Professional Documents

Culture Documents

Untitled

Uploaded by

shrikrushna javanjalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

shrikrushna javanjalCopyright:

Available Formats

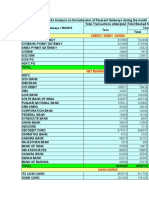

Appendices

Appendices

Appendix I

List of Public and Private Sector Banks of the Basis of Total Assets (as on 31st March 2011)

Total Assets Total Assets

Public Sector Banks Private Sector Banks

(in millions) (in millions)

State Bank of India (SBI) 12237360 ICICI Bank Ltd. 4062340

Punjab National Bank 3783250 HDFC Bank Ltd. 2773530

Bank of Baroda 3583970 Axis Bank Ltd. 2427130

Bank of India 3511730 YES Bank 590070

Canara Bank 3360790 The Federal Bank Ltd. 514560

IDBI Ltd. 2533770 Kotak Mahindra Bank Ltd. 508510

Union Bank of India 2359840 The Jammu & Kashmir Bank Ltd. 505080

Central Bank of India 2097570 Indusind Bank Ltd. 456360

Indian Overseas Bank 1787840 ING Vysya Bank Ltd. 390140

UCO Bank 1633980 The South Indian Bank Ltd. 328200

Oriental Bank of Commerce 1613430 The Karnataka Bank Ltd. 316930

Syndicate Bank 1565390 The Karur Vysya Bank Ltd. 282250

Allahabad Bank 1512860 Tamilnad Mercantile Bank Ltd. 161170

Corporation Bank 1435090 City Union Bank Ltd. 145920

Indian Bank 1217180 The Dhanalakshmi Bank Ltd. 142680

Andhra Bank 1089010 The Lakshmi Vilas Bank Ltd. 133010

Faculty of Management Sciences and Liberal Arts 149

Appendices

State Bank of Hyderabad 1066980 The Catholic Syrian Bank Ltd. 98290

United Bank of India 900410 Development Credit Bank Ltd. 73720

Vijaya Bank 816910 Nainital Bank Ltd. 32920

Bank of Maharashtra 764420 The Ratnakar Bank Ltd. 32300

Dena Bank 708380 SBI Commercial & International Bank Ltd. * 6650

Punjab & Sind Bank 685500 The Bank of Rajasthan Ltd. ** 0

State Bank of Patiala 812860

State Bank of Travancore 709770

State Bank of Bikaner & Jaipur 629540

State Bank of Mysore 520320

State Bank of Indore* 0

Faculty of Management Sciences and Liberal Arts 150

Appendices

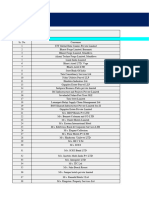

Appendix II

Total Number of Bank Branches and ATMs

Number of Branches Number of ATMs

Year Bank Semi- Metro

Urba

Group Rural Urba Polita Total Onsite Offsite Total

n

n n

Public 18221 11163 9505 9127 48,016 6722 6262 12,984

2006

Private 1033 1769 1910 1804 6,516 3309 4350 7,659

Public 18112 11728 10168 9658 49,666 10289 6040 16,329

2007

Private 985 2064 2118 1936 7,103 4258 5541 9,799

Public 18526 12685 11260 10418 52,889 12902 8886 21,788

2008

Private 1031 2368 2417 2159 7,975 5315 6652 11,967

Public 18995 13600 12165 11188 55,948 17379 9898 27,277

2009

Private 1113 2638 2715 2411 8,877 6996 8324 15,320

Public 19567 14595 12920 11743 58,825 23797 16883 40,680

2010

Private 1201 3037 3027 2762 10,027 8603 9844 18,447

Public 20387 15978 13569 12277 62,211 29795 19692 49,487

2011

Private 1311 3814 3315 3162 11,602 10648 13003 23,651

Public 22188 17773 14248 13257 67,466 34012 24181 58,193

2012

Private 1581 4687 3569 3615 13,452 13249 22830 36,079

Public 24124 19554 15080 13903 72,661 40241 29411 69,652

2013

Private 2361 5445 3882 3881 15,569 15236 27865 43,101

Public 27427 21876 16343 14770 80,416 65920 44504 110,424

2014

Private 3725 5948 4148 4213 18,034 17199 31268 48,467

Public 29547 23490 17421 15504 85,962 69902 58909 128,811

2015

Private 4270 6447 4530 4728 19,975 18897 32593 51,490

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 151

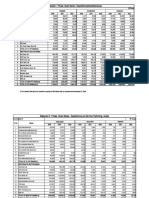

Appendices

Appendix III

ATMs per Ten Thousand Saving Accounts

Public Banks Private Banks

Savings Savings

Year Total ATMs/10000 Total ATMs/10000

Accounts Accounts

ATMs Saving A/Cs ATMs Saving A/Cs

(in 0000') (in 0000')

