Professional Documents

Culture Documents

Untitled

Uploaded by

Michael deMonetCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

Michael deMonetCopyright:

Available Formats

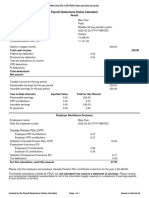

FS3 Final Settlement System (FSS)

Paye Statement of Earnings

A. Payee Information For Year Ended 31 December 2021

Surname : Yance Identity : 0251480A

First Name : Michael John Social : A67979343

Address : Flat 1, Block 32, Milner Spouse's ID. :

: Triq Milner

: SWQ

: Malta

Telephone No.: +356 99966034

B. Period From 07 DEC 2021 To 31 DEC 2021

C. Gross Emoluments

Gross Emoluments (FSS Main or FSS Other Method) 954.32 OT Hrs. 0.00

Overtime (Eligible for 15% tax deduction) 0.00

Director’s Fees 0.00 Cat.1 0.00

Gross Emoluments (FSS Part time Tax Method Used) 0.00 Cat.2 0.00

Fringe Benefits 0.00 Cat.3 0.00

Share Options fringe benefits taxed at 15% 0.00

Total Gross Emoluments 954.32

Non Taxable Car Cash Allowance 0.00

D. Tax Deductions

Tax Deductions (FSS Main or FSS Other Method) 0.00

Tax Deductions (Eligible Overtime) 0.00

Tax Deductions (FSS Part time Tax Method Used) 0.00

Tax Arrears Deductions (as per amount on PCU2(A)) 0.00

15% tax on Share Options 0.00

Total Tax Deductions 0.00

E. Social Security Information

Year Weekly Wage Contributions Maternity Weeks

Number Class Payee Payer Total Fund w/out Pay

2021 276.92 3 C 83.07 83.07 166.14 2.49

Totals 3 83.07 83.07 166.14 2.49 0

Voluntary Occupational Pension Scheme contribution or payment

F. Payer Information

Business AX Hotel Operations Plc Payer PE No. 423194

Address AX Business Park

AX Group

Triq Id-Difiza Civili

MQB MST 1741

Principal's Full Name Laura Galea

Principal's Position Head of Finance

Principal's

Signature ________________________________ Date : 31 DEC 2021

© Dakar Software Systems

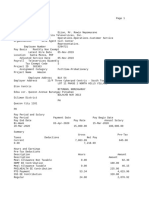

FS-3 TOTALS REPORT

Total Gross Pay : 954.32

Total Gross (Otime) : 0.00

Total Directors Fees : 0.00

Total Fringe Benefts : 0.00

Total Tax : 0.00

Total Tax (Overtime) : 0.00

Total Tax Arrears : 0.00

Total N.I. : 166.14

Total Union 1 : 0.00

Total Union 2 : 0.00

Total Maternity Fund : 2.49

Total Otime Tax Hrs : 0.00

*** End of Report ***

© Dakar Software Systems

You might also like

- Sbi Afi 2012Document48 pagesSbi Afi 2012Moneylife FoundationNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Handbook - European Choral AssociationDocument24 pagesHandbook - European Choral AssociationMonica SaenzNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Vat Summary-30-09-2010Document2 pagesVat Summary-30-09-2010anon_978060No ratings yet

- Caterpillar Sis (01.2014) MultilanguageDocument10 pagesCaterpillar Sis (01.2014) MultilanguageTemmy Candra Wijaya100% (1)

- Koharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadDocument4 pagesKoharian, Dhak Khana Khas, Barki, Lahore Wahgah Town Qasim ShahzadBasit RiazNo ratings yet

- BillDocument5 pagesBillPratap BilluNo ratings yet

- Practice Quiz Reflection Project Initiation and Key ComponentsDocument3 pagesPractice Quiz Reflection Project Initiation and Key ComponentsFalastin Tanani67% (3)

- TNL21846451 112020-UnlockedDocument2 pagesTNL21846451 112020-UnlockedAshutosh DubeyNo ratings yet

- Declaration 3130333240279Document6 pagesDeclaration 3130333240279haunted houseNo ratings yet

- Barangay Budget Preparation Forms LiquiciaDocument3 pagesBarangay Budget Preparation Forms LiquiciaMaria RinaNo ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- 2021 IK Return WDocument6 pages2021 IK Return Wali razaNo ratings yet

