Professional Documents

Culture Documents

Required of ALL Applicants

Uploaded by

Valecia G Wolf-RodriguezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Required of ALL Applicants

Uploaded by

Valecia G Wolf-RodriguezCopyright:

Available Formats

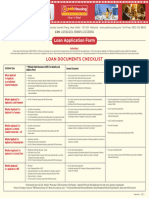

Disability:IN Supplier Certification Checklist

(Businesses Seeking New Certification)

Required of ALL applicants:

Completed on-line application and $300 non-refundable processing fee submitted at the time of

application submission

Payment by credit card is preferred but checks may be made payable to Disability:IN (Payment

by check may delay application review.)

Documents of Business/Enterprise Owner(s):

□ Proof of U.S. Citizenship or Permanent Resident Status:

Passport

Birth Certificate

Green Card

□ Government Issued Picture ID

Passport

Driver’s License

State ID Card

□ Disability Status (see Appendix A)

Business Enterprise Documents (Please submit all documents listed for the applicable business

structure.):

C-Corporation

□ Brief history of business (startups submit brief business plan)

□ Resume of owner(s)

□ Form 1120 Schedule G

□ Certificate of incorporation

□ Articles of Incorporation

□ Minutes of first board meeting establishing current ownership (proprietary information may be

redacted)

□ Minutes from most recent meeting of shareholders (proprietary information may be redacted)

□ Minutes from most recent meeting of the Board (proprietary information may be redacted)

□ Corporate bylaws

□ Copies of stock certificates (both sides) or proof of stock purchase or equity agreement by

owner(s) with a disability and/or currents stock transfer ledger

S-Corporation

□ Brief history of business (startups submit brief business plan)

□ Resume of owner(s)

□ Form 1120s Schedule K

□ Certificate of incorporation

□ Articles of Incorporation

□ Minutes of first board meeting establishing current ownership (proprietary information may be

redacted)

□ Minutes from most recent meeting of shareholders (proprietary information may be redacted)

□ Minutes from most recent meeting of the Board (proprietary information may be redacted)

□ Corporate bylaws

□ Copies of stock certificates (both sides) or proof of stock purchase or equity agreement by

owner(s) with a disability and/or currents stock transfer ledger

LLC or L3C Single Member

□ Brief history of business (startups submit brief business plan)

□ Resume of owner(s) with a disability

□ Articles of organization

□ Certificate of organization (for businesses in states which issue certificates)

□ LLC regulations/operating agreement

□ Form 1065 Schedule C, Form 1120 Schedule G, OR 1120s Schedule K-1

LLC or L3C Multi-Member

□ Brief history of business (startups submit brief business plan)

□ Resume of owner(s) with a disability

□ Articles of organization

□ Certificate of organization (for businesses in states which issue certificates)

□ LLC regulations/operating agreement

□ Form 1065 K-1s (for each owner), Form 1120 Schedule G, OR Form 1065 Schedule K-1 (for each

owner)

Partnership

□ Brief history of business (startups submit brief business plan)

□ Resume of owner(s) with a disability

□ Partnership agreements

□ Proof of capital investment by LGBT partners

□ Limited partnership agreements

□ Profit sharing agreements

□ Form 1065 K-1s (for each owner), Form 1120 Schedule G, OR Form 1065 Schedule K-1 (for each

owner)

Sole Proprietor

□ Brief history of business (startups submit brief business plan)

□ Resume of owner with a disability

□ Form 1040 Schedule C

□ Applicable operating business license and/or permits

□ Assumed name documents (if applicable)

Other Required Documents as Applicable

□ Operating business license and/or permits

□ Previous year financial statement (profit & loss statement and balance sheet; startups

provide opening balance sheet)

□ 3 years of most recent federal tax returns (signed copies)

Start-ups shall provide personal federal tax returns in lieu of business returns for any

years in which business returns were not filed.

If you have not met the income threshold for filing for any of the three (3) years, please

provide your SSD, SSI benefit statements for those years.