2006

26,162 12,608 0.48 3,201 7,659 2.39

2007

28,364 16,329 0.58 3,454 9,799 2.84

2008

32,041 21,788 0.68 4,346 11,967 2.75

2009

36,600 27,277 0.75 4,758 15,320 3.22

2010

42,012 40,680 0.97 5,100 18,447 3.62

2011

47,038 49,487 1.05 5,784 23,651 4.09

2012

52,103 58,193 1.12 7,734 36,079 4.67

2013

61,184 69,652 1.14 9,356 43,101 4.61

2014

73,480 110,424 1.50 10,751 48,467 4.51

2015

88,389 128,811 1.46 12,057 51,490 4.27

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 152

Appendices

Appendix IV

Region Wise Percentage of ATM per 10000 Savings Accounts

Rural Semi-Urban Urban Metropolitan

Bank

Year

Group Accounts ATMs % Accounts ATMs % Accounts ATMs % Accounts ATMs %

Public

Banks 11,708 4289 37 12,030 10968 91 8,788 13451 153 9,486 11972 126

2010

Private

Banks 442 901 204 1,129 3499 310 1,572 6124 390 1,956 7923 405

Public

Banks 13,747 5872 43 13,874 13278 96 9,944 16186 163 9,473 14151 149

2011

Private

Banks 518 1262 244 1,353 4784 354 1,760 7576 431 2,153 10029 466

Public

Banks 16,037 6673 42 15,803 15135 96 10,568 19213 182 9,696 17172 177

2012

Private

Banks 625 1937 310 1,683 7520 447 1,955 11525 590 3,471 15097 435

Public

Banks 19,472 8552 44 19,177 18445 96 11,862 22518 190 10,673 20137 189

2013

Private

Banks 773 2982 386 2,046 9244 452 2,258 13349 591 4,280 17526 410

Public

Banks 30,186 27401 91 28,464 36481 128 16,115 36139 224 13,625 28644 210

2015

Private

Banks 1,276 4219 331 2,726 11698 429 3,010 14768 491 5,046 20805 412

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 153

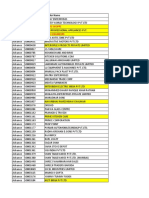

Appendices

Appendix V

Average Transactions per Debit Card

Public Sector Banks Private Sector Banks

% No. of Total % No. of Total

No .of Average No .of Average

Transactions Transactions Transactions Transactions

Year outstanding Transaction outstanding Transaction

at at at ATM & at at at ATM &

cards Per Card cards Per Card

ATMs POS POS ATMs POS POS

2012 214589999 96 4 3776451135 18 59888110 89 11 1534319261 26

2013 260557307 95 5 4166944277 16 67294457 85 15 1506438311 22

2014 315974308 94 6 4934319617 16 75209210 83 17 1665002217 22

2015 459626728 93 7 5892793327 13 90787177 80 20 1801829494 20

2016 548501376 91 9 7069380453 13 110279190 75 25 2061247765 19

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 154

Appendices

Appendix VI

Percentage of Debit Cards Issued

Saving Accounts Debit Cards No. of Debit Cards

Years

Public Banks Private Banks Public Banks Private Banks Public Private

2012 521030851 77337286 214589999 59888110 41 77

2013 611840899 93559492 260557307 67294457 43 72

2014 734800214 107505915 315974308 75209210 43 70

2015 883891585 120572232 459626728 90787177 52 75

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 155

Appendices

Appendix VII

