Professional Documents

Culture Documents

Advanced Enzyme Q1FY19

Uploaded by

YasahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Enzyme Q1FY19

Uploaded by

YasahCopyright:

Available Formats

Advanced Enzyme Technologies Limited (ADVENZYMES)

28 August 2018 CMP: ₹207

Q1-FY19 Result Update Target: ₹366

Advanced Enzyme Technologies Ltd. reported good set of numbers in Q1 FY19. Revenue for the quarter grew by 38.2% yoy at

Rs.1043mn led by growth in Human, Animal & Food Segment. EBITDA grew by 63.6% yoy at Rs.484mn with margins at 46.4%,

an increase of 722 bps. PAT margins stood 29.9% at Rs.312mn in Q1 FY19 as against 21.6% at Rs.163mn in Q1 FY18.

On segmental front, animal HC witnessed a growth of 23% yoy at Rs.134mn and food segment witnessed a growth of 20% at

Rs.55mn on y-o-y basis. Human HC witnessed growth of 42% yoy at Rs.788mn and Industrial processing witnessed a degrowth

of 16% at Rs.41mn on y-o-y basis. Human HC contributes 78% of total revenues; Animal HC contributes 13% while food and

industrial processing both contributes 5% and 4% respectively.

On geographic front, India and US contribute 41% and 51% respectively. Europe contributes 2% and Asia (Ex-India) contributes

4% while others contribute 2% in Q1 FY19.

Management is confident of achieving ~4400-4500mn revenue in FY19. They expect EBITDAM & PATM to be in the range of

~40-45% and 21-26% respectively. Management has guided EBITDA to be in the range of 1900mn to 2000mn and a bottom line

in excess of 1100mn. All of this growth is expected to be organic and broadly 60% of this growth will come from the human

nutrition segment, about 20% will come from animal nutrition and another 20% will come from the bio-processing sector.

Currently, AETL positions itself as a niche player in the global markets and operates in certain segments of the enzyme industry.

Company enjoys strong entry barriers and benefits from high degree of customer stickiness. We continue to believe that long

term growth prospects of the company remains intact. We remain positive on the stock from long term perspective and

maintain BUY rating with a target price of Rs.366.

1 Analyst: CA Saurabh Joshi Anand Rathi Research

saurabhjoshi@rathi.com

Advanced Enzyme Technologies Limited (ADVENZYMES)

Quarterly Results

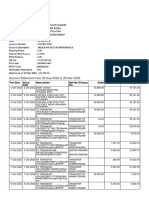

Financial Results (₹ Mn.)

Consolidated

(In ₹ mn) Q1-FY19 Q1-FY18 Chg

Net Sales 1,043 755 38.2%

Operating Expense 559 459 21.8%

EBITDA 484 296 63.6%

Other Income 4 3

Depreciation 52 38

EBIT 436 261 66.7%

Interest 14 13

PBT 422 248 70.3%

Tax 110 85

Exceptional Items - -

PAT 312 163 92.0%

Margins

Consolidated

Margins Q1-FY19 Q1-FY18 Chg BPS

Operating Margin % 46.4% 39.2% 722

Net Margin % 29.9% 21.6% 840

Source: Company, Anand Rathi Research

2 Anand Rathi Research

Advanced Enzyme Technologies Limited (ADVENZYMES)

