Professional Documents

Culture Documents

Assignment 5 Decision Tree

Uploaded by

Felicity Lumapas0 ratings0% found this document useful (0 votes)

38 views1 pageThe document contains an assignment to verify the profit projections on a decision tree for a project by Dante. It shows the calculations to get profits of $2,650,000 and $650,000 at the end branches. The optimal strategy for Dante is to take the expected value at each node, which is $2,350,000. The market research cost would need to decrease by at least $130,000 for Dante to change its decision. A risk profile for Dante's strategies is provided showing payoffs and probabilities.

Original Description:

Mansci

Original Title

Assignment-5-Decision-Tree

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains an assignment to verify the profit projections on a decision tree for a project by Dante. It shows the calculations to get profits of $2,650,000 and $650,000 at the end branches. The optimal strategy for Dante is to take the expected value at each node, which is $2,350,000. The market research cost would need to decrease by at least $130,000 for Dante to change its decision. A risk profile for Dante's strategies is provided showing payoffs and probabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views1 pageAssignment 5 Decision Tree

Uploaded by

Felicity LumapasThe document contains an assignment to verify the profit projections on a decision tree for a project by Dante. It shows the calculations to get profits of $2,650,000 and $650,000 at the end branches. The optimal strategy for Dante is to take the expected value at each node, which is $2,350,000. The market research cost would need to decrease by at least $130,000 for Dante to change its decision. A risk profile for Dante's strategies is provided showing payoffs and probabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Name: Sarah Gywneth T.

Sarmiento Management Science

Mr. Rene Argenal

Assignment # 5: Decision Tree

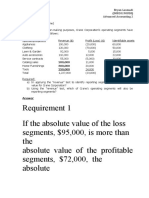

a. Verify Dante’s profit projections shown at the ending branches of the decision tree by calculating

the payoffs of $2,650,000 and $650,000 for the first two incomes.

For the 1st outcome: For the 2nd outcome:

Bid: 200,000 Bid: 200,000

Win Contract: 2,000,000 Win Contract: 2,000,000

Market Research: 150,000 Market Research: 150,000

High Demand: 5,000,000 High Demand: 3,000,000

=5,000,000- =3,000,000-

(200,000+2,000,000+150,000) (200,000+2,000,000+150,000)

=$2,650,000 =$650,000

b. What is the type of optimal decision strategy for Dante, and what is the expected profit for this

project?

Expected Value at nodes:

2: 0.8 (2000) + 0.2 (200) = 1,560

4: 0.6 (2350) + 0.4 (1150) = 1,870

8: 0.85 (2650) + 0.775 (650) = 2,350

9: 0.225 (2650) + 0.775 (650) = 1,100

10: 0.60 (2800) + 0.4 (800) = 2,000

c. What would the cost of the market research study have to be before Dante would change its

decision about the market research study?

Cost would have to decrease from at least $130,000

d. Develop a risk profile for Dante.

Strategies Payoff Probability

Bid, Lose Contract -200 0.20

Win Contract, build complex, 800 0.32

no market research (moderate

demand)

Win Contract, build complex, 2,800 0.48

no market research (high

demand)

You might also like

- Cake - Extra - James - SukreeDocument72 pagesCake - Extra - James - SukreeAkshay SinghNo ratings yet

- Quiz Adv2 - Bryan LesmadiDocument9 pagesQuiz Adv2 - Bryan LesmadiBryan LesmadiNo ratings yet

- Aep32 Prelim Exam AnswerDocument4 pagesAep32 Prelim Exam AnswerTan ToyNo ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- SOLUTION - Steeley Associates Versus Concord FallsDocument6 pagesSOLUTION - Steeley Associates Versus Concord Fallscarenski50% (2)

- Steeley Associates Versus Concord Falls: (1) Request The PermitDocument6 pagesSteeley Associates Versus Concord Falls: (1) Request The PermitRoxanne Jabe BatomalaqueNo ratings yet

- Soal: Case of Decision Tree ApplicationDocument4 pagesSoal: Case of Decision Tree ApplicationHeruBudiPriantoNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Ass. Chapter 11 Shareholders Equity (Part 2)Document12 pagesAss. Chapter 11 Shareholders Equity (Part 2)Jea Ann CariñozaNo ratings yet

- Goal SeekDocument7 pagesGoal SeekdNo ratings yet

- Ebook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFDocument36 pagesEbook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFpearlgregoryspx100% (11)

- Canadian Income Taxation 2018 2019 21st Edition Buckwold Test BankDocument38 pagesCanadian Income Taxation 2018 2019 21st Edition Buckwold Test Banklochaphasiawdjits100% (12)

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Date Particulars: in The Books of XYZ JournalDocument38 pagesDate Particulars: in The Books of XYZ JournalAnanya ChoudharyNo ratings yet

- Analyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsDocument46 pagesAnalyzing Project Cash Flows: T 0 T 1 Through T 10 AssumptionsHana NadhifaNo ratings yet

- Solution P7Document4 pagesSolution P7Maria Sitanggang UparNo ratings yet

- Acctg233 Investment Centers and Transfer PricingDocument5 pagesAcctg233 Investment Centers and Transfer PricingNino Joycelee TuboNo ratings yet

- Canadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1Document36 pagesCanadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1aliciahollandygimjrqotk100% (22)

- BACC497 - Midterm Revision Sheet - AK - Fall 2023-2024Document8 pagesBACC497 - Midterm Revision Sheet - AK - Fall 2023-2024bill haddNo ratings yet

- Practice Assignment 1 SolutionDocument5 pagesPractice Assignment 1 SolutionJared PriceNo ratings yet

