤Sector 137

➤Sector 138

➤Sector 139

➤Sector 140

➤Sector 140A

➤Sector 141

➤Sector 142

➤Sector 143

➤Sector 143B

➤Sector 144

➤Sector 145

➤Sector 146

➤Sector 147

➤Sector 148

➤Sector 149

➤Sector 150

➤Sector 151

➤Sector 152

➤Sector 153

➤Sector 154

➤Sector 155

➤Sector 156

➤Sector 157

➤Sector 158

➤Sector 159

➤Sector 160

➤Sector 161

➤Sector 162

➤Sector 163

➤Sector 164

➤Sector 165

➤Sector 166

➤Sector 167

➤Sector 168

➤Sector Noida Phase 2

➤Sector NEPZ

FAQs

What Is The Circle Rate In Noida?

Circle Rates in Noida is the minimum value at which any land or

property in Noida can be sold or transferred. The government determines

the circle rates depending on the type of property, usage of the property,

age of property etc.

What Are Flat Registration Charges In Noida?

Registration charges are an additional levy over and above the stamp

duty and are levied to cover the government's cost of running registration

offices. While registering property in Noida you will need to pay a

registration fee of ₹ 10,000 plus tax.

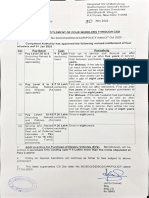

What Are NOIDA Authority Transfer Fees Payable

For Transfer Of Property In Noida Records?

Property in Noida is leasehold and not freehold. The Noida authority is

the owner of the property and gives out property on 90-year lease.

Before sale – purchase or transfer of property, the seller must obtain a

transfer permission or transfer memorandum from the Noida authority.

This requirement applies to all properties built on plots allotted by the

Noida authority including on flats built by private developers and

builders on land allotted by Noida authority. Transfer fee or TM fee, as it

is called, varies based on the location of the property and is charged

based on the area of the property. The charges may, at times, be almost

the same as the stamp duty payable on registration of the property. Note

that transfer charges payable to Noida authority are in addition to the

stamp duty payable on registration. Some people argue that this amounts

to double taxation.

How To Obtain TM Or Transfer Permission From

Noida Authority?

The seller needs to make an application with the Noida authority in a

prescribed format known as “Transfer Application Form” on stamp

paper. The permission, once granted, is valid for six months. Transfer

charges are payable along with the application.

Related Topics (

Delhi Circle Rates

Gurgaon Circle Rates

Noida Circle Rates

Faridabad Circle Rates

Ghaziabad Circle Rates

Jaipur Circle Rates

Mumbai Ready Reckoner

Pune Ready Reckoner

Tax Benefit on Home Loan

Our News - Dec 2021

2021-02-25 : Cut in circle rates in Delhi to boost Real

estate

The government on February 5 decided to reduce circle rates

for properties in Delhi by 20% flat until September 30, 2021.

The move is expected to make it substantially cheaper for

people to do property transactions, revive the real estate

sector and create new jobs.

*Terms and conditions apply. Credit at sole discretion of lender, which is subject to

credit appraisal, eligibility check, rates, charges and terms. Information displayed is

indicative and collected from public sources. Read More

About Us Careers

Terms and Conditions Privacy Policy

Unsubscribe Important Legal Disclaimer

Lending Partners Blog

Home Loan

)

Personal Loan

)

Car Loan

)

Gold Loan

)

Loan Against Property

)

Business Loan

)

Two Wheeler Loan

)

Credit Card

)

Deposit

)

Credit Score

)

Aadhaar

)

PAN Card

)

Saving Schemes

What

Looking

are you

for looking

an investment?

for? )

GET DETAILS

APPLY

You might also like

- Noida Property Circle RatesDocument4 pagesNoida Property Circle RatesYogesh BaggaNo ratings yet

- UntitledDocument18 pagesUntitledVed Prakash PantNo ratings yet

- DL Reg Aug CSD ListDocument14 pagesDL Reg Aug CSD Listfatrag amloNo ratings yet