Average Number of Savings Accounts per Branch

Rural Semi-Urban Urban Metropolitan

Year No. of No. of No. of No. of

Public Private Public Private Public Private Public Private

Accounts Accounts Accounts Accounts

2006 6639 56 44 10419 61 39 11274 57 43 13688 50 50

2007 7047 58 42 10380 65 35 11270 57 43 13872 48 52

2008 7830 59 41 10991 65 35 12167 54 46 14871 46 54

2009 8880 61 39 11795 66 34 12214 56 44 14618 48 52

2010 9665 62 38 11961 69 31 11996 57 43 15159 53 47

2011 10696 63 37 12231 71 29 12636 58 42 14525 53 47

2012 11178 65 35 12483 71 29 12894 58 42 16915 43 57

2013 11345 71 29 13564 72 28 13682 57 43 18704 41 59

2014 11554 77 23 14713 73 27 14856 56 44 19198 42 58

2015 13206 77 23 16345 74 26 15894 58 42 19460 45 55

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 156

Appendices

Appendix VIII

Sector Wise Non-Performing Assets of Public Sector Banks

Public Private

Non-Priority Non-Priority

Priority Sector Public Priority Sector Public

Years Amount Amount Amount Amount Amount Amount

(in % to (in % to (in % to (in % to (in % to (in % to

millions) Total millions) Total millions) Total millions) Total millions) Total millions) Total

2006 223737 54.1 186640 45.1 3405 0.8 22840 29.2 55414 70.8 40.2 0.1

2007 229536 59.5 151580 39.3 4902 1.3 28842 31.2 63525 68.8 27.9 0.0

2008 252867 63.6 141631 35.6 2987 0.8 34185 26.3 95575 73.7 0.1

2009 243180 55.2 192510 43.7 4740 1.1 36400 21.6 131720 78.0 750.0 0.4

2010 308480 53.8 259290 45.3 5240 0.9 47920 27.6 125920 72.4 0.0

2011 412450 58.1 298030 41.9 2780 0.4 48230 26.8 131470 73.2 1530.0 0.8

2012 562000 50.0 593000 50.0 3200 2.9 51000 27.9 132000 72.1 0.0 0.0

2013 669000 42.9 890000 57.1 52000 26.0 148000 74.0 0.0

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 157

Appendices

Appendix IX

NPAs of Scheduled Commercial Banks Recovered through Various Channels

No. of Amount Amount % of

Recovery

Years cases involved (in recovered* Amount

Channles

referred millions) (in millions) Recovered

Lok Adalats 268090 2144000 265000 12.36

2005-06 DRTs 3534 6273000 4735000 75.48

SARFAESI 41180 8517000 3363000 39.49

Lok Adalats 548308 4023000 96000 2.39

2008-09 DRTs 2004 4130000 3348000 81.07

SARFAESI 61760 12067000 3982000 33.00

Lok Adalats 476073 1700000 200000 11.76

2011-12 DRTs 13365 24100000 4100000 17.01

SARFAESI 140991 35300000 10100000 28.61

Lok Adalats 9131199 88700000 4300000 4.85

2014-15 DRTs 171113 378900000 53100000 14.01

SARFAESI 1241086 470500000 115200000 24.48

Source: RBI, various issues

Faculty of Management Sciences and Liberal Arts 158

Appendices

Appendix X

Questionnaire on Customer Satisfaction

Objective: Data are collected for research work and other than this has no other

purpose. The Information collected from respondents would be kept

confidential.

