Professional Documents

Culture Documents

Afar-13 Notes - Joint Arrangements

Uploaded by

Vincent Luigil AlceraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afar-13 Notes - Joint Arrangements

Uploaded by

Vincent Luigil AlceraCopyright:

Available Formats

ADVANCED FINANCIAL ACCOUNTING AND REPORTING

AFAR-13 | JOINT ARRANGEMENTS

-

- JINT ARRANGEMENT

- JOINT CONTROL

- at least two parties must have joint control; not all

- case 2 & 3

= no joint control; only collective control

→ A & B can decide w/o C, and A & C can decide w/o B (case 2)

→ may opt for joint arrangement if unanimous decision is specific among parties

- TYPES OF JOINT ARRANGEMENTS

- JO (lol)

→ has separate rights on both assets and liab.

- JV

→ requires net amount for assets and liab

- HOWTO DETERMINE (IF JO OR JV)

- “separate vehicle” = separate entity

- no separate vehicle = JO

- has a separate vehicle = either JO or JV

- ACCOUNTING FOR JOINT OPERATIONS

- w/ books = same accounting procedure for partnerships

- w/o books → TBD

- e.g.,

→ Saturday revenue = distributed to weekday assignees equally

- problem solving

note: JO account

= debited for expenses incurred

= credited for income-related transactions

- note: profit/loss should be the same in each party

- JO debit = receivable

- JO credit = payable

- problem 1 (w/o separate books)

- note: they may choose not to have entries in the formation of a joint operation

- need to monitor simultaneously

- Dec. 1

- L is liable if ever the JO won’t continue

- problem II

- problem III

- problem IV

- problem V

- problem VI

- JOINT VENTURE

- apply equity method whether investment in associate or joint venture

- problem VII

JO or Inv. in Associate won’t matter; equity method prevails

- problem VIII

Alcera, Vincent Luigil C. | BSA 4-11

16/03/2023; hope I graduate on time :’]

You might also like

- Four Bsns TypesDocument1 pageFour Bsns TypesRazel Joy De JesusNo ratings yet

- Intercorporate Investments: Transaction: 0055281182Document112 pagesIntercorporate Investments: Transaction: 0055281182Jatin SachdevaNo ratings yet

- 2020 L2 FraDocument112 pages2020 L2 FrajitrapaNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- Equity InvesetmentzDocument1 pageEquity InvesetmentzromamikhaelalouisseNo ratings yet

- AFAR-11 Intercompany Sales Fixed AssetsDocument1 pageAFAR-11 Intercompany Sales Fixed AssetsVincent Luigil AlceraNo ratings yet

- Reading 39 PDFDocument38 pagesReading 39 PDFKaramjeet SinghNo ratings yet

- IAS 21, IfRS 11, IAS 28 (For Consolidation)Document1 pageIAS 21, IfRS 11, IAS 28 (For Consolidation)dominicNo ratings yet

- 2020 L1 Fixed IncomeDocument116 pages2020 L1 Fixed Incomegulshan.rajvanshNo ratings yet

- Audit of Property, Plant, and Equipment, Wasting Assets, and Intangible AssetsDocument9 pagesAudit of Property, Plant, and Equipment, Wasting Assets, and Intangible AssetsyhygyugNo ratings yet

- Bad Debt, Inventory, DepreciationDocument2 pagesBad Debt, Inventory, Depreciationrio_harcanNo ratings yet

- Afar-14 Notes - Smes - Investments in Joint VenturesDocument1 pageAfar-14 Notes - Smes - Investments in Joint VenturesVincent Luigil AlceraNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- Solution Manual For Financial AccountingDocument4 pagesSolution Manual For Financial AccountingHang Thanh PhamNo ratings yet

- Joint ArrrangementsDocument5 pagesJoint ArrrangementsGIGI BODONo ratings yet

- Audit Finance ReportingDocument5 pagesAudit Finance ReportingIbtissam BelkaydNo ratings yet

- 2020 - L1 - Fix IncDocument116 pages2020 - L1 - Fix IncMlungisi MalazaNo ratings yet

- ABC Module 01: Business Combinations-V1Document4 pagesABC Module 01: Business Combinations-V1Robelyn GabrielNo ratings yet

- Annex III - Model Historical Financial StatementsDocument2 pagesAnnex III - Model Historical Financial StatementsING_PUICONNo ratings yet

- Class 1: Steps For Filing LawsuitDocument3 pagesClass 1: Steps For Filing LawsuitRiyaa RuwalaNo ratings yet