- HPFC ReSale Pre-Rented and Lease Inventory-5Document6 pagesHPFC ReSale Pre-Rented and Lease Inventory-5Arvin DabasNo ratings yet

- May CSD Car Price List With DL RegDocument17 pagesMay CSD Car Price List With DL RegkhajaNo ratings yet

- Jan CSD Car Price List With BH RegDocument18 pagesJan CSD Car Price List With BH Reggochristo5658No ratings yet

- Mar CSD Car Price List With BH RegDocument17 pagesMar CSD Car Price List With BH Regsandeep kumarNo ratings yet

- BH Reg Aug CSD ListDocument14 pagesBH Reg Aug CSD Listfatrag amloNo ratings yet

- HPFC Pre-Rented and Lease Inventory-1Document5 pagesHPFC Pre-Rented and Lease Inventory-1arvindabas34No ratings yet

- HPFC Pre-Rented and Lease InventoryDocument5 pagesHPFC Pre-Rented and Lease InventoryArvin DabasNo ratings yet

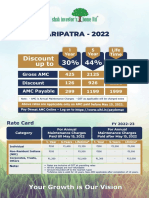

- Paripatra - 2022: Discount Up ToDocument2 pagesParipatra - 2022: Discount Up ToNafisur RahmanNo ratings yet

- Eldeco Aamantran Price ListDocument5 pagesEldeco Aamantran Price ListGreen Realtech Projects Pvt LtdNo ratings yet

- Circle Rates in New Delhi Today (11 Nov 2021) - BankbazaarDocument8 pagesCircle Rates in New Delhi Today (11 Nov 2021) - BankbazaarDevenderNo ratings yet

- OYO Traveller Insurance PlanDocument5 pagesOYO Traveller Insurance PlanPriya SharmaNo ratings yet

- SHRIRAM NCD-Issue-Structures-DETAILS PDFDocument5 pagesSHRIRAM NCD-Issue-Structures-DETAILS PDFDeepakNo ratings yet

- 237 Brochure 2023 FINALDocument15 pages237 Brochure 2023 FINALJoe WaigwaNo ratings yet

- Project Name - Marvel Izara Phase - I StylaDocument3 pagesProject Name - Marvel Izara Phase - I StylaArun KumarNo ratings yet

- India Pune Residential MB Q2 2023Document2 pagesIndia Pune Residential MB Q2 2023Pranav KarwaNo ratings yet

- Mojo Platinum Credit Card: INR 1000 INR 1000Document4 pagesMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- Item Rate Boq: Validate Print HelpDocument4 pagesItem Rate Boq: Validate Print HelpContact TecbootNo ratings yet

- ManesarDocument10 pagesManesarankurNo ratings yet

- Tower 17 Booklet (Final Version)Document8 pagesTower 17 Booklet (Final Version)zahidNo ratings yet

- NIACL-Officer Benefits & HR Orientation BookletDocument48 pagesNIACL-Officer Benefits & HR Orientation BookletSumit SelokarNo ratings yet

- Masdar - City - Factsheet - en 2022 - V3Document7 pagesMasdar - City - Factsheet - en 2022 - V3darshil kamaniNo ratings yet

- Ahmad Hamidi MaduDocument129 pagesAhmad Hamidi MaduAfiq NadzmiNo ratings yet

- Nirala Greenshire - PNB OfferDocument25 pagesNirala Greenshire - PNB OfferJagdeep ChawlaNo ratings yet

- Pioneer Industrial Park: Bilaspur Chowk, Pathredi, Gurgaon (NH-08) W.E.F. 13/02/2008 Price List Payment PlansDocument3 pagesPioneer Industrial Park: Bilaspur Chowk, Pathredi, Gurgaon (NH-08) W.E.F. 13/02/2008 Price List Payment PlansPooja WaybhaseNo ratings yet

- Rev - Notes (Land Rent)Document6 pagesRev - Notes (Land Rent)Khure UllainNo ratings yet

- A Pricelist 20 Aug 16 V4Document22 pagesA Pricelist 20 Aug 16 V4sishir mandalNo ratings yet