- Mushak: 6.3: Details of Registered PersonDocument1 pageMushak: 6.3: Details of Registered PersonAnonymous ZGcs7MwsLNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Ministry of Economy: CNPJ/CPF Copany Name/NameDocument2 pagesMinistry of Economy: CNPJ/CPF Copany Name/NameJuliana Kelly FlorêncioNo ratings yet

- Wedding Card Manufacturing Project ReportsDocument12 pagesWedding Card Manufacturing Project Reportsravi100% (1)

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- Priya Mushroom FarmingDocument8 pagesPriya Mushroom FarmingPriyanga ShanmugamNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- HalimaDocument1 pageHalimavera atienoNo ratings yet

- Provisional: Provisional Income Tax CalculationDocument1 pageProvisional: Provisional Income Tax CalculationM. A Hossain & Associates Tax ConsultantsNo ratings yet

- Asad Naseer Malik ITR 2022Document6 pagesAsad Naseer Malik ITR 2022Deen with AyaanNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Annual 2 2024Document7 pagesAnnual 2 2024blguadlawan2012No ratings yet

- Payee Information: From ToDocument1 pagePayee Information: From ToNuria ValenciaNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportZelalem RegasaNo ratings yet

- TOROITICHDocument1 pageTOROITICHtoroitich Titus markNo ratings yet

- 10094069 (93)Document1 page10094069 (93)tagalog.vinceclarenze308129No ratings yet

- Afs 1Document2 pagesAfs 1TetrachemNo ratings yet

- Afs 1Document2 pagesAfs 1TetrachemNo ratings yet

- Afs 1Document2 pagesAfs 1TetrachemNo ratings yet

- Afs 1Document2 pagesAfs 1TetrachemNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Project: Siddhartha InnovativeDocument6 pagesProject: Siddhartha InnovativeGarvit ModiNo ratings yet

- House No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisDocument3 pagesHouse No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisMadiah abcNo ratings yet

- Skill Developmetn Instituter Project RepotDocument7 pagesSkill Developmetn Instituter Project RepotPriyotosh DasNo ratings yet

- Accenture Fin ModelDocument14 pagesAccenture Fin ModelShashi BhushanNo ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- PDFDocument3 pagesPDFdelmundomarkanthony15No ratings yet

- MADAD KHAN-PunjabDocument6 pagesMADAD KHAN-PunjabFarhan AliNo ratings yet

- Kahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Document3 pagesKahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Asif ShahzadNo ratings yet

- Associate Information: Ayansys Solutions Private Limited (Payslip)Document1 pageAssociate Information: Ayansys Solutions Private Limited (Payslip)B BhaskarNo ratings yet

- ReceiptDocument1 pageReceiptFull Gospel KanduyiNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document6 pagesForm GSTR-3B (See Rule 61 (5) )Asma KhanNo ratings yet

- ReceiptDocument1 pageReceiptNdavi KiangiNo ratings yet

- Declaration 3520219250593Document4 pagesDeclaration 3520219250593fiaz AhmadNo ratings yet

- Computation of Total Income 1: Assessee's Name: DOB PAN Address AY StatusDocument1 pageComputation of Total Income 1: Assessee's Name: DOB PAN Address AY StatusPrasang GuptaNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document7 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Bm ShopNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- ReceiptDocument1 pageReceiptisaiahkipkosgei36No ratings yet

- ReceiptDocument1 pageReceiptEugene MmarengeNo ratings yet

- Sre Opol Q4 2022Document6 pagesSre Opol Q4 2022Mia ActubNo ratings yet

- Declaration4120159310489 PDFDocument2 pagesDeclaration4120159310489 PDFMohsin Ali Shaikh vlogsNo ratings yet

- Declaration 3740661995848Document5 pagesDeclaration 3740661995848Syed Bilal BukhariNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument3 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Declaration 3710137689404Document4 pagesDeclaration 3710137689404Fizzah Fatimah MinhasNo ratings yet

- ReceiptDocument1 pageReceiptwkendithuraniraNo ratings yet

- Hillan Kipchumba Ronoh's KRA Tax Returns 2022Document1 pageHillan Kipchumba Ronoh's KRA Tax Returns 2022Alvin RoddyNo ratings yet