Financials

(In ₹ mn) FY-17 FY-18 FY-19E FY-20E (In ₹ mn) FY-17 FY-18 FY-19E FY-20E

Net Sales 3,314 3,957 4,491 5,120 Liabilities

Operating Expense 1,807 2,317 2,564 2,908 Equity Share Capital 226 223 223 223

EBITDA 1,507 1,640 1,927 2,212 Reserves & Surplus 4,375 5,368 6,538 7,896

Other Income 29 14 18 20 Totat Shareholder's Funds 4,602 5,591 6,761 8,119

Depreciation 122 183 209 225 Minority Interest 124 226 226 226

EBIT 1,413 1,471 1,735 2,008 Long-Term Liabilities 197 198 198 198

Interest 48 81 87 95

Other Long-term Liabilities 8 52 52 52

Misc. items - - - -

Deferred Tax Liability 175 219 219 219

PBT 1,366 1,390 1,648 1,913

Short-term Liabilities 653 988 1,118 1,275

Tax 442 454 478 555

Total 5,758 7,274 8,574 10,089

Minority Interest (17) - - -

Assets

PAT 906 936 1,170 1,358

Net Fixed Assets 4,096 5,018 5,678 5,964

Long-Term L&A 191 22 22 22

Margins FY-17 FY-18 FY-19E FY-20E Non Current Investments 1 1 1 1

Other Non-Current Assets 1 126 126 126

Sales Growth % 12.8% 19.4% 13.5% 14.0%

Current Asset 1,470 2,107 2,748 3,976

Operating Margin % 45.5% 41.4% 42.9% 43.2%

Total 5,758 7,274 8,574 10,089

Net Margin % 27.4% 23.6% 26.1% 26.5%

3 Anand Rathi Research

Advanced Enzyme Technologies Limited (ADVENZYMES)

Rating and Target Price history:

ADVENZYMES rating history & price chart ADVENZYMES rating details

120

Date Rating Target Price Share Price

100 21-June-2017 BUY 415 333

22-Sept-2017 BUY 415 266

80 08-Feb-2018 BUY 415 264

28-May-2018 BUY 366 225

60 28-Aug-2018 BUY 366 207

Nifty 500 ADVENZYME

Source: Bloomberg, Anand Rathi Research Source: Bloomberg, Anand Rathi Research

NOTE: Prices are as on 28th Aug, 2018 close.

4 Anand Rathi Research

Advanced Enzyme Technologies Limited (ADVENZYMES)

Disclaimer:

Research Disclaimer and Disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014

Anand Rathi Share and Stock Brokers Ltd. (hereinafter refer as ARSSBL) (Research Entity) is a subsidiary of the Anand Rathi Financial Services Ltd. ARSSBL is a corporate

trading and clearing member of Bombay Stock Exchange Ltd, National Stock Exchange of India Ltd. (NSEIL), Multi Stock Exchange of India Ltd (MCX-SX), United stock

exchange and also depository participant with National Securities Depository Ltd (NSDL) and Central Depository Services Ltd. ARSSBL is engaged into the business of

Stock Broking, Depository Participant, Mutual Fund distributor.

The research analysts, strategists, or research associates principally responsible for the preparation of Anand Rathi Research have received compensation based upon

various factors, including quality of research, investor client feedback, stock picking, competitive factors, firm revenues.

General Disclaimer: - This Research Report (hereinafter called “Report”) is meant solely for use by the recipient and is not for circulation. This Report does not

constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The

recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of

purchase or sale of any security, derivatives or any other security through ARSSBL nor any solicitation or offering of any investment /trading opportunity on behalf of

the issuer(s) of the respective security (ies) referred to herein. These information / opinions / views are not meant to serve as a professional investment guide for the

readers.No action is solicited based upon the information provided herein. Recipients of this Report should rely on information/data arising out of their own

investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or

making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by ARSSBL

to be reliable. ARSSBL or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy

and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of

the directors, employees, affiliates or representatives of ARSSBL shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary

damages, including lost profits arising in any way whatsoever from the information / opinions / views contained in this Report. The price and value of the investments

referred to in this Report and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide

for future performance. ARSSBL does not provide tax advice to its clients, and all investors are strongly advised to consult with their tax advisers regarding taxation

aspects of any potential investment.

Continued…

5 Anand Rathi Research

Advanced Enzyme Technologies Limited (ADVENZYMES)

Disclaimer:

Contd.

Opinions expressed are our current opinions as of the date appearing on this Research only. We do not undertake to advise you as to any change of our views

expressed in this Report. Research Report may differ between ARSSBL’s RAs and/ or ARSSBL’s associate companies on account of differences in research methodology,

personal judgment and difference in time horizons for which recommendations are made. User should keep this risk in mind and not hold ARSSBL, its employees and

associates responsible for any losses, damages of any type whatsoever.