1. Name__________________________________

2. Age : 21 & Below 22 – 25 26 – 29 30 – 33 34 &

Above

3. Gender: Male Female

4. Educational Qualification:

Below 10th 10th 10+2 Graduate Post Graduate Nil

Others NIL If others, Specify________

5. Occupation:

Salaried Student Self Employed Professional

Others If others, Specify______________________________

6. Annual Income (optional):

Upto ` 50000 50001 - Rs. 100000 ` 100001 - Rs. 150000 `

150001 – 200000 above 200001

7. Address/Place of Residence:

Urban Semi Urban Rural

8. Name of your Bank:_______________________________________

Please rate the following with respect to your experience with your bank:

Strongly

Strongly Agree Agree Neutral Disagree

Disagree

SA A N D SD

Sno Statements SA A N D SD

Effectiveness

1 Courteous and friendly employee behavior

2 Recognition as a valued customer

3 Maintenance of customer confidentiality

4 Fast and efficient services

5 Trained and knowledgeable bank personnel

Faculty of Management Sciences and Liberal Arts 159

Appendices

6 Bank’s reputation

7 Feeling of security in bank transactions

Access

8 Availability of sufficient number of ATMs

9 User friendly internet and mobile banking facility

10 Short waiting time at the counter

11 Wide bank branch network

12 Adequate customer services & support of the bank

Cost

13 Transparency in fees and other charges

14 Bank’s timely refund facility

Bank has adequate Processing Charges for using the

15

services

Tangibles

Easy access to account statements and various

16

information

17 Clean, pleasant and attractive décor

18 Well dressed and neat appearing employees

19 Equipped with modern technology

Reliability

20 Identifies and correction of errors in service delivery

21 Sincere interest taken by staff in solving the problems

Empathy

22 Convenient operating hours

23 Personal attention paid to customers

24 Consideration to specific needs

25 Effective complaint handling

Overall Satisfaction

26 Say positive things about the bank to other people

Intend to continue being a customer of the bank for a

27

long time to come

Encourage friends and relatives to use the service

28

offered by the bank

Suggestions if any:

___________________________________________________________________

Faculty of Management Sciences and Liberal Arts 160

You might also like

- JCB 3CX - 4CX - 214 - 214e - 215 - 217-1Document25 pagesJCB 3CX - 4CX - 214 - 214e - 215 - 217-1lahcen boudaoud100% (6)

- Luxury Customer ProfilingDocument16 pagesLuxury Customer ProfilingIndrani Pan100% (1)

- Young and BeautifulDocument8 pagesYoung and BeautifulDiana AdrianaNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesGyanendra AgrawalNo ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/Advancesprakasht_1No ratings yet

- Statement I: Private Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Private Sector Banks: Deposits/Investments/AdvancesanandbhawanaNo ratings yet

- Statement I: Public Sector Banks: Deposits/Investments/AdvancesDocument8 pagesStatement I: Public Sector Banks: Deposits/Investments/AdvancesNirmal SinghNo ratings yet

- ATM & Card Statistics For March 2018 POS AtmsDocument6 pagesATM & Card Statistics For March 2018 POS AtmsMathews KunnekkadanNo ratings yet

- Annexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020Document2 pagesAnnexure-I Regionwise Deployment of Atms For The Quarter Ended March 2020JNR ENTERPRISESNo ratings yet

- Appendix: Table 8.1: Non Performing Assets of Different BanksDocument8 pagesAppendix: Table 8.1: Non Performing Assets of Different Banksshreeya salunkeNo ratings yet

- Irctc 1Document2 pagesIrctc 1adityachak20No ratings yet

- Icici Feb 20Document266 pagesIcici Feb 20Ram ChiyeduNo ratings yet

- Advances Public & Private Sector BanksDocument1 pageAdvances Public & Private Sector BanksPankaj MaryeNo ratings yet

- SBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbDocument11 pagesSBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbamarmuz16No ratings yet

- EquityDocument277 pagesEquityhidulfiNo ratings yet

- Economics - Demand ForecastingDocument23 pagesEconomics - Demand ForecastingKLN CHUNo ratings yet

- Samples DetailsDocument4 pagesSamples Detailsswaroop shettyNo ratings yet

- Data Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)Document13 pagesData Analysis: Pradhan Mantri Jan-Dhan Yojana (Pmjdy)vivek adkineNo ratings yet

- DSP Equity Opportunities FundDocument8 pagesDSP Equity Opportunities FundswaypnilshandilyaNo ratings yet

- Mirae Asset Full Portfolio January 2020Document69 pagesMirae Asset Full Portfolio January 2020brijsingNo ratings yet

- Sbi Mutual Fund: Scheme Name: Portfolio Statement As OnDocument9 pagesSbi Mutual Fund: Scheme Name: Portfolio Statement As OnNithin K ReethanNo ratings yet