- Financial One PagerDocument1 pageFinancial One Pagerlildude84678No ratings yet

- Template Cost Proposal Draft (050416)Document4 pagesTemplate Cost Proposal Draft (050416)AdhithyaNo ratings yet

- Byd Terms and ConditionsDocument4 pagesByd Terms and ConditionsrajuchachajeNo ratings yet

- Sunteck ShareDocument4 pagesSunteck ShareLalit AgrawalNo ratings yet

- Statutory Cost Market NormsDocument1 pageStatutory Cost Market NormsColliers InternationalNo ratings yet

- Eth 20061859 300618Document113 pagesEth 20061859 300618Saurabh PednekarNo ratings yet

- 4th Floor - Cost SheetDocument1 page4th Floor - Cost SheetKrishnan NadarNo ratings yet

- DHA Quetta Smart City: Usman ImtiazDocument2 pagesDHA Quetta Smart City: Usman ImtiazUsman ImtiazNo ratings yet

- Pay and Park 2 TenderDocument113 pagesPay and Park 2 TenderSaurabh PednekarNo ratings yet

- Company LogoDocument4 pagesCompany LogoRahul SoniNo ratings yet

- Educative Series Green Housing LoanDocument2 pagesEducative Series Green Housing LoanRohith RaoNo ratings yet

- Bid No.7100126584: Municipal Corporation of Greater MumbaiDocument113 pagesBid No.7100126584: Municipal Corporation of Greater MumbaiSaurabh PednekarNo ratings yet

- My Savings SOC Dec 2022Document2 pagesMy Savings SOC Dec 2022JD GamingNo ratings yet

- The DLF Group, Is India's Largest Real Estate CompanyDocument21 pagesThe DLF Group, Is India's Largest Real Estate CompanyvsnabdeNo ratings yet

- Eth 20061855 300618Document113 pagesEth 20061855 300618Saurabh PednekarNo ratings yet

- Automatic FreeDocument5 pagesAutomatic FreeAnshu SenNo ratings yet

- EdgeReport TMB IPONotes 02 09 2022 648Document21 pagesEdgeReport TMB IPONotes 02 09 2022 648vishal3152No ratings yet

- Travel ExpenseDocument1 pageTravel Expenseavinash chaudharyNo ratings yet

- Fsez at A GlanceDocument22 pagesFsez at A GlanceQaz TopazNo ratings yet

- Digi-Flat: For Investing / Rental YieldDocument8 pagesDigi-Flat: For Investing / Rental Yieldshoba vNo ratings yet

- Od 124266336756182000Document2 pagesOd 124266336756182000nsmankr1No ratings yet

- Bhutani CyberthumDocument14 pagesBhutani CyberthumJagdeep ChawlaNo ratings yet

- Reliance Industries Limited PVC Business Group: Page 1 of 13Document13 pagesReliance Industries Limited PVC Business Group: Page 1 of 13Akshat JainNo ratings yet

- 2.5 BHK 1065 SQFT CodDocument26 pages2.5 BHK 1065 SQFT CodGaurav RaghuvanshiNo ratings yet

- Make This My Homepage Advertise With UsDocument11 pagesMake This My Homepage Advertise With UsRaj DeepNo ratings yet

- Pakistan Railways: Tender NoticeDocument56 pagesPakistan Railways: Tender Noticezeeshan tanveerNo ratings yet

- TG Rental Structure - 13-Jun-2021Document2 pagesTG Rental Structure - 13-Jun-2021tanveerwajidNo ratings yet

- UBL Car Loan Calculator (Repayment Schedule) (2) Updated New Calculation SheetDocument1 pageUBL Car Loan Calculator (Repayment Schedule) (2) Updated New Calculation SheetBatista FirangiNo ratings yet

- New Landscapes EstimatesDocument13 pagesNew Landscapes EstimatesMathew YoyakkyNo ratings yet