ARSSBL and its associates or employees may; (a) from time to time, have long or short positions in, and buy or sell the investments in/ security of company (ies)

mentioned herein or (b) be engaged in any other transaction involving such investments/ securities of company (ies) discussed herein or act as advisor or lender /

borrower to such company (ies) these and other activities of ARSSBL and its associates or employees may not be construed as potential conflict of interest with respect

to any recommendation and related information and opinions. Without limiting any of the foregoing, in no event shall ARSSBL and its associates or employees or any

third party involved in, or related to computing or compiling the information have any liability for any damages of any kind.

Details of Associates of ARSSBL and Brief History of Disciplinary action by regulatory authorities & its associates are available on our website i. e. www.rathionline.com

Disclaimers in respect of jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would

subject ARSSBL to any registration or licensing requirement within such jurisdiction(s). No action has been or will be taken by ARSSBL in any jurisdiction (other than

India), where any action for such purpose(s) is required. Accordingly, this Report shall not be possessed, circulated and/or distributed in any such country or jurisdiction

unless such action is in compliance with all applicable laws and regulations of such country or jurisdiction. ARSSBL requires such recipient to inform himself about and to

observe any restrictions at his own expense, without any liability to ARSSBL. Any dispute arising out of this Report shall be subject to the exclusive jurisdiction of the

Courts in India.

Copyright: - This report is strictly confidential and is being furnished to you solely for your information. All material presented in this report, unless specifically indicated

otherwise, is under copyright to ARSSBL. None of the material, its content, or any copy of such material or content, may be altered in any way, transmitted, copied or

reproduced (in whole or in part) or redistributed in any form to any other party, without the prior express written permission of ARSSBL. All trademarks, service marks

and logos used in this report are trademarks or service marks or registered trademarks or service marks of ARSSBL or its affiliates, unless specifically mentioned

otherwise.

Contd.

6 Anand Rathi Research

Advanced Enzyme Technologies Limited (ADVENZYMES)

Disclaimer:

Contd.

Statements on ownership and material conflicts of interest, compensation - ARSSBL and Associates

Answers to the Best of the knowledge

Sr. and belief of the ARSSBL/ its

Statement

No. Associates/ Research Analyst who is

preparing this report

ARSSBL/its Associates/ Research Analyst/ his Relative have any financial interest in the subject company? Nature of Interest (if applicable), is given

1 against the company’s name?. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have actual/beneficial ownership of one per cent or more securities of the subject company, at the

2 end of the month immediately preceding the date of publication of the research report or date of the public appearance?. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have any other material conflict of interest at the time of publication of the research report or at

3 the time of public appearance?. NO

4 ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have managed or co-managed public offering of securities for the subject company in the past

5

twelve months.

NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for investment banking or merchant banking or brokerage

6 services from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for products or services other than investment banking or

7 merchant banking or brokerage services from the subject company in the past twelve months. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation or other benefits from the subject company or third party in

8 connection with the research report. NO

ARSSBL/its Associates/ Research Analyst/ his Relative have served as an officer, director or employee of the subject company.

9 NO

10 ARSSBL/its Associates/ Research Analyst/ his Relative has been engaged in market making activity for the subject company. NO

7 Anand Rathi Research

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Contacts Pe Funds-Ankita (Updated)Document15 pagesContacts Pe Funds-Ankita (Updated)YasahNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chart of The Week-Declining CAD To Aid Domestic GrowthDocument1 pageChart of The Week-Declining CAD To Aid Domestic GrowthYasahNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chart of The Week - Indias Electronics Export A Shining StarDocument1 pageChart of The Week - Indias Electronics Export A Shining StarYasahNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Karvy - AadhaarForm-Non-IndividualDocument1 pageKarvy - AadhaarForm-Non-IndividualYasahNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fund Focus - Axis Arbitrage Fund - June 2023Document3 pagesFund Focus - Axis Arbitrage Fund - June 2023YasahNo ratings yet