- Company Overview MMMDocument2 pagesCompany Overview MMMkrishna370sharmaNo ratings yet

- Chapter 4Document31 pagesChapter 4koushik kumarNo ratings yet

- Demand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameDocument12 pagesDemand Forecasting - Economics Exam Date: 08/05/2022 Roll No. Student NameAakash WaliaNo ratings yet

- 1 Monthly Portfolio Jun 18Document122 pages1 Monthly Portfolio Jun 18Jennifer NievesNo ratings yet

- CPOFDocument28 pagesCPOFhidulfiNo ratings yet

- IRCTC Online Transaction April 2010Document4 pagesIRCTC Online Transaction April 2010DesidhunNo ratings yet

- Sbi Contra Fund Portfolio (January-2022!12!1)Document12 pagesSbi Contra Fund Portfolio (January-2022!12!1)CgggvvgvvNo ratings yet

- Monthly Portfolio Aug 18Document126 pagesMonthly Portfolio Aug 18Jennifer NievesNo ratings yet

- Canara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Document6 pagesCanara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Omprakash Yadav KedarNo ratings yet

- Sbi Blue Chip Fund Portfolio (November-2020-43-1)Document9 pagesSbi Blue Chip Fund Portfolio (November-2020-43-1)swapnil solankiNo ratings yet

- Sbi Small Cap Fund Portfolio (November-2022-329-1)Document11 pagesSbi Small Cap Fund Portfolio (November-2022-329-1)Shivam PorwalNo ratings yet

- Portfolio Statement of Edelweiss Balanced Advantage Fund As On December 31, 2021 (An Open Ended Dynamic Asset Allocation Fund)Document23 pagesPortfolio Statement of Edelweiss Balanced Advantage Fund As On December 31, 2021 (An Open Ended Dynamic Asset Allocation Fund)K ThomasNo ratings yet

- MaharashtraDocument14 pagesMaharashtraParas SachanNo ratings yet

- Atm, Acceptance Infrastructure and Card Statistics For The Month February 2022 Atms Pos Micro Atms On-Site Off-Site On-Line Off-LineDocument6 pagesAtm, Acceptance Infrastructure and Card Statistics For The Month February 2022 Atms Pos Micro Atms On-Site Off-Site On-Line Off-LineMathews KunnekkadanNo ratings yet

- Estimated RateDocument10 pagesEstimated Rateashok omegaNo ratings yet

- January 2018Document119 pagesJanuary 2018Jennifer NievesNo ratings yet

- TB6 STST1118Document3 pagesTB6 STST1118rajsirwaniNo ratings yet

- Portfolio As On Aug 31,2020Document12 pagesPortfolio As On Aug 31,2020Krishna KusumaNo ratings yet

- Share MarketDocument39 pagesShare Marketrajupatel10No ratings yet

- Sbi Blue Chip Fund June 2023Document9 pagesSbi Blue Chip Fund June 2023varipe1667No ratings yet

- DCB Feb 2024Document2 pagesDCB Feb 2024poojasri.in36No ratings yet

- Private Sector Banks 2020-22Document8 pagesPrivate Sector Banks 2020-22Sidharth Sankar RathNo ratings yet

- SBI-MultiCap-Fund 2Document9 pagesSBI-MultiCap-Fund 2garvitaneja477No ratings yet

- PVT Sec BKS 2012 14Document32,767 pagesPVT Sec BKS 2012 14Shital AndhariaNo ratings yet

- LM 1753Document11 pagesLM 1753Jahangir ChohanNo ratings yet

- 51 Acp-March2015Document3 pages51 Acp-March2015Projects ScholarsDenNo ratings yet

- Desert Public Sec SinglDocument49 pagesDesert Public Sec SinglPankaj KumarNo ratings yet

- Determinants of Profitability of Banks in India: A Multivariate AnalysisDocument19 pagesDeterminants of Profitability of Banks in India: A Multivariate AnalysisNeelNo ratings yet