- PriceList - Dasnac Burj Noida - 99acresDocument2 pagesPriceList - Dasnac Burj Noida - 99acresShraine DakotaNo ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- NLRC Citizen's CharterDocument151 pagesNLRC Citizen's CharterIsabel HigginsNo ratings yet

- Horizon Real EstateDocument72 pagesHorizon Real EstateShobhit GoswamiNo ratings yet

- Transfer of SharesDocument12 pagesTransfer of SharesromaNo ratings yet

- Deed of Absolute SaleDocument10 pagesDeed of Absolute SaleKim Dela CruzNo ratings yet

- UK TaxDocument8 pagesUK TaxAvinash sncsNo ratings yet

- Vikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaDocument9 pagesVikki Mae J. Amorio Business Organization Ii BL5-3 Year Atty. Therese Xyza Gemelo - AbarcaVikki AmorioNo ratings yet

- Housing Society Matters - Volume - I - Issue No. 11 - 16.07.2014 To 31.07.2014Document12 pagesHousing Society Matters - Volume - I - Issue No. 11 - 16.07.2014 To 31.07.2014chandrapcnath100% (1)

- FormDocument5 pagesFormDeepa BhatiaNo ratings yet

- Chapter 10 RPGTDocument24 pagesChapter 10 RPGTdiyana farhanaNo ratings yet

- Stamp Duty BookDocument18 pagesStamp Duty BookGeetika Anand100% (2)

- National Conference Organized by ICAI - Cell Tower Radiation HazardsDocument290 pagesNational Conference Organized by ICAI - Cell Tower Radiation HazardsNeha KumarNo ratings yet

- Professional Practice - Unit 6.3 - Sale DeedDocument10 pagesProfessional Practice - Unit 6.3 - Sale DeedShraddha 08No ratings yet

- Full CatalogueDocument128 pagesFull Cataloguemohammed naveedNo ratings yet

- Bangalore Property Buying ChecklistDocument42 pagesBangalore Property Buying ChecklistSudhakar GanjikuntaNo ratings yet

- Section 123 of The NIRC Now Reads AsDocument3 pagesSection 123 of The NIRC Now Reads AsReianne ChavezNo ratings yet

- Chimaeze Franklin Udochukwu: Customer StatementDocument8 pagesChimaeze Franklin Udochukwu: Customer StatementfrankNo ratings yet

- Sec. 17 - Documents Whose Registration Is CompulsoryDocument5 pagesSec. 17 - Documents Whose Registration Is CompulsoryKamruz ZamanNo ratings yet

- NigeriaDocument5 pagesNigeriamayorladNo ratings yet

- Deed of Cancellation of Contract of SaleDocument3 pagesDeed of Cancellation of Contract of SaleD.F. de Lira0% (1)

- Master NotesDocument270 pagesMaster NotesdavidcleeNo ratings yet

- The Co-Operative Societies Act, 1912Document13 pagesThe Co-Operative Societies Act, 1912RishabhMishraNo ratings yet

- Stamp DutiesDocument14 pagesStamp Dutiessparsh9634100% (4)

- Cir VS Manila BankersDocument1 pageCir VS Manila BankersAnny YanongNo ratings yet

- Tax 2 Prefinals FinalDocument45 pagesTax 2 Prefinals FinalHanna Mae MataNo ratings yet

- Tripartite Agreement FormatDocument7 pagesTripartite Agreement Formataquaankit67% (3)

- Law of ConveyancingDocument36 pagesLaw of ConveyancingPutri ArpandiNo ratings yet

- Stamp DutyDocument4 pagesStamp DutyMuhammad Irfan Riaz75% (4)

- NIRC Outline With SectionsDocument16 pagesNIRC Outline With SectionstakyousNo ratings yet

- DLF Samavana Kasauli PlotsDocument34 pagesDLF Samavana Kasauli PlotsMani GoalNo ratings yet

- INCOME TAX Ready Reckoner - by CA HARSHIL SHETHDocument38 pagesINCOME TAX Ready Reckoner - by CA HARSHIL SHETHCA Harshil ShethNo ratings yet