Professional Documents

Culture Documents

Chart of The Week-Declining CAD To Aid Domestic Growth

Uploaded by

Yasah0 ratings0% found this document useful (0 votes)

7 views1 pageOriginal Title

Chart of the Week-Declining CAD to aid domestic growth

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageChart of The Week-Declining CAD To Aid Domestic Growth

Uploaded by

YasahCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

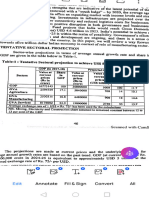

Declining CAD to aid domestic growth

➢ India’s current account deficit (CAD) decreased to 0.2% of the GDP

($1.4bn) in Q4FY23 from 1.6% ($13.4bn) OF GDP in Q4FY22

What caused CAD to decline ?

• Decline in Trade deficit in FY23 which was on account of lower

commodity prices as compared to previous quarters/year (e.g., Brent

crude corrected from ~$139 in March’22 to ~$75/barrel currently)

• Strong increase in Service exports that has gone up to 4.5% of GDP in

Q4FY23 from 3.3 % of GDP in Q4FY22. During 2022-23, services

exports grew faster (27.9 %) than merchandise exports (6.9 %).

• Within Services, Manufacturing services (up ~298%), Constructions

(up ~251%), Telecom & services (up ~17%) & Other business services

(up ~282%) grew in Oct-Dec’22 over Oct-Dec’21

What’s the way forward ?

• Service exports have been growing in FY23 and is expected to remain

stable in the near future

• Overall BOP (Balance of Payment) should be close to neutral with a

marginal deficit with Capital inflows funding the high CAD.

Going forward, Neutral CAD, moderating inflation, end of rate hike cycle in

2023 makes an ideal case for Fixed Income Investors and reap benefits of

higher yields.

Dt – 10.07.2023 Source: Economic ABSLAMC Research, RBI Bulletin For Private Circulation Only

You might also like

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Ciptadana Results Update 1H23 BBTN 21 Jul 2023 Maintain Buy TP Rp2Document8 pagesCiptadana Results Update 1H23 BBTN 21 Jul 2023 Maintain Buy TP Rp2ekaNo ratings yet

- Ki BBTN 20240212Document8 pagesKi BBTN 20240212muh.asad.amNo ratings yet

- Nirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Document11 pagesNirmal Bang Berger Paints Q3FY22 Result Update 11 February 2022Shinde Chaitanya Sharad C-DOT 5688No ratings yet

- Viet Capital CTD@VN CTD-20221130-MPDocument13 pagesViet Capital CTD@VN CTD-20221130-MPĐức Anh NguyễnNo ratings yet

- BoP 4QFY23 Jun 27 2023 - OthersDocument7 pagesBoP 4QFY23 Jun 27 2023 - Othersrahul ingleNo ratings yet

- IIFL - Union Budget - 2022-2023 - 20220202Document26 pagesIIFL - Union Budget - 2022-2023 - 20220202Bharat NarrativesNo ratings yet

- Infosys 140422 MotiDocument10 pagesInfosys 140422 MotiGrace StylesNo ratings yet

- JLL - Singapore Property Market Monitor 1Q 2022Document2 pagesJLL - Singapore Property Market Monitor 1Q 2022WNo ratings yet

- Kuwait Quarterly Brief 20230228 EDocument6 pagesKuwait Quarterly Brief 20230228 ERaven BlingNo ratings yet

- CIptadana Results Update 3Q23 BBCA 20 Oct 2023 Maintain Buy TP Rp10Document7 pagesCIptadana Results Update 3Q23 BBCA 20 Oct 2023 Maintain Buy TP Rp10edwardlowisworkNo ratings yet

- CTD-20211125-MP VietcapDocument15 pagesCTD-20211125-MP VietcapĐức Anh NguyễnNo ratings yet

- Gem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportDocument14 pagesGem Riverside To Support 2022 Growth Outlook: Dat Xanh Group (DXG) (BUY +56.0%) Update ReportLê Chấn PhongNo ratings yet