- Milkiy FF 2011Document263 pagesMilkiy FF 2011Asfawosen Dingama100% (1)

- Michael de Monet Yance: Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingDocument1 pageMichael de Monet Yance: Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingMichael deMonetNo ratings yet

- Zuzana Sammut Jurcik Intercontinental MaltaDocument1 pageZuzana Sammut Jurcik Intercontinental MaltaMichael deMonetNo ratings yet

- Ahmed Ali: Hospitality ProfessionalDocument4 pagesAhmed Ali: Hospitality ProfessionalMichael deMonetNo ratings yet

- Public Health Passenger Locator Form: Thank You For Helping Us Protect Your HealthDocument1 pagePublic Health Passenger Locator Form: Thank You For Helping Us Protect Your HealthMichael deMonetNo ratings yet

- Authorisation Institution Authorisation Results: Print Transaction DetailsDocument1 pageAuthorisation Institution Authorisation Results: Print Transaction DetailsMichael deMonetNo ratings yet

- EU Digital Passenger Locator Form (DPLF)Document3 pagesEU Digital Passenger Locator Form (DPLF)Michael deMonetNo ratings yet

- Daniela Filipa Jorge Simões: Work Experience Front O Ce SupervisorDocument4 pagesDaniela Filipa Jorge Simões: Work Experience Front O Ce SupervisorMichael deMonetNo ratings yet

- UntitledDocument1 pageUntitledMichael deMonetNo ratings yet

- List of Weddings at Your Hotel From April 2020 To December 2020Document6 pagesList of Weddings at Your Hotel From April 2020 To December 2020Michael deMonetNo ratings yet

- Application Receipt: Validity of Receipt Is Subject To Bank Clearance When Payment Is Made by ChequeDocument1 pageApplication Receipt: Validity of Receipt Is Subject To Bank Clearance When Payment Is Made by ChequeMichael deMonetNo ratings yet

- Please Find The Attached Cover Note File For Your Policy.: Dear Michael John de Monet YanceDocument2 pagesPlease Find The Attached Cover Note File For Your Policy.: Dear Michael John de Monet YanceMichael deMonetNo ratings yet

- Subscription Confirmation: Videoshop - Video EditorDocument2 pagesSubscription Confirmation: Videoshop - Video EditorMichael deMonetNo ratings yet

- Our Lady of Fatima University Valenzuela, Philippines 2009 Bachelor of Science in Nursing (Completed)Document1 pageOur Lady of Fatima University Valenzuela, Philippines 2009 Bachelor of Science in Nursing (Completed)Michael deMonetNo ratings yet

- Employment Contract: POLO Rome Template MaltaDocument4 pagesEmployment Contract: POLO Rome Template MaltaMichael deMonetNo ratings yet

- Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingDocument1 pageOur Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingMichael deMonetNo ratings yet

- Unpaid: Host Name Guest NameDocument1 pageUnpaid: Host Name Guest NameMichael deMonetNo ratings yet

- Balik-Manggagawa Information Sheet: Appointment Date: June 29, 2021 01:00 PMDocument2 pagesBalik-Manggagawa Information Sheet: Appointment Date: June 29, 2021 01:00 PMMichael deMonetNo ratings yet

- Mobile Phones: CompareDocument1 pageMobile Phones: CompareMichael deMonetNo ratings yet

- Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingDocument1 pageOur Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingMichael deMonetNo ratings yet

- Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingDocument1 pageOur Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingMichael deMonetNo ratings yet

- Education: About MeDocument2 pagesEducation: About MeMichael deMonetNo ratings yet

- Incident Report: Date: 07.02.21Document1 pageIncident Report: Date: 07.02.21Michael deMonetNo ratings yet

- Michael John Yance: 9587278 27 FEB 2022 MLT-POZ - VR100 Euro 08:30 10:15Document1 pageMichael John Yance: 9587278 27 FEB 2022 MLT-POZ - VR100 Euro 08:30 10:15Michael deMonetNo ratings yet

- Our Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingDocument1 pageOur Lady of Fatima University Valenzuela, Philippines 2007 Bachelor of Science in NursingMichael deMonetNo ratings yet