□ Most recent itemized payroll records listing all full/part-time employees

□ Contract or work history for the past three years (include contact name, and type of work

performed or type of contract received)

□ Third party agreements such as:

Management agreements

Real estate lease agreements

Service agreements

Affiliate/subsidiary agreements

Equipment rental and purchase agreements

□ Proof of bonding capacity

□ Documentation from the secretary certifying the names of all current members of the

board of directors

□ Voting agreements and other equity interests including stock options, warrants, buy/sell

agreements, and right of first refusal

□ Proof of authority to do business in all states where authority has been granted

□ Schedule of advances made to corporation for the preceding three years

APPENDIX A. Disability status qualifiers (One required for each eligible owner)

□ Records issued from a licensed, registered, or certified vocational rehabilitation specialist (i.e.,

State or private) stating that the applicant individual is a person with a disability

□ An Individualized Education Program (IEP) can also be submitted for an applicant who has a

learning disability

□ Federal agency, State agency, or an agency of the District of Columbia or a U.S. territory that

issues or provides disability benefits stating that the applicant individual is a person with a

disability

□ Disability:IN Physician’s Form from a licensed medical professional (e.g., a physician or other

medical professional duly certified to practice medicine by a State, the District of Columbia, or a

U.S. Territory) stating that the applicant individual is a person with a disability

□ Service-Disabled Veteran-Owned Business Enterprise, must submit a Department of Defense

Form 214 (DD214), as well as their Disability Ratings Letter from the Veterans Administration.

Already WBENC or NGLCC Certified?

□ Government Issued Picture ID

Passport

Driver’s License

State ID Card

□ Disability Status (see Appendix A)

□ NGLCC or WBENC Certificate (must be valid and active)

If within 90 days of expiring, we will request updated certificate once received.

Already VA Verified SDVOSB?

□ Government Issued Picture ID

Passport

Driver’s License

State ID Card

□ Proof of U.S. Citizenship or Permanent Resident Status:

Passport

Birth Certificate

Green Card

□ Disability Status:

Department of Defense Form 214 (DD214)

Disability Ratings Letter from the Veterans Administration.

□ Brief history of business (startups submit brief business plan)

□ Most recent year Financial Statement

Profit & Loss statement matching most recent year of federal tax return filed (start-ups

provide an opening balance sheet)

□ One (1) Year completed signed Federal Tax Return

Include Schedule C, K or applicable schedule(s) based on business legal structure

Start-ups shall provide personal federal tax returns in lieu of business returns for any

years in which business returns were not filed.

If you have not met the income threshold for filing for any of the three (3) years, please

provide your SSD, SSI benefit statements for those years.

□ VA Verification Letter

Please be advised that the National Certification Committee reserves the right to request additional

documents following initial review if disability ownership, management and control is not adequately

established.

You might also like

- Commercial - Loan - Application PDFDocument4 pagesCommercial - Loan - Application PDFKent WhiteNo ratings yet

- C-Corp Checklist: File Certificate of Incorporation With The Delaware Secretary of StateDocument2 pagesC-Corp Checklist: File Certificate of Incorporation With The Delaware Secretary of StateKevin Joe NathanNo ratings yet

- MSC - Documents Needed in A Family Law FileDocument6 pagesMSC - Documents Needed in A Family Law FileMy Support CalculatorNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- How To Register A Company in TanzaniaDocument7 pagesHow To Register A Company in TanzaniaPaschal MazikuNo ratings yet

- RFBT MCQ Class No. 3172Document51 pagesRFBT MCQ Class No. 3172hyunsuk fhebieNo ratings yet

- Decision From The Western District Court of AppealsDocument7 pagesDecision From The Western District Court of AppealsSt. Louis Business Journal100% (1)

- Sec Registration of Representative Office: Basic Requirements To HaveDocument8 pagesSec Registration of Representative Office: Basic Requirements To HaveGabriel CarumbaNo ratings yet

- Recruitment AgreementDocument4 pagesRecruitment AgreementGerard OlonaNo ratings yet

- Conflict of Laws Agpalo Notes - ChaptersDocument18 pagesConflict of Laws Agpalo Notes - ChaptersAnonymous IobsjUat100% (1)

- How To Register A Corporation in The PhilippinesDocument5 pagesHow To Register A Corporation in The PhilippinesJoy DimaculanganNo ratings yet

- Personal Financial StatementDocument4 pagesPersonal Financial StatementKent WhiteNo ratings yet