- Pakistan Strategy 2020.Document60 pagesPakistan Strategy 2020.muddasir1980No ratings yet

- 4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedDocument5 pages4716156162022739schneider Electric Infrastructure Ltd. Q4FY22 - SignedbradburywillsNo ratings yet

- $rhzr4e1 PDFDocument27 pages$rhzr4e1 PDFAryan Sheth-PatelNo ratings yet

- 02 CMD 2023 Financial Progress VPDocument14 pages02 CMD 2023 Financial Progress VPRaimund KlapdorNo ratings yet

- Q2 2022 Earnings PresentationDocument25 pagesQ2 2022 Earnings PresentationIan TorwaldsNo ratings yet

- 2021 q2 Earnings Results PresentationDocument17 pages2021 q2 Earnings Results PresentationZerohedgeNo ratings yet

- SBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdateDocument8 pagesSBI Cards and Payment Services (Sbicard In) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- 15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareDocument16 pages15124-CardinalStone Research 2022 Macro Outlook Consolidating Recovery-ProshareOladipo OlanyiNo ratings yet

- Infosys (INFO IN) : Q1FY21 Result UpdateDocument14 pagesInfosys (INFO IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Kotak Mahindra Bank (KMB IN) : Q2FY20 Result UpdateDocument10 pagesKotak Mahindra Bank (KMB IN) : Q2FY20 Result UpdateHitesh JainNo ratings yet

- Bangladesh - A Compelling Growth StoryDocument38 pagesBangladesh - A Compelling Growth StoryiamnahidNo ratings yet

- Ciptadana Results Update 1Q23 BBRI 5 May 2023 Maintain Buy TP Rp6Document6 pagesCiptadana Results Update 1Q23 BBRI 5 May 2023 Maintain Buy TP Rp6ekaNo ratings yet

- QNB Research On Boubyan Bank KuwaitDocument14 pagesQNB Research On Boubyan Bank KuwaitAli Al-SalimNo ratings yet

- Larsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYDocument10 pagesLarsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYVikas AggarwalNo ratings yet

- Scan 03-Jan-2024Document1 pageScan 03-Jan-2024ashishdt68No ratings yet

- Investor Digest: HighlightDocument14 pagesInvestor Digest: HighlightYua GeorgeusNo ratings yet

- Quarterly Construction Cost SG 2022 Q1Document13 pagesQuarterly Construction Cost SG 2022 Q1quict.handongecNo ratings yet

- 0 - 3qfy20 - HDFC SecDocument11 pages0 - 3qfy20 - HDFC SecGirish Raj SankunnyNo ratings yet

- Pra Tinjau SahamDocument8 pagesPra Tinjau SahamADE CHANDRANo ratings yet

- Karnataka Bank LTD - Q4FY22 - Result Update - 31052022 - 31-05-2022 - 10Document8 pagesKarnataka Bank LTD - Q4FY22 - Result Update - 31052022 - 31-05-2022 - 10Jill SanghrajkaNo ratings yet

- Cayman Votes - General Elections in The Best-Run Country in The CaribbeanDocument4 pagesCayman Votes - General Elections in The Best-Run Country in The CaribbeanAlanNo ratings yet

- AbacusShortTakes 10262022Document6 pagesAbacusShortTakes 10262022ignaciomannyNo ratings yet

- NBFC Sector Update Fy23 VFDocument50 pagesNBFC Sector Update Fy23 VFSHREEMAYEE PANDANo ratings yet

- PNB Housing Finance - 1QFY20 Result - JM FinancialDocument11 pagesPNB Housing Finance - 1QFY20 Result - JM FinancialdarshanmaldeNo ratings yet

- NagaCorp 2022 Interim Results PresentationDocument16 pagesNagaCorp 2022 Interim Results PresentationJonathan ChoiNo ratings yet