- ISOM2700 Practice Set3Document10 pagesISOM2700 Practice Set3gNo ratings yet

- Answer-Key-Chapter-5-BC DeJesusDocument15 pagesAnswer-Key-Chapter-5-BC DeJesusMerel Rose FloresNo ratings yet

- Tugas Chapter 6 - Sandra Hanania - 120110180024Document4 pagesTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNo ratings yet

- Executive Summary & Project Information Study - Salang Subdivision (Malaybalay City)Document2 pagesExecutive Summary & Project Information Study - Salang Subdivision (Malaybalay City)clinnton macaNo ratings yet

- Ass.4 PertubalDocument5 pagesAss.4 PertubalNatividad, Kered ZilyoNo ratings yet

- Solutions: Case #1:: Quiz 1Document3 pagesSolutions: Case #1:: Quiz 1Andrew wigginNo ratings yet

- Canadian Income Taxation 2017 2018 Canadian 20th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2017 2018 Canadian 20th Edition Buckwold Test Banklovellhebe2v0vn100% (31)

- Japhet S. Pasadilla Accounting For Special Transactions PROBLEM 1: Benson ConstructionDocument2 pagesJaphet S. Pasadilla Accounting For Special Transactions PROBLEM 1: Benson ConstructionpompomNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Sheet 3 Decision TreeDocument3 pagesSheet 3 Decision TreeAhmed ElmalahNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- Chapter 21Document67 pagesChapter 21Ellie Yson100% (1)

- Intermediate Accounting Chapter 9-14Document10 pagesIntermediate Accounting Chapter 9-14thea tangalinNo ratings yet

- 08 - Task - Performance - 1 - BENJAMIN 1Document4 pages08 - Task - Performance - 1 - BENJAMIN 1Justine OrdonioNo ratings yet

- UntitledDocument6 pagesUntitledSIMRAN BURMANNo ratings yet

- Acc 301 Week 5Document9 pagesAcc 301 Week 5Accounting GuyNo ratings yet

- Chapter 2Document24 pagesChapter 2Tewodros TadesseNo ratings yet

- Actual Budget: Answer: Difficulty: Objective: 7Document10 pagesActual Budget: Answer: Difficulty: Objective: 7kareem abozeedNo ratings yet

- Assignment 7Document6 pagesAssignment 7eric stevanusNo ratings yet

- Answers To Questions Answers To Exercises Exercise 1-1 Part A Normal Earnings For Similar Firms ($15,000,000 - $8,800,000) X 15% $930,000Document2 pagesAnswers To Questions Answers To Exercises Exercise 1-1 Part A Normal Earnings For Similar Firms ($15,000,000 - $8,800,000) X 15% $930,000sameerNo ratings yet

- F9 Financial Management Progress Test 1 PDFDocument3 pagesF9 Financial Management Progress Test 1 PDFCoc GamingNo ratings yet

- Hospital Suply inc-GroupC1Document5 pagesHospital Suply inc-GroupC1AnulaNo ratings yet

- Total Assets 402,000 96,000 430,800Document2 pagesTotal Assets 402,000 96,000 430,800Melwin CalubayanNo ratings yet

- Solution Cost and Management AccountingDocument7 pagesSolution Cost and Management AccountingbillNo ratings yet

- Lets Try This 4Document2 pagesLets Try This 4syramaebillones26No ratings yet

- H.W ch4q7 Acc418Document4 pagesH.W ch4q7 Acc418SARA ALKHODAIRNo ratings yet

- Average Waiting Time For An Order of Z39Document2 pagesAverage Waiting Time For An Order of Z39Elliot RichardNo ratings yet

- Module 03 Tute Que Perf Comp & OligopolyDocument4 pagesModule 03 Tute Que Perf Comp & OligopolyTrang PhamNo ratings yet

- Kena Bizuneh Damessa Individual Assignment RiskDocument8 pagesKena Bizuneh Damessa Individual Assignment Riskdagneabera13No ratings yet

- Gross Profit Variance Analysis Multi ProductDocument1 pageGross Profit Variance Analysis Multi Product1903443No ratings yet

- Name: Victo, Jose Antonio B. A-223: Exercise #1Document4 pagesName: Victo, Jose Antonio B. A-223: Exercise #1Jose AntonioNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- Information Technology Outsourcing Transactions: Process, Strategies, and ContractsFrom EverandInformation Technology Outsourcing Transactions: Process, Strategies, and ContractsNo ratings yet

- Mansci AssignmentDocument1 pageMansci AssignmentFelicity LumapasNo ratings yet

- StudentsDocument1 pageStudentsFelicity LumapasNo ratings yet

- CA Individual Task VersionDocument2 pagesCA Individual Task VersionFelicity LumapasNo ratings yet

- Notes 06 - Correlation (1) - 1593768894Document26 pagesNotes 06 - Correlation (1) - 1593768894Felicity LumapasNo ratings yet

- Marketing AssignmentDocument3 pagesMarketing AssignmentFelicity LumapasNo ratings yet

- ParCor-Answer AssignmentDocument31 pagesParCor-Answer AssignmentFelicity LumapasNo ratings yet

- UntitledDocument18 pagesUntitledFelicity LumapasNo ratings yet

- Cost Accounting Refers To The Recording of The Transaction Related To The Cost IncurredDocument3 pagesCost Accounting Refers To The Recording of The Transaction Related To The Cost IncurredFelicity LumapasNo ratings yet

- Shrinkage Is A Kind of Spoilage Which Occurred The Production Has Taken PlaceDocument1 pageShrinkage Is A Kind of Spoilage Which Occurred The Production Has Taken PlaceFelicity LumapasNo ratings yet

- UntitledDocument4 pagesUntitledFelicity LumapasNo ratings yet