- Calvo v. UCPBDocument1 pageCalvo v. UCPBJovelan V. EscañoNo ratings yet

- Sec Registration of Representative Office: Basic Requirements To HaveDocument8 pagesSec Registration of Representative Office: Basic Requirements To HaveGabriel CarumbaNo ratings yet

- Cease and Desist, UPL of Marty Stone, McCalla Raymer Leibert Pierce LLPDocument19 pagesCease and Desist, UPL of Marty Stone, McCalla Raymer Leibert Pierce LLPNeil Gillespie100% (1)

- DO 174-17 Checklist of RequirementsDocument1 pageDO 174-17 Checklist of RequirementsKleng Alcordo90% (10)

- Deed of Customary Conveyance Obinna UdechiDocument9 pagesDeed of Customary Conveyance Obinna Udechichijioke chineloNo ratings yet

- G.R. No. 124922 - Martinez, J. - June 22, 1998: Jimmy Co. vs. Court of Appeals and Broadway Motor Sales CorporationDocument2 pagesG.R. No. 124922 - Martinez, J. - June 22, 1998: Jimmy Co. vs. Court of Appeals and Broadway Motor Sales CorporationJm SantosNo ratings yet

- Business RegistrationDocument67 pagesBusiness RegistrationRheneir MoraNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

- Bond of EmploymentDocument3 pagesBond of EmploymentRakesh RanaNo ratings yet

- Ic 11 Top4sure Most Important 'Last Day Revision' Test 3Document27 pagesIc 11 Top4sure Most Important 'Last Day Revision' Test 3Kalyani JayakrishnanNo ratings yet

- DTI, SEC, BSP and BOI RequirementsDocument22 pagesDTI, SEC, BSP and BOI Requirementsni_kai2001No ratings yet

- DOLE - DO 174.renewal - Version1Document1 pageDOLE - DO 174.renewal - Version1amadieu100% (1)

- NSC Vs CADocument1 pageNSC Vs CALourd Sydnel RoqueNo ratings yet

- Prieto v. CADocument2 pagesPrieto v. CAAlfonso Miguel Dimla100% (1)

- D - O - 174-17 ChecklistDocument1 pageD - O - 174-17 ChecklistJoy WongNo ratings yet

- Gulf Resorts, Inc. V. Philippine Charter Insurance Corporation GR NO 156167, MAY 16, 2005 FactsDocument9 pagesGulf Resorts, Inc. V. Philippine Charter Insurance Corporation GR NO 156167, MAY 16, 2005 Factsmartina lopezNo ratings yet

- BPDocument2 pagesBPRACHEL DAMALERIONo ratings yet

- D - O - 174-17 ChecklistDocument1 pageD - O - 174-17 ChecklistRolando ManalotoNo ratings yet

- Uprading of CategoryDocument15 pagesUprading of CategoryApl Dugui-es ToleroNo ratings yet

- Loan Application: Company InformationDocument8 pagesLoan Application: Company InformationChristian AwukutseyNo ratings yet

- (DOLE) Checklist For Issuance of Certificate of Registration Pursuant To DO 174-17 (For Job Contractor or Sub-Contractor)Document1 page(DOLE) Checklist For Issuance of Certificate of Registration Pursuant To DO 174-17 (For Job Contractor or Sub-Contractor)Carmela CalangiNo ratings yet

- Documentation Required For Certification With WOSB - 2022Document6 pagesDocumentation Required For Certification With WOSB - 2022Verena StreberNo ratings yet

- Application Letter and Forms - 1 - 68786-0Document9 pagesApplication Letter and Forms - 1 - 68786-0Tiffany RimpilloNo ratings yet

- Document Check List For Project LoanDocument2 pagesDocument Check List For Project LoanVishy BhatiaNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- What Is Closure of BusinessDocument5 pagesWhat Is Closure of BusinessaigurlroarNo ratings yet

- BUSLIC Business Licence FormDocument10 pagesBUSLIC Business Licence Formcrew242No ratings yet

- What Is Tax Residency CertificateDocument2 pagesWhat Is Tax Residency CertificateRahul SNo ratings yet