- TCB 1Q23 ResultsDocument4 pagesTCB 1Q23 ResultsLinh NguyenNo ratings yet

- Can Fin Homes Ltd-4QFY23 Result UpdateDocument5 pagesCan Fin Homes Ltd-4QFY23 Result UpdateUjwal KumarNo ratings yet

- Third Quarter 2020 Earnings Results Presentation: October 14, 2020Document16 pagesThird Quarter 2020 Earnings Results Presentation: October 14, 2020Zerohedge100% (1)

- City Union Bank: IndiaDocument5 pagesCity Union Bank: IndiadarshanmadeNo ratings yet

- Current Status of Indian EconomyDocument2 pagesCurrent Status of Indian EconomyHrithik NaikNo ratings yet

- Wipro HDFC 15042020Document12 pagesWipro HDFC 15042020Pramod KulkarniNo ratings yet

- KI SECTOR Banking 20230303Document7 pagesKI SECTOR Banking 20230303jovalNo ratings yet

- Aavas Q4FY21 ResultsDocument16 pagesAavas Q4FY21 ResultsdarshanmaldeNo ratings yet

- KEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceDocument4 pagesKEC International LTD (KEC) : Continued Traction in Railway & Civil Help Post Stable PerformanceanjugaduNo ratings yet

- Economic Bulletin Vs January 2023 20231302Document1 pageEconomic Bulletin Vs January 2023 20231302RiannaNo ratings yet

- Kampala Market Update q3 2022 q3 2022 9407Document1 pageKampala Market Update q3 2022 q3 2022 9407Nomadic ValuerNo ratings yet

- NH Korindo PTPP - FY20 Performance Below EstimatesDocument6 pagesNH Korindo PTPP - FY20 Performance Below EstimatesHamba AllahNo ratings yet

- JLL SG 1q20 Property MarketDocument2 pagesJLL SG 1q20 Property MarketYasmin AsrandaNo ratings yet

- Equirus - Securities - Solar - Industries - India - 1QFY21 Result - Final - Take - 17092020Document9 pagesEquirus - Securities - Solar - Industries - India - 1QFY21 Result - Final - Take - 17092020shahavNo ratings yet

- HDFC ReportDocument8 pagesHDFC ReportPreet JainNo ratings yet

- SAWAD230228RDocument8 pagesSAWAD230228RsozodaaaNo ratings yet

- JLL Singapore Property Market Monitor 2q2022Document2 pagesJLL Singapore Property Market Monitor 2q2022david kusumaNo ratings yet

- NUVAMADocument11 pagesNUVAMAcoureNo ratings yet

- T&T - Canada-Market-Intelligence-2023-Q2Document12 pagesT&T - Canada-Market-Intelligence-2023-Q2thamindulorensuNo ratings yet

- Budget FY23 Focusing Fiscal Consolidation: June 12, 2022Document18 pagesBudget FY23 Focusing Fiscal Consolidation: June 12, 2022NAUROZ KHANNo ratings yet

- EdgeReport YESBANK ConcallAnalysis 30-04-2022 233Document2 pagesEdgeReport YESBANK ConcallAnalysis 30-04-2022 233prashant_natureNo ratings yet

- Your 2022 Budget HighlightsDocument2 pagesYour 2022 Budget HighlightsCityPressNo ratings yet

- Contacts Pe Funds-Ankita (Updated)Document15 pagesContacts Pe Funds-Ankita (Updated)YasahNo ratings yet

- Sundaram - Common Transaction Slip - Aadhaar - With PAN FinalDocument1 pageSundaram - Common Transaction Slip - Aadhaar - With PAN FinalYasahNo ratings yet

- Chart of The Week - Indias Electronics Export A Shining StarDocument1 pageChart of The Week - Indias Electronics Export A Shining StarYasahNo ratings yet

- NISM-Series-V-A: Mutual Fund Distributors Certification ExaminationDocument1 pageNISM-Series-V-A: Mutual Fund Distributors Certification ExaminationYasahNo ratings yet

- Fund Focus - Axis Arbitrage Fund - June 2023Document3 pagesFund Focus - Axis Arbitrage Fund - June 2023YasahNo ratings yet