- JOINT ARRANGEMENTSDocument61 pagesJOINT ARRANGEMENTSsikute kamongwaNo ratings yet

- Accounting Standard On Joint Ventures AS 27Document13 pagesAccounting Standard On Joint Ventures AS 27pranavrajput190703No ratings yet

- Revision of Accounting Midterm OfficialDocument38 pagesRevision of Accounting Midterm Official23005504No ratings yet

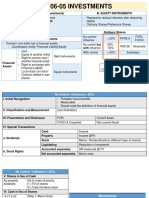

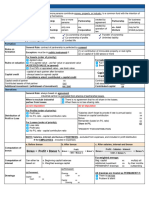

- Far 06-05 Investments PDFDocument8 pagesFar 06-05 Investments PDFZee MarvsNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (1)

- Non Current LiabilitiesDocument3 pagesNon Current LiabilitiesBryan ReyesNo ratings yet

- Corporations - OLDocument11 pagesCorporations - OLTNo ratings yet

- ACC 211 Financial Accounting 1-Ekiti AdealuDocument63 pagesACC 211 Financial Accounting 1-Ekiti AdealuShehuNo ratings yet

- FA101 PrelimsDocument11 pagesFA101 Prelimscyra6flores6verderaNo ratings yet

- Partnership Accounts OverviewDocument26 pagesPartnership Accounts OverviewZohair HumayunNo ratings yet

- Unit 5 Partnership Dissolution With LiquidationDocument7 pagesUnit 5 Partnership Dissolution With LiquidationTed MedallaNo ratings yet

- Exam 1 ReviewDocument6 pagesExam 1 Reviewamberamir152001No ratings yet

- Ch-4 Ratios TheoryDocument3 pagesCh-4 Ratios TheoryShubham PhophaliaNo ratings yet

- Black Letter Law Grid - Property Law II Study Guide - Quick Reference Law School GuideDocument1 pageBlack Letter Law Grid - Property Law II Study Guide - Quick Reference Law School GuideJJ850100% (7)

- Notes for L3Document11 pagesNotes for L3yuyin.gohyyNo ratings yet

- Security: DiscoveryDocument39 pagesSecurity: DiscoverySayan BiswasNo ratings yet

- US CMA Gleim Part 2Document258 pagesUS CMA Gleim Part 2Joy Krishna Das100% (1)

- PartnershipDocument9 pagesPartnershipSherrizah Ferrer MaribbayNo ratings yet

- PARTNERSHIPDocument6 pagesPARTNERSHIPEeuhNo ratings yet

- Agency Relationships and Principal LiabilityDocument44 pagesAgency Relationships and Principal LiabilitytomNo ratings yet

- Series 63 NotesDocument8 pagesSeries 63 Notesleo2331100% (2)

- Mat CalculaterDocument1 pageMat CalculatershriniskNo ratings yet

- Foundations in Accounting: Maintaining Financial RecordsDocument33 pagesFoundations in Accounting: Maintaining Financial RecordsKewish JhanjhanNo ratings yet

- IAS 7 Statement of Cash Flows - How To Construct Statement of Cash FlowsDocument5 pagesIAS 7 Statement of Cash Flows - How To Construct Statement of Cash FlowsReenestus DumeniNo ratings yet

- Ast Millan CH1Document2 pagesAst Millan CH1Maxine OngNo ratings yet

- General Provisions of ObligationsDocument4 pagesGeneral Provisions of ObligationsLe ZymNo ratings yet

- ECS1601-chapter 1 and 2 SummaryDocument2 pagesECS1601-chapter 1 and 2 SummarySanelisiwe Thanduxolo GasaNo ratings yet

- Chapter 1 8Document19 pagesChapter 1 8Ren AikawaNo ratings yet

- Company Financial Statement AnalysisDocument5 pagesCompany Financial Statement Analysisarbazhabibkk4No ratings yet

- Unit 13 Joint Venture Accounts: 13.0 ObjectivesDocument22 pagesUnit 13 Joint Venture Accounts: 13.0 ObjectivesChandreshNo ratings yet

- Residency StatusDocument13 pagesResidency StatusPhương NguyễnNo ratings yet

- Taxation of Partnerships and PartnersDocument121 pagesTaxation of Partnerships and PartnersEmir Salihovic100% (4)

- Partnership 1767 - 1783Document3 pagesPartnership 1767 - 1783herraENo ratings yet