- Mary JaneDocument7 pagesMary JaneMary Jane O ApelladoNo ratings yet

- Due Diligence - Checklist: FolderDocument13 pagesDue Diligence - Checklist: FolderRipple NagpalNo ratings yet

- Close Business in The PhilippinesDocument4 pagesClose Business in The PhilippinesSimpson BueguyNo ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- Documents Required For Registration of Free Zone CompaniesDocument2 pagesDocuments Required For Registration of Free Zone CompaniesbeybakNo ratings yet

- Business Solutions Membership ApplicationDocument6 pagesBusiness Solutions Membership ApplicationGary LeeNo ratings yet

- OverseasDocument8 pagesOverseasrachelNo ratings yet

- Annex C DividendsDocument1 pageAnnex C DividendsJonalyn BalerosNo ratings yet

- PAG IBIG Housing LoanDocument38 pagesPAG IBIG Housing LoanKrisha Jean ManzanoNo ratings yet

- Prepare The Required Documents For SEC RegistrationDocument4 pagesPrepare The Required Documents For SEC RegistrationVanessa May Caseres GaNo ratings yet

- Step-By-Step Corporate RegistrationDocument3 pagesStep-By-Step Corporate Registrationjen mikeNo ratings yet

- US Acceptable DocumentationDocument5 pagesUS Acceptable DocumentationMargie LamarreNo ratings yet

- Step 1: Check Your Qualifications: Bdo BankDocument4 pagesStep 1: Check Your Qualifications: Bdo BankCristy JavinarNo ratings yet

- Checklist Requisitos Corporate ValuationDocument1 pageChecklist Requisitos Corporate ValuationLightDavidNo ratings yet

- Legal - Registration ProceduresDocument10 pagesLegal - Registration ProceduresnoowrieliinNo ratings yet

- EVS Documentation RequirementsDocument1 pageEVS Documentation RequirementsJack MaynorNo ratings yet

- CC Apartment Application Template Final 2013Document8 pagesCC Apartment Application Template Final 2013Ste ClearyNo ratings yet

- Flowchart Final License ApplicationDocument23 pagesFlowchart Final License ApplicationWinona Marie BorlaNo ratings yet

- SDFDocument3 pagesSDFShantsmackayNo ratings yet

- DD For Venture Capital FundingDocument18 pagesDD For Venture Capital FundingAmareshNo ratings yet

- Client UpdateDocument4 pagesClient UpdateAnonymous mFCE1fNo ratings yet

- ALVEO CHECKLIST - Indiv LocalDocument1 pageALVEO CHECKLIST - Indiv LocalLiv ValdezNo ratings yet

- Scholar Loan Details For BITS PILANIDocument2 pagesScholar Loan Details For BITS PILANImdsaadiNo ratings yet

- Platinum Membership GuideDocument19 pagesPlatinum Membership GuideBunny Sardina PandonganNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Acfrogamw68s Ivb0x4savprvphwgyvov Othndcwxcmb1mwcw7ciylzw8sqzgvsfnhmt72fq6lfrq8ftcipvdlaongvq6tpzl0xktbvhwhzsujve01h0sjbyw9i9hgDocument5 pagesAcfrogamw68s Ivb0x4savprvphwgyvov Othndcwxcmb1mwcw7ciylzw8sqzgvsfnhmt72fq6lfrq8ftcipvdlaongvq6tpzl0xktbvhwhzsujve01h0sjbyw9i9hgEmily MandinNo ratings yet

- 023 CV02 E - GuideDocument6 pages023 CV02 E - GuidejamesbeaudoinNo ratings yet

- 22 Stock Audit Report FormatDocument15 pages22 Stock Audit Report FormatSaptarshi CoomarNo ratings yet

- How To Apply For Certificate of Registration in The PhilippinesDocument5 pagesHow To Apply For Certificate of Registration in The PhilippinesD GNo ratings yet

- PDF 20231226 215837 0000Document3 pagesPDF 20231226 215837 0000cheska.movestorageNo ratings yet

- Checklist Compliance CertificateDocument7 pagesChecklist Compliance CertificatethulasikNo ratings yet

- ACT Now!: New Regulations Are HereDocument1 pageACT Now!: New Regulations Are HereValecia G Wolf-RodriguezNo ratings yet