- Motilal Oswal Asset Management Company LimitedDocument2 pagesMotilal Oswal Asset Management Company LimitedYasahNo ratings yet

- NISM-Series-V-A: Mutual Fund Distributors Certification ExaminationDocument1 pageNISM-Series-V-A: Mutual Fund Distributors Certification ExaminationYasahNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Gran Cu 260718Document8 pagesGran Cu 260718YasahNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- BNPP Categorisation of SchemesDocument6 pagesBNPP Categorisation of SchemesYasahNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sundaram - Common Transaction Slip - Aadhaar - With PAN FinalDocument1 pageSundaram - Common Transaction Slip - Aadhaar - With PAN FinalYasahNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- A. Mutual Funds B. Depositories C. Registrar & Transfer AgentsDocument1 pageA. Mutual Funds B. Depositories C. Registrar & Transfer AgentsYasahNo ratings yet

- ICICIDocument5 pagesICICIYasahNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- KYC Non Individual AnnexureDocument1 pageKYC Non Individual AnnexureYasahNo ratings yet

- Axis Bluechip Fund Attribution Analysis PDFDocument7 pagesAxis Bluechip Fund Attribution Analysis PDFYasahNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Impact On GDP in FY20-21 Due To COVID-19: Source: RBI, CSO, SIAM, Ministry of Commerce & Industry, CGADocument3 pagesImpact On GDP in FY20-21 Due To COVID-19: Source: RBI, CSO, SIAM, Ministry of Commerce & Industry, CGAYasahNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Fsol Cu 060818Document8 pagesFsol Cu 060818YasahNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Covid 19 - Opening Doors For InnovationDocument3 pagesCovid 19 - Opening Doors For InnovationYasahNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Impact of Q1FY21 Results On Equity Market: Ason1 July' 20Document4 pagesImpact of Q1FY21 Results On Equity Market: Ason1 July' 20YasahNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Fiis - Long Term Investors or Fly by Night Operators: Source: Sebi, DSP, MoneycontrolDocument3 pagesFiis - Long Term Investors or Fly by Night Operators: Source: Sebi, DSP, MoneycontrolYasahNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Weekly Market CompassDocument4 pagesWeekly Market CompassYasahNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Nasdaq 100 Commentary - January 2023 PDFDocument2 pagesNasdaq 100 Commentary - January 2023 PDFYasahNo ratings yet

- Vaccine Series Part 4 - 0901 - 2021 PDFDocument4 pagesVaccine Series Part 4 - 0901 - 2021 PDFYasahNo ratings yet

- Weekly Market Compass 21 Sep PDFDocument3 pagesWeekly Market Compass 21 Sep PDFYasahNo ratings yet

- Fund Focus - Axis Arbitrage Fund - September 2022Document3 pagesFund Focus - Axis Arbitrage Fund - September 2022YasahNo ratings yet

- FAQ On CKYC For ChannelsDocument5 pagesFAQ On CKYC For ChannelsYasahNo ratings yet

- Market Update PPT - July 2022 (Debt)Document19 pagesMarket Update PPT - July 2022 (Debt)YasahNo ratings yet

- Fund Focus - Axis Bluechip Fund - Aug 2022Document5 pagesFund Focus - Axis Bluechip Fund - Aug 2022YasahNo ratings yet

- Axis Long Duration Fund - NFODocument20 pagesAxis Long Duration Fund - NFOYasahNo ratings yet

- Weekly Market Compass - 23 NovDocument4 pagesWeekly Market Compass - 23 NovYasahNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Weekly Market Compass - 7 Dec 22Document3 pagesWeekly Market Compass - 7 Dec 22YasahNo ratings yet

- KKBS Week 6 - CH 7 Bond ValuationDocument22 pagesKKBS Week 6 - CH 7 Bond ValuationLili YaniNo ratings yet