- BNPP Categorisation of SchemesDocument6 pagesBNPP Categorisation of SchemesYasahNo ratings yet

- A. Mutual Funds B. Depositories C. Registrar & Transfer AgentsDocument1 pageA. Mutual Funds B. Depositories C. Registrar & Transfer AgentsYasahNo ratings yet

- Fsol Cu 060818Document8 pagesFsol Cu 060818YasahNo ratings yet

- ICICIDocument5 pagesICICIYasahNo ratings yet

- Karvy - AadhaarForm-Non-IndividualDocument1 pageKarvy - AadhaarForm-Non-IndividualYasahNo ratings yet

- Motilal Oswal Asset Management Company LimitedDocument2 pagesMotilal Oswal Asset Management Company LimitedYasahNo ratings yet

- Gran Cu 260718Document8 pagesGran Cu 260718YasahNo ratings yet

- Fund Focus - Axis Bluechip Fund - Aug 2022Document5 pagesFund Focus - Axis Bluechip Fund - Aug 2022YasahNo ratings yet

- Nasdaq 100 Commentary - January 2023 PDFDocument2 pagesNasdaq 100 Commentary - January 2023 PDFYasahNo ratings yet

- Covid 19 - Opening Doors For InnovationDocument3 pagesCovid 19 - Opening Doors For InnovationYasahNo ratings yet

- Impact On GDP in FY20-21 Due To COVID-19: Source: RBI, CSO, SIAM, Ministry of Commerce & Industry, CGADocument3 pagesImpact On GDP in FY20-21 Due To COVID-19: Source: RBI, CSO, SIAM, Ministry of Commerce & Industry, CGAYasahNo ratings yet

- Fiis - Long Term Investors or Fly by Night Operators: Source: Sebi, DSP, MoneycontrolDocument3 pagesFiis - Long Term Investors or Fly by Night Operators: Source: Sebi, DSP, MoneycontrolYasahNo ratings yet

- Weekly Market CompassDocument4 pagesWeekly Market CompassYasahNo ratings yet

- Impact of Q1FY21 Results On Equity Market: Ason1 July' 20Document4 pagesImpact of Q1FY21 Results On Equity Market: Ason1 July' 20YasahNo ratings yet

- Axis Bluechip Fund Attribution Analysis PDFDocument7 pagesAxis Bluechip Fund Attribution Analysis PDFYasahNo ratings yet

- Vaccine Series Part 4 - 0901 - 2021 PDFDocument4 pagesVaccine Series Part 4 - 0901 - 2021 PDFYasahNo ratings yet

- Weekly Market Compass 21 Sep PDFDocument3 pagesWeekly Market Compass 21 Sep PDFYasahNo ratings yet

- FAQ On CKYC For ChannelsDocument5 pagesFAQ On CKYC For ChannelsYasahNo ratings yet

- Axis Long Duration Fund - NFODocument20 pagesAxis Long Duration Fund - NFOYasahNo ratings yet

- KYC Non Individual AnnexureDocument1 pageKYC Non Individual AnnexureYasahNo ratings yet

- Weekly Market Compass - 7 Dec 22Document3 pagesWeekly Market Compass - 7 Dec 22YasahNo ratings yet

- Market Update PPT - July 2022 (Debt)Document19 pagesMarket Update PPT - July 2022 (Debt)YasahNo ratings yet

- KIM Cum Application Form - Axis Long Duration Fund - 0Document34 pagesKIM Cum Application Form - Axis Long Duration Fund - 0YasahNo ratings yet

- Fund Focus - Axis Arbitrage Fund - September 2022Document3 pagesFund Focus - Axis Arbitrage Fund - September 2022YasahNo ratings yet

- Weekly Market Compass - 23 NovDocument4 pagesWeekly Market Compass - 23 NovYasahNo ratings yet

- BEF131 Module Module - Approved Version25012019Document121 pagesBEF131 Module Module - Approved Version25012019Chileshe J. KashimbayaNo ratings yet