- ACC200 - Group Statements Chapter 5 - Part 1Document38 pagesACC200 - Group Statements Chapter 5 - Part 1kchabalala91No ratings yet

- AFAR.PARTNERSHIPDocument3 pagesAFAR.PARTNERSHIPkenNo ratings yet

- Accounting For Joint VenturesDocument18 pagesAccounting For Joint VenturesRyan Dave AlutayaNo ratings yet

- Demand and Supply Analysis Draft 1Document1 pageDemand and Supply Analysis Draft 1Vincent Luigil AlceraNo ratings yet

- Afar-12 Notes - Foreign Currency Transactions and TranslationDocument5 pagesAfar-12 Notes - Foreign Currency Transactions and TranslationVincent Luigil AlceraNo ratings yet

- Afar-14 Notes - Smes - Investments in Joint VenturesDocument1 pageAfar-14 Notes - Smes - Investments in Joint VenturesVincent Luigil AlceraNo ratings yet

- Afar-15 Notes - Job Order CostingDocument3 pagesAfar-15 Notes - Job Order CostingVincent Luigil AlceraNo ratings yet

- ACCO 20193 Product Price ComputationDocument9 pagesACCO 20193 Product Price ComputationVincent Luigil AlceraNo ratings yet

- Beginning AssetsDocument5 pagesBeginning AssetsVincent Luigil AlceraNo ratings yet

- Main Article: Family of Dwight D. EisenhowerDocument3 pagesMain Article: Family of Dwight D. EisenhowerVincent Luigil AlceraNo ratings yet

- Politics Claro Recto 8Document3 pagesPolitics Claro Recto 8Vincent Luigil AlceraNo ratings yet

- AFAR-11 Intercompany Sales Fixed AssetsDocument1 pageAFAR-11 Intercompany Sales Fixed AssetsVincent Luigil AlceraNo ratings yet

- ACCO 20193 Feasibility Study Doables Part 2Document2 pagesACCO 20193 Feasibility Study Doables Part 2Vincent Luigil AlceraNo ratings yet

- Politics Claro Recto 4Document3 pagesPolitics Claro Recto 4Vincent Luigil AlceraNo ratings yet

- Survey DataDocument5 pagesSurvey DataVincent Luigil AlceraNo ratings yet

- Politics Claro Recto 1Document2 pagesPolitics Claro Recto 1Vincent Luigil AlceraNo ratings yet

- Politics Claro Recto 6Document3 pagesPolitics Claro Recto 6Vincent Luigil AlceraNo ratings yet

- Politics Claro Recto 5Document3 pagesPolitics Claro Recto 5Vincent Luigil AlceraNo ratings yet

- Starring Jimmy Fallon in February 2020Document2 pagesStarring Jimmy Fallon in February 2020Vincent Luigil AlceraNo ratings yet

- Sweetener Received Acclaim From Music Critics. at Metacritic, Which AssignsDocument2 pagesSweetener Received Acclaim From Music Critics. at Metacritic, Which AssignsVincent Luigil AlceraNo ratings yet

- Politics Claro Recto 3Document2 pagesPolitics Claro Recto 3Vincent Luigil AlceraNo ratings yet

- Artistry and Influences of Doja CatDocument2 pagesArtistry and Influences of Doja CatVincent Luigil Alcera100% (1)

- Doja Cat 4Document3 pagesDoja Cat 4Vincent Luigil AlceraNo ratings yet

- Politics Claro Recto 2Document2 pagesPolitics Claro Recto 2Vincent Luigil AlceraNo ratings yet

- Dreamed A Dream (2009) and The Gift (2010) .: Sweetener (Album)Document4 pagesDreamed A Dream (2009) and The Gift (2010) .: Sweetener (Album)Vincent Luigil AlceraNo ratings yet

- 2012-2017: Career Beginnings and Record Deal: of The RageDocument2 pages2012-2017: Career Beginnings and Record Deal: of The RageVincent Luigil AlceraNo ratings yet

- See Also: The Sweetener Sessions and Sweetener World TourDocument2 pagesSee Also: The Sweetener Sessions and Sweetener World TourVincent Luigil AlceraNo ratings yet

- Ariana Grande 4Document3 pagesAriana Grande 4Vincent Luigil AlceraNo ratings yet

- Ariana Grande 8Document3 pagesAriana Grande 8Vincent Luigil AlceraNo ratings yet