- Base RatesDocument8 pagesBase Ratesaditya_pandya_4No ratings yet

- SBI Conservative Hybrid Fund42f20d97 389d 4950 9e47 A534fcf06917Document14 pagesSBI Conservative Hybrid Fund42f20d97 389d 4950 9e47 A534fcf06917swaminathan sureshNo ratings yet

- Mirae Asset Full Portfolio - March 2020Document68 pagesMirae Asset Full Portfolio - March 2020KarlosNo ratings yet

- Canara Robeco Infrastructure: Monthly Portfolio Statement As On December 31, 2018Document70 pagesCanara Robeco Infrastructure: Monthly Portfolio Statement As On December 31, 2018navuru5kNo ratings yet

- Mirae Asset Monthly Full Portfolio August 2019Document61 pagesMirae Asset Monthly Full Portfolio August 2019sunnyramidiNo ratings yet

- 1.banking Network SummaryDocument2 pages1.banking Network SummaryPHANI MADHAV MARKUNDANo ratings yet

- AppendicesDocument105 pagesAppendicesshani807No ratings yet

- Mirae Asset Full Portfolio-January2019Document54 pagesMirae Asset Full Portfolio-January2019Richa BhargavaNo ratings yet

- Advance Payment LastDocument12 pagesAdvance Payment LastSunil PatelNo ratings yet

- Mirae Asset Monthly Full Portfolio January 2021Document86 pagesMirae Asset Monthly Full Portfolio January 2021Ram hereNo ratings yet

- Canara Robeco Elss Tax Saver: Monthly Portfolio Statement As On March 31, 2024Document14 pagesCanara Robeco Elss Tax Saver: Monthly Portfolio Statement As On March 31, 2024ptus nayakNo ratings yet

- Investment ReviewDocument4 pagesInvestment Reviewinfoassets4indiaNo ratings yet

- Figures As On Mar 31,2019: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsDocument12 pagesFigures As On Mar 31,2019: Company/Issuer/Instrument Name Isin Equity & Equity Related InstrumentsJennifer NievesNo ratings yet

- Small Money Big Impact: Fighting Poverty with MicrofinanceFrom EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNo ratings yet

- Summary and ConclusionsDocument19 pagesSummary and Conclusionsshrikrushna javanjalNo ratings yet

- BibliographyDocument14 pagesBibliographyshrikrushna javanjalNo ratings yet

- Research MethodologyDocument6 pagesResearch Methodologyshrikrushna javanjal100% (1)

- Results and DiscussionDocument51 pagesResults and Discussionshrikrushna javanjalNo ratings yet

- 07 AcknowledgementDocument2 pages07 Acknowledgementshrikrushna javanjalNo ratings yet

- 08 AbbriviationDocument3 pages08 Abbriviationshrikrushna javanjalNo ratings yet

- UntitledDocument2 pagesUntitledshrikrushna javanjalNo ratings yet

- 09 List of TableDocument3 pages09 List of Tableshrikrushna javanjalNo ratings yet

- 01 Front PagesDocument1 page01 Front Pagesshrikrushna javanjalNo ratings yet

- Chapter 1 IntroductionDocument10 pagesChapter 1 Introductionshrikrushna javanjalNo ratings yet

- Final Sip - SuyashDocument37 pagesFinal Sip - Suyashshrikrushna javanjalNo ratings yet

- SIP OF INVENTORY MANAGEMET (1) Pradeep PDocument48 pagesSIP OF INVENTORY MANAGEMET (1) Pradeep Pshrikrushna javanjalNo ratings yet

- Rushikesh ProjectDocument45 pagesRushikesh Projectshrikrushna javanjalNo ratings yet

- "To Study of Inventory Management With Referance To Bajaj Auto LTD, Nigdi, PuneDocument17 pages"To Study of Inventory Management With Referance To Bajaj Auto LTD, Nigdi, Puneshrikrushna javanjalNo ratings yet

- Resume Dhananjay DevaleDocument2 pagesResume Dhananjay Devaleshrikrushna javanjalNo ratings yet

- Final SIP Project LOKESHDocument46 pagesFinal SIP Project LOKESHshrikrushna javanjalNo ratings yet