- Econ124 Chapter 5Document5 pagesEcon124 Chapter 5Piola Marie LibaNo ratings yet

- BehaviourDocument86 pagesBehaviouroscu0802100% (1)

- Notes On Theory of Consumer Behaviour in Cardinal View PDFDocument4 pagesNotes On Theory of Consumer Behaviour in Cardinal View PDFHanan Hamid GillNo ratings yet

- Chartians Thread TivitikoDocument8 pagesChartians Thread TivitikoPawan ChaturvediNo ratings yet

- MCQs On Commodities-For Reference and Enhancing KnowledgeDocument85 pagesMCQs On Commodities-For Reference and Enhancing KnowledgeNavneetNo ratings yet

- Bài tập Unit 1- Nguyễn Thùy Linh-1811110353Document3 pagesBài tập Unit 1- Nguyễn Thùy Linh-1811110353Linh NguyễnNo ratings yet

- Metal IndexDocument3 pagesMetal IndexChandresh YadavNo ratings yet

- Adani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementDocument3 pagesAdani Institute of Infrastructure Management Trimester IV Port and Shipping ManagementShivani KarkeraNo ratings yet

- International Economics I Answers 1Document5 pagesInternational Economics I Answers 121070350 Bùi Thùy DươngNo ratings yet

- Principle of Business Past Paper 2006Document8 pagesPrinciple of Business Past Paper 2006Dark Place0% (1)

- Exotic Interest-Rate Options: Marco MarchioroDocument66 pagesExotic Interest-Rate Options: Marco MarchioroVishalMehrotraNo ratings yet

- The Ludhiana Stock Exchange Limited Was Established in 1981Document10 pagesThe Ludhiana Stock Exchange Limited Was Established in 1981PREET10No ratings yet

- Erlend OlsonDocument2 pagesErlend OlsonerlendolsonoilNo ratings yet

- Demand Estimation & ForecastingDocument15 pagesDemand Estimation & ForecastingSufana UzairNo ratings yet

- 2023 Case StudyDocument4 pages2023 Case Studymin xuan limNo ratings yet

- Barings Bank: Nick LeesonDocument13 pagesBarings Bank: Nick LeesonHoong KeeNo ratings yet

- CMT Level 1Document101 pagesCMT Level 1stuartb4u0% (1)

- Drivers and Logistics Implications of InternalizationDocument21 pagesDrivers and Logistics Implications of InternalizationAbegail50% (2)

- Kapil TraderDocument15 pagesKapil TraderAjay Singh NirwanNo ratings yet

- A Trader's Guide To Futures: Thought Leadership With A Global PerspectiveDocument34 pagesA Trader's Guide To Futures: Thought Leadership With A Global PerspectiveAdemir Peixoto de AzevedoNo ratings yet

- Commodities Trading by KT AstrologerDocument2 pagesCommodities Trading by KT AstrologerRavi GoyalNo ratings yet

- Module 1 - Introduction To DerivativesDocument29 pagesModule 1 - Introduction To DerivativesSunny SinghNo ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Basic APMC Supply ChainDocument14 pagesBasic APMC Supply ChainajayjhaitmNo ratings yet

- The Global EconomyDocument8 pagesThe Global EconomyKimmehhloves VlogxxxNo ratings yet

- Us Commodity Ventures: Introduction To Commodity TradingDocument36 pagesUs Commodity Ventures: Introduction To Commodity TradingsivarajkannanNo ratings yet

- Elasticity of Demand WorksheetDocument3 pagesElasticity of Demand WorksheetVijay KumarNo ratings yet

- Candlesticks Lesson 2: Single Candlestick PatternsDocument10 pagesCandlesticks Lesson 2: Single Candlestick Patternssaied jaberNo ratings yet

- St. Lawrence High School: A Jesuit Christian Minority InstitutionDocument3 pagesSt. Lawrence High School: A Jesuit Christian Minority InstitutionAzam AkhtarNo ratings yet