- Doja Cat 1Document2 pagesDoja Cat 1Vincent Luigil Alcera100% (1)

- Woman, Which Was Met With Positive Reviews and Commercial SuccessDocument2 pagesWoman, Which Was Met With Positive Reviews and Commercial SuccessVincent Luigil AlceraNo ratings yet

- Everything Proves, She's Already A Major Force" On A Release Showing HowDocument2 pagesEverything Proves, She's Already A Major Force" On A Release Showing HowVincent Luigil AlceraNo ratings yet

- CPA 1 - Financial AccountingDocument8 pagesCPA 1 - Financial AccountingPurity muchobella100% (1)

- Case 01 Buffett 2015 F1769TNDocument18 pagesCase 01 Buffett 2015 F1769TNVaney IoriNo ratings yet

- Financial Statement Analysis: Assignment Part 2Document11 pagesFinancial Statement Analysis: Assignment Part 2Duc BuiNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument12 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Aditum Venture Capital Fund FlyerDocument2 pagesAditum Venture Capital Fund FlyerAdil KhanNo ratings yet

- Equity Research Methodology 031604Document1 pageEquity Research Methodology 031604vardashahid100% (1)

- FIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance FinanceDocument69 pagesFIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance Financedaniel_foo_16No ratings yet

- FM Unit 1 Lecture Notes - Financial Managment and EnvironmentsDocument4 pagesFM Unit 1 Lecture Notes - Financial Managment and EnvironmentsDebbie DebzNo ratings yet

- TOPIC 4 (2) International Financial Reporting Standards (IFRS) V AaoifiDocument36 pagesTOPIC 4 (2) International Financial Reporting Standards (IFRS) V AaoifikkNo ratings yet

- What Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsDocument1 pageWhat Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsMichelle Ang100% (2)

- CA Inter Gr-1 Accounting E-BookDocument200 pagesCA Inter Gr-1 Accounting E-BookShubham KuberkarNo ratings yet

- F.S. Analysis AssignmentDocument2 pagesF.S. Analysis AssignmentSeiha ChhengNo ratings yet

- Ifrs 16 Leases MiningDocument48 pagesIfrs 16 Leases MiningBill LiNo ratings yet

- Hy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Document34 pagesHy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Priyesh DoshiNo ratings yet

- Real Estate Investment AnalysisDocument25 pagesReal Estate Investment AnalysisKulbhushan SharmaNo ratings yet

- Net Present Value and Other Investment Criteria: Principles of Corporate FinanceDocument26 pagesNet Present Value and Other Investment Criteria: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- Chapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document47 pagesChapter 8 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Ross12e - CHAPTER 2 - Mini Case - Warf Computers - SolutionDocument3 pagesRoss12e - CHAPTER 2 - Mini Case - Warf Computers - SolutionHemil ShahNo ratings yet

- Last Assignment of PRC-04 December 2022Document94 pagesLast Assignment of PRC-04 December 2022mudassar saeedNo ratings yet

- The Return From One Investment Is 0.711 More Than The Other (Your Answer Is Incorrect)Document6 pagesThe Return From One Investment Is 0.711 More Than The Other (Your Answer Is Incorrect)Dolly TrivediNo ratings yet

- Seminar 2 Presentation QuestionsDocument17 pagesSeminar 2 Presentation QuestionsJennifer YoshuaraNo ratings yet

- IAS 20 Summary: Accounting for Government GrantsDocument2 pagesIAS 20 Summary: Accounting for Government Grantsenzo100% (1)

- Wharton Strategic Business Planning Part 33785Document54 pagesWharton Strategic Business Planning Part 33785earl58100% (1)

- FINC521-Corporate Finance - Part1 PDFDocument3 pagesFINC521-Corporate Finance - Part1 PDFAjit Kumar100% (1)

- Formulas Notes PDFDocument2 pagesFormulas Notes PDFDildar SainiNo ratings yet

- Liezl A. Ventusa Fm136-E Hedge FundsDocument16 pagesLiezl A. Ventusa Fm136-E Hedge FundsRodel PerezNo ratings yet

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- CapstructDocument17 pagesCapstructPushpraj Singh BaghelNo ratings yet

- Gobinath Balasubramanian, Chief Investment OfficerDocument18 pagesGobinath Balasubramanian, Chief Investment OfficerGopinath BalaNo ratings yet

- ICAI Valuation StandardsDocument43 pagesICAI Valuation StandardsBala Guru Prasad TadikamallaNo ratings yet