- Link and List of Documents Eligibility Check and Link For Apply LoanDocument3 pagesLink and List of Documents Eligibility Check and Link For Apply LoanValecia G Wolf-RodriguezNo ratings yet

- UntitledDocument2 pagesUntitledValecia G Wolf-RodriguezNo ratings yet

- Petition For Allocation of Parental ResponsibilitiesDocument7 pagesPetition For Allocation of Parental ResponsibilitiesValecia G Wolf-RodriguezNo ratings yet

- Hazardous, Restricted, and Perishable Mail, To Incorporate New StatutoryDocument149 pagesHazardous, Restricted, and Perishable Mail, To Incorporate New StatutoryValecia G Wolf-RodriguezNo ratings yet

- UntitledDocument4 pagesUntitledValecia G Wolf-RodriguezNo ratings yet

- Credit Card Receipts - Monthly Reconciliation: Company Accounting LedgerDocument13 pagesCredit Card Receipts - Monthly Reconciliation: Company Accounting LedgerValecia G Wolf-RodriguezNo ratings yet

- Invoice: Your Company NameDocument2 pagesInvoice: Your Company NameValecia G Wolf-RodriguezNo ratings yet

- Order Regarding Confirmation of A Custody Determination: District CourtDocument2 pagesOrder Regarding Confirmation of A Custody Determination: District CourtValecia G Wolf-RodriguezNo ratings yet

- All Payments Are Made To Personallnguar: Over 20 Years Experience in The Credit IndustryDocument3 pagesAll Payments Are Made To Personallnguar: Over 20 Years Experience in The Credit IndustryValecia G Wolf-RodriguezNo ratings yet

- Case Number BC292517 Russell Armstrong V Anthony Vinatieri, Aka Anthony Sawin, and Does 1-25Document9 pagesCase Number BC292517 Russell Armstrong V Anthony Vinatieri, Aka Anthony Sawin, and Does 1-25RealityBustersNo ratings yet

- Concept Map-1Document1 pageConcept Map-1Luigi Enderez BalucanNo ratings yet

- Software Maintenance AgreementDocument3 pagesSoftware Maintenance Agreementacer012006No ratings yet

- 06 Evangelista V CirDocument1 page06 Evangelista V CirslumbaNo ratings yet

- Rev MOP With HUF 2014Document46 pagesRev MOP With HUF 2014RajendraYadavNo ratings yet

- E Spik Ex MagneDocument72 pagesE Spik Ex MagnejohnnyNo ratings yet

- Ballatan V CADocument1 pageBallatan V CAbusinessmanNo ratings yet

- Ghana ACT 690 Copyright ActDocument34 pagesGhana ACT 690 Copyright ActRichard OppongNo ratings yet

- Termination of Construction Contract: Due To Poor PerformanceDocument8 pagesTermination of Construction Contract: Due To Poor PerformanceketemaNo ratings yet

- Part 2: Contract Definition, Classification and DistinctionsDocument5 pagesPart 2: Contract Definition, Classification and DistinctionsCzar MartinezNo ratings yet

- Lease ContractDocument3 pagesLease ContractJosh RonbackNo ratings yet

- Ballb - 504 PDFDocument3 pagesBallb - 504 PDFkhadija khanNo ratings yet

- Business Taxation MT Quiz 1Document3 pagesBusiness Taxation MT Quiz 1Reverie MetherlanceNo ratings yet

- Rajasthan Rent Control (Amendment) Act, 2017Document9 pagesRajasthan Rent Control (Amendment) Act, 2017Harshit Singh ChandelNo ratings yet

- Onerous Donations ("For Valuable Consideration") Do Not Need To Be in A Public Instrument. Private Will Suffice/It Just Has To Be A Valid ContractDocument2 pagesOnerous Donations ("For Valuable Consideration") Do Not Need To Be in A Public Instrument. Private Will Suffice/It Just Has To Be A Valid ContractyassercarlomanNo ratings yet

- NBA Employment ContractDocument5 pagesNBA Employment ContractMr VoralpenNo ratings yet

- Appoinmtent Letter - Arigala Deva PrasadDocument7 pagesAppoinmtent Letter - Arigala Deva Prasadsv netNo ratings yet