- Group Assignment 1Document2 pagesGroup Assignment 1Adis TsegayNo ratings yet

- The July 31Document4 pagesThe July 31Douglas M. DougyNo ratings yet

- Tasty Carrot BudgetDocument8 pagesTasty Carrot BudgetIbrahim AmmarNo ratings yet

- 122 Burk v. Ottawa Gas - ElectricDocument1 page122 Burk v. Ottawa Gas - ElectricJai HoNo ratings yet

- Reverse Charge Mechanism in VATDocument22 pagesReverse Charge Mechanism in VATbinuNo ratings yet

- Atmos Energy Corporation Consolidated Balance Sheets: September 30Document7 pagesAtmos Energy Corporation Consolidated Balance Sheets: September 30Betty M. VargasNo ratings yet

- MBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Document25 pagesMBA104 - Almario - Parco - Chapter 1 Part 2 Individual Assignment Online Presentation 3Jesse Rielle CarasNo ratings yet

- Junaid Ass 3Document3 pagesJunaid Ass 3Junaid AhmadNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Motley Fool "Options Edge" HandbookDocument11 pagesThe Motley Fool "Options Edge" Handbookapi-25895447100% (4)

- Chapter 1 Fundamental Principles of ValuationDocument22 pagesChapter 1 Fundamental Principles of ValuationEmilyn MagoltaNo ratings yet

- Reading 45 Introduction To Asset-Backed SecuritiesDocument15 pagesReading 45 Introduction To Asset-Backed SecuritiesNeerajNo ratings yet

- ACCA FA Progress Test PDFDocument21 pagesACCA FA Progress Test PDFNicat IsmayıloffNo ratings yet

- Ia MidtermDocument5 pagesIa MidtermCindy CrausNo ratings yet

- E. I. Du Pont de Nemours and Company - Case 2Document15 pagesE. I. Du Pont de Nemours and Company - Case 2raphael_cruz_2No ratings yet

- Sol Man Chapter 12 Share Based Payments Part 1 2021 - CompressDocument12 pagesSol Man Chapter 12 Share Based Payments Part 1 2021 - CompressWynne RamosNo ratings yet

- Financial Accounting 2 Conrado ValixDocument549 pagesFinancial Accounting 2 Conrado ValixJM Dela Cruz100% (1)

- ICICIdirect MahindraLifespace Coverage PDFDocument27 pagesICICIdirect MahindraLifespace Coverage PDFsantu13No ratings yet

- Alibaba Group Announces March Quarter and Full Fiscal Year 2023 ResultsDocument44 pagesAlibaba Group Announces March Quarter and Full Fiscal Year 2023 ResultsAdemarjr JuniorNo ratings yet

- MAS-42E (Budgeting With Probability Analysis)Document10 pagesMAS-42E (Budgeting With Probability Analysis)Fella GultianoNo ratings yet

- SH FormsDocument42 pagesSH FormsRajeev KumarNo ratings yet

- Financial AssetsDocument35 pagesFinancial AssetsAshutosh KumarNo ratings yet

- Lexcel Pack 2010Document30 pagesLexcel Pack 2010vivalakhan7178No ratings yet

- FM Unit 3Document22 pagesFM Unit 3Krishnapriya S MeenuNo ratings yet

- Final Exam Intermediate Accounting 2Document2 pagesFinal Exam Intermediate Accounting 2William TabuenaNo ratings yet

- StatementXXXXXXXXX1798 PragatikumariDocument5 pagesStatementXXXXXXXXX1798 PragatikumariAdventurous FreakNo ratings yet

- Role of Banks in Working Capital ManagementDocument59 pagesRole of Banks in Working Capital Managementswati29mishra100% (6)

- CMA - Volume 1Document181 pagesCMA - Volume 1Abdul QaviNo ratings yet

- Balanza de ComprobacionDocument9 pagesBalanza de ComprobacionNoemí MontañezNo ratings yet

- Cash ManagementDocument82 pagesCash ManagementAjiLalNo ratings yet