- Certificate: Yamunanagar, Nigdi, Pune Has Completed His Internship at Our HDB Financial Services LTD at PuneDocument1 pageCertificate: Yamunanagar, Nigdi, Pune Has Completed His Internship at Our HDB Financial Services LTD at Puneshrikrushna javanjalNo ratings yet

- What Is IELTS?Document6 pagesWhat Is IELTS?ANGLISHTNo ratings yet

- Heat Gun ManualDocument15 pagesHeat Gun Manualcharles blairNo ratings yet

- Class V Maths Annual 2017 18Document9 pagesClass V Maths Annual 2017 18Pravat TiadiNo ratings yet

- Mid-Term Test Part 1: Listening: Time Allowance: 90 MinsDocument4 pagesMid-Term Test Part 1: Listening: Time Allowance: 90 MinsThu Lan HàNo ratings yet

- High Court of KeralaDocument4 pagesHigh Court of KeralaNidheesh TpNo ratings yet

- Asn To BWNDocument7 pagesAsn To BWNuwzennrheemlpro.comNo ratings yet

- Thi Giua Ki 2Document2 pagesThi Giua Ki 2Trang nguyenNo ratings yet

- 2020 TassapDocument4 pages2020 Tassapzhouh1998100% (1)

- Inalcik Za OdrinDocument11 pagesInalcik Za OdrinIvan StojanovNo ratings yet

- IO FormativeDocument3 pagesIO Formativenb6tckkscvNo ratings yet

- H. Muhammed Ka Parichay (Kannada)Document96 pagesH. Muhammed Ka Parichay (Kannada)Q.S.KhanNo ratings yet

- Questionnaire Survey About Life Quality of Students in Can Tho CityDocument6 pagesQuestionnaire Survey About Life Quality of Students in Can Tho CityTrọng TrầnNo ratings yet

- Interdisciplinary Research Process and Theory 3rd Edition Repko Test BankDocument3 pagesInterdisciplinary Research Process and Theory 3rd Edition Repko Test BankMichaelFloresjidbc100% (16)

- Food Groups and What They DoDocument26 pagesFood Groups and What They DoCesar FloresNo ratings yet

- Railway StoresDocument3 pagesRailway Storesshiva_gulaniaNo ratings yet

- Knowledge For You (Knowledge4u.org) Magazine Volume 1 Issue 1Document4 pagesKnowledge For You (Knowledge4u.org) Magazine Volume 1 Issue 1Brîndușa PetruțescuNo ratings yet

- Flowmix 3000VDocument2 pagesFlowmix 3000VĐỗ Văn KhiêmNo ratings yet

- Motivation and Learning - 31032019Document17 pagesMotivation and Learning - 31032019kumar6125100% (1)

- Socio Cultural Factors Influencing Child Nutrition Among Mothers in Calabar Municipality Cross River State NigeriaDocument34 pagesSocio Cultural Factors Influencing Child Nutrition Among Mothers in Calabar Municipality Cross River State NigeriaTAJUDEEN AZEEZNo ratings yet

- Abhishek Panchal: Work ExperienceDocument3 pagesAbhishek Panchal: Work ExperienceNitin MahawarNo ratings yet

- Als Assessment Form 1 Individual Learning Agreement: Department of EducationDocument9 pagesAls Assessment Form 1 Individual Learning Agreement: Department of EducationRitchie ModestoNo ratings yet

- VS VS: Duelo de TitanesDocument4 pagesVS VS: Duelo de TitanesArgenis LugoNo ratings yet

- A Review of Prime Hydration - The UproarDocument3 pagesA Review of Prime Hydration - The UproarDANIEL STEPHANO TERAN VEGA0% (1)

- Ester An IntroductionDocument22 pagesEster An IntroductionAnandNo ratings yet

- Improve Web-UI PerformanceDocument4 pagesImprove Web-UI Performancekenguva_tirupatiNo ratings yet

- Marcel and The White Star 1Document12 pagesMarcel and The White Star 1Ali Hamidi100% (1)

- The Myth of The Indian Middle Class TEXTDocument2 pagesThe Myth of The Indian Middle Class TEXTSumaiya Shaheedha AnvarNo ratings yet