- Metrics: Marriot Bonvoy EnrollmentsDocument8 pagesMetrics: Marriot Bonvoy EnrollmentsMichael deMonetNo ratings yet

- Sepj7M: Price From USD 179Document1 pageSepj7M: Price From USD 179Michael deMonetNo ratings yet

- Metrics #Value!: Marriot Bonvoy EnrollmentsDocument9 pagesMetrics #Value!: Marriot Bonvoy EnrollmentsMichael deMonetNo ratings yet

- UntitledDocument4 pagesUntitledMichael deMonetNo ratings yet

- Career Overview: CommunicationDocument2 pagesCareer Overview: CommunicationMichael deMonetNo ratings yet

- Amplificadores Automotivos PyramidDocument13 pagesAmplificadores Automotivos Pyramidedusf1000No ratings yet

- Architecture of Neural NWDocument79 pagesArchitecture of Neural NWapi-3798769No ratings yet

- APS PresentationDocument32 pagesAPS PresentationRozack Ya ZhackNo ratings yet

- ENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Document3 pagesENGLISH 4 (General & Specific Sentence, Main Idea & Key Sentence) )Analiza Dequinto BalagosaNo ratings yet

- RSM222.f22.CourseOutline v3 2022-09-05Document9 pagesRSM222.f22.CourseOutline v3 2022-09-05Kirsten WangNo ratings yet

- TEFL Entrance ExamDocument3 pagesTEFL Entrance ExammerekNo ratings yet

- Job Sheet 1Document5 pagesJob Sheet 1Sue AzizNo ratings yet

- Taxonomy: Family StaphylococcaceaeDocument40 pagesTaxonomy: Family StaphylococcaceaeMarissa Terrado SorianoNo ratings yet

- Biography of Anna HazareDocument4 pagesBiography of Anna HazareGenesis FirstNo ratings yet

- Asme Bladder Accumulator DatasheetDocument3 pagesAsme Bladder Accumulator DatasheetSamad A BakarNo ratings yet

- Crusher 4Document39 pagesCrusher 4kediliterapiNo ratings yet

- Theben Timer SUL 181DDocument2 pagesTheben Timer SUL 181DFerdiNo ratings yet

- Procedures Involved in The Ansys ACP17.2Document10 pagesProcedures Involved in The Ansys ACP17.2Vijayanandh RNo ratings yet

- Automatic Coconut Dehusking MachineDocument12 pagesAutomatic Coconut Dehusking MachineKumaresh Salem0% (1)

- Thom22e ch03 FinalDocument44 pagesThom22e ch03 FinalDionisius AlvianNo ratings yet

- FCC O Cials Denounce Lawmakers' Attempts To Censor NewsroomsDocument52 pagesFCC O Cials Denounce Lawmakers' Attempts To Censor NewsroomsKeithStewartNo ratings yet

- WebMethods System Requirements 8xDocument7 pagesWebMethods System Requirements 8xmaxprinceNo ratings yet

- Loch ChildrenDocument4 pagesLoch ChildrenLauro De Jesus FernandesNo ratings yet

- Module 1Document64 pagesModule 1Jackyson RajkumarNo ratings yet

- Final Lab Manual Main Ars 200280705008Document6 pagesFinal Lab Manual Main Ars 200280705008shalini pathakNo ratings yet

- Chapter 7odeDocument29 pagesChapter 7odeRoberto NascimentoNo ratings yet

- (AVA Academia) Lorraine Farrelly - The Fundamentals of architecture-AVA Academia (2012) - Trang-137-161Document25 pages(AVA Academia) Lorraine Farrelly - The Fundamentals of architecture-AVA Academia (2012) - Trang-137-161Thảo VyNo ratings yet

- Interection 2 Reading Teacher's Book PDFDocument165 pagesInterection 2 Reading Teacher's Book PDFتركي الزهراني0% (1)

- Autodesk Design Review: About DWF and DWFXDocument7 pagesAutodesk Design Review: About DWF and DWFXNesreNo ratings yet

- 88 Year Old Man Missing in SC - Please ShareDocument1 page88 Year Old Man Missing in SC - Please ShareAmy WoodNo ratings yet

- Titus Selection of DiffuserDocument14 pagesTitus Selection of DiffuserhanyassawyNo ratings yet